Dear readers,

thank you for being here and for your interest in my work! If you like this article and if you want to support my work, please feel free to subscribe! Please read the disclaimer at the end of this article. This is not an investment advice!

About The Kroger Co.

Founded in 1883 and incorporated in 1902, KR 0.00%↑ Kroger Co. has grown to become a cornerstone of the American grocery market, emphasizing convenience through its supermarkets, pharmacies, and fuel centers. The company's strategic focus revolves around four pillars: Fresh, Our Brands, Data & Personalization, and Seamless, aiming to foster customer loyalty through value and convenience.

Kroger’s operations are vast, with 2,722 supermarkets (2,257 with pharmacies and 1,665 with fuel centers) across 35 states and the District of Columbia as of early 2024. These stores vary from combination food and drug stores to multi-department and price impact warehouse stores, with nearly all featuring pharmacies and many offering fuel centers. This diverse format mix helps Kroger cater to a broad customer base, emphasizing a seamless shopping experience that integrates physical and digital retail.

The company's revenue comes primarily from consumer sales in these stores and online platforms, with profitability hinging on strategic product pricing that covers extensive procurement, distribution, and operational costs. Kroger's merchandising strategy is significantly supported by its private label products, which represented over $31 billion in sales in 2023. These products range from premium to value-tier items and include organic options under the Simple Truth® brands. Kroger operates 33 food production plants, including bakeries and dairies, which produce about 30% of the overall units and 43% of the grocery category units of “Our Brands” products sold in their supermarkets.

Kroger also leverages its extensive data from customer interactions—enhanced by its loyalty programs—to personalize shopping experiences and develop alternative profit streams like Kroger Precision Marketing. This retail media venture offers advertising solutions, contributing significantly to Kroger's profitability in the digital space.

Krogers Strategy

Kroger's value creation model is based on its omnichannel retail approach which encompasses elements like fuel and health and wellness. This model supports Kroger in maintaining customer loyalty and increasing sales, which is crucial for long-term growth. The strategy is built around four key pillars: Fresh, Our Brands, Personalization, and Seamless, aiming to enhance the shopping experience and expand both physical and digital customer engagement.

To drive growth, Kroger focuses on increasing identical sales excluding fuel and expanding its operating margin. This involves maximizing retail growth opportunities, continuing strategic investments in workforce development, offering greater value to customers, and enhancing its digital and ecommerce platforms. Kroger anticipates that ecommerce will grow at a double-digit rate, outpacing other food at home sales categories.

Efforts to expand operating margins include initiatives aimed at improving gross margins and increasing productivity through cost-saving measures and process simplifications. These initiatives also involve using technology to better the associate experience without detracting from customer service.

Kroger plans to sustain strong free cash flow and adheres to disciplined capital deployment. Investment priorities include high-return opportunities that facilitate long-term, sustainable earnings growth. Financial strategies are designed to preserve an investment-grade debt rating and maintain a net total debt to adjusted EBITDA ratio within the target range of 2.30 to 2.50. Moreover, Kroger aims to grow its dividend over time and continue returning excess cash to shareholders through stock repurchases, which were paused in the third quarter of 2022 to prioritize de-leveraging following the proposed merger with Albertsons.

Overall, Kroger's strategy is expected to deliver total shareholder returns within the target range of 8% to 11% over time, although this projection does not take into account the effects of the proposed merger with Albertsons.

Key financials and metrics

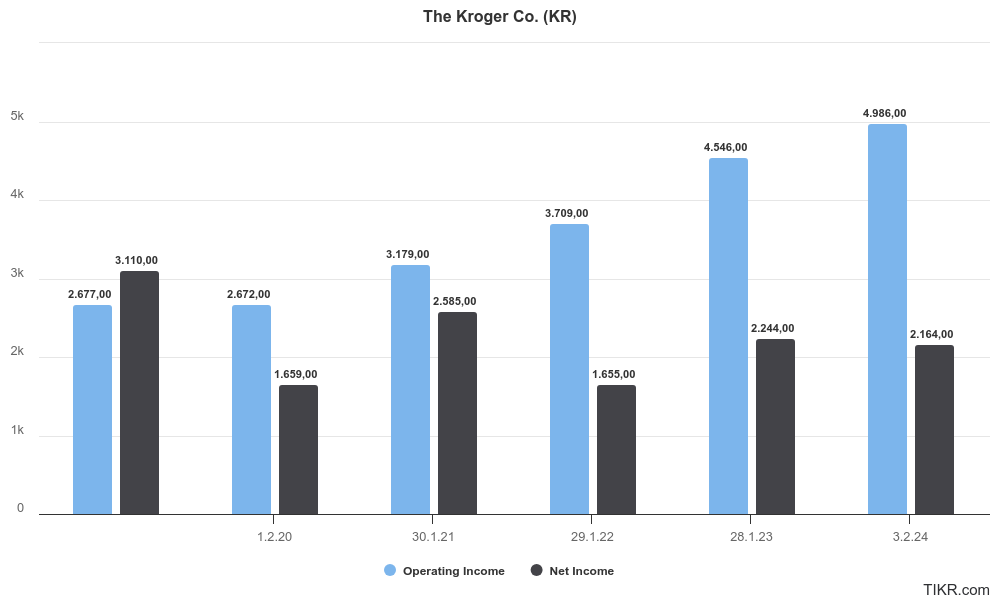

In the fiscal year 2023, Kroger achieved net sales of $150 billion, demonstrating a steady growth trajectory with a compound annual growth rate (CAGR) of approximately 4.2% since 2019. The operating income for the same period reached nearly $5 billion, marking a robust CAGR of 13.2% over the last six years. While net income has shown more variability, it still recorded a substantial $2.2 billion in FY 2023.

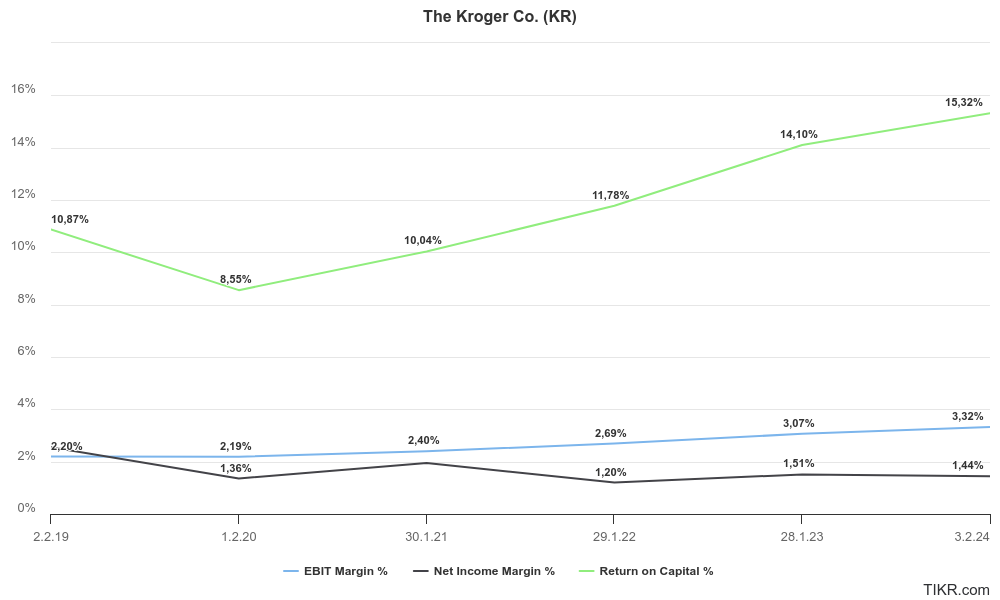

The company's operational cash flow stood at $6.8 billion in FY 2024, with a Free Cash Flow (FCF) of $2.9 billion, translating into an FCF margin of 1.92%. Notably, Return on Capital has shown consistent improvement in recent years, culminating in an impressive 15.3% in the last year. The net margin has remained stable, and there has been an enhancement in the operating margin, which improved to 3.3% in the last year.

In summary, Kroger's solid business model is reinforced by robust financial metrics. The company's margins are not only stable but also healthy. Net sales are increasing at a slow but consistent pace, underscoring Kroger's financial resilience and operational effectiveness.

What Investors should know about Kroger

Share Repurchases

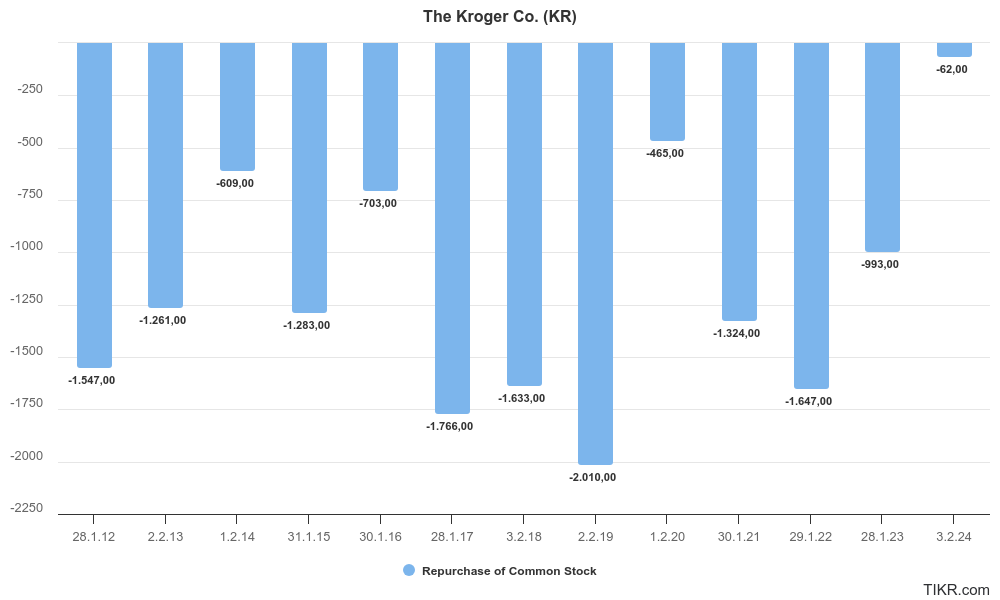

Kroger maintains active share repurchase programs, designed to allow the systematic repurchase of its common shares. These programs, which can be suspended or terminated at any time by the Board of Directors, have facilitated significant buybacks. Notably, repurchases were paused during the third quarter of 2022 to focus financial resources on reducing debt following the announcement of a proposed merger with Albertsons.

Additionally, Kroger has a longstanding repurchase initiative from December 1999, aimed at mitigating dilution from employee stock options and long-term incentive plans. This 1999 Repurchase Program is exclusively funded through the proceeds from the exercise of stock options and related tax benefits, with the company buying back approximately $62 million in shares in 2023 and $172 million in 2022.

Since 2012, Kroger has consistently reduced its share count through stock repurchases, decreasing the number of outstanding shares by 39% over the past 12 years. During this period, The Kroger Co. has invested more than $15 billion in these repurchase initiatives, underlining its commitment to enhancing shareholder value.

In September 2022, the Board authorized a new $1.0 billion share repurchase program intended for execution through open market purchases, private transactions and block trades. However, no shares have been repurchased under this new authorization as of February 3, 2024, with the full amount remaining available for future use. This pause in buybacks correlates with the company’s strategic priority to de-leverage in the wake of its planned merger with Albertsons.

Dividends

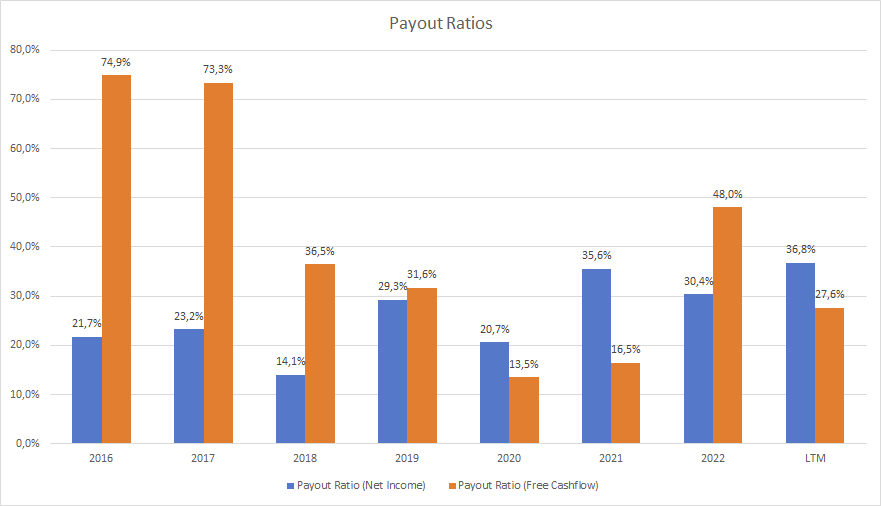

Since 2012, Kroger's dividends per share have exhibited impressive growth, increasing at a compound annual growth rate (CAGR) of 14.6%. This robust performance highlights Kroger as a compelling case for investors looking for strong dividend growth. Additionally, since 2018, the payout ratios—particularly the dividend payout ratio—have remained at a consistently low level, suggesting that further increases in dividends are likely. At the moment the dividend yield stands at around 2.0%

Opiod Settlement

Kroger has been involved in various lawsuits accusing the company, among others, of creating a public nuisance through the distribution and dispensing of opioids. On September 8, 2023, Kroger announced a preliminary agreement to settle the majority of these opioid claims, which could potentially be brought against them by states, subdivisions, and Native American tribes where they operate.

Under this agreement, Kroger will pay up to $1,200 million to states and subdivisions, and $36 million to Native American tribes for abatement efforts, along with approximately $177 million to cover attorneys’ fees and costs. This settlement, which is yet to be finalized concerning certain non-monetary terms, provides an opportunity for the involved parties to opt-in. The effectiveness of the settlement is contingent upon sufficient participation from these parties and is not considered an admission of wrongdoing or liability by Kroger.

In fiscal year 2023, Kroger recognized charges of $1,413 million related to this settlement, net of tax impacts amounting to $1,113 million, classified under "Operating, general and administrative" expenses. The payments are structured to be made in equal installments over 11 years totaling approximately $1,236 million and over 6 years for the $177 million, respectively.

As of February 3, 2024, Kroger recorded estimated settlement liabilities of $284 million under "Other current liabilities" and $1,129 million under "Other long-term liabilities". These records reflect the uncertainty of the settlement's final terms and the possibility that actual losses could materially differ from current estimates.

Additionally, Kroger settled opioid litigation claims with West Virginia in 2023, incurring a $62 million charge, and with New Mexico in 2022, resulting in an $85 million charge. Both settlements resolved all opioid-related lawsuits and claims by these states against Kroger, with no admission of wrongdoing or liability. Despite these settlements, Kroger remains committed to vigorously defending against any unresolved claims and lawsuits related to opioids.

Managements Outlook on 2024

For 2024, Kroger anticipates achieving identical sales growth without fuel between 0.25% and 1.75%. The company expects FIFO operating profits to range from $4.6 billion to $4.8 billion, with adjusted net earnings per diluted share projected to be between $4.30 and $4.50, a slight decrease from the $4.56 adjusted EPS reported in 2023 on a similar 52-week basis.

Kroger forecasts inflation at around 1%, aligning with external predictions and its long-term financial strategy. The company plans to drive revenue growth by enhancing customer value and improving the seamless shopping experience, which includes lowering prices and raising associate wages while also focusing on productivity and cost-saving measures. These initiatives are expected to support growth in Kroger's alternative profit businesses and maintain stable long-term initiatives and gross margins.

Rodney McMullen, Kroger's CEO, highlighted during the Q4 call the importance of increasing the number of loyal households and digitally engaged customers as key drivers for profit growth and powering the company's business model. The FIFO gross margin rate and adjusted Operating, General, and Administrative (OG&A) rate, both excluding fuel costs, are expected to stay relatively flat year-over-year.

In terms of quarterly performance, stronger sales are anticipated in the latter half of the year, counteracting the SNAP headwinds and lower inflation expected in Q1. Sales in Q1 are predicted to be at or slightly below the lower end of the annual guidance, improving to the middle of the guidance range in Q2, and reaching the higher end in the latter half of the year.

Specifically for the quarterly earnings per share in 2024, Q1 is expected to see a low double-digit decline year-over-year, making it the most challenging quarter for sales growth. Q2 earnings should align closely with the previous year, Q3 is projected to see a double-digit increase, and Q4 is expected to match the previous year’s performance, adjusted for a 52-week basis. These projections reflect Kroger’s strategic adjustments in response to varying inflation and sales conditions throughout the year.

Update on Kroger and Albertsons Merger

On October 13, 2022, Kroger entered into a merger agreement with Albertsons ACI 0.00%↑, wherein Albertsons’ shareholders would convert their shares into a right to receive $34.10 per share, reduced by $6.85 due to a pre-closing dividend, making the adjusted price $27.25 per share. To meet regulatory approvals, they planned divestitures including forming a subsidiary (SpinCo) which would be spun off. However, this was later adjusted by selling what would have been SpinCo's business to C&S Wholesale Grocers in a deal for 413 stores among other assets, negating the need for SpinCo.

The transaction is set to close following FTC approval and the finalization of the merger. Financing strategies include a $17.4 billion bridge loan reduced by a $4.75 billion term loan agreement, and potentially, senior notes, commercial paper, and other credit facilities. The merger has faced significant legal challenges, including a complaint from the FTC to block the merger due to antitrust concerns, leading to multiple lawsuits in various states aiming to prevent the merger’s completion.

These legal actions have temporarily restrained the merger, with a series of injunctions and hearings scheduled across 2024 to decide its fate. The parties involved have continually adjusted their divestiture plan to alleviate regulatory concerns, showing a proactive stance towards facilitating the merger's approval.

FTC's Major Concerns

This deal, set to be the largest in the history of U.S. supermarket mergers, aimed to unify the two giants under one corporate banner, potentially reshaping the competitive landscape of the American grocery market. However, the Federal Trade Commission (FTC) has flagged significant antitrust concerns, suggesting a tough road ahead for approval.

The FTC’s complaint is grounded in the potential substantial lessening of competition that such a merger would precipitate, which violates Section 7 of the Clayton Act and Section 5 of the FTC Act. The merger would meld the top two supermarket chains in the country, thereby diminishing competition significantly. This reduction is predicted to have far-reaching effects including increased prices for consumers, and stunted wage growth and benefits for nearly 700,000 workers across both chains, spanning 48 states.

Market Concentration: A critical point of the FTC's argument is the predicted increase in the Herfindahl-Hirschman Index (HHI), a commonly used measure of market concentration. The merger would elevate the HHI to levels that are presumed to lessen competition substantially, especially in hundreds of local markets where Kroger and Albertsons currently compete head-to-head.

Workforce Impact: The merger's implications extend beyond the marketplace to the labor market. Both companies are significant employers within the supermarket sector, and their competition helps to elevate wages and improve benefits for their employees through collective bargaining. The FTC argues that the merger would weaken this dynamic, potentially degrading workforce conditions and compensation.

Divestiture Shortcomings: In response to these concerns, Kroger and Albertsons have proposed divesting several stores to C&S Wholesale Grocers. However, the FTC has criticized this plan as insufficient. It contends that C&S, with limited retail operating experience, would not provide the robust competition needed to counterbalance the merger's negative effects. This aspect of the complaint underscores the complexities of remedial divestiture in antitrust cases, particularly when the buyer may not continue competitive practices.

Broader Implications

This standoff with the FTC underscores a more vigorous enforcement regime under the current administration, signaling that future mergers in essential service sectors will face stringent scrutiny. The outcome of this merger will not only affect the involved companies but could also set a precedent for market concentration thresholds and the adequacy of divestiture solutions in maintaining competitive markets.

Looking Ahead

As the proceedings advance, the central issues will revolve around the FTC’s ability to demonstrate the merger’s potential harms against Kroger and Albertsons' defense, particularly their ability to mitigate these harms through divestitures. The legal and economic analyses will delve deep into local market conditions, the effectiveness of the divestiture plan, and the overall impact on market competition and consumer prices.

This case promises to be a defining moment in antitrust enforcement, with potential ripple effects on how future corporate consolidations are approached, particularly in the supermarket industry, where competition directly influences the price and quality of goods available to consumers. As stakeholders from various sectors watch closely, the resolution of this case will likely illuminate key aspects of corporate strategy, regulatory oversight, and public welfare in the context of market consolidation.

My personal view on the merger

Kroger pays a fair price for Albertsons

The merger agreement prices Albertsons at $34.10 per share, incorporating a $6.85 "special dividend," which places Albertsons' valuation at approximately $24.6 billion. Analysts project a Free Cash Flow (FCF) of around $1.5 billion for the fiscal year ending, with an EBIT (Earnings Before Interest and Taxes) of $2.5 billion. These financial metrics are expected to remain relatively stable through 2025.

Based on these figures, Albertsons' market capitalization to Free Cash Flow ratio (MC/FCF) is approximately 16.4x. When adding about $8.5 billion in net debt to the $24.6 billion equity value, the Enterprise Value (EV) sums up to $33.1 billion. This calculation leads to an EV/EBIT ratio of 13.2x, suggesting the valuation is reasonably fair.

Currently, Albertsons is trading at lower multiples, with an 8.2x MC/FCF and 10.7x EV/EBIT, indicating that the stock might be undervalued in the market.

Kroger is buying an operationally inferior company

The proposed merger between Kroger and Albertsons has the potential to streamline distribution costs and lower acquisition prices, positioning the combined entity to intensify competition with retail behemoths such as Walmart, Amazon, and Costco. However, there is a risk of price increases in markets currently dominated by the merging companies, unless structural modifications are made to the merger.

It's important to note that Albertsons' operational metrics appear to lag behind Kroger's, suggesting that Kroger may face considerable challenges in assimilating the two operations. Significant time and financial investment will be required to align Albertsons' performance with Kroger's standards. As a result, the anticipated synergies from the merger may be offset, at least in the short to medium term, as resources are allocated towards operational optimization.

High debt levels and no further share repurchases

In anticipation of the merger with Albertsons, Kroger has suspended its share repurchase program. Furthermore, the transaction is expected to be fully financed through debt, which will substantially increase Kroger’s financial leverage. Over the past few years, Kroger has significantly reduced its debt in absolute terms and improved its Net Debt/EBITDA ratio to robust levels. However, absorbing the new debt from this merger will likely be a prolonged process due to the scale and cost of integrating Albertsons into Kroger's operations. This large-scale integration will not only be time-consuming but also capital-intensive, potentially impacting Kroger’s financial health in the short to medium term.

Debt-financed pre-closing dividend at Albertsons is dubious

In October 2022, as part of the merger agreement with Kroger, Albertsons declared a special cash dividend of $6.85 per share of Class A common stock, scheduled to be paid in November 2022 to stockholders recorded as of October 24, 2022. However, the Washington State Attorney General filed for a temporary restraining order on November 1, 2022, which was granted by the Superior Court of King County, blocking the dividend's payment.

Subsequent legal battles ensued, with the Superior Court extending the restraining order in December 2022 while the case was referred to the Washington Supreme Court. The state's highest court ultimately rejected the Attorney General's appeal and lifted the restraining order in January 2023, allowing the Company to proceed with the dividend payment of approximately $3.916.9 million on January 20, 2023.

Simultaneously, the Attorneys General of the District of Columbia, California, and Illinois also attempted to block the payment through the federal courts in November 2022. Their efforts were consistently denied, including the rejection of an emergency injunction pending appeal by the federal court of appeals for the District of Columbia in December 2022. Consequently, there were no injunctions from the federal courts concerning the payment of the Special Dividend, clearing all legal hurdles for the Company to disburse the dividend as planned.

Cerberus Capital Management, the largest shareholder of Albertsons, holding approximately 26% of its outstanding shares, orchestrated a dubious transaction by issuing a dividend of about $4 billion to shareholders, including themselves, well before the actual merger with Kroger was finalized. Moreover, this dividend was primarily financed through debt. From an analytical perspective, this move by Cerberus appears to be an attempt to secure a substantial cash-out, potentially compromising Albertsons' financial stability and consequently affecting its merger with Kroger. I just do not like that kind of business behavior.

High risk due to FTC actions

The proposed merger between Kroger and Albertsons has already incurred significant expenses for Kroger, with merger-related costs totaling $268 million in 2023 and $34 million in 2022, even though the merger has not yet been finalized. These costs primarily stem from legal and consulting fees. The ongoing legal battle with the FTC is expected to be costly and could prolong these expenses.

Should the merger eventually receive approval, Kroger and Albertsons may be required to undertake significant divestitures to satisfy regulatory approvals. These divestitures could potentially diminish the overall attractiveness of the transaction, rendering the incurred expenses substantial and possibly wasteful.

Additionally, if the merger agreement is terminated by either party due to not closing by the designated outside date, a termination fee of $600 million will be due, provided that all other closing conditions have been met except for regulatory approval. This situation could further complicate matters, potentially leading to legal disputes and adding to the financial and operational burdens already faced by the company. In such a scenario, the substantial costs and the efforts invested in pursuing the merger may ultimately prove unfruitful.

Stock Valuation

I have chosen to value The Kroger Co. independently of the proposed merger due to the high level of uncertainty surrounding it. At present, it seems impractical to forecast the merger's outcome or even its occurrence with any reliability. Therefore, my valuation of The Kroger Co. is based on its stand-alone capabilities.

For my Discounted Cash Flow (DCF) model, I'm projecting a conservative top-line growth of approximately 1.2% annually, with a terminal value growth rate of 0.5%. I estimate normalized net income to be 1.7% of revenue and forecast a Free Cash Flow (FCF) Margin, relative to sales, also at 1.7%. Applying these estimates to the DCF model yields a fair value of around $55 per share in the base case scenario. In more optimistic projections, my bullish case suggests a potential value of up to $62 per share, while the bearish case indicates a value closer to $48 per share. Based on these figures, I conclude that Kroger's stock is currently trading at or near fair value.

When examining Kroger's Next twelve month Multiple (NTM) Enterprise Value to EBIT (EV/EBIT) Ratio, it currently stands at 12.62x, which is in line with its 10-year historical average of 12.63x. This further supports the stock's fair valuation. Although the 3-year and 5-year averages are somewhat higher, they do not significantly indicate that the stock is undervalued at this time.

Summary and conclusion

Kroger's business model is notably robust, driving strong financial performance characterized by high consistency and reliability. The company's strategic use of its loyalty program and data analytics has enabled it to achieve slow yet steady organic sales growth.

The potential merger with Albertsons could present a significant opportunity for Kroger to close the gap with larger competitors such as Walmart and Costco. However, this prospect is laden with risks and uncertainties, notably the rigorous opposition from the FTC, which could render the merger a costly endeavor. There's a real possibility that the merger may not materialize, or it might result in a less than ideal scenario that brings more challenges than opportunities.

Presently, the stock appears to be fairly valued, and Kroger's practice of consistently increasing its dividend provides an attractive proposition for investors. Nonetheless, the suspension of its share repurchase program, previously a key investor incentive, is a temporary setback. As a shareholder, I maintain my investment in Kroger, holding onto my position amidst these developments.

Disclaimer: The information provided in this publication is for educational and informational purposes only and does not constitute financial advice. The content is solely reflective of my personal views and opinions based on my research and is not intended to be used as a basis for investment decisions. While every effort is made to ensure that the information is accurate and up-to-date, the writer makes no representations as to the accuracy, completeness, suitability, or validity of any information in this post and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. All readers are advised to conduct their own independent research or consult a professional financial advisor before making any investment decisions. The author is invested in Kroger.