Disclaimer: The information provided in this publication is for educational and informational purposes only and does not constitute financial advice. The content is solely reflective of my personal views and opinions based on my research and is not intended to be used as a basis for investment decisions. While every effort is made to ensure that the information is accurate and up-to-date, the writer makes no representations as to the accuracy, completeness, suitability, or validity of any information in this post and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. All readers are advised to conduct their own independent research or consult a professional financial advisor before making any investment decisions. The author is invested in the mentioned stock.

*Affiliate link – Get 15% off Fiscal.ai (formerly Finchat)

De’Longhi (DLG) – Brewing Long-Term Value in Coffee and Beyond

De’Longhi isn’t just the brand behind your morning espresso—it’s a surprisingly resilient, cash-generating business with global reach and a strong foundation in consumer appliances. In this post, we take a closer look at the company behind the machines: its business model, financial strength, and what makes it an interesting candidate for long-term investors. From fundamentals to valuation, I’ll walk you through my analysis—including why my DCF points to an intrinsic value.

General Description

De’Longhi S.p.A.* is an Italian-based small appliance manufacturer best known for its espresso coffee machines. Headquartered in Treviso, Italy, the company has grown into a global player present in over 120 markets, supported by a workforce of around 10,500 employees. De’Longhi’s portfolio spans several well-known brands – including its namesake De’Longhi for coffee makers and kitchen appliances, Kenwood for food preparation, Braun (licensed) for kitchen and home products, Ariete for home appliances, and the recently acquired NutriBullet/Magic Bullet blender brands. These brands have deep heritage (Kenwood since 1947, Braun over 90 years, etc.) and together “have made the history of small domestic appliances” in their categories.

Originally founded in 1902 as a craftsman workshop, De’Longhi evolved from producing portable heaters and air conditioners into a diversified appliance group. Today, the company’s core focus is coffee: it produces everything from fully automatic espresso machines and pump espresso makers to drip coffee makers and grinders for household consumers. Notably, De’Longhi is a global leader in espresso coffee machines, with its products often winning awards for design and innovation. In recent years, the company has also expanded into the professional coffee machine market – for example by partnering with or acquiring stakes in specialty espresso machine makers Eversys (Switzerland) and La Marzocco (Italy) – reflecting a strategic move into higher-end “prosumer” and commercial coffee equipment. Beyond coffee, De’Longhi’s product range includes kitchen appliances (mixers, blenders, food processors under Kenwood and Braun), home care devices (irons, vacuum cleaners), and comfort appliances like portable air conditioners and heaters. This broad product mix gives the company multiple revenue streams, though espresso machines remain its crown jewel.

Latest Financials at a Glance

De’Longhi delivered strong results in FY 2024, rebounding from a softer prior year. Key figures from the 2024 annual results include:

Revenues: €3,497.6 million, up +13.7% year-over-year (from €3,075.9 million in 2023). This double-digit growth was driven by both organic sales momentum (~6.6% like-for-like growth) and the consolidation of acquisitions. Notably, Q4 2024 saw an 18% YoY sales surge, accelerating the full-year growth.

Net Profit: €310.7 million for 2024, a +24% increase vs. €250.4 million the year prior. The net profit margin improved to roughly 8.9% of sales, reflecting better operational leverage.

Operating Profit/EBIT: ~€430–€480 million (approximate, based on context) – underlying profitability rose as margins expanded. Adjusted EBITDA came in at €559.8 million, representing a solid 16% EBITDA margin, up from ~14% in the previous year. This indicates improved efficiency and pricing power, aided by higher volumes and some easing of input cost pressures.

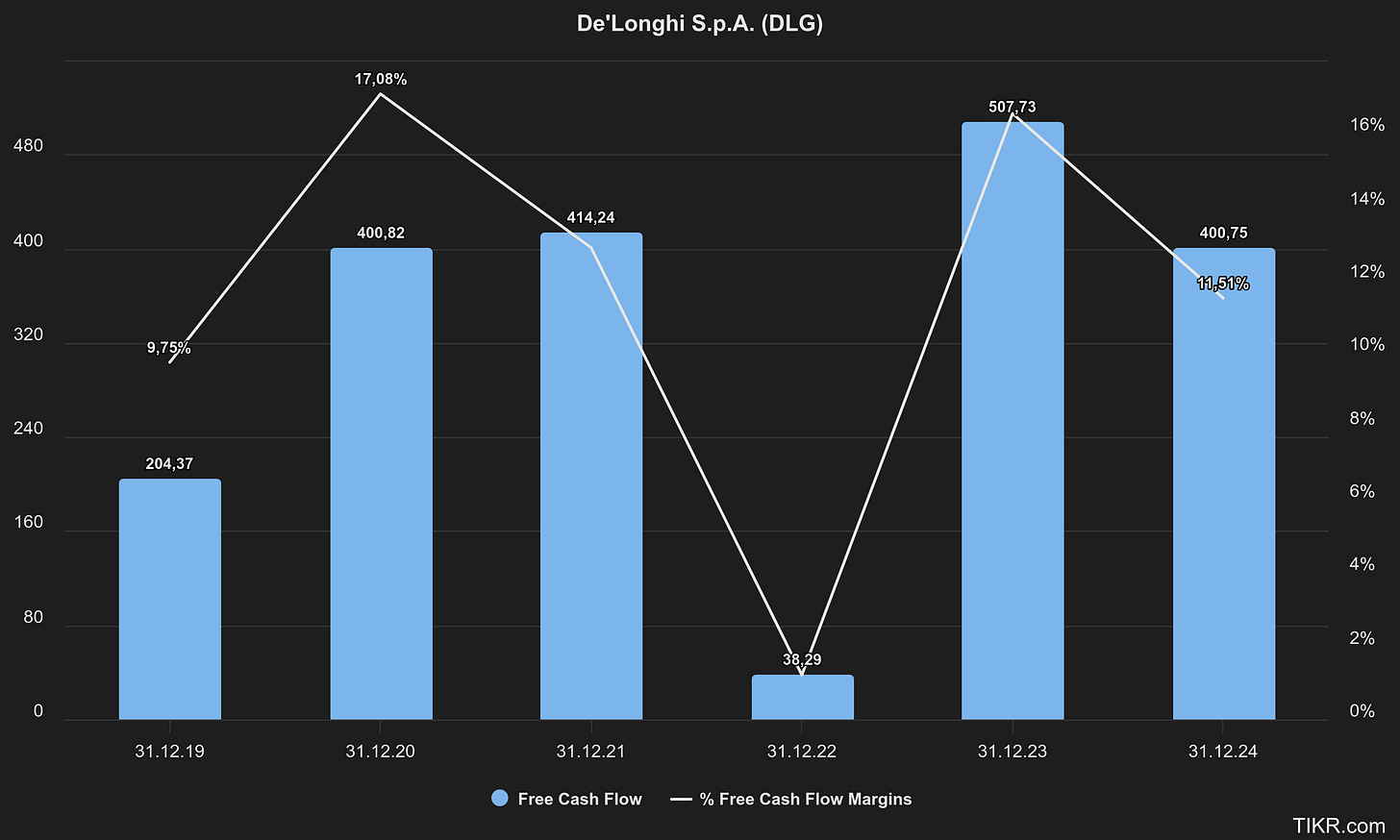

Cash Flow and Balance Sheet: De’Longhi is in a net cash position. By end of 2024, the company’s net financial position was positive €643 million, meaning cash exceeds debt – for the second year in a row net cash was above €600 million. Free cash flow for 2024 was robust at €416 million (with a ~74% cash conversion from EBITDA), reflecting efficient working capital management after heavy investments in prior years. This strong cash generation reinforces De’Longhi’s ability to self-fund growth initiatives and shareholder returns.

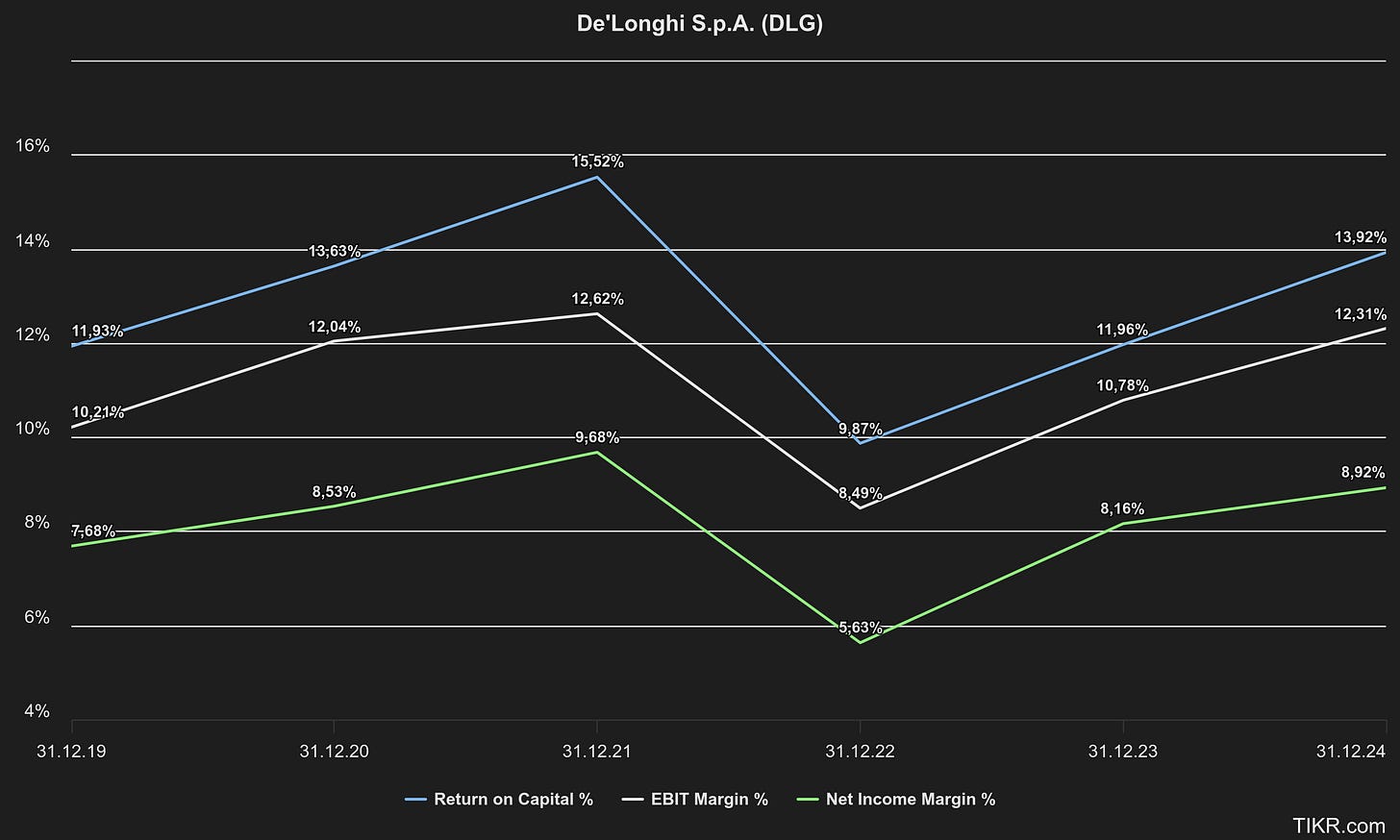

Overall, 2024 was a year of renewed growth for De’Longhi. After a pandemic-related boom in 2020–21 followed by a normalization in 2022–23, the company returned to solid growth in 2024 thanks to booming coffee machine demand and contributions from acquired businesses. All geographic regions contributed, especially Europe (helped by rising consumer interest in at-home espresso and a recovery in demand for professional coffee equipment). The strong finish to 2024 provides momentum into 2025, as evidenced by Q1 2025 results that continued to show revenue and profit growth.

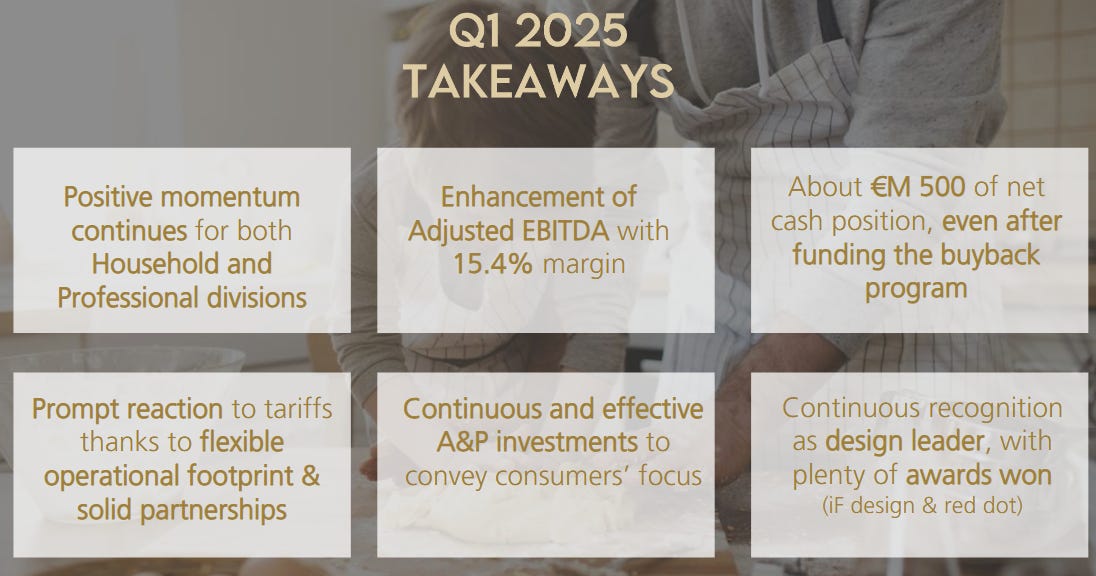

De’Longhi delivered a strong start to 2025 with its first-quarter results, reporting revenues of €755.2 million, a year-over-year increase of 14.6 percent. This growth was driven by both the core household division, which achieved 7.2 percent organic growth, and an impressive 22 percent increase in the professional coffee segment, which now accounts for 13 percent of total revenue. Profitability improved across the board, with adjusted EBITDA rising 24 percent to €116.3 million, corresponding to a margin of 15.4 percent. EBIT came in at €80.2 million, reflecting a margin of 10.6 percent and a year-over-year gain of nearly 24 percent. Group net profit also saw double-digit growth, reaching €57.4 million, up 11.7 percent compared to the previous year.

The company continues to show strong financial health, maintaining a net cash position of €482.8 million, up from €307.6 million a year ago. Inventory levels increased slightly, contributing to a rise in net working capital to €84.9 million, as the company proactively manages potential trade disruptions and builds supply chain resilience. De’Longhi also highlighted ongoing investments in marketing and innovation, including its global campaign with Brad Pitt and continued recognition for product design with several major awards.

Despite temporary challenges such as increased logistics costs and some softness in the U.S. nutrition segment, De’Longhi reaffirmed its full-year guidance, reflecting management’s confidence in the underlying business trends. Overall, Q1 2025 demonstrated continued momentum and operational strength, particularly in the expanding professional segment, positioning the company well for the rest of the year.

Key financials

Business Model and Strategy

De’Longhi’s business model centers on designing and marketing innovative small appliances, while leveraging a mix of in-house manufacturing and outsourcing for production. The company prides itself on “technology, design and quality” in a single group – essentially blending Italian design flair with engineering know-how to create appliances that command premium pricing. Product development is a key focus (for example, designing user-friendly fully automatic espresso machines or high-performance blenders), and De’Longhi regularly refreshes its lineup to drive consumer interest. Manufacturing is global: De’Longhi operates some production facilities in Italy (for high-end machines) and in other locations (Eastern Europe and China) for volume products, and also relies on OEM partners for certain items. This flexible production model helps balance cost efficiency with quality control.

On the sales side, De’Longhi has a worldwide distribution network. Its appliances are sold through major retailers (electronics and department stores, appliance specialists), online e-commerce channels, and its own direct-to-consumer websites. The company benefits from strong brand recognition – a consumer looking for a cappuccino maker or a kitchen mixer in many countries will likely consider one of De’Longhi’s brands. This brand equity allows De’Longhi to maintain healthy margins and defend market share in the mid-to-premium segment of appliances.

Business Segments: Internally, De’Longhi now organizes its operations into two divisions: the Household division and the Professional division.

The Household division covers consumer products (the vast majority of revenue) across several categories:

Coffee Makers (Household) – Fully automatic espresso machines, manual pump espresso machines, capsule machines, drip coffee makers, grinders, etc., primarily under the De’Longhi brand. This is the core category for the group.

Food Preparation – Kitchen machines (stand mixers), blenders, food processors, toasters, etc., mainly under Kenwood, Braun, and now NutriBullet/Magic Bullet for blenders.

Comfort & Home Care – Portable air conditioners, space heaters, air purifiers, humidifiers, irons, and vacuum cleaners under various brands (De’Longhi, Braun, Ariete).

Other smaller categories like kettles, fryers, etc. (often grouped with kitchen appliances).

The Professional division is a newer segment focusing on professional espresso machines and equipment for commercial use (coffee shops, offices, restaurants). This includes the operations of Eversys, a Swiss maker of high-end commercial espresso systems (De’Longhi acquired a majority stake), and La Marzocco (a revered Italian maker of cafe espresso machines – De’Longhi has an ownership interest and distribution partnership). The professional segment also targets high-end “prosumer” customers – serious home baristas who buy commercial-grade or semi-professional machines (e.g., La Marzocco’s Linea Mini). This division, while currently much smaller than the household side, is strategic for capturing growth in out-of-home coffee consumption and in the premium enthusiast market.

As the chart above shows, coffee-related products dominate De’Longhi’s revenue mix (over three-fifths of sales in 2024), while kitchen and other household appliances make up the balance. Geographically, Europe is De’Longhi’s largest market (about half of revenues), with North America and Asia-Pacific also significant. The company has a direct presence or subsidiaries in many countries to handle marketing and distribution, tailoring product offerings to local tastes (for example, drip coffee makers for the US, fully automatic espresso machines for Europe). This global footprint and multi-brand portfolio are key elements of De’Longhi’s business model, allowing it to capture consumer trends worldwide.

Strengths

Leading Market Position in Coffee Machines: De’Longhi is a global leader in espresso and coffee makers, a category enjoying structural growth as the “coffee culture” spreads worldwide. Its coffee segment contributed 62% of revenue in 2024, and the company holds a top rank in both domestic espresso machines and a growing presence in professional machines. This leadership is bolstered by strong brand recognition and continuous product innovation (e.g., new models like the La Specialista series of espresso machines). Being the market leader gives De’Longhi pricing power, scale advantages, and a reputational edge over smaller competitors.

Diversified Brand Portfolio: The company owns a portfolio of reputable brands across different appliance niches, giving it multiple “hooks” to attract consumers. For example, De’Longhi (coffee/comfort appliances), Kenwood (food prep), Braun (kitchen and home), NutriBullet (blenders), and Ariete (various small appliances) each target specific product domains and customer segments. This multi-brand strategy allows cross-selling and reduces reliance on any single brand’s fortunes. Many of these brands have decades of heritage, which fosters consumer trust and loyalty.

Global Reach and Distribution: With sales in over 120 countries and a balanced presence across Europe, Americas, and Asia, De’Longhi can capitalize on growth in different regions. It is not overly dependent on any one country’s economy. The company has established distribution networks and local subsidiaries that understand regional consumer preferences (for instance, promoting automatic espresso machines in Europe, drip machines in the US, or air conditioners in Asia). This global scale also helps in sourcing and production flexibility, as it can shift manufacturing or suppliers across regions to manage costs and mitigate disruptions.

Strong Financials (Cash Generation and Stability): De’Longhi’s operations generate healthy cash flows, and the company carries minimal debt with a substantial net cash reserve. This financial strength is a competitive advantage: it provides resilience during economic downturns, and it gives management firepower to invest in R&D, marketing, or acquisitions without jeopardizing stability. The consistent free cash flow (over €400m in 2024) also supports shareholder returns (dividends/buybacks) while still funding growth. In addition, key profitability metrics like EBITDA margin (~16%) are solid for a manufacturing company, indicating efficient operations and brand-driven pricing.

Innovation and Product Development: A mixture of Italian design and engineering, De’Longhi’s products are often at the forefront of consumer trends. The company invests in developing new features (e.g., smart connected coffee machines, better milk frothing technology, quieter blenders) which helps differentiate its products in a crowded market. Its ability to continually refresh product lines (such as launching improved espresso machine models or new NutriBullet blender variants) keeps consumers upgrading. This innovation culture, along with a reputation for quality, is a major strength in maintaining market share and margins – customers are willing to pay a premium for a De’Longhi or Kenwood appliance known to be reliable and well-designed.

Long-Term Family Leadership and Culture: De’Longhi is still led in part by the founding De’ Longhi family (CEO Fabio de’ Longhi is a family member). This can be viewed as a strength in that it provides stability and a long-term orientation – management tends to prioritize sustainable growth and brand equity over risky short-term moves. The corporate culture emphasizes Italian craftsmanship and “makers” mentality (pride in creating excellent products), which can translate to strong employee commitment and product quality.

Weaknesses

High Reliance on Coffee Segment: While being a leader in coffee machines is a strength, it is also a concentration risk. Over half of De’Longhi’s sales now come from household coffee makers, and nearly two-thirds including professional coffee. This means the company’s fortunes are tied to the growth trajectory of the consumer coffee machine market. If demand for at-home espresso machines slows (for instance, if the trend of upgrading home coffee setups fades post-pandemic), De’Longhi could face a significant growth challenge. The heavy focus on coffee also means exposure to competition from various angles – from other premium brands like JURA or Breville to lower-cost Asian manufacturers and even the capsule coffee systems (e.g., Nespresso) ecosystem which is partly outside De’Longhi’s full control (though De’Longhi does produce some Nespresso machines via partnerships). In short, the company is not as diversified as some larger appliance peers, making it vulnerable if the coffee category stumbles.

Consumer Discretionary Exposure and Cyclicality: De’Longhi’s products are largely discretionary consumer goods – households buy espresso machines, mixers, or portable ACs when they have disposable income and confidence. This makes sales vulnerable to economic cycles. In recessions or under high inflation, consumers may delay upgrading kitchen appliances or buying a new coffee maker. We saw some softness in 2022–2023 when inflation surged and consumers became price-conscious, impacting appliance demand. A significant downturn in major markets (Europe in particular) could materially slow De’Longhi’s growth. Moreover, some product lines (like AC units or heaters) can be seasonal and even weather-dependent, adding volatility. The company must navigate these demand swings and manage inventory carefully.

Competition (Including Low-Cost Entrants): The small appliance industry is highly competitive, with many players across different price tiers. De’Longhi faces competition from established global companies such as Philips (which owns the Saeco and Gaggia coffee brands), Group SEB (owns Krups, Tefal, etc.), Breville, Electrolux, and others, depending on the product. In coffee machines specifically, rivals include JURA (Swiss, in high-end automatics), Breville (in premium drip and espresso in some markets, sold as Sage in Europe), Philips, and a plethora of cheaper Chinese brands or unbranded OEM products in lower-end segments. This competition puts pressure on market share and requires continuous marketing spend and innovation. De’Longhi’s premium positioning means if a competitor releases a similarly featured machine at a lower price, it could erode De’Longhi’s sales. Also, for non-coffee categories like blenders or mixers, the company’s brands compete against specialists (e.g., Vitamix in blenders) or broad-line rivals. Intense competition can also lead to price wars or the need for higher promotional discounts, which would hurt margins.

Margin Pressures from Input Costs and Supply Chain: Like all manufacturers, De’Longhi is exposed to fluctuations in raw material costs (plastics, steel, electronics) and components (many sourced from Asia). In recent times, global supply chain disruptions and cost inflation (for shipping, commodities, microchips, etc.) have put pressure on margins. While De’Longhi managed to improve profitability in 2024, continued inflation or new tariffs/trade barriers can pose a risk. For instance, U.S. tariffs on imported appliances could impact De’Longhi’s costs by an estimated €15–€20 million. If such costs cannot be passed on via higher prices, they would squeeze margins. Additionally, currency exchange fluctuations (e.g., a strong Euro) can make European exports less competitive or erode overseas earnings. The company must also manage its supply chain efficiently – any hiccups (like a factory shutdown in China or delays in semiconductor chips for its machines) could disrupt product availability.

Integration and Execution Risk in Acquisitions: De’Longhi’s expansion into the professional coffee arena via acquisitions/investments (Eversys, La Marzocco, and the acquisition of NutriBullet in consumer space in 2020) comes with execution risks. Integrating new companies, cultures, and product lines can be challenging. For example, scaling up Eversys’s manufacturing to meet demand or ensuring the La Marzocco partnership yields results will test management. There’s a risk that these acquisitions might not deliver the expected growth or profitability if not managed well, or if competition in the professional segment intensifies (commercial coffee equipment is a niche with strong incumbents too). Additionally, the professional division is a new business model (B2B sales, different customer service needs, etc.) for De’Longhi – it may take time to build the same expertise there as it has in consumer markets. Any missteps could mean the investment doesn’t pay off as hoped.

Governance and Share Structure: While family leadership has upsides, it can also be viewed as a weakness by some investors if it leads to less-than-optimal governance (e.g., entrenchment or slower decision-making). The De’ Longhi family, through entities, holds a significant stake, which means minority shareholders have limited influence. So far there haven’t been major governance issues reported, but it’s something for investors to monitor in any family-controlled firm. Also, the company has instituted increased voting rights for long-term shareholders (a loyalty share scheme), which can further cement control. This is not a dire weakness per se, but worth noting from an investor perspective.

In summary, De’Longhi’s business is fundamentally solid with competitive strengths in brand and execution, but it is not without risks. The company’s ability to continue growing will depend on managing these weaknesses – diversifying its product base, defending against competition, and maintaining agility in a changing consumer and cost environment.

Keep reading with a 7-day free trial

Subscribe to Kroker Equity Research to keep reading this post and get 7 days of free access to the full post archives.