#124 Einhell - A Stock Analysis

Cordless Powerhouse for Long-Term Investors

Disclaimer: The information provided in this publication is for educational and informational purposes only and does not constitute financial advice. The content is solely reflective of my personal views and opinions based on my research and is not intended to be used as a basis for investment decisions. While every effort is made to ensure that the information is accurate and up-to-date, the writer makes no representations as to the accuracy, completeness, suitability, or validity of any information in this post and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. All readers are advised to conduct their own independent research or consult a professional financial advisor before making any investment decisions. The author is not invested in the mentioned stock.

*Affiliate link – Get 15% off Fiscal.ai (formerly Finchat)

Einhell Germany AG – Cordless Powerhouse for Long-Term Investors

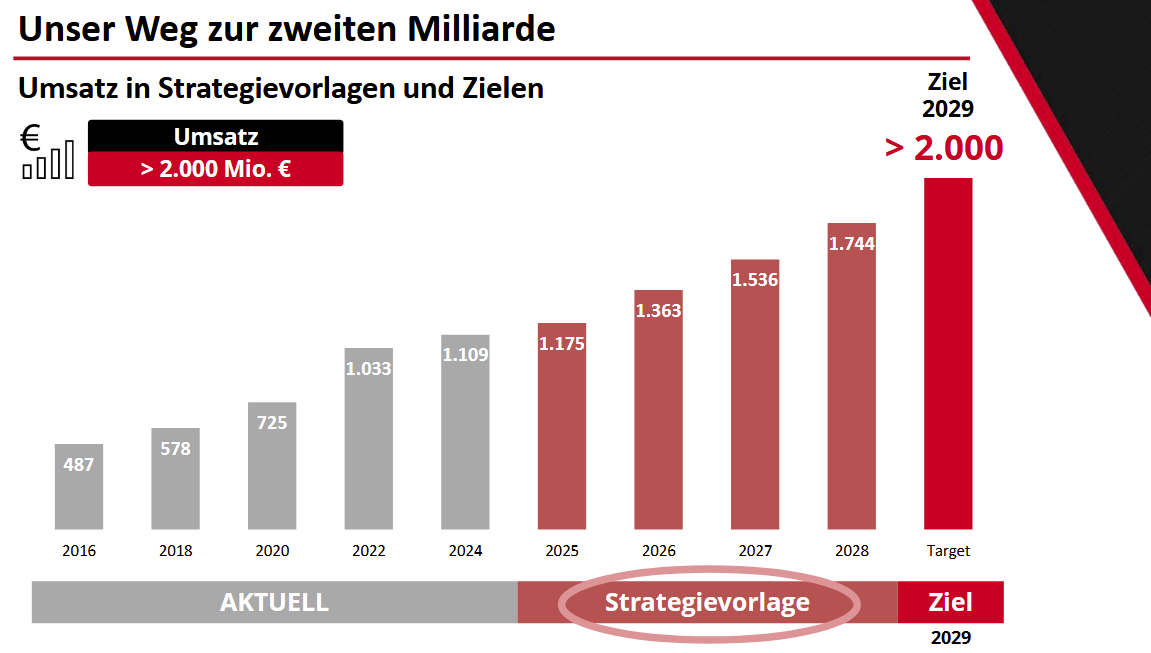

Einhell Germany AG* has established itself as a rising force in the global DIY and garden tools market, thanks to its focus on cordless innovation and steady international growth. After delivering record results in 2024, rewarding shareholders with higher dividends, and setting bold goals like hitting €2 billion in sales by 2029, the company offers a mix of stability and growth that’s hard to ignore. In this post, we’ll take a closer look at Einhell’s business, strategy, and what the future might hold.

Company Overview

Einhell Germany AG is a leading manufacturer of power tools and garden equipment, known especially for its cordless technology. Founded in 1964 in Bavaria, the company has grown from a small regional firm into a global player in battery-operated DIY and garden tools, employing over 2,500 people worldwide. Einhell operates nearly 50 subsidiaries and sells its products in more than 100 countries. Its product range includes hand-held power tools, stationary workshop equipment, lawn and garden care tools, as well as accessories like irrigation and drainage solutions. Einhell primarily distributes through DIY retail chains, e-commerce platforms, and other specialized dealers in the home improvement market, ensuring broad market reach.

A cornerstone of Einhell’s success is its Power X-Change platform – an innovative 18-volt rechargeable battery system compatible with a wide array of tools. Since its introduction in 2015, the Power X-Change ecosystem has expanded to over 300 cordless tools and garden devices that all run on the same interchangeable batteries. This “one battery fits all” concept offers customers convenience and cost savings by enabling them to power many tools with a single battery system. It has propelled Einhell to become a market leader in cordless tools and garden equipment, catering to DIY enthusiasts and professionals alike. Users appreciate the cordless freedom, performance, and value for money that Einhell’s products provide, backed by the company’s focus on quality and customer service.

Einhell has also invested heavily in building its brand internationally. Notably, it partnered with high-profile sports teams to raise its global profile. Since 2021 Einhell has been the “Official Home & Garden Expert” for FC Bayern Munich, and in 2023 it became the “Official Tool Expert” of the Mercedes-AMG PETRONAS Formula 1 team. These partnerships, along with active marketing campaigns in over 70 countries, have boosted Einhell’s brand visibility and reinforced its image of “Cordless Excellence.”

Operationally, Einhell’s manufacturing is largely outsourced to Asia, with rigorous quality control by its Asian subsidiaries. The company’s sourcing hubs in China and other parts of Asia handle product procurement and quality assurance. To strengthen its supply chain, Einhell has begun producing strategic components itself – for example, it established its own battery production facility in Hungary to reduce reliance on external suppliers and improve supply security. Einhell’s distribution subsidiaries (across Europe, the Americas, Australia, South Africa, etc.) handle local marketing and sales, ensuring proximity to customers in each region. This global yet vertically integrated structure is part of Einhell’s strategy to control quality, manage costs, and respond swiftly to market demand.

Latest Financials (FY 2024 & H1 2025)

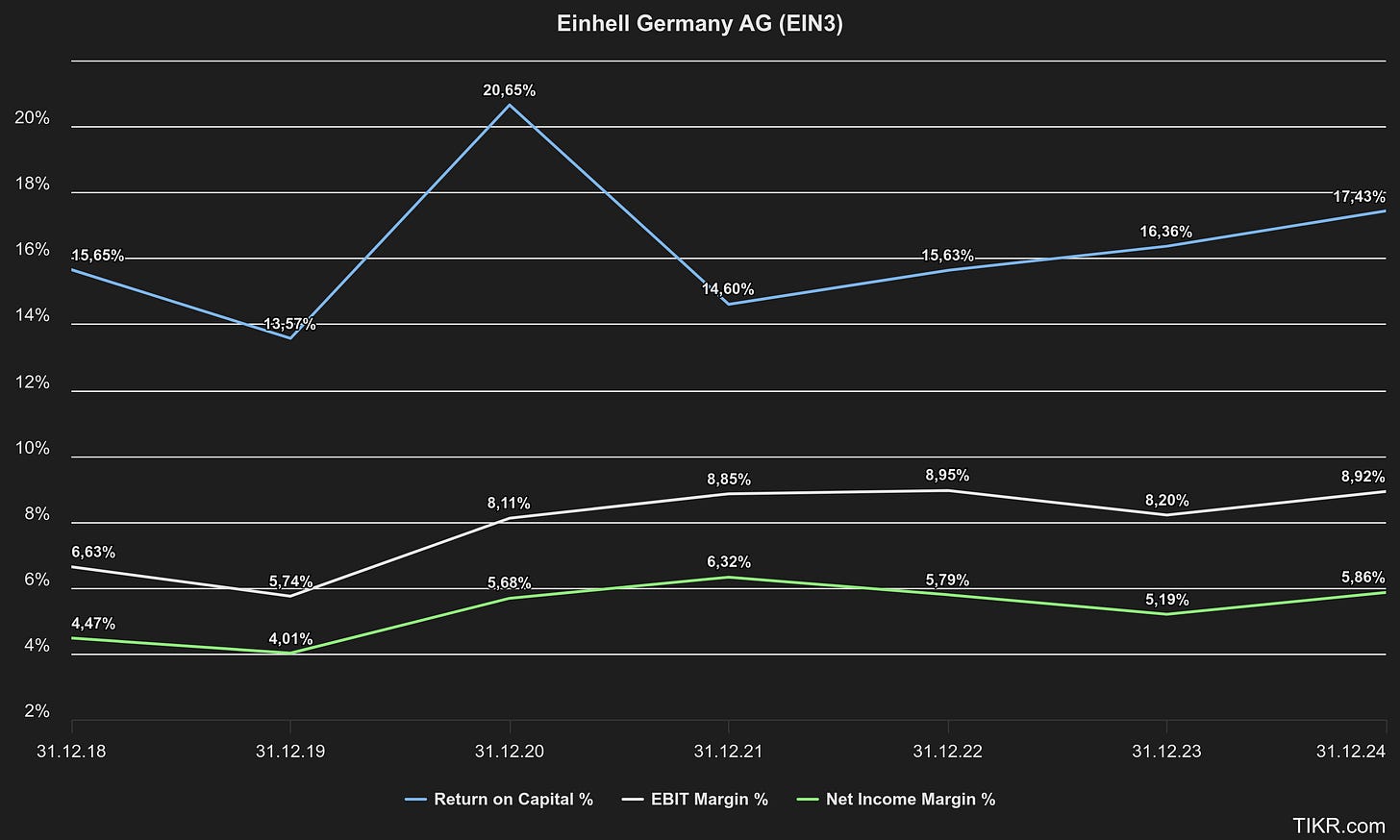

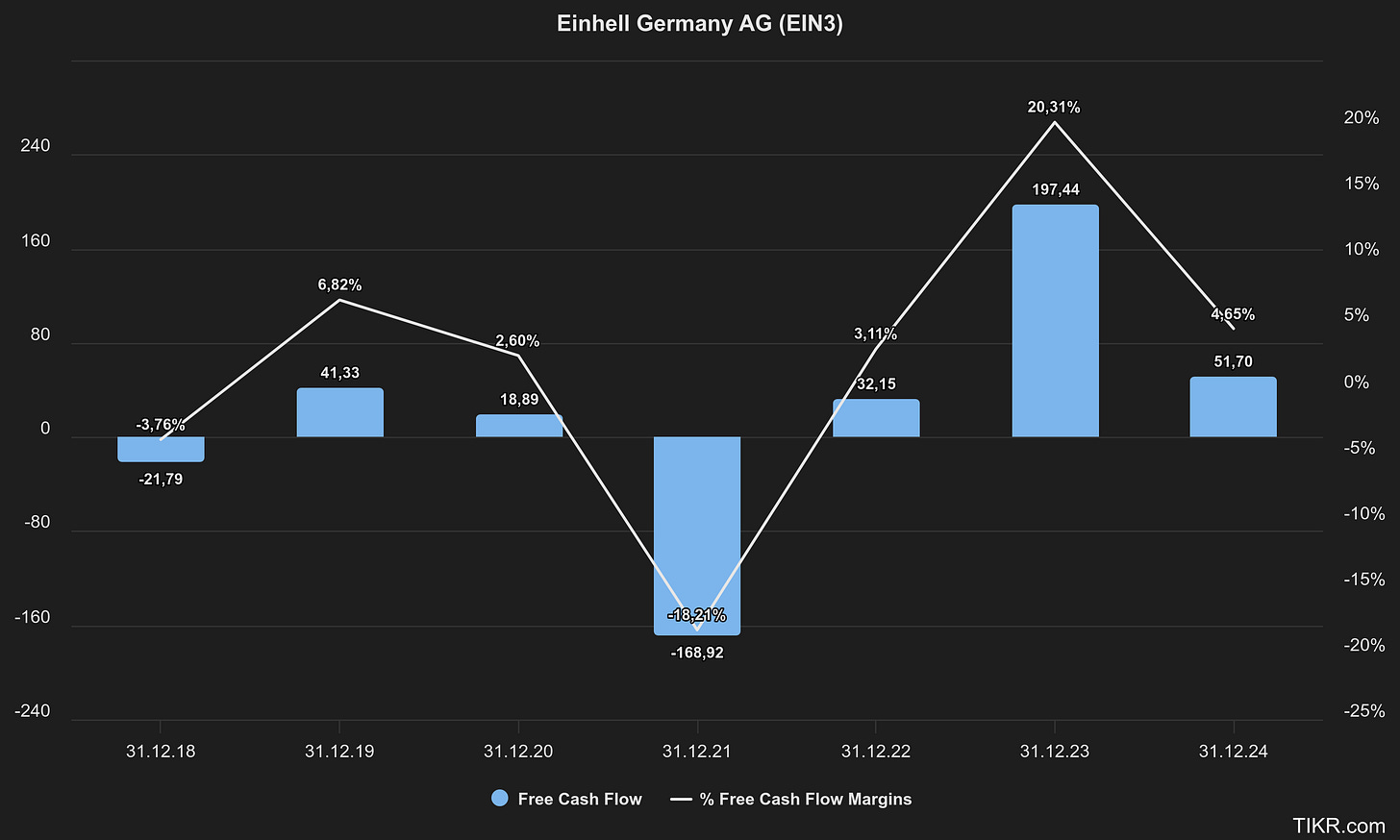

2024 was a record year for Einhell, marked by all-time high revenue and earnings. Group revenue reached €1.11 billion in 2024, a robust increase of +14.2% over 2023. This strong top-line growth was fueled by healthy demand for Einhell’s products, especially in its core European markets and from its expanding Power X-Change lineup. Profitability also improved significantly: earnings before taxes (EBT) were €98.5 million, up +30.6% year-on-year, yielding a pre-tax profit margin of 8.9% (versus 7.8% in 2023). Operating profit (EBIT) similarly rose ~25%. These results indicate that Einhell managed not only to grow sales but also to expand margins, thanks to operating leverage and possibly some easing in costs.

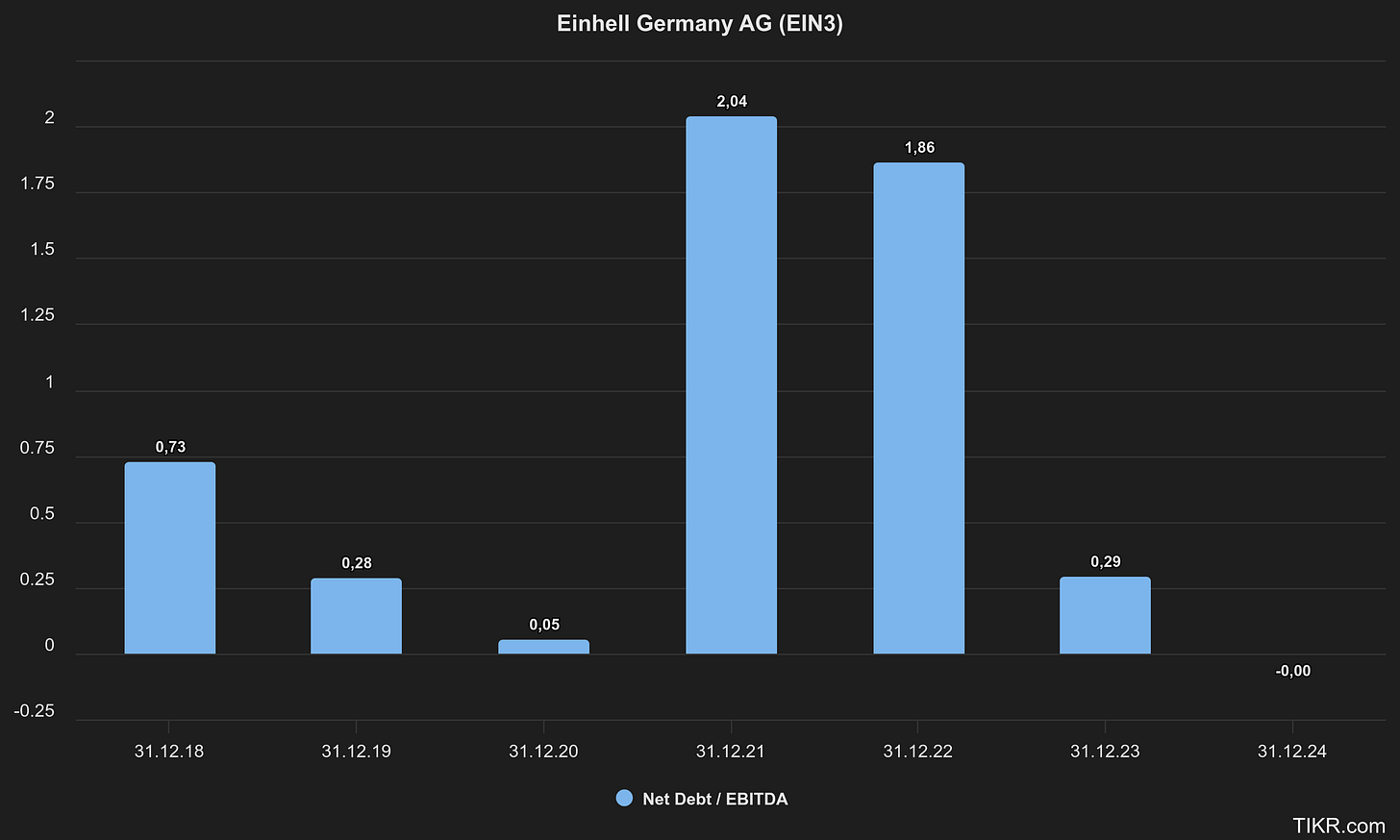

Notably, Einhell closed 2024 in a net cash position, with about €20 million net cash on its balance sheet. The company carries effectively no net debt, which provides financial stability and flexibility for future investments or shareholder returns. The balance sheet strength and record earnings led the Board to propose significantly higher dividends for 2024 (paid in 2025): €1.50 per preference share and €1.48 per ordinary share, up from €0.97/€0.95 in the previous year. This was a more than 50% increase in the dividend, reflecting management’s confidence in Einhell’s financial performance.

The momentum continued into the first half of 2025. H1 2025 saw Einhell’s revenue grow ~9.3% year-on-year to about €630 million (H1 2024 was €576.2 m). Despite a challenging economic environment and currency volatility, Einhell also achieved higher earnings. Preliminary figures show H1 2025 EBT of roughly €59 million, up from €50.1 m in the prior-year period. This implies the pre-tax margin stayed strong at over 9.3%, even after absorbing some adverse exchange-rate effects. Management expressed satisfaction with this performance and at the July 2025 Annual General Meeting confirmed the full-year 2025 forecast, indicating confidence that Einhell can meet its targets for the year.

Geographically, Einhell’s growth in 2024 was driven in large part by Western Europe (including the D/A/CH region) where end-customer demand was very strong. The company gained market share in its home and nearby markets, as consumers embraced the Power X-Change battery family for DIY projects. Eastern Europe also contributed positively (with particular strength in Turkey). Outside Europe, Einhell’s subsidiary in Australia (acquired as Ozito) was a standout performer, contributing nearly €198 million in revenue in 2024 – making it the largest single contributor to group sales. Overall, Einhell’s diversified presence helped it achieve balanced growth. However, it’s worth noting that two major retail customers each accounted for over 10% of Einhell’s revenue in 2024 (one contributed ~€187 m, another ~€191 m), which underscores some customer concentration (more on that later in risk factors).

Looking forward, Einhell’s guidance for FY 2025 (as provided earlier this year) is for about €1.16 billion in revenue with a pre-tax profit margin between 8.5% and 9.0%. This suggests management expects to roughly repeat the strong 2024 performance in 2025, albeit with a more modest top-line growth of ~4-5%. The cautious outlook likely reflects a tougher macroeconomic climate (higher inflation and interest rates potentially weighing on consumer spending on non-essential DIY products). Even so, Einhell’s first-half results indicate it is on track, and the company continues to invest in product development, brand building, and expansion to sustain growth.

Key Financials

Business Model and Competitive Position

How Einhell makes money: Einhell operates primarily in the consumer and prosumer (professional-consumer) market for power tools and garden equipment. Its business model centers on designing and engineering a broad range of affordable, reliable tools – from drills, saws, and grinders to lawnmowers and leaf blowers – and selling them through retail channels worldwide. Einhell’s products aim to offer solid quality at a value price point, often positioning the brand between low-end no-name tools and premium professional brands. This value-for-money proposition has resonated with DIY enthusiasts and budget-conscious professionals globally.

A key element of Einhell’s model is the razor-and-blade strategy via the Power X-Change battery platform. By getting customers into its cordless ecosystem (e.g. buying a starter kit with a tool and battery), Einhell encourages additional purchases of “bare” tools (without battery) that can all be powered by the same batteries. This drives customer loyalty and repeat sales across its 300+ product lineup, as users invested in Power X-Change are more likely to stick with Einhell for future tool needs. The expanding platform – targeting 450 compatible devices by 2027 – also allows Einhell to upsell higher-capacity batteries and new specialized tools to its user base.

Manufacturing and supply chain: Einhell outsources most of its production to manufacturing partners in Asia (primarily China and Vietnam), which helps keep costs competitive. The company’s Asian subsidiaries handle sourcing, supplier management, and quality control on the ground. To mitigate supply chain risks, Einhell has diversified its supplier base and even built its own battery and charger plant in Hungary for critical components. Quality assurance is integrated with suppliers to maintain standards. This hybrid model – outsourced production with internal oversight – enables Einhell to scale production flexibly without heavy capital investment in factories, while still ensuring product quality.

Sales and distribution: Einhell’s revenue is generated at the point of sale of its products (there are no long-term service contracts – it’s a straightforward product sales model). The company sells through multiple channels:

Retail chains: Einhell supplies major DIY/hardware store chains (like home improvement superstores) in various countries. For example, in Australia, Einhell (through Ozito) has a major partnership likely with Bunnings Warehouse, and in Europe it supplies chains such as OBI, Bauhaus, etc. Some of these retailers are large – indeed one major customer (likely a retail chain) accounted for ~€191 m of revenue in 2024.

E-commerce: Einhell products are available via online marketplaces (such as Amazon) and the company’s own web stores in certain regions. E-commerce is a growing channel allowing Einhell to reach customers directly.

International subsidiaries and partners: Einhell’s subsidiaries in each region manage local marketing and distribution. In markets where Einhell doesn’t have a subsidiary, it partners with local distributors. This network ensures proximity to customers and local market knowledge in each region.

Einhell’s competitive position in the industry is unique. It is not as large or as famous globally as some heavyweights like Bosch (DIY tools), Stanley Black & Decker (DeWalt, Black+Decker), Makita, or TTI (Milwaukee, Ryobi). However, Einhell has carved out a strong niche by offering a comprehensive cordless system at an affordable price point. Its tools often receive positive reviews for being “good enough” for most tasks at a fraction of the cost of high-end professional tools. The broad compatibility of batteries across all Einhell devices is a selling point, as some competitors have multiple battery lines or more expensive ecosystems. Einhell’s rapid growth to €1+ billion revenue and market leadership in cordless DIY tools demonstrates its competitive strength.

At the same time, Einhell faces intense competition. Virtually all major tool makers now emphasize cordless technology, so Einhell must continually innovate to keep its platform attractive. Established brands like Bosch, Makita, and Stanley (with their 18V/20V platforms) target similar customers. Additionally, new low-cost entrants from Asia and retailer “store brands” could pressure Einhell’s market share over time. Einhell’s strategy to counter this includes broadening its product range (entering new segments like cleaning devices, storage solutions, and even a higher-end “Professional” tool line for trade users) and expanding geographically to find new growth.

Strengths:

Innovative Battery Ecosystem: The Power X-Change one-battery-for-all system is a major asset, driving customer loyalty and cross-selling opportunities. It aligns with consumer demand for cordless convenience and has given Einhell a first-mover advantage in some markets.

Strong Growth Track Record: Einhell has doubled its sales within the last decade (crossing €1 billion by 2022), showcasing successful execution of its strategy. Even in challenging times, it has delivered revenue and profit records.

Global Diversification: With sales spread across Europe, Asia-Pacific, and beyond, Einhell isn’t overly reliant on any single market. This helped it capitalize on growth hotspots (e.g. Australia, Eastern Europe). New market entries (USA, India, Middle East, etc.) provide further upside potential.

Solid Financials: The company is debt-free on a net basis and generates healthy cash flows. This financial strength allows continued investment in R&D, marketing, and potential acquisitions without jeopardizing stability.

Shareholder-Friendly Moves: Einhell’s family owners and management have shown commitment to shareholder value through rising dividends and a recent 3-for-1 stock split (in 2024) aimed at improving share liquidity. The strong insider ownership can also ensure management is aligned with long-term growth (the founding Thannhuber family remains a significant shareholder).

Weaknesses and Risks:

Consumer Cyclicality: Einhell’s business is tied to consumer spending on home improvement and garden projects, which can be discretionary. High inflation or economic downturns can soften demand as people postpone tool purchases. For instance, if inflation persists, end customers might cut back on non-essential DIY goods – a risk the CEO has highlighted.

Competition & Pricing Pressure: Einhell operates in a fiercely competitive market. Giants with deeper R&D pockets or brand prestige could squeeze Einhell’s market share. Competitors’ strategic shifts or aggressive pricing by low-cost rivals (including Chinese brands) could pressure Einhell’s sales and margins. Einhell mitigates this by continuously expanding its product lines and emphasizing innovation and value.

Supply Chain and Cost Risks: Relying on Asian manufacturing means exposure to supply chain disruptions, tariffs, and commodity cost swings. Einhell tries to hedge against material cost increases and to qualify multiple suppliers, but events like factory shutdowns, shipping delays, or surges in steel/plastic prices could impact its inventory and profitability.

Customer Concentration: As noted, a few large retail partners account for a sizable chunk of Einhell’s revenue (two customers >10% each). Losing a big account or seeing a major retailer reduce orders (perhaps to push their own private labels) would create a notable hole in sales. Management maintains that dependency risk is under control, but concentration is still a watch item.

Execution of Expansion: Einhell’s growth plan involves entering new markets like the United States – the world’s largest DIY market. Succeeding there is not guaranteed; it will pit Einhell against entrenched U.S. brands and require substantial marketing and distribution investments. Missteps in expansion (or an acquisition that doesn’t pay off) could strain resources. Similarly, the push into new product categories (e.g. higher-end professional tools) carries the risk of unknown competition and potential dilution of focus.

Management Transition: The long-standing CFO is set to resign at end of 2025, and while the CEO has been at the helm for over 20 years, any leadership changes bear monitoring. The company’s success has been closely tied to its visionary management; ensuring a smooth transition and continuity in strategy is important for investor confidence.

Dividends and Shareholder Returns

Einhell has a history of steady dividend growth, sharing its profits with shareholders. The company typically pays one annual dividend per year (after the Annual General Meeting in summer). For the 2024 financial year, Einhell’s Board significantly hiked the dividend as a reward for record results: €1.50 per preference share and €1.48 per common share were paid in July 2025. This was a big jump from the €0.97/€0.95 paid the prior year. On a merged basis, this roughly equates to around €1.49 per share, which at the year-end 2024 stock price (€63) was a yield of ~2.3%. In fact, Einhell’s dividend yield is presently about 2%, and the payout ratio is quite conservative (~24% of earnings). This low payout ratio suggests there is room for further dividend increases, assuming earnings continue to grow. The company’s dividend policy appears progressive but prudent – it raises the dividend in line with profit growth while retaining plenty of earnings to reinvest in the business (or buffer against downturns).

It’s worth noting that Einhell has two classes of shares: ordinary shares (with voting rights) and preference shares (no voting rights, but with a €0.02 higher dividend). Both classes receive dividends, with preference shares getting the slight extra €0.02 per share. The presence of preference shares is common in some German companies and is largely a legacy of how the company raised capital historically while the founding family retained voting control. In Einhell’s case, the Thannhuber family (through Thannhuber AG and related parties) holds a large portion of the shares – especially the non-voting preference shares – ensuring they maintain economic interest and influence. In mid-2024, shareholders approved a 3-for-1 stock split which tripled the number of shares (making the per-share metrics like EPS and DPS one-third, but improving liquidity). This split in August 2024 made the stock price more accessible to retail investors and increased the total share count to ~11.32 million shares.

What about share buybacks? So far, Einhell has not engaged in notable share repurchase programs. The focus for returning cash has been on dividends. Third-party analyses indicate Einhell’s buyback activity is essentially zero (a 0.00 buyback ratio), meaning the company isn’t retiring stock via buybacks. This is not unusual for a mid-sized growth company – management has preferred to reinvest cash into expansion and to reward shareholders through steadily growing dividends. From an investor perspective, the lack of buybacks isn’t a major issue given the stock’s decent dividend and the company’s strong internal growth opportunities. However, if Einhell continues to accumulate cash (beyond what’s needed for growth), it could consider buybacks in the future as another way to boost shareholder value. For now, investors can primarily count on dividends (and the compounding of those payouts) as the direct return, while the real upside is expected to come from stock price appreciation driven by business growth.

Current Valuation of the Stock

Despite its solid growth and profitability, Einhell’s stock is trading at relatively modest valuation multiples. This could present an opportunity for long-term investors, but it also reflects the market’s cautious view of cyclical consumer-oriented companies in the current environment. Here are some key valuation metrics for Einhell Germany AG:

Price-to-Earnings (P/E) Ratio: Based on consensus estimates, Einhell’s forward P/E for 2025 is around 11.3× (and about 10× for 2026). This is a fairly low earnings multiple, both in absolute terms and compared to broader equity markets. It suggests the market is not overpaying for Einhell’s earnings – in fact, one might say Einhell is valued at a single-digit to low-double-digit P/E, which often signals a value stock territory if the company has decent growth prospects. Historically, Einhell’s P/E has ranged widely, but at ~11× it’s well below peaks (the stock traded above 20–25× earnings at times in past upcycles). The modest P/E likely reflects caution about the sustainability of recent earnings growth given economic headwinds, but it may undervalue the company’s long-term growth potential if Einhell can continue expanding internationally.

Dividend Yield: At the current share price, Einhell offers a dividend yield of about 2.0–2.3%. The 2025 forward yield is around 2.2% based on expected dividend increases. This yield is relatively attractive in absolute terms (above the market average in Germany, and certainly higher than zero growth tech stocks), providing some income while investors wait for capital appreciation.

In addition to multiples, my own discounted cash flow (DCF) valuation suggests upside. Using a normalized net income margin of 5%, a WACC of 9%, assumed CAGR of 5% for net sales and EPS growth, and a terminal growth rate of 1.6%, I arrive at an intrinsic valuation of roughly €90 per share

In summary, Einhell’s valuation metrics (P/E ~11, ~2% yield) suggest a cautiously valued stock. The market seems to be pricing in either a slowdown in growth or the risks of the sector (consumer cyclical, competition, etc.). For value-oriented long-term investors, this pricing could be appealing: you are acquiring a growing, profitable business at a price that implies only modest growth expectations. If Einhell can continue its growth trajectory (even at a moderate pace) and sustain high single-digit margins, then at this valuation the stock could deliver solid returns (through earnings growth and some multiple expansion). On the other hand, the low valuation also reflects that investors demand a margin of safety here – any stumble in performance or decline in earnings could keep the stock subdued. Overall, Einhell currently looks more like a “GARP” (Growth at a Reasonable Price) or value stock than a high-flying growth stock, which suits patient long-term shareholders.

Investment Thesis – Bullish vs. Bearish Case

Why Bulls Might Like Einhell (Bullish Case):

Proven Growth & Ambitious Goals: Einhell has shown it can grow revenue and earnings at double-digit rates, even in mixed economic conditions. Management is aiming for the “next billion” in sales by 2029, which signals an ambition to roughly double revenue again over the next 4–5 years. If achieved, this could drive significant share price appreciation. The company’s strategic vision (second billion by 2029, third billion by 2035) demonstrates long-term growth thinking.

Power X-Change Dominance: The company’s strong position in the cordless market (with an expanding ecosystem of 300+ products) gives it a competitive moat in the DIY segment. As battery adoption in tools still has room to grow (e.g. many corded tool users may yet upgrade), Einhell can capture those converting customers. Its large installed base of batteries also almost guarantees a stream of future tool purchases by those users – a sort of built-in demand.

New Markets = New Growth Runways: Einhell’s expansion into large markets like the USA, India, and Middle East could unlock substantial new revenue streams. The U.S. market in particular is several times the size of any European market – even a modest success there could boost Einhell’s top line materially. The company has a track record of international expansion (Australia was a success story), giving some confidence they can execute abroad.

Financial Health and Optionality: With net cash on hand and strong cash generation, Einhell can fund growth internally and is resilient against downturns. It can also consider accretive acquisitions (as it did with Ozito in Australia, or smaller stakes in Asia) to spur growth. Shareholders benefit from this financial strength through rising dividends and potentially other actions (like special dividends or buybacks in the future if excess cash builds).

Attractive Valuation: Bulls would argue that Einhell’s low valuation (P/E ~11, EV/S <0.8) is unjustified for a company with its track record and prospects. If the company continues to grow earnings at, say, high single-digit or low double-digit rates, the stock could rerate to a higher multiple. Even without rerating, an investor collecting ~2% dividend yield and say 8-10% annual earnings growth could see a solid total return. Any positive shift in market sentiment – for example, if consumer spending improves or Einhell posts strong results – could catalyze stock upside from these levels.

Why Bears Might Be Cautious (Bearish Case):

Cyclical Headwinds: The macro environment poses a risk. With inflation and high interest rates, consumers in Europe and elsewhere might cut back on DIY spending. There’s evidence that post-pandemic, the DIY boom has cooled. If Einhell’s growth stalls or if a recession hits its key markets, revenue could flatten or decline, putting pressure on profits. Bears worry that the strong 2020–2022 period (when people invested in home/garden during lockdowns) pulled forward demand that might not repeat, and comparisons will be tougher.

Margin Pressures: Einhell operates on mid-single-digit net margins, which leave only a small buffer if things go wrong. Rising input costs (materials, labor in Asia) or continued currency volatility (a strong Chinese Yuan or US dollar vs. euro could raise cost of goods) can eat into margins. In H1 2025, currency effects were a noted headwind. Additionally, to push into new markets like the U.S., Einhell may need to spend heavily on marketing or offer lower prices initially, which could crimp margins in the near term.

Competitive Risks: The power tools industry has low switching costs for consumers (aside from battery ecosystems). If a competitor introduces a superior battery platform or aggressively targets Einhell’s niche, growth could slow. For example, Bosch or Makita could decide to compete more fiercely in the value segment, or retailers might promote their own house brands as alternatives. Einhell must also keep innovating – if its tools lag in technology (e.g., brushless motors, battery efficiency) or quality, it could lose reputation. Bears point out that Einhell’s success has likely not gone unnoticed by bigger rivals, who might respond.

Reliance on Key Partners: Einhell’s dependence on a few large retailers is a vulnerability. If one of those top customers (say a big-box chain or Amazon) significantly reduces orders – perhaps due to overstocking, a strategic shift, or opting for another supplier – Einhell’s sales would be hit hard in the short term. Similarly, its supplier concentration in Asia means any major disruption (political issues, factory problems) could delay products. These concentration risks could lead to volatile results.

Valuation Trap?: While the valuation is low, bears caution it might be low for a reason. Perhaps the market expects Einhell’s earnings to peak and then decline if demand normalizes. If 2024 was a high-water mark for margins (due to favorable mix or one-time factors), future earnings could be lower, making the P/E not as cheap as it looks. Additionally, small cap stocks like Einhell (market cap ~$800m) can trade at discount due to lower liquidity and visibility. The family ownership structure (with a large stake held by insiders) might also reduce the free float and keep some investors away, limiting upside until the company gets more recognition or moves to a larger index. In essence, the bear case is that Einhell might be a “value trap” if growth fizzles out – the stock could stay cheap or even decline if profits shrink.

Outlook and Future Prospects

Einhell’s management remains optimistic yet realistic about the near future. For 2025, as noted, they forecast slight growth in revenue and stable high-single-digit profit margins. This essentially means holding onto the gains made in 2024, even if the broader economy is sluggish. Longer-term, Einhell’s strategy is to keep expanding on multiple fronts: product range, geographic reach, and market presence.

A core part of the outlook is the continued expansion of the Power X-Change platform. Einhell plans to broaden this battery ecosystem to 450 tools by 2027, which implies launching dozens of new products in the coming years. These could include more professional-grade tools (Einhell has introduced a “Professional” line aimed at trade users), as well as entirely new categories like cleaning equipment and storage systems – all cordless and battery-compatible. By continually innovating within the platform, Einhell aims to capture more share of wallet from DIY customers and keep them in the fold. The battery tech itself may also improve (e.g., higher capacity batteries, faster charging) which would enhance the appeal of the ecosystem.

Geographically, international growth is a huge opportunity. Einhell has publicly stated goals to increase its revenue to a second billion, which will largely come from tapping new markets. The company is setting up operations in the United States, Mexico, India, and Middle Eastern countries like Saudi Arabia and UAE. The U.S. entry, in particular, is slated as the “next strategic goal” now that Einhell has built a strong base in Europe and achieved leadership in cordless tools there. If Einhell can replicate even a fraction of its European success in North America, it would be transformative – but it will also require patience and investment. We might see more partnerships or even acquisitions to accelerate U.S. growth (similar to how Einhell bought Ozito to establish itself in Australia). By continuing to invest in brand development (e.g., high-profile sponsorships and marketing campaigns) Einhell is making sure it’s not a hidden champion for long – greater brand awareness can translate into increased consumer trust and willingness to try its products globally.

On the operations side, Einhell will focus on supply chain resilience and efficiency. Management has noted efforts like reducing dependence on China by broadening the supplier base. The new battery plant in Hungary is an example of vertical integration to secure key components. We can expect Einhell to perhaps set up more regional assembly or distribution centers as it grows (to cut shipping costs and respond faster to local demand). Digitalization and e-commerce are also trends Einhell likely will leverage – selling direct to consumers online could grow as a portion of its business, improving margins and customer insights.

One external factor to watch is the overall DIY market trend. After a pandemic-era boom, the market had cooled, but there are signs it could stabilize. If inflation eases and consumer confidence returns, home improvement projects could pick up again, benefiting companies like Einhell. Additionally, sustainability trends could drive demand for battery-electric tools (as opposed to gasoline-powered garden equipment, for example) – Einhell, with its electric cordless focus, is well positioned to capitalize on a shift away from fossil-fuel tools for gardens and yards.

Overall, Einhell’s outlook can be described as cautiously optimistic. The company is not resting after hitting €1 billion in sales; it’s pressing forward with expansion plans and product innovation. The near-term growth might be moderate due to macro conditions, but the long-term vision is intact. Analysts covering Einhell generally remain positive, noting that its guidance for 2025 appears achievable and that its strategy of internationalization (especially the planned U.S. market entry) could unlock significant value. As with any growth story, execution will be key – investors should keep an eye on how well Einhell converts these plans into results, particularly in new markets.

Conclusion

In conclusion, Einhell Germany AG presents an intriguing case for long-term investors seeking exposure to the consumer tools sector with a twist of growth. The company combines a compelling business model – centered on a successful battery platform – with a track record of robust execution and a shareholder-friendly approach. Its financial performance has been strong, delivering record revenue and earnings in 2024 and carrying positive momentum into 2025. Einhell’s strategy of continuous innovation (expanding its cordless product family) and bold expansion into new markets demonstrates visionary management that is not content to stay static.

From an investment standpoint, Einhell offers a blend of value and growth. The stock’s valuation is reasonable – even arguably cheap – relative to its earnings and potential, with a nice dividend yield as a bonus. However, investors should weigh the risks: Einhell operates in a cyclical, competitive arena, and its fortunes are tied to consumer spending patterns and its ability to fend off larger rivals. The bullish scenario envisions the company continuing its growth trajectory toward that next billion in sales, which could reward investors handsomely. The bearish scenario warns of macro and competitive headwinds that could make the recent highs hard to sustain.

Ultimately, Einhell has positioned itself as a leader in the cordless DIY revolution, and it has the ingredients – strong brand, expanding global footprint, solid finances – to keep building on that leadership. For long-term investors, the stock represents a chance to invest in a mid-cap company with a straightforward business, run by experienced insiders, aiming for steady growth in an ongoing secular trend (cordless tool adoption). As always, due diligence is important: one should monitor how Einhell navigates the current economic challenges and whether its U.S. foray shows early promise. But if management’s confidence is any indicator (recall their vision of reaching €2 billion and then €3 billion in revenue in the coming years), Einhell’s story may still be in the middle chapters. With a bit of patience, investors could find that this “cordless powerhouse” continues to charge ahead, powering both DIY projects around the world and portfolios along with it.