Dear Readers,

Thank you for being here and showing interest in my work! Your support means the world to me. If you enjoyed this article and would like to see more, please consider subscribing and giving it a like—it really helps grow our community of investors.

Thank you for your continued support!

Please read the disclaimer at the end of this article. This is not an investment advice!

Welcome to part 2 of the 5-part Disney DIS 0.00%↑ analysis series.

Part 1: General Overview and Entertainment Segment

Part 2: Sports Segment

Part 3: Experiences Segment

Part 4: Group Financials and recents developments

Part 5: Outlook, Valuation and Conclusion

In this part, we will take a closer look at the sports segment of The Walt Disney Company. If you missed part 1:

Sports Segment

Disney's Sports segment is a crucial pillar of its media empire, encompassing the production and distribution of sports-related television and direct-to-consumer (DTC) video streaming content across global markets. The cornerstone of this segment is ESPN, a highly recognizable brand within the sports broadcasting industry, and Star-branded sports channels in India. Through these channels and services, Disney covers a vast array of sporting events, reaching millions of viewers both domestically and internationally.

The Sports segment represents approximately 20% of Group sales and 17% of operating income.

ESPN – A Dominant Force in Sports Media

ESPN is a flagship entity in Disney’s sports portfolio, with Disney owning 80% of the company. Domestically, ESPN operates eight 24-hour sports channels: ESPN, ESPN2, ESPNU, ESPNEWS, SEC Network, ACC Network, ESPN Deportes, and the Longhorn Network. Each channel serves a specialized audience, covering a broad range of sports from professional leagues to collegiate events. For instance, ESPN and ESPN2 focus on major professional and college sports, while ESPNU is dedicated to college athletics, and the SEC and ACC Networks focus on specific collegiate athletic conferences.

In addition to linear television channels, ESPN programs sports content for the ABC network, known as "ESPN on ABC." This partnership allows ESPN to leverage ABC’s wider broadcast reach, particularly for high-profile sporting events. ESPN also holds numerous valuable sports programming rights, including contracts with major U.S. leagues and events such as the NFL, NBA, Major League Baseball (MLB), National Hockey League (NHL), NCAA football and basketball, tennis tournaments like the US Open and Wimbledon, and golf events like the Masters and the PGA Championship. This extensive range of rights enables ESPN to broadcast live sporting events, sports news, and analysis, catering to a wide audience of sports enthusiasts.

ESPN+ – Direct-to-Consumer Sports Streaming

To complement its traditional television offerings, Disney launched ESPN+, a subscription-based DTC streaming service that offers thousands of live sporting events, on-demand content, and original programming. The platform allows fans to access content on mobile and internet-connected devices, either as a standalone service or bundled with Disney+ and Hulu, expanding Disney's reach in the streaming market.

ESPN+ has exclusive rights to distribute certain sports content, including UFC pay-per-view events in the U.S., making it a go-to platform for mixed martial arts fans. In addition, ESPN+ streams live events from a variety of sports, such as soccer, hockey, baseball, college sports, golf, tennis, and cricket. The service generates revenue from subscription fees, advertising, and pay-per-view fees, with its subscriber base growing to approximately 26 million by September 2023. This growth highlights the increasing demand for DTC sports content, as consumers shift towards digital platforms for their viewing experience.

International Expansion – ESPN’s Global Reach

Beyond the U.S., ESPN operates approximately 40 sports channels in over 105 countries and territories, making it a major global player in sports broadcasting. These channels, available in four languages, provide coverage of popular international sports like soccer, cricket, and rugby. Many of the channels that were previously branded under Fox Sports have now transitioned to the ESPN brand, further consolidating Disney's presence in the global sports market.

In the Netherlands, for example, ESPN operates through Eredivisie Media & Marketing CV (EMM), in which Disney holds a 51% stake. EMM controls the media and sponsorship rights for the Dutch Premier League, further expanding ESPN’s soccer portfolio. ESPN’s international subscribers totaled approximately 59 million as of September 2023, reflecting its wide global footprint.

Star Sports in India – Dominating the Cricket Market

In India, Disney's sports presence is largely defined by its Star-branded channels, which offer sports content in four languages across ten channels. Star Sports holds rights to a wide array of popular sporting events, with a strong emphasis on cricket—a national passion in India. The channels air international cricket matches, Indian Premier League (IPL) games, and major soccer leagues, providing comprehensive coverage to Indian sports fans. Star Sports had an estimated 82 million subscribers as of September 2023, further demonstrating Disney's dominance in the Indian sports market.

Equity Investments – Expanding Through Partnerships

In addition to its wholly owned channels, Disney holds several equity investments in sports media companies, the most significant of which is its 30% stake in CTV Specialty Television, Inc. in Canada. CTV operates a range of sports and entertainment channels, including The Sports Networks (TSN) and Le Réseau des Sports (RDS), which further extend Disney’s reach into the Canadian market. The financial results of these equity investments are included in Disney’s consolidated operations, providing additional revenue streams and further diversifying its sports media portfolio.

Competition and Seasonality in Disney’s Sports Segment

The sports segment of Disney, primarily driven by ESPN and its associated networks, operates in a highly competitive and seasonal environment. It faces competition for viewers, advertising dollars, distribution deals, and sports rights from a wide array of players in the media and entertainment landscape.

Competition

Viewer and Audience Share: Sports networks like ESPN compete for viewers’ attention not only with other television networks but also with a growing number of digital platforms. Competitors include other sports-focused networks, independent television stations, and media such as direct-to-consumer (DTC) streaming services like Netflix and Amazon Prime Video, which are increasingly entering the sports arena. Additionally, social media platforms, video games, and user-generated content have become formidable rivals, as they vie for the same attention span.

Advertising Revenue: The competition extends into the realm of advertising, where sports networks must compete with various types of media, including other TV networks, independent stations, multichannel video programming distributors (MVPDs), and digital platforms. Advertisers have a wide range of options, including newspapers, magazines, radio, and even billboards, making it critical for ESPN and Star Sports to maintain strong viewership numbers, especially during live sports events, to attract premium advertisers.

Distribution Rights: Another key area of competition is for carriage agreements with MVPDs (cable, satellite, and telecommunications providers), which distribute ESPN and other sports channels. These agreements are periodically renewed or renegotiated, and the evolving market conditions, including the consolidation of cable and satellite operators, can impact Disney’s ability to secure favorable terms. As more consumers shift to streaming services, Disney faces increasing competition from other networks for prime placement and visibility on these platforms.

Sports Rights and Talent: Disney’s sports operations are also in constant competition with other media companies and streaming platforms for broadcasting rights to live sports events. Major sports leagues, such as the NFL, NBA, and MLB, sell exclusive broadcast rights, and Disney must compete with players like NBCUniversal, Fox, and tech companies like Amazon for these coveted contracts. Additionally, the company competes for creative talent, on-air personalities, and production capabilities that are vital to the success of sports broadcasting.

Seasonality

The sports business is highly seasonal, with advertising revenues and viewership fluctuating based on the timing of major sports seasons and events. For instance, ESPN’s advertising revenue is closely tied to the NFL season, college football and basketball seasons, and high-profile events such as the NBA Finals, the Masters, and the College Football Playoff. Sports events also vary in frequency, with some happening annually, while others like the Olympics or the FIFA World Cup occur every two or four years, introducing further variability in revenue patterns.

In addition to seasonality in viewership, affiliate revenues, which are derived from subscriptions through MVPDs, can fluctuate based on subscriber trends. As consumers increasingly opt for cord-cutting or switch to streaming services, these revenues can be affected. Moreover, the timing of sports seasons and events can impact advertising demand, with peak periods often corresponding to major tournaments or playoff seasons.

In summary, Disney’s sports segment operates in a fiercely competitive market where it must consistently secure prime sports rights, attract top talent, and maintain favorable distribution terms to remain a leader. Seasonality adds another layer of complexity, with the timing of sports seasons and events directly influencing revenue streams, particularly from advertising.

Financials + KPI’s

Let's take a closer look at the financials and KPI’s for the Sports segment.

Revenue Streams – Driving the Business of Sports

Disney’s sports operations generate significant revenue from various sources:

Affiliate Fees – Disney charges cable and satellite providers for carrying ESPN and other sports channels. These fees are a crucial revenue stream, given the strong demand for live sports content.

Advertising – Sports programming attracts premium advertising dollars due to its large and engaged viewership. Advertisers value live sports as they tend to draw real-time audiences, reducing the chances of viewers skipping ads.

Subscription Fees – ESPN+ and other DTC platforms generate revenue through monthly subscription fees, as well as from bundled packages with Disney+ and Hulu.

Other Revenues – This includes income from pay-per-view events on ESPN+, sublicensing of sports rights to other broadcasters, and licensing the ESPN brand for merchandise and other uses.

Expenses – The Cost of Sports Broadcasting

Running such a vast sports media operation comes with significant costs, primarily driven by:

Programming and Production Costs – Acquiring the broadcasting rights to major sporting events is a significant expense for Disney. These rights allow ESPN to air premium sports content, but they come at a high cost, often requiring multi-billion-dollar agreements. Additionally, producing live sports broadcasts involves high operational costs, including staffing, production equipment, and technology support.

Technology and Distribution Costs – Operating digital streaming services like ESPN+ requires investment in technology infrastructure and distribution networks to ensure a seamless user experience across different devices.

Marketing and Administrative Expenses – Disney invests heavily in marketing its sports offerings to maintain and grow its audience, as well as to promote its subscription services and pay-per-view events.

When analyzing the revenue streams of Disney's sports segment, affiliate fees represent the largest share of income, followed by advertising revenue, which remains a significant contributor, ahead of subscription fees and other revenue sources. As previously mentioned, these revenues are highly seasonal due to their dependence on major sporting events, leading to fluctuations across quarters. The following charts illustrate these variations.

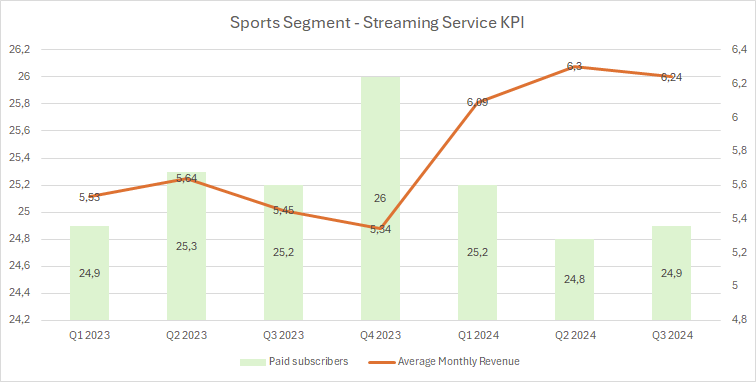

The subscriber base for ESPN+ has shown some fluctuation but has remained relatively stable overall. In Q1 2024, a price increase resulted in a 3% decline in the number of subscribers. However, the average monthly revenue per subscriber rose by nearly 10%, leading to an overall subscription fee increase of approximately 9.7%, which has since stabilized.

In terms of profitability, the operating margin for the sports segment has declined over the past few years, dropping from 17% to around 14%. In absolute figures, this represents an operating income of approximately $2.5 billion. The overall performance of the sports segment can be divided into three main businesses: ESPN Domestic, ESPN International, and Star India.

ESPN Domestic is the clear driver of both profitability and growth within the sports segment. It contributes the largest share of revenues and has seen consistent growth in both revenue and operating income over recent years, maintaining a stable operating margin between 19% and 20%.

ESPN International, however, presents a different picture. Revenue has remained flat since 2022, and the business is currently operating at a loss. This lack of growth, combined with ongoing operating losses, highlights the challenges faced in international markets.

Even more concerning is the Star India business. While India represents a key growth market for the future, Star India has not shown any significant revenue growth and is currently generating substantial losses.

In summary, while Disney's sports segment remains profitable overall, with an operating margin of approximately 14%, the underperformance of ESPN International and Star India is a cause for concern. These two divisions are currently struggling and will require strategic realignment to improve their financial performance and contribute more meaningfully to the segment's overall success.

Competitive strenghts

Disney's sports segment has several competitive strengths that have enabled it to maintain a dominant position in the sports broadcasting and streaming landscape:

Strong Brand Recognition (ESPN)

ESPN is one of the most recognizable and trusted names in sports media globally. It is synonymous with high-quality sports coverage and analysis, which gives Disney a significant edge in retaining both viewers and advertisers. The ESPN brand’s reputation as a leader in sports content, combined with its broad reach across multiple platforms, is a key competitive strength.

Content Portfolio

Disney’s sports segment covers a wide array of sports, from major American leagues (NFL, NBA, MLB, NHL) to international soccer (Premier League, La Liga) and other global sports such as cricket and mixed martial arts. This diversity allows Disney to capture a broad audience, catering to fans across different sports, regions, and demographics. Its ability to secure long-term broadcasting rights for marquee events, such as the College Football Playoff, the Masters, and UFC pay-per-views, is a significant advantage.

Multiple Distribution Channels

Disney’s sports content is distributed across a range of platforms, including traditional television, direct-to-consumer streaming services, and mobile apps. This multi-platform approach enables the company to reach a broad audience. ESPN+, Disney’s sports streaming service, is a leader in the direct-to-consumer (DTC) sports space, offering live events, on-demand content, and original programming. ESPN’s partnership with Hulu and Disney+ further strengthens its DTC offering, making it more attractive to a wide range of subscribers.

Long-Term Sports Rights

One of Disney's strongest competitive advantages lies in its long-term agreements with top sports leagues and events. Securing broadcast rights for high-demand content like the NFL, NBA, and college sports allows ESPN to remain a go-to source for live sports, which are critical for attracting viewers in real-time and commanding premium advertising rates.

Exclusive Content and Bundling

By offering exclusive content on ESPN+, such as UFC pay-per-view events and specialized sports leagues, Disney creates a competitive edge in the streaming market. Bundling ESPN+ with Disney+ and Hulu adds value to subscribers, encouraging them to stay within Disney’s ecosystem rather than turning to competing platforms.

Strong Advertising Appeal

Live sports consistently attract large, engaged audiences, making ESPN a prime advertising platform. Disney’s sports segment benefits from the fact that sports viewers are more likely to watch programming in real-time, limiting ad-skipping and making sports programming particularly valuable to advertisers. The ability to offer premium advertising slots during high-profile sports events strengthens ESPN’s position in the competitive media landscape.

Part III

In Part III of this series, we will take a look at the Experiences segment of The Walt Disney Company.

Thank you once again for being here and for your interest! If you enjoyed my analysis, please consider leaving a "like" and subscribing. Your support means a lot!

Disclaimer: The information provided in this publication is for educational and informational purposes only and does not constitute financial advice. The content is solely reflective of my personal views and opinions based on my research and is not intended to be used as a basis for investment decisions. While every effort is made to ensure that the information is accurate and up-to-date, the writer makes no representations as to the accuracy, completeness, suitability, or validity of any information in this post and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. All readers are advised to conduct their own independent research or consult a professional financial advisor before making any investment decisions. The author is not invested in the mentioned stocks.