Dear readers,

thank you for being here and for your interest in my work! If you like this article and if you want to support my work, please feel free to subscribe! Please read the disclaimer at the end of this article. This is not an investment advice!

Introduction

Ulta Beauty ULTA 0.00%↑ is recognized as a prominent specialty beauty retailer in the United States, differentiated by its extensive range of beauty products and services. Here's a concise overview of Ulta Beauty's key features:

Product Assortment: Ulta Beauty offers a comprehensive collection of over 25,000 products from more than 600 brands spanning a wide array of categories, including prestige and mass market cosmetics, fragrances, skincare, haircare, and professional salon tools. This diverse selection aims to cater to a broad spectrum of consumer preferences and needs.

Retail Presence: The company operates 1,385 stores, most of which are strategically located in easily accessible, high-traffic areas. The design of Ulta Beauty stores is intentionally bright and open to facilitate product discovery and exploration. Additionally, Ulta Beauty has integrated beauty services within the majority of its stores, including full-service hair salons and Benefit™ Brow Bars. The Ulta Beauty at Target initiative extends a curated selection of prestige beauty products to certain Target locations, further expanding its retail footprint.

Digital Engagement: Ulta Beauty's online platforms, including its website and mobile applications, are designed to offer engaging, interactive, and personalized shopping experiences. Advanced features such as virtual try-on and skin analysis tools, powered by augmented reality and artificial intelligence, aim to enhance the online customer journey. A variety of fulfillment options, including in-store pickup and same-day delivery, are available to meet different customer preferences.

Loyalty Program: The Ultamate Rewards loyalty program plays a pivotal role in Ulta Beauty's customer engagement strategy. Members earn points for purchases which can be redeemed for discounts on products or services. This program, which accounts for over 95% of the company's total sales, supports Ulta Beauty in gathering insights into customer preferences and tailoring experiences and promotions accordingly.

Customer Experience: Ulta Beauty prioritizes creating a positive and welcoming environment for guests across all channels. The company employs knowledgeable associates and offers unique service offerings to enhance the shopping experience, aiming to build strong customer engagement and loyalty.

Established in 1990, Ulta Beauty was founded with the intention of disrupting traditional beauty retail channels by offering a wide range of beauty products and services under one roof. Targeting beauty enthusiasts, a demographic characterized by their passion for beauty and high expectations for their shopping experiences, Ulta Beauty seeks to serve approximately 65% of shoppers who are believed to account for more than 80% of beauty products and services spending in the U.S.

Strategic Framework

Ulta Beauty's strategy aims to captivate beauty enthusiasts across diverse demographics, recognizing their enduring passion for beauty even amidst economic uncertainties and the ongoing challenges posed by the COVID-19 pandemic. Despite a dynamic operational and competitive landscape, and continued pressures from supply chain and labor costs, consumer engagement in the beauty sector remains robust, with a notable return to in-person shopping complemented by sustained online purchasing habits.

In 2021, Ulta Beauty refined its strategic framework to enhance its market leadership and ensure sustainable, profitable growth. This strategy rests on six pillars:

Breakthrough Growth: By broadening the definition of beauty to encompass self-care and wellness, Ulta aims to captivate consumers with a curated, inclusive assortment that taps into leading trends. Focus areas include growth in core categories (makeup, skincare, haircare, fragrance), development of strategic platforms (e.g., Conscious Beauty, BIPOC-founded brands), exclusive brand partnerships, and assortment optimization for increased profitability.

Omnichannel Experience Evolution: Recognizing consumers' preference for physical store interactions alongside the convenience of digital channels, Ulta seeks to blur the lines between these experiences. Plans include expanding physical store presence, enhancing service offerings, and leveraging digital innovations to create a seamless omnichannel journey.

Deepening Beauty Community Presence: Leveraging insights from over 43.3 million Ultamate Rewards members, Ulta intends to foster deeper connections with beauty enthusiasts. This involves amplifying the brand's purpose, engaging with social media and content creators, innovating within the loyalty program, and utilizing data for personalized marketing.

Operational Excellence: In response to macroeconomic cost pressures, Ulta is focused on process optimization, technology upgrades (e.g., ERP platform enhancements), and supply chain improvements to support growth while maintaining efficiency and agility.

Culture and Talent Development: Ulta emphasizes a guest and associate-centric culture that values performance and collaboration. The strategy includes attracting, developing, and retaining talent across the organization, ensuring a supportive environment that encourages growth and contribution.

Environmental and Social Impact: Ulta commits to driving positive change in the beauty industry, promoting inclusivity, and making sustainable product choices easier for consumers. Efforts include managing environmental footprints and collaborating on broader sustainability challenges.

Overall, Ulta Beauty's strategic direction is designed to leverage consumer insights and operational strengths to expand its leadership in the beauty market, enhance guest experiences, and achieve long-term, sustainable growth amidst a changing retail landscape.

From my perspective, the strategic framework is both robust and straightforward. With effective management at the helm, such a framework has the potential to drive substantial success. This has been clearly demonstrated by Ulta Beauty, which has effectively leveraged its strategic approach to achieve remarkable outcomes.

Market and Competition

In 2023, Ulta Beauty operated within the expansive U.S. beauty products and salon services industry, a market valued at approximately $181 billion according to forecasts by Euromonitor International and IBIS World Inc. Of this, the beauty products sector accounted for about $112 billion, spanning cosmetics, haircare, fragrances, bath and body, skincare, salon styling tools, and other toiletries, where Ulta Beauty captured a 9% market share. The company competes across all significant product categories and price points, offering an array of prestige, mass, and salon products.

The salon services segment of the market, worth approximately $69 billion, covers hair, skin, and nail services. Ulta Beauty's share in this sector is less than 1%, despite having full-service hair salons in almost every store and providing brow bars, makeup services, and ear piercing in most locations, alongside skin services in about 150 stores. This positioning reflects Ulta Beauty's comprehensive approach to capturing a broad spectrum of the beauty and salon services market.

Competition in both the beauty products and salon services markets is intense and multifaceted. For beauty products, Ulta Beauty's main competitors include a variety of retail formats such as traditional department stores, specialty stores, grocery and drug stores, mass merchandisers, and both the online operations of national retailers/brands and pure-play e-commerce entities. The salon services and products market is highly fragmented, with competition primarily coming from both chain and independent salons.

Ulta’s Business operations

Ulta Beauty is dedicated to providing a personalized and compelling shopping experience across multiple channels, including physical stores, a digital platform, and strategic partnerships, to meet customers wherever they prefer to shop.

Stores: Data indicates a strong preference among Ulta Beauty's loyalty members for shopping in physical stores, with 76% of members in fiscal 2023 making purchases exclusively in-store. Ulta's retail locations are strategically situated in convenient, high-traffic areas, with the typical store encompassing around 10,000 square feet. This space includes a full-service salon and a layout that has evolved to meet changing customer expectations and merchandising strategies. Ulta Beauty stores offer a wide range of beauty services, employing skilled professionals to provide both services and educational experiences. Retail store leases typically have a 10-year initial term with options for two or three extension periods of five years each, at Ulta Beauty's discretion.

Throughout fiscal years 2021 to 2023, Ulta has actively expanded and optimized its store network, with a vision to grow its store footprint to between 1,500 to 1,700 locations in the U.S. As of February 3, 2024, Ulta Beauty managed 1,385 retail stores across all 50 states. The company utilizes insights from market share data and loyalty member preferences to select new store locations, aiming for a high-performing real estate portfolio. A significant investment is required to open a new store, with costs varying by location. Recent store layouts have been redesigned to facilitate easier exploration and shopping by intuitively grouping like categories together.

Digital Platform: Alongside expanding physical stores, Ulta Beauty is enhancing its digital presence to cater to the growing number of customers engaging online. In fiscal 2023, 18% of loyalty members shopped both in-store and online. The digital platform serves dual purposes: generating sales and driving traffic to various Ulta channels. Omnichannel customers, in particular, are highly valued, spending significantly more than those who shop exclusively in retail. Ulta continues to refine its online experience, adding new features and content to establish itself as a premier online beauty destination. The company is also improving its order fulfillment capabilities to offer faster delivery and convenient options like "Buy Online, Pick-up in Store," curbside pickup, and same-day delivery in select areas.

Partnerships: Ulta Beauty has formed a strategic partnership with Target Corporation to create "Ulta Beauty at Target," a shop-in-shop concept featuring a curated selection of prestige brands. This collaboration aims to expand Ulta's reach and introduce new customers to its offerings. As of February 3, 2024, the concept was available in over 500 Target locations and online, with plans to expand to up to 800 Target locations. This partnership allows Ulta Beauty loyalty members to earn points on purchases made at these shop-in-shops, although points can only be redeemed at Ulta Beauty stores or online platforms.

Through these diverse retail channels and strategic initiatives, Ulta Beauty seeks to enhance guest engagement and broaden its market reach, adapting to the evolving preferences of beauty enthusiasts.

Merchandise

Ulta Beauty's merchandising strategy emphasizes offering an extensive selection of both branded and private label beauty products across a wide range of categories, from cosmetics to salon styling tools. The company's product assortment, one of the largest in the industry, spans more than 25,000 products from over 600 established and emerging brands, catering to various price points and including Ulta Beauty’s own private label, the Ulta Beauty Collection. The merchandising team is dedicated to keeping the product lineup fresh and aligned with the latest beauty and fashion trends, sales data, and new product launches, ensuring relevance and diversity that matches the broad spectrum of customer preferences.

Conscious Beauty at Ulta Beauty®: In response to growing consumer interest in products that support personal well-being and ethical values, Ulta launched Conscious Beauty at Ulta Beauty® in 2020. This initiative focuses on clean ingredients, cruelty-free, vegan products, and sustainable packaging, offering transparency to help customers make choices that align with their values. The program, which began with 187 brands, had expanded to include over 300 brands by February 2023, with many certified across multiple pillars. The launch also saw the publication of the “Made Without List,” setting ingredient standards for clean beauty products, and the formation of the Conscious Beauty Advisory Council.

The Wellness Shop: Reflecting the increasing consumer focus on self-care and the connection between beauty and wellness, Ulta introduced The Wellness Shop in selected stores and online. This section features products across categories like everyday care, supplements, relax and renew, and intimate wellness, among others.

Diversity and Inclusion: Ulta Beauty has committed to diversity and inclusion throughout its marketing, product assortment, and training efforts. In fiscal 2023, the company increased its range of Black-owned and founded brands to 50, moving towards its goal of dedicating 15% of its assortment to such brands over time.

Private Label and Exclusive Products: The Ulta Beauty Collection, the company’s private label, plays a crucial role in its growth strategy, providing quality, trend-right products that reinforce Ulta’s position as a contemporary beauty destination. This collection, along with other permanent exclusives contributes significantly to Ulta's sales, with permanent and temporary exclusive products together accounting for approximately 8% of total net sales in fiscal 2023.

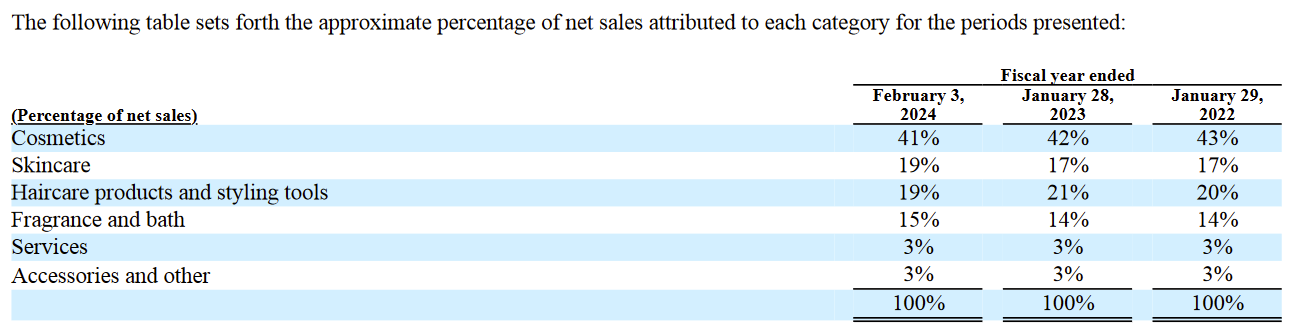

Product Categories and Sales Distribution: Ulta Beauty’s offerings are spread across six main categories: cosmetics, haircare and styling tools, skincare, fragrance and bath, services, and accessories among others. These categories collectively form a balanced portfolio, contributing to the company's revenue through a mix of product sales and services.

Share Repurchase Program

In March 2020, the Board of Directors initiated a share repurchase program allowing the repurchase of up to $1.6 billion in common stock, superseding any previous programs. This 2020 initiative did not have a set expiration but could be halted or stopped at any discretion. Subsequently, in March 2022, a new program was authorized, permitting the repurchase of up to $2.0 billion in common stock, thereby nullifying the unused portions of the 2020 program. Similar to its predecessor, this 2022 program could also be paused or ended at any time.

Over the fiscal years ending in 2024, 2023, and 2022, the company repurchased millions of shares at significant costs, with the total cost of shares repurchased in these years amounting to $1,009.3 million, $900.0 million, and $1,521.9 million, respectively.

On March 12, 2024, a new share repurchase program was authorized, once again allowing for the repurchase of up to $2.0 billion in common stock. This 2024 program effectively replaces any remaining authority under the 2022 program and, like its predecessors, does not have a fixed expiration date, retaining the option for suspension or discontinuation at any moment.

Since 2020, the number of outstanding shares for the company decreased from 57.84 million to 49.3 million, marking a 14.8% reduction over the last five years.

International Expansion

Ulta Beauty announced plans for international expansion into Mexico in 2025 through a joint venture with Axo. This move aims to leverage Ulta Beauty's differentiated value proposition in the sizable and growing Mexican beauty market.Ulta Beauty's planned expansion into Mexico represents a strategic move to extend its reach beyond the United States and tap into the considerable opportunities within the Mexican beauty market. This decision to enter Mexico is driven by several key factors:

Market Potential: The Mexican beauty market is characterized as sizable and growing, indicating a significant opportunity for Ulta Beauty to introduce its unique value proposition and wide range of beauty products and services.

Brand Awareness: Preliminary research suggests there's already a healthy awareness of the Ulta Beauty brand among Mexican consumers. This existing brand recognition is expected to facilitate smoother entry and quicker adoption by the local market.

Geographical Proximity: The strong engagement observed in Ulta Beauty stores located in areas geographically adjacent to Mexico underscores the potential for success in the Mexican market. This proximity likely contributes to the existing brand awareness and interest among Mexican consumers.

Strategic Partnership: To expedite its market entry and minimize initial risks, Ulta Beauty has chosen an asset-light partnership approach. The company announced a joint venture with Axo, a seasoned operator known for its experience with global brands. This partnership is aimed at leveraging Axo's local market knowledge and operational expertise to successfully launch and operate Ulta Beauty stores in Mexico.

Planned Launch in 2025: The initiative is set to materialize with the first Ulta Beauty stores expected to open in Mexico in 2025. This timeline allows for thorough market preparation and the establishment of a solid foundation for success.

Financial Implications: For fiscal 2024, the venture into Mexico is not anticipated to have a material impact on Ulta Beauty's financials. This cautious approach reflects the company's strategy of measured international expansion and the initial investment in establishing the brand in a new market.

Ulta Beauty's expansion into Mexico is seen as an incremental long-term opportunity to grow its international footprint and introduce its differentiated retail model to new consumers. By partnering with Axo, Ulta Beauty aims to navigate the complexities of entering a new market while capitalizing on the significant potential of the Mexican beauty industry. Further details and updates on the expansion strategy are expected to be shared as the launch date approaches.

Upcoming Investor day in 2024

In the discussion about Ulta Beauty's outlook and strategic direction during the Q4 earnings call, it was announced that the company plans to host an investor event in Chicago this fall. The purpose of this event is to share Ulta Beauty's longer-term plans and outlook with investors. This investor day is anticipated to offer valuable insights into the company's strategic initiatives, financial goals, and growth strategies, providing investors with a clearer understanding of Ulta Beauty's direction and prospects for the future.

Managements Outlook for 2024

For fiscal 2024, Ulta Beauty has outlined a comprehensive financial outlook that reflects both the company's growth ambitions and the challenges it anticipates in the evolving retail landscape. Here's a detailed overview of what Ulta Beauty expects for 2024:

Net Sales Expectations: Ulta Beauty projects its net sales to be in the range of $11.7 billion to $11.8 billion. This forecast is indicative of the company's confidence in its continued ability to attract customers and drive sales through both existing and new stores, as well as its e-commerce platform.

Comparable Sales Growth: The company anticipates comparable sales growth to be between 4% and 5%. This expected growth is likely to be supported by Ulta Beauty's strategic initiatives, including its loyalty program enhancements, digital and in-store experience improvements, and merchandise assortment expansions. The growth rate suggests a robust but moderating growth trajectory compared to the unprecedented growth rates seen in recent years.

Operating Margin: Ulta Beauty expects its operating margin to range between 14% and 14.3% of sales. This outlook takes into account the planned strategic investments across the company, including new store openings, technology advancements, and marketing initiatives. It also reflects an awareness of ongoing operational challenges, such as wage pressures and supply chain costs.

Diluted Earnings Per Share (EPS): The company's diluted earnings guidance is set in the range of $26.20 to $27 per share. This guidance reflects an expectation of continued profitability and financial health, despite the various investments and challenges anticipated in fiscal 2024.

Capital Expenditures: Capital expenditures are planned to be between $415 million and $490 million, highlighting Ulta Beauty's commitment to investing in its growth. These investments are expected to cover new store openings, store remodels and relocations, supply chain enhancements, IT infrastructure upgrades, and routine store maintenance.

Depreciation: Depreciation for fiscal 2024 is projected to be between $275 million and $280 million, reflecting ongoing investments in fixed assets and technology to support Ulta Beauty's growth and operational efficiency.

Strategic Initiatives: Ulta Beauty plans to focus on expanding and enhancing its physical footprint, driving growth across digital platforms, and deepening guest loyalty and engagement. Key strategies include evolving the Ulta Beauty Collection, amplifying Luxury at Ulta Beauty, and further leveraging its partnership with Target.

This outlook for 2024 showcases Ulta Beauty's strategic focus on growth, operational excellence, and enhancing the customer experience. While anticipating a moderating growth rate in the beauty category, the company remains optimistic about its position and strategy to navigate the competitive landscape and continue delivering value to its stakeholders.

Key Metrics

I sometimes find it challenging to articulate the significance of financial figures, as they often speak volumes on their own. However, through the upcoming graphics, I aim to emphasize that Ulta Beauty has consistently increased its revenue and income over recent years. More impressively, the company has managed to sustain high levels of profitability, as evidenced by its EBIT margin, and has achieved a remarkable Return on Invested Capital (ROIC). Achieving such financial performance, especially within the retail sector, is no small feat. This positions Ulta Beauty among the elite retailers in terms of financial efficiency and effectiveness.

Valuation

Between 2017 and 2024, Ulta Beauty achieved a commendable Compound Annual Growth Rate (CAGR) of 12.7% in revenue, though it's anticipated to moderate to around 5% annually moving forward. Operating income, which grew at a CAGR of 14.4%, is also expected to decelerate to levels more aligned with sales revenue growth. Based on these projections, I estimate a fair value per share to be within the $420 to $460 range. Given the current stock price of approximately $514 per share, this suggests that Ulta Beauty's stock might currently be overvalued.

Regarding its Price-to-Earnings (P/E) and Enterprise Value to Earnings Before Interest and Taxes (EV/EBIT) ratios, based on the expected earnings for the next twelve months, the stock is trading at multiples of 19.19x and 15.56x, respectively. This is in comparison to its 5-year averages of 22.85x and 18.84x. At first glance, this might indicate that the stock is undervalued. However, it's crucial to consider that growth expectations have significantly reduced compared to previous years. Therefore, the lower multiples appear to be justified, reflecting the adjusted growth outlook more appropriately.

Conclusion

Ulta Beauty stands out as a high-quality business, distinguished by its employee and customer-centric approach. This approach has fostered a culture that customers deeply value, encouraging them to become loyal participants in the membership program. Through this loyalty program, Ulta Beauty gathers valuable customer data, which is then ingeniously utilized to enhance the customer experience and achieve financial objectives. This cycle of loyalty and culture forms a distinctive moat around Ulta Beauty, making it a model difficult for competitors to replicate.

Despite being categorized as "just" a retailer, Ulta Beauty boasts impressive Return on Invested Capital (ROIC) and profit margins, testament to its management's capability and operational excellence.

The most recent strategic update occurred in 2021, and during the Q4 earnings call, management announced an investor day scheduled for this fall. This event is something I plan to monitor closely and will provide an updated assessment of the company thereafter.

Currently, I perceive Ulta Beauty's stock to be slightly overvalued. However, I've decided to initiate a position in the company, believing in its potential for growth and its promising long-term outlook.

Disclaimer: The information provided in this publication is for educational and informational purposes only and does not constitute financial advice. The content is solely reflective of my personal views and opinions based on my research and is not intended to be used as a basis for investment decisions. While every effort is made to ensure that the information is accurate and up-to-date, the writer makes no representations as to the accuracy, completeness, suitability, or validity of any information in this post and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. All readers are advised to conduct their own independent research or consult a professional financial advisor before making any investment decisions. The author is invested in ULTA.

Nice work; very interesting company. Seems to have substantial first mover advantage, and broad brand assortment with available product testers, knowledgeable sales staff and loyalty program will appeal to many.

Since there is a general fear of de-rating due to Ulta, currently at 1385 stores, reaching its target range of 1500-1700 stores over the next 5+ years, I reverse engineered to see what rate of sales growth was implied by the current stock price. Appears investors are assuming a 1% decline/year over the next 10 years; since the company seems perfectly capable of growing same store sales at 3-5%, this seems overly pessimistic.

Currently trying to understand how much of a threat manufacturers are with direct to consumer (DTC); for consumers who already know what they want, being able to order online is a real timesaver.

Review of the proxy's management incentive programs reveals an effort to move from 1-year goals, but it is still too focused on the short term in my view. Would like to see ROIC or similar ratio with FCF in numerator, instead of simple EBT.