I recently resumed screening for high-quality companies and was surprised by how many promising stocks are out there waiting to be discovered and invested in. With so many great opportunities, I thought it might be fun to share my findings with you. Depending on their valuations, these insights might even help guide your future investment decisions.

Welcome to Episode 1 of my new series, “World’s Best Stocks.” In each post, I’ll highlight three stocks that I believe are high-quality companies. There’s no strict methodology here—I’ll simply provide a brief overview of each stock along with some of my thoughts. I plan to post these articles regularly, but without a fixed schedule, as I prefer to keep things flexible. This first post will be a free one, but from time to time I will also post some kind of "special editions" for paid subscribers.

For this first episode, I used the Finchat (Affiliate Link) screener with the following filters:

ROIC 10Y Average >= 15%

Revenue 10Y CAGR >=10%

Diluted EPS before extra items 10Y CAGR >= 10%

Net Debt/EBITDA =<3

EPS Forward 2Y CAGR >=10%

These filters are very though and I think if a company meets these it is really high quality.

#1 Pandora A/S (CPSE-PNDORA)

ROIC 10Y Average = 11.74%

Revenue 10Y CAGR = 30.23%

Diluted EPS before extra items 10Y CAGR = 11.6%

Net Debt/EBITDA = 1.53

EPS Forward 2Y CAGR = 16.14%

Market Cap = $12.2 billion

Total Return last 10Y = 238%

Forward P/E = 15.61

Pandora A/S is a Danish jewelry company that specializes in designing, manufacturing, and selling a wide range of jewelry, including charm bracelets, rings, necklaces, and earrings. Established in 1982 in Copenhagen by Per Enevoldsen, the company has grown into a prominent global brand. Known for its customizable jewelry, particularly its charm bracelets, Pandora operates in numerous countries worldwide and caters to a broad customer base. The company focuses on offering a variety of jewelry options that combine quality with affordability, while also emphasizing sustainability in its business practices.

First thoughts

I was pleasantly surprised to find this Danish jewelry company in the screener results, which piqued my curiosity. At first glance, the company appears to be performing well, with impressive capital efficiency and profitability. From what I understand, it’s not positioned as a luxury brand but rather as a “premium jewelry” company, offering more affordable options. I recently noticed one of their stores in my hometown and took a quick look through the windows. The store had the appearance of a typical jeweler. I plan to explore this further, as I’m currently unsure what drives the company’s strong performance and whether it presents a solid investment opportunity. With a forward P/E ratio of 15.61, this high-quality company could be an attractive option.

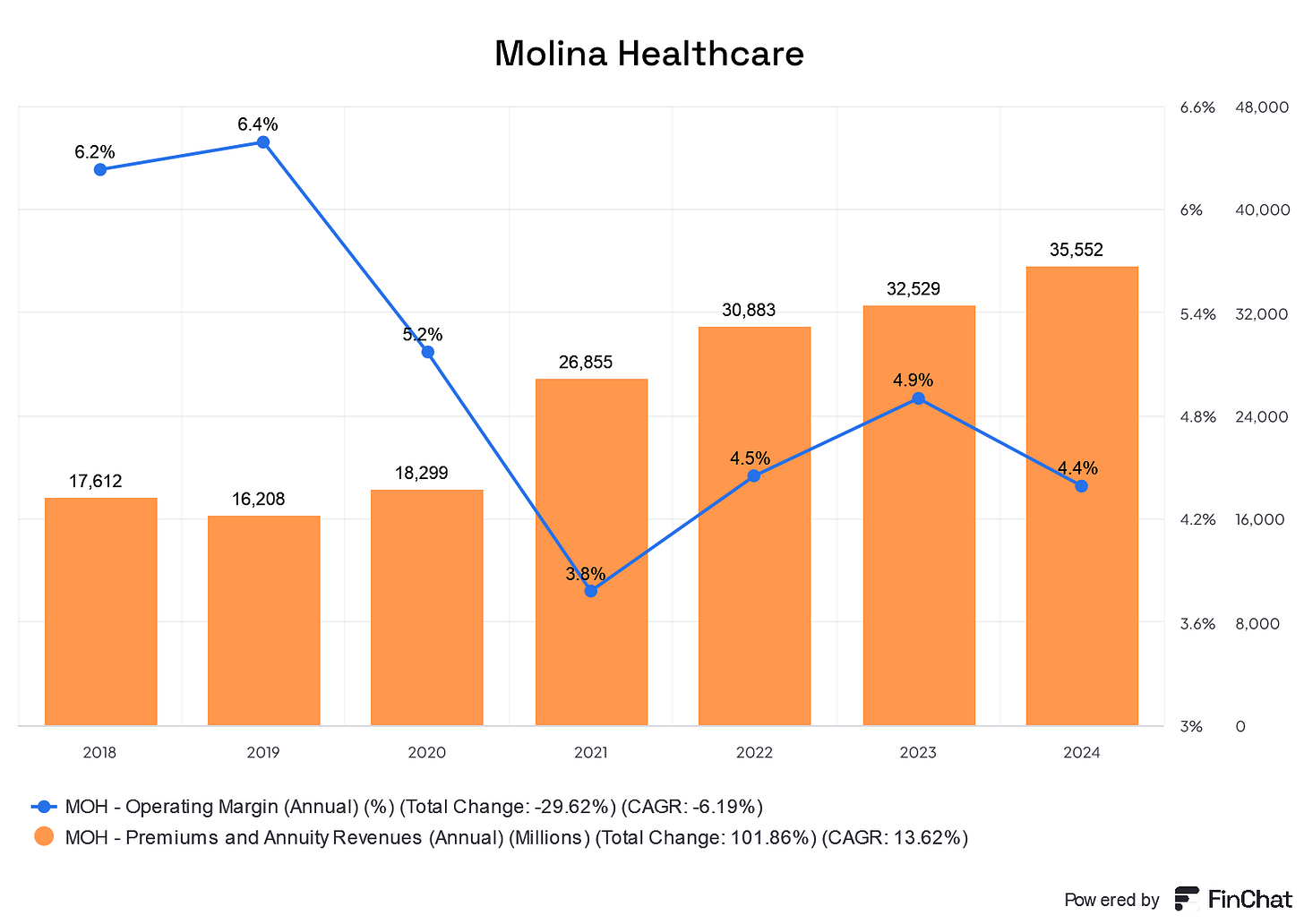

#2 Molina Healthcare (NYSE-MOH)

ROIC 10Y Average = 32.78%

Revenue 10Y CAGR = 16.91%

Diluted EPS before extra items 10Y CAGR >= 54.87%

Net Debt/EBITDA = -1,16

EPS Forward 2Y CAGR =12.95%

Market Cap = $20.5 billion

Total Return last 10Y = 156%

Forward P/E = 13.16

Molina Healthcare is an American managed care company that provides health insurance services to individuals and families through government programs such as Medicaid and Medicare. Founded in 1980 by Dr. C. David Molina in Long Beach, California, the company initially focused on providing healthcare to low-income individuals who were uninsured or underinsured. Over the years, Molina Healthcare has expanded its operations across multiple states, offering a range of healthcare services and products. The company is committed to improving access to quality healthcare for underserved populations and operates both health plans and primary care clinics in several states across the U.S.

First thoughts

Molina Healthcare recently caught some attention when Michael Burry, known for his role in "The Big Short," invested in its stock. The screener results are intriguing, particularly the high return on invested capital (ROIC) for an insurance company. However, I won’t be exploring this stock further, as it falls well outside my area of expertise. My hesitation isn’t due to the fact that it’s an insurance company, but rather because of the complexities of the American healthcare system. I find it difficult to assess whether a company is well-positioned within such a complicated landscape. If you have a better understanding of the U.S. healthcare system and feel confident in evaluating companies within it, I would recommend looking into Molina Healthcare further—it could be worth the effort.

#3 Evolution A/B (OM-EVO)

ROIC 10Y Average = 54.09%

Revenue 10Y CAGR = 46.77%

Diluted EPS before extra items 10Y CAGR = 54.87%

Net Debt/EBITDA = -0.47

EPS Forward 2Y CAGR >=12.35%

Market Cap = $19.9 billion

Total Return last 10Y = 542.9%

Forward P/E = 14.82

Evolution AB is a Swedish company that specializes in the development and provision of live casino solutions for the online gaming industry. Founded in 2006, Evolution has grown to become a leading provider in the live casino market, offering a wide range of live-streamed games, including roulette, blackjack, and baccarat, as well as game show-style offerings. The company partners with many of the world's top online gaming operators, providing them with high-quality live casino experiences. Evolution AB is headquartered in Stockholm, Sweden, and operates studios in several countries, serving a global client base. The company is recognized for its innovation and continuous expansion in the online gaming sector.

First thoughts

Recently, I came across some compelling analyses of Evolution AB, and it's clear there are solid reasons for the attention it’s receiving. The company is showing impressive growth with outstanding financial performance. However, it's important to consider the ethical implications of investing in the online gambling industry. If you’re comfortable with that aspect, Evolution AB presents a very interesting investment opportunity. I will definitely be taking a closer look at this company as its valuation looks attractive to me with a forward P/E of 14.82.

Thank you once again for being here and for your interest! If you enjoyed my analysis, please consider leaving a "like" and subscribing. Your support means a lot!

Disclaimer: The information provided in this publication is for educational and informational purposes only and does not constitute financial advice. The content is solely reflective of my personal views and opinions based on my research and is not intended to be used as a basis for investment decisions. While every effort is made to ensure that the information is accurate and up-to-date, the writer makes no representations as to the accuracy, completeness, suitability, or validity of any information in this post and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. All readers are advised to conduct their own independent research or consult a professional financial advisor before making any investment decisions. The author is not invested in the mentioned stocks.

Thanks for the opinions of EVO AB - the company seems so powerful with its profitability.

Also, didn’t knew molina healthcare’s op was that low.

By the way, can i ask the reason you chose finchat screener among other screeners?