Quick update: I needed to temporarily remove my post to update the section on revenue, as I realized it was missing some critical information. My apologies for any confusion or inconvenience this may have caused. Thank you for your understanding!

Dear readers,

thank you for being here and for your interest in my work! If you like this article valuable and if you want to support my work, please feel free to subscribe! Please read the disclaimer at the end of this article. This is not investment advice!

PayPal's PYPL 0.00%↑ stock often sparks lively debates among investors. Instead of dwelling on quarterly fluctuations, I prefer to delve into the broader perspective, focusing on the full-year 2023 earnings. This analysis will not cover the new CEO or delve into PayPal's range of products and services. My approach centers on analyzing the data, steering clear of speculating on the outcome of strategic decisions or the success of newly introduced or revamped offerings.

My expertise lies not in the intricacies of these products but in interpreting PayPal's regularly published financial and critical non-financial metrics. My goal is to distill these metrics into actionable insights, providing investors with the essential information needed to make informed decisions about investing in or avoiding PayPal's stock. Let's explore these key metrics, which I believe are crucial for investors.

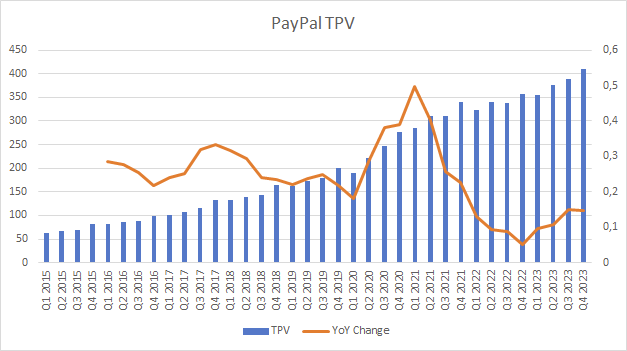

Total Payment Volume

PayPal releases a diverse array of metrics related to its payment network, such as the number of active accounts and the frequency of transactions per account. However, in my analysis, the Total Payment Volume (TPV) stands out as the most pivotal metric. This is because TPV is directly correlated with transaction revenue and expenses, serving as a crucial indicator of the company's financial health and operational scale. Since 2015, PayPal's TPV has exhibited a Compound Annual Growth Rate (CAGR) of 23.5%, expanding from $281.76 billion to $1,529 billion in 2023. This growth trajectory saw a notable spike during the pandemic, reflecting a surge in digital payment adoption, followed by a sharp decline as the initial pandemic-driven boom subsided. In 2023, however, TPV growth has shown signs of acceleration, returning to more sustainable levels. This adjustment suggests a stabilization of growth patterns post-pandemic, highlighting PayPal's adaptability and enduring relevance in the evolving digital payment landscape.

Revenue and Revenue growth

The majority of PayPal's revenue is closely tied to the development of its Total Payment Volume (TPV), yet it's noticeable that revenue growth has not kept pace with TPV expansion. Since 2015, PayPal has achieved a Compound Annual Growth Rate (CAGR) in revenue of 15.7%. This growth rate has consistently diminished over time, despite a notable surge in 2020. Over the past two years, revenue growth has stabilized at approximately 8%. The critical insight from this analysis, in my view, is that while PayPal's revenues continue to rise, they do so at a significantly reduced rate compared to the period before the pandemic. This deceleration suggests that a substantial portion of growth was effectively pulled forward into 2020 and 2021, leading to the current normalization in growth rates.

Transaction Margin

This metric is instrumental in deciphering PayPal's business evolution and the quality of its Total Payment Volume (TPV). By calculating the revenue as a percentage of TPV (Revenue/TPV), we gain insight into how much PayPal earns from each dollar of payment volume processed.

A critical observation is the consistent decline in the Transaction Margin from 3.28% in 2015 to 1.95% in 2023, marking a significant decrease of approximately 40.5%. While there are occasional upticks in certain quarters, the overarching trend is decidedly downward. This pattern underscores that PayPal's TPV growth is increasingly driven by offering lower fees to merchants to capture a larger market share. This strategy highlights the intensely competitive nature of the digital payments landscape, where PayPal faces challenges in maintaining pricing power. The downward trend in Transaction Margin vividly illustrates the competitive pressures that PayPal navigates, revealing crucial insights into its strategic pricing decisions and market positioning.

Operating Margin and Return on invested capital

Despite facing numerous challenges, PayPal has successfully maintained a robust operating margin and, even more notably, has managed to increase its Return on Capital, culminating in 2023 with its highest recorded value of approximately 14.92%. This achievement is particularly impressive given the pressure on transaction margins. It indicates that management has effectively controlled costs and that, despite lower transaction margins, the payment platform is scalable. This scalability is essential for PayPal, mirroring the business models of Visa and Mastercard, where success hinges on processing higher payment volumes. This ability to enhance Return on Capital amidst margin pressures highlights PayPal's operational efficiency and strategic adeptness in navigating the competitive landscape of digital payments.

Free Cashflow

The adage "Cash is King" remains pertinent for PayPal, emphasizing the significance of liquidity in its operations. However, it's evident that Free Cash Flow (FCF) generation has encountered challenges in recent years, partly due to the company's strategic emphasis on the "buy now, pay later" (BNPL) option. This strategic choice has had a tangible impact, as evidenced by an increase in PayPal's Average Days Sales Outstanding (DSO), indicating a lengthening period for collecting payments.

Despite these pressures, it's commendable that PayPal continues to report a healthy Free Cash Flow Margin. Nevertheless, the company faces substantial challenges in this area, and sustaining these levels of free cash flow will be both difficult and essential. The ability to maintain a robust Free Cash Flow Margin amidst these adversities will be critical for PayPal's financial health and its capacity to fund ongoing operations, invest in growth opportunities, and navigate the competitive landscape of digital payments.

Valuation

Currently, PayPal is trading at notably low valuation multiples, marking its position at 12.47x of LTM TEV/EBIT, an all-time low for the company. Other valuation metrics, such as a Price/Earnings ratio of 15.34x, reinforce this perspective of undervaluation. However, the question arises: is this valuation justified? Looking ahead to 2024, PayPal's revenue growth is anticipated to be around 7%, with EBIT and EPS expected to remain relatively stable. Specifically, PayPal forecasts its non-GAAP EPS for the full year to align closely with the previous year's EPS of $5.10. Additionally, the company projects a free cash flow of approximately $5 billion for 2024, maintaining its commitment to uphold an investment-grade credit rating while planning for at least $5 billion in share repurchases. For Q1 2024, PayPal has set revenue growth expectations at about 6.5% at spot rates and 7% on a currency-neutral basis, reflecting the company's strategic emphasis on adapting to ongoing changes and new initiatives through quarterly revenue guidance.

In my typical approach, I utilize a Discounted Cash Flow (DCF) Model to estimate a fair value per share, grounding this analysis in normalized earnings and incorporating all pertinent information available to me. Based on this methodology, my fair value estimation for PayPal's shares ranges from $82 to $92, suggesting that the stock is currently undervalued with a margin of safety ranging between 141% to 156%. This valuation indicates a significant potential for appreciation from its current levels, raising the question of whether the market has fully recognized PayPal's growth prospects and financial resilience.

Conclusion on PayPal

In wrapping up the discussion on PayPal, it's clear that the company presents a divisive case, with arguments both in favor of and against its potential. A straightforward examination of the financials reveals PayPal as a profitable entity experiencing a deceleration in growth, yet it continues to expand and currently boasts a valuation that could be considered undervalued, perhaps excessively so. My personal stance leans towards a more positive view of PayPal's operations and its stock than its reputation might suggest. Despite previous setbacks, my investment in PayPal remains steadfast, driven by a long-term optimism that patience will ultimately payout. It's crucial to note that this perspective is strictly my own and should not be construed as investment advice.

Disclaimer: The information provided in this publication is for educational and informational purposes only and does not constitute financial advice. The content is solely reflective of my personal views and opinions based on my research and is not intended to be used as a basis for investment decisions. While every effort is made to ensure that the information is accurate and up-to-date, the writer makes no representations as to the accuracy, completeness, suitability, or validity of any information in this post and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. All readers are advised to conduct their own independent research or consult a professional financial advisor before making any investment decisions. The author is invested in H&M Group.

Herzlichen Dank für die, wie ich es betrachte, gute Recherche