Disclaimer: The information provided in this publication is for educational and informational purposes only and does not constitute financial advice. The content is solely reflective of my personal views and opinions based on my research and is not intended to be used as a basis for investment decisions. While every effort is made to ensure that the information is accurate and up-to-date, the writer makes no representations as to the accuracy, completeness, suitability, or validity of any information in this post and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. All readers are advised to conduct their own independent research or consult a professional financial advisor before making any investment decisions. The author is not invested in the mentioned stock.

BRP Inc.: Riding Through Cycles

General Description

BRP Inc. (Bombardier Recreational Products) is a Canadian powersports and marine vehicle company known for its iconic recreational brands and innovative engineering. Founded in 2003 as a spin-off from Bombardier Inc.’s recreational products division, BRP has built on an 80-year legacy of ingenuity to become a global leader in snowmobiles, watercraft, off-road vehicles, and related engines and components. Headquartered in Valcourt, Quebec, the company sells its products in over 130 countries and employs nearly 20,000 people worldwide. BRP’s industry-leading product portfolio includes Ski-Doo and Lynx snowmobiles, Sea-Doo personal watercraft, Can-Am on-road and off-road vehicles, Rotax engines, and a range of boats and pontoons (through brands like Alumacraft, Manitou, and Quintrex). These brands have become synonymous with adventure and high performance in their respective categories. BRP trades on the Toronto Stock Exchange (DOO) and NASDAQ (DOOO), reflecting its status as a publicly listed company focused on recreational powersports.

BRP’s products span multiple terrains and seasons. For example, the company’s Sea-Doo line of personal watercraft is a market leader in on-water recreation, offering jet-powered “jet skis” for leisure and sport. One of BRP's flagship offerings is the Sea-Doo PWC, seen below skimming the water with its trademark combination of speed and maneuverability. On snow, BRP’s Ski-Doo snowmobiles (and Lynx brand in Europe) dominate winter powersports, a segment the company’s original founder famously pioneered. Meanwhile, its Can-Am division produces all-terrain vehicles (ATVs), side-by-side off-road buggies, and Spyder/Ryker three-wheeled on-road motorbikes, serving riders year-round. This broad lineup across snow, water, and land gives BRP a diversified presence in the recreational vehicle industry, with products designed for both casual consumers and enthusiast markets. The company complements its vehicles with a robust parts, accessories, and apparel business, which not only adds revenue but helps build a loyal lifestyle community around each of its brands.

Overall, BRP is recognized as a top-tier manufacturer in the powersports industry, leveraging its strong brand portfolio and engineering expertise to deliver thrilling recreational experiences. From a long-term investor’s perspective, understanding BRP’s background and product scope is key: this is a company with deep roots in innovation, global reach, and a stable of well-known brands that have defined powersports for decades.

Short Summary of Latest Financials

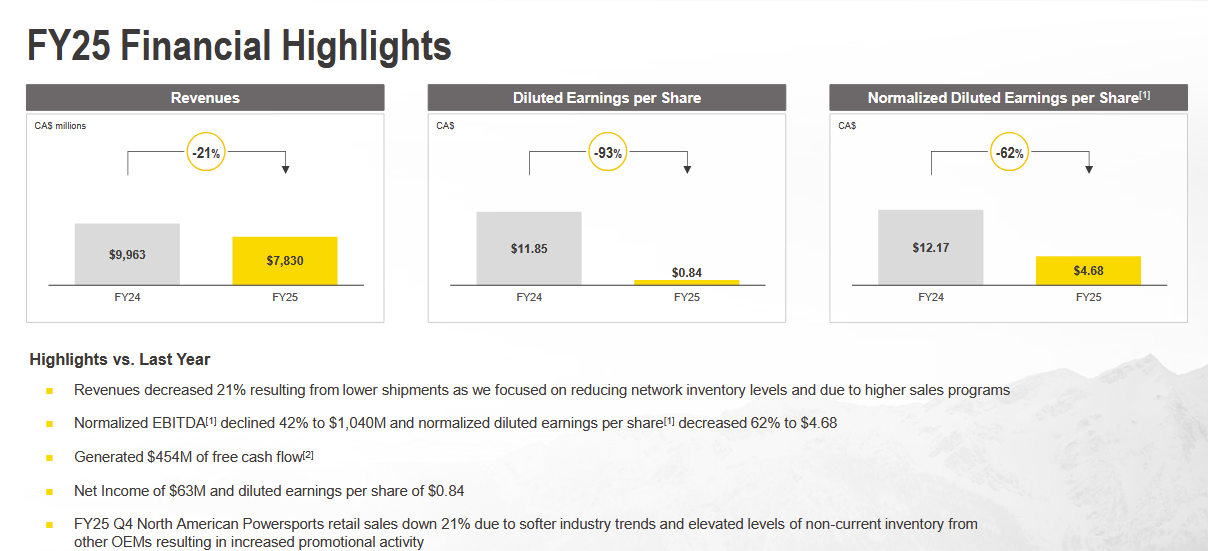

BRP’s latest financial results illustrate the sharp swing in performance the company experienced as the powersports cycle turned downward. In the most recent fiscal year (FY2025, for the 12 months ended January 31, 2025), BRP’s revenues dropped to $7.83 billion, a 21% decline from the prior year’s record sales. This pullback in revenue reflects a softening of demand after a pandemic-fueled boom, as well as the company’s deliberate effort to ship fewer units to help dealers clear excess inventory. Profitability was hit even harder: BRP’s net income nearly evaporated, falling 93% year-over-year to only $62.7 million for FY2025. By comparison, the previous fiscal year had net profit well above $700 million, so FY2025 marked a significant downturn in earnings. In fact, BRP posted a small net loss in the latest fourth quarter, losing about $44.5 million in Q4 versus a $302.8 million profit in Q4 of the prior year.

Several factors drove this abrupt financial reversal. During FY2025, BRP saw a 19.7% drop in Q4 revenues as the company cut shipments to reduce dealer stock amidst “continued softer demand”. North American retail sales fell 21% in that quarter, particularly hurt by a weak snowmobile season (due to poor winter weather) and some market share loss in off-road vehicles. The reduction in sales volume, combined with heavier promotional discounts to move older products, compressed BRP’s profit margins. Additionally, BRP recorded an impairment charge related to its boat manufacturing (Marine) business being held for sale, which further weighed on the bottom line. Despite these challenges, it’s worth noting BRP had entered this downturn from a position of strength: fiscal 2024 was a banner year, with all-time high revenue of $10.37 billion and robust net income of $744.5 million. That strong prior year provides context – FY2025’s slump underscores the highly cyclical nature of BRP’s business, where demand can swing dramatically with economic conditions, weather, and channel inventory dynamics.

In summary, BRP’s latest financials show the company navigating a rough patch after an exceptional boom. Revenue and earnings have retrenched significantly in the most recent year, primarily due to external headwinds (weaker consumer demand and inflationary pressures) and proactive inventory corrections. Long-term investors should view these results in context: BRP’s management took short-term pain (in the form of lower sales and profits) to protect its dealer network and brand health, a strategy that could position the company for a cleaner recovery once industry conditions stabilize.

Key financials

Comprehensive Business Model Description

BRP generates its revenue by designing, manufacturing, and selling a wide array of recreational vehicles, propulsion systems, and related parts. The company operates through two main business segments – Powersports and Marine – although powersports vehicles account for the vast majority of its sales and profits. Below is a breakdown of BRP’s business model, including key product lines, customer markets, and value propositions:

Powersports Segment: This is BRP’s core business, comprising everything from off-road ATVs to on-road motorcycles and snow machines. Within Powersports, BRP further divides its offerings into three categories: Year-Round Products, Seasonal Products, and Powersports Parts, Accessories & Apparel (PA&A). Year-Round Products include all-terrain vehicles (ATVs), side-by-side (SSV) utility/sport vehicles, and the three-wheeled Can-Am Spyder/Ryker roadsters – vehicles that can be used in any season. Seasonal Products consist of winter snowmobiles (Ski-Doo and Lynx) and summer personal watercraft (Sea-Doo), as well as recreational pontoons (the Sea-Doo Switch pontoon falls here). The PA&A division covers aftermarket parts, accessories, clothing, and maintenance services for BRP’s vehicles, plus sales of Rotax engines to OEM clients (for example, Rotax engines power many go-karts and light aircraft). The Powersports segment is the earnings engine of BRP – in recent years it has contributed over 95% of total revenues, dwarfing the marine boat segment. It’s also where BRP’s strongest competitive advantages lie, thanks to brand loyalty and continuous innovation in vehicle design.

Marine Segment: This segment was an attempt to diversify into the recreational boating market. It includes boat manufacturers (acquisitions like Alumacraft for fishing boats, Manitou for pontoon boats, and Telwater/Quintrex in Australia) as well as the now-discontinued Evinrude outboard engine line and related marine PA&A. BRP’s marine segment has been relatively small – only a few hundred million dollars in sales – and in recent years it struggled to turn a profit. In 2020, BRP exited outboard engine manufacturing (closing Evinrude) and in late 2024 the company announced plans to sell off its boat manufacturing businesses to refocus on its core powersports operations. Notably, Sea-Doo personal watercraft are not part of the marine segment; those sit under Powersports (as Seasonal products). After the marine divestiture (which excludes the Sea-Doo PWC line), BRP will essentially be a pure-play powersports vehicle company.

How BRP makes money: The bulk of revenue comes from unit sales of new vehicles through a global network of independent dealers. BRP designs and manufactures vehicles in its own facilities (with major production sites in Canada, Mexico, the U.S., Finland, and Austria) and sells them to distributors/dealers, who in turn retail to consumers. High-volume products like the Can-Am off-road series and Ski-Doo snowmobiles drive unit sales, especially in North America which is BRP’s largest market. BRP complements these vehicle sales with a lucrative stream of parts, accessories, and apparel. This not only boosts margin (aftermarket parts carry higher profit margins than vehicles) but also enhances the customer experience – for example, BRP owners buy helmets, riding gear, upgrade kits, and maintenance parts, creating recurring revenue beyond the initial vehicle purchase. BRP’s customer base ranges from powersports enthusiasts (e.g. snowmobilers, ATV riders, personal watercraft racers) to casual leisure consumers and commercial clients (farmers using side-by-sides, tour operators, etc.). The company’s value proposition centers on delivering superior performance, innovative features, and a fun, reliable ride. BRP’s brands often command premium pricing in their segments due to strong brand equity (e.g. Ski-Doo is often considered the gold standard for snowmobiles) and the company’s history of product innovation (such as inventing the first sit-down personal watercraft, or adding tech like intelligent suspension to ATVs). By continuously refreshing its product lineup – introducing new models, engine improvements, and even branching into electric vehicles – BRP aims to keep customers upgrading and attract new riders into the fold.

Geographically, BRP’s sales are skewed toward North America and Western Europe, with North America (the U.S. and Canada) accounting for a majority of revenues in most years. The U.S. market is especially critical, and BRP has optimized its manufacturing footprint to serve it efficiently – many of its products are built in Mexico and Canada, benefiting from tariff-free access to the U.S. under USMCA. This North American focus means BRP’s fortunes are tied to consumer trends in these markets, though the company is present in over 100 countries overall. It uses subsidiaries and distributors to reach powersports customers in regions like Scandinavia (big for snowmobiles), Australia (off-road and marine products), and Latin America.

In summary, BRP’s business model is about selling fun and adventure in the form of machines – and then selling the gear and parts to support those machines. It thrives on product innovation, a strong dealer network, and branding that resonates with outdoor recreational lifestyles. Long-term profitability comes from maintaining volume growth (through new products and market expansion) while also capturing high-margin aftermarket sales and leveraging efficient production. Investors evaluating BRP should pay attention to how well the company balances its product mix, manages inventory with dealers, and continues to differentiate its brands in a competitive leisure market.

Strengths and Weaknesses

Like any company, BRP has internal strengths that help it compete and grow, as well as weaknesses that pose challenges. Below is an analysis of key advantages and disadvantages inherent to BRP’s business:

Strengths:

Iconic Brands & Market Leadership: BRP owns some of the most recognized brands in powersports – from Ski-Doo and Sea-Doo to Can-Am – which often hold #1 or #2 market positions in their categories. This brand equity translates into customer loyalty and the ability to command premium pricing. The company has a track record of gaining market share even in competitive markets; for instance, BRP’s Can-Am off-road division reached a 30% market share in side-by-side vehicles, hitting that milestone a year ahead of plan. In the last growth cycle, BRP consistently outpaced industry growth (e.g. North American powersports sales +8% for BRP vs +1% industry in FY2024), highlighting strong execution and competitive strength.

Culture of Innovation: With roots tracing back to the invention of the snowmobile, BRP has innovation in its DNA. The company continually refreshes its product lineup and pushes into new categories. Recent examples include developing electric vehicles, such as the upcoming all-electric Can-Am motorcycles slated for launch in late 2024, and exploring “low voltage and human-assisted” product ideas for future markets (which could hint at e-bikes or other new mobility devices). This innovative drive helps BRP expand its addressable market and stay ahead of evolving consumer preferences (e.g. demand for eco-friendly recreational vehicles). It also means the company can tap new revenue streams beyond its traditional gasoline-engine products.

Diversified Product Portfolio: BRP’s range of products across snow, water, and off-road segments provides some balance to its revenue. While all are discretionary recreational items, the seasonal diversification is a plus – for example, a poor snow season might hurt snowmobile sales, but BRP can still benefit if summer demand for watercraft or ATVs is strong. The broad portfolio (multiple product categories and price points) also allows cross-selling and keeps customers within the BRP family as they pursue different hobbies. A Ski-Doo snowmobile owner might buy a Sea-Doo for summer; an ATV rider might later upgrade to a Can-Am side-by-side. This ecosystem of products and accompanying accessories increases customer lifetime value for BRP.

Strong Free Cash Flow & Shareholder Returns: During upcycles, BRP’s business throws off significant cash. The company generated over $1 billion in free cash flow in FY2024, an all-time high. Management has used this cash to reward shareholders, notably through aggressive share buybacks and a growing dividend. In FY2024, BRP returned about $502 million to shareholders via share repurchases and dividends, and even in the tougher FY2025 it returned another $277 million through buybacks/dividends. The company has a policy of consistently paying a dividend (nine consecutive years of dividends as of 2024) and has raised the payout over time (most recently a 17% increase to C$0.21 quarterly). These actions reflect confidence in BRP’s financial strength and provide tangible returns to long-term investors.

Operational Advantages (Manufacturing & Supply Chain): BRP has optimized its manufacturing footprint and supply chain in ways that give it cost and flexibility benefits. A significant portion of production is in Mexico, which, under the USMCA trade agreement, allows duty-free export to the U.S. market. This has insulated BRP from some tariff issues that hit competitors who import from overseas. In fact, when new U.S. tariffs targeted imports from Asia in 2025, BRP was largely unscathed while some rivals faced higher costs – a Citi analysis noted BRP’s supply chain setup “avoided serious tariff implications,” turning a potential threat into a relative advantage. Additionally, BRP’s in-house engine division (Rotax) and vertical integration of key components can help control quality and innovation. The company’s global dealer network is another strength – BRP has spent years building and supporting an extensive dealer base, which is hard for new entrants to replicate.

Weaknesses:

Cyclical, Weather-Dependent Demand: BRP’s business is highly cyclical and sensitive to external factors like consumer confidence, disposable income, and weather conditions. Powersports purchases (ATVs, snowmobiles, etc.) are big-ticket discretionary items, so in economic downturns or periods of high interest rates, consumers can delay or cancel these purchases. The recent 21% plunge in North American retail sales in Q4 FY2025 illustrates this vulnerability – demand softened significantly as macro conditions turned and financing costs rose. Additionally, weather can impact sales: a mild winter or late snowfall can dramatically hurt snowmobile demand (as seen in FY2025 when “unfavorable winter conditions” led to lower snowmobile sales). This reliance on Mother Nature and economic cycles means BRP’s revenues and profits can swing widely, making planning and steady growth challenging.

High Operating Leverage: BRP has substantial fixed costs tied to its manufacturing operations and R&D. When volume declines, as it did in FY2025, profitability can drop sharply because those fixed costs aren’t easily reduced in the short term. The company acknowledged that reduced factory utilization and lower shipment volumes in Q4 FY2025 led to negative leverage on gross margins – fixed production costs were spread over fewer units, hurting margins. This high operating leverage is great in boom times (amplifying profits on the way up) but a weakness in downturns, as seen by the steep fall in earnings when sales contracted. It requires BRP to carefully manage production and inventories to avoid grossly over- or under-producing, a delicate balancing act with dealers.

Overexposure to North America: While BRP is a global company, a large portion of its sales and growth depend on the U.S. and Canadian markets. The U.S. in particular is the largest powersports market in the world and BRP’s single biggest revenue source. This geographic concentration means any economic slowdown, regulatory change, or shift in consumer taste in North America disproportionately affects BRP. For example, if high gasoline prices or environmental regulations discourage ATV use in the U.S., BRP could feel the impact strongly. The company is expanding internationally, but it faces stiff competition in Europe and other regions, and no other market can yet replace North America’s scale for BRP. Concentration risk is thus a weakness; BRP’s fortunes are somewhat tied to North American economic health and outdoor recreation trends.

Struggles in the Marine Business: BRP’s foray into the boat and outboard engine segment has been a weak spot. The marine division consistently underperformed, with lower margins and even losses that dragged on overall results. The company already exited the outboard motor business in 2020 (shutting down Evinrude), and in 2024 BRP decided to divest its boat manufacturing brands (Alumacraft, Manitou, Telwater) entirely. The marine segment also caused one-time charges, such as the impairment of marine assets held for sale in FY2025, which hit earnings. While BRP is now correcting this by selling the marine unit, the episode highlights a weakness: the company’s expertise and competitive advantage clearly lie in powersports vehicles, not boats. The marine venture diverted resources and ended with write-downs – a reminder that not all diversification efforts succeed. Long-term investors might view this as a learning cost, but it underlines that BRP’s strength is narrower than its initial ambitions (i.e. stick to powersports).

Dealer Inventory Management & Channel Risk: BRP sells via independent dealers, so maintaining a healthy dealer channel is critical. If dealers end up with too much inventory (as happened in late 2024 when industry demand slowed), it creates a cascade of problems: dealers discount old stock, order fewer new units, and competitor discounting can force margin-eroding promotions. BRP experienced this in off-road vehicles recently – competitors with excess inventory flooded the market with non-current models, forcing BRP to lose some market share in the short term and implement higher sales incentives. This scenario is a weakness because BRP doesn’t have direct control of retail pricing or inventory once products ship to dealers. It relies on forecasting and responsive production cuts to avoid channel stuffing. Missteps in demand forecasting or dealer management can lead to either lost sales (if too little inventory) or profit-killing discounts (if too much). In FY2025, BRP made the tough choice to proactively cut shipments to help dealers, which hurt short-term revenue. The incident shows that the dealer-dependent distribution model carries risks around inventory and requires vigilant management to align supply with demand.

Competitive and Regulatory Pressures: The powersports industry is quite competitive, with formidable rivals in each segment (e.g. Polaris and Yamaha in off-road, Arctic Cat in snowmobiles, Kawasaki in PWCs, etc.). While BRP is a leader, it must continuously fend off competition through innovation and marketing. Competitors can impact BRP’s performance by aggressive pricing or new product introductions. Additionally, regulatory trends pose a long-term challenge: environmental regulations on emissions or noise could affect snowmobiles, boats, and ATVs. BRP has to invest in cleaner engine tech (hence its move into electric) to address these. If the company is slow to adapt to regulatory changes (emissions standards, safety requirements, tariffs on imports, etc.), it could face headwinds. We saw an example with tariffs – global trade disputes introduced uncertainty and could have severely hurt BRP if they targeted its supply chain, to the point the company delayed issuing FY2026 guidance due to tariff-related economic uncertainty. While BRP managed to avoid the worst of recent tariffs, it’s a reminder that external policy risks are a factor outside the company’s control and can be considered a weakness or risk factor going forward.

In weighing BRP’s strengths and weaknesses, it’s evident that the company’s brand power, innovation, and cash generation are strong assets that have driven its success over time. However, the cyclicality, operational risks, and external dependencies (dealers, economy, weather) mean investors must be prepared for volatility. Successful long-term investment in BRP likely hinges on the company’s ability to leverage its strengths to navigate and mitigate its weaknesses through the cycles.

Dividends and Share Buybacks

BRP has a history of actively returning capital to shareholders through a combination of dividend payments and share repurchases. For a long-term investor, these actions provide insight into management’s confidence and capital allocation discipline.

Dividends: BRP initiated a regular dividend in the late 2010s and has since grown it steadily. The company currently pays a quarterly dividend of C$0.21 per share, after announcing a 17% increase to that rate in early 2024. This brings the annualized dividend to C$0.84 per share (approximately US$0.65, depending on exchange rates). At the recent stock price levels (in the mid-C$30s to C$40s range), BRP’s dividend yield is roughly 1.5–2%, which is a modest income stream for investors. The dividend is well-covered by earnings in normal years – for instance, during the strong FY2024, the payout ratio was quite low relative to earnings, whereas in the weak FY2025, earnings coverage was tight but the company maintained the dividend. Notably, BRP has paid dividends for nine consecutive years as of 2024, without interruption.

Even as profits dipped in the latest year, the Board opted to keep the dividend unchanged, signaling a commitment to returning cash to shareholders. For Canadian investors, BRP’s dividends are designated as “eligible dividends” for tax purposes. Overall, the dividend policy appears to emphasize steady growth in the payout when feasible (as evidenced by several raises in past years, from an initial ~$0.09 quarterly a few years ago to $0.21 now) while keeping the payout ratio conservative to allow for reinvestment and buybacks.

Share Buybacks: BRP’s use of share repurchases has been significant and opportunistic. The company has frequently authorized Normal Course Issuer Bids (NCIBs) to buy back a portion of its outstanding shares. In periods of strong cash flow, BRP has repurchased shares aggressively, which both returns surplus cash to shareholders and boosts future earnings per share by reducing the share count. For example, in FY2024 BRP deployed about C$502 million for share repurchases and dividends combined – a very large capital return that year, funded by record cash flows. In FY2025, despite the downturn, BRP still spent C$277 million on buybacks and dividends, indicating that it views its stock as undervalued and a worthy investment even in tougher times. Over the past five years, the share count has indeed fallen due to buybacks (the diluted weighted average shares outstanding dropped from ~81 million in 2019 to ~73 million by 2025). This reduction enhances each remaining share’s claim on earnings and is a shareholder-friendly move when done at reasonable prices. Notably, management and insiders (including the founding family and private equity backers from the spin-off) hold significant stakes, so they are incentivized to increase shareholder value through buybacks.

BRP tends to repurchase shares when it has excess liquidity and when it believes the stock is undervalued. During FY2023–FY2024, BRP’s strong performance led to substantial buybacks, and the company even took on some debt in prior years to fund special buyback programs (demonstrating confidence in its financial position). However, investors should be aware that BRP’s buyback activity may fluctuate with the cycle – in lean times they may conserve cash (or like FY2025, reduce the scale of repurchases), whereas in boom times they return lots of cash. The Board has to balance funding growth investments (new products, capacity expansion) with these returns.

In terms of policy outlook: BRP’s dividend yield, while not high, provides a steady baseline return, and the company’s willingness to raise the dividend indicates a long-term commitment to income return. The buybacks have been meaningful in enhancing shareholder value, effectively supplementing the dividend by bolstering share price and EPS. During the latest earnings, management reiterated its stance on shareholder returns – even in FY2025’s volatile environment, they continued the quarterly dividend and did not rule out opportunistic repurchases. In fact, analysts have noted that BRP’s management has “actively supported shareholder value through aggressive share buybacks, while maintaining dividend payments”. For a long-term investor, this track record is encouraging: it suggests that when the company does well, shareholders directly participate in that success through higher payouts and when the stock is cheap, the company is willing to invest in itself via buybacks.

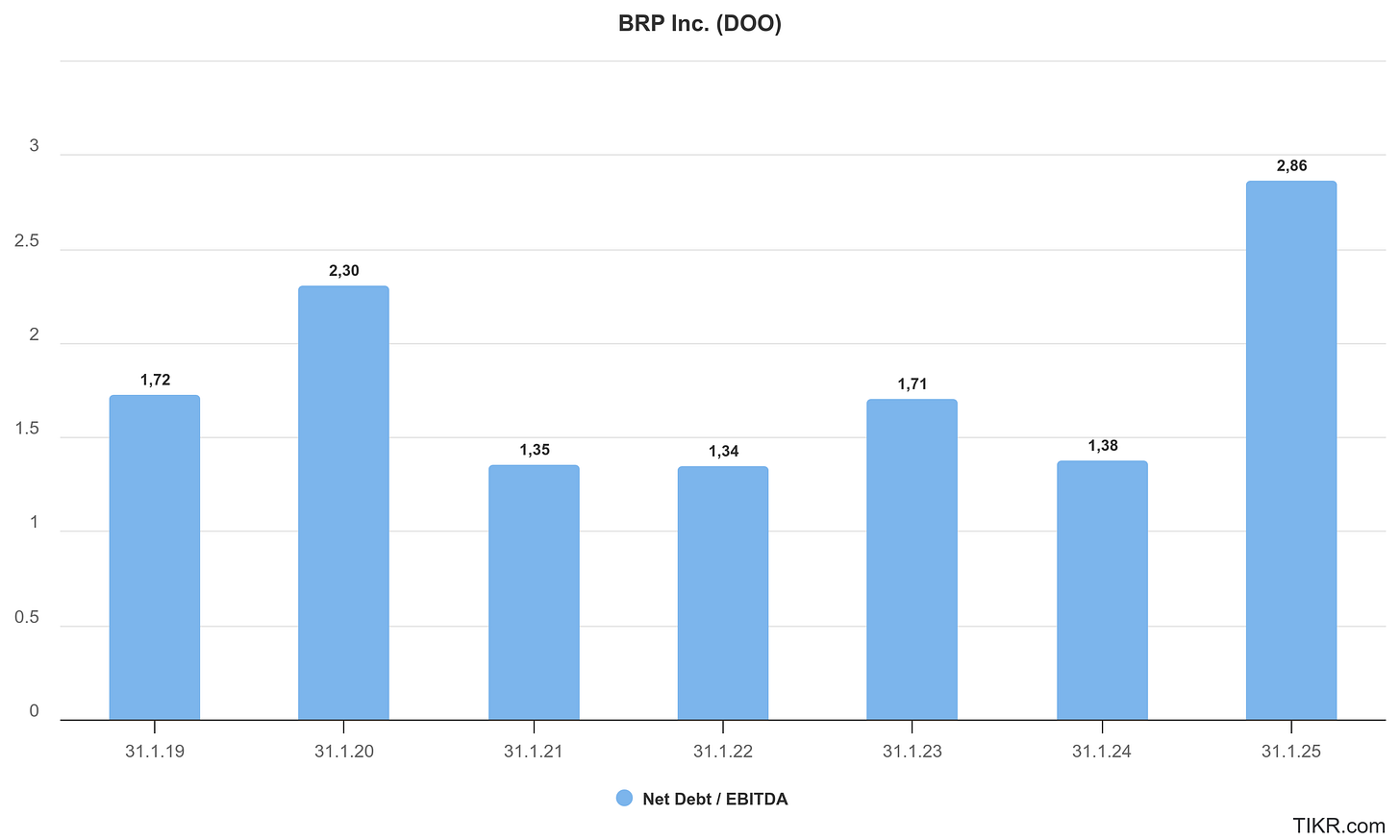

To summarize, BRP’s capital return strategy has been a mix of a growing, sustainable dividend and sizable share repurchases funded by excess cash flow. This indicates a shareholder-friendly approach. Investors can reasonably expect BRP to continue paying dividends quarterly and to resume heavier buybacks when business conditions improve. It’s a prudent strategy that returns cash without jeopardizing growth initiatives – for instance, even after big buybacks, BRP’s leverage remained modest (debt/EBITDA below ~2× at the end of FY2024). This balance of growth and yield makes BRP’s stock potentially attractive to long-term investors who appreciate both capital gains and income.

Stock Valuation

For quick reference, BRP Inc. trades under the ticker “DOO” on the Toronto Stock Exchange and the corresponding U.S. ADR ticker “DOOO” on Nasdaq. The shares you and I actually buy are the Subordinate Voting Shares; behind the scenes there’s also a small rump of Multiple-Voting founder stock, so total share count depends on which class you include. On a fully diluted basis, BRP has about 73 million shares outstanding (all classes combined), of which roughly 34½ million are the freely traded Subordinate Voting Shares that show up under the DOOO ticker.

The International Securities Identification Number (ISIN) is CA05577W2004, handy if you’re hunting for the stock on non-North-American trading platforms.

Market cap naturally swings with the share price, but at the recent mid-C$50s print in Toronto (≈ US $35 on Nasdaq) BRP’s equity is valued at roughly C$3.8 billion, or about US $2.6–2.8 billion. That puts the company firmly in mid-cap territory—large enough for decent liquidity, but still small enough that multiple expansion (or contraction) can move the needle for long-term holders.

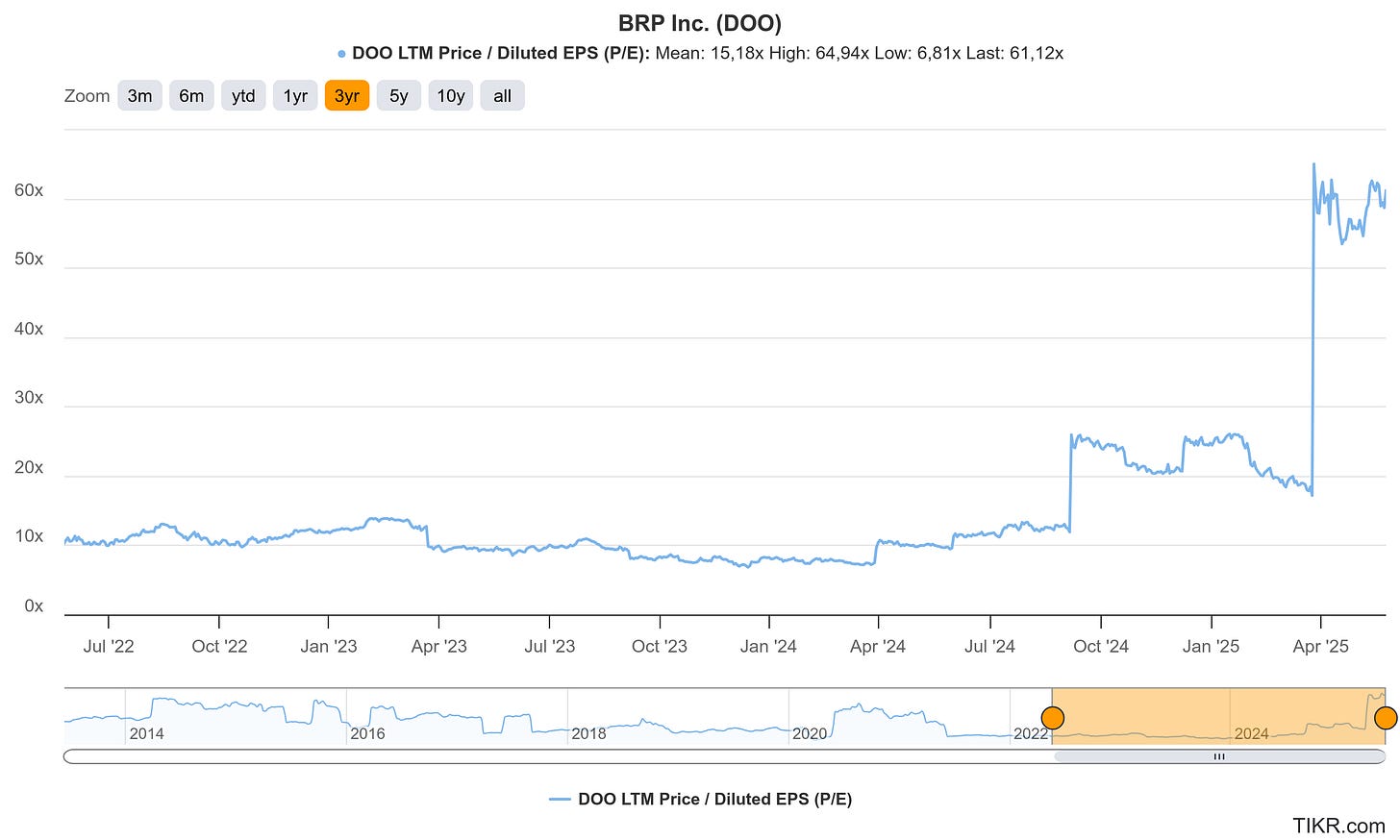

When you glance at the trailing-twelve-month P/E curve the stock looks eye-wateringly expensive—north of 60 × LTM earnings today versus a three-year average of ~15 ×. But that spike isn’t the market suddenly awarding BRP a luxury multiple; it’s the math reacting to a collapse in the “E.” FY-25’s profit downdraft slashed the denominator, so even a share price that has been cut nearly in half now screens optically expensive on a trailing basis. In other words, the chart is screaming “cyclical trough,” not “irrational exuberance.”

That’s why the second panel, the forward-looking dashboard of NTM P/E and EV/EBIT , is the more useful lens. Here, BRP trades around 15 × next-twelve-month earnings and ~13 × EV/EBIT, both hovering a few turns above their respective three-year means (~11 × and ~9 ×). Two things jump out:

Multiples jumped in late-2024 even as the share price fell. The culprit again is earnings—the Street slashed its 2025–26 estimates, so the ratios rose automatically. That tells us the market is already baking in a fair amount of pain.

Valuation is sitting in the upper half of its recent range, not at the top. The forward P/E peaked at 22 × during the pandemic boom and troughed near 6.5 × last year. Sitting at ~15 × today puts the stock closer to “mid-cycle fair” than “distress” on consensus numbers.

Put the two charts together and the takeaway is nuanced:

Trailing metrics are useless right now—they simply highlight how deep the earnings hole is. Forward metrics suggest the market is willing to pay a mid-teens multiple for a rebound that is still very much a forecast, not a fact. If you think FY-26/27 earnings snap back anywhere near FY-24’s C$9+ EPS, the implied P/E two years out drops into single digits and the stock looks cheap. If you’re skeptical of a quick recovery, the current 13-15 × run-rate multiple could be a ceiling, not a floor.

In short, BRP is being priced like a cyclical stalwart expected to muddle through a rough patch rather than a busted growth story—or a bargain basement special. The investment call now hinges less on headline valuation and more on your conviction in the earnings rebound that those forward numbers assume.

Bullish and Bearish Investment Case

BRP is the kind of company that inspires both bullish optimism and bearish caution among investors. Let’s outline both sides of the investment case:

Bullish Case (Reasons to be optimistic):

Strong Brand Equity and Customer Loyalty: Bulls argue that BRP’s powerful brands (Ski-Doo, Sea-Doo, Can-Am, etc.) give it a durable competitive moat. These brands have an enthusiastic following and high market shares in their segments, which suggests BRP can maintain pricing power and volume growth over the long term. The company’s ability to take market share in good times (for example, outgrowing competitors with new product launches) demonstrates an edge that should resume once the macro environment improves. Long-term demand for fun and adventure isn’t going away, and BRP’s names are among the first that consumers consider in powersports.

Proven Growth and Resilience: Prior to the recent downturn, BRP delivered impressive growth – revenue compounded at ~13% annually over five years – and long-term shareholders were handsomely rewarded (a 141% total return over the last five years, even after the recent dip). This shows that BRP has been a value-creating compounder, capable of growing through product innovation and strategic expansion. Bulls believe that the current slump is cyclical, not structural. They point out that management acted decisively to cut inventory and protect the business, which, while painful now, sets BRP up to recover faster than less agile competitors. Once dealer inventories normalize, BRP can ramp up production and sales to meet renewed demand, potentially recapturing any lost market share. In short, bulls see the recent headwinds as temporary hurdles that a well-run company like BRP can overcome, returning to growth in the coming years.

Undervalued Stock Price: The bullish camp emphasizes that BRP’s stock is deeply undervalued based on fundamentals. With the share price beaten down (~40% off highs), the stock trades at very low multiples. Bulls could argue that the market has overreacted to short-term earnings weakness, pricing BRP as if a prolonged recession or permanent decline is on the horizon. If instead BRP’s earnings revert closer to normal (even somewhere between the FY2024 peak and FY2025 trough), there is significant upside. Under even conservative scenarios the fair value seems to be materially higher than the current price. This value gap, combined with ongoing buybacks (reducing share count) and a healthy dividend, makes the risk/reward attractive for patient investors.

Innovation and New Markets as Growth Catalysts: Bulls are excited about BRP’s upcoming product initiatives – notably the launch of electric motorcycles under the Can-Am brand and other electric models. This move opens BRP to new customer segments (e.g. urban riders, environmentally conscious users) and could be a game-changer if executed well. The company’s commitment to electrification (without abandoning its core petrol-based products) is seen as prudent: it can capture growth in emerging EV markets while still cashing in on legacy segments. Additionally, BRP’s exploration of new categories (“human-assisted” products) hints at things like electric bikes or other micro-mobility devices, which could tap into trends beyond traditional powersports. Bulls view BRP as an innovator that’s not standing still – they believe these new products can add meaningfully to revenue over the next decade, on top of recovery in the core business.

Focused Strategy and Leaner Operations: With the exit of the struggling marine division, BRP will be more focused on what it does best – powersports. Bulls applaud this decision, as it removes a drag on earnings and frees up resources to invest in higher-return areas. Management’s strategy to “double down on Powersports” and push innovation further was explicitly laid out as a long-term plan. This suggests that once the dust settles, BRP could emerge as an even stronger leader in its core markets, potentially taking advantage of weaker competitors or industry consolidation. The company’s cost structure and balance sheet remain solid (debt levels are manageable and fixed rates, and the balance sheet is described as “healthy” by the CEO). This financial stability means BRP can weather the storm and still invest in growth. Bulls argue that when consumer demand returns, BRP is poised for a sharp rebound in earnings – and any positive surprise (e.g. a quicker recovery, a hit new product, easing of tariffs) could send the stock significantly higher from its currently depressed valuation.

Bearish Case (Reasons for caution):

Cyclical Downturn Could Be Prolonged: Bears caution that the powersports industry is in a down-cycle that may last longer or cut deeper than bulls expect. High inflation and interest rates have made recreational toys less affordable; financing an ATV or snowmobile is pricier, and consumers facing economic uncertainty might cut discretionary spending for multiple seasons. The 21% drop in BRP’s retail sales in the latest quarter might not just be a one-quarter issue but a sign of persistent softness. Bears note that BRP had a massive surge during 2020–2021 (when consumers with stimulus money sought outdoor activities), and now demand could be undergoing a mean reversion or saturation. In other words, the boom pulled forward a lot of sales, and the hangover could be tough. If a broader economic recession hits, BRP’s sales and profit could remain under pressure or even decline further, making current earnings estimates too optimistic. The company’s decision to withhold FY2026 guidance due to uncertainty underscores that even management is unsure how soon the tide will turn. From a bearish view, BRP might be facing a lean period where revenue stays flat or drops and margins remain compressed by promotional efforts – in which case, the stock might not be as cheap as the forward multiples suggest (because “E” in the P/E could disappoint).

Margin Pressure and Profit Volatility: Bears point out that BRP’s recent results reveal how quickly profitability can evaporate. Net income fell over 90% in one year, and the company even posted a quarterly loss – this highlights profit volatility that could spook investors and keep the stock’s valuation low. In the current environment, BRP has had to boost sales incentives and cut production, which hurt margins. Those pressures might not abate soon: competitors still have excess inventory and will likely continue discounting, forcing BRP to either sacrifice volume or match promotions. Additionally, input costs (materials, labor) remain relatively high due to inflation, squeezing margins from the cost side. Bears worry that even when sales volumes stabilize, margin recovery might lag. If BRP has to permanently contend with a more price-competitive market or lower operating leverage (to avoid inventory gluts), its peak margins might be lower going forward. That would mean the stellar earnings of FY2022–FY2024 won’t fully repeat, justifying a lower valuation. In short, the bearish case is that BRP’s earnings power is structurally lower in the near-to-medium term than bulls anticipate, due to a combination of lower volumes and thinner margins.

Balance Sheet and Financial Risk: While BRP’s debt is moderate, bears note that net debt did increase during the boom (partly to fund buybacks), and the company now has to manage through a downturn with those obligations. The weakening of the Canadian dollar or other currencies vs. the US dollar can hurt BRP, as seen by an “unfavorable foreign exchange variation on U.S.-denominated long-term debt” impacting recent net income. In FY2025, BRP’s operating cash flow dropped by more than half, and if earnings stay weak, there’s a risk that leverage ratios creep up. While no immediate solvency issues exist, the reduced cash flow might limit BRP’s ability to keep funding buybacks or even maintain dividends if things got worse. Bears argue that the company might need to preserve cash for operations and capex (especially with EV investments), which could dampen the shareholder return story in the near term. Furthermore, any mis-execution on new product launches (like the expensive task of developing EV motorcycles) could strain finances. Essentially, bears keep an eye on financial flexibility – if the downturn is protracted, BRP could be forced to scale back capital returns or take on more debt, which would be unfavorable for equity holders.

Uncertain Reception of New Ventures: Another bearish point concerns BRP’s strategic moves into new areas like electric vehicles. While bulls are excited, bears caution that entering the electric motorcycle market is not guaranteed to succeed. This space already has competition (from dedicated EV startups and from motorcycle incumbents dabbling in electric), and consumer adoption of electric bikes is still early. Developing and marketing a successful electric Can-Am will require heavy investment and could face setbacks (range anxiety, battery costs, etc.). If these new products don’t sell as hoped, BRP could end up writing off R&D or pricing them at low margins to gain traction. Similarly, exploring new “low voltage” product categories might distract management or dilute focus. Bears might point to past instances (like the failed Evinrude revival or the money-losing boat acquisitions) to argue that BRP’s ventures outside its core are not sure bets. Thus, there is execution risk in the growth story – if the new initiatives falter, BRP would have expended resources that could have been used elsewhere, and the market might penalize the stock for wasted investment.

Macro and External Risks: The bearish case also emphasizes the broad range of external risks facing BRP. Global tariff disputes, while recently somewhat favorable to BRP, still introduce uncertainty in supply chains and could flare up again – a change in trade policy could quickly raise BRP’s costs or complicate its Mexico production advantages. Regulatory pressures for emissions could increase costs for BRP’s ICE (internal combustion engine) products or even limit their use in certain areas (for instance, bans on two-stroke engines in some jurisdictions). Also, changing demographics pose a question: Will younger generations have the same enthusiasm (and financial ability) for powersports as the previous ones? If not, long-term growth could stagnate. Bears also note that weather volatility (possibly exacerbated by climate change) might increasingly make seasonal business unpredictable – e.g. consistently warmer winters could structurally reduce snowmobile sales over time. In essence, the bears see a lot of clouds on the horizon that could hamper BRP’s performance in ways beyond management’s control, and thus they argue for caution until there’s clearer evidence of the storm passing.

In summary, the bullish case hinges on BRP’s strong fundamentals (brand, innovation, historical growth) and the belief that the current troubles are cyclical and already priced into a cheap stock – making it a compelling long-term opportunity. The bearish case rests on the idea that the down-cycle may be longer or deeper than anticipated, with sustained pressure on sales and margins, and that the stock’s low valuation is justified given the risks and uncertainties.

A prudent long-term investor will weigh these perspectives: Is BRP a temporarily out-of-favor gem that will regain its luster, or has the landscape changed enough to warrant a more cautious view? The reality could incorporate elements of both – which is why an outlook analysis is important, to see how the future might play out for BRP.

Outlook

Looking ahead, BRP’s future will be shaped by how well it navigates the current downturn and capitalizes on emerging opportunities in the powersports industry. Here are the key elements of the company’s outlook in terms of strategy, trends, and expectations:

Near-Term Caution, Long-Term Confidence: In the immediate future (the next 12–18 months), BRP itself is cautious. The company refrained from providing an FY2026 financial forecast because of economic uncertainties and ongoing tariff negotiations globally. This suggests that FY2026 (calendar 2025) may be another challenging year in terms of visibility. Management’s priority in the near term is to manage dealer inventory and maintain financial discipline. They have indicated they will continue proactively adjusting production so as not to flood the channel – even if that means sacrificing some sales in the short run – in order to protect the “dealer value proposition” (i.e. ensure dealers can sell products without massive discounts). Investors should expect BRP to keep a tight lid on costs and perhaps run a leaner operation until demand definitively picks up.

However, the tone for the long-term outlook is optimistic. CEO José Boisjoli stated that BRP’s strategy is to “double down on Powersports” and that over the longer term this focus, combined with relentless innovation, will solidify BRP’s industry leadership. The company views its product portfolio as second-to-none and believes it has a strong platform for resumed growth when conditions improve. In particular, management highlighted that BRP’s dealer network remains strong and the balance sheet is healthy, positioning the company to “sustain profitable growth” as the environment stabilizes. So while the next quarter or two might be subdued, BRP is essentially saying: we’re getting our house in order now so that we can hit the ground running when the market turns.

Recovery Drivers: A few factors could drive BRP’s recovery. First, dealer inventories are already coming down – North American network inventory was reduced by 13% year-on-year by early 2025 (18% reduction excluding snowmobiles, which had a seasonal buildup). As the company and dealers sell through remaining older stock, BRP will be in a position to resume normal wholesale shipments, which will boost factory volumes. The company anticipates that this leaner inventory stance, although it caused some short-term market share loss, will prove beneficial in the long run by preserving dealer profitability and brand equity. So, one can expect wholesale sales to bounce back once the channel clears – possibly as soon as the next model-year launch cycles if retail demand shows any uptick.

Second, new product launches are on the horizon. BRP has already teased and is near rollout for its Can-Am electric motorcycles, the Pulse and Origin, due to launch in late 2024. These will mark BRP’s entrance into the two-wheel motorcycle market (a new domain for the company, since Can-Am had only made three-wheelers in recent years) and, importantly, into the EV arena for powersports. The reception of these electric bikes will be something to watch in 2025–2026. If successful, they could open a growth avenue and demonstrate BRP’s ability to innovate beyond internal combustion. BRP is also likely to introduce electric or hybrid versions of some existing vehicles (there has been talk in the industry of electric side-by-sides or possibly an electric Sea-Doo in development). The expansion of the EV lineup over the next few years is a core pillar of BRP’s outlook, aligning with global trends towards electrification. While EV adoption in powersports may be gradual, BRP aims to be at the forefront, which could attract new customers and perhaps even generate new recurring revenue (e.g. software updates, battery subscriptions, etc., down the line).

Additionally, BRP continues to refine its core product lines. Every year the company typically releases upgraded models – for example, new Ski-Doo models with improved suspension or new Rotax engine options, or limited-edition ATVs with advanced features. These incremental innovations keep existing enthusiasts upgrading. BRP hinted at “pushing innovation further” as part of its long-term plan, so we can expect them to leverage technology (like smarter ride control, connectivity, possibly autonomy features in the future) to differentiate their products. In essence, the outlook includes a steady cadence of product improvements that can stimulate replacement demand.

Focus on Core and Exit from Marine: A significant element of BRP’s strategy is the divestiture of the Marine segment. In October 2024, BRP initiated a formal process to sell its boat manufacturing businesses. By spring 2025, it had agreements in place to sell the Alumacraft boat brand assets to a third party, and similar moves are likely underway or completed for Manitou and the Australian Telwater group. The company is retaining the Sea-Doo and Rotax marine engine technologies for now, but essentially BRP is exiting the traditional boat manufacturing space. This has two implications for the outlook: (1) BRP will lose the revenue that those marine brands contributed (roughly $400–500 million annually historically), but (2) its overall profit margins should improve because those businesses were low or negative margin. After the divestiture, BRP becomes a more streamlined powersports company, and management can redeploy capital and focus towards higher-return ventures (like EVs, or perhaps acquisitions in the powersports realm if opportunities arise). The sale also likely brings in some cash proceeds, which could strengthen the balance sheet or fund other initiatives. In sum, the outlook for BRP is to do “more of what we’re good at” and less of what wasn’t working. Investors could view this positively, as a return to core competencies.

Market and Industry Trends: The broader powersports industry is expected to eventually resume growth, albeit at a possibly slower pace than the frenetic pandemic years. Demographic trends show a growing interest in outdoor recreation among various groups, including younger riders and women (segments that BRP has been actively encouraging through marketing and community building). There is also potential for international growth – markets like Eastern Europe, Asia, and Latin America have untapped demand for off-road and personal watercraft, and BRP’s presence in 130+ countries positions it to capture some of that over time. That said, macro conditions will dictate the pace. If inflation eases and consumer confidence rebuilds by 2025, one could see a release of pent-up demand: many consumers sat out purchases in 2023–2024 due to high prices or economic worries, and they might come back to market when conditions improve. BRP’s FY2025 guidance (issued in early 2024) already anticipated a decline in revenue to $9.1–$9.5 billion (with inventory normalization). For FY2026 (calendar 2025) and beyond, the company has not given numbers, but an investor might extrapolate that once the one-time inventory reset is done, BRP could return to a growth trajectory, albeit maybe mid-single-digit growth at first. Over a multi-year horizon, if BRP’s EV products and global expansion take hold, growth could reaccelerate.

On the cost side, some relief might come as well: supply chain snarls and component shortages that plagued manufacturers in 2021–2022 have been largely resolving. BRP could benefit from easing logistics costs and more stable supply, which helps production planning and potentially margins. Also, as the company reduces the heavy promotions (once inventory is right-sized, they won’t need as many discounts), margins should recover. Management’s comment about having a “healthy balance sheet” implies they don’t foresee needing drastic cost cuts or capital raises – they can fund their strategic initiatives and weather the cycle with current resources.

Risks and Challenges: Even with a generally positive long-term outlook, BRP faces challenges it will need to manage. One is competition – competitors are not idle and will also launch new products and vie for market share. Polaris, for example, will be rolling out new off-road models, and others might push into electric or connected vehicle tech as well. BRP will need to ensure its innovation truly differentiates its products (e.g. better performance, better design) to keep its edge. Another challenge is successfully marketing the new electric lineup: persuading traditional riders to embrace electric (or attracting a new customer base entirely) will be crucial for those products’ success. The company’s ability to create excitement (like it did with the Sea-Doo Spark or the Maverick X3 SSV in past years) will be tested in this new arena.

Additionally, macro risks remain part of the outlook. Trade policies are a wildcard; for instance, if tariffs between the U.S. and Europe or China shift unfavorably, it could impact input costs or retail pricing abroad. Economic conditions in BRP’s key markets (U.S., Canada, Europe) will heavily influence how rosy the next few years are. A mild recession could delay recovery for a bit, whereas a soft landing or rebound in consumer spending would accelerate it.

Strategic Vision: The essence of BRP’s outlook, as communicated by management, is to focus on being the “OEM of choice” in powersports by leveraging its diversified product portfolio and strong fundamentals. They are also “excited” about new markets like electric motorcycles as a means to expand their addressable market. This indicates a vision where BRP is not only regaining strength in its existing business lines but also extending into adjacent opportunities that could fuel the next leg of growth. Investors can expect continued investments in R&D, marketing to new customer segments, and perhaps strategic partnerships (for instance, BRP might partner with battery tech firms or software firms to enhance its new products – similar to how auto OEMs have approached EVs).

In conclusion, BRP’s outlook can be characterized by short-term headwinds but solid long-term opportunities. The company is doing the right things to navigate the current storm (cutting inventory, controlling costs) and is setting the stage for a rebound (with new products and a focus on its strengths). If economic conditions cooperate and execution stays strong, BRP could emerge from this down-cycle in a very strong position: a leaner, more focused company ready to resume its growth trajectory in the global powersports arena.

Conclusion

BRP Inc. presents a nuanced picture for the long-term investor – a company with leading brands and a history of innovation that is currently traversing a rough patch in its industry cycle. In summary, here are the key takeaways:

Market Leader with Deep Roots: BRP is a top player in the recreational powersports market, backed by legendary brands like Ski-Doo, Sea-Doo, and Can-Am that have become household names among enthusiasts. Its 80+ years of know-how and spin-off from Bombardier laid a strong foundation, and over the past decade it proved capable of delivering growth and shareholder value (over 19% annual total return to shareholders in the last five years). This heritage and brand loyalty give BRP a competitive moat that should endure beyond temporary market swings.

Cyclical Challenges, but Not Structural Decline: The latest financial results showed a sharp downturn – record FY2024 profits gave way to a 93% earnings drop in FY2025 as demand softened and the company proactively scaled back production. While this underscores the volatility of the business, it appears to be largely a cyclical correction after an unusually strong boom. BRP’s management has responded by realigning inventory, which hurt short-term sales but protects long-term brand health. There is evidence that the company is already outperforming competitors in some respects (taking prudent actions first, maintaining price discipline). Once macro conditions improve (or even stabilize), BRP has the potential to bounce back, with revenues and margins recovering toward more normal levels. The core demand for powersports – fueled by consumers’ desire for outdoor adventure – remains intact, just at a lower ebb due to economic factors.

Robust Business Model and Refocused Strategy: BRP’s diversified portfolio across multiple product categories and seasons provides multiple revenue streams, and its lucrative parts and accessories business adds a steady income source. Going forward, the company is refocusing on its bread-and-butter powersports segment, exiting the underperforming boat manufacturing business. This strategic pivot should improve overall profitability and allow BRP to invest more in areas with greater return. Meanwhile, BRP is not standing still – it’s pushing into electric vehicles and new product categories, an effort that could open up new growth avenues and keep it ahead of regulatory and consumer trends. If these initiatives succeed, BRP could capture a first-mover advantage in the electrification of powersports, complementing its ICE product dominance.

Shareholder-Friendly Capital Allocation: From an investor’s perspective, BRP has shown a commitment to sharing its success. The company pays a regular (and growing) dividend and has aggressively repurchased shares when times were good. This has enhanced shareholder returns and signals management’s confidence in BRP’s value. Even during the recent slump, BRP maintained its dividend and continued buybacks at a moderated pace, underlining a long-term orientation towards rewarding shareholders. For an investor looking at multi-year ownership, these capital return policies add to the total return potential beyond just stock price appreciation.

Valuation Appears Attractive – but Requires Patience: At the current juncture, BRP’s stock trades at a low valuation relative to its normalized earnings power – a forward P/E in the single digits and EV/EBITDA likewise around 7×. This suggests that the market has set a low bar, pricing in a lot of caution. Should BRP’s earnings even partially mean-revert, the stock could see significant upside. For instance, one analysis noted the stock is already “priced for an extended recession” and any easing of that scenario could rerate the shares higher. That said, the timing of a full recovery is uncertain; investors may need to weather continued volatility in the coming quarters. Essentially, BRP looks like a value play on a cyclical rebound – it offers a compelling valuation with the caveat that the turnaround might take a few quarters to materialize. Long-term investors who believe in the company’s strengths might view the current price as an opportunity, while acknowledging that patience and fortitude may be required in the interim.

Key Risks to Monitor: No analysis is complete without reiterating the risks. For BRP, the main watchpoints include consumer demand trends (are sales stabilizing or still falling?), inventory levels (are dealers clearing out stock as planned?), and margin signals (gross margin improvement as promotions ease would be a positive sign). Additionally, keep an eye on the success of new products like the electric Can-Am motorcycles – early reception and reviews in 2024–2025 will be telling. Macro factors like interest rates, fuel prices, and trade policies also loom large for the company. Long-term investors should monitor these factors and management’s commentary in upcoming quarters to gauge whether the bullish thesis is playing out or if bearish concerns are intensifying.

In conclusion, BRP Inc. offers a blend of high-quality business attributes and cyclical risk. It has shown that it can grow and innovate over the long run, and its products resonate strongly with consumers. The current downturn has put the company’s resilience to the test, but management’s actions demonstrate prudent stewardship aimed at long-term health. For a long-term investor, BRP represents a case where you’re investing in a market leader that’s temporarily out of favor. If one believes that people will continue to seek out snow-covered trails on Ski-Doos and splash across lakes on Sea-Doos in the years ahead – and that BRP will be selling them those vehicles – then the company’s future remains bright beyond the present cycle. As BRP navigates the next few quarters, investors will gain more clarity, but from today’s vantage point, the company appears poised to ride out the storm and eventually return to delivering growth and rewards for those who stay the course.

The analysis presents a clear picture of BRP navigating a significant cyclical downturn. The moves to divest the marine segment and manage dealer inventory, alongside the push into EVs, are central to the company's efforts to realign for future growth.

One key aspect is the valuation context: assessing BRP based on forward-looking estimates rather than current trough earnings is indeed critical.

The path forward will largely depend on the conviction in, and timing of, the earnings recovery against what appears to be already priced into those forward multiples.

Excellent analysis. Adding this to our Best Stock Pitches newsletter today.