Dear readers,

thank you for being here and for your interest in my work! If you like this article and if you want to support my work, please feel free to subscribe! Please read the disclaimer at the end of this article. This is not an investment advice!

In February of this year, I wrote about Stellantis, the European automotive giant. At that time, the stock boasted an attractive valuation and had a promising outlook for reaching its fair value. Since then, much has transpired, including the release of Q1 2024 figures and a recently held investor day. In this article, I aim to provide an updated perspective on the company's current standing and future prospects.

If you do not know the company or my last article about Stellantis, I recommend to have a look :-).

Stellantis Q1 2024 earnings

In the first quarter of 2024, Stellantis found itself at a critical juncture, grappling with significant headwinds while preparing for a crucial wave of new products. The company's financial performance reflected these challenges, underscoring the complexities of managing a transition period.

Financial Overview

Stellantis reported net revenues of €41.7 billion, a stark 12% decline compared to the same period in 2023. This drop was primarily driven by lower volumes, adverse foreign exchange effects, and an unfavorable product mix. Despite efforts to stabilize revenue through firm net pricing, these measures were insufficient to counterbalance the downturn. Consolidated shipments also saw a 10% reduction, falling to 1,335 thousand units. This decline was attributed to strategic production adjustments and inventory management intended to prepare for the upcoming product launches in the latter half of 2024.

Inventory and Sales Highlights

The total new vehicle inventory increased to 1,393 thousand units by March 31, 2024, indicating an improvement in levels and structure since December 2023. However, this build-up also signals a potential overstock situation if new models fail to meet market expectations. On a positive note, global sales of Battery Electric Vehicles (BEVs) and Low Emission Vehicles (LEVs) grew by 8% and 13%, respectively, suggesting a growing acceptance of Stellantis' electrified offerings.

Regional Performance

North America: The region faced a significant 20% drop in shipments, primarily due to portfolio transitions involving key models like the Ram 1500 and the new Dodge Charger. While the Jeep Wagoneer experienced robust growth, it was not enough to offset the overall decline. Net revenues plummeted by 15%, highlighting the difficulties in managing these transitions effectively.

Enlarged Europe: Shipments in this region fell by 6%, driven by inventory reduction efforts and lower volumes of popular models like the Peugeot 3008. The 13% decrease in net revenues reflects the impact of these volume reductions and negative pricing trends, raising concerns about market competitiveness.

Middle East & Africa: This region was a bright spot, with consolidated shipments up by 42%, led by strong performance in the Algerian market. However, even here, the 24% increase in net revenues was tempered by adverse foreign exchange effects, particularly from the Turkish lira.

South America: Shipments declined by 7%, with lower volumes of Fiat and Peugeot models. Although net revenues only saw a minor 2% decrease, this was due to pricing increases that masked underlying weaknesses, including the negative impact of the Argentine peso's devaluation.

China and India & Asia Pacific: This region faced severe challenges, with a 46% drop in both consolidated shipments and net revenues. The decline was driven by economic conditions, increasing competition, and negative foreign exchange effects, raising questions about Stellantis' strategy in these critical markets.

Maserati: The luxury brand's performance was particularly troubling, with shipments plummeting by 61% and net revenues by 55%. This significant decline was largely due to inventory reduction initiatives and decreased volumes in North America, casting a shadow over the brand's future prospects.

Strategic Initiatives and Future Outlook

Despite these challenges, Stellantis continued to advance its Dare Forward 2030 strategic plan. This included launching three new BEVs, ramping up production of electric drive modules in the U.S., and expanding hydrogen fuel cell vehicle production in Europe. The company also adopted generative AI for R&D and customer services, aiming to enhance efficiency and reduce costs.

Financially, Stellantis approved an ordinary dividend of €1.55 per share, a 16% increase from the previous year, and progressed with its €3.0 billion share buyback program for 2024. However, these moves may not fully assuage investor concerns given the broader revenue and shipment declines. The company maintains a commitment to achieving double-digit Adjusted Operating Income (AOI) margins and positive industrial free cash flow for the year, but macroeconomic uncertainties could pose significant obstacles.

Key take aways from Q1 2024

Q1 2024 was a challenging period for Stellantis, marked by declining revenues and shipments amidst a strategic transition. While the company is gearing up for a new product wave, the mixed performance across regions and the steep declines in key areas like North America and Maserati highlight the difficulties ahead. Stellantis' ability to navigate these challenges and successfully launch its new products will be crucial in determining its trajectory in the coming months.

Stellantis 2024 Investor Day

The event promised a comprehensive look into Stellantis' strategic direction, financial outlook, and the initiatives driving its future.

Carlos Tavares, CEO of Stellantis, set the tone by highlighting the company's distinct advantages in a rapidly evolving automotive industry. Stellantis, born from the merger of Fiat Chrysler Automobiles and PSA Group, stands out with its global scale and strong market leadership, particularly in North America and Europe. The company's multi-energy flexibility is a critical asset, allowing it to profitably deliver products across various energy sources, including internal combustion engines (ICE), plug-in hybrid electric vehicles (PHEV), and battery electric vehicles (BEV).

Tavares emphasized the need to adapt to changing customer expectations and the electrification mandate, both of which are reshaping the industry. Stellantis is committed to zero-emissions transportation, aiming for margin parity between EV and ICE vehicles. Additionally, the company is strategically positioning itself to compete with the rise of Chinese automakers, leveraging partnerships like the one with Leapmotor to stay competitive.

Strategic Pillars Driving Success

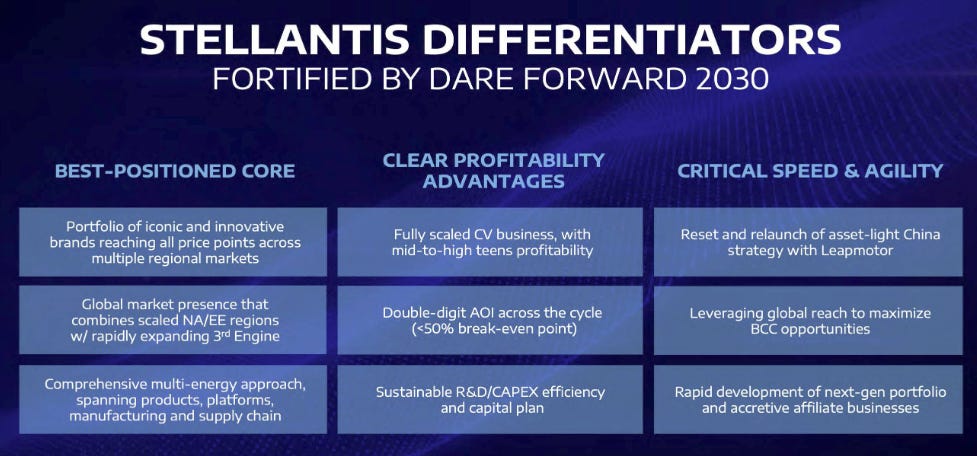

The heart of Stellantis' strategy lies in its nine key differentiators:

Iconic and Innovative Brands: Stellantis boasts an extensive portfolio of iconic and innovative brands, including Jeep, Ram, Fiat, Peugeot, and many others. Each brand addresses specific market segments and customer needs, enhancing Stellantis' market reach. This diverse lineup allows Stellantis to cater to a wide array of customer preferences, from luxury and performance enthusiasts to eco-conscious consumers.

Global Market Presence: Stellantis combines a strong presence in North America and Europe with a rapidly expanding footprint in regions such as the Middle East, Africa, Latin America, and Asia-Pacific. This global reach ensures a balanced revenue stream and reduces reliance on any single market. Stellantis' strategic market penetration provides resilience against regional economic fluctuations and regulatory changes.

Multi-Energy Approach: Stellantis employs a multi-energy platform strategy that supports internal combustion engines (ICE), plug-in hybrid electric vehicles (PHEV), and battery electric vehicles (BEV) on the same production lines. This flexibility allows the company to adapt quickly to changes in market demand and regulatory requirements, ensuring efficient and cost-effective manufacturing. The ability to pivot between energy sources positions Stellantis to meet diverse customer and market needs seamlessly.

Profitability and Efficiency: Stellantis is recognized for its above-average profitability metrics and efficiency in research and development (R&D) and capital expenditures (CapEx). The company consistently delivers double-digit adjusted operating income (AOI) margins, showcasing its ability to manage costs effectively while investing in future technologies and innovations. This commitment to profitability ensures that Stellantis remains financially robust amidst industry disruptions.

Commercial Vehicles Leadership: Stellantis holds a leadership position in the commercial vehicle segment, particularly in Europe and Latin America. The company's commercial vehicles are a significant contributor to its overall profitability and provide a stable revenue stream. Stellantis plans to continue expanding its commercial vehicle offerings, including electrified options, to meet growing market demand for sustainable transportation solutions.

Advanced Sourcing Strategies: Stellantis leverages advanced sourcing strategies to remain competitive, particularly against low-cost producers such as Chinese automakers. The company's approach includes best-cost country sourcing and strategic partnerships, ensuring access to high-quality, cost-effective materials and components. These strategies enable Stellantis to maintain competitive pricing and enhance profitability.

Asset-Light Strategy in China: In China, Stellantis has adopted an asset-light strategy, focusing on leveraging partnerships and local expertise rather than heavy capital investment. This approach allows Stellantis to minimize risks and maximize flexibility in one of the most competitive automotive markets. By collaborating with local partners like Leapmotor, Stellantis can efficiently navigate regulatory complexities and rapidly evolving market dynamics.

Technological Leadership: Stellantis is investing heavily in advanced technologies, including electric powertrains, autonomous driving, and connected vehicle solutions. The company's technological advancements ensure that its products remain competitive and appealing to customers, while also meeting stringent regulatory requirements. Stellantis' focus on innovation positions it at the forefront of the automotive industry's technological revolution.

Sustainability and Circular Economy: Stellantis is dedicated to sustainability and has established a circular economy business unit focused on remanufacturing, repairing, reusing, and recycling parts and vehicles. This initiative supports Stellantis' decarbonization goals and contributes to a more sustainable business model. By embracing circular economy principles, Stellantis aims to reduce its environmental footprint and promote resource efficiency.

Financial Performance and Outlook

Natalie Knight, the Chief Financial Officer of Stellantis, provided a comprehensive insight into the company’s financial goals, capital allocation strategy, and the outlook for 2024 during the Investor Day. Her presentation focused on how these financial strategies are interconnected with the broader goals of Stellantis, tying together various elements discussed throughout the day.

2024 is described as a pivotal year of transition for Stellantis, heavily focusing on electrification and optimization in North America. Knight emphasized the importance of mastering inventory optimization, pricing calibration, product mix, marketing effectiveness, and cost control to ensure success in North America. Additionally, the significant shift towards Low Emission Vehicles (LEV) and Battery Electric Vehicles (BEV) is expected to contribute to 15% of group revenues by the end of the year, with an even higher proportion in Europe .

Capital Allocation Strategy

Knight detailed Stellantis' capital allocation strategy, which revolves around four key components:

Efficient Liquidity Setup: Stellantis aims to maintain a strong liquidity position to manage short-term volatility and support medium-term organic growth and top-line expansion. The goal is to have available industrial liquidity at 25-30% of revenues, aligning with industry standards .

Sustainable AOI Margins: The company is committed to maintaining Adjusted Operating Income (AOI) margins above 10% across the business cycle. This is driven by a strong presence in the profitable North American market, growth in emerging markets, and leadership in commercial vehicles .

Focused Investment in Growth Areas: Stellantis plans to invest heavily in future-focused areas such as multi-energy platforms, software, and Advanced Driver Assistance Systems (ADAS). Approximately 60% of the R&D and CAPEX spending will be directed towards these areas, compared to the previous focus on ICE vehicles and core investments .

Shareholder Returns: Knight emphasized Stellantis' strong commitment to returning value to shareholders through both dividends and share buybacks. This commitment is underpinned by the company's solid financial performance and robust balance sheet, which enable it to generate significant cash flow.

Share Buybacks

Stellantis has planned substantial share buybacks as part of its capital return strategy. The company aims to buy back shares to not only return excess cash to shareholders but also to enhance shareholder value by reducing the number of shares outstanding, which can potentially increase earnings per share (EPS).

Dividends

Knight reiterated the company's intention to maintain a stable and sustainable dividend policy. Stellantis targets a dividend payout range of 25-30% of net income. This approach ensures that shareholders receive a regular and predictable return on their investment while allowing the company to reinvest in growth opportunities.

For the year 2024, Stellantis is on track to deliver a record €7.7 billion in dividends and stock buybacks. This substantial return reflects the company’s confidence in its financial health and its ability to generate consistent cash flow. Knight assured investors that the company’s strategy of balancing capital returns with investments in future growth areas remains intact

Operational Efficiency and Cost Management

Knight highlighted several operational efficiencies and cost management strategies. Stellantis is leveraging its multi-energy platform strategy to adapt quickly to varying market demands and optimize manufacturing processes. This strategy allows the company to produce BEVs, PHEVs, and ICE vehicles on the same production lines, enhancing flexibility and reducing costs .

Additionally, Stellantis is focusing on vertical integration and strategic partnerships to improve cost competitiveness. The collaboration with Leapmotor is a prime example, leveraging Leapmotor's cost-effective production and technological advancements for global markets .

Outlook for 2024

Knight acknowledged several challenges for 2024, particularly in North America, where manufacturing issues in some U.S. plants and the need for more sophisticated go-to-market strategies are areas of focus. However, she expressed confidence in the company's ability to address these issues through improved operational performance, better inventory management, and cost reductions in raw materials and headcount .

The second half of 2024 is expected to see significant momentum, with 15-20% of revenues coming from new products launched during the year. Stellantis also anticipates a positive impact from improved working capital dynamics and reduced R&D and CAPEX expenditures .

Challenges and Opportunities

Stellantis anticipates limited growth in the global market, projecting a modest increase of just 0-2% in global unit sales. This conservative outlook is shaped by the normalization of industry supply and heightened price sensitivity among customers, especially in the increasingly competitive EV market. To address these issues, Stellantis is enhancing marketing initiatives, improving the competitiveness of new products, and recalibrating pricing and incentive strategies.

Rising industry inventories and the complexity of rolling out new product offerings amidst shifting customer preferences towards smaller vehicles present significant challenges in North America. Inventory management is not optimal, with the "days supply" higher than desired. Stellantis is enhancing marketing initiatives to boost customer engagement and drive sales, improving inventory management to better align with market demand, and launching new electrified products to meet customer preferences and regulatory requirements.

The European market is characterized by fragmentation and regulatory hurdles, with varying policies and levels of support for electrification across different countries. Increased competition from Chinese automakers, who are making significant inroads with competitively priced EVs, and European tariffs on Chinese imports add complexity. Stellantis aims to leverage its leadership in light commercial vehicles to maintain its market position, expand its BEV offerings to meet regulatory standards and the growing demand for zero-emission vehicles, and invest in brand-specific growth strategies to strengthen market presence and competitiveness.

The global push towards electric vehicles brings uncertainties in adoption rates and regulatory requirements. Achieving margin parity between EVs and internal combustion engine (ICE) vehicles involves significant challenges in technology development and cost management. Stellantis is investing in advanced battery technologies and AI-powered platforms to enhance product offerings and maintain competitiveness. The company is also focusing on software and connectivity to improve the customer experience and position itself as a leader in autonomous and connected vehicles.

The U.S. and European markets are expected to face profitability headwinds due to competitive pressures, regulatory changes, and shifting market dynamics. To sustain profitability amidst these challenges, Stellantis is committing to strong capital returns through dividends and stock buybacks to maintain shareholder value, managing costs, and improving efficiency.

Navigating the complex regulatory environment in different regions involves compliance with emission standards, fuel efficiency requirements, and government incentives for EV adoption. Political uncertainties, such as changes in trade policies and the imposition of tariffs, can impact Stellantis' operations and profitability. Stellantis is investing in brand-specific growth strategies to strengthen market presence and competitiveness, and focusing on software and connectivity to improve the customer experience and position itself as a leader in autonomous and connected vehicles.

Managing the shift from ICE to electrified vehicles requires balancing the legacy ICE business with the new EV business, involving significant changes in manufacturing processes, product development, and customer engagement. Stellantis is investing in advanced battery technologies and AI-powered platforms to enhance product offerings and maintain competitiveness. The company is also focusing on software and connectivity to improve the customer experience and position itself as a leader in autonomous and connected vehicles.

Regional and Brand-Specific Strategies

North America: A Key Focus Area

Carlos Zarlenga, COO of North America, emphasized the importance of improving market share in this critical region. Acknowledging past challenges, he outlined a strategic plan to regain and expand market share by returning to basics. This approach focuses on maintaining pricing for value, aligning production with demand, and enhancing marketing efforts. A key part of this strategy involves the recent hiring of new marketing leadership to drive transformational changes.

Stellantis is also introducing new products and mid-cycle actions, particularly in the truck segment with the Ram brand. These new models are designed to meet the evolving demands of North American consumers. Furthermore, Stellantis is positioning itself to lead in the electrification of the North American market. By offering a range of internal combustion engine (ICE), plug-in hybrid electric vehicle (PHEV), and battery electric vehicle (BEV) models, the company aims to meet diverse customer needs and smoothly transition to an electrified future. The expected growth in the electrified vehicle segment presents a significant opportunity for Stellantis to capture additional market share.

Europe: Stabilization and Strategic Growth

In Europe, Stellantis has managed to stabilize its market share and is planning for further growth through strategic initiatives. The company's strong lineup of electrified vehicles positions it well to maintain and grow its market share. The focus is on expanding the range of BEVs and PHEVs to meet both regulatory requirements and consumer demand.

By tailoring offerings to meet the specific demands of various European markets, Stellantis aims to enhance its competitive position. This strategy involves leveraging its diverse brand portfolio to provide localized solutions that cater to the unique preferences of European consumers, ensuring a robust market presence across the continent.

Third Engine: Emerging Markets and Growth Opportunities

The regions collectively referred to as the "Third Engine" (South America, Middle East, Africa, and Asia Pacific) are crucial for Stellantis' growth strategy. The company is focused on increasing market share in these regions by expanding its presence and leveraging cost-competitive manufacturing. This includes localized production and strategic partnerships to enhance market coverage and profitability.

In emerging markets, Stellantis aims to introduce affordable electrified vehicles to capture market share. The strategy includes offering a mix of ICE, PHEV, and BEV models that meet the specific needs and economic conditions of these diverse markets. This approach ensures that Stellantis can cater to a broad range of consumers while driving growth in these high-potential regions.

Brand Strategies: Leveraging Strong Identities

Each brand within Stellantis plays a critical role in the company's market share strategy. Jeep, for instance, boasts a strong brand identity and leadership in the PHEV segment, which are key drivers of its market share. The introduction of new models and expansion into additional segments, such as the mid-size SUV and small SUV categories, are expected to boost Jeep's market presence significantly.

Ram is also focused on maintaining and growing its market share through electrification and the introduction of new truck models. The brand's commitment to innovation and sustainability aligns with the evolving preferences of consumers in North America and other regions.

In Europe, Peugeot, Fiat, and Citroën continue to be key players. These brands are introducing innovative, electrified models to meet the growing demand for sustainable mobility solutions, aiming to capture and grow market share in their respective segments. By leveraging their strong market presence and reputation for quality, these brands are well-positioned to drive growth in Europe.

My critical view on the Investor day

While the Stellantis 2024 Investor Day presentation highlighted many positive aspects, some elements should be viewed more critically:

Electrification Mandate and Margin Parity: Achieving margin parity between EVs and ICE vehicles is a significant challenge that many automakers are grappling with. The transition involves high upfront costs, ongoing investments in technology, and uncertain consumer adoption rates. The company's confidence in achieving this parity might be more aspirational than realistic, especially in the short term.

Technological Leadership Claims: Investing in advanced technologies like autonomous driving and AI-powered platforms is crucial, but the timeline for achieving significant market penetration and profitability in these areas is uncertain. Many competitors are also investing heavily in these technologies, and Stellantis' ability to outpace them remains to be seen.

Regulatory and Market Challenges in Europe and China: The presentation’s optimistic outlook on overcoming regulatory fragmentation in Europe and competing with Chinese automakers might downplay the complexities involved. Navigating different regulatory environments and facing fierce competition from established Chinese brands are substantial hurdles.

Inventory Management in North America: The current high "days supply" and the shift in customer preferences towards smaller vehicles present ongoing challenges. While Stellantis plans to enhance marketing and product competitiveness, the effectiveness of these measures in reducing inventory levels and boosting market share is uncertain.

As the Investor Day drew to a close, it was clear that Stellantis is leveraging its strategic pillars and differentiated strengths to navigate the evolving automotive landscape. However, some of the company’s projections and strategies should be viewed with a critical eye, considering the substantial risks and challenges ahead. While the future holds potential for transformation and growth, Stellantis must navigate these complexities carefully to achieve its ambitious goals.

Updated Stock valuation

In February, I estimated a fair value for Stellantis stock to be between €35 and €40 per share. Initially, the stock rose to over €27, showing a significant increase, but then it plummeted due to weak Q1 numbers. It is now trading at around €19 to €20 per share.

Given the Q1 figures and recent developments, it appears that Stellantis' revenue for this year will decrease compared to 2023. Last year, Stellantis achieved net sales of €189 billion and an adjusted operating income of €24 billion, with an operating income margin of 12.8%. The Q1 press release indicates that the margin will be "double-digit" but lower than the previous year, so I estimate it to be around 10.5%. Assuming a consensus net sales figure of about €184 billion, this would translate into an adjusted operating income of €19.3 billion. Earnings per share are estimated to be around €5.

With a recent share price of €19, the stock trades at a forward P/E ratio of 4.75, which looks very cheap. Additionally, the forward EV/EBIT (EV = €73.2 billion) ratio is just 3.79. Although these ratios are slightly higher than my February estimation, I still believe the stock is undervalued, with a fair value of about €35 per share.

What do you think about the valuation of Stellantis? Let me know!

Final conclusion

Stellantis is navigating a particularly challenging period for the automotive industry, characterized by significant geopolitical uncertainties and the complex transition to electric vehicles. This transition is increasingly criticized and not as widely accepted by customers as initially expected. Despite these challenges, the management team has generally performed well. However, my gut feeling is that they may overestimate their brand strength in North America and Europe, where Stellantis has been losing market share in recent years and has struggled to halt this decline.

The Dare 2030 plan sets an ambitious target of €300 billion in net sales by 2030. Although there are still several years to go, I am skeptical about Stellantis' ability to achieve this goal given the limited unit growth in the automotive industry, intense competition, and various other headwinds. I would be pleased if Stellantis could maintain its market share in its primary markets, achieve growth in its "third engine," and sustain its strong operating margins and free cash flow generation. Achieving these would enable the company to return substantial amounts of cash to investors through dividends and share buybacks.

Despite my concerns, I still believe the stock is undervalued and remain committed to my investment.

Disclaimer: The information provided in this publication is for educational and informational purposes only and does not constitute financial advice. The content is solely reflective of my personal views and opinions based on my research and is not intended to be used as a basis for investment decisions. While every effort is made to ensure that the information is accurate and up-to-date, the writer makes no representations as to the accuracy, completeness, suitability, or validity of any information in this post and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. All readers are advised to conduct their own independent research or consult a professional financial advisor before making any investment decisions. The author is invested in Stellantis.

Recession may hit hard the business but it is true for most of the business