Disclaimer: The information provided in this publication is for educational and informational purposes only and does not constitute financial advice. The content is solely reflective of my personal views and opinions based on my research and is not intended to be used as a basis for investment decisions. While every effort is made to ensure that the information is accurate and up-to-date, the writer makes no representations as to the accuracy, completeness, suitability, or validity of any information in this post and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. All readers are advised to conduct their own independent research or consult a professional financial advisor before making any investment decisions.

Small Caps for your Dividend Portfolio

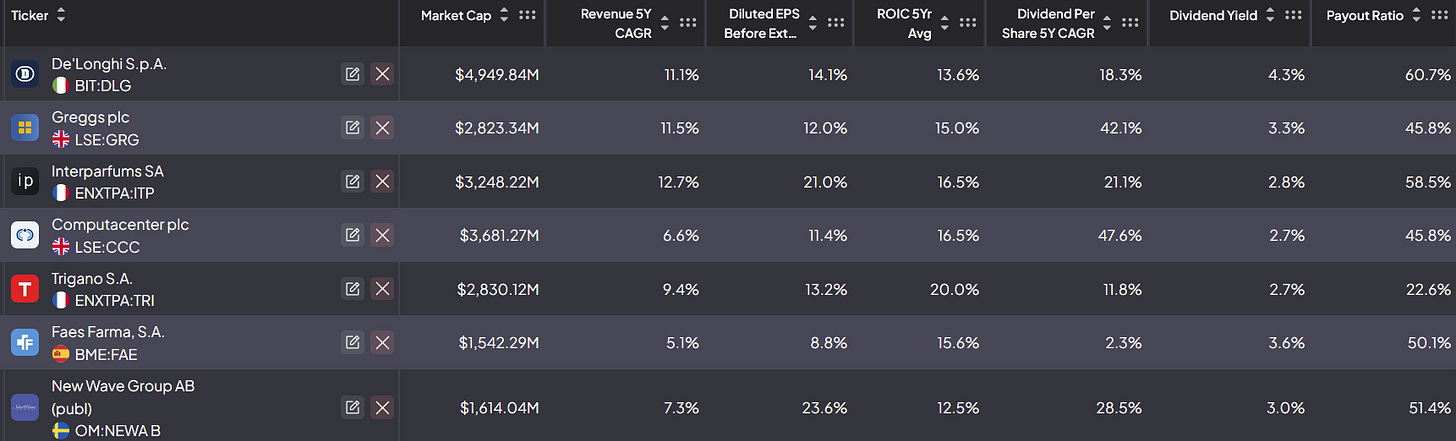

Many investors focus on blue-chip dividend payers, but there are plenty of lesser-known companies quietly rewarding shareholders. Below are seven such “under the radar” dividend stocks from various industries in Europe, each with a brief business overview and key dividend stats.

All seven companies featured here exhibit signs of high quality, with strong returns on invested capital (ROIC), consistent earnings growth, and disciplined capital allocation. Most have grown their dividends significantly over the past five years—despite operating in diverse industries and regions—demonstrating both resilience and a commitment to rewarding shareholders.

A detailed deep dive on each of these companies will be published in the coming weeks and added to the Stock Valuation Watchlist soon.

De’Longhi (Italy)

Business: De’Longhi is an Italian home appliance maker best known for its espresso machines and kitchen equipment. The company sells its products globally, with Europe as its largest market.

Dividend: De’Longhi offers a dividend yield of roughly 4%, with a payout ratio around 60% of earnings. The dividend has been growing quickly – about 18% per year on average over the past five years – though past increases have included some large one-time jumps.

Faes Farma (Spain)

Business: Faes Farma is a Spanish pharmaceutical company that develops and sells prescription drugs, generic medications, over-the-counter remedies, and even animal nutrition products. The firm’s research focuses on areas like allergy treatments, vascular health, and gastrointestinal disorders, and it operates mainly in Spain and select international markets (e.g. Portugal and Latin America).

Dividend: Faes Farma offers a dividend yield of about 3.6%. The payout ratio is roughly 50% of earnings, indicating a balanced split between dividends and retained profit. The dividend has trended upward over the long term (around 15% average annual growth in recent years), though the company did modestly trim its payout in the last year amid fluctuating earnings. Even so, the dividend remains well-covered and has room to grow if earnings improve.

Greggs (UK)

Business: Greggs is a UK-based bakery and food-on-the-go chain with over 2,600 shops nationwide. It’s famous for its affordable baked goods (like the iconic sausage rolls) and serves a broad customer base with breakfast, lunch, and coffee offerings.

Dividend: Greggs’ shares yield roughly 3% at recent prices. The dividend payout ratio is a moderate ~48% of earnings, indicating the payout is comfortably covered. Greggs has grown its dividend at a solid clip (around 14% CAGR over the last three years) as earnings have rebounded, and it even paid a special dividend in 2023 amid strong results.

Computacenter (UK)

Business: Computacenter is a British IT services provider, offering technology infrastructure, consulting, and outsourcing to large corporate and public-sector clients. It is one of Europe’s leading independent IT infrastructure service firms, advising organizations on everything from cloud services to managed IT support.

Dividend: Computacenter’s stock yields approximately 2.7%. The dividend payout ratio is around 45–50% of earnings, a comfortably sustainable level. Notably, the dividend has grown very fast – roughly 47% annualized over five years – thanks to strong profit growth and some special payouts. This high growth rate underscores how rapidly Computacenter has ramped up returns to shareholders in recent years.

Trigano (France)

Business: Trigano is a French manufacturer of recreational vehicles and camping gear. The company produces motorhomes, caravans, trailers, and related outdoor accessories under numerous brands across Europe. Trigano is a market leader in European motorhomes and benefits from the long-term popularity of camping and RV travel.

Dividend: Trigano’s dividend yield is about 2.7% at current share prices. The payout ratio is low – only around 20–30% of earnings – leaving plenty of room for reinvestment or future increases. Dividend growth has been strong: roughly 18% per year on average in recent history, although the company’s actual dividend payments have occasionally been uneven (with periodic special dividends in past years).

Interparfums (USA/France)

Business: Interparfums, Inc. produces and distributes prestige perfumes under licensing agreements with numerous luxury brands (e.g. Coach, Montblanc, Jimmy Choo). Headquartered in New York with operations in Paris, the company develops fragrances for fashion houses and sells them worldwide.

Dividend: Interparfums currently yields about 2.3%, with a dividend payout ratio near 60% of earnings. The company has a four-year streak of dividend increases; the most recent hike was roughly 13% (to an annualized $3.20 per share), reflecting a strong growth trajectory in its payouts.

New Wave Group (Sweden)

Business: New Wave Group AB is a Swedish conglomerate that designs, acquires, and develops consumer brands in the corporate promo, sports apparel, and home/giftware sectors. Its diverse portfolio ranges from promotional products (customizable workwear, pens, drinkware) to sports and leisure brands (like Craft and Cutter & Buck for athletic wear) and home furnishings (including the famous Orrefors Kosta Boda glassware line).

Dividend: New Wave Group’s dividend yield is around 3%. The company pays out roughly 50–52% of its earnings as dividends, a reasonable ratio that suggests the dividend is sustainable. Impressively, New Wave has delivered ~20% annual dividend growth in recent years, reflecting robust business expansion and a shareholder-friendly approach (the dividend has grown from 2.00 SEK to 3.50 SEK per share over the past few years).

Each of these seven companies combines a steady (and often growing) dividend with a unique business model, making them attractive income plays off the beaten path. While not household names, they demonstrate that strong dividends can be found beyond the usual blue-chip suspects – sometimes in very different industries and geographies – offering diversification for the dividend-focused investor.

What future there is for De Longhi? How long untill there is cheaper/better Chinese competitor?

Good post.