Disclaimer: The information provided in this publication is for educational and informational purposes only and does not constitute financial advice. The content is solely reflective of my personal views and opinions based on my research and is not intended to be used as a basis for investment decisions. While every effort is made to ensure that the information is accurate and up-to-date, the writer makes no representations as to the accuracy, completeness, suitability, or validity of any information in this post and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. All readers are advised to conduct their own independent research or consult a professional financial advisor before making any investment decisions. The author is invested in the mentioned stock.

*Affiliate link – Get 15% off Fiscal.ai (formerly Finchat)

Greggs PLC – A Tasty Prospect for Long-Term Investors

Greggs isn’t your typical high-growth darling, nor is it a flashy tech name grabbing headlines — but it is one of the UK’s most recognizable consumer brands, and it’s quietly building something impressive. With over 2,600 shops, a vertically integrated model, and a reputation for great value, Greggs has carved out a unique position in the fast-moving world of food-on-the-go.

After a sharp pullback in the share price, I decided it was time to revisit the investment case — not just through recent financials or market chatter, but by digging into the fundamentals and running my own valuation. In this post, I break down Greggs' business model, its strengths and risks, and why I believe the stock offers solid long-term potential.

Let’s take a closer look at what makes Greggs tick — and whether it belongs on your watchlist (or in your portfolio) heading into 2026.

Company Overview

Greggs PLC* is the UK’s leading “food-on-the-go” bakery and quick-service restaurant chain. Best known for its sausage rolls, pastries, sandwiches, and coffee, Greggs has built a ubiquitous presence on British high streets and travel hubs. As of the end of 2024, Greggs operated over 2,600 shops across the UK – in fact, it now has more outlets in the UK than McDonald’s. The company operates a vertically integrated model with 12 regional bakeries and distribution centers supplying its stores. This in-house supply chain allows Greggs to offer fresh, differentiated products at competitive prices, reinforcing its reputation as a value-for-money brand. In consumer surveys, Greggs ranks No.1 for value among UK quick-service food brands and is the most considered food-to-go brand by UK consumers. Overall, Greggs has become a beloved British brand by making convenient, tasty food “accessible to everyone” – from morning coffee and breakfast baguettes to the famous lunchtime bakes and even late-night bites.

Latest Financial Highlights

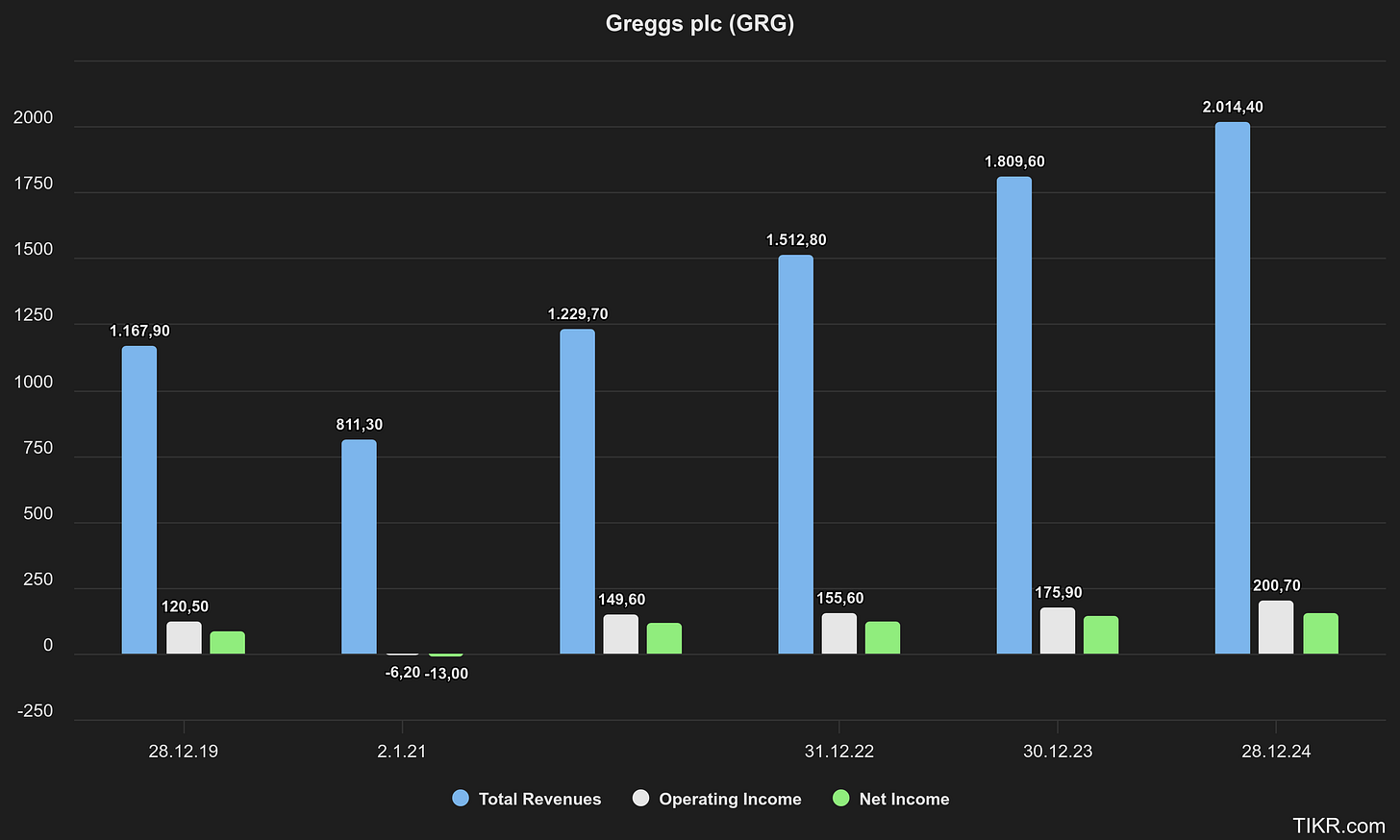

Greggs has delivered solid growth in recent years, even amid challenging economic conditions. In 2024, total sales surpassed £2 billion for the first time, reaching £2,014 million – an 11.3% increase over 2023’s £1,810 million. This growth was driven by new shop openings and higher demand; like-for-like sales in company-managed shops rose a healthy 5.5% year-on-year. Underlying profits grew even faster: underlying pre-tax profit climbed to £189.8 million, up 13.2% from £167.7 million in 2023. After including one-off gains, statutory pre-tax profit was £203.9 million. Underlying diluted earnings per share came in at 137.5 pence, an increase of about 11%.

These results reflect both robust demand and effective cost management. Greggs was able to pass through some price increases in 2024 without losing customers – volume growth accompanied price inflation, a sign of market share gainsin a tough consumer environment. Gross margin ticked up slightly, and operating margin held around 10%. The company also continued its rapid expansion, opening a net 145 new shops in 2024 (226 openings and 81 closures/relocations), bringing the year-end store count to 2,618. Growth was balanced across locations – from high street and suburban shops to travel centers, petrol forecourts, and partnerships inside supermarkets. This broad presence helped total revenue top the £2 billion milestone and keeps Greggs on pace with its ambitious growth plan (more on that in the outlook section). Overall, 2024’s results underscore Greggs’ resilience and steady expansion, even as cost-of-living pressures weighed on UK consumers.

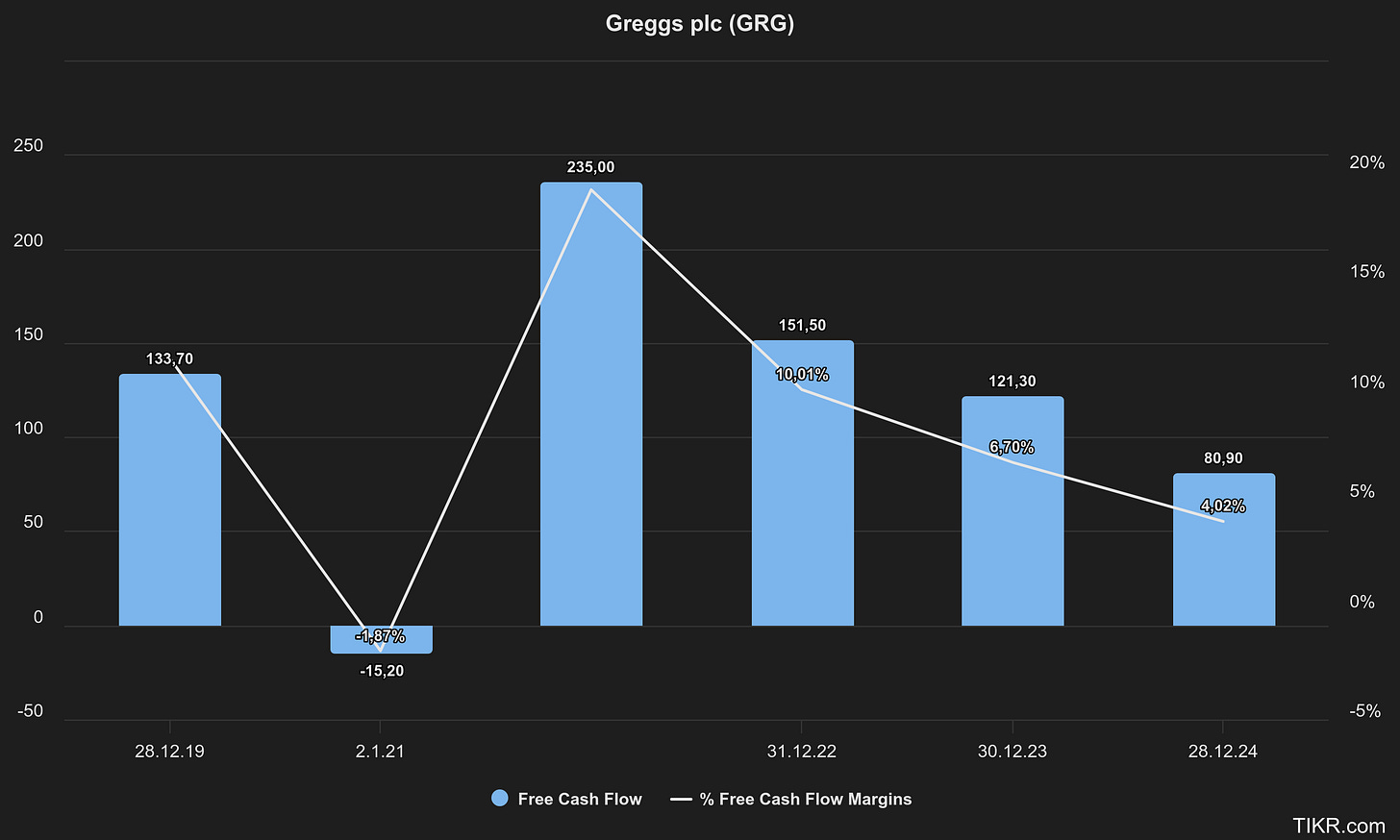

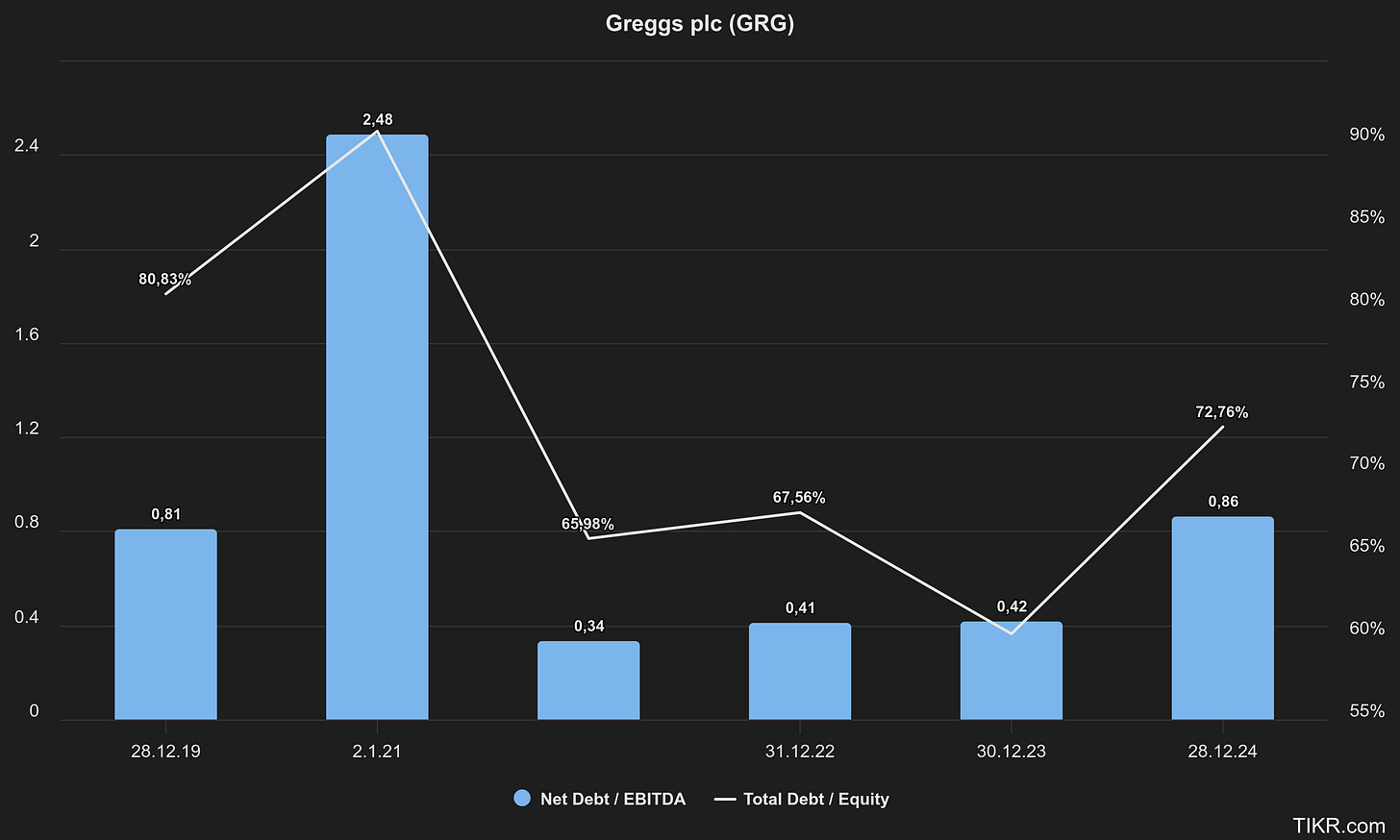

Greggs ended 2024 with a strong balance sheet (the company has typically carried net cash and minimal debt). This financial strength gives management flexibility to invest in growth initiatives while also returning cash to shareholders. We’ll next examine how Greggs’ business model underpins its performance, as well as its key strengths and weaknesses.

In its mid-2025 trading update, Greggs reported total sales grew 6.9% year-on-year to £1.027 billion in the 26 weeks ended June 28, while like-for-like sales in company-managed shops rose by 2.6% . Growth was solid throughout May, but June’s unusually hot weather—the warmest for England since records began—caused footfall to dip, especially for hot bakery items. Management said this led to a “modest shortfall” versus their plan, and they now expect full-year operating profit to be modestly below 2024’s level.

Despite markets reacting by sending the stock down around 13–15% following the update, the company emphasized the slowdown was due to temporary weather factors—not fundamental demand changes. They also reaffirmed that shop expansion remains on track with 87 openings (31 net) during H1 and a target of 140–150 net new shops by year-end, and highlighted their confidence in ongoing cost-mitigation and improved second-half performance.

Key financials

Business Model and Competitive Advantages

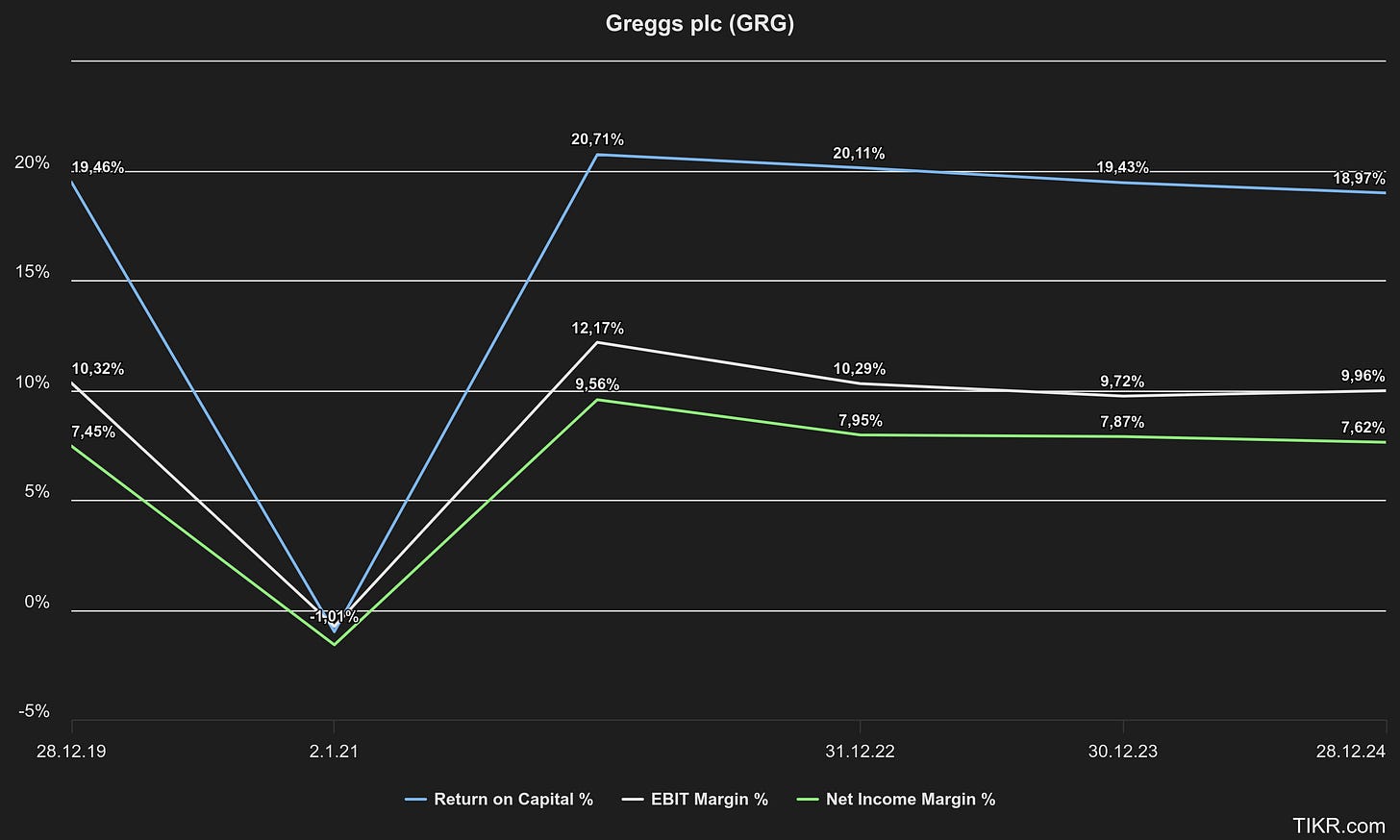

Greggs’ business model is often cited as a key reason for its success. At its core, Greggs is a vertically integrated food retailer – it manufactures a large proportion of its products in-house (from dough preparation to baking) and distributes them through its own supply chain to its network of shops. This vertical integration yields several advantages: it helps control quality and costs, supports consistently low prices, and enables quick rollout of new menu items nationwide. In fact, Greggs’ in-house supply chain has allowed it to maintain gross profit margins above 60% in recent years – an impressive figure for a value-focused food retailer. By owning production, Greggs isn’t as exposed to supplier pricing power and can capture the full margin from oven to point-of-sale.

Another pillar of the model is high shop density and convenience. With thousands of outlets across city centers, town high streets, shopping malls, transit hubs (train stations, airports), petrol stations, and even inside some supermarkets, a Greggs is never far away for most Brits. This convenience drives frequent, impulse purchases. The company keeps its menu and pricing uniform, leveraging scale for bulk procurement savings. Greggs is also predominantly an on-the-go format (small footprint shops with limited seating), which keeps operating costs lower than traditional cafes or restaurants. The value proposition is central: Greggs positions itself as an affordable treat – e.g. offering breakfast meal deals, sandwiches, pastries and coffee at prices often under £3–£4. During economic downturns, this appeals to cost-conscious consumers, helping Greggs steal market share as people “trade down” from pricier eateries. The brand’s strength is evident in consumer surveys where Greggs leads on both value for money and quality perceptions in its category.

Importantly, Greggs has shown it can innovate and adapt its business model. Historically known for morning and lunchtime trade, the company is expanding into evening hours with hot meal offerings (pizza slices, chicken goujons, potato wedges, etc.) and later store closing times. It’s also developing digital channels – the Greggs App and Click & Collect ordering, plus partnerships with delivery services (e.g. Just Eat and Deliveroo). Digital sales now account for a growing mid-single-digit percentage of revenue and have increased basket sizes (delivery orders tend to be larger). Greggs’ marketing is another strength – the brand’s playful, unpretentious image (such as launching a limited-edition Greggs jewelry line, or tongue-in-cheek holiday ads with celebrity Nigella Lawson) keeps it culturally relevant and frequently in the press at little cost. All these factors – vertical integration, scale, value branding, menu innovation, and marketing – combine to form Greggs’ competitive moat in the UK food retail landscape.

Strengh and Weaknesses

Key Strengths

Strong Brand & Customer Loyalty: Greggs enjoys a devoted customer base and high brand recognition. It consistently ranks at the top for popularity and value in UK food-on-the-go surveys. Customers know exactly what to expect: convenient locations, low prices, and tasty comfort food. This brand equity makes expansion easier (new stores quickly gain footfall) and acts as a buffer against new competitors.

Value Proposition: Value is Greggs’ defining strength. In a world of £3+ lattes and £5 sandwiches, Greggs offers low-priced alternatives (coffee for around £1.50, breakfast deals under £3, etc.). During times of squeezed consumer budgets, this positioning is a huge advantage. The company managed to raise prices modestly in 2023–2024 while still growing transaction volumes, showing that many customers stick with Greggs even after small price hikes.

Vertical Integration & Scale: Owning its production (bakery) and distribution means Greggs can produce high volumes at low unit cost. It has near total control over product quality and innovation. This integration has kept gross margins above 60%, unusually high for the industry. Furthermore, with 2,600+ shops and growing, Greggs achieves economies of scale in procurement and marketing. It can spread fixed costs (like bakery capex, R&D) over a huge sales base.

Growth Opportunities: Despite already having a large presence, Greggs sees plenty of room for growth. Management’s target is to double revenue by 2026 vs 2020 levels, driven by reaching “significantly more than 3,000” UK shops longer-term. New shop formats (drive-thrus, train station kiosks, airport outlets) and partnerships (with retailers like Tesco, Sainsbury’s for in-store Greggs counters) are unlocking locations previously untapped. The evening trading initiative and expanded hot food menu could increase sales per store by capturing dinner-time traffic. Likewise, continued growth in delivery and digital orders adds incremental revenue. Greggs has also invested in extending its product range (e.g. developing vegan alternatives like the vegan sausage roll, which was hugely successful). These growth avenues give a long runway beyond just the core bakery sales.

Financial Discipline: Greggs runs a tight ship financially. It has generally no net debt, healthy cash generation, and a disciplined approach to expansion. Even as it invests heavily in new shops and supply chain capacity, it has maintained a 2× dividend cover policy and occasionally returns surplus cash via special dividends. This prudence reduces risk and signals management’s confidence in sustainable growth.

Challenges and Weaknesses

No investment is without risks. Greggs does face certain challenges and potential weaknesses that long-term investors should consider:

Geographic Concentration: Greggs is essentially a UK-only business. All its stores are in the United Kingdom, meaning the company’s fortunes are tied to the UK economy and consumer trends. Unlike some peers, it has no geographic diversification. If UK consumer spending weakens significantly (due to recession, high inflation, etc.), Greggs cannot lean on growth in other countries to offset it. The company did trial some international locations years ago (e.g. a few in Belgium) but currently has no overseas presence, so its growth story is all about further UK penetration.

Market Saturation Concerns: With over 2,600 shops, Greggs has blanketed many parts of the UK. Hitting 3,000+ shops will require pushing into smaller towns or more shops in close proximity. There is a risk of cannibalizationor diminishing returns on new stores in saturated areas. Management will need to be careful in site selection to ensure new units add incremental sales. The good news is there are still whitespace opportunities (e.g. some southern England regions, more travel hubs) – but eventually, UK store growth will naturally mature, which could slow the company’s top-line expansion in the long run.

Cost Inflation & Margin Pressure: Greggs’ low-priced offerings mean it operates on relatively thin margins per item, so cost inflation is a constant challenge. Recent years saw rising food input costs, higher energy bills, and increasing wages (as UK labor costs have climbed). These pressures actually caused a slight dip in gross margin (from ~63% in 2021 to ~60.7% in 2023) and operating margin (from 12.2% to 9.5% over the same period). While Greggs managed these headwinds admirably, sustained inflation could crimp margins if not offset by price rises or efficiency gains. The company is also undertaking a major capital investment program to expand production capacity, which temporarily increases costs (2024 is the peak capex year at £250–280 million spend). Execution risk is present – big projects can run over-budget or face delays, potentially impacting profitability in the short term.

Competitive Landscape: Greggs operates in the highly competitive food-to-go market. It faces competition from both small independent bakeries/cafés and large chains (like Pret a Manger, Costa Coffee, McDonald’s breakfast menu, supermarket grab-and-go sections, etc.). There is also the ever-present threat of new entrants or changing consumer preferences (e.g. more people choosing healthier snacks or lunch options). Greggs must continuously update its menu (including healthier choices, which it has been working on by reducing salt, sugar, and calories in recipes) to stay relevant. If the company ever loses its footing on food quality or value pricing, customers could defect quickly given the plethora of alternatives.

Weather and External Factors: Interestingly, even the weather can impact sales. Because Greggs serves a lot of hot food and relies on foot traffic, extreme weather can hurt business. A recent example: an unusually hot June 2025 heatwave in the UK kept people at home and depressed footfall, leading to weaker sales that month. Greggs issued a profit warning that year, cautioning that full-year profit might be slightly below the prior year due to the heatwave’s impact. The stock dropped nearly 15% on that news. Similarly, very cold or snowy weather can reduce shoppers out and about. These factors are obviously beyond the company’s control but do introduce volatility quarter-to-quarter. Over the long run, one-off weather events tend to even out, but investors should be prepared for the occasional bump in the road (or blip in the bake, in Greggs’ case).

In summary, Greggs’ weaknesses are mostly about managing growth responsibly and navigating external headwinds. None of these appear insurmountable, but they warrant attention. Next, we’ll look at how Greggs rewards shareholders and how the stock is currently valued, before diving into the bull vs bear cases and the outlook ahead.

Keep reading with a 7-day free trial

Subscribe to Kroker Equity Research to keep reading this post and get 7 days of free access to the full post archives.