#21 Stellantis - The automotive powerhouse

A closer look at Stellantis and its attractive valuation

Dear readers,

thank you for being here and for your interest in my work! If you like this article and if you want to support my work, please feel free to subscribe! Please read the disclaimer at the end of this article. This is not an investment advice!

About Stellantis

Stellantis is a prominent global automaker and mobility provider that has a vast operation in designing, engineering, manufacturing, distributing, and selling vehicles, components, and production systems worldwide. Its comprehensive vehicle portfolio includes luxury vehicles under the Maserati brand; premium vehicles by Alfa Romeo, DS, and Lancia; global sport utility vehicles from Jeep; American brands such as Dodge, Ram, and Chrysler; and European brands like Abarth, Citroën, Fiat, Opel, Peugeot, and Vauxhall. The company emphasizes centralized operations to enhance global efficiency and supports its vehicle offerings with related service parts, accessories, and financial services through subsidiaries, joint ventures, and commercial arrangements with third-party financial institutions. Additionally, Stellantis is involved in the components and production systems sector under the Teksid and Comau brands, although it has sold Teksid's cast iron automotive components business.

In 2023, Stellantis operated through six reportable segments, reflecting its diverse global operations:

North America: Focused on manufacturing, distributing, and selling vehicles in the United States, Canada, and Mexico under brands like Jeep, Ram, Dodge, Chrysler, Fiat, and Alfa Romeo. Its manufacturing footprint spans these countries.

Enlarged Europe: Managed operations for manufacturing, distribution, and sales in Europe (including EU members, the UK, and EFTA members) primarily under Peugeot, Citroën, Opel/Vauxhall, DS, and Fiat brands, with plants across multiple European countries.

Middle East & Africa: Concentrated on vehicle manufacturing, distribution, and sales primarily in Turkey, Egypt, and Morocco under brands like Peugeot, Citroën, Opel, Fiat, and Jeep, with manufacturing facilities in Morocco and Turkey through a joint venture with Tofas.

South America: Engaged in manufacturing, distributing, and selling vehicles primarily under the Fiat, Jeep, Peugeot, and Citroën brands, focusing on Brazil and Argentina as the main markets, with manufacturing plants located in these countries.

China, India & Asia Pacific: Operations in this region are carried out through subsidiaries and joint ventures, focusing on manufacturing, distributing, and selling vehicles under various brands including Jeep, Peugeot, Citroën, Fiat, DS, and Alfa Romeo. Manufacturing locations include China, India, and Malaysia through joint ventures and wholly owned subsidiaries.

Maserati: Dedicated to the design, engineering, development, manufacturing, worldwide distribution, and sales of luxury vehicles under the Maserati brand.

Stellantis also engages in other activities, categorized under "Other Activities," which include industrial automation systems (Comau brand), cast iron and aluminum component production (Teksid brand), mobility services (Free2move and Share Now), circular economy initiatives, software and data businesses, and financial services. These services support dealer and customer financing primarily in North America, Enlarged Europe, South America, and China.

The company's strategic initiatives included advancing modular vehicle platforms for BEVs, developing new electric propulsion systems, focusing on battery cell chemistry and design, investing in autonomous driving technology, enhancing connectivity and software capabilities, and exploring hydrogen fuel cell technology.

The company's approach to manufacturing is encapsulated in the Stellantis Production Way (SPW), which emphasizes best-in-class performance across various metrics including health and safety, quality, throughput, cost, and environmental impact. SPW aims to empower employees, enhance skill sets, share best practices, and use production assets efficiently.

Stellantis Strategy

Dare Forward 2030

Stellantis' Dare Forward 2030, announced by CEO Carlos Tavares, sets ambitious goals focusing on sustainability, electrification, and customer satisfaction, aiming for net-zero emissions by 2038, 100% BEV sales in the EU, 50% in the US, and doubling net revenues to €300 billion while maintaining high profitability. The plan emphasizes diversity, operational excellence, and investment in technology, including a significant push towards BEVs, software development, and hydrogen fuel cell technology, with strategic partnerships to bolster innovation and market expansion.

In 2023, significant strides were made towards these goals, notably reducing carbon emissions, launching the first Circular Economy Hub in Italy, and improving diversity and employee engagement. Technological advancements included selling 350,000 BEVs, revealing new BEV models on the STLA Medium platform, and forming critical partnerships for battery technology and semiconductor supply. Value creation efforts have seen growth in commercial vehicles' market share, enhancement of financial services, and strategic global investments, notably in Leapmotor.

Stellantis' progress in Care, Tech, and Value domains underlines its dedication to leading the automotive industry's transformation through electrification and digitalization, ensuring sustainability, market leadership, and robust financial health.

Strategic and technological initiatives

Stellantis is aggressively advancing its Dare Forward 2030 strategic plan, focusing on electrification, autonomous driving, connectivity, and sustainability. Key initiatives include:

Modular Vehicle Platforms: Introduction of four BEV-centric platforms (STLA Small, Medium, Large, and Frame) designed for a range of vehicles from ultra-compact cars to full-size trucks and SUVs. These platforms are flexible and will share electrified components to adapt to technological advancements. Notably, the STLA Medium platform, unveiled in July 2023, offers a range of over 700 kilometers, marking a significant stride in electric vehicle (EV) technology.

Electric Propulsion and Battery Technology: A €140 million investment in Kokomo, Indiana, for producing electric drive modules (EDMs) signals a push towards electric propulsion systems that are modular and efficient. Stellantis is also focusing on developing nickel-based and nickel cobalt-free battery chemistries and has opened its first battery technology center in Italy. Strategic partnerships and plans for gigafactories in North America and Europe aim to bolster battery production capabilities, targeting 400GWh of battery capacity by 2030.

Autonomous Driving and Connectivity: Through acquisitions and partnerships, including with aiMotive, Waymo, and Aptiv, Stellantis is advancing autonomous driving technology. The development of the "STLA Brain," an electronic and software architecture, underscores efforts to streamline vehicle connectivity and software capabilities.

Hydrogen Fuel Cell Technology: The acquisition of a stake in Symbio highlights Stellantis' commitment to zero-emission hydrogen mobility, with production of hydrogen fuel cells underway in France.

Semiconductors: The creation of the SiliconAuto joint venture with Foxconn in June 2023 aims to design and sell advanced semiconductors for the automotive industry, supporting future needs including the STLA Brain architecture with full over-the-air (OTA) updating capabilities.

These efforts showcase Stellantis' commitment to leading in clean energy, autonomous driving, advanced connectivity, and the production of competitive electric and hybrid vehicles, aligning with its strategic vision for the future of mobility.

General Risks and Opportunities

Stellantis faces a mix of trends, uncertainties, and opportunities that shape its business landscape. Vehicle shipments and sales are influenced by consumer demand, economic conditions, and the availability and cost of financing. Logistics challenges in Europe have led to increased costs, though initiatives are in place to mitigate these impacts. Financing plays a critical role, with changes in interest rates affecting vehicle affordability and sales mix.

The transition to electrification involves substantial investments and is subject to regulatory developments, consumer acceptance, and potential impacts on margins. Product development and technology advancements are crucial for maintaining competitiveness and meeting changing consumer preferences and regulatory requirements.

The profitability of vehicles varies based on factors such as size, model, and propulsion system, with larger vehicles and those with additional options typically being more profitable.

Pricing competition remains intense in the automotive industry, and production costs are influenced by raw material prices, tariffs, and labor costs. Economic conditions directly affect vehicle demand, with current uncertainties potentially leading to lower sales in more profitable segments.

Regulatory challenges, particularly around emissions standards and the transition to electrification, require significant investment and adaptation.

Foreign exchange rates also impact financial results, with currency fluctuations affecting net revenues and cash positions.

Stellantis is navigating these complex factors with strategic initiatives aimed at sustainability, electrification, and leveraging technological advancements to ensure future growth and profitability.

FY 2023 results and achievements

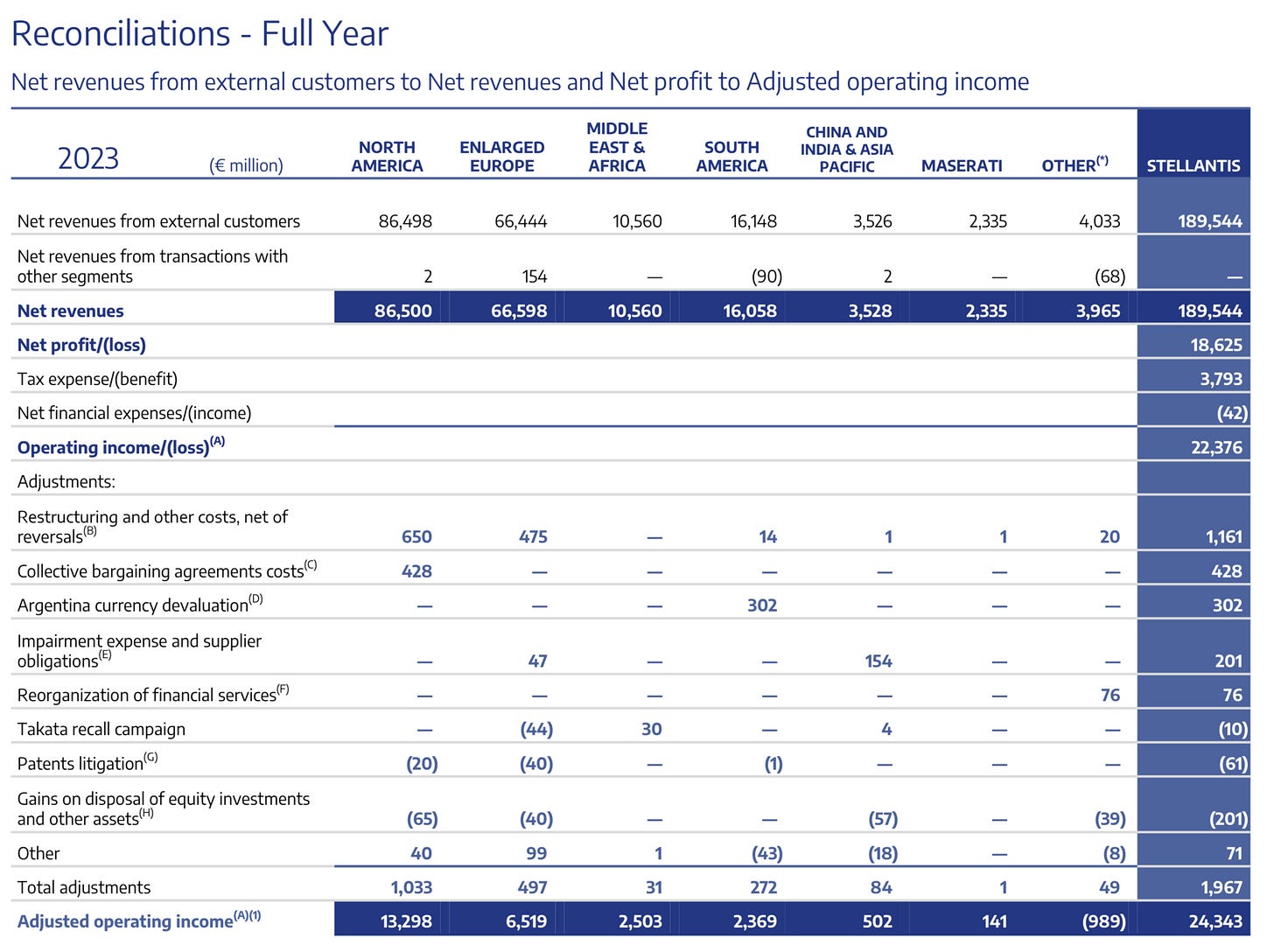

Stellantis capped off an impressive year, posting net revenues of €189.5 billion and an operating income of €22.4 billion. The adjusted operating income reached €24.3 billion, showcasing robust financial health. The lion's share of the success came from the North America Segment, contributing 45% of sales (€86.5 billion) and 55% of income (€13.3 billion), alongside the Enlarged Europe Segment, which accounted for 35% of sales (€66.6 billion) and 27% of operating income (€6.5 billion). Together, these segments represented approximately 80% of Stellantis group sales and 82% of its adjusted operating income, highlighting their pivotal role in the company's success. Additionally, Stellantis also demonstrated strength in smaller automotive markets, particularly in the Middle East, Africa, and South America.

The overall sales surged by 6%, driven by an 8.2% increase in volume/mix and a 6.5% price increase, though slightly offset by currency impacts. The company successfully shipped nearly 6.2 million vehicles, predominantly in Enlarged Europe and North America.

Key financial indicators such as the EBIT Margin and ROIC reflect Stellantis' strong performance, with an EBIT Margin of 12.1% and an ROIC of 19.8%.

Stellantis employs a unique definition for "Industrial free cash flow," essentially representing the free cash flow from its automotive business. Despite differences in calculation methodologies, this metric aligns closely with traditional definitions of free cash flow, offering a clear view of the company's liquidity and financial flexibility.

In summary, Stellantis' financial outcomes for 2023 were exceptionally positive, underscoring a year of substantial achievement and robust results across key segments and metrics.

Investment case for Stellantis

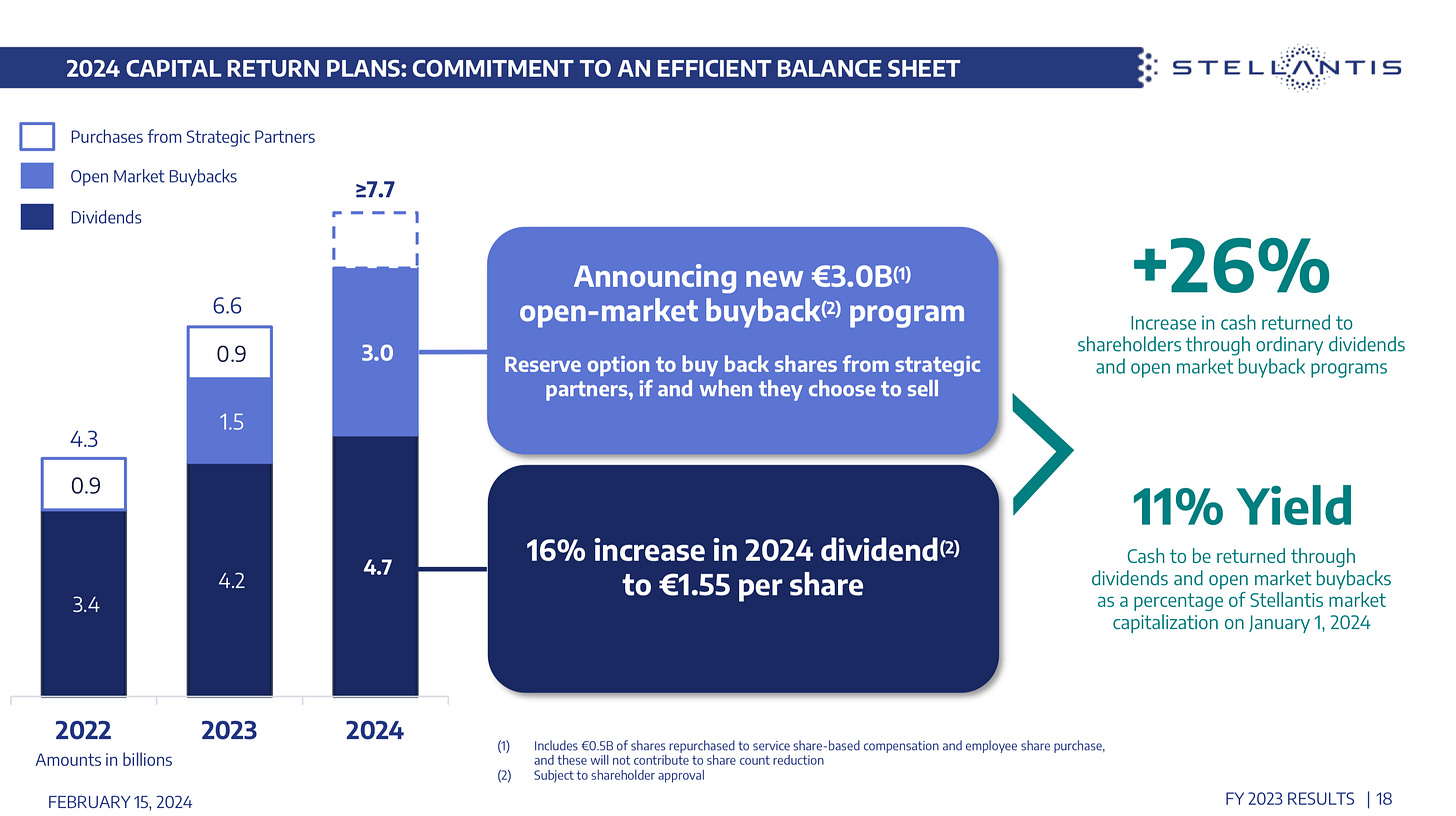

Capital Allocation

For 2024, Stellantis management has announced a dividend increase of 16%, raising it to €1.55 per share, which currently yields approximately 6.4%. In addition, the company has unveiled a new share buyback program valued at €3 billion. It's important to note, however, that €0.5 billion of this allocation is earmarked for share-based compensation and employee share purchase plans, which will not contribute to a reduction in the share count. This detail is crucial for investors assessing the program's impact on share value. Furthermore, in 2023, Stellantis executed share buybacks amounting to roughly €2.4 billion, demonstrating its ongoing commitment to returning value to shareholders.

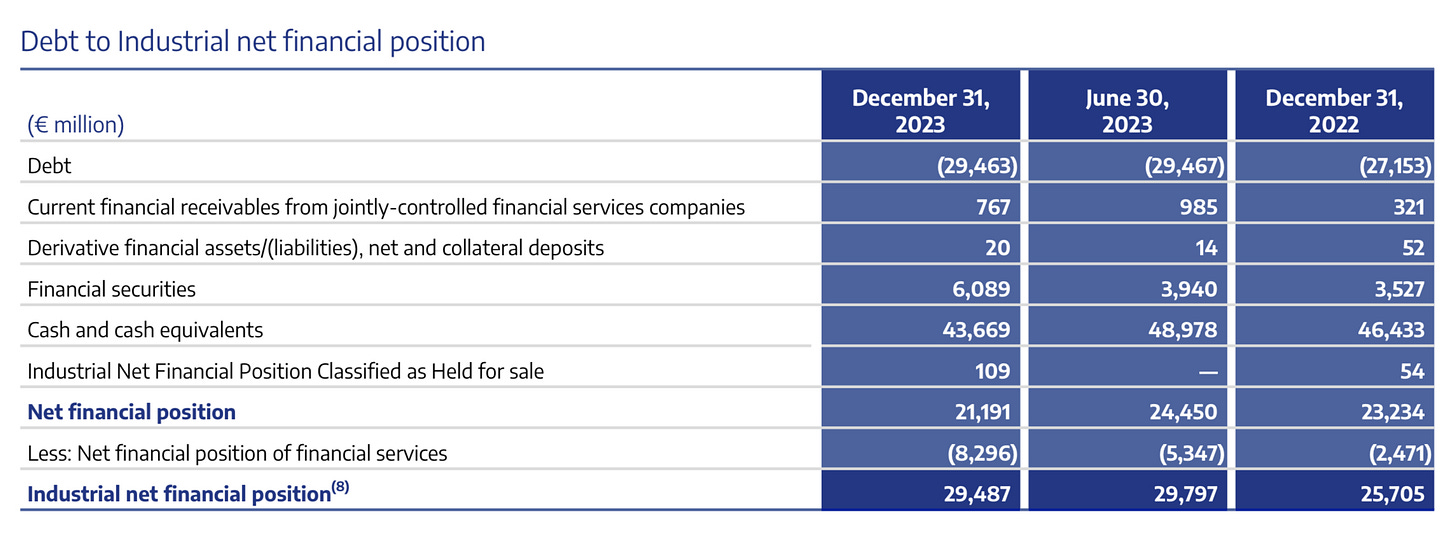

Debt free due to huge Cash position

Stellantis boasts a substantial cash reserve on its balance sheet, totaling approximately €43.7 billion. When accounting for both its operational debt and the liabilities from its financial services division, the company still maintains a positive net financial position. Unique to Stellantis, the calculation of its net debt also includes financial securities, a practice not universally adopted. Despite this distinctive approach, the net debt figure remains positive, effectively indicating that Stellantis operates in a debt-free capacity.

Small exposure to China

The significant presence in the Chinese automotive market has long been emphasized by experts, particularly by German carmakers, as a critical success factor. However, Stellantis, with a modest market share of approximately 0.3% in China and sales of around 69 thousand vehicles, yielding net revenues of about €1.1 billion, has taken a different trajectory. Initially perceived as a potential weakness, Stellantis' limited exposure to the Chinese market has emerged as a strategic advantage amidst the economic challenges and heightened political risks following the COVID-19 pandemic. With its primary focus on North America and Europe—regions known for their economic and geopolitical stability—Stellantis is well-positioned to capitalize on its strategic market orientation.

Low valuation

Stellantis presents a compelling investment case due to its, in my view, attractive valuation, bordering on undervaluation. Analyzing its performance in 2023, Stellantis is positioned at a P/E ratio of 4.14x, though I have a preference for the LTM TEV/EBIT metric, which stands at 3.42x. There's an anticipation that margins may face challenges in 2024 due to various headwinds, potentially leading to a slight decrease in EBIT. Nonetheless, Stellantis remains attractively priced at about 3.6 to 3.5 NTM TEV/EBIT or 4.5 NTM P/E, depending on which estimate you consider. While I maintain a cautious stance on Stellantis achieving its ambitious 2030 revenue target of €300 billion as set out in the Dare Forward 2030 strategy, especially through organic growth alone, my fair value estimate for Stellantis shares ranges between €35-40. Despite the stock being even more affordably priced in the past (it surged over 40% in the last year), it still represents, from my perspective, a value opportunity.

Declining Market share in main regions

Despite recording a robust performance in 2023 and showcasing promising developments and profitability, Stellantis is navigating through significant challenges in its key markets. Since its inception in 2021, Stellantis has experienced a decline in market share in both the US and Europe, which are its primary markets. In the US, the company has seen a nearly 2 percentage point drop over two years. Although specific reasons for this trend were not elaborated during its earnings call, the significant strikes in the latter half of the year likely had a detrimental effect.

In Europe, the situation appears more concerning, with market share contracting by approximately 3.8%, indicating a more pronounced decline. During the earnings call, CEO Carlos Tavares expressed optimism about reversing this trend. The presentation suggested that intense competition, including from new entrants primarily from China, played a role in this market share erosion.

CEO Carlos Tavares: “Even though a little bit like in the U.S., we suffered on the share, we lost 140 basis points. We believe that this is coming back quite strongly, and we'll have the opportunity to discuss because we see that our order book is now being filled in a very efficient manner.”

This trend warrants close monitoring as a continuing loss in market share may prompt management to consider price reductions as a strategy to regain market presence, potentially at the expense of profit margins.

Conclusion

Stellantis, formed from the merger of Fiat Chrysler Automobiles (FCA) and Peugeot Societe Anonyme (PSA), stands as a global automotive powerhouse, boasting a diverse portfolio of 14 brands that cater to various customer segments worldwide. Since its formation, Stellantis has demonstrated robust financial performance, leveraging synergies, adopting a centralized approach, and utilizing shared platforms across its brands to enhance cost efficiency and operational effectiveness. Currently, this strategy is proving successful.

Several factors contribute to a positive investment outlook for Stellantis. These include its attractive valuation, strong commitment to rewarding shareholders through dividends and share buybacks, a debt-free balance sheet, minimal exposure to the volatile Chinese market, and a significant presence in the stable markets of the US and Europe. However, it's important to acknowledge challenges, such as intense competition and declining market share in these key regions, alongside the broader industry's pivotal shift towards electric vehicles (EVs).

From a personal perspective, having invested in Stellantis since August of the previous year and recently augmenting my stake, the investment rationale appears compelling to me. Nevertheless, it's crucial to remain mindful of the inherent risks involved.

Disclaimer: The information provided in this publication is for educational and informational purposes only and does not constitute financial advice. The content is solely reflective of my personal views and opinions based on my research and is not intended to be used as a basis for investment decisions. While every effort is made to ensure that the information is accurate and up-to-date, the writer makes no representations as to the accuracy, completeness, suitability, or validity of any information in this post and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. All readers are advised to conduct their own independent research or consult a professional financial advisor before making any investment decisions. The author is invested in Stellantis.

Hallo Herr Kroker ,das englische passt für mich noch nicht so sehr, die Plattform finde ich sehr interessant, herzlichen Dank, mal sehen, was mit Stellantis auf uns zu kommt

Great company and Carlos Tavares is an amazing CEO. They also announced a 2bn bonus for their employees.