Dear readers,

thank you for being here and for your interest in my work! If you like this article and if you want to support my work, please feel free to subscribe! Please read the disclaimer at the end of this article. This is not an investment advice!

About Kri-Kri

Kri-Kri Milk Industry S.A., a key player in the dairy industry, specializes in producing ice cream, yogurt, and fresh milk. The company boasts a widespread distribution network that includes supermarket chains and small retail outlets throughout Greece. Internationally, Kri-Kri exports its products to over 40 countries. The headquarters and main production facilities are situated in Serres, in northern Greece. Additionally, the company operates a logistics center in Aspropyrgos, in the Attica region, which primarily supports the distribution of products to southern Greece.

Kri-Kri is classified as a European small-cap company with a market capitalization of approximately €350 million. The company experiences relatively low trading activity, with an average daily trading volume of about €20,000. This modest volume indicates limited liquidity, which is typical for smaller market cap companies and may be a consideration for investors looking at trading dynamics and ease of entry or exit in Kri-Kri’s shares.

Kri-Kri’s organization

The company's reportable segments are organized into two main categories: Ice-cream and Dairy-Yogurt. The Ice-cream segment involves the production and distribution of ice cream, with separate performance metrics for operations within Greece and other countries. Similarly, the Dairy-Yogurt segment focuses on the production and distribution of mainly yogurt, and to a lesser extent milk, primarily within the Serres municipality, with distinct performance evaluations for both domestic and international operations.

Kri-Kri’s strategy

Kri-Kri's business strategy and model are built on two main pillars: offering quality dairy products at competitive prices and expanding its presence in the private label sector. The company has successfully positioned itself as a provider of high-quality yogurt and ice cream, priced lower than its main competitors, appealing to both domestic and international markets. By leveraging high-quality ingredients and traditional Greek recipes, Kri-Kri ensures a superior taste experience while maintaining cost-effectiveness through streamlined production and optimized supply chains.

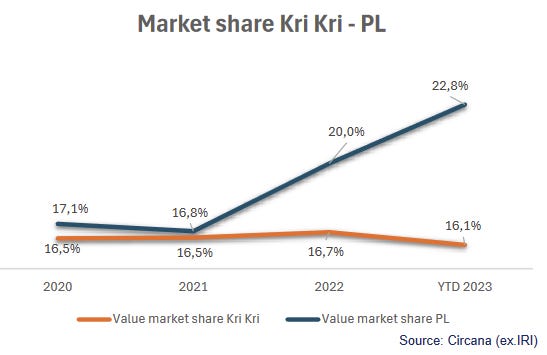

Additionally, Kri-Kri has significantly penetrated the private label market by collaborating with large supermarket chains to produce bespoke dairy products under retailer brands. This strategy not only diversifies Kri-Kri’s revenue streams but also boosts its market penetration as private label products become increasingly popular for their value-for-money. Since 2020, the volume share of private label yogurt in Greece has increased by almost 8 percentage points, with Kri-Kri emerging as a major player due to its dominance in producing private label yogurt.

Kri-Kri's growth strategy prominently features geographic expansion as the company explores new territories to enhance its market presence. From 2016 to 2022, Kri-Kri achieved a compound annual growth rate (CAGR) of approximately 30% in its export sales, increasing its international revenues to €106 million last year. The company now exports to over 40 countries, which helps diversify its market base and reduce its dependence on the Greek market. This successful international expansion is largely driven by Kri-Kri's adaptability to local tastes and preferences, particularly focusing on regions where Greek yogurt is popular. Notably, around 70% of its foreign sales in 2023 were concentrated in Italy and the UK, which are significant markets offering considerable opportunities.

Kri-Kri's business strategy is deeply rooted in innovation and a broadening product assortment, particularly focusing on niche markets such as high-protein and lactose-free products, as well as targeting specific demographics like kids and infants. The company has achieved a leading position in the children's segment, capturing about 40% market share while also venturing into the infant category. These niche categories offer higher margins and substantial growth potential due to changing consumer tastes and increasing health consciousness.

Furthermore, Kri-Kri supports its innovative approach with an extensive distribution network that spans across Greece and is bolstered by a logistics center in Aspropyrgos for Southern Greece. Over recent years, Kri-Kri has expanded its domestic network to include 20,000 points of sale for ice cream and comprehensive presence in all Greek supermarkets for yogurt. Internationally, the company continues to strengthen its distribution channels, using importers or establishing its own warehouses, such as in the UK, to enhance market reach.

Another cornerstone of Kri-Kri’s operational success is its access to high-quality raw milk, essential for its dairy products. Located in Northern Greece, a region prominent in dairy farming, Kri-Kri benefits from proximity to a steady supply of fresh milk, which not only ensures product quality but also helps manage production costs effectively. The Central Macedonia region, where Kri-Kri is situated, produces about 50% of Greece's domestic milk, with Kri-Kri utilizing 25% of that output. This strategic advantage is amplified by the company's highly efficient and automated production lines, further enhancing its operational efficiency and profitability.

Market overview

Yogurt Market

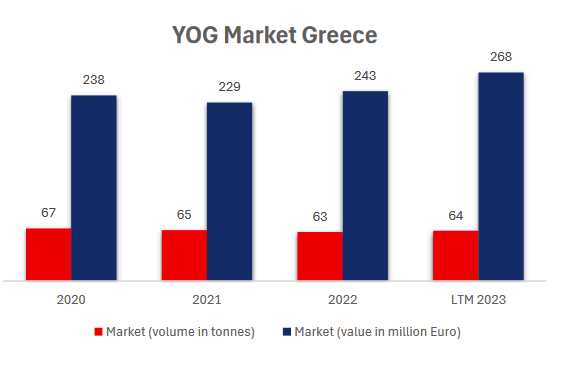

In Greece, yogurt is an essential part of the traditional diet, commonly consumed as a snack or a meal component, unlike in other countries where it is often seen as a dessert. The Greek yogurt market is estimated to be around 64K metric tons in volume, translating to approximately €200 million in value. In recent years, the market has seen a decline in volumes due to economic recessions, COVID-19 restrictions, and input cost inflation. Additionally, the market has experienced a shift towards private label products, which have grown to represent about 35% of the volume in 2022, up from 27% in 2020.

Kri-Kri stands out in this competitive landscape, not only as the second-largest player in branded yogurt volumes but also as a dominant force in the private label sector through its partnerships with major retailers. The company produces a significant share of the yogurt sold under private labels, bringing its total market share in the Greek yogurt sector to approximately 23%, making it the market leader. This unique position shields Kri-Kri from the competitive pressures typical in other markets where private labels are gaining share.

Kri-Kri's success is also evident in its branded products, where it has consistently gained market share against competitors. From around 13% in 2014, Kri-Kri’s branded volume share has increased to between 16% in recent years. The company has aligned its branded value share more closely with its volume share, particularly through growth in specialized categories like functional, kids, and infant yogurts, which command higher prices.

Looking forward, while the overall market volume may remain stable, the expansion of private labels is expected to continue. This trend should favor Kri-Kri, especially as market prices stabilize in 2024, allowing the company to capitalize on its strong position in higher-value segments.

Ice cream market

The global ice cream market is expected to grow by approximately 4% in value terms over the next few years, driven by changing consumer preferences and innovation, particularly towards healthier options like reduced-fat, low-sugar, and dairy-free alternatives. Capitalizing on these trends, Kri-Kri has begun exporting its Greek Frozen Yogurt ice cream series, which combines the appeal of ice cream with the health benefits of yogurt. This product offers an extended shelf life, an advantage that Kri-Kri hopes to leverage in potential expansions, such as into the US market.

In the Greek market, ice cream sales in 2023 reached around €202 million. Kri-Kri holds about 14% of this market, competing primarily against major players like Unilever, Froneri (Nestlé), and various private labels. Private labels are particularly strong continuing to attract consumer interest.

Looking forward, the Greek market is anticipated to experience low to mid single-digit growth, around 3-4%, slightly above GDP growth. This optimism is supported by factors such as a 2-3% increase in tourist arrivals, longer summer periods due to climate conditions, and continued product innovation, such as in frozen yogurt and sugar-free options.

Financial Analysis

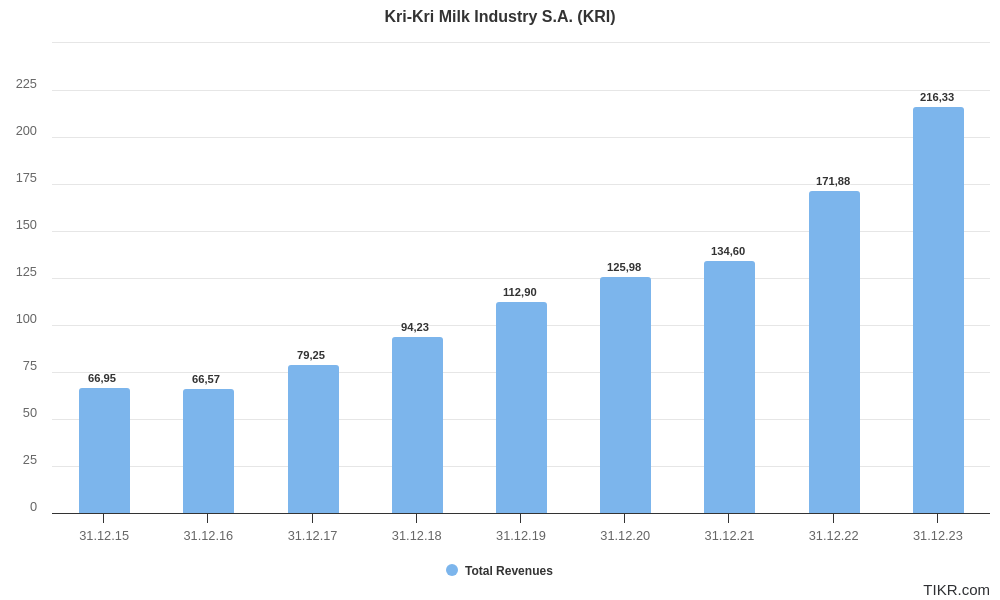

Kri-Kri has experienced substantial growth in its sales since 2015, with a CAGR of approximately 18.3%, increasing from around €67 million to €216 million in 2023.

The Dairy Yogurt segment remains the primary revenue driver, accounting for 81% of sales. From 2020 to 2023, sales in this segment grew at a CAGR of 20.3%, the growth rate in the Ice-Cream Segment was 17.3%.

In 2023, sales were nearly evenly split between the Greek market and exports to other countries, with respective CAGRs of 15.3% and 24.8%. It is anticipated that in 2024, export sales will surpass domestic sales for the first time.

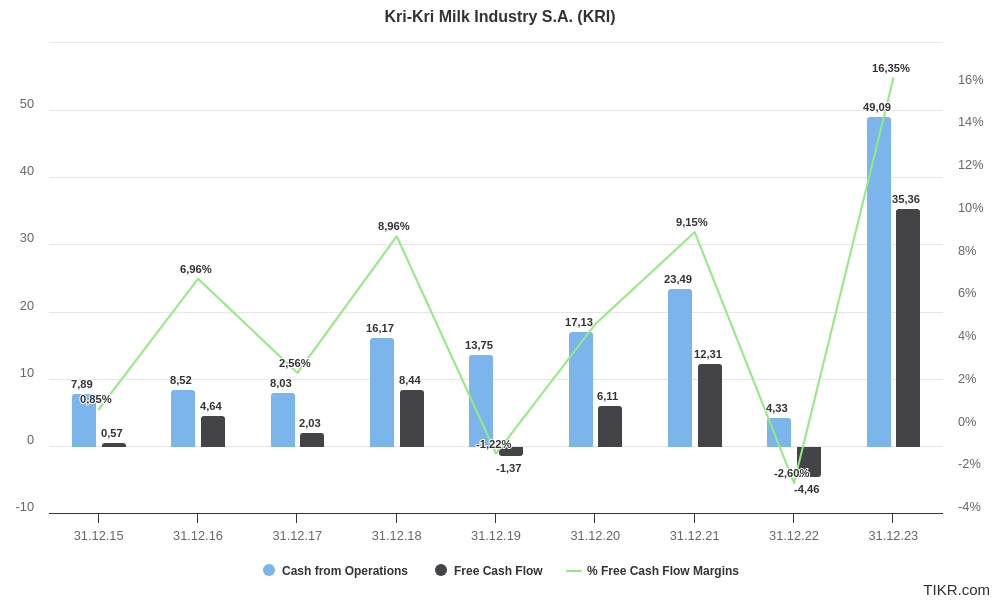

Kri-Kri reported record net and operating income in 2023, rebounding from significant challenges in 2022 due to rising raw material costs, particularly raw milk. In 2023 the company was able to successfully increase prices several times.

This recovery led to record margins, with an EBIT margin of 18.5%, a net margin of 14.9%, and an ROIC of 32.6%. However, management anticipates these margins are not sustainable, projecting a normalization to an EBIT margin around 15%, which they consider typical.

Analysis of EBIT and EBIT Margin per segment reveals that the Ice-Cream segment significantly outperforms the Dairy Yogurt segment in terms of profitability. This suggests that greater growth in the Ice-Cream segment could enhance overall profitability.

In terms of cash flow, Kri-Kri consistently generates significant free cash flow, with average FCF margins around 5.6%.

During the latest earnings call, management stated that its maintenance CapEx is approximately €4 million annually. Between 2016 and 2023, Kri-Kri's CapEx averaged 7.9% of sales, peaking at nearly 14% in 2019 but has since declined to about 5%-6%, a level expected to continue.

The company has also seen significant improvements in its cash conversion cycle since 2016, with management effectively reducing inventory and receivable days.

Currently, Kri-Kri is considered virtually debt-free and operates with a healthy financial structure, maintaining an equity ratio of 65%. This robust financial management underscores the company’s stability and efficiency in operations.

Raw Milk prices

One One crucial factor in analyzing Kri-Kri's profitability is the cost of raw milk, which is the primary raw material used in their products. Notably, 86% of the cost of sales and 71% of overall costs are attributed to raw materials.

Raw milk prices in Greece, which can be tracked on the European Union's website, saw a significant increase in 2022, rising from approximately €39 per 100kg to a peak of €60 per 100kg. Prices have since stabilized at around €52 per 100kg.

It's important to understand that Kri-Kri may need to lower its prices in response to further declines in raw milk prices due to a local regulation. This law mandates that gross margins cannot exceed the levels achieved in 2021, effectively capping the potential for gross margin improvement. This regulatory environment underscores the importance of cost management for Kri-Kri in maintaining profitability under fixed margin constraints.

Shareholder Structure

Kri-Kri's shareholder structure has been noted for a significant majority holding by the Tsinavos family. As of the latest available information, the Tsinavos family holds around 72.8% of the company. This substantial family ownership indicates strong control and stability in the strategic direction of the company.

Additionally, the shareholder base includes domestic institutional investors, who hold about 11.9% of the company, and foreign institutional investors with an 8.6% stake. This composition shows a mix of local and international confidence in Kri-Kri's business operations and its potential for growth.

The structure also reflects the typical arrangement in many family-owned businesses in Greece, where founding family members retain a significant portion of equity, providing continuity and a deep, enduring commitment to the company's success. This can be advantageous in terms of long-term strategic planning and maintaining a consistent approach to business management and growth.

Kri-Kri's annual report includes details of transactions with its majority shareholders, such as obtaining loans and incurring related interest expenses. From a governance perspective, these transactions are considered standard and do not raise concerns. They are disclosed transparently in the company's financial reports, indicating a commitment to corporate governance norms. There is no indication of any unusual or dubious activities associated with these transactions, underscoring their routine nature within the scope of Kri-Kri’s business operations.

As highlighted earlier in this article, Kri-Kri experiences notably low trading volumes. During the latest earnings call, the company's Chief Financial Officer mentioned that major shareholders are considering placing a small number of shares on the open market to enhance liquidity. This move is intended to increase the stock's trading volume and make it more accessible to a broader range of investors.

“A question about the free float. As I’m aware, the major shareholders are in consideration of a small placement this year in order to help the liquidity of the share.”

- CFO Kostas Sarmadakis during Q4 Call -

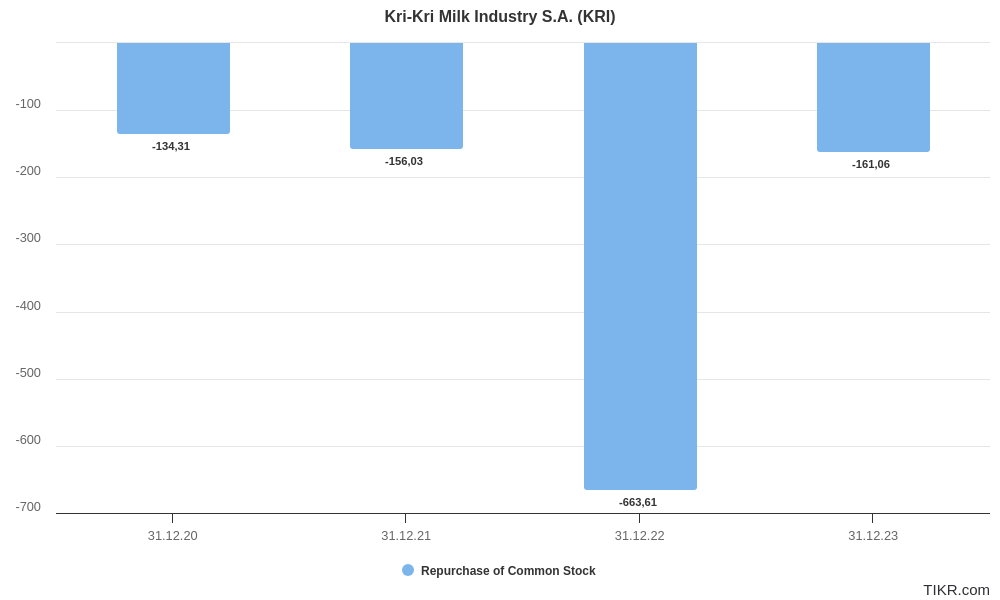

Share repurchases and dividends

Kri-Kri's dividend policy aims to distribute an increasing dividend annually, contingent on the company's profitability. In 2022, the shareholders' Annual General Meeting approved a gross dividend of €0.20 per share. For 2023, the Board of Directors plans to propose an increased gross dividend of €0.35 per share at the Annual General Meeting, pending shareholder approval. At the moment the dividend yields at 3.3%

According to the decision from the Annual General Meeting of Shareholders on July 5, 2022, Kri-Kri has implemented a share buyback program allowing the acquisition of up to 5% of its total shares. As of December 31, 2023, the company held 69,201 of its own shares, with an acquisition value of €455,051. The company has been repurchasing shares on a regular basis for years.

Valuation

For my Discounted Cash Flow (DCF) model, I have based my projections on the following assumptions: a revenue Compound Annual Growth Rate (CAGR) of between 5.9% and 7.5% over the next five years, a normalized net margin of approximately 10%, and a Free Cash Flow (FCF) margin ranging from 5.5% to 6.6%. The model assumes that the company will maintain a debt-free status. Based on these parameters, the fair value per share is estimated to be between €14.30 and €16.70, suggesting a significant undervaluation given the current share price of €10.50. This results in a margin of safety ranging from 136% to 159%.

In the base scenario, the fair value of the stock is calculated at €15.50, with a margin of safety of 148%. This analysis indicates that the shares are substantially undervalued, presenting a potentially attractive investment opportunity.

Currently, the stock is covered by a single analyst from Eurobank, who has set a price target of €13.60. The report (Link) is well-written and offers many insightful details, although some of the market share figures mentioned do not align with the data in the company reports, and their sources are unclear. Additionally, the report includes a Discounted Cash Flow (DCF) model where the analyst projects significantly higher free cash flows than my estimates. However, the analyst applies a higher Weighted Average Cost of Capital (WACC) of 9.7% than I use. I assess the WACC at about 6%, reflecting a view of the company as having lower risk.

Conclusion

Kri-Kri is a Greek small-cap company that plays a significant role in the dairy industry. It not only markets its own brands but also serves as a key producer of private label products for large retail chains. The company has demonstrated robust growth and remarkable profitability. It operates debt-free and generates substantial amounts of free cash flow, which it regularly returns to shareholders through dividends and share repurchases.

In 2023, Kri-Kri showcased its pricing power by effectively managing significant increases in the cost of raw milk, which is a crucial component of its products. The company is family-owned, managed with a long-term, careful approach, and known for its conservative financial management. However, the stock is quite illiquid and currently only covered by one institutional investor.

The markets for ice cream and Greek yogurt are expected to grow, and Kri-Kri is well-positioned to capitalize on these opportunities. The stock appears to be undervalued at present. I recently started investing in Kri-Kri, and due to the limited trading volume, careful attention to limit prices is necessary when buying the stock. I plan to significantly increase my position in the coming weeks, as part of a broader strategy to focus more on small and medium caps in my personal portfolio.

Disclaimer: The information provided in this publication is for educational and informational purposes only and does not constitute financial advice. The content is solely reflective of my personal views and opinions based on my research and is not intended to be used as a basis for investment decisions. While every effort is made to ensure that the information is accurate and up-to-date, the writer makes no representations as to the accuracy, completeness, suitability, or validity of any information in this post and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. All readers are advised to conduct their own independent research or consult a professional financial advisor before making any investment decisions. The author is invested in Kri-Kri.

Great piece! Worried that I won't be able to buy as another commenter stated that it is unavailable via IBKR. I think a 6% WACC is extremely low in this interest rate environment - I typically model using 9-11% to be conservative.

That's an amazing deep dive. This is my first time reading about the stock and I am impressed by its ability to pass prices to consumer without losing market share. It impressively increased the top line in the last 4 quarters, yet trading at very reasonable price. I will definitely keep an eye on it as a possible addition to my portfolio!