Disclaimer: The information provided in this publication is for educational and informational purposes only and does not constitute financial advice. The content is solely reflective of my personal views and opinions based on my research and is not intended to be used as a basis for investment decisions. While every effort is made to ensure that the information is accurate and up-to-date, the writer makes no representations as to the accuracy, completeness, suitability, or validity of any information in this post and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. All readers are advised to conduct their own independent research or consult a professional financial advisor before making any investment decisions. The author is not invested in the mentioned stock.

*Affiliate link – Get 15% off Fiscal.ai (formerly Finchat)

Mips AB: Helmet Safety Innovator

Imagine you’re speeding down a mountain trail on your bike, the wind rushing past as you navigate sharp turns and rocky terrain. In that moment, the last thing on your mind is the engineering behind your helmet – until you take a fall. That simple piece of gear can mean the difference between a minor bruise and a life-changing injury.

This is where Mips AB comes in. The Swedish company has spent decades perfecting technology designed to protect our most vital asset – the brain. From cyclists and skiers to motorcyclists and construction workers, Mips’ signature yellow dot has become a quiet but powerful symbol of safety.

But Mips isn’t just innovating in helmet design; it’s also a fascinating business story. With a scalable, high-margin model and a near-monopoly position in a niche market, the company has attracted the attention of long-term investors worldwide. In this post, we’ll dive deep into Mips AB – exploring its financial performance, growth opportunities, and whether the stock offers a compelling investment case today.

Company Overview

Mips AB* is a Swedish company that has become a global leader in helmet safety systems. The company’s flagship technology is the Multi-directional Impact Protection System (MIPS) – a patented low-friction layer integrated into helmets to reduce harmful rotational forces during angled impacts. This innovation was born out of over 25 years of scientific research into brain injuries and helmet design. Rather than manufacturing helmets itself, Mips operates as an “ingredient brand”, partnering with hundreds of helmet manufacturers across sports like cycling, skiing, equestrian, and motorcycling. These brands incorporate the MIPS safety layer into their helmet models, allowing a slight movement of the head inside the helmet during a crash and thereby reducing the risk of brain trauma.

Today, Mips is one of the most recognizable names in the industry – you can spot its small yellow dot logo on many premium helmets as a symbol of added safety. In fact, Mips technology has become an industry standard: an analysis of top-rated helmet models shows that 91 of the top 100 are equipped with MIPS, and the first non-MIPS helmet only appears at rank 30. Over 200 helmet brands, including the majority of leading bike and snow-sports manufacturers (e.g. Specialized, Fox, POC), are Mips customers. This widespread adoption highlights the value of Mips’ solution – it allows helmet makers to differentiate their products with proven safety enhancements, which consumers increasingly look for. Overall, Mips AB’s mission is clear and compelling: “to lead the world towards safer helmets”, and its technology-driven approach and broad industry partnerships have positioned it as a key player in making helmet-wearing activities safer for everyone.

Latest Financial Performance (Short Summary of Financials)

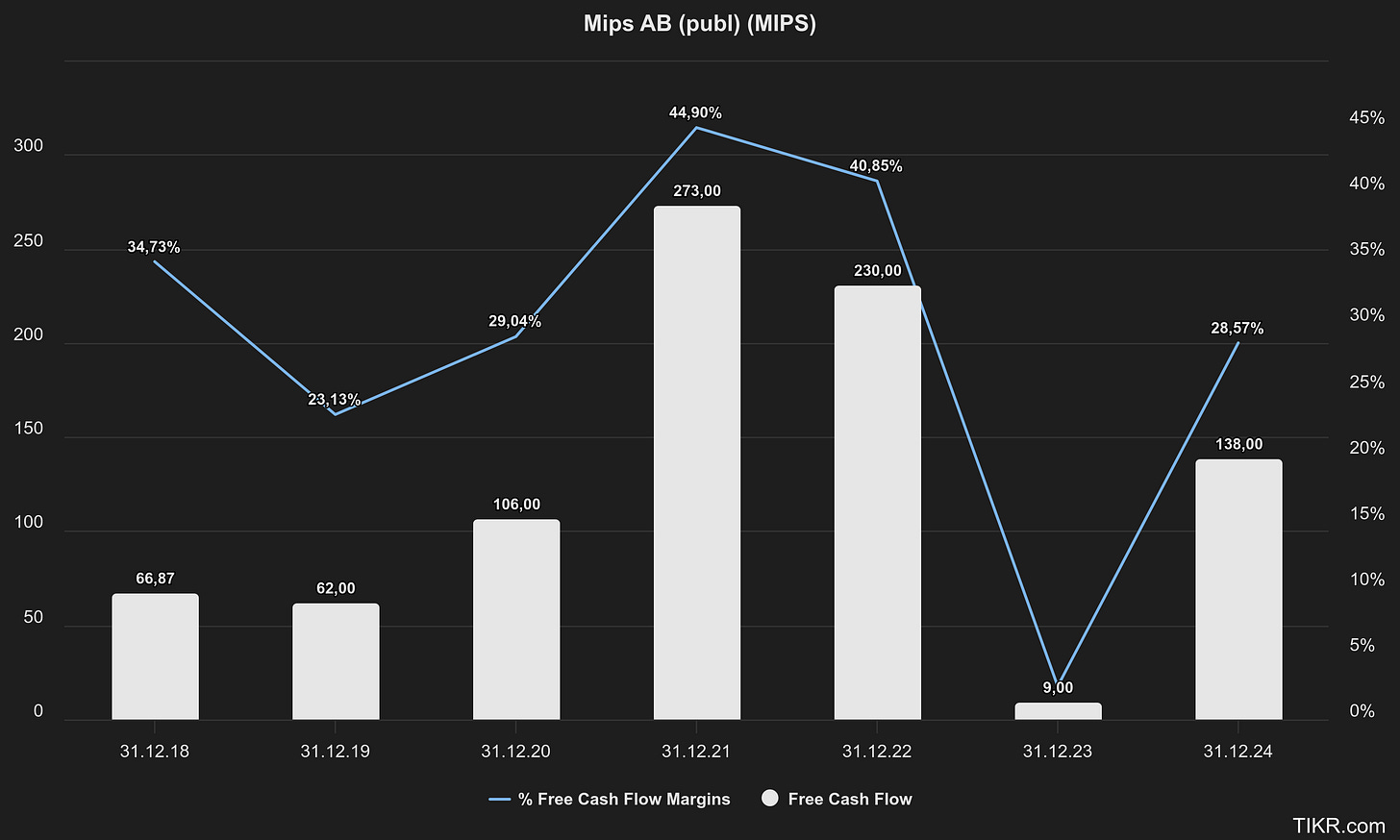

After a period of turbulence in 2022–2023 (when the bike helmet market went from boom to inventory glut), Mips rebounded strongly in 2024. The company’s full-year 2024 results showed a sharp recovery: net sales grew +35% to SEK 483 million (approximately $45M), with organic growth of 35%. Profitability improved dramatically as well – operating profit (EBIT) rose +148% to SEK 174 million, lifting the full-year EBIT margin to a healthy 36.1%. Earnings per share for 2024 more than doubled to SEK 5.32. These figures marked a strong comeback from the prior year, which had seen a sales decline due to post-pandemic market normalization. In the final quarter of 2024, Mips had its best quarter ever, with net sales up 58% year-on-year and EBIT margin hitting 43% – boosted by customers refilling orders as their excess inventories cleared out. The robust finish to 2024 also enabled the company to generate solid cash flows (SEK 142M from operations in 2024) and propose an increased dividend (more on dividends later).

The momentum carried into early 2025, though with some new challenges. In Q1 2025, Mips posted stellar growth – net sales jumped 40% year-on-year to SEK 116M (with 42% organic growth) and operating profit surged +78%, reflecting strong demand across all helmet categories. Notably, the Sports helmet segment (especially bike helmets) led the charge in Q1, and even the newer Safety category (industrial/work helmets) saw a remarkable +60% sales growth as Mips expanded into that market. This showed that demand was bouncing back broadly as the helmet market normalized and new MIPS-equipped models launched. However, Q2 2025 proved more mixed. Net sales for April–June 2025 were essentially flat (+1% to SEK 135M) compared to the strong quarter a year prior, although on a constant-currency basis organic growth was still +12%. Profitability in Q2 was weaker: operating profit was SEK 41M, down from 52M, with the EBIT margin softening to 30.1% (versus an unusually high 38.9% last year). Mips attributed this short-term dip to challenging conditions – in particular, an unexpected imposition of high import tariffs in the US caused many helmet brands to temporarily slow orders and even relocate some production out of China. This created uncertainty and a pause in new helmet development projects during the quarter. The good news is that by late Q2 the situation was stabilizing: Mips saw an uptick at the end of the quarter as customers adjusted to the tariffs and resumed production. Moreover, the tariff issue did not directly hurt Mips’ costs (since Mips sells on ex-works terms where the customer handles tariffs). Despite the headwinds, the company managed to increase first-half 2025 net sales by +16% (23% organic) and keep operating profit flat year-on-year for Jan–June.

In summary, Mips’ recent financial performance reflects a return to growth after the pandemic-era volatility. The company has demonstrated high operating leverage – as sales recovered, profits and margins expanded strongly. Even with Q2’s bump in the road, underlying demand appears healthy and broad-based across regions and categories. Mips remains profitable, debt-free, and cash-generative, which provides stability as it navigates short-term industry challenges. Long-term investors can take note that management has reaffirmed its growth ambitions: after achieving SEK ~483M in 2024 revenue, Mips updated its long-term target to exceed SEK 2 billion in annual net sales by 2029 – implying a ~4x increase over the coming years. Achieving this will depend on the company’s business model strengths and its execution, which we discuss next.

Key financials

Business Model

Mips AB’s business model is both unique and highly scalable. The company doesn’t make or sell helmets to end-users; instead, Mips inserts itself into the helmet value chain as a B2B technology provider. In practice, this means Mips works closely with helmet manufacturers (its customers) to integrate the MIPS safety layer into their helmet designs. Mips typically collaborates during the R&D phase of a new helmet model – providing the low-friction layer design and know-how, and ensuring the helmet passes safety tests with the MIPS system installed. Once a helmet model is approved and goes into production, Mips generates revenue through licensing and component sales.

How Mips makes money: The company charges its partner helmet brands in a few ways: - Integration/Development Fees: When a helmet brand decides to add MIPS to a new model, there may be an upfront implementation or tooling fee. Mips assists in adapting the helmet’s design to include their liner, and this development service can involve custom fitting of the MIPS layer. - Per-Unit Licensing Fees: The primary revenue stream comes once the helmet enters production. Mips typically invoices the helmet brand a licensing fee for each helmet produced with the MIPS technology. In other words, for every MIPS-equipped helmet that rolls off the factory line, a fee is paid to Mips for the use of its patented technology and IP. This fee structure aligns Mips’ success with the sales volume of its partners’ helmets. - Component Sales: In many cases, Mips also supplies the physical low-friction layers or related components (through contract manufacturers). The helmet factories often order the MIPS liner inserts via Mips, which arranges delivery from its suppliers to the helmet assembly line. Mips thus earns a margin on these components. Notably, the MIPS layer is a simple plastic layer that is inexpensive to produce, which helps Mips maintain very high gross margins (consistently around 70%+).

This “ingredient brand” model has several attractive features. It allows Mips to leverage the distribution, manufacturing, and marketing capabilities of all the established helmet brands worldwide, rather than trying to build those channels itself. By embedding its safety technology into others’ products, Mips reaches a far larger market than it could alone. The helmet brands, in turn, benefit because they can offer a premium safety feature backed by Mips’ research – a strong selling point to safety-conscious consumers. It’s a symbiotic relationship: Mips focuses on R&D and innovation in helmet safety, while its partners incorporate and promote the technology. As an example of this dynamic, Mips has described itself as an “ingredient brand” similar to how Gore-Tex is for outdoor apparel – consumers may specifically seek out helmets “with MIPS”, which in turn encourages more manufacturers to partner with Mips.

Scalability: The beauty of Mips’ model is that it scales efficiently. Once the technology is developed and a partnership established, selling one million MIPS liners is not fundamentally more complex than selling one thousand – Mips can ramp volume largely via its outsourcing and licensing agreements. The company has a small employee base relative to its revenue, focusing on engineers and sales staff who sign up new brands and support existing clients. Production of the MIPS layer is outsourced, and because the product is lightweight and small, logistics are straightforward. This translates into high operating leverage. For instance, even during a sales downturn in 2022, Mips maintained gross margins above 70%, and in growth years its EBIT margins have exceeded 35-40%. The high margins and low capital requirements (Mips carries virtually no inventory or manufacturing assets) mean it can generate strong cash flow as it grows. Mips essentially operates as a royalty-on-every-helmet model – a classic scalable business. This has enabled impressive financial performance over the long term: from 2014 to 2019 (pre-pandemic), Mips grew revenue per share at ~62% CAGR and earnings at 62% CAGR, showcasing the compounding potential of its model.

Strengths of Mips’ Business

Mips AB enjoys a number of competitive strengths and advantages that have fueled its success:

Market Leadership & Brand Recognition: Mips is the undisputed market leader in rotational-impact helmet safety. Its technology is considered the gold standard – as evidenced by 9 out of the top 10 bike helmet brands and all of the top snow-sports helmet brands partnering with Mips. The company’s yellow-dot “MIPS inside” branding on helmets is increasingly recognized by consumers as a mark of superior safety. This brand pull makes helmet companies eager to collaborate with Mips to boost their product appeal.

Patented Technology & Research Edge: The MIPS system is backed by a deep portfolio of patents (around 300 patents across 40 families) developed over decades of research in biomechanics. This intellectual property creates a moat, making it difficult for copycat competitors to offer a similar solution without legal risk. Additionally, Mips continuously refines its technology – for example, launching new versions like MIPS Air Node (a lighter, advanced variant) in 2025. The company’s long head start in testing and data (with third-party validations of effectiveness) gives it scientific credibility that is hard for new entrants to match.

Wide Adoption and Network Effects: With over 200 helmet brands on board, Mips benefits from a network effect in the industry. Helmet makers see that most of their peers (and competitors) are using MIPS, so not adopting it could be a competitive disadvantage. This creates a “prisoner’s dilemma” dynamic: few want to be the only brand without MIPS, especially if retailers and consumers are demanding it for safety reasons. Mips’ large customer base also gives it access to vast market feedback and usage data, helping improve the product and further entrench its position.

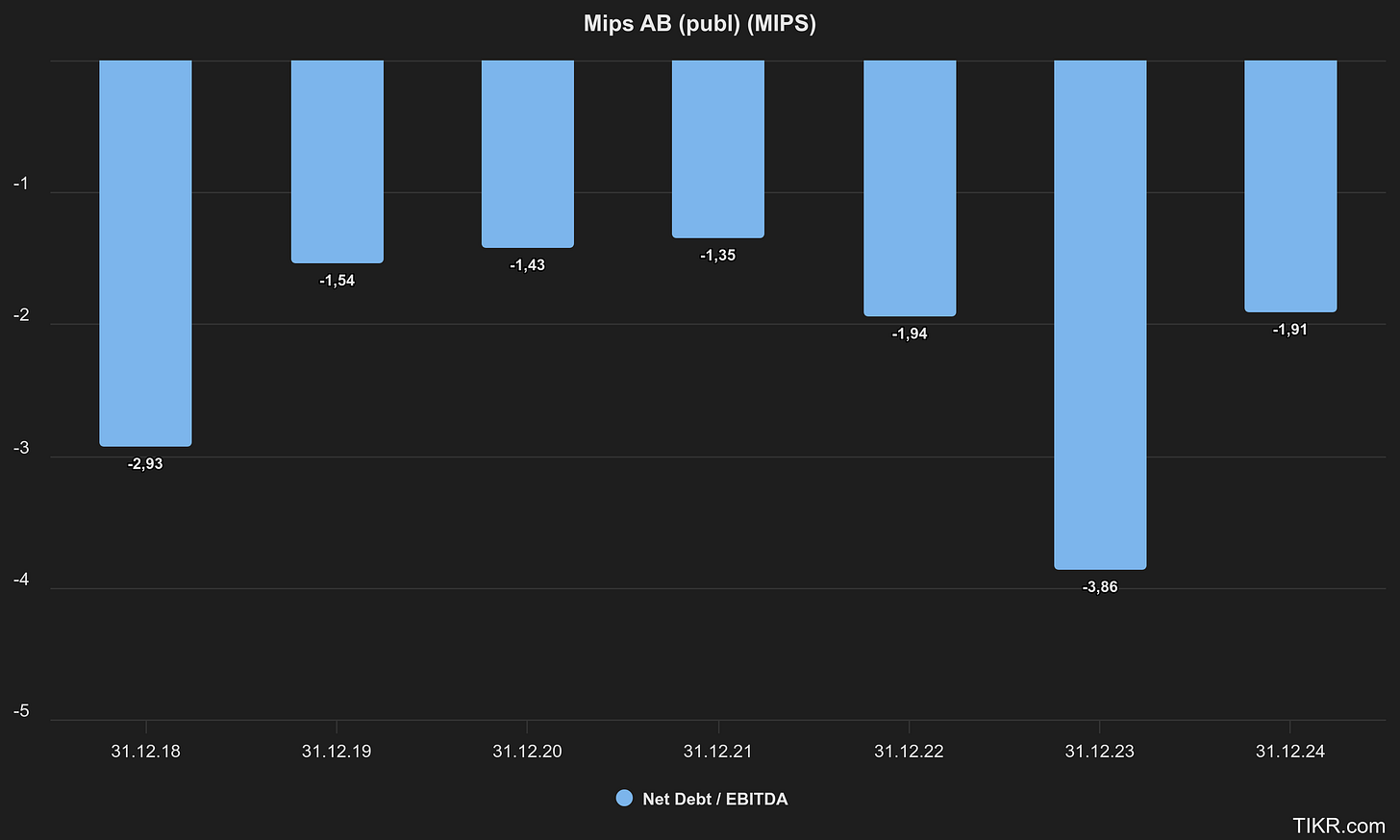

Scalable, Asset-Light Financial Model: As described, Mips’ licensing model yields high margins and low capital expenditure. The company has no long-term debt and consistently strong cash generation. It can thus fund growth initiatives (R&D, marketing, new market entry) internally while also returning cash to shareholders (via dividends). Mips’ high return on capital (historically 35%+ ROIC) indicates it can grow profitably without heavy reinvestment – a sign of a robust business model.

Multiple Growth Avenues: Mips is not just resting on its laurels in bike and snow helmets; it is expanding into new segments. The Motorcycle helmet category is a big market where Mips is growing penetration (the company noted continued growth and increasing demand in on-road motorcycle helmets in 2024). Another major opportunity is the Safety/Industrial helmet category – think construction hardhats, military helmets, police tactical helmets, etc. Mips has only begun to tap this, but recent partnerships with global leaders like MSA Safety (launched first MIPS-equipped hardhat in 2024) and Husqvarna (chainsaw/forestry helmets) show promise. These markets have huge volumes and a growing awareness of the importance of brain injury prevention, representing significant long-term growth potential if Mips’ technology becomes standard there as well.

Weaknesses and Risks

Despite its strengths, Mips AB faces several weaknesses and risk factors that long-term investors should consider:

Dependence on Partner Brands and the Helmet Market: Mips’ fortunes are tied to the helmet industry’s health. It does not sell directly to consumers, so it relies on helmet manufacturers continuing to integrate MIPS and successfully sell their helmets. If a major partner (for example, a top helmet brand) decided to reduce or eliminate MIPS from their line, it could impact Mips’ sales. The helmet market itself is cyclical and linked to consumer discretionary spending – as seen in recent years, a surge in bike sales during COVID-19 was followed by a slowdown and inventory correction. Economic downturns or changes in sports participation trends could soften helmet demand, indirectly hitting Mips. In summary, Mips has indirect control over end-market demand and faces the classic risk of a B2B supplier relying on its customers’ success.

Customer Alternatives and Imitation: One oft-cited risk is competition from “in-house” solutions developed by helmet brands. Since Mips charges a fee, a few larger brands have experimented with their own rotational impact technologies (for instance, POC’s short-lived “SPIN” pads, or Trek/Bontrager’s WaveCel technology in bike helmets). These alternative solutions indicate that if helmet makers believe they can create a comparable safety feature without paying Mips, they might try. However, so far none of these has gained broad traction against MIPS – POC’s solution faced patent infringement claims and was eventually discontinued in favor of re-adopting MIPS, and WaveCel remains limited to one brand. Still, the threat exists that a new technology could emerge or that some brands might resist the Mips “tax.” If a consortium of helmet companies teamed up on a standard or if a new innovation leapfrogs MIPS’ approach, Mips would need to respond. The company’s high margins could entice competitors if they see an opening.

Intellectual Property Duration: Mips’ technology is patented, but patents don’t last forever. The company’s first patents date back to the early 2000s, and though Mips has continually filed new patents (and has a large portfolio), some core aspects of the slip-plane technology could eventually come off-patent in the years ahead. If/when that happens, it could potentially allow low-cost imitators to copy the basic concept legally (especially in markets where safety standards might allow generic solutions). Mips will have to rely on its brand, ongoing R&D, and trade secrets to maintain an edge beyond the patent life. This risk is somewhat mitigated by Mips’ strong brand relationships and the complexity of proving a new solution’s efficacy (which requires trust and data), but it is a long-term consideration.

External Factors (Regulation and Tariffs): As seen recently, unexpected trade policies (like US tariffs on China-made goods) can disrupt Mips’ customers and cause short-term pain. While Mips itself avoided direct costs from tariffs, the indirect effect was slower orders. Similarly, changes in regulations could have mixed impacts – for example, if governments or sports bodies start mandating rotational impact protection in helmets, it could vastly expand Mips’ market (a positive), but it might also attract more competition or require Mips to reduce pricing as it becomes a standard. Regulatory scrutiny on safety claims is another factor; Mips must continually substantiate that its product really improves outcomes (so far studies and lab tests support MIPS, but real-world injury reduction data will be an important ongoing proof point).

In weighing these weaknesses, it’s worth noting that many helmet makers ultimately find partnering with Mips easier than going it alone – Mips has stated that customers are not heavily incentivized to compete with it, since using MIPS saves them R&D effort and gives them a marketable feature. Nonetheless, long-term investors should keep an eye on industry trends and any shifts in how helmet safety is achieved.

Dividends and Share Buybacks

Mips AB may be a growth-oriented company, but it has also rewarded shareholders with significant dividends in recent years. The company follows a practice common among Swedish mid-cap firms of returning excess cash via dividends. In fact, the Board has been surprisingly generous: for the financial year 2024, Mips’s Board proposed a dividend of SEK 6.50 per share, up from SEK 6.00 the previous year. To put that in perspective, the SEK 6.50 dividend equaled 122% of the net earnings for 2024 – meaning Mips paid out more than its full-year profit in dividends. This high payout ratio was similar in 2023 (when a SEK 6.00 dividend was paid despite a dip in earnings). The rationale is likely that Mips had accumulated cash from earlier high-profit years and did not need to reinvest all of its earnings, so it distributed cash to shareholders. At a share price around 380 SEK, the 6.50 SEK annual dividend represents a ~1.7% dividend yield, which is modest, but the key point is the commitment to returning cash.

The company’s dividend policy (implied by practice) seems to emphasize a steady or rising dividend over time, rather than a fixed payout ratio. Even during the tougher 2022, Mips maintained its dividend, which signals confidence in its long-term cash generation ability. For investors, these dividends provide some tangible return while they wait for growth to unfold.

On the other hand, share buybacks have not played a significant role in Mips’ capital allocation. Mips has not undertaken notable stock repurchase programs in recent years – its buyback yield is effectively 0%. The share count has remained relatively stable (aside from minor increases due to employee option programs or similar). Management appears to prefer dividends for returning cash, possibly due to the stock’s high valuation (buying back shares at a high P/E could be seen as less attractive). The absence of buybacks isn’t necessarily a negative; it simply means dilution has been minimal and the company prioritizes direct cash dividends.

In summary, Mips can be viewed as a shareholder-friendly company: it carries no debt, generates solid free cash flow, and returns a good portion of that cash to shareholders, primarily via dividends. Long-term investors can likely expect dividends to continue (though perhaps not always at such a high payout if earnings grow). A risk to note is that if Mips identifies a big growth investment or an acquisition, its dividend could be reined in – but at present the company’s growth doesn’t require heavy capex, enabling it to do both: invest in the business’s growth and reward shareholders.

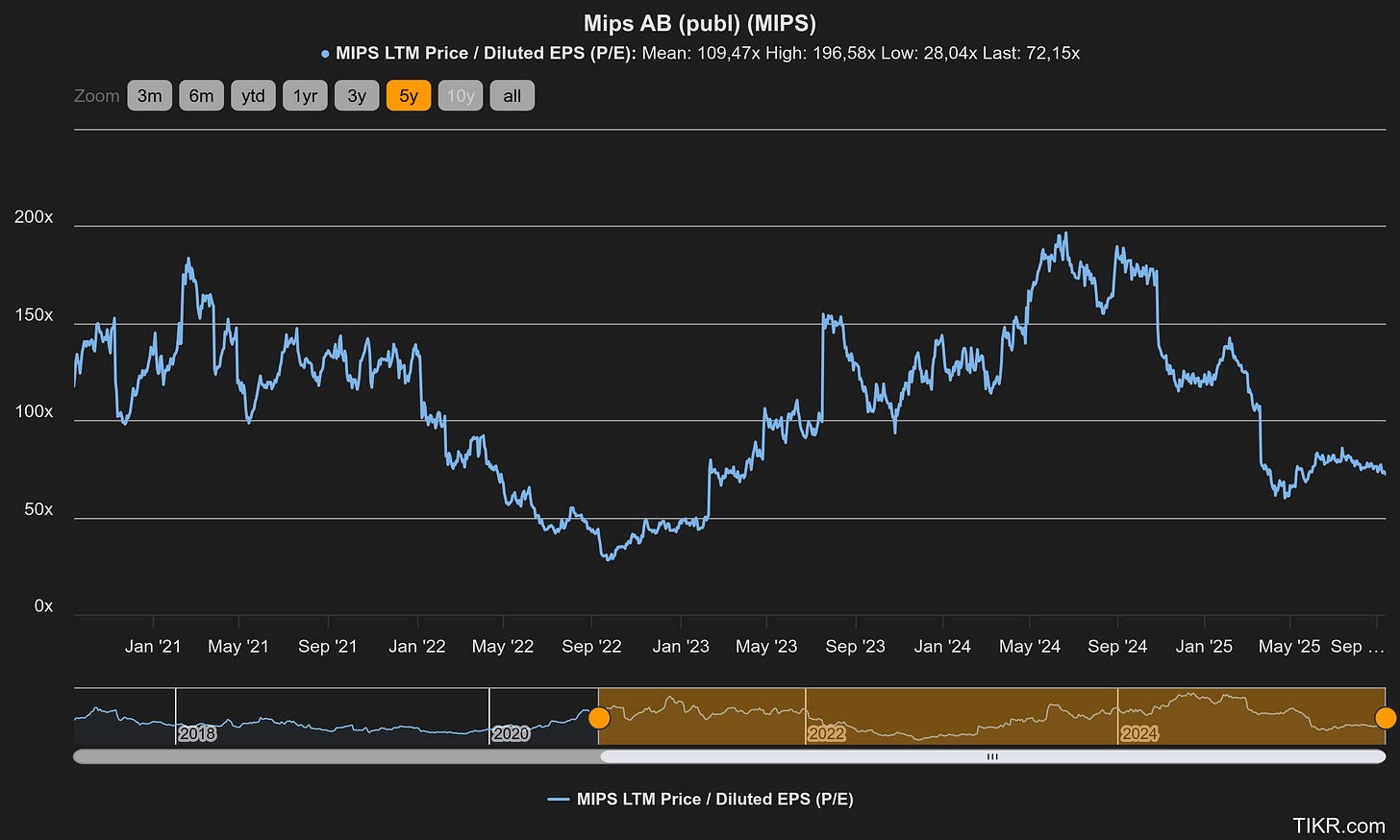

Stock Valuation

Mips AB’s stock valuation reflects its strong performance and growth prospects – the market has generally assigned Mips a premium valuation multiple. As of late 2025, the stock trades around the mid-300 SEK range (approx. $35–40 in US ADR terms), which equates to a price-to-earnings (P/E) ratio in the high double digits (roughly 60–70 times trailing earnings). By traditional measures, this is a rich valuation. For context, about a year and a half ago (April 2023), when the stock was near SEK 470, it was trading around 55× trailing earnings and 70× free cash flow. The share price has since moderated to ~380 SEK, but earnings have grown, so the P/E remains elevated. Investors are effectively pricing in continued high growth for years to come.

Why would investors pay such a high multiple? It’s largely due to Mips’ unique market position and expansion potential. Mips is viewed as a high-growth, high-margin “compounder” business, often drawing comparisons to other niche industry leaders. Sell-side analysts remain optimistic: throughout mid-2025, many analysts reiterated Buy ratings on Mips with target prices frequently in the SEK 500–600+ range. For example, Handelsbanken Capital Markets upgraded Mips to “Buy” in May 2025 and set a price target of SEK 600, implying significant upside from current levels. The bullish valuation case typically rests on Mips achieving its long-term goals (such as ~SEK 2 billion in revenue by 2029) and expanding margins, which would dramatically increase earnings. If one believes Mips can, say, quadruple sales in the next 5–6 years with 50%+ EBIT margins (as the company’s targets suggest), then today’s P/E multiples start to look more reasonable on a forward basis.

That said, there is valuation risk. A high-growth stock like Mips can experience multiple contraction if growth disappoints or even if sentiment shifts. It’s worth noting Mips’ stock history: after its 2017 IPO around SEK 50 per share, the stock soared to over SEK 1250 at its peak in late 2021, then plunged to around SEK 400 in 2022. Early investors still saw incredible gains (the IPO-to-2023 CAGR was ~38%), but the ride was volatile. The lesson is that valuation matters – at the 2021 peak the stock was clearly overextended relative to near-term earnings, and when the pandemic bike boom cooled off, the P/E contracted sharply. Currently, at ~70× trailing earnings, Mips is cheaper than it was at that peak, yet it’s not a bargain in the absolute sense. Long-term investors might justify the valuation if they have confidence in a decade of growth ahead. Nonetheless, any investment in MIPS at these levels should come with the understanding that the stock’s price can swing with sentiment, and that earnings growth must be delivered to grow into the valuation. Monitoring metrics like the PEG ratio or comparing Mips to other high-growth, high-margin firms may provide additional perspective – but truly, few companies have the exact profile of Mips, making direct comps difficult.

In sum, Mips AB trades at a premium that mirrors its quality and growth outlook. The valuation is a bet on Mips’ continued dominance and expansion into new markets. Bulls argue that the stock’s premium is deserved due to Mips’ near-monopoly status and compounding potential, whereas bears caution that any slowdown could compress the multiple. This tension is what makes the next section – the bullish vs. bearish cases – especially relevant.

Bullish Investment Case

Why might a long-term investor be bullish on Mips AB? Here are the key points that underpin the optimistic thesis:

Dominant Market Position: Mips is essentially the “go-to” provider for helmet safety technology worldwide. Its penetration of top helmet brands and models is unmatched. Such dominance is rare for a small company and suggests Mips could enjoy outsized profits as the de facto standard in a growing niche. Bulls see Mips almost as a toll collector on the helmet industry – whenever and wherever helmets are sold with advanced safety, Mips is there collecting a fee. This quasi-monopoly status (with no equal competitor in sight) allows pricing power and stable growth, much like other famous ingredient brands (Gore-Tex, Intel-inside, etc.).

Long Runway for Growth: Even after its success so far, Mips still has a huge addressable market. Consider that most helmets sold globally today still do not have MIPS or similar tech – especially in markets like Asia and in categories like basic road helmets or industrial hardhats. The company is targeting >SEK 2 billion in sales by 2029, which implies capturing only a fraction of the tens of millions of helmets produced annually. As awareness of concussion and brain injury risks increases, helmet buyers (from cyclists to construction firms) are expected to demand better protection. Bulls believe Mips is in prime position to capitalize on this secular trend toward safety. The expansion into Motorcycle and Safety helmets provides incremental growth engines on top of the core Sports (bicycle/snow) segment. These new categories are already showing traction – e.g. Mips nearly doubled the number of safety helmet models on the market in 2024. If Mips replicates in industrial helmets what it did in bike helmets, the revenue potential could multiply.

High Margins and Earnings Power: Mips’ financial profile is very attractive – >70% gross margins and potential for 40%+ operating margins in a strong year. This means that as sales grow, profits can grow even faster (as seen in 2024’s rebound). The company’s net margins and ROIC are already high, and management even aspires to 50% EBIT margins long-term. If that is achieved, Mips would generate tremendous free cash flow. High margins also provide a buffer in downturns (Mips stayed profitable even when sales dropped in 2022). Bulls are confident that a business with this margin structure and capital-light model can compound earnings reliably. Mips can fund all necessary R&D and expansion internally while still paying dividends, showcasing a self-sustaining growth story.

Strong Management and Execution: Although not as easily quantifiable, believers in Mips point to its track record of execution. Since going public, the company (led by CEO Max Strandwitz) has generally delivered on its strategic goals: expanding into new brands, weathering the post-Covid slump, and keeping costs in check. The fact that Mips navigated the volatile pandemic cycle and emerged with updated, higher targets speaks to a confident leadership. Moreover, insiders have shown commitment (the founders and early investors held significant stakes; one of the early backers was a major helmet company, indicating alignment with industry interests). Bulls trust that management will continue to steer Mips to capitalize on its many opportunities, possibly even exploring adjacent markets (any head protection application could be fair game for MIPS tech – football helmets, military gear, etc., although these are longer-term possibilities).

Favorable Safety Trends and Optionality: Broader societal trends favor Mips. There is increasing attention on concussions in sports, stricter workplace safety regulations, and more cyclists and skiers globally – all fueling demand for better helmets. If any sport or country mandates rotational protection in helmets, Mips’ market could leap forward overnight. Additionally, Mips’ technology has optionality – the company could conceivably extend into providing safety testing services, certification, or even new protective gear innovations leveraging its knowledge. While the core focus remains helmets, bulls appreciate that Mips is essentially a platform for head safety innovation, which could spawn new revenue streams in the future.

In short, the bullish case sees Mips AB as a high-quality, one-of-a-kind business with a long growth runway and durable competitive advantages. For a long-term investor, the combination of market leadership, growth potential, and profitability makes Mips an attractive investment – the type of company that could continue compounding value over a decade or more if all goes well.

Bearish Investment Case

On the flip side, a bearish or cautious view of Mips AB emphasizes the following points and potential pitfalls:

Growth Could Slow as Markets Saturate: Bears worry that Mips’ explosive growth phase in helmets might slow down sooner than bulls expect. The easy wins in Sports helmets (bikes, ski, etc.) may have been achieved now that most premium brands use MIPS. Further penetration might be harder, especially moving down to cheaper helmet segments where cost is critical and consumers may be less aware of MIPS. If organic growth settles into a lower trajectory (say single-digit percentage growth once the post-inventory rebound is done), the current valuation would look expensive. Essentially, Mips must keep finding new sources of growth to justify its price – whether that’s new categories or geographic expansion. Any sign of plateauing (for instance, if annual growth falls below 10% consistently) could deflate the bullish narrative. The bearish case points out that after a certain point, Mips’ revenue growth will inevitably decelerate as penetration increases, making it more of a steady business than a high-growth story.

Customer Concentration and Pushback: While Mips has many customers, not all are equal in volume. A significant portion of revenue likely comes from a handful of large helmet OEMs. If one or two of these major customers decided to reduce their reliance on MIPS, it could impact sales materially. For example, a large multi-sport helmet brand might negotiate harder on pricing or adopt a dual-source approach (using MIPS in some models but a cheaper alternative in entry-level models). There’s also the risk of pushback on pricing – helmet makers could argue MIPS’ licensing fees cut into their margins, especially if helmet prices face pressure. Since Mips charges per unit, if its customers face cost inflation elsewhere (materials, tariffs, etc.), they may look to save costs on components like MIPS. In a worst-case scenario, a few big brands could form a consortium to develop a royalty-free alternative standard (even if inferior, they might market it aggressively). Such dynamics have happened in other industries when a supplier became too profitable. So far, Mips’ relationships appear strong, but the power balance between Mips and the helmet giants is something bears keep an eye on.

Competitive Threats – Known and Unknown: The bearish case doesn’t ignore that currently Mips has no peer of similar scale, but it highlights that the cost of entry is not extremely high if someone were to invent around MIPS’ patents. For instance, WaveCel (used by Trek’s Bontrager helmets) is a different technology (a collapsible cellular structure) aimed at the same problem of rotational impacts. It hasn’t overtaken MIPS in market share, but it shows innovation is ongoing in helmet tech. Additionally, big players in protective gear (think 3M, Honeywell, or others in industrial safety) could decide to invest in this space if they see profit. A large company could potentially develop an alternative and use its clout and integration to compete. Also, as MIPS’ core patents expire in the future, generic copycats might proliferate, especially in low-end helmets or in regions with weaker IP enforcement. Bears essentially say: Mips’ moat, while strong now, might narrow over time, either through technological disruption or simply through more competition sharing the “helmet safety” pie. If Mips were to lose its status as the default solution, its margins and growth would suffer.

Macroeconomic and Cyclical Risk: Mips is indirectly tied to cycles in consumer spending on sporting goods and motorcycles. A recession or even just normalization after the pandemic surge could hurt helmet sales. We saw a taste of this in 2022 when bike industry demand dropped sharply and Mips’ sales fell, showing the business is not recession-proof. Bears argue that high valuation growth stocks like Mips can get hit twice in a downturn – first from earnings decline and second from multiple contraction. If inflation, tariffs, or supply chain issues drive helmet prices up, consumers might delay replacing helmets, impacting volumes. In a deep recession scenario, discretionary purchases like a new ski helmet might be cut, and Mips’ royalty stream would decline accordingly. Essentially, while helmets are safety items, they are not entirely immune to economic forces, and Mips’ asset-light model doesn’t shield it from demand swings.

Execution and Key-Person Risk: As a relatively small company (by global standards, around 100 employees and under $50M revenue), Mips’ success has been built on a specialized team. The loss of key personnel – for example, the chief scientists behind the technology or top sales relationships – could slow the pace of innovation or client acquisition. Additionally, expanding into new sectors like industrial helmets might require different sales channels and longer sales cycles (dealing with corporations and safety regulators rather than consumer retail channels). If Mips mis-executes in those new markets or fails to adapt its approach, growth could disappoint. Bears might also mention currency risk (Mips reports in SEK but sells globally, so a strengthening krona could hurt reported results) and regulatory risk (if a scandal or study questioned MIPS efficacy, it could hit the brand). While none of these are imminent threats, they collectively underline that Mips is not without risk despite its strong position.

In summary, the bearish case is not that “Mips will fail” – it’s more about caution that great companies don’t always make great investments at any price. Mips has to keep proving itself to support the lofty expectations. Any stumble in growth, any erosion of its competitive moat, or any external shock could lead to a significant re-rating of the stock. Long-term investors must weigh these risks against the upside potential.

Outlook and Future Prospects

Looking ahead, Mips AB’s outlook appears broadly positive, with some near-term caution but strong long-term drivers. In the near term (the next 1-2 years), the company expects a more normalized market environment after the rollercoaster of the pandemic period. The inventory issues that plagued 2022 have largely resolved, meaning helmet manufacturers are back to ordering regularly based on true consumer demand. Mips entered 2025 with encouraging sales trends in its core Sport category (especially cycling helmets) and with momentum in Motorcycle and Safety categories. One headwind in 2025 has been the US-China tariff situation, which introduced uncertainty and a temporary slowdown in Q2. However, this is likely a transient issue as companies adjust supply chains; Mips noted that many customers are already relocating helmet production out of China to mitigate tariffs. Once these adjustments are done (perhaps over a couple of quarters), helmet brands should refocus on new product development – meaning new MIPS-equipped models in the pipeline. In fact, despite the noise, Mips still saw double-digit organic growth in early 2025 and maintained high gross margins, which bodes well if macro conditions stay reasonably stable.

Over the medium to long term, the outlook is driven by Mips’ expansion plans and industry trends: - Mips’ management is firmly committed to growth, as evidenced by the updated 2029 target of >SEK 2 billion revenue. Achieving that would require roughly a 25% compound annual growth rate from 2024 levels, a ambitious goal. The building blocks of that growth are increasing penetration in all three key helmet categories (Sports, Motorcycle, Safety) and further geographic expansion. There are still many helmets in the world without MIPS – emerging markets and lower-tier brands are future conversion opportunities as costs come down and awareness rises. - The Safety (industrial) helmet segment could become a significant revenue contributor by the end of the decade. Mips has been candid that this category is less mature and initially slower, but the interest from companies like MSA and Honeywell (which acquired a competitor’s tech for hardhats) indicates a trend. As workplace safety regulations tighten and employers seek to reduce head injuries, the adoption of MIPS in construction and industrial helmets may accelerate. Mips’ success in doubling safety helmet models in 2024 is a positive sign, and the company remains “positive about prospects for this category” going forward. We can expect more partnership announcements and product launches in Safety. - Product innovation will continue to be a focus. Mips regularly launches new or improved versions of its tech (e.g., the MIPS Integra designs that are better integrated into helmets, or the new ultra-light Mips Air offerings). These not only improve performance but also help convince more helmet brands to come on board (some brands may have waited for thinner, lighter implementations, which Mips is now providing). The company’s R&D in areas like MIPS for earbuds (to reduce fall impact) or other headgear, while speculative, show that Mips is exploring adjacent applications for its core concept of a slip-plane for impact protection. - On the financial front, Mips is likely to maintain strong profitability even as it invests. The company has signaled it will continue investing in marketing and consumer awareness (for instance, more presence at trade shows and consumer events to educate the public on MIPS benefits). This is important because if end-users actively seek helmets with MIPS, it drives a virtuous cycle for demand. These investments could weigh slightly on margins in the short run, but are meant to accelerate revenue growth. Given the scalable model, if revenue hits management’s targets, margins could further expand due to operating leverage (and they have an aspirational goal of 50% EBIT margin longer-term).

In terms of external outlook: The broader conversation around concussion safety in sports (from youth sports up to professional levels) and in workplaces is intensifying. This could lead to regulatory tailwinds for Mips. For example, if cycling race organizers or ski federations start mandating helmets with rotational protection for competition, that would effectively mandate MIPS or similar technology in all approved helmets. Some moves in this direction have been seen in motor sports (Mips hosted a safety symposium with FIM, the motorcycle racing federation, to advocate for better helmet safety). While not guaranteed, such developments could rapidly expand Mips’ market.

Mips also benefits from any trend that increases helmet usage generally – e.g., the rise of e-bikes and e-scooters in cities (leading to more city commuters wearing helmets), or growth in adventure sports participation. Each helmet sold in the world is a potential incremental “slot” for MIPS. Thus, the secular trend of safety awareness and helmet adoption is a background tailwind.

To temper the optimism, the outlook isn’t without challenges: competition or alternatives could slowly nibble at some segments, and the company will have to execute well to hit its aggressive targets. But as of now, Mips’ future looks bright. Analysts covering the company largely expect strong growth to continue in 2026 and beyond, and the multiple Buy recommendations with high price targets underscore a prevailing belief that Mips will keep outperforming. If Mips can navigate short-term bumps (like tariffs) and continue its expansion into new markets, it stands to significantly increase its scale in coming years. The company’s own vision of tripling or quadrupling in size by the end of the decade, while bold, is grounded in a realistic assessment of how much headroom remains in helmet safety worldwide.

Conclusion

Mips AB presents a compelling story for long-term investors: it is a small company with a big global niche, offering a critical safety innovation in a way that has created a virtuous cycle of adoption among helmet makers. The company’s general description as a helmet safety innovator is well-earned – Mips took a scientific concept (mitigating rotational brain injury) and commercialized it so successfully that it’s now practically synonymous with helmet safety. We’ve seen how Mips’ business model – licensing its MIPS layer to helmet brands – yields high margins and scalability, and how that has translated into strong financial performance (with some ups and downs along the way). We’ve also examined its strengths (market leadership, patents, brand, financial model) and the risks it faces (valuation, potential competition, reliance on partners). The bullish case envisions Mips continuing to dominate and expand, compounding earnings for years to come, whereas the bearish case urges caution about high expectations and possible headwinds.

For an investor with a long-term horizon, Mips AB offers an appealing mix of qualities: it is innovative, asset-light, and still in a growth phase with new markets to penetrate. The company’s ability to generate profits and dividends even during tougher times adds a layer of resilience to the story. Of course, investing in Mips at current levels requires confidence that the helmet safety trend will only grow and that Mips will remain at the forefront of it. This is not a value stock; it’s a growth stock with execution and market-growth risk.

However, if Mips delivers on its ambitions, the payoff could be significant – both in terms of investor returns and in the social impact of making helmets safer worldwide. The outlook suggests more growth on the horizon, supported by rising safety awareness and Mips’ own strategic push into areas like motorcycle and industrial helmets. In conclusion, Mips AB is a unique, high-quality business that has carved out a leadership role in a important niche. It deserves consideration from long-term investors looking for growth, albeit with the understanding that patience and a strong stomach for stock volatility may be required. With its professional yet entrepreneurial approach, Mips is riding the long-term wave of helmet safety innovation, aiming to create value for both its customers (through safer helmets) and its shareholders (through business growth and dividends) in the years ahead.

I like MIPS but ended up selling a while back. Another recent analysis made a good point worth considering...

"Those SEK 46 million in annual legal costs that management calls "normal"? That's more of a confession. You don't spend 10% of revenue on lawyers if your moat is secure. You spend it when multiple competitors are probing your defences, finding ways around your patents, forcing you to play whack-a-mole with litigation. POC tried and partially succeeded. Trek's WaveCel performs equally well in Virginia Tech testing. Every successful workaround encourages three more attempts."

Super interesting deep-dive. Given Mips’ dominance in bike and snow helmets, do you think the real growth kicker over the next 5 years will come from industrial safety helmets, or is motorcycle adoption still the bigger prize?