Disclaimer: The information provided in this publication is for educational and informational purposes only and does not constitute financial advice. The content is solely reflective of my personal views and opinions based on my research and is not intended to be used as a basis for investment decisions. While every effort is made to ensure that the information is accurate and up-to-date, the writer makes no representations as to the accuracy, completeness, suitability, or validity of any information in this post and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. All readers are advised to conduct their own independent research or consult a professional financial advisor before making any investment decisions. The author is not invested in the mentioned stock.

Computacenter: A Steady Tech Services Provider

Company Overview

Computacenter plc is a British multinational IT services company that provides technology infrastructure solutions to both public- and private-sector customers. Founded in 1981 and headquartered in Hatfield, UK, Computacenter has grown into a leading independent technology partner for large corporate and government clients. The company helps organizations Source, Transform, and Manage their IT infrastructure – from procuring hardware and software to implementing systems and providing ongoing support and managed services. Computacenter is listed on the London Stock Exchange (ticker: CCC) and is a constituent of the FTSE 250 Index. Today it operates globally with over 20,000 employees across Europe, North America, and other regions, positioning itself as a trusted IT adviser and outsourcing partner for many large enterprises.

Latest Financial Performance (FY2024 and Q1 2025)

FY2024 Results: In its most recent full-year results (for the year ended Dec 31, 2024), Computacenter delivered a “solid performance” despite a challenging first half. Revenue for 2024 was £6.96 billion, a modest increase of 0.6% from £6.92 billion in 2023. However, pretax profit declined about 10% year-on-year to £244.6 million (from £272.1 million in 2023), reflecting tighter margins and higher costs. The first half of 2024 faced tough comparisons and weaker market demand, but the company saw a strong rebound in H2 – in fact, the second half of 2024 was the most profitable in Computacenter’s history. CEO Mike Norris noted that North America achieved “another record year” and Germany performed robustly, offsetting softer market conditions in the UK. Strong cash generation enabled continued investment and shareholder returns, including completion of a £200 million share buyback during the year. Computacenter maintained its final dividend at 47.4 pence, bringing the total dividend for 2024 to 70.7 pence per share – a 1% increase over last year.

Q1 2025 Update: The momentum from late 2024 has carried into early 2025. In a trading update for Q1 2025 (quarter to March 31), management reported a “good performance…ahead of the prior year and in line with our expectations.” Although detailed figures weren’t disclosed, the company highlighted that Group Technology Sourcing (product resale) revenue grew strongly year-on-year (helped by an easier comparison and strong demand in North America), while Group Services revenue was slightly up, driven by growth in professional services even as managed services saw a slight decline. Regionally, North America continued its strong growth (helped by a large order backlog from 2024), the UK showed “excellent growth” in professional services, and Germany delivered solid results despite a temporarily weaker public sector market following local elections.

Outlook from Q1: By the end of Q1 2025, Computacenter’s order backlog for products remained “healthy, comfortably exceeding” the backlog of the prior year. The company acknowledges increased macroeconomic and geopolitical uncertainty, which makes customer demand harder to predict, but notes it has no direct exposure to trade tariffs and serves local markets locally. Management remains mindful but optimistic – after an encouraging start to 2025, they expect to “make progress for the year as a whole in constant currency” and continue gaining market share. In other words, 2025 is forecasted to show growth in revenue and earnings, with an extra boost to EPS from the reduced share count after the buybacks.

Key financials

Business Model and Strategy

Computacenter’s business model centers on providing end-to-end IT infrastructure services through three core service lines:

Technology Sourcing (TS): This is the procurement and delivery of IT hardware, software, and related services (historically referred to as supply chain or product reselling). Computacenter works with thousands of technology vendors to help customers source the right equipment and software licenses. This segment generates the majority of the company’s revenue (around 60% of total revenues in 2022), but typically at lower margins. It leverages Computacenter’s scale and supplier relationships to fulfill large-volume orders of PCs, servers, networking gear, cloud licenses, etc., often as part of wider IT projects.

Professional Services (PS): This includes consulting, integration, and project-based services to design and implement technology solutions. Computacenter’s professional services teams assist clients with IT architecture, deployment/migration projects, and other technical consulting to “transform” their IT infrastructure. This is a higher-margin segment (about 23% of revenue in 2022) and has been growing nicely – for example, in 2024 professional services revenue grew nearly 12% in constant currency, outpacing the market. These services often complement the product sourcing business (e.g. installing what TS sells).

Managed Services (MS): Ongoing IT outsourcing and support services fall in this bucket. Computacenter takes over the management of clients’ IT operations (such as service desk support, data center management, cloud operations, maintenance, and IT outsourcing contracts). Managed Services provide steady, recurring revenue (roughly 17% of 2022 revenue) through multi-year contracts. This business leverages Computacenter’s international service centers and support hubs (the company has major service centers in the UK, Germany, Spain, South Africa, etc. to support global clients). Managed Services margins are generally in between TS and PS, but performance can depend on efficient delivery and avoiding problem contracts.

These three service lines are integrated to offer full lifecycle support: Computacenter can sell a client the equipment, deploy and integrate it, then manage it on an ongoing basis. This one-stop-shop model aims to make Computacenter a strategic partner for large organizations’ digital transformation initiatives. The company’s customer base spans many industries and the public sector, and it focuses on large accounts – as of 2024, Computacenter had 192 major customers generating over £1 million in gross profit annually, an increase from 179 such clients in 2023. Geographically, the business is well diversified: originally UK-focused, Computacenter now earns significant revenue in Germany (where it has been established since the 1990s) and North America, which has become a high-growth region for the group after a series of acquisitions and new contract wins (North America delivered record revenues and profit in 2024). This global footprint allows Computacenter to service multinational clients and pursue growth opportunities outside its maturing European core markets.

Strengths and Weaknesses of the Business

Every company has its competitive advantages as well as challenges. Below is a summary of Computacenter’s key strengths and weaknesses:

Strengths:

Established Market Position: Computacenter is a leading player in IT infrastructure services in Europe, with over four decades in business. It is trusted by many large enterprises and government agencies, thanks to a track record of reliable delivery. The company’s inclusion in the FTSE 250 and long-term relationships with blue-chip clients attest to its stability and reputation.

Balanced Business Mix: The combination of product resale (Technology Sourcing) and higher-value services (professional and managed) provides a balanced revenue stream. Hardware and software reselling drives volume (and often acts as an entry point to clients), while services drive margin and long-term client retention. This mix helped Computacenter navigate market cycles – for instance, when product demand was soft in early 2024, growth in professional services helped compensate.

Global Reach with Local Delivery: Computacenter operates in 70+ countries (through its own operations or partners) and can service clients globally, but it maintains a “local supply for local demand” approach (i.e. serving each region with local resources). This reduces exposure to cross-border tariffs or trade frictions, and allows tailored support for clients in each market. Its key regions – UK, Germany, France, and expanding presence in the US – provide a diversified geographic footprint so the company isn’t reliant on a single economy.

Strong Customer Base & Backlog: The firm has a broad, sticky customer base, increasingly with large recurring engagements. As noted, the number of major £1m+ customers reached 192 in 2024. Moreover, Computacenter entered 2025 with a record order backlog for product sales, up 116% year-on-year as of Dec 2024. This hefty backlog (especially from North America hyperscale clients) gives good revenue visibility for the near term and suggests it is gaining market share in product deals.

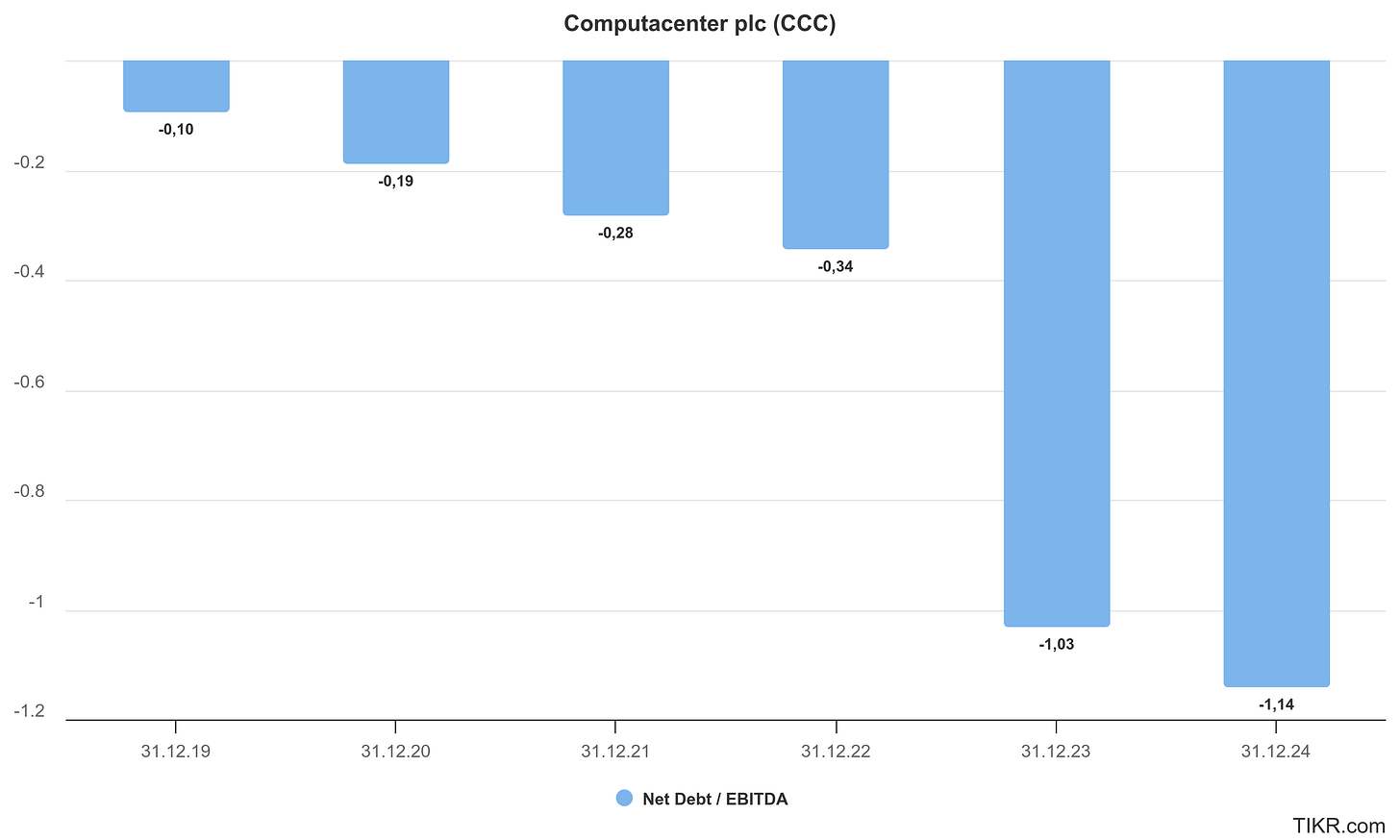

Robust Balance Sheet and Cash Generation: Unlike many IT services peers, Computacenter carries net cash rather than net debt. Even after completing a £200 million share buyback in 2024, the company had £482.2 million in net funds at year-end. Operating cash flow is consistently strong (2024 saw £417m net cash from operations), thanks to efficient working capital management and the services business’s cash generation. This financial strength gives management flexibility to invest in new capabilities, pursue acquisitions, or return cash to shareholders – “nearly £1 billion” has been returned to investors since 2013 while still growing the business.

Shareholder-Friendly Strategy: Computacenter has a track record of increasing dividends and executing share buybacks (more on this in the next section). For long-term investors, the company’s commitment to returning surplus cash (while maintaining a “strong balance sheet” and investing in growth) is an attractive trait, indicating disciplined capital allocation.

Weaknesses:

Low-Margin Core Business: A large portion of Computacenter’s revenue comes from reselling technology products, a business with thin gross margins (overall gross margin was ~14.9% in 2024). While this drives volume, it limits profitability – any mis-execution or shift in vendor terms can squeeze margins further. The reliance on big hardware/software deals means the business can sometimes be “flattered” by one-off transactions; for example, historically a large software license sale one quarter could boost revenue but not recur. Maintaining profitability requires tight cost control and high efficiency in logistics.

Cyclical IT Spending & Macroeconomic Sensitivity: Computacenter’s fortunes are tied to enterprise IT investment cycles. In economic downturns or when companies tighten capital spending, product sales and project work can slow down significantly. The company experienced this in parts of 2023/24, when a “more challenging IT market” and macro uncertainty hit demand. Management has warned that global economic and political uncertainty makes forecasting customer demand difficult. In a severe recession, corporations and governments might delay large IT projects or seek to renegotiate service contracts, which would impact Computacenter’s growth.

Recent Underperformance in Key Areas: Despite overall stability, certain segments have struggled. In FY2024, the UK business had “disappointing results” – UK revenue fell 4.6% year-on-year (from £1.21bn to £1.16bn) due to weaker-than-expected demand for hardware. The German segment’s revenue also dipped ~2%, impacted by a large underperforming Managed Services contract. Moreover, across the group, the Managed Services division saw a 5.3% revenue decline in 2024, partly due to delays in onboarding new contracts and a couple of major contracts in the UK and Germany that underperformed. These issues highlight execution risks – a single troubled services contract can drag on margins and growth. It’s crucial for Computacenter to iron out such problems (which management says they are addressing going forward).

Competitive and Fragmented Market: The IT services industry is highly competitive. Computacenter competes with global IT outsourcers (like IBM, DXC, Atos), cloud service providers, as well as a host of local value-added resellers and systems integrators. Winning new enterprise deals often requires aggressive pricing or significant upfront investment. There’s a risk of margin pressure if competition intensifies, especially in the product resell arena where customers can shop around. Additionally, technology vendors could choose to sell more directly or consolidate channels, which would threaten middleman distributors like Computacenter.

Technological Change and Adaptation: The tech industry evolves rapidly (cloud computing, AI, cybersecurity, etc.), and Computacenter must continually update its offerings. The company’s ability to remain relevant depends on investing in new capabilities (it spent £36.8m on internal investments in 2024 to improve skills and productivity). If it misses a major tech trend or fails to build expertise in new areas (for example, AI infrastructure or advanced cybersecurity), it could lose out on growth opportunities. Likewise, the shift to cloud and “as-a-service” models means customers might buy less physical infrastructure over time – Computacenter will need to capture new types of demand to compensate.

In summary, Computacenter’s strengths lie in its scale, trusted relationships, and solid financial foundation, but it faces the typical challenges of an IT services firm: low margins on commodity sales, dependence on client IT budgets, and execution risks in complex service delivery.

Keep reading with a 7-day free trial

Subscribe to Kroker Equity Research to keep reading this post and get 7 days of free access to the full post archives.