#122 WisdomTree - A Stock Analysis

A Comprehensive Long-Term Investment Analysis

Disclaimer: The information provided in this publication is for educational and informational purposes only and does not constitute financial advice. The content is solely reflective of my personal views and opinions based on my research and is not intended to be used as a basis for investment decisions. While every effort is made to ensure that the information is accurate and up-to-date, the writer makes no representations as to the accuracy, completeness, suitability, or validity of any information in this post and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. All readers are advised to conduct their own independent research or consult a professional financial advisor before making any investment decisions. The author is not invested in the mentioned stock.

*Affiliate link – Get 15% off Fiscal.ai (formerly Finchat)

WisdomTree (WT) – A Comprehensive Long-Term Investment Analysis

In the ever-evolving world of asset management, WisdomTree (NYSE: WT) has carved out a niche as an innovative ETF provider blending the efficiency of passive investing with the strategic edge of active management. From record-high assets under management to bold moves into digital finance and new asset classes like farmland, the company’s trajectory offers both compelling growth potential and unique risks. This analysis takes a closer look at WisdomTree’s business model, financial performance, and strategic outlook to help long-term investors weigh the opportunities and challenges ahead.

Company Overview

WisdomTree, Inc. (NYSE: WT)* is a global asset manager best known for its exchange-traded funds (ETFs) and other exchange-traded products (ETPs). The company has built a reputation as an innovator in the ETF industry, pioneering alternative indexing strategies under the banner of “Modern Alpha” – essentially combining the potential outperformance of active management with the low-cost benefits of passive funds. In practice, many WisdomTree ETFs use fundamentals (like dividends or earnings) rather than market cap weights, differentiating them from vanilla index funds. Today, WisdomTree offers a diverse suite of ETPs across equities, fixed income, commodities, currencies, leveraged/inverse strategies, alternatives, and even cryptocurrency exposures. It operates globally with a presence in the United States and Europe, managing over $100 billion in assets for investors.

In recent years, the company has also expanded beyond traditional ETFs into digital finance initiatives. It launched a blockchain-native digital wallet called WisdomTree Prime, offering access to tokenized assets and digital funds, and introduced WisdomTree Connect for institutions to access digital offerings. This reflects management’s view that blockchain-enabled finance and tokenization are a natural extension of its asset management business. Overall, WisdomTree positions itself as a “modern” financial services company – rooted in the fast-growing ETF market, while pushing into new frontiers like digital assets. For long-term investors, understanding both sides of this business is key to evaluating the stock.

Latest Financials at a Glance

Before diving into the business model, let’s summarize WisdomTree’s recent financial performance. The company’s latest earnings (Q2 2025) showed continued growth and improving profitability:

Revenues: WisdomTree generated $112.6 million of operating revenues in Q2 2025, which was about a 5% increase year-over-year. Top-line growth was driven by higher assets under management (AUM) compared to a year ago, even though average fee rates saw slight pressure.

Earnings: Net income for Q2 2025 was $24.8 million, up roughly 14% from $21.8 million in the same quarter of 2024. Earnings per share (EPS) came in at $0.17 (or $0.18 on an adjusted basis), compared to $0.13 a year prior. The higher profitability reflects operating leverage – revenues grew faster than expenses – and also some one-time benefits (discussed later).

Record AUM: Assets under management hit a record $126.1 billion at the end of June 2025. This represents an 8.9% increase from the prior quarter, thanks to a combination of market appreciation and strong net inflows. In Q2 alone, the firm saw about $3.5 billion of net inflows, with investors especially favoring WisdomTree’s international developed equity and U.S. equity products. Year-to-date through mid-2025, total net inflows were over $6.5 billion – a healthy organic growth rate for an asset manager.

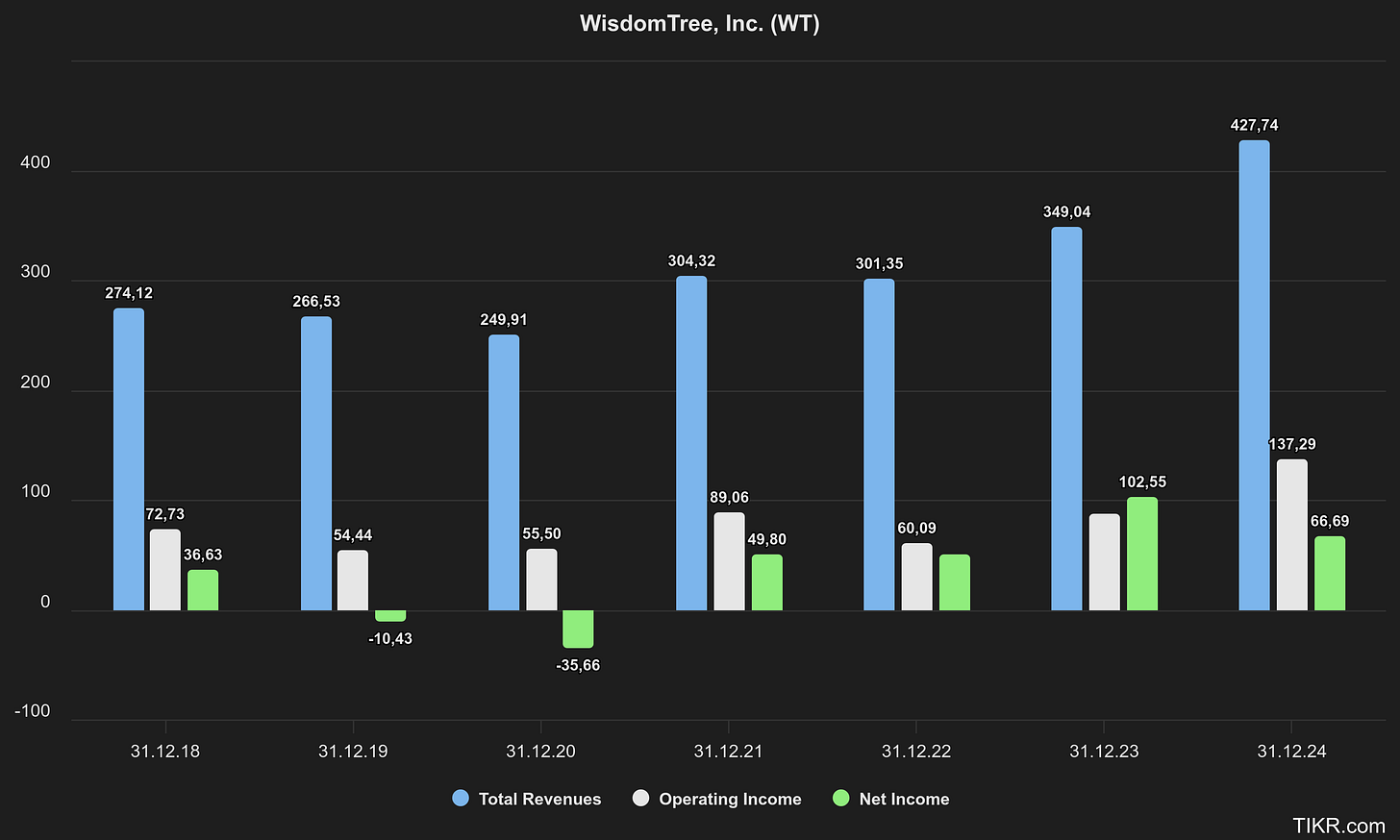

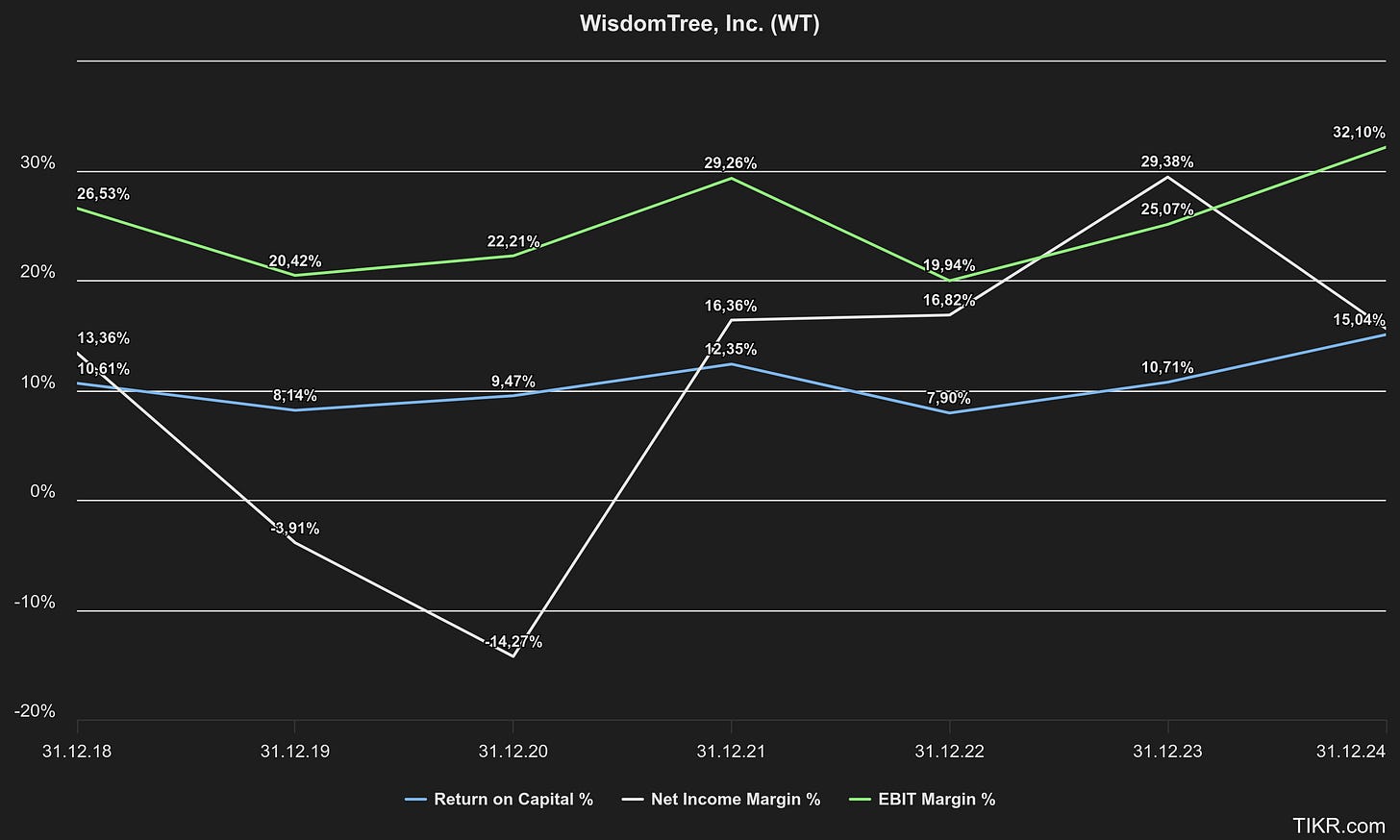

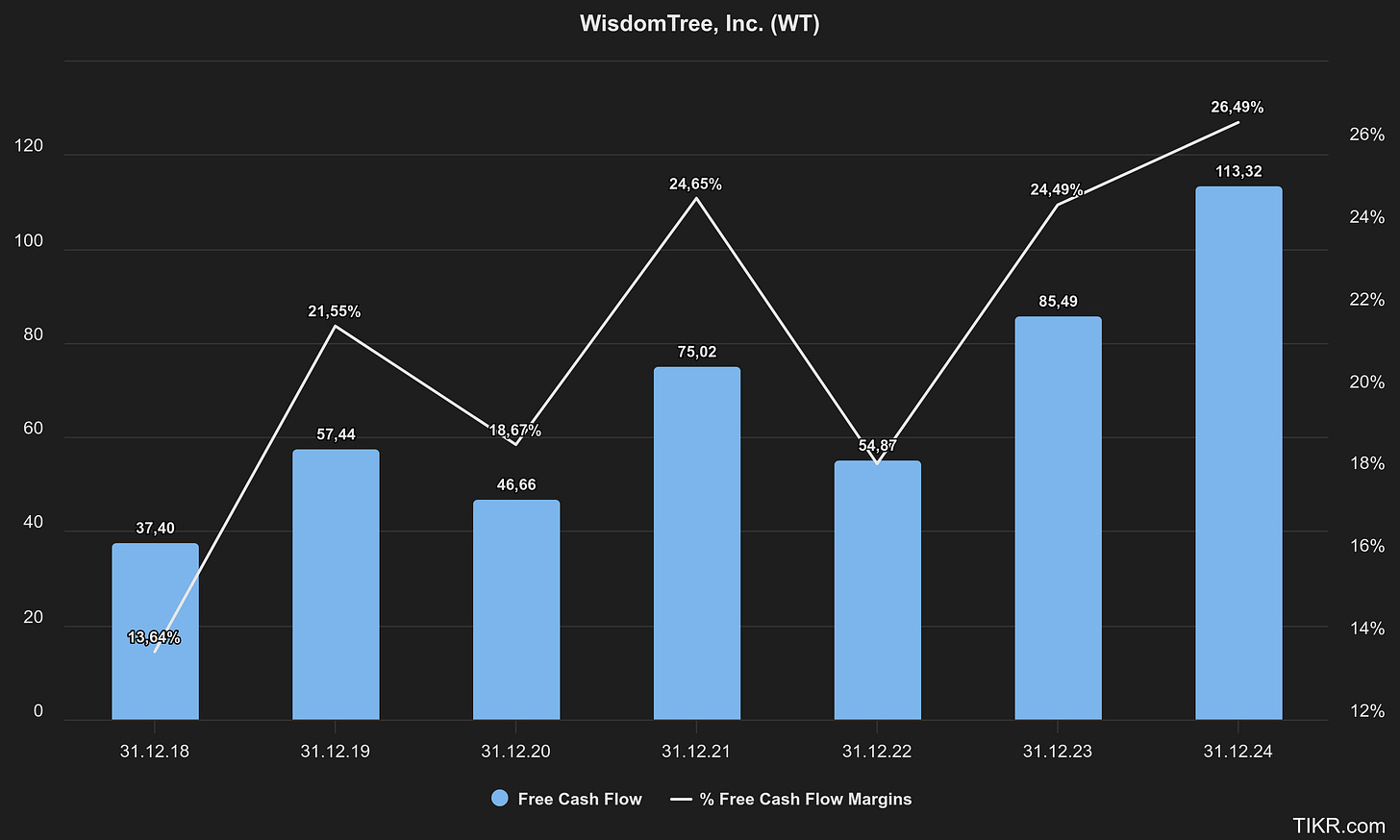

Margins: WisdomTree’s profitability metrics are solid. In Q2 2025 the gross margin was 81% and operating profit margin about 31% (32.5% adjusted) – indicating a highly scalable business model. These margins are roughly on par with larger asset managers, and the company actually expanded its operating margin by about 0.8 percentage points versus the prior quarter (excluding certain one-time costs). This margin expansion trend has been ongoing; for full-year 2024, operating income jumped ~57% on a 22% revenue increase, yielding roughly 700 basis points of margin improvement year-over-year.

In summary, WisdomTree’s recent results show positive momentum: rising revenues, improving earnings, and all-time-high asset levels. The company is benefitting from both favorable markets and investor inflows. Next, we’ll examine how WisdomTree makes money – and what gives it an edge (or potentially holds it back) in the competitive investment management industry.

Assets under Management (AUM)

The chart below visualizes WisdomTree’s AUM progression over the past five years. After dipping in 2022, AUM recovered strongly in 2023 and 2024 and surged to a record $126 billion by June 2025. Overall, AUM has more than doubled since early 2020, underscoring robust organic inflows and favorable market appreciation.

The upward trajectory, punctuated by temporary declines during turbulent markets, highlights WisdomTree’s ability to capture investor inflows across ETFs and other products. The strong rebound in 2023–2025 reflects growth in higher‑fee categories such as international developed market equity, fixed income and cryptocurrency as noted in the company’s monthly metrics releases.

Key financials

Business Model Overview

At its core, WisdomTree’s business model is that of an ETF sponsor and asset manager. The company earns the bulk of its revenue from advisory fees charged on the AUM in its funds. These fees are usually a percentage of assets (for example, an ETF might charge 0.30% annually). With over $126 billion in AUM, even relatively small fee rates translate into substantial revenue. WisdomTree’s average advisory fee across its products was around 0.35% as of mid-2025 – higher than ultra-cheap index funds, but justified by more specialized strategies the firm offers. Notably, WisdomTree does not rely on performance fees or one-off transaction fees; its revenue is recurring and tied to asset levels and fee rates.

Several aspects define WisdomTree’s business model and strategy:

Product Strategy – “Modern Alpha” ETFs: Unlike traditional index fund providers that market purely passive, market-cap weighted funds, WisdomTree made its name with fundamentally-weighted ETFs. For example, it launched dividend-weighted equity funds (where companies with larger total dividends get higher weight) and earnings-weighted funds, seeking to outperform standard benchmarks. This Modern Alpha approach is a cornerstone of its product lineup. Over the years, the firm has launched many first-to-market ETFs in various categories, showcasing a culture of innovation. This includes early entries into currency-hedged equity ETFs in the 2010s, more recently cryptocurrencies and thematic funds, and even tokenized assets now. The ability to create proprietary indexes in-house (for many of its ETFs) also helps keep costs reasonable and avoids licensing fees, which supports margins.

Global and Diversified Offerings: WisdomTree operates in two main geographic segments – the U.S. (where it offers ETFs listed on NYSE/Nasdaq) and Europe (offering ETPs listed across Europe). Its product catalog spans equities, fixed income, commodities, currencies, alternatives, leveraged/inverse products, and crypto. As of December 2024, no single asset class dominates the mix: they truly offer a broad suite of strategies. This diversification means the company isn’t overly reliant on one segment of the market. For instance, if equity markets are down, interest in gold or fixed income products might be up, helping offset. Geographic breadth also helps: WisdomTree has been expanding in Europe (celebrating 10 years in the region in 2024 with a comprehensive ETP lineup), which adds another engine for growth outside the maturing U.S. ETF market.

Distribution and Clients: The firm distributes its funds through all major channels in asset management. This includes financial advisors (wirehouses, registered investment advisors, broker-dealers), institutional investors, private wealth managers, and retail online brokerage platforms. WisdomTree has a dedicated sales force that works with advisors and institutions to drive adoption of its funds. Additionally, the company provides model portfolios and advisor solutions – essentially packaged allocations of ETFs and tools – to embed its products in the portfolios advisors build for clients. As of 2024, over 2,500 advisors were using at least one WisdomTree model portfolio, a strategy aimed at deepening relationships and improving asset retention. This focus on advisor-centric distribution recognizes that financial advisors influence a huge portion of investment flows.

Digital Assets Strategy: Unusually for an ETF company, WisdomTree is investing in blockchain and digital asset initiatives as a long-term strategic expansion. Management views tokenization as a next-generation opportunity in financial services. They launched WisdomTree Prime, a mobile app (available in 45 U.S. states as of 2024) that allows users to invest, save, and even spend via digital assets and tokenized funds. For example, one can buy tokenized gold or even a blockchain-based money market fund (WisdomTree’s WTGXX digital fund) and use it via a debit card. For institutional partners, WisdomTree Connect offers direct access to these digital funds through APIs or wallets. While still in early stages, these efforts aim to position WisdomTree as an early mover in regulated digital finance, potentially tapping new customers and revenue streams in the future. The company emphasizes “responsible DeFi”, meaning they are working within regulatory frameworks (e.g., obtaining a New York trust charter in 2024 to operate digital services). In summary, WisdomTree’s business model is evolving – it remains an asset manager at heart, but one that is blending traditional ETFs with cutting-edge fintech.

Having outlined how WisdomTree operates, let’s evaluate the strengths that underpin its business, and the weaknesses/challenges it faces.

Strengths and Competitive Advantages

1. Innovative Product Suite & First-Mover Advantage: A key strength for WisdomTree is its track record of innovation in the ETF space. The company has often been first-to-market with new types of ETPs. Over the years it pioneered products like dividend-weighted equity ETFs, currency-hedged international funds, and more recently cryptocurrency ETPs. This innovation keeps the lineup fresh and allows WisdomTree to capture investor interest in emerging themes. Notably, WisdomTree’s unique Modern Alpha approach set it apart from plain-vanilla peers – the firm’s alternative weighting strategies offer investors a differentiated value proposition (seeking better returns or income). This has contributed to strong fund performance: as of 2024, over 80% of WisdomTree’s U.S.-listed AUM was in funds ranking in the top quartile of their peer group over a 3-year period, and ~59% of AUM had 4- or 5-star Morningstar ratings. In other words, many of its funds have delivered competitive results, which is a selling point to attract and retain investors.

2. Diversified and Global AUM Base: WisdomTree’s ~$126 billion of AUM is spread across a broad array of asset classes and two continents. This diversification is a strength because it reduces reliance on any single product or market. The firm’s product mix includes equities (U.S., international, emerging markets), fixed income, commodities (it even runs one of the world’s largest physical gold ETFs), and niche strategies. It also has a significant European franchise, acquired in 2018 and grown since, which gives exposure to the growing European ETP market. Diversification helped WisdomTree navigate volatile periods; for example, if equity flows slowed, the company often still saw inflows into its commodity or fixed-income products (or vice versa). A broader product set also means WisdomTree can offer multi-asset solutions (like the model portfolios) and be a one-stop shop for certain clients. All of this can enhance the stability and growth of overall AUM over the long term.

3. Strong Operating Leverage and Improving Profitability: The company has been effective at scaling its operations. WisdomTree’s expenses don’t grow as fast as its revenues, leading to expanding profit margins as AUM rises. In 2024, revenue jumped 22% while operating income jumped 57%, reflecting significant scale efficiencies and cost control. By streamlining operations and internalizing certain functions (like creating its own indexes), WisdomTree has kept its expense base in check. The result is a highly scalable model – gross margins over 80% and operating margins in the 30%+ range are quite healthy. Additionally, the company has taken strategic actions to boost earnings per share, such as retiring an old gold payment obligation in 2023 and repurchasing a costly preferred stock in 2024; these moves “meaningfully enhanced” EPS. For investors, improving profitability means higher earnings growth even if revenue grows at a moderate pace. WisdomTree’s net income has grown robustly (from roughly $43 million in 2022 to $102 million in 2023), and continued to rise in 2024 and 1H 2025, indicating the business model’s earnings power as it gains scale.

4. Shareholder Returns (Dividends & Buybacks): WisdomTree has a history of returning capital to shareholders, which is a plus for long-term investors. The company initiated a regular dividend in 2014 and has consistently paid a quarterly cash dividend since then. The dividend has been $0.03 per share quarterly for many years running, which at the current stock price equates to roughly a 1% annual yield. While not a high yield, this dividend policy signals management’s confidence in steady cash flows and commitment to reward shareholders. In addition, WisdomTree’s board has authorized share repurchase programs from time to time. Notably, in February 2025 the board expanded the buyback authorization to a total of $150 million (extended through April 2028). This was a significant increase, as about $33.5 million remained from the prior program at 2024 year-end before the expansion. In 2024, the company actually put buyback dollars to work: it repurchased ~5.7 million shares of common stock in open-market transactions and also retired all of its Series A convertible preferred shares held by an activist investor (more on that later). These actions reduced the outstanding share count and prevented potential dilution (the preferred stock was convertible into 14.75 million common shares). Overall, WisdomTree’s capital return track record – a steady dividend and opportunistic buybacks – is a strength, as it shows the company can invest in growth initiatives and return excess cash to shareholders simultaneously.

5. Early Mover in Digital Assets (Long-Term Opportunity): While still in its nascent stages, WisdomTree’s push into blockchain and digital assets could turn into a strategic advantage. The firm is one of the first traditional asset managers to create a regulated platform for tokenized funds and digital currencies. By investing early in this area, WisdomTree is developing technology, regulatory know-how, and products that competitors largely haven’t. If finance indeed moves toward tokenization of securities or if demand for digital-native investment products grows among younger investors, WisdomTree will be well-positioned to capitalize. Management refers to this as building the next phase of growth alongside its core ETF business. For example, they have already launched Digital Funds (blockchain-based mutual funds), a tokenized money market fund, tokenized gold, and others on the WisdomTree Prime app. These new offerings could attract assets outside the traditional ETF wrapper. It’s an unproven but potentially significant long-term opportunity – and WisdomTree has a head start, aligning itself with the “future of finance” narrative. In sum, the company’s willingness to innovate (from ETFs to digital assets) is an overarching strength, indicating a culture that can adapt and seek out growth in evolving markets.

Weaknesses and Challenges

Despite its many strengths, WisdomTree faces several challenges and risk factors that investors should keep in mind:

1. Intense Competition & Fee Pressure: The asset management industry is fiercely competitive, especially in ETFs. WisdomTree’s competitors include not just specialized ETF firms but also asset management giants like BlackRock (iShares), Vanguard, and State Street (SPDR ETFs) which dominate the market with scale and ultra-low fees. A clear trend in recent years is that investor money has been flowing into the lowest-cost index funds. In fact, funds with expense ratios of 0.20% or less accounted for ~73% of global ETF net inflows over the past three years, even though those funds represent only ~32% of industry revenue. This underscores that investors gravitate to cheaper products. For WisdomTree, which often charges higher fees (its average advisory fee is ~0.35%), this is a challenge – it must justify its fees with superior strategies or performance. The risk is that fee compression could erode margins or that WisdomTree loses market share if it cannot keep pace on pricing. The company’s strategy of offering differentiated “smart beta” products helps, but larger rivals have also launched similar factor-based or smart beta ETFs, sometimes at lower fees. Additionally, big firms have enormous distribution reach and marketing budgets. As a mid-sized player, WisdomTree must continuously prove its value to retain advisor mindshare. Price competition is an ever-present headwind in this business, and it puts pressure on firms to either cut fees or offer something unique enough that investors will pay a bit more. So far WisdomTree has managed this well, but it remains a key challenge.

2. Reliance on Market Conditions (Asset Volatility): Like all asset managers, WisdomTree’s fortunes are tied to the financial markets. When markets rise, AUM usually rises (via both investment gains and new inflows), boosting revenue. But in a market downturn, AUM can fall due to both declining asset values and potential outflows as investors retreat. This cyclicality is a structural weakness – the company has limited control over macroeconomic and market forces. For example, in a severe equity bear market or recession, WisdomTree’s equity-heavy AUM could shrink considerably, quickly pressuring fees and profits. We saw hints of this in past episodes: e.g., during early 2020’s pandemic crash, and in 2022 when markets were choppy, WisdomTree experienced lower earnings (indeed, the firm had a net loss in some quarters around 2020) as AUM and fee revenue dipped. Moreover, certain flagship products can be volatile. Historically, WisdomTree had big successes like its Japan Hedged Equity ETF in the 2010s – which gathered huge assets but later saw outflows when the theme went out of favor. Such concentration in a few hit funds can be a double-edged sword. While currently AUM is at a record high, investors should be prepared for AUM volatility over cycles. The company has tried to mitigate this by diversifying products and focusing on stickier assets (like model portfolios), but it’s impossible to escape market risk in this industry.

3. Smaller Scale vs. Giants – Need for Scale: WisdomTree’s ~$126B AUM, while substantial, is an order of magnitude smaller than the AUM of industry leaders (BlackRock is over $9 trillion, Vanguard similarly in the trillions). In asset management, scale brings competitive advantages: greater resources for marketing, the ability to spread costs, better bargaining power with service providers, etc. Smaller firms may struggle with thinner margins if they try to compete on price, and they have to be more selective in investments. WisdomTree itself acknowledges the importance of scale – noting that industry consolidation is driven by fee and cost pressures that “highlight the importance of scale and operating efficiency”. Indeed, the past few years saw many acquisitions in the asset management space. Being smaller could make WisdomTree a potential target (which could actually be a positive for shareholders if a premium buyout occurs) but it also means the firm might have less room for error. It must achieve growth organically or via niche acquisitions to keep from falling behind. The company did make a transformative acquisition in 2018 (the European ETF business from ETF Securities), and more recently is acquiring Ceres Partners (a farmland asset manager) in 2025 to diversify further. But integrating acquisitions and realizing expected benefits is another challenge. In short, lack of mega-scale is a weakness in an industry where scale matters, though WisdomTree is doing a decent job punching above its weight.

4. Strategic Initiatives Still Unproven (Digital Assets Focus): While we cited WisdomTree’s digital assets strategy as a potential strength, it is also a risk. The company is spending real dollars on developing its digital platform (WisdomTree Prime, digital funds, etc.) and these initiatives currently generate minimal revenue. There is execution risk here – the broader adoption of tokenized assets or blockchain-based finance in mainstream investing is far from certain. It’s possible that these efforts take much longer to bear fruit, or that uptake remains niche. In the meantime, such projects add to the company’s expenses. Critics have questioned this pivot: for instance, an activist shareholder (ETFS Capital) argued that WisdomTree’s attempt “to evolve from an ETF business into decentralized finance (DeFi) relying on blockchain technology” was misguided and outside its core competency. If management’s bet on digital finance doesn’t pay off, it could mean wasted resources and distraction from the core ETF franchise. Furthermore, operating in the digital asset arena exposes WisdomTree to new regulatory and security risks that traditional asset managers don’t face. Compliance with evolving crypto regulations, ensuring strong cybersecurity for digital wallets, and simply competing with fintech and crypto-native firms will be challenging. The company acknowledges that success in digital assets will depend on continuing to offer innovative products and robust controls in a field where the risks (and competitors) are still emerging. In summary, WisdomTree’s foray into blockchain is ambitious but carries uncertainty – a long-term investor will need to monitor whether this becomes a money-maker or a money pit.

5. History of Activist Shareholder Pressure: An additional challenge worth noting is the shareholder activism the company has faced, which reflects some discontent with past performance and strategy. ETFS Capital, a 10% shareholder (and former owner of the European business WisdomTree bought), launched a campaign in 2023–2024 criticizing WisdomTree’s high operating costs, capital allocation, and its focus on digital assets. The activist argued that the company’s intrinsic value was significantly higher than its stock price and pushed for changes including potential divestitures, cost cuts, and management/board changes. In 2023, ETFS Capital succeeded in getting one of its nominees elected to WisdomTree’s board, and in 2024 it ran a “withhold vote” campaign against certain directors. While the board ultimately remained intact, the tussle likely pressured WisdomTree’s management to respond (indeed, shortly after, in August 2024, WisdomTree repurchased ETFS Capital’s convertible preferred shares for $143.8 million, which could be seen as a partial concession to remove an overhang and appease that investor). The activist saga indicates that governance and strategic direction have been points of contention. For long-term investors, activist involvement is a double-edged sword: it can catalyze positive change (cost discipline, focus on core business), but it can also create instability or short-term focus. The episode underscores that WisdomTree must prove it can allocate capital wisely (the activist wanted more buybacks/dividends) and keep expenses in check, or else face continued shareholder pressure. This remains an ongoing consideration, though for now the company seems to have addressed some activist concerns by simplifying its capital structure and accelerating growth.

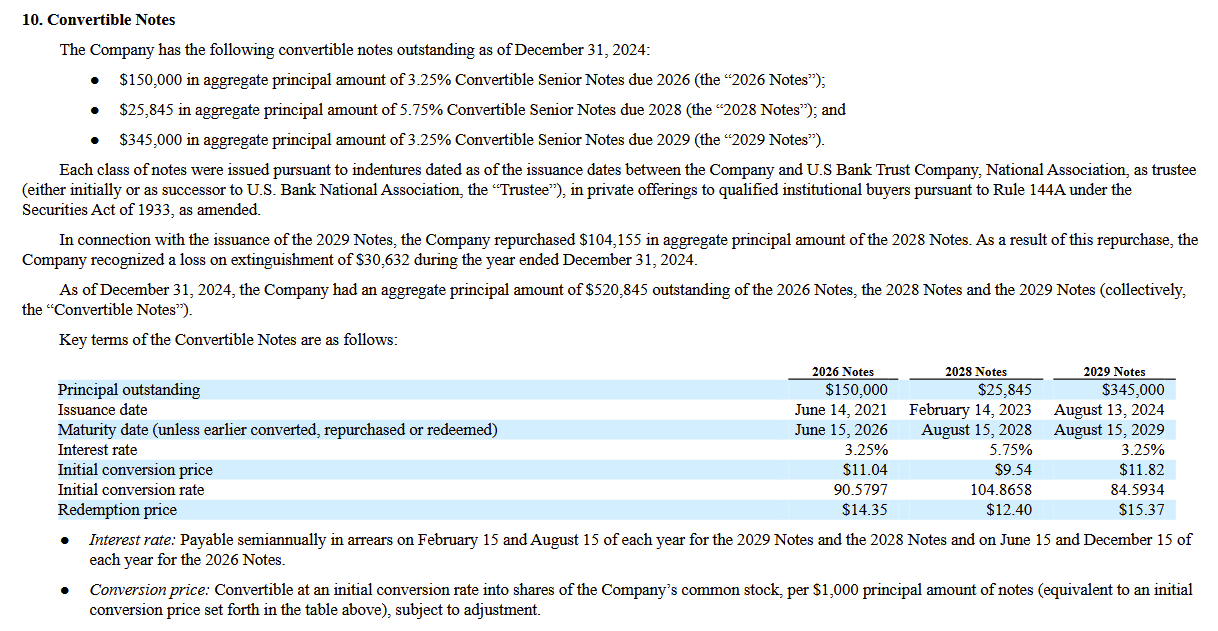

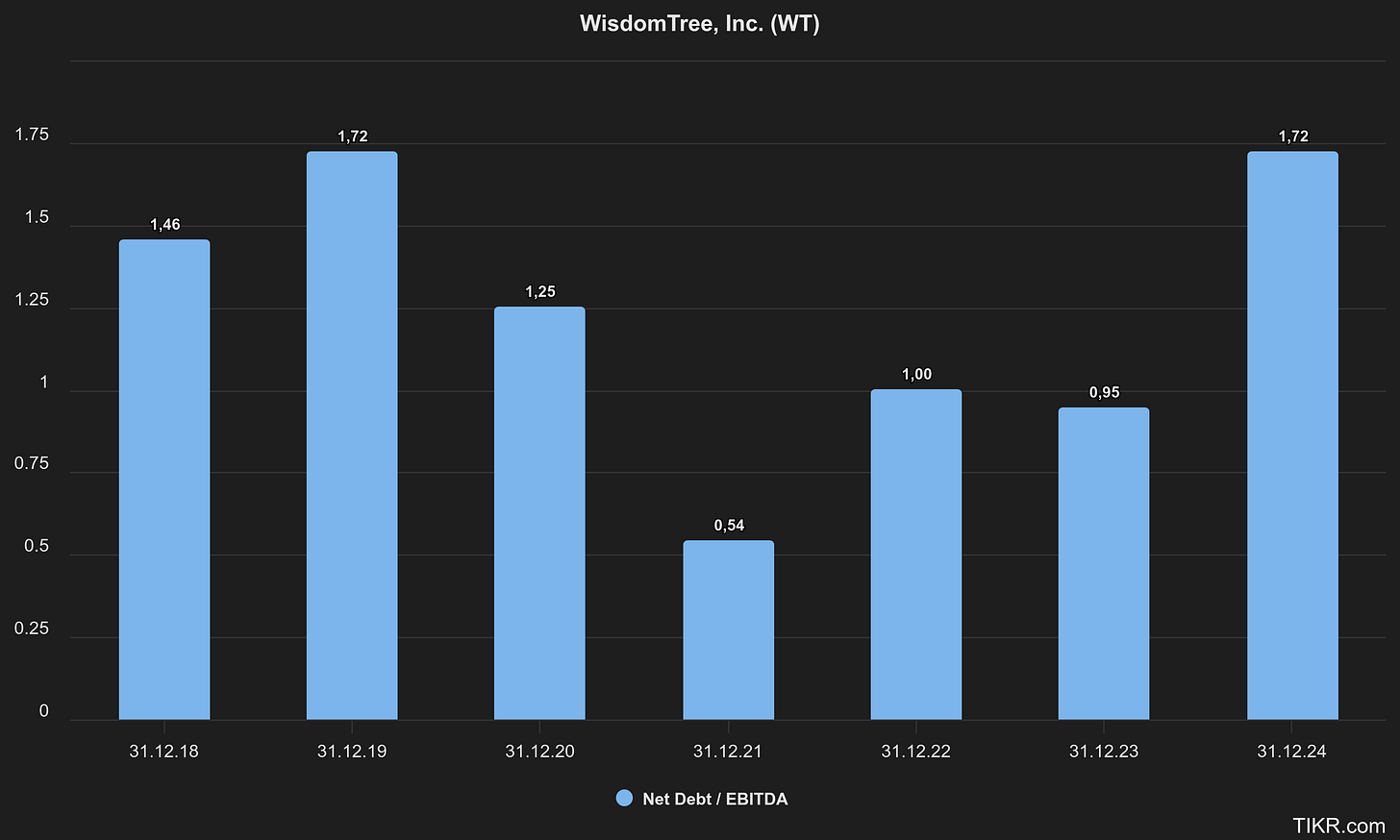

6. Moderate Leverage and Dilution Risk: Unlike many asset-light peers, WisdomTree has taken on debt in the form of convertible notes. As of 2024-2025, the company has several tranches of convertible bonds (maturing 2026, 2028, 2029) totaling around $520 million in principal. While these financings provided cash (some used for buybacks and paying off the preferred), they come with interest costs and potential dilution if converted to equity. In fact, the conversion prices for these notes are in the $11–12 per share range – with the stock now trading in the low-to-mid teens, conversion is a real possibility by maturity. If all these convertibles turned into shares, it could add tens of millions of shares to the float (diluting existing shareholders). Management did proactively repurchase a portion of the 2028 notes and some common shares alongside issuing the 2029 notes, which is encouraging. However, the remaining debt means interest expense that eats into earnings (though at relatively low coupons 3.25–5.75%) and the overhang of future dilution. This leverage is not overly high relative to cash flow, but it’s something to watch – especially for a business that is primarily equity-funded normally. Long-term investors would prefer to see WisdomTree continue using excess cash to retire debt or buy back shares to minimize dilution.

In summary, WisdomTree’s weaknesses are mostly about operating in a tough competitive landscape and ensuring its strategic bets pay off. Next, we’ll examine the stock’s valuation and then outline the bullish and bearish cases for investing in WisdomTree at this juncture.