Dear Readers,

Thank you for being here and showing interest in my work! Your support means the world to me. If you enjoyed this article and would like to see more, please consider subscribing and giving it a like—it really helps grow our community of investors.

Thank you for your continued support!

Please read the disclaimer at the end of this article. This is not an investment advice!

Welcome to part 3 of the 5-part Disney DIS 0.00%↑ analysis series.

Part 1: General Overview and Entertainment Segment

Part 2: Sports Segment

Part 3: Experiences Segment

Part 4: Group Financials and recents developments

Part 5: Outlook, Valuation and Conclusion

In this part, we will take a closer look at the Experience segment of The Walt Disney Company. If you missed part 1 or part 2:

Experiences Segment

The Walt Disney Company’s Experiences segment encompasses a broad range of entertainment offerings, including theme parks, cruises, resorts, and vacation experiences. Central to this segment are the Disney Parks and Resorts, which are located around the world.

In Florida, the Walt Disney World Resort includes four major theme parks: Magic Kingdom, EPCOT, Disney’s Hollywood Studios, and Disney’s Animal Kingdom. These parks feature a variety of attractions and experiences, along with over 18 resort hotels, vacation properties, the Disney Springs shopping district, golf courses, water parks, and a sports complex.

In California, the Disneyland Resort includes the original Disneyland Park and Disney California Adventure, with a mix of fantasy and adventure. Internationally, Disneyland Paris, Hong Kong Disneyland, and Shanghai Disney Resort each blend local culture with Disney’s storytelling. In Tokyo, Tokyo Disney Resort operates under a licensing agreement.

Disney Cruise Line offers cruises designed for families, with five ships catering to different age groups through entertainment, dining, and relaxation options. The fleet is expanding with new ships like the Disney Treasure and Disney Adventure.

The Disney Vacation Club (DVC) offers a timeshare program across 16 resort locations, including properties in Walt Disney World, Disneyland, Aulani in Hawaii, and more, with accommodations ranging from studios to villas.

Adventures by Disney and National Geographic Expeditions offer guided travel experiences focused on natural and cultural exploration, led by expert guides.

The Experiences segment generates revenue through park admissions, resort stays, vacation packages, cruise services, and merchandise sales. Disney also licenses its intellectual property for a variety of consumer products.

Lets have a closer look into some aspects of the Experience segment. It is managed through two business lines: Parks & Experiences and Consumer Products.

Parks & Experiences

Parks & Resorts

The Walt Disney World Resort in Florida spans 25,000 acres and features four theme parks: Magic Kingdom, EPCOT, Disney’s Hollywood Studios, and Disney’s Animal Kingdom. In addition to the parks, it offers 18 hotels, vacation properties, and a 120-acre Disney Springs retail district. The resort also hosts recreational activities such as golf, water parks, and the ESPN Wide World of Sports Complex.

The Disneyland Resort in Anaheim, California covers 489 acres and includes Disneyland Park and Disney California Adventure, along with three hotels and the Downtown Disney shopping and entertainment district. Disneyland features classic themed lands, while California Adventure offers areas like Avengers Campus and Cars Land.

Aulani, a Disney Resort & Spa in Oahu, Hawaii, is a 21-acre oceanfront resort blending Hawaiian culture and Disney amenities. It includes 350 hotel rooms, an 18,000-square-foot spa, and 480 vacation club units, offering a relaxing family retreat.

Disneyland Paris, located near Paris, spans 5,200 acres with two parks: Disneyland Park and Walt Disney Studios Park. The resort features seven hotels, 250,000 square feet of conference space, and the Disney Village shopping and dining area.

The Asia Theme Parks—Hong Kong Disneyland Resort and Shanghai Disney Resort—are included in Disney’s financials as variable interest entities (VIEs), where Disney holds less than 50% ownership but manages operations and earns fees.

Hong Kong Disneyland Resort, co-owned by Disney and the Government of Hong Kong, covers 310 acres with eight themed areas including Adventureland, Fantasyland, and World of Frozen. The resort also offers three hotels and conference facilities.

Shanghai Disney Resort, a 1,000-acre joint venture between Disney and Shanghai Shendi Group, features seven themed lands, including Adventure Isle and Tomorrowland, with two hotels and a third under construction. An eighth area, Zootopia, will open in 2023.

Tokyo Disney Resort, located six miles east of Tokyo, spans 494 acres and is owned and operated by Oriental Land Co., Ltd. (OLC). The Walt Disney Company earns royalties from the resort's revenues. The resort also includes five Disney-branded hotels, offering over 3,000 rooms, a monorail, and a shopping and entertainment complex called Ikspiari. A 475-room hotel is under construction at Tokyo DisneySea, expected to open in 2024.

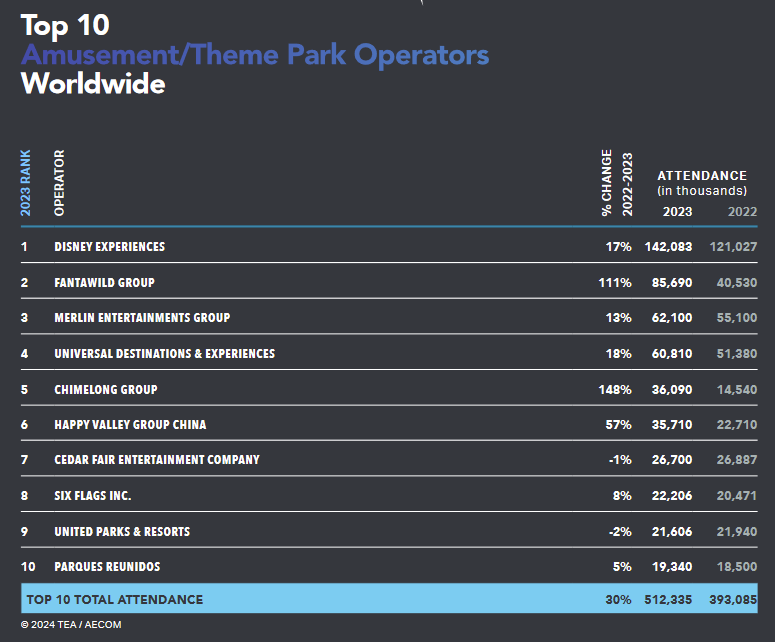

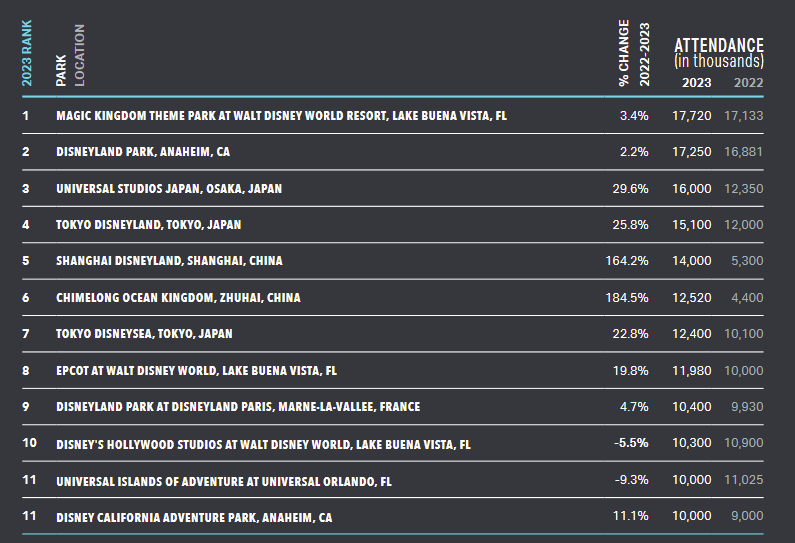

Attendance

The 2023 AECOM Theme Index Report (Link) highlights Disney Parks and Resorts as the dominant force in the global theme park industry. Magic Kingdom continues to be the most visited park in the world, drawing 17.7 million visitors in 2023, maintaining its 18-year streak at the top. Disneyland in California follows closely behind with 17.25 million visitors. In total, eight out of the top ten most visited theme parks globally are Disney parks.

The report also highlights significant growth at certain Disney parks, such as EPCOT, which saw a nearly 20% increase in attendance, largely driven by new attractions like Guardians of the Galaxy: Cosmic Rewind. On the international front, Shanghai Disneyland experienced a dramatic rise in attendance, jumping from 10th to 5th place globally, with a 164% increase in visitors compared to the previous year.

Overall, Disney’s strategy of continuous investment in new attractions and experiences, as well as the lifting of pandemic-related travel restrictions, has led to a strong recovery for its parks worldwide

Disney Cruise Line

Disney Cruise Line operates five ships across North America, Europe, and the South Pacific, catering to families with themed areas for children, teens, and adults. The fleet includes Disney Magic and Disney Wonder (85,000 tons, 875 staterooms each), Disney Dream and Disney Fantasy (130,000 tons, 1,250 staterooms each), and Disney Wish (140,000 tons, 1,250 staterooms). Many cruises include a stop at Castaway Cay, a private Bahamian island.

The fleet is expanding with Disney Treasure and Disney Adventure (2025), and an eighth ship (2026). The Disney Treasure and the eighth ship will be 140,000 tons with 1,250 staterooms, while the Disney Adventure will be 200,000 tons with 2,100 staterooms and will operate in Southeast Asia. Additionally, Disney Lookout Cay at Lighthouse Point on Eleuthera Island will open as a new destination in summer 2024.

Consumer Products

Consumer Products at The Walt Disney Company include licensing and retail operations. Through licensing, Disney earns royalties from third-party products across categories like toys, apparel, home décor, accessories, electronics, and more, using characters from popular franchises such as Mickey and Friends, Star Wars, Spider-Man, Disney Princess, and Frozen.

In retail, Disney sells branded products via shopDisney websites and Disney Store locations. As of September 30, 2023, Disney operates 40 stores in Japan, 20 in North America, 2 in Europe, and 1 in China. Disney also creates and publishes books, comic books, and other products based on its franchises in various countries and languages.

Financials and KPI’s

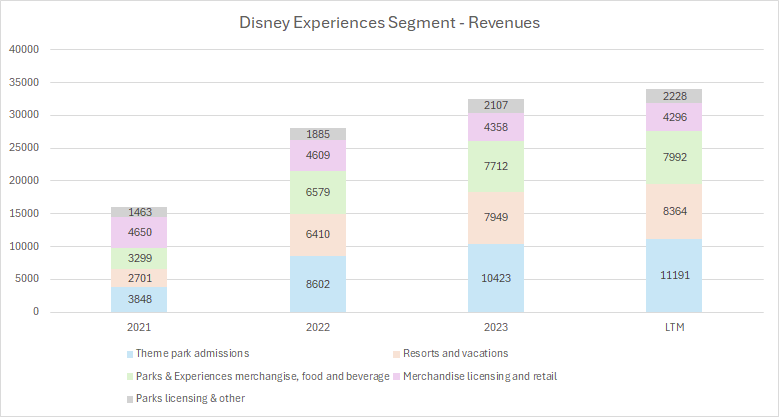

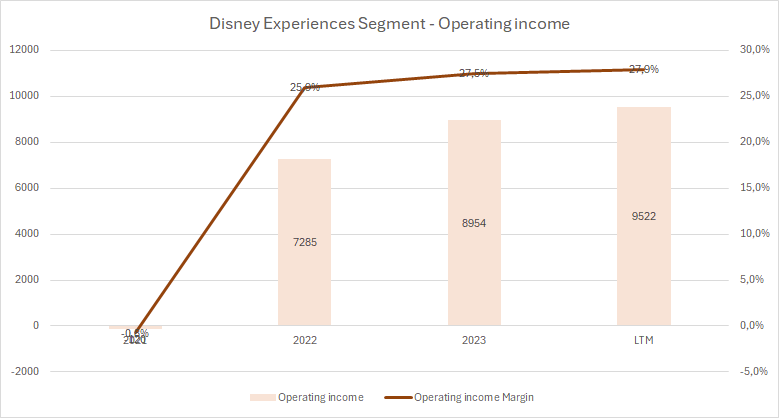

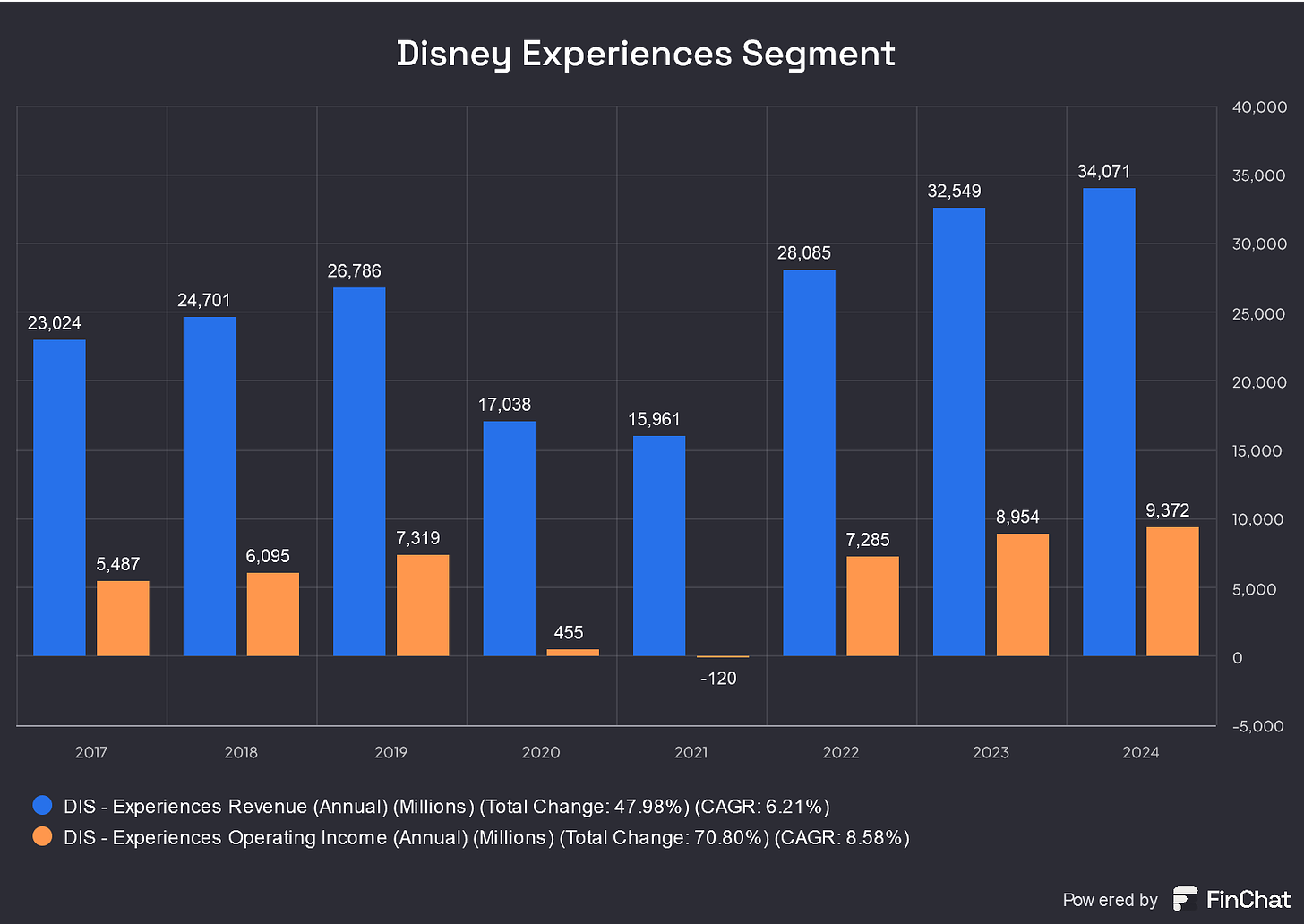

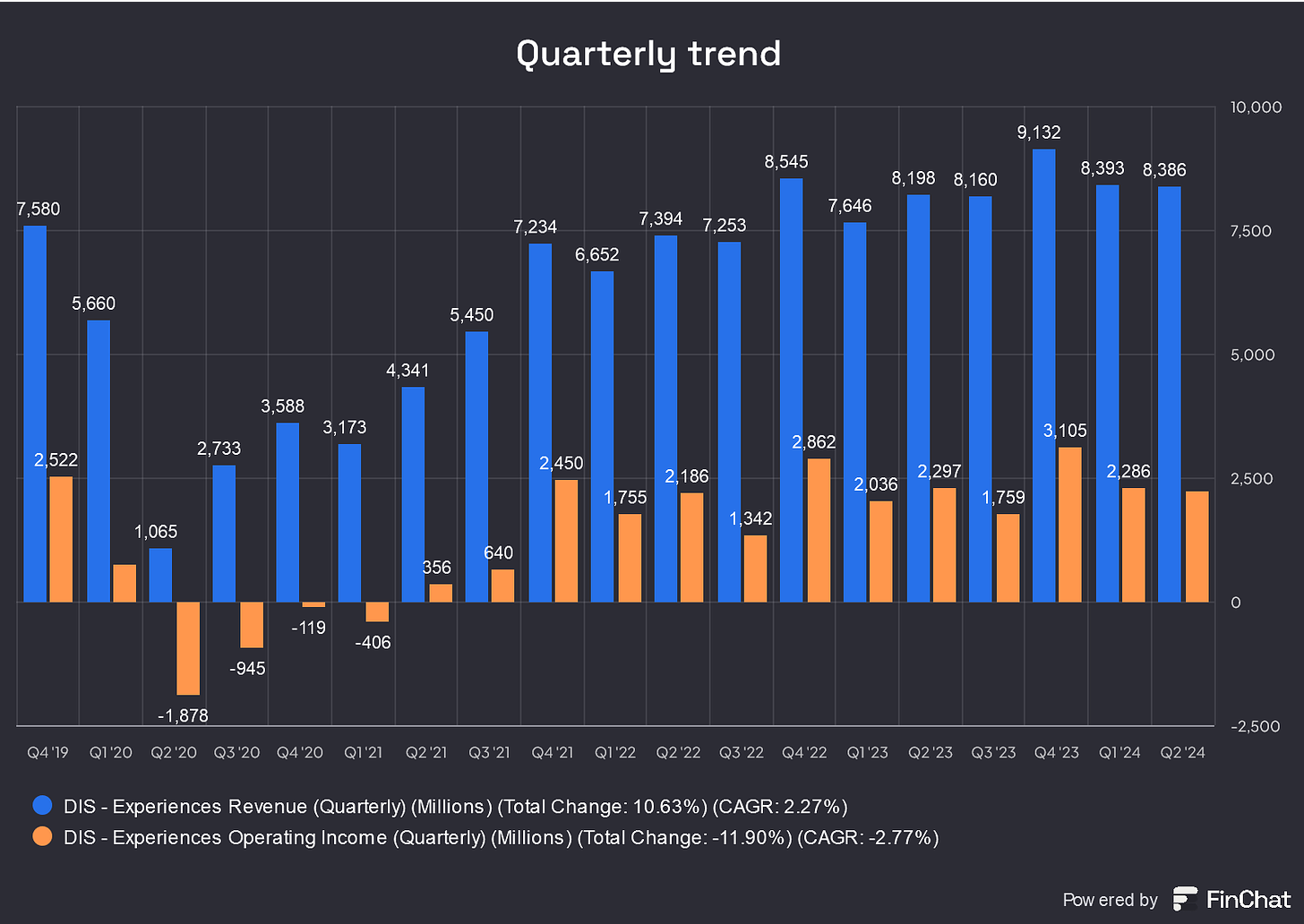

In the past twelve months, Disney's Experiences Segment generated approximately $34 billion in revenue and $9.4 billion in operating income, achieving a strong operating margin of 27.5%. While the segment is highly profitable for Disney, it was significantly impacted during the COVID-19 pandemic in 2020 and 2021, when park closures and limited operations severely affected performance. However, since 2022, the segment has shown an impressive recovery, returning to robust growth and profitability.

The revenue streams for this segment include:

Theme park admissions (32.8% share of revenue)

Resorts and vacations (24.5%)

Parks & Experiences merchandise, food and beverage (23.4%)

Merchandise licensing and retail (12.6%)

Parks licensing & other (6.5%)

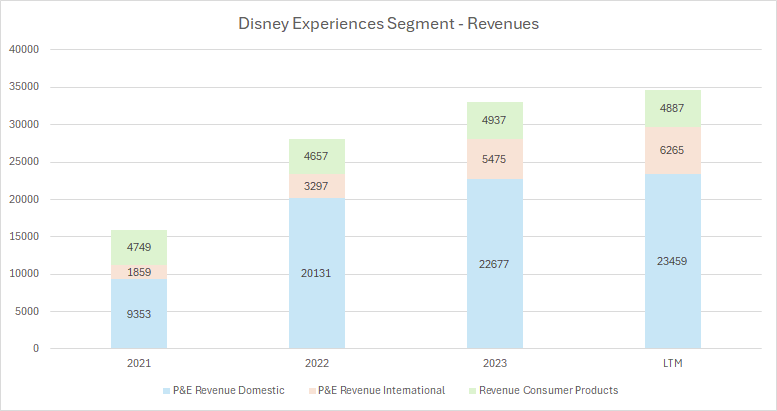

Disney further breaks down its revenue for this segment into two categories: Parks and Experiences (P&E) and Consumer Products. Within the P&E category, the company distinguishes between domestic and international revenues. The majority of sales are generated by the domestic (U.S.) parks, while international parks are now the second-largest contributor. Consumer Products account for nearly $5 billion of the segment’s overall net sales.

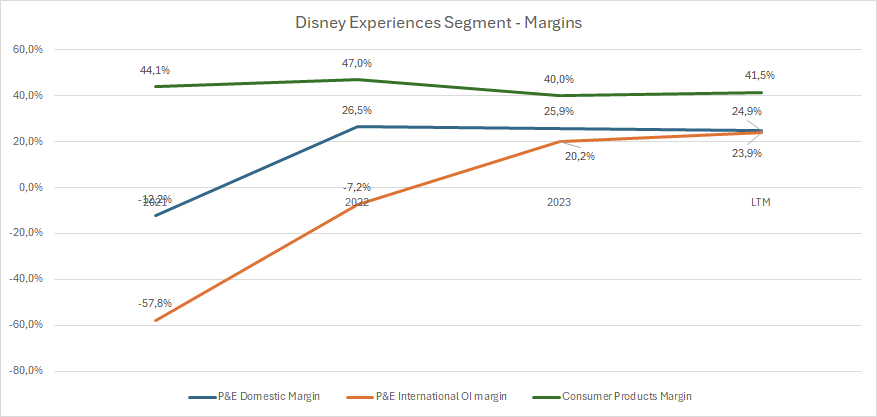

During the pandemic, operating income mirrored the decline in revenue, turning negative in 2021. However, it has since rebounded significantly, reaching $9.5 billion over the past twelve months, with a strong operating margin of 27.9%.Although the Consumer Products division contributes the smallest share of revenue, it is the most profitable, boasting an operating margin of over 40%, a level maintained even during the pandemic. The domestic Parks & Experiences segment operates with a margin of approximately 25%, showing a slight negative trend. Meanwhile, the international Parks & Experiences segment took longer to recover but has now nearly matched the profitability of its domestic counterpart.

Although the Consumer Products division contributes the smallest share of revenue, it is the most profitable, boasting an operating margin of over 40%, a level maintained even during the pandemic. The domestic Parks & Experiences segment operates with a margin of approximately 25%, showing a slight negative trend. Meanwhile, the international Parks & Experiences segment took longer to recover but has now nearly matched the profitability of its domestic counterpart.

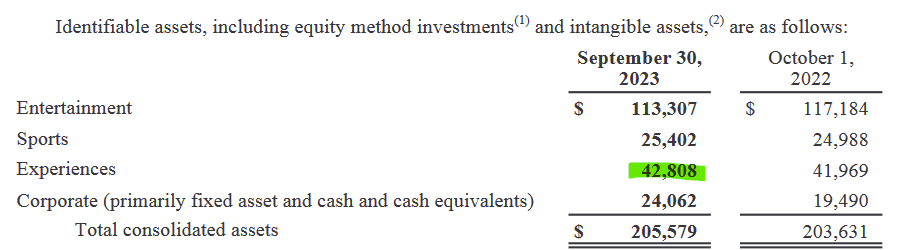

As of September 30, 2023, the Experiences segment holds total assets of nearly $43 billion. This translates to an impressive return on assets (ROA) of approximately 21%, a strong indicator of the segment's efficiency and profitability.

The Experiences segment is a major contributor to Disney’s operating income and remains highly profitable, though its overall growth is moderate. Since 2017, the segment's revenue has grown at a compound annual growth rate (CAGR) of 6.2%, while operating income has increased at a slightly higher CAGR of 8.6%, reflecting steady but measured expansion.

Competition and Seasonality

Disney's theme parks, resorts, Disney Cruise Line, and Disney Vacation Club face competition from various forms of entertainment, lodging, and tourism. Factors beyond their control, such as economic conditions, health concerns, political environments, travel trends, oil prices, and weather, can influence profitability. The licensing and retail business competes with other licensors, publishers, and retailers of character-based products, home entertainment, and children’s merchandise.

Disney’s theme parks and resorts operate year-round, with peak attendance during summer, winter, and spring holidays. Revenues often increase during major celebrations like park anniversaries. The licensing, retail, and wholesale segments see higher revenues in the first and fourth fiscal quarters, driven by seasonal consumer spending and key releases in film, games, and TV programming.

Competitive strengh

Disney's Experiences segment has a significant competitive advantage, or moat, built on several key strengths. First and foremost is the company's vast portfolio of iconic intellectual property (IP), including globally recognized franchises like Mickey Mouse, Star Wars, Marvel, and Frozen. These characters and stories are integrated into Disney’s theme parks, resorts, and cruises, creating a powerful emotional connection with visitors that is hard for competitors to replicate.

The second major advantage is the ability to deliver unique, immersive experiences. Disney’s theme parks and resorts are meticulously designed to blend storytelling with cutting-edge technology, offering attractions like Star Wars: Galaxy's Edge and Pandora - The World of Avatar that immerse visitors in magical worlds. These experiences, which go beyond typical amusement parks, set Disney apart.

Disney’s global footprint is another strength. With theme parks in the US, France, China, and Japan, Disney has access to a broad, diversified customer base. This international presence helps mitigate risks associated with local economic conditions or competition in any one region.

Additionally, Disney benefits from vertical integration, allowing it to leverage its characters and stories across multiple platforms. Movies, TV shows, and characters created in its studios are seamlessly incorporated into theme parks, merchandise, and cruises, which enhances customer engagement and deepens brand loyalty.

Disney’s exclusive locations and resorts also add to its competitive edge. Unique offerings like Castaway Cay (a private island for Disney Cruise Line guests) and exclusive on-site theme park hotels offer one-of-a-kind experiences that can't be found elsewhere. Programs like Disney Vacation Club and Adventures by Disney further enhance this exclusivity, providing specialized vacation experiences.

The company’s strong brand trust and customer loyalty also play a key role. Disney is known for providing family-friendly entertainment with a focus on quality service, which fosters strong customer loyalty. Many visitors are repeat guests, seeing Disney vacations as a premium, trusted experience.

Finally, Disney’s operational excellence gives it a distinct advantage. From effective crowd management to personalized guest services, Disney’s parks are designed to provide seamless and enjoyable experiences, making them more efficient and enjoyable than many competitors.

Part IV

In Part IV of this series, we will take a look at the Group Financials and recents developments.

Thank you once again for being here and for your interest! If you enjoyed my analysis, please consider leaving a "like" and subscribing. Your support means a lot!

Disclaimer: The information provided in this publication is for educational and informational purposes only and does not constitute financial advice. The content is solely reflective of my personal views and opinions based on my research and is not intended to be used as a basis for investment decisions. While every effort is made to ensure that the information is accurate and up-to-date, the writer makes no representations as to the accuracy, completeness, suitability, or validity of any information in this post and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. All readers are advised to conduct their own independent research or consult a professional financial advisor before making any investment decisions. The author is not invested in the mentioned stocks.