Disclaimer: The information provided in this publication is for educational and informational purposes only and does not constitute financial advice. The content is solely reflective of my personal views and opinions based on my research and is not intended to be used as a basis for investment decisions. While every effort is made to ensure that the information is accurate and up-to-date, the writer makes no representations as to the accuracy, completeness, suitability, or validity of any information in this post and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. All readers are advised to conduct their own independent research or consult a professional financial advisor before making any investment decisions. The author is not invested in the mentioned stock.

Systemair - A Long-Term Investment Deep Dive

Company Overview

Systemair AB is a leading global supplier of ventilation, heating, and cooling products and systems with a presence in 51 countries. Founded in 1974 by Gerald Engström (now Chairman), the Sweden-based company has grown from a pioneer of the circular in-line duct fan into one of Europe’s largest ventilation companies. Today Systemair operates 26 factories in 19 countries and encompasses about 90 subsidiaries, employing around 6,700 people worldwide. Its product range spans fans, air handling units, air distribution products, air-conditioning systems, and heating products, marketed under well-known brands including Systemair, Frico, Fantech, and Menerga. These products are used to provide energy-efficient HVAC (heating, ventilation, air conditioning) solutions for homes, commercial buildings, and industrial applications.

From the start, Systemair’s business model has emphasized simplicity and reliability in ventilation. The company often enters new markets by acquiring local distributors or manufacturers and integrating them into its global platform – a strategy that has steadily expanded its geographic reach over five decades.

As of 2025, Systemair boasts operations across Europe, North America, the Middle East, Asia, Africa, and Australia, exporting to over 135 countries. This broad footprint not only drives growth but also diversifies risk across regions. Notably, Systemair has reported an operating profit every year since its founding in 1974, an impressive record that speaks to the resilience of its business model.

Over the past 10 years, the company’s sales have grown at an average rate near 8–9% annually – solid if not spectacular growth, achieved through a combination of organic expansion and strategic acquisitions. This steady growth, coupled with a commitment to energy-efficient products that improve indoor air quality, aligns Systemair with long-term trends in sustainability and healthy buildings.

Latest Financials (FY 2024/25)

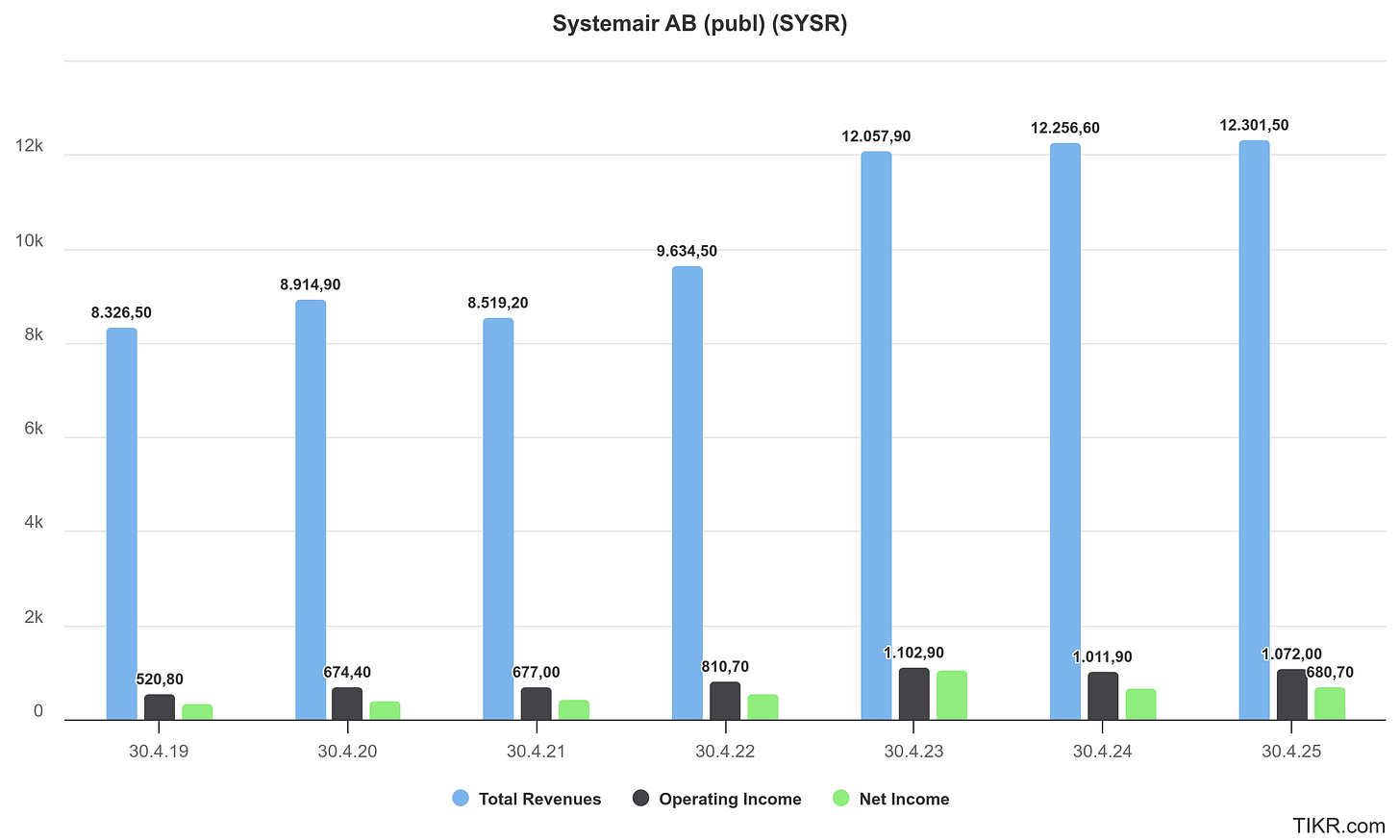

Systemair follows a fiscal year from May 1 to April 30. The latest results for the fiscal year 2024/25 (year ended April 30, 2025) show the company delivered modest growth with improving profitability. Net sales were SEK 12.30 billion, essentially flat (+0.4%) versus the prior year’s SEK 12.26 billion. Organic growth was slightly higher at +2.0%, but currency headwinds (a strong Swedish krona) dampened the reported top-line.

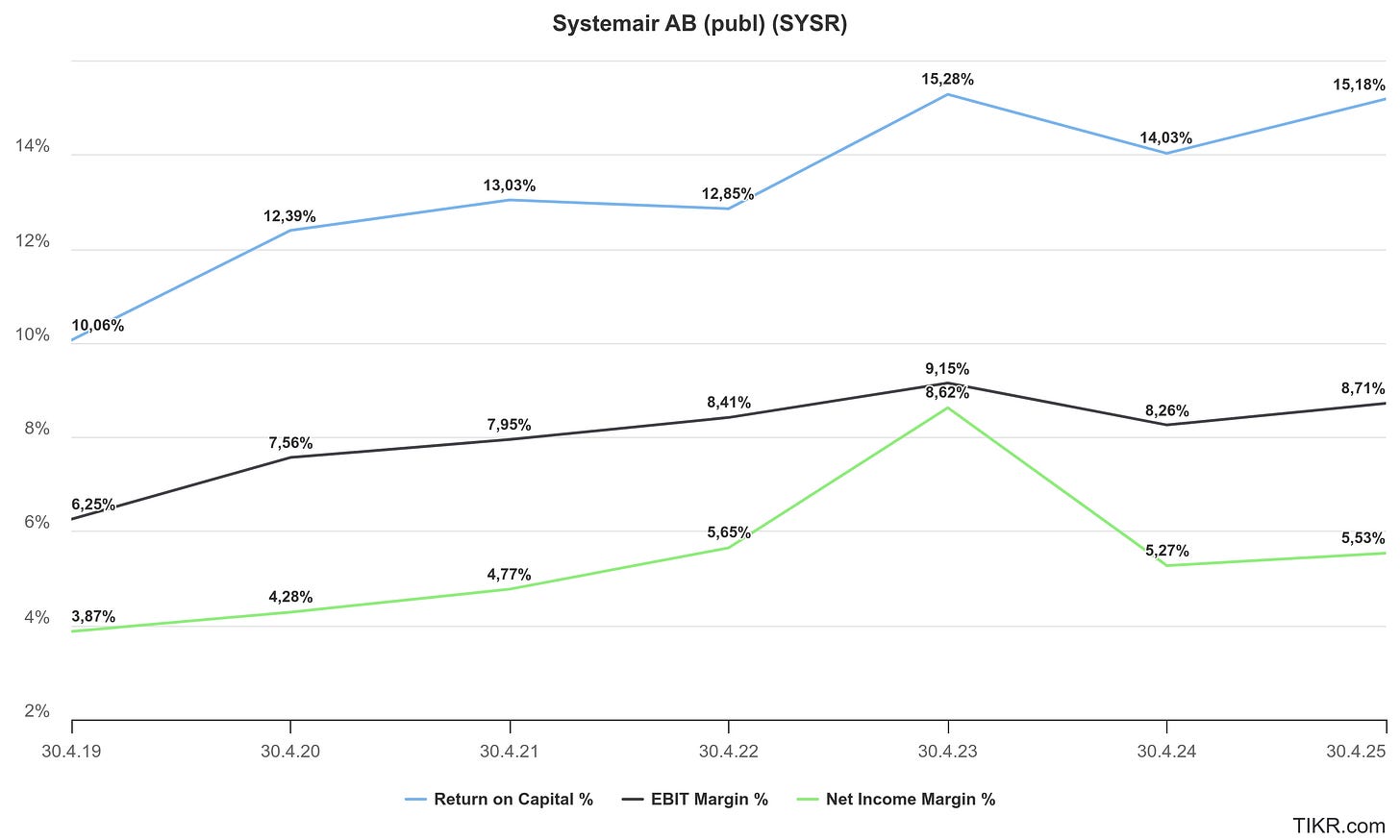

Despite the tepid revenue growth, operating profit (EBIT) increased to SEK 1,100 million, up 14% from SEK 963 million in FY 2023/24. The EBIT operating margin improved to 8.9% (from 7.9% the prior year) as gross margins benefited from better factory utilization, a favorable product mix, and cost savings. Net profit after tax came in at SEK 686 million, a 5% rise from SEK 654 million last year, yielding basic earnings per share of SEK 3.27 (vs 3.10).

In FY 2024/25, Systemair managed to slightly grow earnings despite essentially flat sales. The revenue stagnation was partly due to currency effects (-2% on sales) and some operational challenges – for example, a factory relocation in India and weaker demand in parts of Europe were headwinds. Nonetheless, gross margin improved to 36.5% in Q4 (up from 35.1%) thanks to cost efficiencies and a favorable product mix. For the full year, the company achieved organic sales growth in most regions except North America and Asia, with particularly good momentum in Eastern Europe (organically +11% in Q4). Meanwhile, operating expenses were kept in check – selling and admin costs rose ~5% organically, roughly in line with inflation.

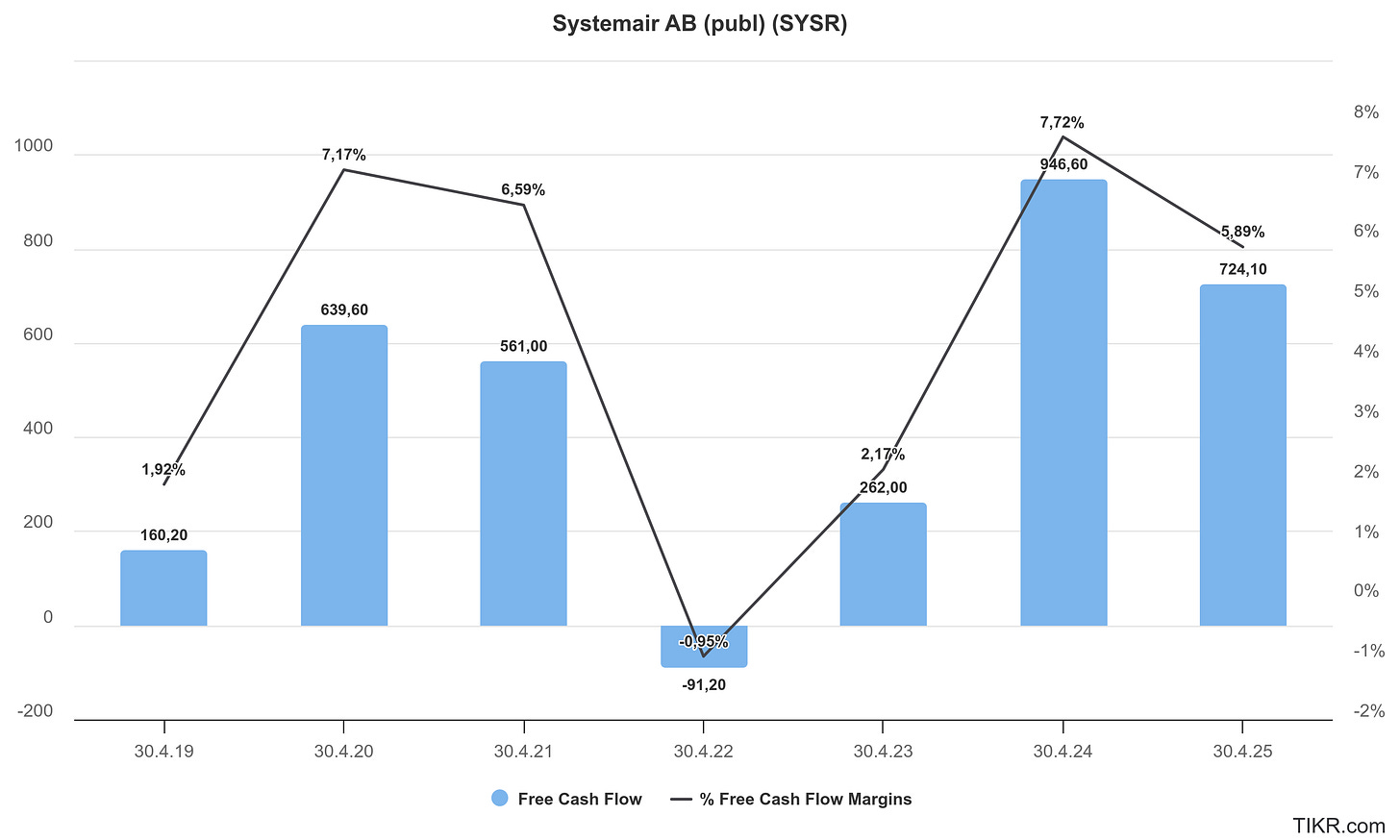

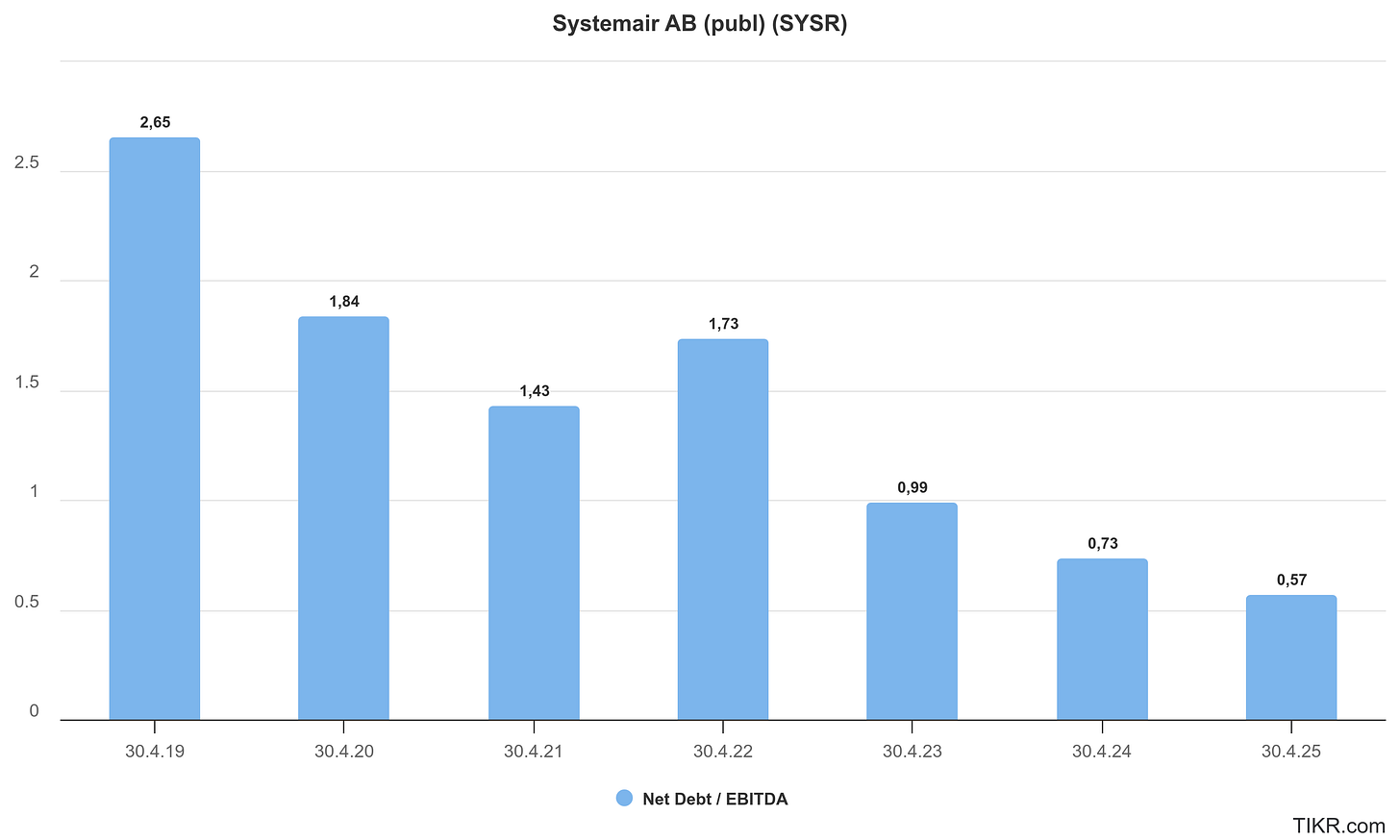

Importantly, Systemair’s cash flow and balance sheet remain healthy. Operating cash flow for 2024/25 was a solid SEK 1,080 million (though down from an unusually strong SEK 1,333m the year before). The company used its cash to reduce net debt: net indebtedness fell to SEK 901 million by April 2025 from SEK 1,070m a year prior, bringing the net debt/equity ratio down to 0.56. The equity/assets ratio stands at a robust 61.5%, reflecting a conservative financial position. In short, Systemair emerged from the 2024/25 fiscal year with little debt and ample financial flexibility, which is a notable advantage in a rising interest rate environment.

To put the latest year in perspective, note that FY 2023/24 had seen a dip in profit due to both macro headwinds and deliberate restructuring. That year, EBIT was hit by one-time costs (a SEK 125m plant relocation charge, etc.) and lacked the prior year’s large gain on a business sale. Consequently, net profit in 2023/24 fell to SEK 654m from a record SEK 1.045 billion in 2022/23. The huge 2022/23 profit was inflated by the divestiture of Systemair’s commercial air-conditioning division to Panasonic, which netted a 445m SEK gain. Excluding that, Systemair’s underlying earnings have been more consistent. The encouraging news for investors is that 2024/25 saw earnings recover closer to underlying trend levels. Adjusted EBIT reached SEK 1,125m (just above the adjusted EBIT of ~SEK 1,085m in 2023/24), indicating that profitability is back on an upward trajectory post-restructuring.

Management highlighted that even in a tough economic climate, the company achieved slight organic growth and improved margins, thanks to prior investments and efficiency efforts. CEO Roland Kasper noted Systemair is “well equipped for future growth in a more robust market” after making long-term investments in production capacity and product development during the year. Overall, FY 2024/25’s results paint a picture of a company that is weathering the current economic softness prudently, maintaining profitability and preparing for an eventual market rebound.

Business Model and Strategy

Systemair’s business model centers on designing, manufacturing, and distributing a comprehensive range of ventilation and indoor climate products. The company prides itself on having “the market’s most comprehensive product range” in ventilation equipment – from basic fans and ducts to large air handling units, heat exchangers, air curtains, and HVAC systems. Its products help circulate clean air, regulate temperatures, and improve indoor air quality in a variety of settings (commercial buildings, residential homes, industrial sites, hospitals, schools, etc.). Many of Systemair’s innovations focus on energy efficiency – for example, heat-recovery ventilation systems and low-energy fans – which address customers’ growing needs to reduce energy costs and meet sustainability goals. This focus aligns with global trends: building regulations are increasingly mandating better ventilation and energy performance, creating demand for the kinds of solutions Systemair provides.

A key element of Systemair’s model is its global network of subsidiaries. Rather than selling entirely through third-party distributors, Systemair has established its own sales offices or acquired local companies in dozens of countries. This gives the company direct access to local markets and customer relationships, while also allowing it to offer locally adapted products and support. At the same time, Systemair operates 26 production facilities across 19 countries to manufacture its goods closer to end markets. This decentralized manufacturing reduces shipping costs and currency risks, and enables faster delivery times. It also means Systemair can flex production across regions to respond to demand shifts.

The global footprint not only fuels growth but provides diversification: no single country or project dominates, and downturns in one region may be offset by strength elsewhere. (Europe is the largest region for Systemair, accounting for roughly 73% of sales, but the company has been expanding in North America, the Middle East, and Asia as well.)

Acquisitions have long been a growth lever for Systemair. The company has made numerous tuck-in acquisitions over the decades – from small local distributors to specialist manufacturers – to broaden its product lineup and enter new markets. For example, the acquisition of Germany’s Menerga in 2013 added high-end air handling systems to the portfolio, and the purchase of Canada’s Changeair brought expertise in school ventilation units.

More recently, in 2023 Systemair divested its commercial air-conditioning division to Panasonic for €100 million, choosing to focus on its core ventilation strengths. (That business, which made chillers and large AC units, was a relatively small part of the company; Panasonic’s scale made it a better owner for that segment.) Systemair still offers cooling products (like heat-pump based ventilation systems and smaller AC units), but the divestiture illustrates management’s discipline in refocusing on areas where Systemair can maintain a competitive edge. The proceeds from that sale helped fortify the balance sheet and can be reinvested into ventilation and air-quality solutions where growth prospects are strongest.

Another strategic pillar is continuous innovation and efficiency. Systemair reinvests a significant share of its profits into product development, automation, and sustainability initiatives. The goal is twofold: to keep its product offering technologically up-to-date (e.g. quieter fans, smart ventilation controls, energy-saving heat exchangers), and to lower production costs to protect margins. The company’s business concept emphasizes relatively standardized, modular products that are easy to install and maintain. This simplicity appeals to contractors and building owners, and also streamlines manufacturing. In effect, Systemair aims to be the cost-efficient producer with a broad catalog – a one-stop-shop for ventilation needs, especially in non-residential construction.

Finally, Systemair’s corporate culture and organization support its business model by being decentralized yet cohesive. Local subsidiaries retain close contact with customers (offering support and service), while headquarters in Skinnskatteberg, Sweden provides group-wide coordination, R&D, and financial control. The long-term presence of founder Gerald Engström (who led the company as CEO for decades and remains Chairman) has provided continuity in vision. As a result, Systemair has managed to integrate many acquisitions without losing operational focus. The company’s AAA credit rating attests to its financial stability and prudent management. All these factors contribute to a business model that has delivered stable growth and profitability over the long run.

Key financials

Strengths and Competitive Advantages

Resilient Track Record: Systemair’s most striking strength is its consistency – it has never had a year of operating loss in over 50 years of existence. Through multiple economic cycles, the company remained profitable, underscoring resilient demand for its ventilation products and solid execution by management. Even during downturns or spikes in input costs, Systemair managed to stay in the black, which speaks to effective cost control and the non-discretionary nature of many of its products (ventilation is often required by building codes). This track record inspires confidence that the company can navigate future challenges while protecting shareholders’ capital.

Leading Market Position: Systemair is Europe’s largest supplier of ventilation products, with an extensive product range and well-known brands. Scale matters in this industry – a broad catalog and large distribution network make Systemair a preferred partner for contractors tackling complex HVAC projects. The company’s ability to offer “everything under one roof” (fans, ducts, air handling units, heaters, chillers, etc.) can simplify procurement for customers and gives Systemair cross-selling opportunities. Its market leadership also affords some pricing power and brand recognition, which new entrants would struggle to match. Furthermore, Systemair’s presence in 50+ countries and diversified customer base reduce its reliance on any single market or project. This geographical spread, coupled with 26 production sites, provides flexibility and reduces risk (for instance, a slump in one region can be offset by growth elsewhere).

Secular Growth Drivers: The long-term outlook for ventilation and energy-efficient HVAC is robust, driven by global trends that play directly into Systemair’s wheelhouse. Energy efficiency and climate regulations are a major tailwind – millions of buildings (especially in Europe) will require upgraded ventilation and heating systems to meet stricter standards and sustainability goals by 2030. Governments in the EU, US, and Asia are rolling out programs to improve indoor air quality and reduce carbon footprints, which often involve installing modern ventilation systems and heat pumps. Additionally, heightened awareness of indoor air quality (partly a legacy of the COVID-19 era and greater focus on health) is driving demand for better ventilation in offices, schools, and public spaces. Systemair’s energy-efficient product line is well positioned to benefit from these trends, as its solutions help customers cut energy use and comply with regulations (e.g. many Systemair products carry energy labels and use eco-friendly refrigerants). In short, sustainability is a catalyst for Systemair – the more emphasis on green buildings and climate control, the more opportunities for the company.

Financial Strength: Unlike some industrial peers, Systemair carries relatively low debt and has a strong balance sheet. Its net debt/EBITDA is modest, and it holds an “AAA” credit rating – the highest grade, reflecting excellent solvency. The equity ratio is over 60%, indicating the business is predominantly equity-financed. This conservative financial posture gives Systemair stability and flexibility. It can invest through downturns, pursue acquisitions opportunistically, and comfortably finance its dividend. In the current environment of rising interest rates, Systemair’s low borrowing needs are a competitive advantage (interest expenses were only SEK 72m in 2024/25, a small fraction of operating profit). This financial strength also means the company is well equipped to handle working capital swings as it grows.

Commitment to Innovation and Quality: Systemair has a reputation for reliable, no-frills products that “just work” – an important strength in the HVAC industry, where failure can be critical. Its products often win points for ease of installation and durability. The company invests continually in R&D to improve performance and efficiency. For example, Systemair has been a pioneer in adopting EC motor technology for fans (which greatly reduces electricity consumption) and in developing heat recovery units that significantly cut energy waste. The focus on energy-efficient designs not only meets regulatory demands but also provides a marketing edge as customers increasingly prioritize lifecycle cost savings. Additionally, Systemair’s global manufacturing means it can incorporate local quality standards and innovations from different markets into its product development. The company’s diversification into related areas (like specialized climate systems for pools via Menerga, or radiant heaters via Frico) shows an ability to broaden its know-how and cross-pollinate innovation across its brands.

Experienced Management and Ownership: While the CEO role is currently in transition (discussed below), Systemair has enjoyed stable leadership for decades. Many senior managers have long tenures, and the Engström family (through Gerald Engström) remains a significant shareholder, aligning the company’s strategy with long-term value creation. Under departing CEO Roland Kasper’s decade of leadership, Systemair doubled its turnover and improved profitability via organic and acquisitive growth. The company also undertook restructurings (like consolidating production in some regions) to streamline operations. This experience and continuity at the helm have contributed to Systemair’s steady course. Even as new leadership comes in, the presence of the founder as Chairman and a seasoned board (which recently proposed Patrik Nolåker, a veteran industrial executive, as new Chairman) should ensure the company’s strategic strengths – like focus on core ventilation and cautious expansion – are maintained.

Weaknesses and Risks

Despite its many strengths, Systemair faces several challenges and inherent weaknesses that investors should consider:

Slow Growth in Recent Years: While Systemair has a long-term growth trend around ~8-10%, the pace has slowed lately. Organic growth was only +2% in FY 2024/25, and reported sales were almost flat. In fact, revenue has basically stagnated over the past two fiscal years (SEK 12.3bn in 2024/25 vs SEK 12.26bn in 2022/23). This is partly due to external factors – a weaker construction market in Europe and currency headwinds – but it highlights that Systemair is not immune to economic cycles. A large portion of its sales is tied to non-residential construction and renovation projects; when these markets soften (as they have with higher interest rates and economic uncertainty), Systemair’s growth can stall. The company’s own financial target is to average 10% annual growth over a business cycle, so recent performance falls short of that goal. If growth does not reaccelerate (through either market recovery or acquisitions), it could weigh on investor sentiment. The heavy dependence on Europe (about 70–75% of sales) is a related risk – the region’s economic growth is sluggish, and factors like the war in Ukraine and high energy costs have dampened construction activity in some European markets.

Cyclical and Macro-Sensitive Demand: Demand for HVAC equipment, especially in commercial segments, tends to be cyclical. During economic downturns or periods of suppressed capital spending, building owners may postpone or scale down ventilation projects. Systemair felt this in parts of its business – for example, its North American sales dipped in the last year amid a cooling construction environment. If a broader recession hits or if high interest rates significantly curtail construction/renovation, Systemair’s orders could be delayed or canceled. The company does not typically disclose a long-term order backlog that could buffer short-term slowdowns, and its products (though necessary in the long run) can see timing delays in procurement. Additionally, Systemair’s exposure to industrial and commercial projects (e.g. office buildings, shopping centers) means it is indirectly exposed to sectors like commercial real estate, which currently faces headwinds (e.g., lower office occupancy may reduce new HVAC installations). In short, Systemair’s revenues can ebb and flow with the investment cycle in construction and real estate, which is a risk outside its control.

Margin Pressure and Target Shortfall: Systemair’s profitability, while solid, remains slightly below its long-term target and below some peers’ margins. The company aims for a 10% operating margin over a cycle, but delivered 8.9% in 2024/25 and averaged in the high single digits in recent years. In a booming year like 2021/22, the margin exceeded 11%, but that was boosted by a one-time gain. The core business margins have been in the 8-9% range, indicating there is room for improvement. Cost pressures could pose a risk – Systemair’s products use a lot of steel, aluminum, and electronics (motors, controls). Volatile commodity prices or supply chain disruptions (like we saw globally in 2021-2022) can squeeze gross margins if the company cannot pass on costs immediately. Moreover, wage inflation in its manufacturing locations could raise operating expenses. Systemair has implemented price increases and efficiency measures, but in competitive tenders it may face limits on pricing power. The risk is that if input costs rise faster than Systemair can adjust pricing, margins could be crimped. Another aspect is scale vs. giants: while Systemair is large in ventilation, it’s smaller than global HVAC conglomerates (like Carrier, Daikin, etc.). Those giants might enjoy better purchasing power for components and larger R&D budgets, potentially pressuring midsize players like Systemair in the future.

Heavy Acquisition Reliance: Much of Systemair’s historical growth has come from acquisitions. While this has expanded the company, it also brings risks. Integrating acquired companies (many of which are in different countries with their own corporate cultures) can be challenging. There’s always a possibility of an acquisition not performing as expected or cultural clashes leading to loss of key employees or customers. Additionally, acquisitions can distract management and tie up capital. Systemair has been generally successful with past deals, but as it continues to acquire, the complexity of managing a portfolio of 90+ entities increases. There is also execution risk in the ongoing restructuring of acquired units – for example, Systemair recently relocated production for its Menerga subsidiary from Germany to Slovenia to cut costs. That restructuring incurred significant one-time costs and presumably some temporary disruption. If such initiatives don’t yield anticipated savings or if new acquisitions underperform, Systemair’s growth and earnings could be impacted. In short, the strategy of growth via acquisition carries integration risk and can inflate goodwill on the balance sheet (which could lead to future impairment charges if those acquired units falter).

Leadership Transition: In April 2025, Systemair announced that CEO Roland Kasper would step down after ten years at the helm. A search for a new CEO is underway, and Kasper will remain until a successor is appointed. While Systemair’s broader strategy is unlikely to change drastically (given the Chairman/founder’s ongoing influence), a change in top leadership does introduce some uncertainty. The new CEO may have a different approach to expansion, cost management, or portfolio focus. Changes at the top can also be unsettling for employees in the short term. Moreover, at the same time, the Board of Directors is seeing change – a new Chairman (Patrik Nolåker) has been proposed to take over from Engström. This simultaneous refresh of CEO and Chair means a significant shift in governance. For investors, leadership transitions pose the risk of strategic shifts or execution hiccups in the near term. Until the new CEO’s vision and capabilities are clear, this remains an uncertainty.

The valuation stock list is now available. You can find it here:

Get an information edge with our ever-evolving dashboard of proprietary intrinsic-value estimates and Quality Scores across a broad universe of equities.

Why it matters

Actionable numbers, not hype. Every fair-value range is built from my in-house DCF and comparable-multiple models, so you can see at a glance where price diverges from worth.

Breadth and depth. You’ll find every company featured in my deep-dive Substack articles — plus a growing roster of great names I’m tracking privately.

Always up to date. Valuations are reviewed at least once a year (often sooner when fundamentals shift), new tickers are added as ideas surface, and low-conviction names are removed.

Plus, you will have full access to all the deep dives and additional valuable content!

Keep reading with a 7-day free trial

Subscribe to Kroker Equity Research to keep reading this post and get 7 days of free access to the full post archives.