Hi everyone,

I have a passion for writing and reading in-depth analyses on stocks. But what I enjoy even more is discovering what other investors hold in their portfolios and understanding their reasons behind those choices. That's why I've decided to share my own investment portfolio and journey with you.

My investing style is heavily influenced by Warren Buffett and Charlie Munger. I believe in investing in high-quality companies at reasonable prices, which aligns with my personal definition of "value investing."

I’m still figuring out the best way to structure these posts, but I believe it's better to start imperfectly than to wait for perfection. While I won't be revealing specific values or weightings, I will openly discuss the positions in my portfolio, major developments, buys, sales, and ideas on my watchlist.

To kick off this series, I'll start by sharing my five largest positions. These might seem like no-brainers to some, but they are the cornerstone of my portfolio. So, let's dive in:

#1 Berkshire Hathaway

Berkshire Hathaway is by far the largest position in my portfolio. Many investors caution against falling in love with a stock, but for me, Berkshire is an exception. It occupies a unique sphere in the stock market, with its unparalleled culture and exceptional management. I’m sure many other investors feel the same way.

There's a saying that you should be able to sleep well with your investments, and Berkshire is the investment that gives me the most peace of mind. I am aware that the company’s culture could be at risk when Warren Buffett is no longer at the helm. However, I believe that the next generation of leadership at Berkshire, particularly Greg Abel and Ajit Jain, will be able to maintain its culture, even if it won't be quite the same. My concern is more about the long-term, over the next 10-15 years, when it might be harder to preserve this culture through further generations of leadership.

From a purely financial perspective, Berkshire Hathaway is an outstanding company with a substantial cash reserve and a remarkable investment portfolio.

For now, I am very satisfied with my position and its performance since I added it to my portfolio around the beginning of 2018.

#2 Microsoft

The second largest holding in my portfolio is Microsoft MSFT 0.00%↑ . This is another no-brainer, as the company consistently achieves record highs in revenue, income, cash flow, and stock performance. CEO Satya Nadella is doing an outstanding job, and Microsoft's leadership position in the cloud business and AI, bolstered by its investment in OpenAI, secures its long-term growth prospects.

#3 LVMH

One day, while my better half and I were shopping on Zeil, Germany's busiest shopping mile in Frankfurt (where I also live), she casually mentioned how everyone seemed to be buying Louis Vuitton bags. The long line in front of the Louis Vuitton store caught my attention. This prompted me to immediately review LVMH's latest annual report, and I decided to invest heavily in the stock. This was a year before COVID, and I added to my position during the pandemic. Since then, LVMH has had an incredible run, and every time I pass a Louis Vuitton store, I take note of the line in front of it.

Recently, I have been considering trimming my position in LVMH due to slowing growth and its high valuation. I haven't made a final decision yet, but I know that I will retain a significant part of my investment in LVMH for the long term. I believe that luxury goods will always perform well because there is a human desire for beautiful and unique items. Bernard Arnault is an excellent manager who focuses on the right priorities.The largest US bank, and arguably the most systemically important bank in the world, holds an incredible $4.1 trillion in assets on its balance sheet and achieved a return on equity of 17% in Q1 2024. These are unbelievable numbers. Adding to its strengths is Jamie Dimon, the best bank CEO in the world. The bank has significantly benefited from rising interest rates and is developing very well. I am convinced that this bank is a great investment. Its stock performance and dividends are very satisfying.

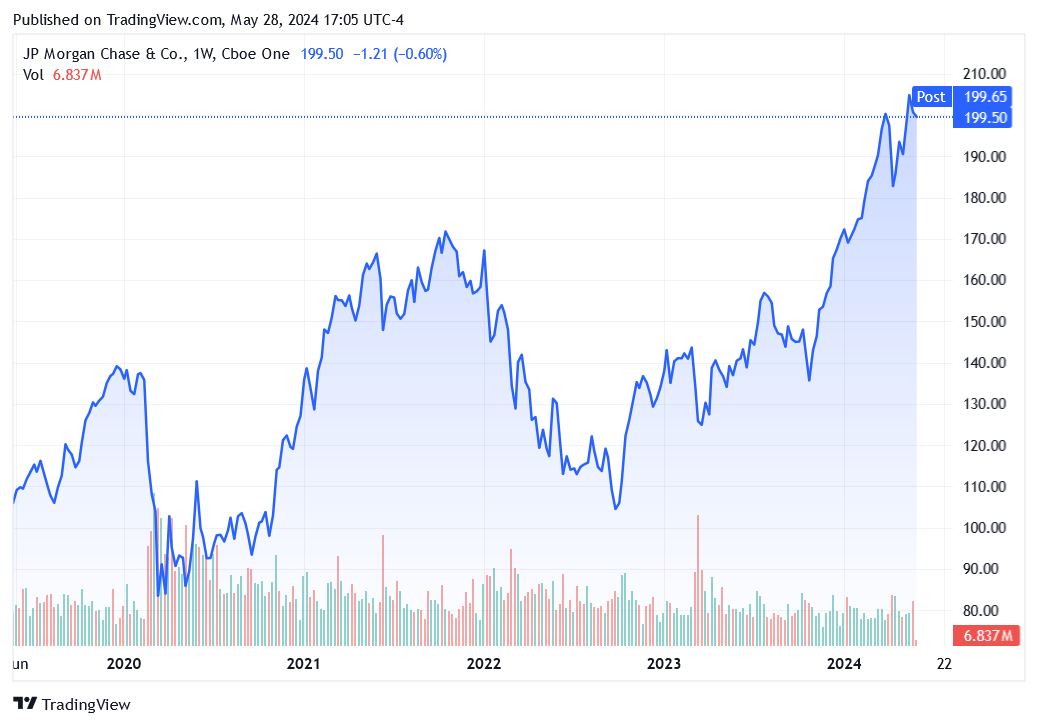

#4 JP Morgan Chase

JP Morgan Chase JPM 0.00%↑ , the largest US bank, and possibly the most systemically important bank in the world, boasts an astonishing $4.1 trillion in total assets on its balance sheet and achieved a return on equity of 17% in Q1 2024. These are unbelievable numbers. Additionally, Jamie Dimon, arguably the best bank CEO in the world, leads the bank. It has significantly benefited from rising interest rates and is developing very well. I am convinced that this bank is a great investment. Its stock performance and dividends are very satisfying.

#5 VISA

Visa's V 0.00%↑ payment network is arguably one of the best businesses in the world. It's a cash-printing machine, and you'd have to work hard to mess it up. It's the kind of business that even an idiot could run and it would still thrive. The stock is always quite expensive, but the risk is very limited and the moat is gigantic. By the way, I am also invested in Mastercard (same business model) and American Express, although AMEX is not directly comparable as it has a more diverse range of business models.

“Buy into a business that's doing so well an idiot could run it, because sooner or later, one will.” - Warren Buffet

As I wrote this first lines about my largest holdings I notice an important factor. The first four ones are not just amazing businesses, they are also run by “superstar” CEO’s. That shows how important a good management and the human factor in investing can be.

What comes next?

I will now regularly write articles under this series to further explain my portfolio, my investment decisions, and my thoughts on specific developments.

I'm looking forward to Lululemon's earnings next week, as this stock is highly controversial at the moment. Many people are very optimistic about the stock and see a great opportunity right now. I share this optimism, but I also keep in mind Charlie Munger's advice, quoting mathematician Jacobi: "Always invert." So, I'm cautious about jumping in at the moment. I already have a small position in LULU 0.00%↑ . There's a Lululemon store in Frankfurt that recently moved to a better location, and I've noticed the brand becoming increasingly popular in Germany. However, I also see an incredible number of competitors originating from social media that shouldn't be underestimated. We'll see what happens.

Additionally, I'm thinking about my next deep dives. I have a long list of small caps and others I want to analyze, and I will publish my next one soon. In the meantime, I recommend checking out my latest Stock Watchlist, where you can find my fair value estimations for many popular stocks.

Thanks for being here and have a great day!

Bernhard

Disclaimer: The information provided in this publication is for educational and informational purposes only and does not constitute financial advice. The content is solely reflective of my personal views and opinions based on my research and is not intended to be used as a basis for investment decisions. While every effort is made to ensure that the information is accurate and up-to-date, the writer makes no representations as to the accuracy, completeness, suitability, or validity of any information in this post and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. All readers are advised to conduct their own independent research or consult a professional financial advisor before making any investment decisions.