Dear Readers,

Thank you for being here and showing interest in my work! Your support means the world to me. If you enjoyed this article and would like to see more, please consider subscribing and giving it a like—it really helps grow our community of investors.

Thank you for your continued support!

Please read the disclaimer at the end of this article. This is not an investment advice!

Welcome to episode 3 of the “World’s best stocks”. Let’s continue to search for the best stocks in the world. As for the first two episodes, I used the Finchat (Affiliate Link) screener with the following filters:

ROIC 10Y Average >= 15%

Revenue 10Y CAGR >=10%

Diluted EPS before extra items 10Y CAGR >= 10%

Net Debt/EBITDA =<3

EPS Forward 2Y CAGR >=10%

But for this post I also filtered for Japanese companies. Only seven companies came up, and I want to share three that I found most interesting.

#1 Keyence Corporation

ROIC 10Y Average = 26.67%

Revenue 10Y CAGR = 13.51%

Diluted EPS before extra items 10Y CAGR = 15.19%

Net Debt/EBITDA = -2.14

EPS Forward 2Y CAGR = 11.19%

Market Cap = $107.7 billion

Total Return last 10Y = 476%

Forward P/E = 36.91

Keyence Corporation is a Japanese multinational company that specializes in automation and sensor technology. Founded in 1974, Keyence provides a wide range of products, including sensors, machine vision systems, barcode readers, and measuring instruments. It serves industries like automotive, electronics, and manufacturing, offering solutions for factory automation and quality control. The company is known for its innovation, high-quality products, and rapid delivery services, as it keeps most products in stock for quick shipment. Headquartered in Osaka, Keyence has a strong global presence, with offices and distributors in over 40 countries.

First thoughts

Keyence was a familiar name to me, but I had never delved deeply into the numbers before. Their profitability and returns are quite impressive. Since Japan implemented new corporate governance rules in recent years, the stock has also performed very well. I appreciate the company's lean business model, which generates a high free cash flow (FCF) margin. While the projected EPS growth over the next two years looks strong, the Forward P/E of 36.91 seems pricey to me. Keyence has the potential for share buybacks, given that one-third of its assets are in cash and short-term investments, but I couldn’t find any indication of a buyback program—typical of many Japanese companies.

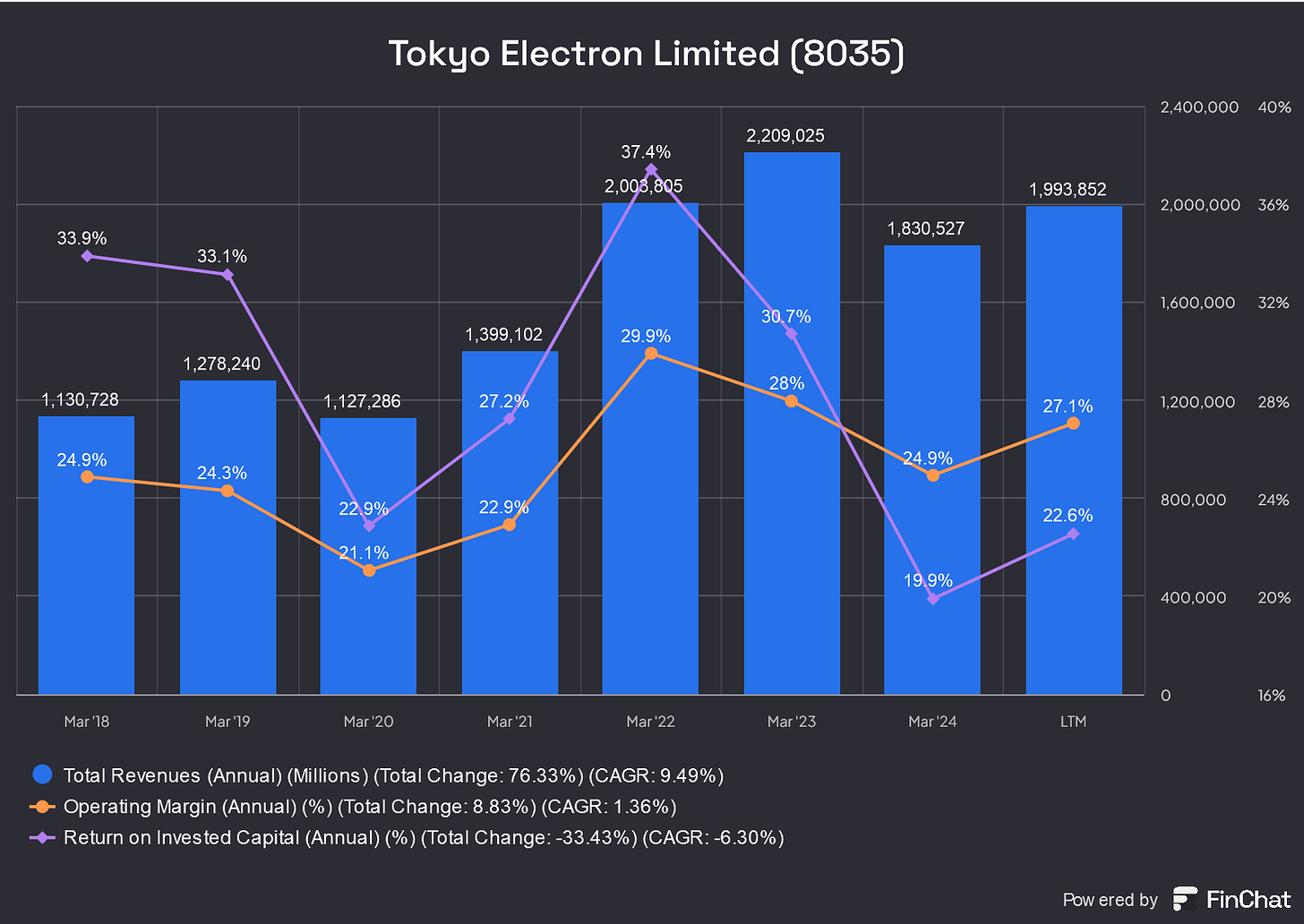

#2 Tokyo Electron Limited

ROIC 10Y Average = 27.51%

Revenue 10Y CAGR = 11.69%

Diluted EPS before extra items 10Y CAGR = 59.62%

Net Debt/EBITDA = -0.74

EPS Forward 2Y CAGR = 29.98%

Market Cap = $71.7 billion

Total Return last 10Y = 1,125%

Forward P/E = 20.31

Tokyo Electron (TEL) is a leading Japanese company in the semiconductor and electronics manufacturing industry. Founded in 1963, the company specializes in the development, production, and sale of equipment used in semiconductor and flat-panel display production. TEL's products include devices for wafer processing, test and inspection, and chip packaging, serving major global tech companies involved in semiconductor manufacturing. The company plays a key role in the global supply chain for advanced technologies such as smartphones, computers, and other electronic devices and is headquartered in Tokyo.

First thoughts

The semiconductor industry, including companies like Tokyo Electron, is an area I don’t feel entirely comfortable with as it falls outside my circle of competence. For those with a better understanding of the industry, I would definitely recommend adding this company to their watchlist. A Forward P/E of 20.31 for a company of this caliber, at least judging by its financials, doesn’t seem unreasonable. It might be worth considering for those more familiar with the space.

#3 MonotaRO Co. Ltd.

ROIC 10Y Average = 30.01%

Revenue 10Y CAGR = 21.05%

Diluted EPS before extra items 10Y CAGR = 26.16%

Net Debt/EBITDA = -0.46

EPS Forward 2Y CAGR = 16.55%

Market Cap = $8.8 billion

Total Return last 10Y = 656%

Forward P/E = 45.39

MonotaRO Co., Ltd. is a Japanese e-commerce company that specializes in supplying industrial and maintenance, repair, and operations (MRO) products. Founded in 2000, the company offers a vast online catalog of tools, safety equipment, office supplies, and other industrial goods, primarily targeting small to medium-sized enterprises (SMEs). MonotaRO’s business model focuses on digital sales and efficient logistics, allowing customers to conveniently order products from its platform with fast delivery. It has become a leader in Japan’s industrial supply market by leveraging its data-driven approach to inventory management and customer service. The company is headquartered in Amagasaki, Japan, and has expanded its operations internationally, with a growing presence in Asia and beyond.

First thoughts

I hadn't heard of this company before, but I'm convinced it's worth a deeper look given its impressive financials. However, at first glance, the Forward P/E of 45.39 seems quite expensive. While the company’s performance is strong, such a high valuation raises concerns about whether its future growth can justify the premium. Further analysis would be needed to determine if the fundamentals support this elevated price.

Thank you once again for being here and for your interest! If you enjoyed my analysis, please consider leaving a "like" and subscribing. Your support means a lot!

Disclaimer: The information provided in this publication is for educational and informational purposes only and does not constitute financial advice. The content is solely reflective of my personal views and opinions based on my research and is not intended to be used as a basis for investment decisions. While every effort is made to ensure that the information is accurate and up-to-date, the writer makes no representations as to the accuracy, completeness, suitability, or validity of any information in this post and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. All readers are advised to conduct their own independent research or consult a professional financial advisor before making any investment decisions. The author is not invested in the mentioned stocks.