Dear readers,

thank you for being here and for your interest in my work! If you like this article and if you want to support my work, please feel free to subscribe! Please read the disclaimer at the end of this article. This is not an investment advice!

Lately, I've noticed an increasing number of positive analyses on Substack and Twitter regarding Dino Polska, highlighting its growth strategy, financial health, and future outlook. Such unanimous optimism often makes me cautious about potentially "hyped" stocks, prompting a deeper investigation into the underlying facts.

In this article, my goal is to appreciate and critically examine the significant success, growth, and robust financials of this company over recent years. While I aim to highlight the remarkable achievements and the strong financial foundation of the company, it's also crucial to shed light on certain aspects that warrant a closer look from investors. These considerations may include challenges and risks that could impact the company's future performance. It's important to note that I do not currently hold any investment in Dino Polska, nor do I plan to initiate a position in the near future. My analysis is intended to provide a balanced perspective, encompassing both the company's commendable successes and the areas that could pose potential concerns for investors.

About Dino Polska

Dino Polska operates a rapidly expanding network of medium-sized grocery supermarkets across Poland, strategically located close to customer residences or in areas with high foot traffic. With 2,406 stores covering 947,919 square meters of selling area as of December 31, 2023, Dino has demonstrated significant growth, adding 933 stores (a 63% increase) over three years. Its business model emphasizes convenience through local positioning, quick store expansions, and a competitive selection of primarily branded and fresh products. The stores are designed to a standard specification, featuring about 400 square meters of sales floor, parking facilities, daily fresh product supplies, around 5,000 stock keeping units (SKUs), and an in-store meat counter.

Dino Polska's scalability is underpinned by centralized management, advanced IT systems, an efficient logistics network comprising eight distribution centers, and a proprietary transportation network. The company benefits from economies of scale through large-volume direct purchasing from producers or their main representatives, allowing for favorable purchase terms that improve as the network grows. This approach, combined with operational leverage and the maturation of the store network, forms a solid foundation for increasing the group's profitability, positioning Dino as one of the fastest-growing retail grocery networks in Poland.

The Dino Polska Group, exclusively operating in Poland, offers a diverse range of approximately 5,000 stock keeping units (SKUs) in its stores, focusing predominantly on branded and fresh products. Fresh products notably constituted 40% of its sales revenue in 2023, underlining the emphasis Dino places on providing fresh groceries alongside branded products at competitive prices. In 2023, branded products, excluding fresh items but including those from the Agro-Rydzyna meat processing plant, formed the majority of Dino's revenue.

Dino's product range is categorized into fresh groceries (including meat products from Agro-Rydzyna), other groceries, and non-grocery items, which respectively accounted for 40%, 48%, and 12% of its 2023 revenue. Fresh groceries include a wide variety of items like meat, poultry, fruits and vegetables, dairy, and bread, delivered daily. Other groceries cover a comprehensive selection of FMCG branded goods, such as children's food, beverages, snacks, and alcohol, making up 48% of sales. Non-grocery products, contributing to 12% of revenue, encompass items like flowers, cleaning agents, and small household appliances.

The Dino Polska Group prides itself on a diversified supplier base, including major producers and their representatives, making it a significant and rapidly growing client for grocery suppliers in Poland. It also supports Polish producers of less recognized brands, providing more affordable alternatives to leading brands, and offers private label products, which represented 6.1% of sales revenue in 2023 (up from 4.5% in 2022).

Agro-Rydzyna, a key supplier, provides high-quality fresh pork and is the primary supplier of cold cuts to Dino, also acting as a middleman for poultry meat purchases. All of Agro-Rydzyna's production is sold through the Dino network, contributing over 13% to Dino's sales revenue in 2023. The top 10 suppliers, excluding Agro-Rydzyna, accounted for nearly 16% of the Group’s revenue, with the largest external supplier constituting less than 5% of revenue, indicating a strategic diversification in supplier relationships.

Dino Strategy

Dino Polska's growth strategy is structured around three main objectives: the rapid organic expansion of its store network, continued growth in like-for-like (LFL) sales revenue, and consistent enhancement of profitability. This approach leverages Dino's inherent strengths and competitive advantages, with a proven track record of expansion from 410 stores in 2014 to 2,406 stores by the end of 2023. The strategy also encompasses environmental considerations, aiming to minimize the impact of operations on the climate and to manage natural resources responsibly.

Rapid Organic Growth in the Number of Stores - Future focus on eastern Poland

Dino has consistently opened an average of 237 stores annually from 2016 to 2022, increasing to 250 in 2023. With a market share of about 7% in Poland's retail grocery sector, there's significant room for growth through increased store density in existing areas and expansion into new regions. Investments to support this growth include securing new sites, building additional distribution centers (each serving approximately 350-400 stores), and expanding the Agro-Rydzyna meat processing capabilities. Moreover, Dino may consider acquiring small, complementary businesses to expedite development and expand its product range or sales channels.

A glance at the distribution of Dino's stores and logistic centers across Poland suggests that the eastern regions, alongside some southern areas, hold potential for future expansion. Notably, the eastern part of Poland, characterized by lower economic development and the sparsest population, poses unique challenges for growth.

The rapid expansion of Dino Polska could lead to situations where some stores may not be profitable, particularly in areas with high store density, leading to potential self-cannibalization. This situation could necessitate impairments, incur costs related to store closures, and necessitate severance payments.

Continued Growth in LFL Sales Revenue

Dino aims to boost LFL sales by attracting more customers and increasing the average purchase value. This goal aligns with consumer trends towards convenience, quality, branded products, and a preference for fresh and healthy food. Dino’s medium-sized supermarkets, positioned close to residential areas, are designed to cater to these preferences, supporting sustained LFL sales growth. The company plans to adapt its product offerings to meet evolving customer expectations and leverage its direct access to reputable producers, its own meat processing plant, and an efficient logistics network for daily deliveries.

You will find my analysis and thoughts on this in the following chapter.

Consistent Improvement in Profitability

Dino has historically achieved strong gross and EBITDA margins and anticipates further profitability improvements through operational scale increases, beneficial business model features, and strategic initiatives. These include exploiting economies of scale, enhancing individual store cost-effectiveness, leveraging operational leverage for higher EBITDA margins, optimizing the logistics network for efficiency, and maintaining effective, cost-conscious marketing policies.

In summary, Dino Polska’s growth strategy is a comprehensive plan focusing on expansion, revenue growth, and profitability enhancement, supported by a commitment to sustainability and environmental stewardship. This multifaceted approach is designed to capitalize on market opportunities, consumer trends, and Dino's operational strengths to ensure long-term success and market leadership in the Polish retail grocery sector.

Past growth and key metrics

Initially, it's imperative to acknowledge Dino Polska's robust performance metrics and its remarkable growth trajectory in recent years. The company has exhibited a nearly 30% Compound Annual Growth Rate (CAGR) in revenues, a testament to its dynamic expansion and market penetration capabilities. Despite this rapid growth, Dino Polska has successfully sustained its operating and normalized net income margins at healthy levels, indicative of efficient operational management and profitability.

Dino Polska's ability to generate strong operating cash flow speaks to its solid financial foundation and operational efficacy. However, in alignment with its strategic focus, the company currently reinvests all generated operating cash flow into the expansion of its store network, leaving no free cash flow available for distribution to shareholders. This reinvestment strategy underscores the company's commitment to long-term growth through geographic and market segment expansion.

Another notable aspect of Dino Polska's financial health is its low debt levels, which have been consistently reduced over the past years. This prudent financial management strategy enhances the company's financial stability and flexibility, positioning it well for sustainable growth and resilience in the face of market fluctuations.

Interesting facts about Dino Polska for Investors

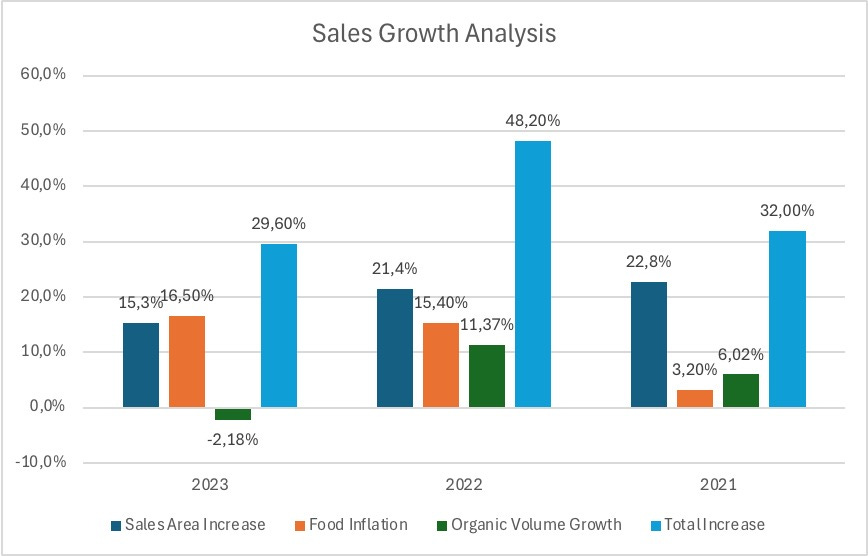

LFL growth primarily driven by higher prices

Dino Polska's data reveal that recent sales growth mainly stems from new store openings and food price inflation in Poland, with actual sales volumes in existing stores showing stagnation or decline. This analysis, while roughly approximated, suggests that growth strategies may lean heavily on expanding sales areas and adjusting for inflation rather than increasing customer volume and purchase frequency in established locations. While sales are rising, this insight could be critical for investors to consider, highlighting a nuanced perspective on the company's growth dynamics.

Deteriorating cash conversion cycle

Dino's publication serves as a benchmark by disclosing vital retail metrics such as days receivable, inventory days, and days payable/trade liabilities, which together define the Cash Conversion Cycle (CCC). In 2023, the calculation of CCC resulted in a slightly positive figure for the first time, at 0.2, indicating a shift. Previously, a negative CCC was advantageous, allowing self-financing through working capital, crucial for Dino's growth strategy. However, with recent changes in trade liabilities and inventory duration, this financial leverage may be diminishing.

Founder and Co-Owner Thomasz Biernacki

Despite being a reclusive figure with no public interviews or photographs and unknown views, Biernacki is celebrated for crafting one of Poland's most significant business successes in recent years. Esteemed as Poland's wealthiest individual by "Wprost" in 2022 and ranked third by "Forbes," his assets are currently valued at over 19 billion PLN. He prioritizes privacy to the extent of using an old-fashioned mobile phone to avoid surveillance.

Biernacki's management style emphasizes direct control over the company, preferring one-on-one meetings and traditional communication methods, including written letters, over modern digital tools. This approach is reflective of his values of privacy and operational security. Despite his aversion to digital communication, Biernacki's leadership has steered Dino through significant growth, maintaining a hands-on role in the company's direction.

Dino's business model is lauded for its self-sufficiency and strategic acumen, owning the land on which its stores are built, unlike its competitors. This strategy not only secures Dino's physical assets but also enriches Biernacki's portfolio, further solidifying his status as a modern magnate.

Biernacki's investments extend beyond Dino, with stakes in construction firms that build Dino markets and control over the supply chain, from production to retail, ensuring cost-effectiveness and profit margin optimization. His aversion to media and public exposure contrasts sharply with his considerable influence in Poland's business landscape, demonstrating that significant success and high profile can coexist with a preference for anonymity and a low-tech lifestyle.

Dubious Related Party Transactions

From a corporate governance perspective, Tomasz Biernacki's extensive investments across the Dino Polska supply chain, including construction firms that build Dino markets, could raise concerns regarding conflicts of interest and transparency. Such vertical integration might concentrate too much control and influence within one individual, potentially overshadowing the interests of other stakeholders. This setup could also limit the company's ability to negotiate with suppliers and contractors objectively, possibly affecting operational flexibility and the capacity to ensure the best terms for the company beyond the interests of a single stakeholder.

Land Purchases vs. Leasing

I believe this isn't a major concern for Dino, but the disclosure lacks specifics on the number of owned versus leased locations. Although Dino's strategy focuses on purchasing land for ownership, the financial statements reveal right-of-use assets and lease liabilities, suggesting some locations are leased. The lease liabilities seem underestimated, given the lease terms reported do not align with the industry standard I observed while auditing a major German retail chain, where leases typically last 10-15 years with options for extension. This discrepancy suggests the liabilities might be higher than reported, though it likely doesn't significantly impact Dino's financial standing, it's an area worth noting for clarity.

Do not underestimate competition

The Dino Polska Group navigates the complexities of an intensely competitive retail landscape, characterized by the proliferation of medium-sized grocery outlets and evolving consumer tastes. This competitive arena is further intensified by rivals wielding greater purchasing power and broader resources, which can encroach upon Dino's profit margins and growth trajectory. The retail market's fragmented structure, coupled with the possibility of consolidations among competitors, poses a tangible risk to Dino's market position and financial performance.

In this environment, the strategic selection of store locations and the appeal of the store format emerge as crucial factors for maintaining Dino's competitive advantage. These elements are pivotal not only for attracting and retaining customers but also for mitigating the pressures of an increasingly competitive and consolidating market. Some of its main competitions are Bierdonka (largest retailer in Poland), Lidl, Eurocash and many more.

Valuation

In evaluating the company's financials, I employ a two-pronged approach: examining the EV/EBIT ratio and utilizing a Discounted Cash Flow (DCF) model. Starting with the EV/EBIT ratio, the company appears to be undervalued at 17.16x, especially when juxtaposed against its historical average of 22.99x. This initial assessment suggests that, even with projections of decelerated revenue and income growth, the company's valuation remains reasonable.

Delving into the DCF model, I estimate the company's fair value to be in the range of 230 to 250 PLN per share. However, the current share price stands at 370 PLN, indicating a potential overvaluation. This disparity is primarily attributed to the company's limited Free Cash Flows (FCF). Presently, the company allocates virtually all of its operating cash flow towards capital expenditures, a strategy that underscores its growth ambitions yet limits immediate free cash availability. While I anticipate a gradual increase in FCF, it is important to temper expectations with the reality that the rapid growth experienced in previous years is likely to moderate.

This comprehensive analysis suggests that while the company presents certain attractive valuation metrics, such as a favorable EV/EBIT ratio, the elevated share price relative to DCF projections and the constrained free cash flow position necessitate a cautious approach. The expectation of slower growth and the significant reinvestment of operating cash flows into capital expenditures are critical considerations for prospective investors.

Conclusion

I hold the view that Dino Polska has experienced an impressive phase of growth, deploying a straightforward yet effective strategy to augment its market share in a fiercely competitive environment. With Poland's economy expanding rapidly and the purchasing power of its citizens on the rise, it's reasonable to anticipate an intensification of market competition. This aspect, in my opinion, seems to be somewhat overlooked by bullish investors.

An analysis of the company's growth dynamics reveals that achieving volume growth in existing stores presents challenges. The less populated and economically weaker eastern regions of Poland exhibit limited growth potential, especially in contrast to the areas where Dino Polska has historically seen rapid expansion. Furthermore, as the company scales, it faces increased complexity in business operations. The risk of market saturation, leading to potential store closures and their associated financial repercussions, cannot be ignored.

Additionally, there are indications of a declining cash conversion cycle, which might necessitate a shift towards a more debt-reliant financing strategy. Up until now, Dino Polska's growth has been commendably fuelled by internally generated funds. However, the expectation for returns, in the form of dividends or share buybacks, will inevitably rise among investors.

Currently, I view the company's stock as overvalued, which solidifies my lack of interest in investing in Dino Polska. Nonetheless, it's important to acknowledge that there are valid arguments in favor of investment. My critical stance could possibly be too harsh, and future developments may prove my conclusions incorrect. Time will tell how the situation unfolds.

Disclaimer: The information provided in this publication is for educational and informational purposes only and does not constitute financial advice. The content is solely reflective of my personal views and opinions based on my research and is not intended to be used as a basis for investment decisions. While every effort is made to ensure that the information is accurate and up-to-date, the writer makes no representations as to the accuracy, completeness, suitability, or validity of any information in this post and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. All readers are advised to conduct their own independent research or consult a professional financial advisor before making any investment decisions. The author is not invested in Dino Polska.

All investments have risks. What you mentioned are fair but more of a boiler plate analysis. There are a lot more to them and how Dino is equipped / or not equipped to compete.

IMHO, the competition risk isn't the highest due to the differentiation of Dino's SKUs among other things, and it's not 'overlooked' by bullish reports. Operating in food retails, you have got to know the competition very well.

Interested reader can find more here - https://open.substack.com/pub/sleepwellinvestments/p/dino-polska-an-open-book-success?r=8u09c&utm_campaign=post&utm_medium=web&showWelcomeOnShare=true

Lastly, I would love Dino share price to go to your fair valuation at 230 PLN, 10x PE would be a no brainer investment to me.

Great article. An additional fact is that population in Poland will decline in the future (which was not the case for Walmart in the US). Although I'm a Dino holder, I'm writing a bear case as well to try to "destroy a beloved idea". Thank you!