Dear Readers,

Thank you for being here and showing interest in my work! Your support means the world to me. If you enjoyed this article and would like to see more, please consider subscribing and giving it a like—it really helps grow our community of investors. Thank you for your continued support!

Please read the disclaimer at the end of this article. This is not an investment advice!

About Meta

Meta Platforms Inc., META 0.00%↑ formerly known as Facebook, Inc., is a prominent technology company that focuses on social media and virtual reality services. Founded by Mark Zuckerberg in 2004 as Facebook, the company rebranded to Meta in October 2021 to highlight its shift towards the evolving concept of the "metaverse." Meta's key platforms include Facebook, one of the largest social networking sites globally, allowing users to share updates, photos, and messages; Instagram, acquired in 2012, which is a popular photo and video-sharing platform; WhatsApp, a messaging application bought in 2014 that offers encrypted communication and is widely used for personal and business purposes; Messenger, originally Facebook's chat feature turned standalone messaging app; and Threads, launched by Instagram in 2023 to compete with Twitter/X as a microblogging platform.

Meta has made substantial investments in the development of the metaverse, a network of interconnected virtual worlds where users can interact in immersive, 3D environments. Virtual spaces like Horizon Worlds and Horizon Workrooms are designed for social interaction and work collaboration, supported by Meta’s virtual reality hardware, Meta Quest (formerly Oculus), which powers these experiences along with gaming and entertainment applications.

A major source of Meta's revenue comes from digital advertising across its platforms. The company leverages vast amounts of user data to deliver highly targeted ads, making its ad platform especially valuable for businesses, including small and medium-sized enterprises seeking to reach specific audiences.

I believe this offers a strong general overview of Meta's business, as most investors are likely familiar with the company's core elements. Now, let's dive into the financials and, most importantly, the stock's valuation.

Financials and KPI’s

Meta's profitability, returns, and growth over the past few years have been exceptional. Over the last five years, Meta has achieved a compound annual growth rate (CAGR) of 19.1% in revenue and 27% in earnings per share (EPS). The company remains debt-free and continues to generate substantial free cash flow, even while making significant investments in unprofitable ventures like the metaverse and its still-evolving AI initiatives. Despite these heavy expenditures, Meta's core business remains highly profitable, demonstrating its ability to balance growth with strategic long-term investments.

The scale of daily active users across Meta's apps is astounding. A staggering 3.27 billion people use their platforms, which accounts for roughly 40% of the global population, assuming a world population of 8 billion. This reach highlights Meta’s unparalleled influence and dominance in the digital space.

Share Repurchases and Dividends

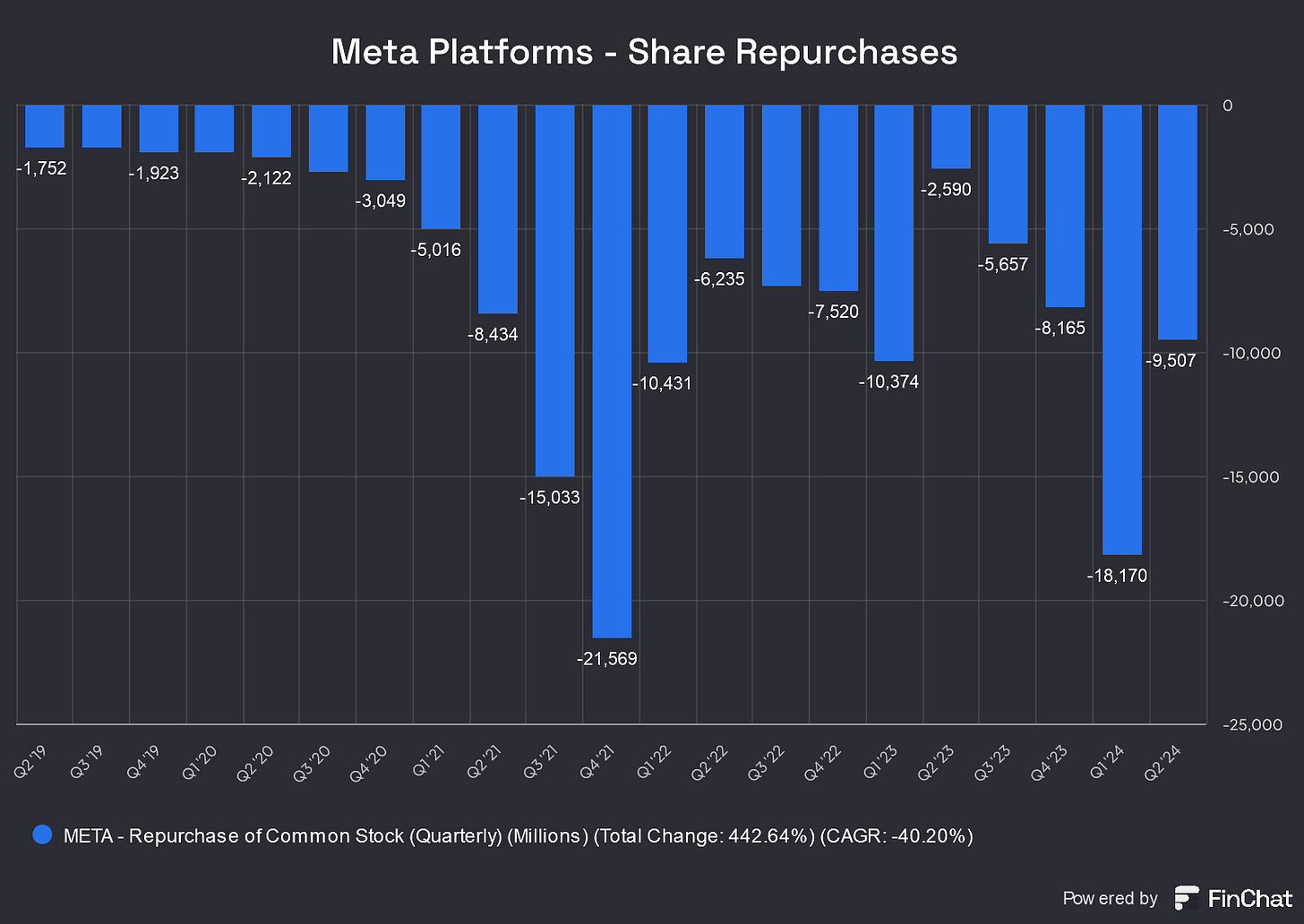

In Q1 2024, Meta paid out a dividend for the first time, amounting to $0.50 per share, with a dividend yield of approximately 0.4%. I believe this dividend will be increased regularly in the coming years, making it an attractive opportunity for both income-focused and dividend growth investors. However, what’s even more significant for Meta is its share repurchase program. The current program still has $60 billion available and authorized, and it is likely to be further expanded. From 2019 through the end of 2023, Meta spent an impressive $141 billion on share buybacks, a substantial amount. Since Q1 2019, the company has reduced its outstanding shares by roughly 11%, highlighting the impact of these buybacks.

Now, let's turn our attention to Meta's stock valuation.

Stock Valuation

Base Case Assumptions

The narrative is built on the core assumption that Meta's apps will maintain their dominance, with the number of daily active people (DAPs) either slightly increasing or remaining near current levels. Average revenue per user (ARPU) is expected to grow, particularly in markets outside of North America. The metaverse and AI ventures are not projected to contribute significantly to Meta’s income growth in the near term. Meanwhile, the company is anticipated to steadily increase its dividend payments and continue executing substantial share buybacks.

Revenue Growth

In the DCF Model, a five-year detailed planning period is used, projecting a 9.7% Compound Annual Growth Rate (CAGR). This trajectory anticipates Meta’s revenue to reach about $238 billion in FY 2029.

EBIT Margin

In the last twelve months, Meta’s EBIT margin was 41.2%. For the DCF Model, I have normalized this margin to an average of 40.0%.

Normalized Net Income Margin

Based on the EBIT margin, the Last Twelve Months (LTM) Normalized Net Income margin stands at 34.3%. Moving forward, it is estimated to stabilize around 33.2%.

Free Cash Flow

My Free Cash Flow assumptions include a Net Capex ratio as a percentage of sales (Net Capex = Capex - Depreciation) of 11.5%, reflecting the average of recent years. Working Capital, expressed as a percentage of sales, is determined by the average Working Capital over the past years, calculated at 2.2% of net sales. The Free Cash Flow estimation does not adjust for stock-based compensation. This results into a normalized free cash flow margin of about 21.0%.

WACC

The Weighted Average Cost of Capital (WACC) is set at 8.0%.

Results

Based on these assumptions, Meta’s equity value is estimated at $1,030 billion. Dividing this by the current number of shares, we derive a fair value per share of $407. In comparison to its latest stock price of $524 the stock appears significantly overvalued.

Adjusting the WACC to 8.5% would lower the fair value per share to $363, while a decrease in WACC to 7.0% would increase it to $463 per share.

Scenarios

Bull Case Scenario:

In an optimistic scenario, assuming a CAGR for revenue of 11.8%, an EBIT Margin of 45.7%, and a normalized net income margin of 35.2%, the fair value per share would be $461. In this scenario the stock appears to be overvalued, too.

Bear Case Scenario:

Conversely, in a pessimistic scenario with a CAGR for revenue of 7.4%, an EBIT Margin of 34.4%, and a normalized net income margin of 31.2%, the fair value per share would be $402. In this scenario the stock also appears to be overvalued.

P/E and EV/EBIT

To further validate the valuation estimate, let’s consider my preferred metrics: forward EV/EBIT and P/E ratios. Over the past five years, the average P/E ratio was approximately 22.39x, while the current P/E stands at 23.21x. Similarly, the average EV/EBIT ratio was 17.46x, and it has now risen to 19.39x. These metrics align with my DCF valuation, reinforcing the view that the stock is somewhat overvalued. Overall, I would conclude that Meta’s stock is currently slightly overvalued.

Conclusion

I think we can all agree that Meta is a high-quality company with exceptional financials. Its apps, like Instagram and WhatsApp, are used by billions of people worldwide. While it's important to acknowledge the negative impacts of social media, such as its effects on children and the spread of misinformation, these issues aren't the focus here, as we're concentrating on the business and stock performance. I believe Meta’s apps will continue to play a significant role in our lives moving forward.

The metaverse, though still a major investment for the company, seems to be a project with an uncertain future. To me, it feels like Meta might be chasing a dead end, and I’m not confident these massive investments will ever fully pay off. Additionally, the returns from Meta’s heavy investments in AI remain to be seen, and I don't expect any significant impact in the near term based on my valuation assumptions.

The stock has surged over 300% from its lows at the end of 2022 and early 2023, now trading close to its all-time high. In my view, the stock is slightly overvalued at current levels. While I am invested in Meta and plan to hold my position, I am not adding to it at these valuations.

Thank you once again for being here and for your interest! If you enjoyed my analysis, please consider leaving a "like" and subscribing. Your support means a lot!

Disclaimer: The information provided in this publication is for educational and informational purposes only and does not constitute financial advice. The content is solely reflective of my personal views and opinions based on my research and is not intended to be used as a basis for investment decisions. While every effort is made to ensure that the information is accurate and up-to-date, the writer makes no representations as to the accuracy, completeness, suitability, or validity of any information in this post and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. All readers are advised to conduct their own independent research or consult a professional financial advisor before making any investment decisions. The author is invested in the mentioned stock.