Introduction

When considering elevators, the name that immediately comes to mind is Otis. As one of the foundational components of modern urban environments, the Otis Elevator Company is intrinsically connected with the industry it helped to establish. The company's reputation extends beyond merely engineering impressive mechanical structures, having crafted its narrative through its involvement in every towering skyscraper that now lines city skylines. Otis has become an essential element of our daily upward journeys, whether in life or in business.

Since Elisha Otis wowed the crowds with his safety elevator brake at the New York World's Fair in 1854, Otis has evolved into the biggest vertical transport system manufacturer worldwide. Otis not only moves people, but also economies, cultures, and innovations. This narrative exemplifies Otis' engineering brilliance, business acumen, and unwavering pursuit of safety and efficiency, which have revolutionized our work and lifestyle.

In this deep dive, we will examine how Otis not only dominates the elevator industry but also adjusts to the ever-changing technological and economic landscape. What motivates Otis to reach new heights in an era of smart cities and sustainable living? How does it sustain its innovative edge while navigating the ups and downs of global markets? Join us as we analyze the business model, strategy, and finances that maintain Otis' leading position in the vertical transportation industry. This informative journey promises to elevate your understanding of the company's success.

The Foundation of Elevation - Otis’s History

Elisha Graves Otis was not just a mechanic; he was a pioneer who literally elevated the world. With the unveiling of his safety brake at the 1854 New York World's Fair, he set in motion a vertical revolution. Buildings could now soar to the sky, and cities were forever transformed. Thus, the Otis Elevator Company was born, playing a crucial role in the phenomenon of urbanization.

Otis's journey started in Yonkers, New York, where Elisha founded a company to produce hoist machines. He addressed a fundamental fear of the time, which was the fear of falling lifts, by incorporating a safety brake that offered a level of safety that had not been achieved before. This invention laid the groundwork for modern skyscrapers, turning a dangerous and exclusive novelty into a commonplace of urban life.

As the world moved into the 20th century, Otis transformed from a company that manufactured dependable elevators to one that shaped contemporary city landscapes. It instigated the implementation of steam-powered and subsequently electric elevators, consistently expanding the limits of what was achievable in terms of architecture and societal expectations of building design.

Through two world wars, the Great Depression, and the postwar boom, Otis Elevator Company's elevators represented resilience and progress. Their technology transported soldiers, materials, and later, the workforce of the world's burgeoning industries and offices. Over time, Otis not only expanded its technology but also its geographical presence, establishing a global footprint and installing elevators in some of the world's most iconic structures.

By the 21st century, Otis had installed elevators in iconic structures such as the Eiffel Tower, the Empire State Building, and the Burj Khalifa, which not only define skylines but also represent human ambition. The company established a legacy of innovation and made its mark in global infrastructure history.

Otis's New Era: The Strategic Unbinding from United Technologies Corporation

As we explore the history of Otis Elevator Company, a significant event emerges in recent years: its separation from United Technologies Corporation (UTC). This transformative split, finalized on April 3, 2020, signaled a fresh start for Otis and launched it into the world as its own publicly traded company. Let us examine the details of this noteworthy corporate action and its impact on Otis.

The Genesis of the Split

The tale commences in November 2018 when UTC declared its intention to dismantle its conglomerate structure following the acquisition of Rockwell Collins, an aerospace company that had greatly augmented UTC's scale and range. The strategic separation was targeted at establishing three specialized corporations: Otis, Carrier, and a renamed UTC concentrating on aerospace, which was later combined with Raytheon Company and named Raytheon Technologies.

Why This Matters for Otis

Sharpened Strategic Focus: Otis gained autonomy after being separated from UTC, allowing the company to tailor its strategies to better serve its core market of elevators and escalators, and to drive innovation with renewed focus. As a result of these changes, Otis has become more agile in the marketplace.

Financial Independence: Being able to manage its finances independently has allowed Otis to channel investments and resources more directly into initiatives that bolster its position in the vertical transportation industry.

Increased Market Agility: As an independent entity, Otis can react more agilely to industry-specific trends, customer needs, and technological advancements, free from the diverse priorities of a conglomerate.

Investor Appeal: The spin-off provided investors with the chance to interact with Otis as a pure-play company, which had potential for growth in the global infrastructure sector due to its distinctive business model.

Navigating Post-Separation Challenge

The transition presented numerous obstacles for Otis. The company needed to create autonomous corporate functions, covering IT systems as well as finance and HR operations, which had previously been integrated into UTC's structure. Moreover, Otis encountered the challenge of redefining its market identity and emerging as a leader in the industry, separate from UTC's influence.

The Market's Verdict

This strategic decision received positive reception from industry analysts and the market. The separation was viewed as a breakthrough for Otis, unlocking possibilities for increased shareholder value and growth. For Otis, the split meant more than just a corporate reorganization; it presented a chance to concentrate solely on its history in elevators and escalators, while also setting a course for innovation and global expansion.

Otis's separation from UTC marked the beginning of a promising new chapter for the company in the vertical transportation industry. It has a unique opportunity to build upon its rich history and expand the scope of its operations.

Reflecting on Otis's successes and challenges, we can appreciate its enduring capacity for innovation and adaptation. The story of Otis is a testament to continuous improvement and strategic foresight. It shows how visionary leadership can create a company that impacts the world in multiple ways.

In the following section, we will analyze the mechanisms of this monumental business: The Otis business model. How does a company that has been a leader since the gaslight era remain at the forefront of the digital transformation age? Come along as we ascend through the corporate narrative of the world's most famous elevator company.

The Mechanics of Success - Otis’s Business Model

Understanding Otis's business model is akin to examining a sophisticated machine's internal mechanisms. The model is carefully designed to balance immediate sales with long-term service, ensuring the company's profitability while promoting ongoing innovation.

The Revenue Streams

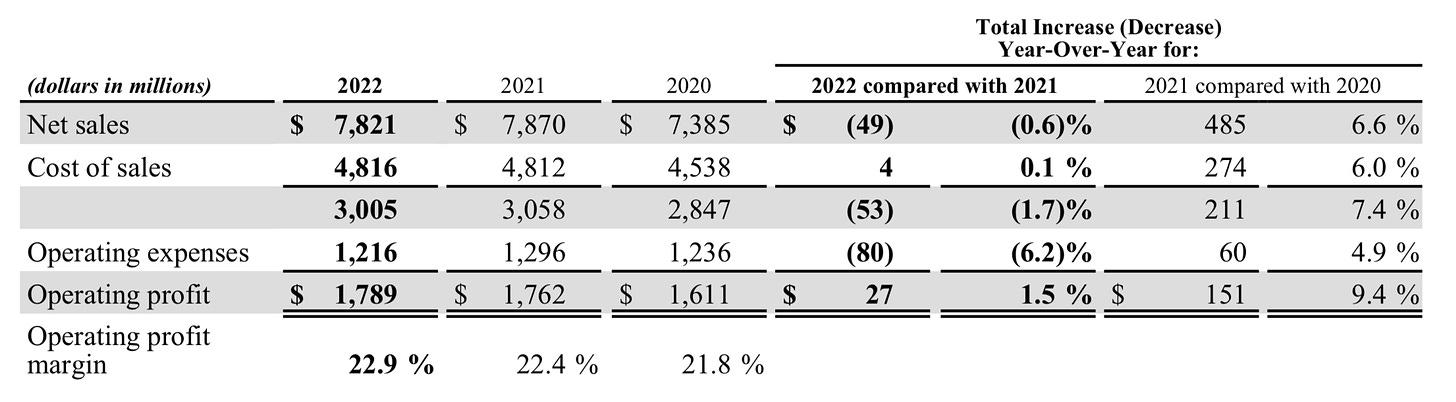

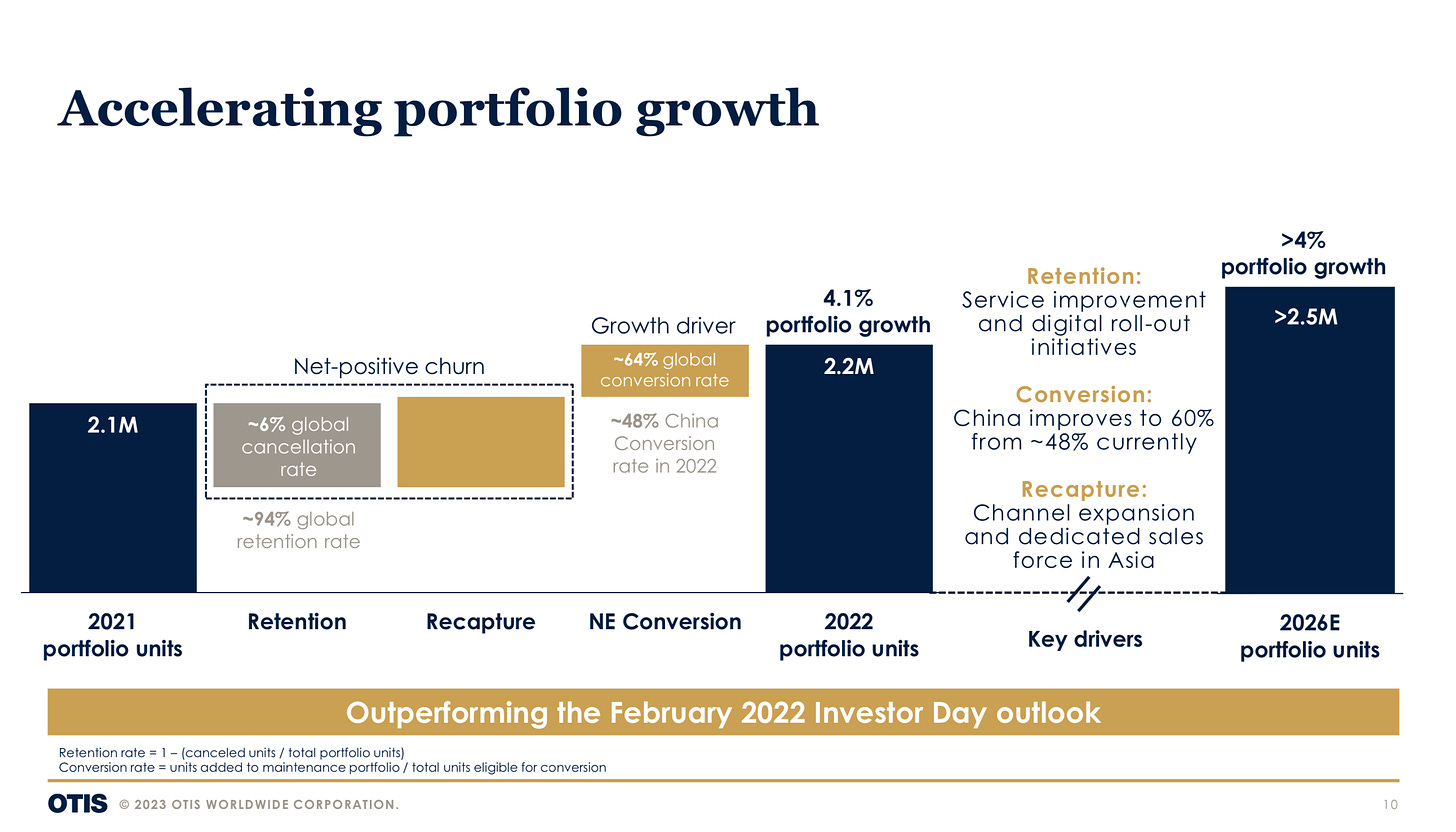

Otis's financial stability derives from a varied revenue engine. Its main source of revenue comes from sales of new elevator and escalator equipment, which initiates business relationships. Nonetheless, the actual durability of Otis's revenue model lies in its after-sales service agreements for its asset base of more than 2.2 million units. These contracts encompass the maintenance, repair, and periodic upgrading of equipment. This generates a steady flow of income over the lifespan of the equipment, which may span several decades. Furthermore, Otis identifies opportunities for growth in modernization projects for aging buildings that require elevator upgrades to meet new standards and expectations.

Understanding Otis's Revenue Recognition: A Key Aspect for Investors

Otis's method of recognizing revenue for new equipment contracts is a critical aspect for investors to grasp. It illuminates how the company records its significant revenue streams and reveals valuable insights into the financial health and operational effectiveness of the business. The following is how Otis recognizes revenue for new equipment contracts:

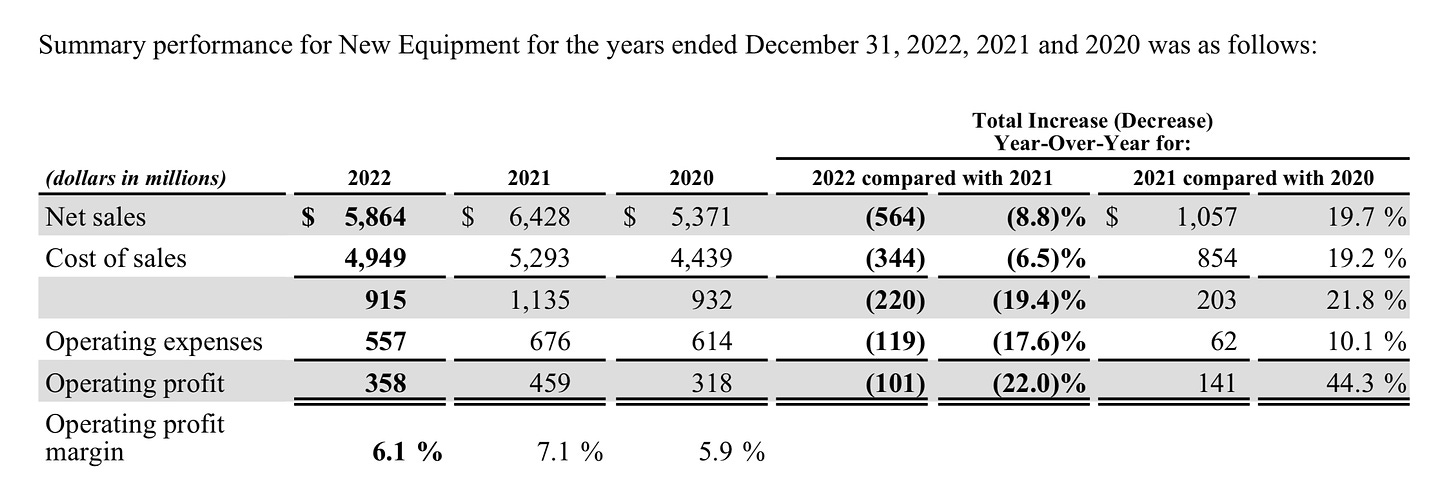

Revenue Generated from new Equipment Contracts: In 2022, Otis recognized revenue of $5.9 billion from its recent equipment contracts. This significant number showcases the extent of Otis's activities in the new equipment industry.

Single Performance Obligation: Otis generally acquires equipment and installation with a singular contract that offers consumers a fully installed unit of either an elevator or escalator. This integration of equipment and installation is ordinarily deemed a single performance obligation.

Recognition of revenue over time: Otis recognizes revenue over time: Otis recognizes revenue over time by measuring progress based on costs incurred to date relative to total estimated costs at completion. This method aligns with the long-term nature of these contracts and the complexity of the products.

Management's Judgment in Cost Estimation: The estimation of costs for these contracts involves significant management judgment because of their long-term nature, product complexity, and project scale. These costs usually comprise labor, materials, subcontractors' costs, and additional direct and indirect costs.

Quarterly Review of Cost Estimates: The management conducts periodic reviews of cost estimates for significant new equipment contracts quarterly and for other contracts at least annually or when situations alter. Conducting these frequent reviews is crucial to guarantee accurate revenue recognition in a timely manner.

Cumulative Catch-Up Method: The Cumulative Catch-Up Method is employed for such reviews. Otis employs the cumulative catch-up approach to account for modifications in contract estimates. This approach requires modifying the cumulative revenue acknowledged to reflect the present estimation of the transaction price and progress made toward completion.

Deciphering Revenue Recognition for Otis's Service Contracts

Otis's methodology for recognizing revenue from service contracts is a crucial aspect investors should comprehend. Below is Otis's approach to revenue recognition for service contracts: It offers insight into the firm's repetitive income streams and financial reporting.

Straight-Line Basis Recognition: Otis recognizes revenue from maintenance contracts on a straight-line basis throughout the year. This approach is consistent with the ongoing nature of the services offered and the associated cost profile.

Prospective Recognition of Contractual Changes: Changes to contractual terms are generally accounted for prospectively. This is due to the fact that adjustments to service agreements generally involve the extension of existing agreements rather than a complete overhaul of the terms and conditions.

Fixed Payments and Transaction Price Considerations: Otis's service contracts generally involve fixed payments, which are received progressively as the services are rendered. This structure implies that there are no significant financing elements within these contracts.

Variable Consideration in Rare Cases: While Otis's contracts do not usually have significant estimates related to variable consideration, exceptions can occur in rare instances of a project having an underlying performance issue.

Allocation in Mixed Contracts: When a single contract comprises several performance obligations, such as new equipment and maintenance services, the transaction price is allocated to each performance obligation accordingly..

Investor Implications

Revenue Stability: Recognizing revenue using the straight-line method for service contracts yields a stable and predictable revenue stream, essential for long-term financial planning and analysis.

Transparency and Predictability: Prospective recognition of changes to contracts and the absence of significant variable factors offer transparency and predictability in revenue reporting.

Financial Reporting Accuracy: Understanding Otis's revenue recognition approach is key to accurately interpreting the company's financial statements, specifically when evaluating its service segment performance. This objective understanding is crucial for investors seeking to make informed decisions.

Customer Focus

A crucial factor of Otis's business model is its emphasis on customer service. The company acknowledges that dependable and efficient customer service is essential in an industry where safety and uptime are top priorities. Otis's commitment to a skilled workforce and utilization of data analytics to anticipate maintenance requirements before they turn into issues demonstrates its customer-focused strategy.

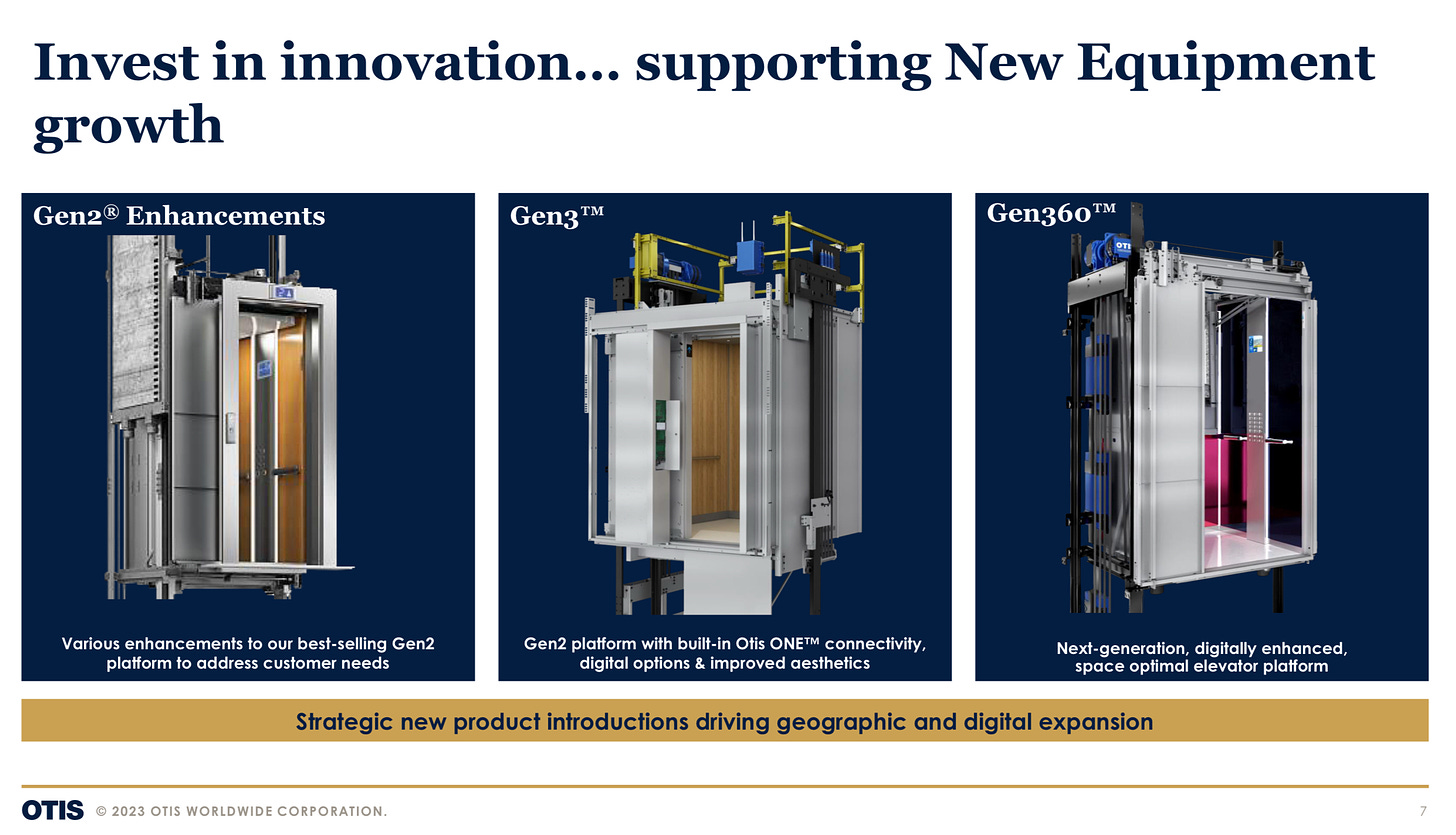

Innovation as a Service

Lastly, Otis doesn't merely sell elevators, but also cultivates innovation experiences. The corporation has integrated the Internet of Things (IoT) to craft sophisticated, smart elevators that enhance user experiences and building management for property owners. These digital solutions are not independent commodities but are integrated into Otis's service offerings, providing customers with state-of-the-art elevator technology as part of their continuous relationship with the corporation.

In the following section, we will investigate how Otis employs its business model to manage market strategies and operations, consistently setting industry benchmarks and meeting customer expectations.

Going Up! Otis’s Market Strategy and Operations

Otis's ascent in the global market is a story of strategic positioning and operational finesse. The company’s strategy pivots on a deep understanding of market dynamics, an agile response to the ever-changing landscape of urban development, and a precise execution of operational efficiencies.

Market Strategy

Otis has developed a marketing strategy that aligns with its mission to keep people moving safely with its reliable products. Central to its strategy is the goal of broadening its horizons through purposeful partnerships, specific advertising endeavors, and utilizing its brand reputation to penetrate emerging markets. These tactics aim not only to promote sales, but also to cultivate new connections and trust in previously unexplored regions.

The corporation's branding strategy highlights its history of maintaining safety and dependability, while prioritizing innovation and customer service. Otis's marketing strategy presents a narrative of a future in which elevators exceed their traditional role as merely boxes on wheels and instead are intelligent, integrated, and a vital component of a seamless building ecosystem.

Operational Excellence

Otis is characterized by its efficiency and high quality standards. The manufacturing processes of the company are designed to minimize waste and increase production efficiency. Otis implements a complex logistics system in its supply chain to ensure timely delivery of both parts and products, therefore reducing downtime and maximizing service levels.

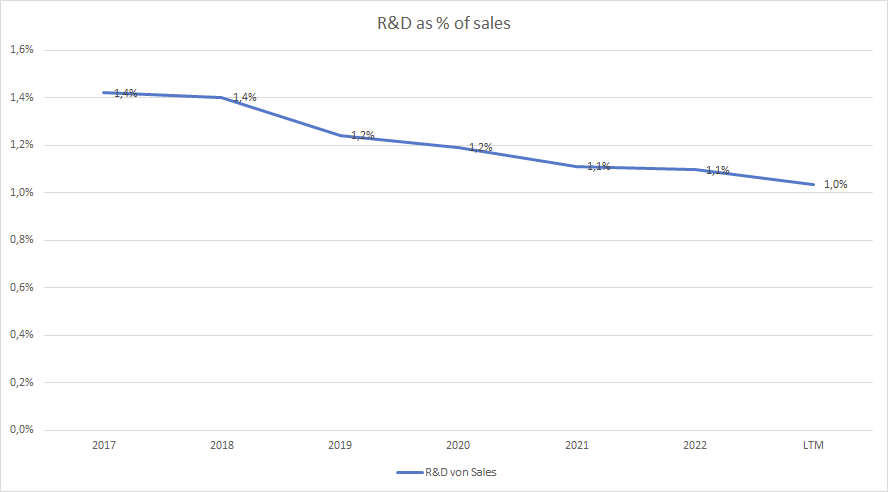

Research and development serves as the basis for Otis's operational strategy. The company allocates a significant portion of its budget to research and development, recognizing the importance of investing in the future. Otis's product line showcases energy-efficient models and cutting-edge features, including destination dispatch and predictive maintenance capabilities, reflecting the results of their R&D efforts.

Sustainability and Innovation

In a world where sustainability is increasingly important, Otis demonstrates its commitment to environmental responsibility through its operations. This commitment is apparent in its implementation of energy-efficient designs in its products and sustainable practices in its global facilities.

Innovation at Otis entails staying up-to-date with digital trends. Otis has fully embraced digital transformation by leveraging tools that enhance elevator performance, improve safety, and offer insightful analytics to customers. Through the integration of such tools into its elevators, Otis is revolutionizing the concept of a comprehensive full-service provider within the vertical transportation sector.

Looking Forward

As we look to the future, Otis' strategy reflects a dual focus on solidifying its position in established markets while expanding into new markets with high growth potential. The firm's global strategy and operational blueprint aim to sustain its leadership in the elevator industry and establish a benchmark for customers' transportation solutions.

In the following section, we will explore the 'Otis Moat' which presents competitive advantages that erect obstructions for rivals and reinforce Otis' market standing.

The Otis Moat - Competitive Advantages and Barriers to Entry

During medieval times, a moat played a significant role in safeguarding a castle from invaders. Similarly, in the business world, a moat symbolizes a set of competitive advantages that shield a company from market rivals. Otis possesses a deep and multifaceted moat, which comprises its cutting-edge technology, extensive service network, strategic partnerships, and outstanding brand reputation.

Patent Portfolio and Innovation

Otis's patent portfolio is an extensive collection of protected technologies that serve as the foundation of its competitive advantage. The company holds patents encompassing a wide array of technologies, ranging from brake systems to digital control mechanisms. This ensures that Otis maintains exclusive rights over its innovative products and services, making it challenging for new entrants to compete and allowing Otis to set industry standards.

Strategic Relationships and Service Network

Otis has established significant partnerships across various sectors, including construction firms and technology partners, to establish a strong foundation of allies that boost its competitive edge. Its unrivaled service network extends its presence to over 200 countries and territories, enabling Otis to cater to multinational clients and local businesses and ensuring access to customer service for every installation.

Brand Equity and Safety Record

Brand equity is a crucial aspect of Otis's competitive advantage. With 165+ years of history, Otis has established itself as a reliable name in the elevator sector. Trust is of the essence in a field that concerns the safety of millions of passengers every day. Otis's resolute dedication to safety has fostered an unparalleled degree of customer loyalty that's difficult to weaken.

Economies of Scale

Otis benefits from economies of scale, which serve as a barrier to entry for smaller competitors. Its size enables greater investment in R&D, more favorable negotiation terms with suppliers, and competitive pricing while maintaining high-quality standards. This advantage in scale poses a significant obstacle for any company aiming to challenge Otis's market position.

Aftermarket Services

The maintenance, repair, and upgrade services provided after the sale by Otis not only generate consistent revenue but also contribute to its competitive advantage. Otis achieves this by securing long-term service contracts for these services. This approach creates a reliable, recurring revenue stream that is less vulnerable to economic fluctuations than new sales, which are influenced by the construction market.

The Importance of a Globalized Workforce

An overlooked aspect of Otis's competitive advantage is its workforce of 69,000 employees, distributed globally. Through the utilization of local talent and their expertise in cultural understanding, Otis can effectively navigate the business and regulatory landscapes of a diversified market better than its competitors.

Challenges to the Moat

However, even a strong moat may not be foolproof. Otis is currently encountering competition from aggressive rivals, technological disruptions, and shifting regulations, which threaten its position as an industry leader. The manner in which it handles these obstacles, whether through strategic acquisitions, improved service offerings, or rapid innovation, will decide the extent and longevity of its moat.

In the following section, we will turn our attention to the financial health of Otis, dissecting the numbers that drive the company's operations and assessing its economic vitality in a competitive landscape.

Financial Elevators - Analyzing Otis’s Financial Health

In the world of business, strong financial health is just as crucial as technological superiority. Otis, with its impressive heritage, provides a compelling case study of financial resilience and strategic expansion. Let us examine the financial strength that drives Otis's worldwide activities.

Analyzing the Financial Statements

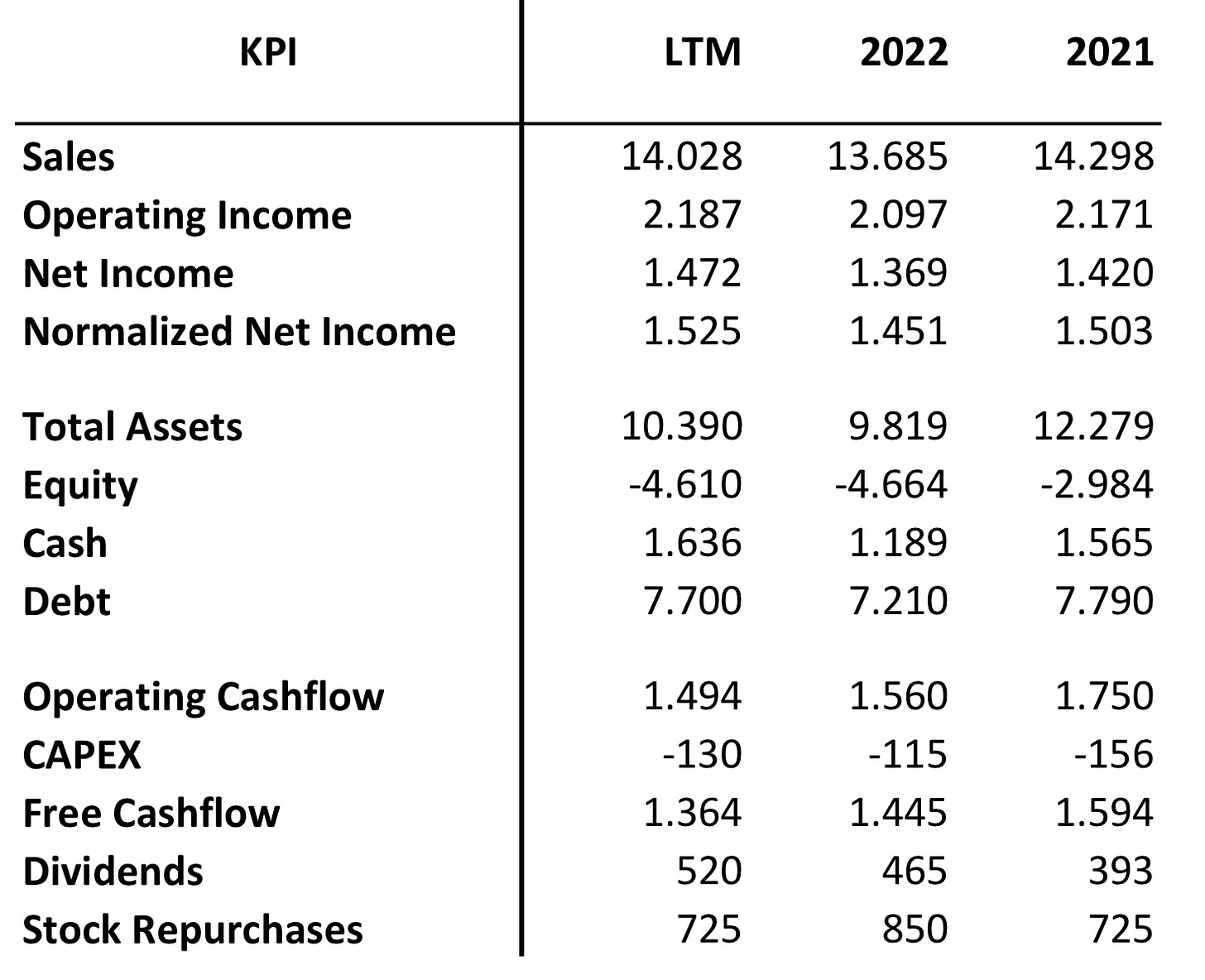

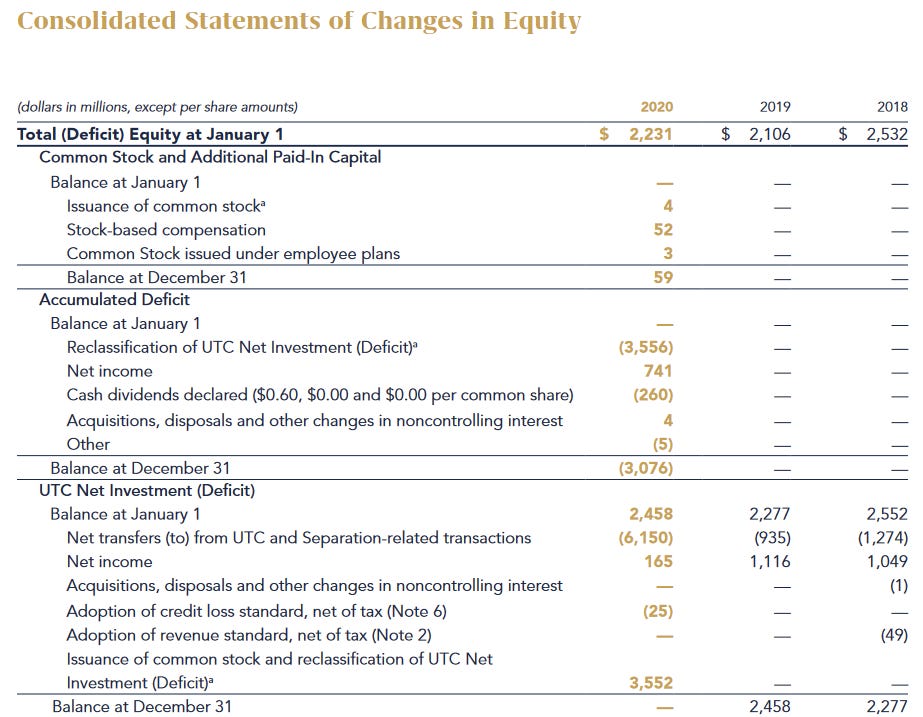

The financial analysis of Otis, consisting of its balance sheet, income statement, and cash flow statement, offers a comprehensive overview of its fiscal health. The Balance Sheet shows a negative equity of approximately $4.6 billion, mostly due to the separation from UTC, which can be found in the 2020 Annual Report.

The "UTC Net Investment" on Otis's Consolidated Balance Sheets represents the financial relationship between Otis and its former parent company, United Technologies Corporation (UTC), as it was portrayed in financial statements prior to Otis's separation as an independent entity. It is a complex accounting issue and it is important for investors to understand that the deficit is not caused by significant losses.

The Otis income statement attests to its profitability. It is crucial to analyze not only the top-line revenue growth but also the operating efficiency reflected in the company's margins. Otis has continuously showcased the capacity to convert sales into profits, a clear indication of strict cost control and a premium market position.

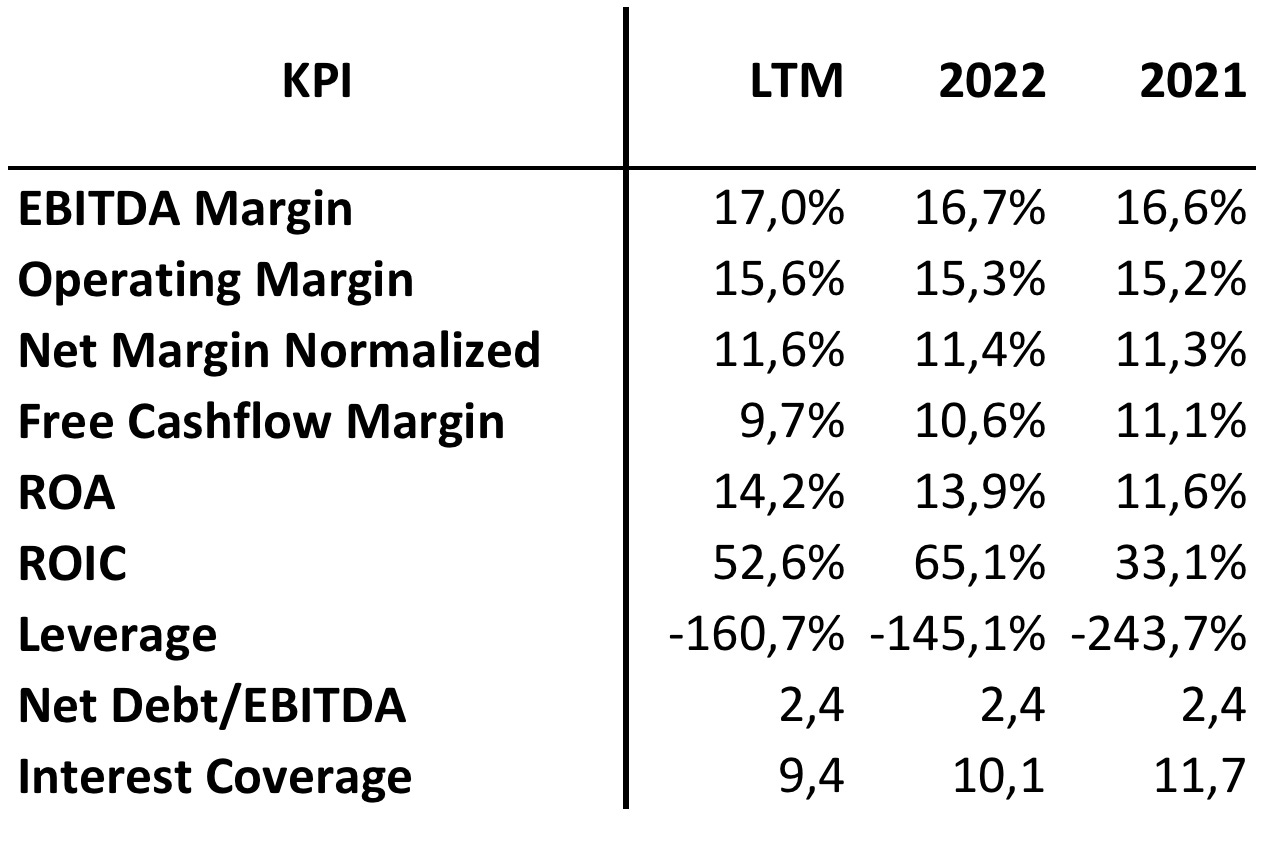

Cash flow is critical to any business, and for Otis, the cash flow statement presents a vibrant narration of operational excellence. Consistent positive cash flow from operations indicates that Otis's core business is generating the necessary funds to sustain and grow without relying excessively on external financing. The confirmed free cash flow margin, ranging from 10% to 12%, supports this claim. Maintaining this margin remarkably is also noteworthy.

Profitability and Cost Structure

Otis's profitability is derived from its efficient cost structure, optimized through substantial technology investment in service delivery and production. This resulted in reduced operating costs over time. Furthermore, Otis's value proposition is reflected in its pricing strategy, enabling it to command strong margins across equipment sales and service contracts. Importantly, it must be emphasized that the company's key profit generator is its service business.

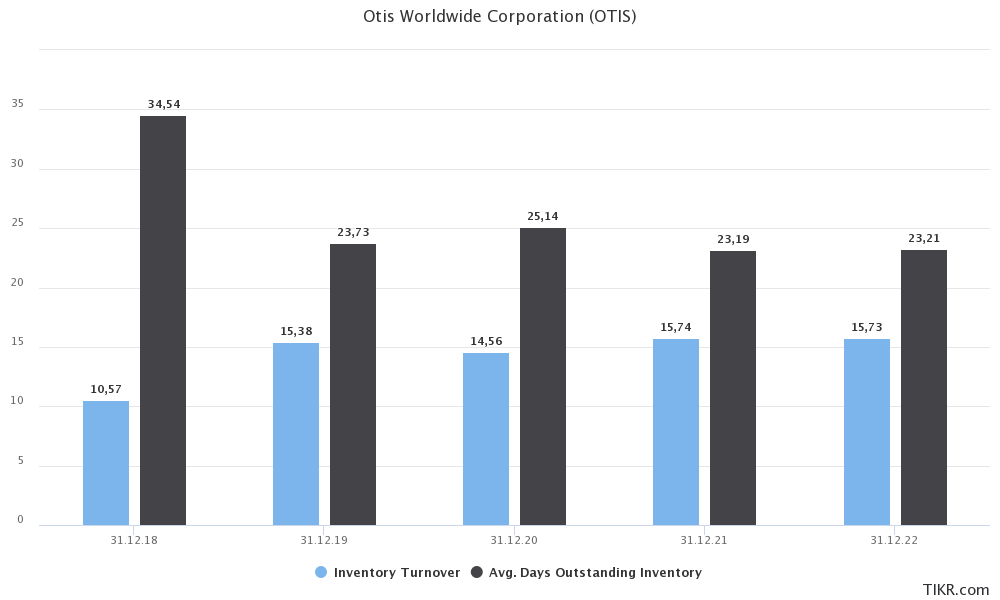

The remarkable high ROIC of OTIS is noteworthy. The company skillfully maintains low invested capital while generating consistent profitability, attesting to its operational excellence. Two key figures in inventory management illustrate this exceptionally well. Despite being a mechanical engineering company, OTIS maintains a high inventory turnover and relatively low avg. days outstanding inventories. This allows the company to maintain a low capital cost base, optimizing returns for shareholders.

The negative leverage is insignificant. Instead, focus on the EBITDA to debt ratio, which averages 2.4, indicating a favorable position.

Investment in Growth

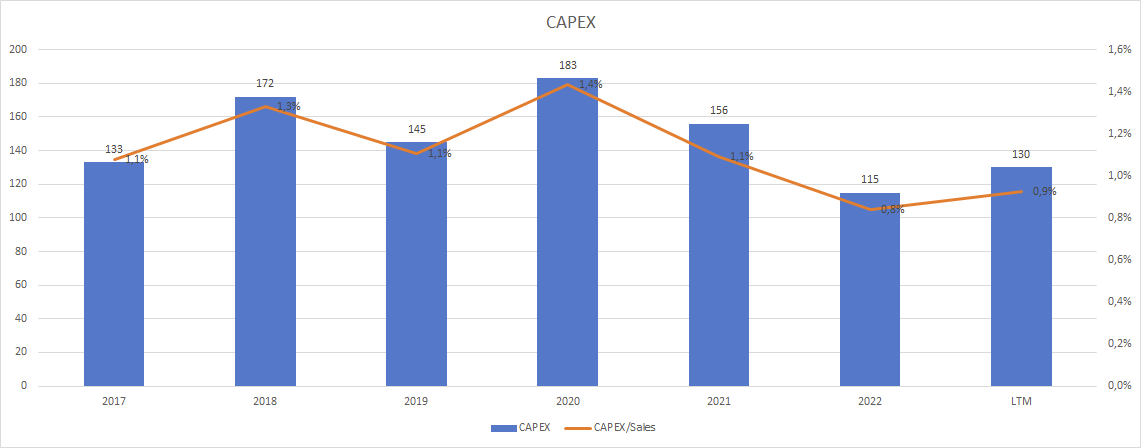

Although Otis is a mature business, it continues to invest in new technology and markets, as evidenced by its capital expenditure details. These investments include upgrading manufacturing facilities, developing new products, and expanding its global service network. Each investment is meticulously calibrated to match market opportunities and potential returns, ultimately enhancing rather than diluting shareholder value.

OTIS has effectively decreased its R&D spending relative to sales in recent years through disciplined management. Furthermore, with an average capital expenditure of just 1.1% of sales, OTIS operates as a low-capital company. As a result, the company has additional funds available to distribute among its shareholders.

Dividends, Stock Repurchases

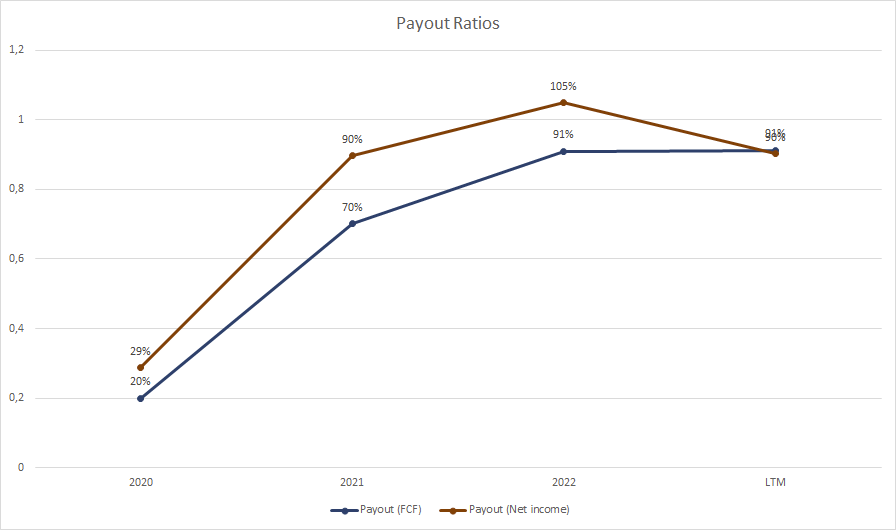

Otis's approach to distributing dividends and repurchasing shares is a reliable indicator of the company's financial health. The company's strategy achieves a balance between returning value to shareholders and reinvesting in the company.

The payout ratios, comprising dividends and share buybacks divided by FCF and net income, have consistently ranged between 90 to 100% ever since OTIS independence. This suggests that all surplus capital is paid out to stakeholders via share buybacks and dividends.

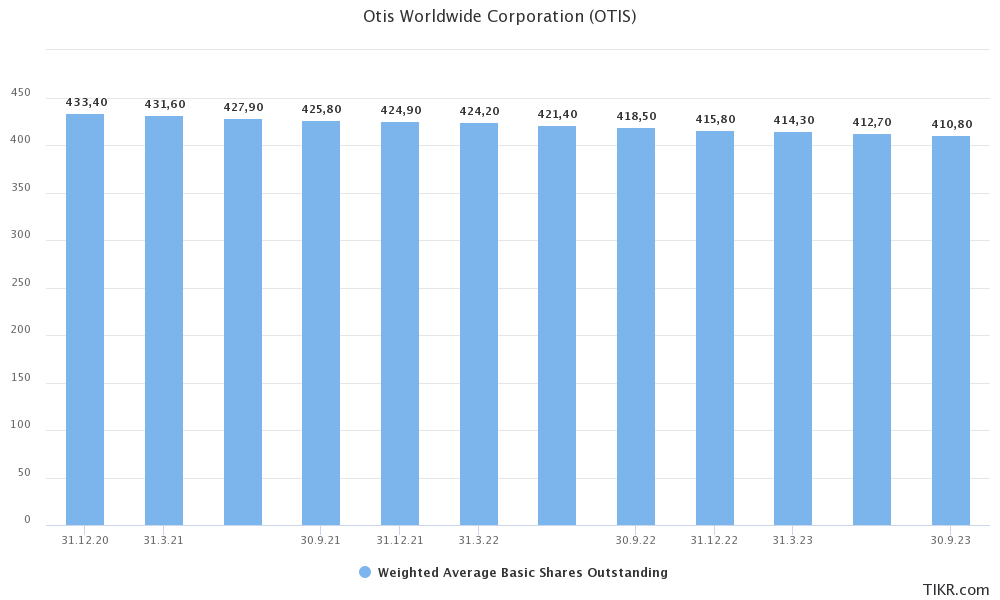

Since 2020, there has been a 5.2% decrease in outstanding shares from 433.4 million to 410.80 million.

Recent development

Otis Worldwide Q3 2023: A Financial Snapshot

The third quarter of 2023 saw Otis Worldwide continue its trajectory of growth and profitability, demonstrating robust financial performance across key metrics. Here’s a breakdown of the key figures:

Revenue Growth: Otis reported revenue of $3.523 billion, reflecting an 8% increase from the same period the previous year when revenue was $3.326 billion. This growth is attributed to the company's sustained demand and effective market strategies.

Operating Profit: The operating profit in accordance with GAAP for the quarter was $571 million, representing a significant surge from the previous year's $529 million, leading to an improvement in the operating profit margin from 15.8% to 16.2%.

Net Income: The year-over-year increase in net income was significant, with it reaching $376 million compared to $324 million, indicating a 16.0% rise. This clearly demonstrates the operational efficiency of Otis and its ability to convert revenue growth into bottom-line results.

Earnings Per Share (EPS): The third quarter of 2023 marked a significant increase in Otis's earnings per share (EPS), rising from $0.77 in Q3 of 2022 to $0.91, an 18.2% growth rate. This improvement in EPS is a clear indication of Otis's profitability and value creation for its shareholders.

Non-GAAP Adjustments: On an adjusted non-GAAP basis, Otis has announced operating profits of $595 million and a net profit of $395 million, which translates to adjusted earnings per share of $0.95. By excluding certain one-time items, these adjustments offer a clearer perspective on the company's operational performance.

Otis Worldwide's 2023 Full-Year Outlook

As we analyze Otis Worldwide's Q3 2023 performance, it's crucial to also examine the company's outlook for the rest of the year. Otis updated its full-year projections, demonstrating optimism regarding its operational and financial path.

Key Projections for 2023

Adjusted Net Sales: Otis expects adjusted net sales of approximately $14.1 billion, signifying an approximate 4% increase from the previous year.

Organic Sales Growth: The company expects organic sales to rise by approximately 5.5%. This includes an increase of around 3% in organic New Equipment sales and an impressive 7.5% increase in organic Service sales.

Adjusted Operating Profit: Otis forecasts an adjusted operating profit of approximately $2.265 billion, signaling a surge of roughly $170 million at constant currency or approximately $140 million at actual currency rates.

Adjusted Earnings Per Share (EPS): The company forecasts an adjusted EPS of approximately $3.00 for the full year.

Financial Strength and Strategic Focus

This updated forecast for 2023 presents Otis Worldwide as not merely preserving its market dominance, but also intentionally enhancing its operational and financial reach. These predictions provide investors, stakeholders, and industry observers a view of Otis Worldwide's future—a future marked by progress, ingenuity, and ongoing profitability.

Looking to the Future

As we look ahead to the future, Otis's financial statements provide insight into the company's preparedness for what lies ahead. Not only do they summarize past performance, but they also demonstrate that Otis is well-positioned for the future with a robust cash reserve, manageable debt levels, and a diverse global revenue stream. Regardless of what challenges may arise, Otis is financially equipped to navigate them successfully.

Valuation and Share Performance

Impressive Share performance since 2020

Since its independence and becoming a publicly traded entity in 2020, Otis Elevator Company's performance in the stock market has been remarkable. Its shares have demonstrated steady growth, boasting a Compound Annual Growth Rate (CAGR) of around 20%. Currently, the last reported price of Otis shares is $84.54, demonstrating the company's strong market position and unwavering investor confidence.

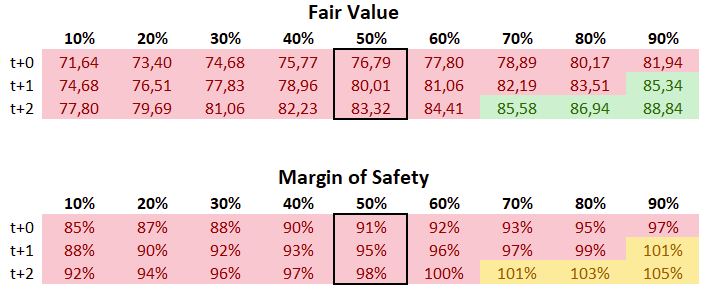

Otis Stock Valuation: DCF Model Insights

After extensive analysis using the DCF model, we've arrived at an estimated fair value range for Otis' stock of $72 to $82 per share. Given the last recorded price of $84.54, it appears that the stock is slightly overvalued in comparison to the DCF model's fair value range.

Investors should consider Otis's long-term prospects. If the company has a solid financial foundation and potential for growth, the current overvaluation may be viewed as a short-term issue.

Conclusion: The fair value estimation of Otis's stock using the DCF model serves as a useful tool for understanding its current market value. Despite being slightly overvalued, investors must examine this analysis based on their investment strategy, risk tolerance, and the company's long-term potential. Informed investment decisions require a balanced approach that considers both fundamental analysis and market dynamics.

The Future Lift - Opportunities and Challenges

As Otis stands today, it faces a range of opportunities and challenges amidst the intersection of tradition and innovation. The company's success will hinge on its ability to strategically plan and anticipate as it adapts to changing landscapes in technology, urban development, and customer demands.

Opportunities Ahead

The trend of urbanization shows no indication of slowing down, and with it arises an expanding need for buildings that convey efficiency and sustainability. Otis is in a favorable position to take advantage of this trend through its smart and energy-efficient elevator solutions, suitable for the cities of tomorrow.

Digitalization also presents a promising avenue for growth. Otis's investment in IoT and connected services creates opportunities for operational efficiency and predictive maintenance, enhancing customer satisfaction and loyalty. By expanding into data-driven services, Otis can evolve from being solely an equipment manufacturer to become a provider of comprehensive mobility solutions.

Otis's Expanding Horizon: The Path to 2.5 Million Units by 2026

As we examine Otis Elevator Company's future prospects, one standout element is the anticipated growth of its installed base. By 2026, Otis aims to expand its installed base to a remarkable 2.5 million units worldwide. This growth is not simply a figure; it symbolizes a strategic expansion opportunity and a testament to Otis's market sway and operational ability. A larger installed base directly contributes to revenue growth, not only through new equipment sales but also through the potential for increased service contracts.

Challenges to Overcome

However, the path is not without challenges. Economic fluctuations can impact construction cycles and, as a result, new equipment demand. Otis must navigate these cycles with strategic acumen, to ensure that it maintains its service excellence to keep revenue flowing.

Regulatory changes pose another obstacle. Global standards for safety and sustainability are becoming more stringent, necessitating constant adaptation. Otis must strive to maintain leadership in compliance and innovation while also ensuring profitability.

The competition is becoming increasingly intense, with high-tech solutions offered at competitive prices from players in Asia and Europe. To stay ahead of the curve, Otis must differentiate itself through exceptional technology, reliability, and service quality.

The Resilience Factor

Otis's ability to adapt to technological disruptions will determine its resilience. The emergence of artificial intelligence and machine learning has both positive and negative implications. While these technologies may revolutionize maintenance and service, they could also attract new competitors to the market.

Otis’s Presence in China

Otis Elevator Company has a large presence in China, similar to other global corporations. This exposure to the Chinese market provides significant opportunities, but also entails risks associated with China's economic climate and geopolitical landscape. This article provides a detailed analysis of Otis's position in China and the corresponding risks involved.

Market Share and Sales: China accounts for a substantial part of Otis's sales, primarily within the New Equipment sector. This market has played an essential role in driving Otis's growth, significantly contributing to its global revenue and installed base expansion.

Risks from Economic Slowdown

Reduced Demand for New Installations: A slowing economy in China could lead to reduced construction activity, affecting demand for new elevator and escalator installations.

Impact on Service Contracts: Economic challenges could impact the service contract market, as building owners and managers may tighten their budgets, which may lead to postponing or decreasing maintenance and upgrade expenses.

Supply Chain Disruptions: Given the significant role of China as a manufacturing hub, any economic downturns may have the potential to impede Otis's supply chains, thereby impacting its global operations.

Geopolitical Tensions and Risks

Regulatory Changes: Geopolitical tensions may cause unanticipated regulatory changes or restrictions, which can have an impact on foreign businesses operating within China. Thus, Otis should navigate these complexities with caution to sustain its market position.

Trade Disputes: Ongoing trade disputes, particularly between China and the United States, may impose tariffs or other trade barriers, impacting Otis's cost structure and profitability.

Conclusion: While China continues to serve as a vital market for Otis, offering ample growth and expansion prospects, the risks that stem from economic slowdown and geopolitical tensions warrant strategic planning and careful consideration. Thus, for Otis to maintain its trajectory of success and growth in China and other regions, it is crucial to achieve a balance between these aspects.

A View from the Top

Considering all these factors, Otis should focus on maintaining its leadership by utilizing the strengths that have sustained its past success, such as innovation, customer service, and a commitment to safety. To ensure a successful future, Otis must develop a robust response to potential economic headwinds, adopt a proactive stance on regulatory compliance, and continuously strive for technological advancement.

In conclusion, Otis's plan for the future may prove to be its most thrilling venture yet, as it strives to raise the benchmarks of an industry it assisted in constructing, one level at a time.

Conclusion

Our examination of Otis Elevator Company highlights a history of success and progressive strategies. Otis's current position as an industry leader is not just a consequence of chance, but rather a culmination of over a century of deliberate decisions and flexible approaches.

From its inception of spearheading safety brakes for elevators to its current position as a leader in global vertical transportation, Otis has consistently displayed its aptitude for overcoming hurdles. The company's business strategy, bolstered by its combination of equipment sales, service agreements, and a concentration on modernization, has demonstrated its durability in the face of fluctuations in the economy and advancements in technology.

Otis's market dominance is underpinned by its competitive advantages, including patented technology, a vast service network, and brand equity. Nevertheless, Otis needs to remain vigilant in the face of competition and changing market conditions. The company should embrace sustainability, digitalization, and the potential of emerging markets to maintain its leading position.

Otis's financial strength and prudence enable the company to pursue future opportunities successfully. With robust financial statements, strategic investments in growth, and a steadfast commitment to creating value for shareholders, Otis is not only surviving but also thriving.

In the current market landscape, Otis Elevator Company's stock appears to be slightly overvalued. This assessment is based on recent financial analyses, including a Discounted Cash Flow (DCF) model, which suggest that the stock's market price is somewhat higher than its intrinsic value. However, this perspective on valuation should be considered in the context of the company's impressive track record since its independence from United Technologies Corporation (UTC).

Since becoming a standalone entity, Otis has demonstrated robust growth, reflected in its strong Compound Annual Growth Rate (CAGR). This growth is not just a testament to its past success but also indicative of its potential for future expansion, especially given its leadership in the elevator and escalator industry and strategic initiatives in emerging markets.

Looking ahead, Otis seems poised to capitalize on the opportunities arising from rapid urbanization, smart city infrastructure, and technological advancements. However, it must remain alert to the challenges that loom on the horizon, including economic downturns, regulatory changes, and competitive pressures.

In conclusion, the history of Otis mirrors human creativity and the tireless quest for advancement. It showcases how adherence to core principles, collaboration, and innovation can propel a business to greater heights. As such, Otis stands out not just as a company, but as an institution representing growth, reliability, and an unwavering drive for progress - an inspiration to stakeholders and industry watchers everywhere.

For long-term investors, Otis's stock thus presents an interesting opportunity. Despite the current overvaluation, its solid performance post-independence and future growth prospects make it a noteworthy consideration for those looking to diversify their investment portfolio.

Disclaimer: The information provided in this publication is for educational and informational purposes only and does not constitute financial advice. The content is solely reflective of my personal views and opinions based on my research and is not intended to be used as a basis for investment decisions. While every effort is made to ensure that the information is accurate and up-to-date, the writer makes no representations as to the accuracy, completeness, suitability, or validity of any information in this post and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. All readers are advised to conduct their own independent research or consult a professional financial advisor before making any investment decisions. The author is not invested in this stock.