Dear Readers,

Thank you for being here and showing interest in my work! Your support means the world to me. If you enjoyed this article and would like to see more, please consider subscribing and giving it a like—it really helps grow our community of investors.

Thank you for your continued support!

Please read the disclaimer at the end of this article. This is not an investment advice!

Long-term Walt Disney DIS 0.00%↑ shareholders have needed nerves of steel to endure what the company and its stock have been through in recent years. At its peak in 2021, Disney reached a market capitalization of $367 billion, only to hit a low of $145 billion just two and a half years later. The journey from exuberance to disillusionment has been swift and dramatic. But I will leave the past in the past and focus on the present and future opportunities. Because Disney's operations are so large and diverse, I will divide this deep dive into 5 parts. The first three parts will provide a general explanation of the business. In part 4 we will examine the group's financials and recent developments, and in part 5 we will look into the future and estimate a fair value for the stock.

Part 1: General Overview and Entertainment Segment

Part 2: Sports Segment

Part 3: Experiences Segment

Part 4: Group Financials and recents developments

Part 5: Outlook, Valuation and Conclusion

About The Walt Disney Company

The Walt Disney Company is a diversified global entertainment conglomerate that operates through three main segments: Entertainment, Sports, and Experiences. Each segment encompasses distinct areas of the business, contributing to Disney's overall success.

Market Cap: $164 billion

Enterprise Value: $210 billion

Employees: 225,000 (as of September 30, 2023)

Segment Overview

Entertainment focuses on non-sports-related content, including global film, television, and direct-to-consumer (DTC) video streaming. This segment manages key business lines such as linear networks (e.g., ABC, Disney Channel, FX), DTC services like Disney+ and Hulu, and content sales/licensing, which includes film distribution, home entertainment, and live events.

Sports is centered around sports-related content, primarily through ESPN, which is 80% owned by Disney. This segment covers both domestic and international sports broadcasting, including ESPN-branded channels and the ESPN+ streaming service, as well as sports networks in India under the Star brand.

Experiences includes Disney’s theme parks, resorts, cruise lines, and consumer products. This segment operates globally, with major theme parks in the U.S., France, Hong Kong, and China, alongside other vacation experiences like Disney Cruise Line and Adventures by Disney. Additionally, this segment oversees merchandise licensing and retail operations, offering Disney-branded products through various channels.

The Entertainment Segment is the largest contributor to Disney's revenue, accounting for approximately 44.3% over the past twelve months. This is followed by the Experiences Segment, which contributes around 36%, and the Sports Segment, which accounts for roughly 20% of the company's revenue.

In terms of operating income contribution, the Experiences Segment has rebounded strongly following the challenging COVID-19 period, now leading with approximately 63% of Disney's operating income. The Entertainment Segment contributes 21%, while the Sports Segment accounts for 17%.

In this series, we will explore each segment in detail in separate posts to gain a deeper understanding of Disney's business. In todays first post we will explore the Entertainment segment.

Entertainment segment

The Entertainment segment of The Walt Disney Company primarily focuses on the production and distribution of non-sports-related content across film, television, and direct-to-consumer (DTC) streaming platforms on a global scale. This segment is divided into three significant lines of business:

Linear Networks - 27% of revenues

Direct-to-consumer - 55% of revenues

Content Sales/Licensing and Other - 18% of revenues

Linear Networks business

The Walt Disney Company's Linear Networks business remains a cornerstone of its traditional television operations, generating substantial revenue through a diverse range of channels. This segment primarily earns from affiliate fees and advertising, with its success rooted in multi-year licensing agreements with multi-channel video programming distributors (MVPDs) and affiliated TV stations. These agreements, often based on per-subscriber rates, are driven by the quality and popularity of Disney’s content.

In the U.S., Disney’s Linear Networks have a strong presence. The ABC Network reaches nearly every household through about 240 affiliated stations and eight Disney-owned stations, offering a mix of primetime specials, daytime shows, news, and sports, with ESPN content featured on ABC. The Disney Channels—Disney Channel, Disney Junior, and Disney XD—cater to various youth demographics, while Freeform targets young adults. The FX Channels and National Geographic Channels appeal to adult audiences with a mix of original series, movies, and documentary content.

Disney owns eight major television stations in key U.S. markets, covering about 20% of U.S. households. Internationally, Disney operates around 285 channels in 40 languages across 190 countries, offering a blend of Disney’s global and locally tailored content.

A strategic asset for Disney's Linear Networks is its 50% ownership in A+E Networks, a joint venture with Hearst Corporation, which includes popular channels like A&E, HISTORY, and Lifetime, known for their strong presence in unscripted programming and historical series across about 200 countries.

Linear Network - Financials

The Linear Networks business, while facing a decline, remains highly profitable, with an operating margin of around 35%. This profitability underscores the enduring value of traditional television, even as the industry grapples with significant challenges. From 2021 to 2023, revenue in this segment fell from $13.5 billion to $11.7 billion, reflecting a 14% overall decline. This downward trend highlights the shifting dynamics in media consumption, as more consumers move away from linear TV in favor of digital and streaming platforms.

The segment's revenues are primarily driven by affiliate fees and advertising. By 2022, affiliate fees had dropped by 4%, and advertising revenues had decreased by 6%. The decline continued into 2023, with affiliate fees falling another 5% and advertising revenues plummeting by 15%. This sharp decline in advertising revenue was particularly concerning, as it signaled not just a loss of viewership but also a diminishing ability to command premium ad rates.

Operating income for the segment also mirrored this downward trajectory. In 2021, Linear Networks reported an operating income of $5.3 billion. By 2022, this figure had slightly decreased by 1% to $5.2 billion, and in 2023, it fell significantly by 21% to $4.1 billion. This drop in profitability was attributed to the ongoing decline in revenues, despite efforts to manage costs through reductions in programming and production expenses.

It is also worth noting that sales are declining both domestically and internationally. These developments underscore the challenges faced by the Linear Networks business as it contends with the rapidly changing landscape of media consumption. The persistent decline in both revenue and operating income indicates that traditional television is under significant pressure.

Direct-to-Consumer Business

Disney's Direct-to-Consumer (DTC) business includes subscription services like Disney+, Disney+ Hotstar, and Hulu, offering a range of general entertainment, family programming, and sports content. These services are available individually or bundled, often with ESPN+. Revenue primarily comes from subscription fees and advertising.

Disney+ and Star+

Disney+ provides global subscribers with content from Disney, Pixar, Marvel, Star Wars, and National Geographic. Outside the U.S. and Latin America, it features a "Star" section for general entertainment. In Latin America, Star+ operates separately, offering entertainment, family content, and live sports. As of Q3 2024 Disney+ Core, which includes Disney+ and Star+, had around 118 million subscribers.

Disney+ Hotstar

Tailored for markets like India and Southeast Asia, Disney+ Hotstar offers a mix of TV shows, movies, sports, and original content in multiple languages, including exclusive cricket streaming rights. By Q3 2024, it had about 36 million subscribers. Both Disney+ Core and Disney+ Hotstar generate revenue mainly from subscriptions, with advertising playing a growing role, especially as Disney expands its ad-supported offerings globally.

Hulu

Hulu, available in the U.S., features content from Disney and third parties, offering both ad-supported and ad-free SVOD services, along with a live TV option. Subscribers can also add premium services like Max and Starz. As of Q3 2024 Hulu had approximately 51 million subscribers. Disney, which owned 67% of Hulu, gained full control after NBC Universal exercised its option to sell its 33% stake to Disney in November 2023.

Direct-to-Consumer - Financials and KPI’s

The Direct-to-Consumer (DTC) business segment has been central to the company’s transformation, reflecting broader shifts in the media and entertainment industry. From 2021 to 2023, the company saw significant subscriber growth but also faced substantial financial losses due to heavy investments in content and technology.

In 2021, the DTC segment generated $15 billion in revenue, driven by the success of Disney+, Hulu, and ESPN+. However, this rapid expansion led to operating losses of $1.2 billion, mainly due to high investment costs. In 2022, revenue increased to nearly $18 billion, with a 26% rise in subscription fees. However, programming and production costs surged, pushing the operating loss to $3.4 billion.

By 2023, revenue grew to $19.9 billion, supported by higher subscription fees and international expansion of Disney+. Despite this, advertising revenue declined by 10%, particularly after losing digital rights to major sporting events in India. The company managed to reduce its operating loss to $2.5 billion by cutting marketing and operational costs. In 2024, the DTC business appears to be profitable for the first time, but we will look at this in more detail in part 4 of this series.

Subscriber growth was significant during this period, rising from 112.9 million in 2021 to 144.2 million in 2023, largely driven by Disney+. However, Disney+ Hotstar saw a decline from 61.3 million subscribers in 2022 to 37.6 million in 2023, following the loss of key sports rights. Hulu also experienced steady growth, reaching 48.5 million subscribers by 2023.

While Disney+ tends to get the most attention, Hulu's revenue share of the DTC business is higher than Disney+ at approximately 54%.

Overall, the DTC segment has been a major driver of revenue and subscriber growth but has also posed challenges in balancing growth with profitability due to the high costs involved.

Content Sales/Licensing and Other

Disney’s Content Sales/Licensing and Other segment is crucial to its business, generating revenue through TV/VOD distribution, theatrical releases, and home entertainment. This segment also includes income from music distribution, stage productions, post-production services by Industrial Light & Magic and Skywalker Sound, and the publication of National Geographic magazine.

TV/VOD Distribution

Disney licenses its content to third-party networks and video service providers, ensuring broad availability across various platforms, including other DTC services.

Theatrical Distribution

Disney has released about 1,100 live-action and 100 animated films globally as of September 30, 2023. While Disney handles most distribution and marketing, some films are exclusively released on its streaming services, depending on the market.

Home Entertainment Distribution

Disney distributes films and episodic content via DVD, Blu-ray, and digital formats through e-tailers like Apple and Amazon, and physical formats through retailers like Walmart and Target. The Disney Movie Club offers direct sales in the U.S. and Canada.

Disney Theatrical Group

This group develops and licenses live shows globally, including The Lion King and Frozen, and licenses IP for Disney On Ice and Marvel Universe Live!.

Disney Music Group

This group manages music-related activities, including recorded music, publishing, and concerts, and distributes music both physically and digitally.

Equity Investment and Content Production

Disney holds a 30% stake in Tata Play Limited in India and produces a wide range of content under various banners like Marvel, Pixar, and Lucasfilm, while also acquiring content from third-party studios. Disney’s extensive content library, spanning nearly 100 years, includes approximately 5,100 live-action films, 400 animated films, and numerous episodic series across various genres.

Content Sales/Licensing and Other - Financials and KPI’s

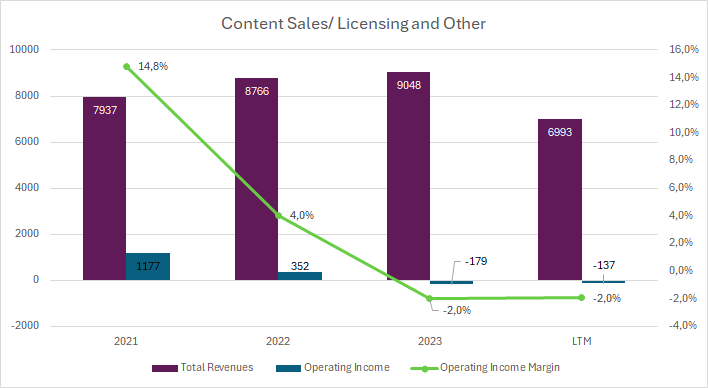

The Content Sales/Licensing business experienced significant changes from 2021 to 2023, highlighting both opportunities and challenges in a rapidly evolving industry.

Revenue in this segment grew from $8.5 billion in 2021 to $9 billion in 2023, driven by successful theatrical releases and the expansion of digital distribution platforms. Major film releases contributed to this growth, with titles in 2022 and 2023 performing well at the box office, reinforcing the importance of theatrical distribution.

However, not all areas saw growth. The home entertainment sector, including DVD, Blu-ray, and digital sales, declined as consumer preferences shifted away from physical media. This decline, along with rising production costs and lower TV and VOD distribution revenues, led to a significant drop in operating income, from $1.2 billion in 2021 to a loss of $179 million in 2023.

Other revenue streams, like music distribution and stage plays, also faced mixed results. While stage plays rebounded post-pandemic, international revenues were impacted by a challenging foreign exchange environment.

Overall, from 2021 to 2023, the Content Sales/Licensing business saw growth through blockbuster films and digital expansion, but faced rising costs and declining traditional revenue streams, underscoring the need for ongoing adaptation to changing consumer preferences and technological shifts.

Competition and Seasonality

The Entertainment segment operates in a highly competitive and dynamic environment, particularly within its Linear Networks and Direct-to-Consumer (DTC) segments. Both of these segments are constantly vying for viewers' attention and audience share against a broad range of competitors, including other television networks, independent stations, and increasingly, digital media such as other DTC streaming services, social media platforms, and video games.

In the realm of advertising, the competition is equally fierce. The company must compete with a variety of media outlets, from traditional television networks and radio stations to modern digital content platforms, newspapers, magazines, and even billboards. This competition extends into local market areas where the company’s television and radio stations fight for both audiences and advertising dollars. As the media landscape continues to evolve, so too does the challenge of securing favorable carriage agreements with multichannel video programming distributors (MVPDs). These agreements, crucial for the distribution of the company’s programming, are subject to periodic renegotiation. However, market conditions—such as consolidation within the cable, satellite, and telecommunications sectors, along with shifting subscriber trends—can make it increasingly difficult to maintain or improve these terms.

Beyond the Linear Networks and DTC businesses, the company’s Content Sales and Licensing segment faces its own set of competitive pressures. This segment competes with all forms of entertainment, from theatrical and episodic content to home entertainment products, pay TV, and video-on-demand (VOD) services. The fluctuating nature of this business, particularly the timing and performance of theatrical releases and home entertainment sales, adds an additional layer of complexity. These results are often influenced by the timing of key releases, competition from other media companies, and the seasonality of vacation and holiday periods.

Moreover, the company is in a constant battle for the creative and performing talent, story properties, and show concepts that are essential to the success of its entertainment businesses. It competes not only with other major media and entertainment companies but also with independent production houses and VOD services. The race to secure the best talent and content often determines the success of the company’s programming and, by extension, its ability to attract advertisers and subscribers.

Advertising revenues, particularly within the Linear Networks and DTC segments, are heavily influenced by seasonal patterns and changes in viewership levels. Typically, domestic advertising revenues tend to peak during the fall, aligning with the new television season, and dip during the summer months. Meanwhile, affiliate revenues, a key component of the company’s financial performance, fluctuate in response to trends in MVPD subscriptions, reflecting the broader shifts in consumer behavior and media consumption.

Competitive Strengh / Moat

The most significant moat of Disney's Entertainment Segment lies in its unparalleled portfolio of intellectual property (IP). Disney's library of characters, stories, and franchises is not only vast but also deeply embedded in global culture. This collection includes some of the most beloved and enduring brands in entertainment history, such as the timeless characters and stories from Disney and Pixar, the superhero universe of Marvel, the epic saga of Star Wars, and the rich explorations offered by National Geographic.

What sets Disney's IP apart is the deep emotional connection it has fostered with audiences over generations. Characters like Mickey Mouse, Simba, and Elsa are not just entertainment figures; they are cultural icons that resonate across age groups and geographies. This kind of brand recognition and loyalty is extraordinarily difficult for competitors to replicate. Audiences who grew up with Disney content often pass their love for these stories and characters down to their children, creating a self-sustaining cycle of engagement that spans generations.

Moreover, Disney’s ability to leverage this IP across multiple platforms—films, television shows, streaming services, theme parks, merchandise, and live events—amplifies its value. For instance, a new Marvel movie doesn't just succeed at the box office; it also drives subscriptions to Disney+, boosts merchandise sales, attracts visitors to theme park attractions, and may even inspire live-action shows or spin-offs. This cross-platform synergy not only maximizes the financial return on Disney's IP but also reinforces the brand's presence in the everyday lives of its audience.

This extensive and strategically utilized IP portfolio gives Disney a significant competitive advantage. It ensures a consistent pipeline of content that is both highly anticipated and widely embraced, enabling Disney to maintain its dominance in the entertainment industry. The strength of Disney’s IP is further solidified by the company’s ability to keep it relevant through continuous innovation, whether by reimagining classic tales or expanding existing universes with fresh narratives and characters.

Part II

In Part II of this series, we will take a look at the sports segment of The Walt Disney Company.

Thank you once again for being here and for your interest! If you enjoyed my analysis, please consider leaving a "like" and subscribing. Your support means a lot!

Disclaimer: The information provided in this publication is for educational and informational purposes only and does not constitute financial advice. The content is solely reflective of my personal views and opinions based on my research and is not intended to be used as a basis for investment decisions. While every effort is made to ensure that the information is accurate and up-to-date, the writer makes no representations as to the accuracy, completeness, suitability, or validity of any information in this post and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. All readers are advised to conduct their own independent research or consult a professional financial advisor before making any investment decisions. The author is not invested in the mentioned stocks.

Super insightful, and appreciate the breakdowns of the segments and KPIs. I’m just fascinated with the company, so I appreciate the work you put into writing this!