#101 Atoss Software SE - A Stock Analysis

Decoding a German Tech Champion for Your Long-Term Portfolio

Disclaimer: The information provided in this publication is for educational and informational purposes only and does not constitute financial advice. The content is solely reflective of my personal views and opinions based on my research and is not intended to be used as a basis for investment decisions. While every effort is made to ensure that the information is accurate and up-to-date, the writer makes no representations as to the accuracy, completeness, suitability, or validity of any information in this post and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. All readers are advised to conduct their own independent research or consult a professional financial advisor before making any investment decisions. The author is not invested in the mentioned stock.

Atoss Software SE: Decoding a German Tech Champion for Your Long-Term Portfolio

Meet Atoss Software SE – A Hidden Gem in Workforce Management?

Atoss Software SE might not yet ring bells worldwide, but within its niche—workforce management (WFM) software—it's established itself as a significant player. Headquartered in Germany, Atoss has built an impressive track record, consistently delivering solid growth and profitability. It’s currently listed on Germany's SDAX and TecDAX indices, making it an intriguing pick for investors exploring the European tech scene.

In this post, I'll dive deep into Atoss Software SE with a focus tailored specifically for long-term investors. We'll explore how the company operates, closely examine its financial performance, and discuss its potential growth trajectory.

You might have heard Atoss described as a "hidden gem," but is that really fair, considering its current market valuation? While it certainly dominates the WFM market in the DACH region (Germany, Austria, Switzerland), its global presence isn't quite as prominent compared to larger international competitors, especially those based in the U.S. This mix of strong local leadership and somewhat lower international visibility creates a compelling dynamic. Investors who specialize in the software sector clearly recognize Atoss’s strengths, making the question of whether it remains a "hidden" opportunity even more interesting.

The Atoss Story: More Than Just Software

General Description: From Vision to TecDAX

Atoss Software’s story began back in 1987 in Munich, when Andreas Obereder founded the company as ATOSS Software GmbH. Fast forward over three decades, and Atoss has evolved dramatically, growing from a modest software startup into a publicly listed Societas Europaea (SE). Today, it trades on the Prime Standard segment of the German Stock Exchange and is featured prominently in both the SDAX and TecDAX indices—a clear nod to its consistent growth and tech credentials. The company’s longevity reflects not only resilience but a knack for adapting to the evolving demands of the software industry.

At the core of Atoss’s identity is a mission focused on "shaping working environments to the benefit of companies, employees, and society," guided by the vision of building a more "human economy." This commitment to creating workplaces that prioritize efficiency alongside employee well-being resonates deeply, especially at a time when retaining talent and supporting employee satisfaction are top business priorities.

From its Munich headquarters, Atoss has expanded throughout Germany and into other parts of Europe, including Belgium, the Netherlands, France, and Sweden. Even beyond its physical footprint, its workforce management (WFM) solutions are actively deployed in over 50 countries, underscoring a significant global reach.

What makes Atoss especially appealing right now is how closely its solutions align with pressing workplace issues—like talent shortages and the rising emphasis on employee well-being. Companies increasingly see workforce management software not just as a helpful tool, but as critical infrastructure for business success. This explains Atoss’s impressive customer metrics, such as an annual cloud churn rate below 2% and net retention rates consistently above 110%. Clearly, Atoss isn't merely optimizing costs—it's genuinely addressing fundamental workforce challenges, which bodes well for its continued growth and customer loyalty.

What Atoss Does: The Toolkit for Modern Workforce Management

At its core, Atoss provides smart, specialized software solutions to streamline workforce management (WFM). Its products cover key areas like time tracking, workforce scheduling, personnel planning, and mobile-friendly features. What makes Atoss stand out is its versatile product range, specifically designed to cater to businesses of varying sizes and complexities.

For large enterprises with intricate operational needs, Atoss offers the ATOSS Staff Efficiency Suite. Highly scalable, this solution is tailored to meet the demands of major domestic and multinational companies. It covers everything from comprehensive time and attendance tracking to advanced workforce scheduling, employee self-service tools, and strategic capacity planning.

Smaller to medium-sized businesses (SMEs) are served by ATOSS Time Control, a product aimed at streamlining HR processes and cutting administrative burdens, helping SMEs enhance efficiency and stay competitive. This suite includes core features such as personnel time recording, shift planning, project time tracking, employee self-service, access control management, and a handy mobile app.

For the smallest businesses or agile teams, Atoss offers Crewmeister, a straightforward online tool that's easy to set up and intuitive to use. Crewmeister handles essential workforce tasks like time recording, shift scheduling, and holiday planning without any unnecessary complexity.

Across all these products, Atoss leverages smart algorithms for workforce forecasting, optimization of personnel structures, capacity planning to match staffing levels with demand, and scheduling designed to maximize productivity. Reflecting broader industry trends, Atoss has provided its products as cloud-based solutions since 2015, alongside traditional on-premises installations.

Atoss’s customer base spans multiple industries, including manufacturing, retail, healthcare, logistics, utilities, and various service sectors. Its client list includes recognizable names like München Klinik, OBI, the City of Ingolstadt, Luzerner Kantonalbank, and HORNBACH Baumarkt AG, demonstrating its broad appeal across sectors.

This tiered product approach—covering the ATOSS Staff Efficiency Suite, ATOSS Time Control, and Crewmeister—is a strategic strength. It allows Atoss to effectively target a wide market spectrum, from multinational corporations down to local startups. This not only expands Atoss’s potential market but also creates built-in opportunities for upselling. For example, a rapidly growing business using Crewmeister can smoothly transition to ATOSS Time Control as its needs evolve. Moreover, serving multiple market segments simultaneously reduces Atoss’s exposure to risks that might arise from dependency on any single customer type or market sector.

Financial Pulse: A Look at the Latest Numbers (Q1 2025 & FY 2024 Recap)

Atoss Software SE has an impressive track record of financial strength, recently celebrating its 19th consecutive record-breaking year in fiscal 2024. Such consistent performance highlights not just resilience but also the effectiveness of its strategic business approach.

Fiscal Year 2024 Highlights (vs. FY 2023)

For the fiscal year ending December 31, 2024, Atoss achieved total revenues of EUR 170.6 million, up 13% from the previous year's EUR 151.2 million. Software revenue—the company's primary revenue stream—reached EUR 124.9 million (about 73% of total sales), marking 15% growth year-over-year. Within software revenue, Cloud & Subscriptions were the standout performer, surging by 37% to EUR 72.4 million. This segment now accounts for 42% of total sales, up from 35% a year ago. Meanwhile, software maintenance revenue rose 9% to EUR 39.0 million (23% of total). Traditional software license sales continued their expected decline, dropping 31% to EUR 13.5 million (now just 8% of total revenue), highlighting the company's successful pivot towards cloud-based solutions.

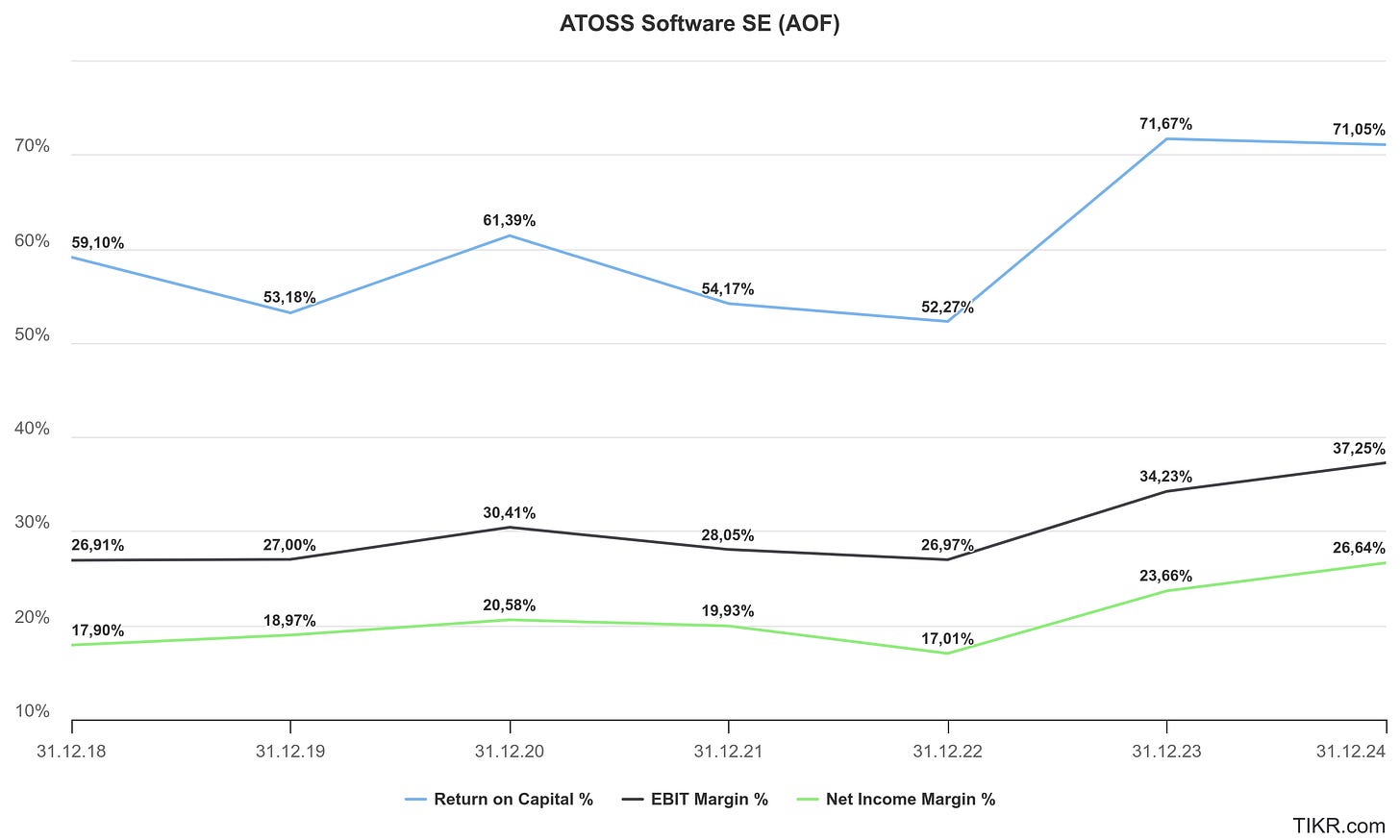

Consulting revenues grew by 8% to EUR 35.9 million (21% of total revenue). Profitability also improved significantly: EBITDA rose by 21% to EUR 67.8 million, resulting in an expanded EBITDA margin of 40% (up from 37% last year). Likewise, EBIT increased by 22% to EUR 63.4 million, lifting the EBIT margin to 37% from 34%. Net profit climbed an impressive 27%, reaching EUR 45.5 million—a net margin of 27%. Adjusted Earnings Per Share (EPS) grew by 27%, from EUR 2.25 to EUR 2.86. Operating cash flow remained robust at EUR 59.5 million (a 13% increase), while liquidity improved markedly by 36% to EUR 112.2 million.

Q1 2025 Performance (vs. Q1 2024)

Atoss sustained its strong momentum into the first quarter of 2025, generating total revenues of EUR 46.3 million—an 11% increase over Q1 2024’s EUR 41.8 million. Software revenues climbed by 14% to EUR 34.0 million, representing about 74% of total quarterly revenue. Once again, Cloud & Subscription revenue led growth, rising by 30% to EUR 21.4 million, now comprising 46% of total revenues. Meanwhile, software maintenance revenues saw a modest increase of 3% to EUR 10.0 million.

Significantly, recurring revenues (cloud plus maintenance) grew by 20% to EUR 31.3 million, now accounting for 68% of total revenues, up from 62% the prior year. Consulting services revenue reached EUR 10.0 million. Despite a "weak economic environment," demand for new software licenses slightly surpassed levels seen in Q1 2024. EBIT remained strong at EUR 15.6 million, with a stable EBIT margin of 34%, in line with the previous year’s quarter. The company's liquidity position remained healthy, standing at EUR 131.9 million.

Further reinforcing the shift to cloud solutions, Atoss's cloud order backlog—representing contractually secured cloud revenues expected within the next 12 months—increased to EUR 92.8 million (up from EUR 85.8 million at year-end 2024). Cloud Annual Recurring Revenue (ARR) also rose by 9% to EUR 86.7 million, while total ARR (Cloud + Maintenance) grew by 7%, reaching EUR 126.4 million.

Key Financial Highlights

The financial results clearly indicate that Atoss’s shift to a Software-as-a-Service (SaaS) model isn’t just progressing—it’s accelerating and already delivering strong results. The substantial increase in Cloud & Subscriptions revenue, now the largest segment of both software and overall revenue, underscores the success of this strategic transition. The corresponding drop in traditional software license sales is a natural, expected outcome rather than a negative sign, given the ongoing cloud transition. Interestingly, even with the strategic push towards cloud offerings, Q1 2025 saw a modest uptick in new license demand, signaling healthy underlying market interest. The growing share of recurring revenue further enhances the predictability and stability of Atoss’s financial outlook.

Equally impressive is the company's ability to maintain—and even expand—its profit margins while investing heavily in future growth. The EBIT margin notably improved to 37% in FY2024 and remained solid at 34% in Q1 2025. This performance is especially remarkable given Atoss’s explicit focus on expanding its sales capabilities and investing in research and development (R&D). While short-term margin strength has benefited from careful cost management and the temporary deferral of some investments, the core profitability of Atoss’s business model remains fundamentally strong. The company's guidance of an EBIT margin of at least 31% for full-year 2025, already accounting for planned investments, reflects management’s confidence in maintaining healthy profitability going forward.