Disclaimer: The information provided in this publication is for educational and informational purposes only and does not constitute financial advice. The content is solely reflective of my personal views and opinions based on my research and is not intended to be used as a basis for investment decisions. While every effort is made to ensure that the information is accurate and up-to-date, the writer makes no representations as to the accuracy, completeness, suitability, or validity of any information in this post and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. All readers are advised to conduct their own independent research or consult a professional financial advisor before making any investment decisions. The author is not invested in the mentioned stock.

*Affiliate link – Get 15% off Fiscal.ai (formerly Finchat)

Faes Farma: A Spanish Pharma with Steady Growth and Ambitious Plans

Faes Farma is a 90-year-old Spanish pharmaceutical company that has evolved into a global player in healthcare. For long-term investors, Faes Farma offers a mix of steady core business performance and strategic growth initiatives. In this post, we'll cover a general overview of the company, its latest financial results (up to 2024 and Q1 2025), a deep dive into its business model with strengths and weaknesses, its shareholder returns (dividends and buybacks), current stock valuation, as well as the bullish and bearish cases for the stock. We’ll conclude with the outlook and what it all means for long-term investors.

General Description

Faes Farma (BME: FAE) is one of the leading Spanish pharmaceutical groups, engaged in the research, development, manufacturing, and marketing of health products. The company operates two main business lines: (1) Pharmaceutical & Healthcare products (human medicines, including prescription and over-the-counter drugs, plus health supplements) and (2) Animal Health and Nutrition (branded as "FARM Faes"). This dual structure means Faes Farma produces everything from allergy pills and gastrointestinal treatments to veterinary feeds. Over its long history (founded in 1933), Faes Farma has expanded well beyond Spain – today it has a presence in over 5 continents and 130+ countries through direct operations or licensing agreements.

The company's human pharma portfolio includes both innovative branded drugs and generics/OTC products, targeting therapeutic areas like allergy (antihistamines), metabolic and bone health (vitamin D analogs), gastrointestinal diseases, and more. A flagship product is Bilastine (brand name Bilastan/Bilaxten), an antihistamine developed in-house and now licensed internationally. Another key product is Calcifediol (Hidroferol), a vitamin D derivative for osteoporosis, which is a top-seller in Spain. Faes Farma also develops raw pharmaceutical materials (APIs) and has built expertise in niche areas like immunology and rare diseases. On the animal side, the company produces feed and nutrition products for livestock and pets.

Geographically, Faes Farma earns revenue from a balanced mix of domestic and international markets. About half of revenue comes from Spain and Portugal (its home markets), while the rest comes from Latin America, Africa/Middle East, and other regions via subsidiaries and distributors. Additionally, a significant portion (roughly 20% of sales) comes from licensing its products globally, where partners sell Faes’s drugs (especially Bilastine) in markets like Japan, Canada, and parts of Europe/Asia. This provides a stream of royalty and milestone income. Overall, Faes Farma’s business model can be described as a diversified pharma model – combining its own R&D-driven products, international expansion, and a stable animal health segment. This diversity helps smooth out risks and adds multiple growth levers.

Recent Financials (2024 & Q1 2025)

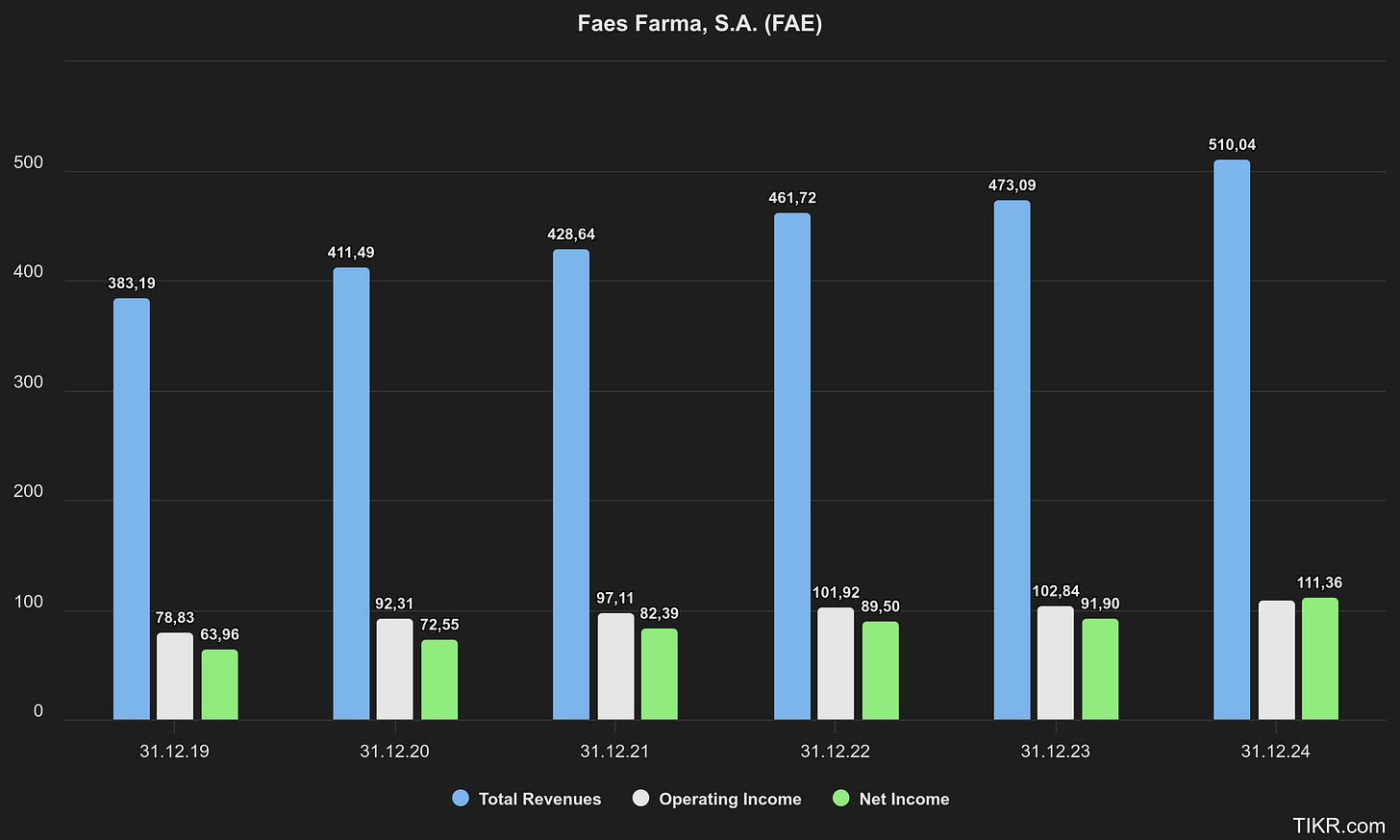

Full-Year 2024: Faes Farma delivered a strong performance in 2024, achieving its highest results ever. Revenue reached €510.0 million, up +7.8% from 2023. This was driven by healthy growth in the core Pharma business (particularly in Spain and international subsidiaries) and solid licensing income. Notably, the pharmaceutical business in Spain grew well, and there was progress in Latin America, plus positive trends in royalties from partners. EBITDA came in at €128.9 million (+5.5% YoY), reflecting a robust operating margin in the mid-20s. Net profit attributable to the parent surged to €111.4 million, a +21% increase over 2023. However, it’s worth noting this jump in net income was partly due to a one-time tax benefit. Excluding a special tax deduction related to a new plant in Derio, underlying net profit growth was about +3%. In other words, the core profit growth was steady but not as dramatic as the headline figure. Even so, 2024’s net profit was a record high.

In terms of segments, we can glean that human pharma sales made up the bulk of revenue, while the smaller Animal Nutrition segment was roughly €52 million (flat year-on-year). Within human pharma, Spain contributed €174.5M and international (ex-license) €179.5M, with an additional €103.8M from license royalties. This balanced mix shows both areas are growing. The top three molecules (Calcifediol, Bilastine, Mesalazine) collectively generated ~€200M in income and grew ~8.5% on average. Faes Farma also finished some heavy capital investments in 2024 – notably opening a new pharmaceutical plant in Derio (Spain) and an animal nutrition plant (ISF) in Huesca. With these investments completed, the company’s cash flow improved and it even paid its entire dividend out of cash flow in 2024.

Q1 2025: The momentum in sales continued into early 2025. In the first quarter of 2025, Faes Farma’s total income was €153.0 million, up +9.7% from €139.4M in Q1 2024. This nearly double-digit growth was driven by strong pharma sales (+11% YoY for product sales) across Spain and international markets. However, net profit for Q1 2025 was €28.4 million, down –6.8% from €30.5M in the prior-year quarter. The decline in quarterly profit was anticipated by management and was due to increased operating costs and some one-off factors. As mentioned earlier, Faes hired more staff (expanding its commercial team in new markets) and incurred temporary parallel costs as it shifted production to the new Derio plant, which squeezed margins in Q1. EBITDA for Q1 fell about 4% YoY (but on an adjusted basis, excluding the “Derio” transition costs, it was up ~3%). In short, Q1 showed strong revenue growth but weaker profitability – a trade-off of investing in growth initiatives.

Management Guidance: Despite the soft patch in margin, Faes Farma reaffirmed its outlook for full-year 2025. The company guides for continued solid sales growth of around +8% to +10% for 2025, but expects reported EBITDA to decrease mid-single-digits due to integration and setup costs (when excluding those one-offs, underlying EBITDA is expected to rise low-single-digits). This guidance aligns with what we saw in Q1. Investors should see 2025 as a “investment year” – short-term earnings may be flat or slightly down, but these expenditures set the stage for future growth. Notably, the completion of acquisitions (Edol in mid-2025 and SIFI likely by Q3 2025) isn’t fully reflected yet in guidance, so there could be an uplift once those businesses start contributing (likely in late 2025 and definitely in 2026).

Key financials

Strenghs and Weaknesses

Strengths:

Diversified Revenue Streams: Faes Farma generates income from human pharmaceuticals in many regions (Spain, LATAM, EU, Asia) as well as from animal nutrition. No single country or segment dominates. In 2024, international pharma sales (excluding licenses) grew +13% to €179.5 M, roughly on par with Spain pharma €174.5 M. Licensing income contributed over €100 M, giving an extra high-margin boost. This diversification makes the company less vulnerable to any one market’s regulation or demand swings.

Proprietary Products & R&D Success: Unlike many small pharma companies, Faes has successfully developed its own drugs. Bilastine, for example, is a second-generation antihistamine discovered by Faes and is now sold in over 100 countries via licensing. Calcifediol (a vitamin D analog) is another proprietary product dominating its niche in Spain. These products provide steady cash flows and demonstrate Faes Farma’s R&D capabilities. The company continues to invest in R&D, with a pipeline including new formulations (e.g. weekly-dose calcifediol approved in 19 European countries) and gastrointestinal drugs in clinical trials. This pipeline, while not massive, suggests potential future growth drivers.

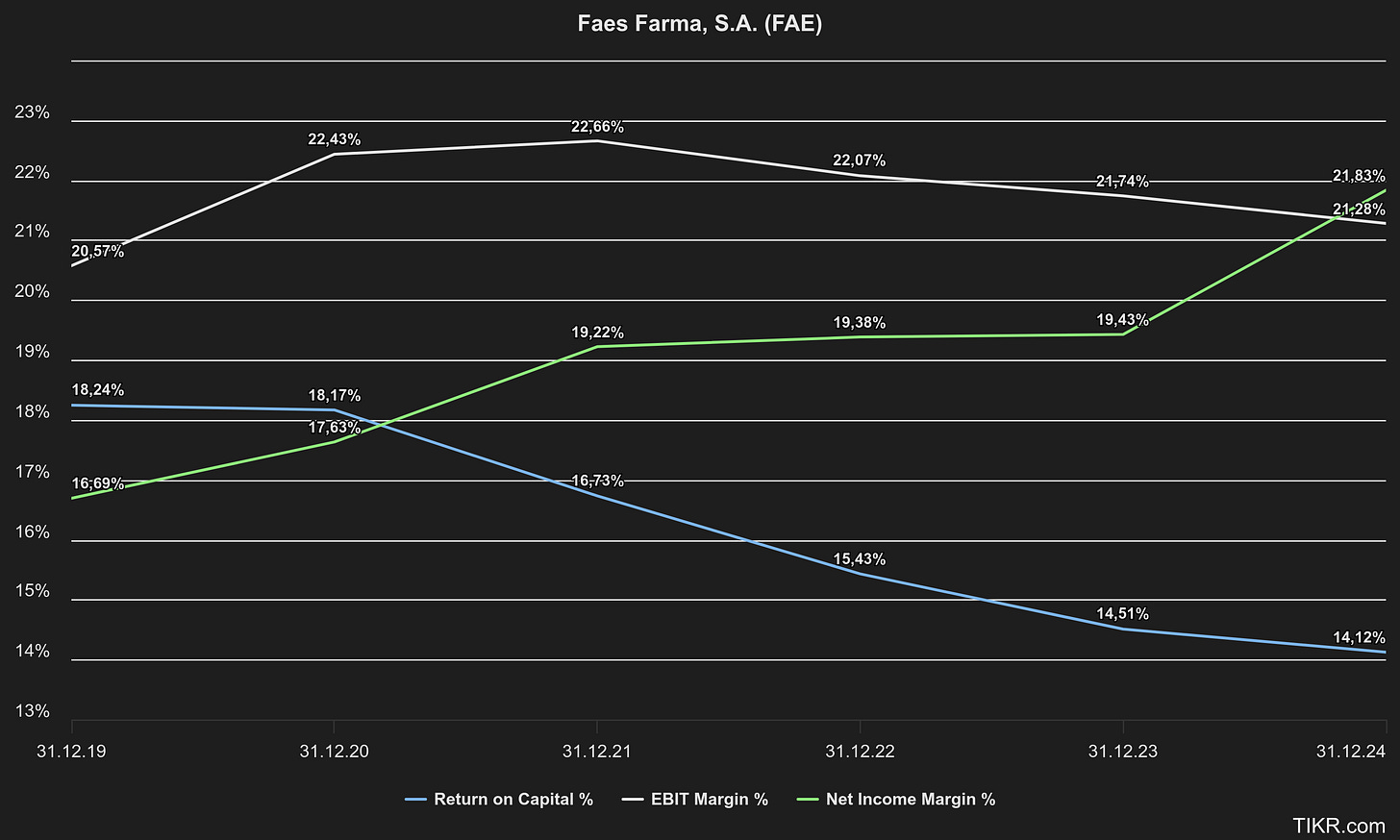

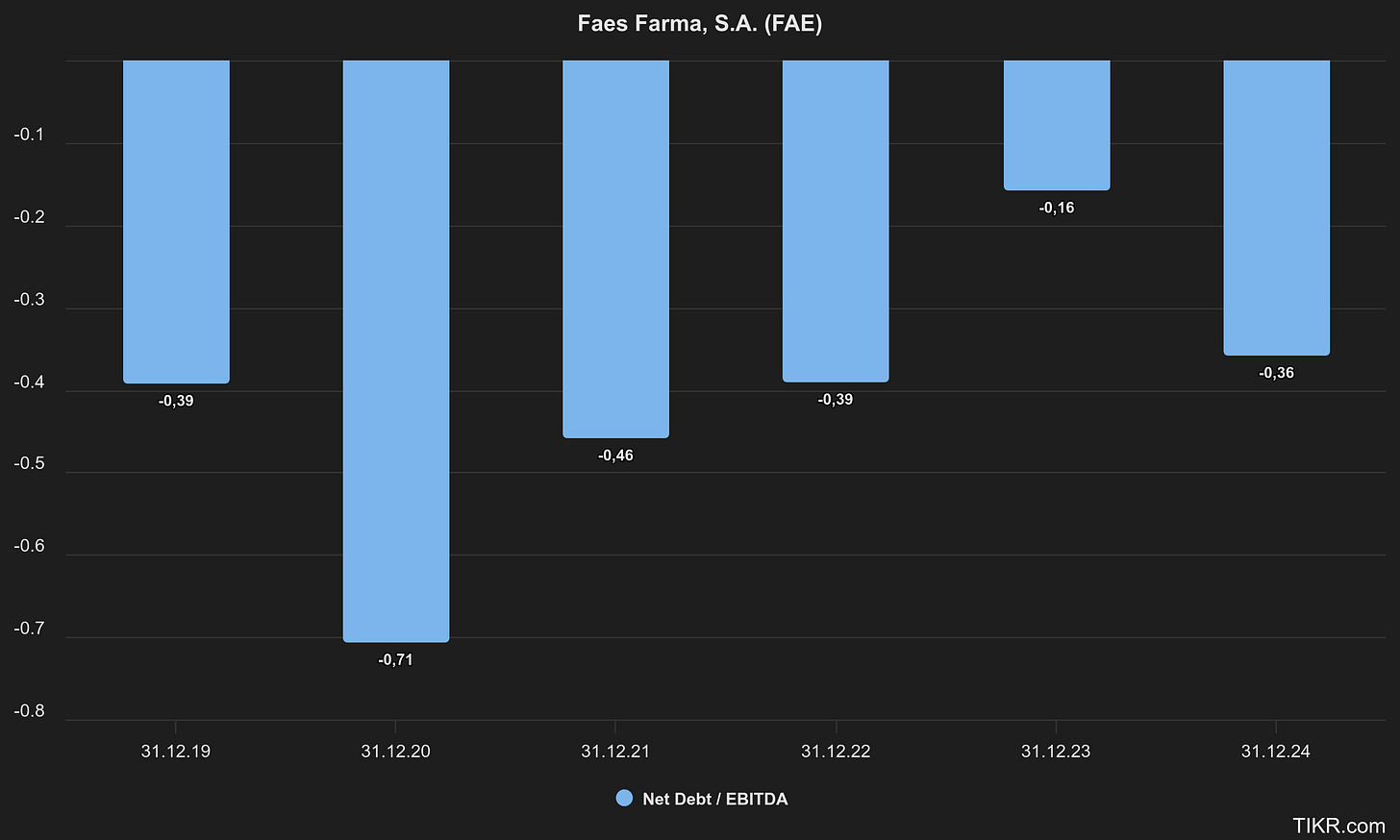

Steady Growth and Profitability: Faes Farma has shown a track record of solid growth and profitability over the years. 2024 was a record year, with revenues reaching €510 million (up +7.8% YoY) and EBITDA of €129 million. Net profit to the parent came in at €111.4 million in 2024, marking the seventh consecutive year of record-high profits. The core pharmaceutical business is growing in the high single digits, driven by strong performance in Spain and Latin America, as well as rising license royalties. Faes also operates with healthy margins (2024 EBITDA margin ~25%, net margin ~22%) and a solid balance sheet (minimal debt), reflecting strong operational efficiency. In fact, the company’s financial position is robust: as of 2024 it had more cash than debt, with a debt-to-equity ratio of just 0.03 and ample interest coverage. This financial strength gives Faes flexibility to invest or withstand industry challenges.

Shareholder-Friendly Policies: As we will detail later, Faes Farma maintains a generous dividend (about 50% payout of earnings) and has proactively managed its equity via buybacks to avoid diluting shareholders. This track record of returning cash to shareholders while still funding growth initiatives is a positive sign of balanced capital allocation.

Strategic Expansion via M&A: A newer strength is Faes Farma’s strategic use of acquisitions to accelerate growth. In 2023–2025, the company embarked on acquisitions to enter new markets and therapeutic areas. Notably, Faes acquired Laboratorios Edol (a Portuguese pharma company) in early 2025 and has agreed to acquire SIFIS.p.A (an Italian ophthalmic pharmaceuticals firm) for about €270 million. These deals transform Faes by adding a significant ophthalmology franchise – a high-growth segment – to its portfolio. Once SIFI is integrated, about 20% of Faes Farma’s revenues will come from ophthalmology products, greatly expanding its presence in that field. Management expects substantial synergies and cross-selling opportunities from combining Edol and SIFI with Faes’s existing business, given overlapping R&D areas and distribution channels. For investors, these acquisitions signal an ambition to grow faster and become a more global, diversified pharma company, rather than remaining a strictly Iberian mid-cap. (We will discuss the execution risks in the bearish section as well.)

Weaknesses

Reliance on Key Products (Concentration Risk): Despite diversification, Faes Farma still derives a large share of profits from a few star products – especially Bilastine and Calcifediol. Bilastine in particular is critical, as it accounts for the majority of the €103.8 M in annual license revenues. Any setback to Bilastine (such as generic competition, pricing pressures, or a safety issue) could significantly impact Faes’s earnings. In fact, Faes already experienced a hit in 2024 from Bilastine price cuts in Japan (a major market): the Japanese government imposed a 7% price reduction and the yen weakened, causing a drop in other operating income. That headwind was offset by growth in other markets, but it highlights the vulnerability to regulatory and pricing changes for key drugs. Likewise, Calcifediol’s success is largely tied to Spain; any future policy change in reimbursement or new competitors could slow that cash cow. The company’s pipeline needs to deliver new products over the coming years to reduce this concentration risk.

Modest R&D Scale and Pipeline Uncertainty: While Faes has a pipeline, it is relatively small compared to large pharmaceutical companies. The R&D budget must be balanced with the company’s size and dividend commitments. There is no guarantee that current projects (e.g. new high-dose formulations or the mesalazine trials) will yield major blockbusters. The company’s strategic plan foresees growth partly from organic innovation, so underperformance in R&D could make it harder to reach long-term targets. In essence, Faes lacks the deep pipeline and research scale of big pharma, which could limit its future growth if it doesn’t successfully acquire or develop new drugs.

Integration and Execution Risks (M&A and Expansion): Faes Farma’s recent expansion moves, while promising, introduce execution risks. Integrating Edol and SIFI will be a major undertaking – combining operations across countries, aligning product portfolios, and realizing synergies. The SIFI deal is sizable (roughly €270M price, almost 2x Faes’s 2024 net profit), and will likely be financed with cash and debt. Large acquisitions can strain management and finances if not executed well. Additionally, Faes has been expanding in Latin America, Africa, and the Gulf region (including integrating a Gulf subsidiary). These moves add complexity and exposure to emerging market risks (currency volatility, political/regulatory risk, etc.). In the first quarter of 2025, Faes’s operating expenses jumped as it hired more sales force in LATAM and incurred duplicate costs while transitioning to a new manufacturing plant. Such expenses are investments in growth, but they dragged short-term profits. EBITDA in Q1 2025 fell –4% year-on-year (on an unadjusted basis) despite nearly 10% revenue growth. This shows how expansion can pressure margins in the near term. If the new initiatives take longer to pay off, Faes Farma’s earnings could plateau or dip, testing investor patience.

Smaller Scale in a Competitive Industry: As a mid-cap pharma, Faes faces competition from much larger global firms in many of its markets. It doesn’t have the marketing muscle of Big Pharma in high-value markets like the US (Faes actually has little presence in the US) and relies on partners for many regions. Its animal nutrition business, while stable, is also in a competitive, commoditized industry. Being smaller means Faes can be more nimble, but it also means less bargaining power with suppliers and buyers, and vulnerability if a larger competitor targets its niches (for instance, a generic drug maker challenging Bilastine in key markets or a larger firm undercutting prices in the animal segment).

Regulatory and Macro Risks: Like all pharma companies, Faes is subject to regulatory approvals, pricing regulations, and patent cliffs. Its growth in emerging markets comes with currency and inflation risks (e.g., devaluation of Latin American currencies can eat into earnings – Faes noted FX headwinds in places like Chile and Nigeria, though mitigated by pricing adjustments). Any severe regulatory changes (such as stricter price controls in Europe or changes in Spain’s healthcare budget) could impact its profitability. While these are not unique to Faes, the company’s size means it has fewer buffers against such shocks than a larger diversified pharma might have.

Despite these challenges, Faes Farma has managed to navigate its environment well so far, as evidenced by its continuous profit growth. Investors should weigh these weaknesses against the strengths when considering the long-term prospects.

Dividends and Share Buybacks

Faes Farma has a shareholder-friendly approach, particularly appealing for long-term investors seeking income. The company has consistently paid dividends and often maintains a ~50% payout ratio of its profits as dividends. For the fiscal year 2024, Faes Farma’s Board approved a total dividend of €0.179 per share, which is about 51% of that year’s earnings. This total payout was delivered in two installments: an interim dividend of €0.041 per share (paid in January 2025) and a final dividend of €0.138 per share to be paid in July 2025. At the stock’s current market price, this dividend implies a yield in the ballpark of 4%–5%, which is quite attractive. For context, the previous year’s dividend (for 2023) was €0.155 per share, so the 2024 dividend represents an increase, reflecting the company’s earnings growth.

One thing to note is that Faes Farma often uses a “flexible dividend” (scrip dividend) program. Under this program, shareholders are given an option to receive new shares instead of cash for part of the dividend. Faes Farma has utilized this to reward shareholders while preserving cash. However – importantly – the company recognizes the dilution risk of issuing new shares, so it has taken steps to mitigate dilution via share buybacks. For example, in 2023 Faes Farma carried out a share buyback program in conjunction with its scrip dividend: from May to October 2023, the company repurchased 5,441,113 shares (roughly 1.7% of outstanding shares) for about €17.7 million. These shares were subsequently cancelled (retired) in November 2023 following shareholder approval, reducing the share capital by that amount. Effectively, Faes returned cash to those who chose to sell their rights, and by canceling the repurchased shares, it kept the total share count roughly stable despite issuing new shares to others who took the scrip. This strategy of half cash, half stock dividend with buyback has been used to keep long-term shareholders whole and avoid buildup of share count. In fact, the number of shares outstanding has stayed around 316 million in 2022–2024, indicating Faes has not materially diluted investors.

Beyond offsetting scrip dividends, Faes Farma’s board has authorization (renewed in 2021) to buy back shares up to the legal limit (10% of capital) for a 5-year period. While Faes is not aggressively buying back stock for reduction beyond the dividend policy, it clearly uses buybacks as a tool to manage capital efficiently. This disciplined capital return policy – a decent dividend yield plus occasional buybacks – underscores management’s commitment to shareholder returns. It’s also worth noting that Faes Farma’s dividends are paid in cash (with the scrip option) and have been sustainable given the company’s earnings and cash flow. In 2024, the entire dividend was paid out of free cash flow (which improved after completion of heavy capex). Long-term investors can likely expect Faes to continue aiming for a ~50% payout ratio going forward, assuming no major changes in strategy or capital needs.

Valuation

For quick orientation, Faes Farma trades in Spain under the ticker “FAE” on the Madrid‐based BME Continuous Market (Bloomberg: FAE SM), and its international security identifier is ISIN ES0134950F36.

The company keeps a fairly tight share count: after the small 2023 scrip dividend buy-back/cancellation cycle, total shares outstanding have drifted down to roughly 309 million as of June 2025. At the current €4-plus share price that translates into a market capitalisation of about €1.4 billion, placing Faes toward the upper end of Spain’s mid-cap league table.

As of mid-2025, Faes Farma’s stock has seen a strong rally, appreciating roughly 30% year-to-date. The shares recently entered the IBEX Medium Cap index in Spain, reflecting its growing market capitalization (~€1.4 billion). Despite this rise, Faes Farma still trades at valuation multiples that appear moderate for a pharma company with its track record and prospects.

If we zoom out over the past five years, Faes Farma’s forward valuation has traced a neat “U”-shape. From late-2020 through mid-2023 the market was happy to leave the shares languishing at 8–11 × EV/EBIT and 10–13 × forward P/E, broadly in line with the company’s own long-run averages (10.1 × and 12.7 × respectively). Those levels suggested investors were pricing Faes as a steady, ex-growth domestic pharma name—despite the fact that revenue, margins and cash generation were inching higher every year (see the profitability and FCF graphs you just looked at).

That perception flipped the moment management began to execute on its 2025–30 growth plan:

The announcement of the new Derio plant and the step-up in international sales traction in 2H-2023 nudged multiples off their lows.

News of the Edol acquisition (Jan-24) and especially the pending SIFI ophthalmology deal (Feb-25) triggered a sharp re-rating. By May-2025, the stock was back at cycle highs—≈ 13.5 × EV/EBIT and ≈ 16 × forward P/E, brushing the top end of the five-year band.

Those headline numbers can look punchy at first glance (“Fifteen times earnings for a mid-cap Iberian pharma? Really?”). Two points keep them grounded:

They are only 1–1½ turns above the five-year average. In other words, the market is rewarding Faes for tangible strategic progress, not handing it a blue-sky multiple.

There is still a gap to the wider mid-cap pharma cohort. European speciality peers with comparable growth profiles often trade 18–22 × forward earnings and mid-teens EV/EBIT—especially those with an ophthalmology angle.

Put differently, the chart tells us the market has moved from undervaluing Faes to pricing it at the low end of a “growth” range—hardly exuberant given the company just laid out a roadmap to double revenue and EBITDA by 2030.

How to square that with the fundamentals you saw earlier?

Balance-sheet comfort ≈ valuation comfort. The earlier leverage graph shows Faes running net cash (-0.36 × ND/EBITDA in FY-24). That cushion means the enterprise-value multiple actually overstates cash-adjusted risk: bolt-on deals can be funded without stressing the balance sheet, a point the multiples alone can’t reveal.

Profitability is trending up, not flat. EBIT margin has marched from 20 % to 22 % and net-income margin from 17 % to 22 % over the period. That lifts “E” in the denominator and offers a natural de-rating mechanism if price stalls.

FCF snap-back. Free-cash-flow margins rebounded to 16 % in 2024 after the cap-ex bulge, meaning Faes is on course to fund its 50 % dividend pay-out and still have dry powder for further M&A—again justifying a notch more optimism in the multiple.

The two graphs together tell a coherent story: the market has finally begun to price in the company’s growth ambitions, but only just enough to pull the stock back to the top of its historical band. If Faes executes—integrating SIFI smoothly, rolling out new formulations, and keeping margins intact—today’s 13–16 × forward multiples could still leave room for upside (either via earnings growth, a peer-level re-rating, or both). Conversely, if integration hiccups or a key product stumbles, the shares have a visible floor: the chart shows buyers have consistently stepped in whenever EV/EBIT dips into single digits.

Bullish and Bearish Investment Case

Bullish Investment Case

Long-term investors can build a bullish thesis on Faes Farma based on several key arguments:

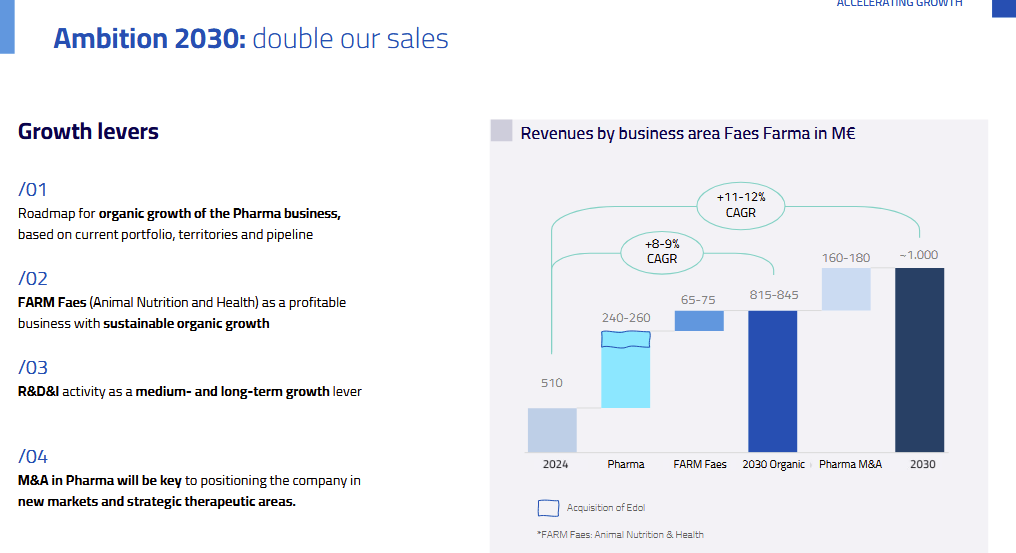

Robust Growth Ambitions (Strategic Plan 2030): Faes Farma’s management has laid out an ambitious Strategic Plan for 2025–2030 aiming to double revenues to €1 billion and double EBITDA to ~€240 million by 2030. This implies a compound annual growth rate (CAGR) in the high single digits for sales and even higher for earnings. The plan is not just wishful thinking – it’s already in motion with concrete steps (like acquisitions and product launches). If Faes achieves these targets, the company will be substantially larger in five years, and shareholders could be rewarded with both earnings growth and likely higher dividends. The strategic roadmap focuses on organic growth in core pharma (leveraging new launches and expanding in existing markets) plus bolt-on M&A as a “strategic lever”. Seeing management commit to quantifiable long-term goals and starting to deliver (record 2024 results, two acquisitions in 2025) is a bullish sign that Faes Farma is entering a new growth phase.

Successful Acquisitions Driving Expansion: The recent acquisitions – Laboratorios Edol (Portugal) and pending SIFI (Italy) – significantly strengthen Faes Farma’s future prospects. These deals give Faes an entry into the high-growth ophthalmology market, adding a portfolio of eye care products and R&D projects. According to the company, once SIFI is merged, ophthalmology will become ~20% of the group’s revenues, and the combined portfolio will have “high potential for internationalization and consolidation in key markets”. In plain terms, Faes will be able to sell Edol/SIFI’s eye products through its global network, and vice versa, creating cross-selling opportunities. Ophthalmology is an attractive field (driven by aging populations and rising eye disease prevalence), so this could be a new growth engine for Faes. Moreover, Faes’s track record with past acquisitions (like its successful integration of a Latin American subsidiary and a Gulf region business) gives confidence that these larger acquisitions can be executed effectively. If integration goes smoothly, the combined company’s earnings power will increase (SIFI reportedly has around €80–90M in annual sales on its own, which would boost Faes’s revenue by ~15-20% once consolidated). The bullish view is that Faes Farma is transforming from a mostly Iberian pharma to a more international, multi-specialty pharma, which should command a higher valuation and growth rate.

Resilient Core Business and Market Leadership: Bulls will point out that Faes’s existing business is very resilient and still growing steadily. In its home market Spain, Faes is a top player in areas like antihistamines (Bilastine/Bilaxten is a leading allergy drug) and vitamin D supplements (Hidroferol). It has a strong relationship with prescribers and a respected brand built over decades. Internationally, Faes has established beachheads in fast-growing markets: e.g., its Latin America subsidiaries saw double-digit growth in 2024 (Mexico +22%, Ecuador +34%, etc. according to the company’s report). Even in smaller markets like the Middle East/Africa, Faes is growing rapidly (it integrated Faes Farma Gulf and saw >20% growth in those regions). This shows the existing product portfolio still has room to grow geographically. Additionally, licensing deals for Bilastine continue to contribute; the product is relatively young in many markets and can keep generating royalties as it penetrates new countries (recent launches in places like Canada, Turkey, etc., were noted). The animal nutrition segment, while not high-growth, provides a stable baseline of revenue and could benefit from any expansion into new feed markets now that the new ISF plant is operational. In short, the bull case sees Faes’s core as a cash cow that funds the growth projects – a nice dynamic for a long-term investment (stable base + growth options).

Attractively Stock with Upside Potential: As discussed in the valuation section, Faes Farma’s stock is trading at a reasonable multiple (~15x forward earnings), which arguably does not price in the ambitious growth plan. If Faes even partially succeeds (say, grows EPS by high single digits annually), the stock could see a double benefit: earnings growth + multiple expansion. It is not hard to imagine the P/E moving up toward 18x or 20x if the market gains confidence in Faes’s growth trajectory, especially given the historically low interest rates in Europe (though rates are rising somewhat now) and the scarcity of mid-cap pharma names with strong dividends. Additionally, Faes’s low debt and strong cash flow mean it can finance growth (and dividends) without much strain – investors don’t have to worry about dilution or distress, which sometimes hang over smaller companies. The company also garnered more attention by joining the IBEX Medium Cap index, which could increase demand from institutional investors. All these factors support a potential re-rating of the stock upwards.

Shareholder Returns and Skin in the Game: Bulls also appreciate that while we wait for the growth to play out, Faes Farma rewards shareholders with a solid dividend (~4% yield). This provides a tangible return and downside protection. The company’s insiders (founding families, etc.) also own a meaningful chunk of shares (insiders hold ~13% of the company), aligning their interests with shareholders. Management’s commitment to a 50% payout and actions like share buybacks indicate confidence in the business. Essentially, an investor gets paid to wait, which makes the risk/reward more favorable.

In summary, the bullish case is that Faes Farma is a fundamentally strong, profitable pharma company that is on the cusp of accelerating its growth through smart strategic moves. If successful, Faes could significantly increase its earnings by 2030, and investors at today’s valuation could see substantial returns (price appreciation plus dividends). The combination of value (low multiples), yield, and growth potential is what makes Faes Farma compelling to long-term, value-oriented investors.

Bearish Investment Case

On the other hand, a cautious or bearish view of Faes Farma would highlight several concerns that could impede the investment thesis:

Integration & Execution Risks – Could Growth Plans Stumble? The most immediate risk is that Faes Farma’s grand expansion plan might not go smoothly. Merging acquisitions like SIFI is no small task – cultural integration, retention of key staff, and merging R&D pipelines can all pose challenges. If SIFI’s integration hits snags or its performance disappoints, Faes might not realize the synergies it’s banking on. The company is spending a lot of capital (SIFI deal ~€270M, Edol €75M); if returns from these investments are lower than expected, it could drag on overall returns. Additionally, Faes is expanding its footprint in many emerging markets simultaneously (Latin America, Middle East, Africa). Managing growth in diverse markets can stretch a company’s operational capabilities. A bear might argue that Faes is taking on too many initiatives at once – new plants, new geographies, new therapeutic area – which increases the odds of execution errors. We already saw a hint of margin pressure in Q1 2025 when all these efforts led to higher costs and a drop in short-term profit. There is a risk that integration costs and operational headaches could persist longer, muting earnings growth for several years. If EBITDA indeed declines in 2025 (as guided) and perhaps sees only modest recovery in 2026, the market could lose patience, and the stock might stagnate or fall.

Reliance on a Few Cash Cows (Product Concentration): Faes Farma’s heavy dependence on Bilastine and a handful of products is a double-edged sword. The bear case emphasizes that Bilastine will eventually face patent expiry in major markets, which could lead to generic competition and a sharp fall in royalties. It’s unclear exactly when each market’s exclusivity ends (Bilastine was first approved around 2010–2011 in some regions, so late 2020s could see patents expire), but the clock is ticking. We already see no growth in Bilastine royalties in 2024 (flat at €83.9M), as price cuts and generics in places like Japan start to take effect. If new markets cannot compensate or if a big market loss occurs, Faes’s high-margin license income could shrink. Similarly, calcifediol (Hidroferol) is hugely important in Spain; any change (like a new competitor drug or a change in clinical guidelines reducing its use) could hit domestic sales. The company is trying to develop new indications and formulations (e.g. weekly calcifediol), but there’s no guarantee these will fully replace the old cash flows. Pipeline risk is part of this: a few clinical trial setbacks or regulatory hurdles for new products could mean Faes has a gap when older products mature. In essence, Faes Farma might struggle to replace its aging blockbusters, a classic small-pharma problem.

Valuation Might Reflect Optimism Already: While we argued the stock looks cheap, a skeptic could counter that the stock’s recent 30% rally has priced in a lot of good news, and the easy gains might be over. At 14x earnings, Faes is no longer the deep bargain (under 10x earnings) it was at the start of 2024. If earnings were to stagnate around the current level (€90–100M underlying net profit), then a mid-teens multiple might actually be fair value or even a bit rich for a slow-growth company. Remember that part of the 2024 earnings jump was a one-off tax benefit; if we normalize earnings (around €95M net profit), the current P/E on underlying earnings is a bit higher. There’s also some concern that margin compression (from inflation in costs or permanent higher expenses) could make those earnings hard to grow. For example, if Faes keeps needing to spend more on R&D and sales to integrate acquisitions, operating leverage might not improve as hoped. In that scenario, bulls’ growth projections might not materialize, and the stock’s upside would be limited. Additionally, if interest rates rise, a 4% dividend yield might not be as attractive as before, potentially putting pressure on the stock valuation.

Macroeconomic and FX Risks: Faes Farma’s increasing exposure to emerging markets brings currency and macro risks that could hurt results. We have seen some of this: in 2024, Faes noted that devaluations (e.g., of the Argentine peso or other Latin currencies) negatively impacted the translated results. If inflation remains high in some markets where Faes operates, it could squeeze consumers or government healthcare budgets, affecting sales. Also, any global downturn or reduction in healthcare spending could impact a smaller company like Faes more intensely in certain markets. On the animal side, that business can be sensitive to agricultural cycles and commodity prices (feed costs, etc.). A spike in raw material costs could compress margins in the nutrition unit. These macro factors are largely out of the company’s control, and while Faes has navigated them so far, they add uncertainty to future forecasts.

Regulatory and Political Risks in Home Market: Spain (and Portugal) remain key markets for Faes (over 40% of revenue combined). Political decisions in Spain – such as pricing interventions, changes in reimbursement policy, or higher taxes on pharma – can directly impact Faes. Spain has at times pushed for lower drug prices or clawbacks to control healthcare costs. If such measures target the kind of products Faes sells (for example, if a generic version of calcifediol is promoted by the public health system or if a reference price system cuts its price), domestic profit could fall. Faes also benefits from some regional tax incentives (as seen with the Derio plant tax deduction in 2024); these are not guaranteed every year. Governance changes (Spain had an election in 2023, for instance) could bring shifts in healthcare policy. For a small-mid cap, losing a few million euros to a new levy or pricing rule can be material.

In sum, the bearish case boils down to execution risk and the possibility that Faes Farma’s best growth days are behind it (if new efforts don’t pan out). An investor should keep an eye on how well Faes handles its acquisitions in the next year or two, and whether the core business can at least maintain its earnings level. If profit were to decline significantly or if debt levels rise too much due to acquisitions, the investment thesis would weaken. As with any stock, it’s wise to monitor these risk factors.

Outlook

Looking ahead, Faes Farma’s outlook is a mix of near-term caution and longer-term optimism. In the short term (2025–2026), management is transparent that earnings will be somewhat subdued as they integrate acquisitions and ramp up new facilities. The official 2025 outlook calls for solid top-line growth (+8-10% revenue) but a dip in reported EBITDA (–6% to –9%) due to one-time costs, with a return to growth in adjusted EBITDA by 2026. This suggests 2025 will be a “transition year.” Investors should not be surprised by flat or slightly lower net profit in 2025 versus 2024 (especially since 2024 had that tax credit). However, beyond 2025, Faes Farma expects to reap the benefits of its investments.

From 2026 onwards, assuming SIFI is fully consolidated and cost synergies start kicking in, we could see an inflection in earnings. The new Derio plant will by then be fully operational and could even allow Faes to take on contract manufacturing or increase production of its own drugs more efficiently (improving gross margins). The strategic plan through 2030 is aggressive: reaching €1 billion sales and €240M EBITDA. To achieve this, Faes will likely continue launching new products (perhaps leveraging SIFI’s ophthalmology R&D, and pushing its own pipeline products to market around 2026–2027). We might also expect further bolt-on acquisitions in emerging markets or niche therapeutics – Faes has indicated M&A is part of the strategy, and they have kept financial flexibility to do it. That said, having just done two sizable deals, they may pause to digest these before attempting another large acquisition.

Geographically, Latin America and other international markets are poised to contribute more to growth. Faes Farma highlighted strong momentum in countries like Mexico, Colombia, Ecuador, etc., and a focus on strategic franchises there. As these markets grow their middle class and healthcare spending, Faes is well positioned with local subsidiaries and products tailored to those needs (e.g., anti-parasite meds, allergy drugs for those climates). Also, entry into new regions: The Gulf region integration suggests Faes sees the Middle East as promising; likewise, the move into Portuguese and Italian markets through Edol and SIFI could open Southern Europe further (Italy will be a new core market with SIFI’s presence). In Africa, Faes’s footprint is tiny (some sales in Nigeria and West Africa via exports), so that could be another frontier long-term.

Another aspect of the outlook is the ophthalmology franchise. Post-SIFI, Faes Farma will become one of the most comprehensive eye-care players among mid-sized pharma, according to the press releases. SIFI brings in products like treatments for ocular conditions (possibly a portfolio of eye drops, intraocular lenses, etc.) and even a drug for a rare eye infection (Acanthamoeba keratitis) which has global potential. There is a genuine growth story here: ophthalmology is a growing market (think aging population needs like cataracts, glaucoma, retinal diseases). Faes can invest in expanding SIFI’s sales beyond Italy (perhaps into Spain/Portugal/LatAm where Faes has presence). The combination could yield high-single-digit growth in that segment. If all goes well, Faes by 2030 might be known just as much for eye care as for allergy or metabolic drugs.

Financially, Faes Farma is likely to remain cautious on debt. It may fund the SIFI deal partly with cash on hand and a moderate debt increase, but given its historically low leverage, the post-deal balance sheet should still be healthy. That means dividends are likely to continue. In fact, Faes has reaffirmed its commitment to shareholder returns, even as it grows. The CEO, at the 2025 shareholders meeting, emphasized pursuing growth “while maintaining an optimal capital structure to continue offering dividends”. So, one can expect the ~50% payout policy to stay intact, and maybe even extra returns (if cash flows jump, perhaps buybacks or a special dividend could occur, though nothing specific has been announced beyond the existing program).

One external factor to watch: the macro environment in Spain/EU (inflation and interest rates). Faes’s products are largely non-cyclical (people need their medications in any economy), so revenue should be resilient. Inflation could raise costs (labor, raw materials), but Faes has shown an ability to pass on some costs or manage them. If interest rates rise significantly, the cost of financing acquisitions could increase; however, Faes’s deals now are mostly locked in and its debt is low, so it’s not highly sensitive to interest rates at the moment.

Overall, the outlook for Faes Farma is cautiously positive. The company itself is confident enough to project a doubling in size by 2030, which suggests management sees a lot of opportunity ahead. The next year or two will be about execution – integrating acquisitions, launching new products (they have, for example, a high-dose metocarbamol muscle pain drug filed for approval), and proving that the expanded Faes can grow profitably. If they deliver, Faes Farma could graduate from being a small Iberian pharma to a mid-sized international player with a recognized global franchise in select areas (like ophthalmology and allergy). For investors, that transition could be very rewarding, though patience and monitoring are key, given the work involved in making it happen.

Conclusion

Faes Farma presents an interesting case for long-term investors: it’s a company with deep roots and stable profitable operations, now entering a new chapter of expansion and growth initiatives. In our analysis, we’ve seen that Faes offers a bit of “everything” – a steady core business (with reliable drugs and an international footprint), a shareholder-friendly dividend policy, and a bold growth plan aiming to turbocharge its scale by 2030. The investment merits here include its solid financials, reasonable valuation, and the potential upside from strategic moves like the ophthalmology expansion.

However, investing in Faes Farma is not without risks. The company’s success will depend on execution – integrating new businesses, continuing to innovate, and managing its reliance on a few big products. The next couple of years will be telling, as Faes digests its acquisitions and navigates a period of heavy investment. Bears point out that things could go wrong in that process, or that Faes might not replicate past growth going forward.

From a long-term perspective though, Faes Farma has characteristics that many investors seek: a defensive, recession-resistant business (people and animals need medicine in any economy), a decent growth kicker from emerging markets and new products, and a management team that has skin in the game and rewards shareholders. The professional but casual tone of Faes’s communications – exemplified by management’s straightforward discussion of goals and challenges – gives some confidence that they are realistic and transparent with investors.

In the end, whether Faes Farma is a suitable investment comes down to your confidence in its strategic plan. If you believe that by 2030 Faes can double its revenue and significantly increase earnings (through its expanded portfolio and global reach), then the stock at today’s valuation could be a compelling long-term buy. You’d be essentially getting a growing dividend and the prospect of capital appreciation as the company’s earnings and market profile expand. On the other hand, if you’re skeptical about small pharma companies executing multiple acquisitions and R&D programs successfully, you might demand to see more proof in upcoming results before committing.

Conclusion in a nutshell: Faes Farma is a well-run mid-cap pharma with a rich history and a promising future roadmap. It balances caution and ambition – keeping its finances healthy and shareholders paid, while also striving to become a bigger, more global player in healthcare. For long-term investors with an eye on the European pharma space, Faes Farma is worth a closer look as a potential addition to a diversified portfolio. As always, one should keep an eye on quarterly progress (especially integration of SIFI/Edol and underlying profit trends) to ensure the investment case stays on track. But so far, Faes Farma has shown that it knows how to grow sustainably, and if that continues, long-term holders could be well rewarded.

Excellent write-up, thanks.