Dear Readers,

Thank you for being here and showing interest in my work! Your support means the world to me. If you enjoyed this article and would like to see more, please consider subscribing and giving it a like—it really helps grow our community of investors. Thank you for your continued support!

Please read the disclaimer at the end of this article. This is not an investment advice!

Welcome to part 4 of the 5-part Disney DIS 0.00%↑ analysis series.

Part 1: General Overview and Entertainment Segment

Part 2: Sports Segment

Part 3: Experiences Segment

Part 4: Group Financials and recent developments

Part 5: Outlook, Valuation and Conclusion

In this part, we will take a closer at the FY 2024 performance of The Walt Disney Company and the development of the overall Group Financials in the last decade. If you missed part 1 or part 2:

Group Financials and recent developments

FY 2024 Results

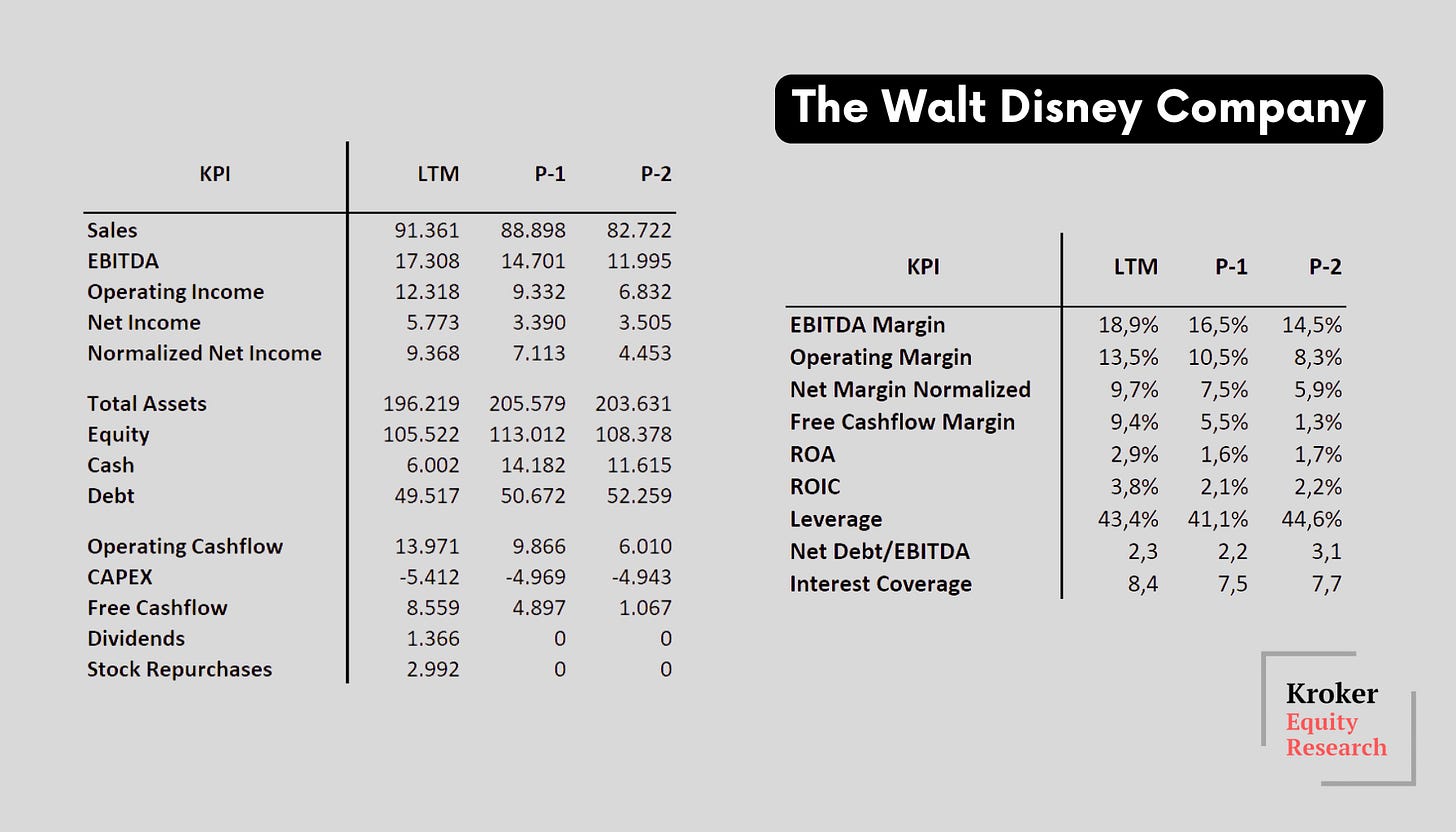

The Walt Disney Company reported solid financial performance for fiscal year 2024, characterized by steady revenue growth and improved profitability. Full-year revenues increased by 3% to $91.4 billion, driven by strong contributions from the Direct-to-Consumer (DTC) and Experiences segments. Operating income rose 21% to $15.6 billion, and diluted earnings per share (EPS) more than doubled to $2.72, compared to $1.29 in the prior year.

Cash flow also showed significant improvement. Cash provided by operations grew 42% year-over-year to $14 billion, reflecting better overall performance across business segments. Free cash flow nearly doubled, increasing by 75% to $8.6 billion, driven by strong cash generation in the Experiences segment and improved profitability in the DTC division.

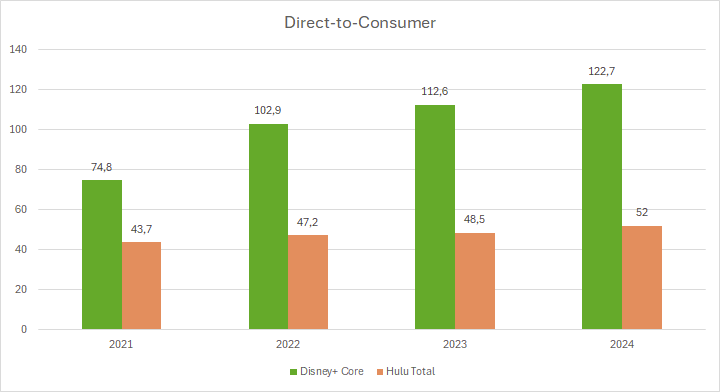

The Entertainment segment, bolstered by the DTC business, demonstrated a strong recovery. DTC revenues grew 15% for the year, reaching $22.78 billion, with the segment achieving profitability in the fourth quarter. Subscriber numbers for Disney+ Core and Hulu combined reached 174 million by year-end, supported by robust adoption of ad-supported tiers and international growth.

The Experiences segment, including theme parks, resorts, and cruise lines, achieved record revenues of $34.1 billion, up 5% from the prior year. Operating income grew by 4% to $9.3 billion. Domestic parks benefited from increased guest spending and stable attendance, while international parks faced headwinds from economic and geopolitical factors. Disney Cruise Line expanded its operations, with plans to double its fleet by 2031 further supporting long-term growth.

The Sports segment, led by ESPN, maintained stable revenues but faced a 2% decline in full-year operating income, ending at $2.41 billion. While domestic operations benefited from higher advertising revenues, increased programming costs and challenges in international markets, such as India, weighed on overall profitability.

Despite these successes, the Linear Networks division continued to face challenges, with declining revenues and profitability due to reduced affiliate and advertising revenues and industry-wide shifts away from traditional broadcasting. Let’s have a closer look at each segment

Entertainment Segment and the DTC Business

Disney’s Entertainment segment delivered a strong performance in fiscal year 2024, showcasing its ability to adapt and thrive in an evolving media landscape. Segment revenues surged 14% in Q4, reaching $10.83 billion, and grew 1% for the full year to $41.19 billion. This growth translated into a remarkable improvement in operating income, which soared to $1.07 billion in Q4, compared to $236 million in the same quarter last year.

The Direct-to-Consumer (DTC) division was a standout contributor, with revenues climbing 15% in both Q4 and the full year, reaching $5.78 billion and $22.78 billion, respectively. This growth was underpinned by a major turnaround in profitability, as DTC operating income hit $253 million in Q4, a sharp contrast to the $420 million loss in the prior-year quarter. Notably, Disney+ Core and Hulu combined to end the year with 174 million subscriptions, with Disney+ adding 4.4 million subscribers in Q4 alone.

Content Sales and Licensing also played a pivotal role, with revenues jumping 39% in Q4 to $2.59 billion. Blockbusters like Inside Out 2 and Deadpool & Wolverine shattered box office records and drove operating income in this category to $316 million in Q4, up from a loss of $149 million in the same period last year. These successes underscored the enduring strength of Disney's theatrical releases and intellectual properties.

However, not all areas performed equally well. The Linear Networks division continued to face challenges, with Q4 revenues declining 6% to $2.46 billion and operating income falling 38% to $498 million. This downturn was driven by reduced affiliate and advertising revenues alongside rising marketing expenses, reflecting ongoing pressures in traditional broadcasting.

Despite these hurdles, Disney made significant strides in streaming profitability. The DTC segment, encompassing Disney+, Hulu, and ESPN+, collectively achieved $321 million in operating income for Q4, marking a substantial recovery from a $387 million loss in the prior year. This progress demonstrates Disney’s ability to leverage its vast content library and adapt to consumer demand for on-demand streaming services.

Creatively, Disney shone brighter than ever, earning a record-breaking 60 Emmy Awards, a testament to the quality and innovation of its television content. These accolades, combined with the segment’s financial performance, highlight Disney's ability to set new benchmarks for the industry.

Looking ahead, Disney’s Entertainment segment is well-positioned for continued growth, driven by the sustained profitability of its DTC platforms and the strength of its theatrical and streaming content. While challenges in Linear Networks remain, the company’s focus on strategic innovation and content excellence ensures its enduring place as a leader in global entertainment.

Disney’s Direct-to-Consumer (DTC) segment demonstrated solid progress in fiscal year 2024, reflecting the company’s focus on expanding its streaming platforms. The segment reported a 15% increase in revenues for both Q4 and the full year, reaching $5.78 billion and $22.78 billion, respectively. More notably, the DTC segment turned profitable in Q4, achieving $253 million in operating income compared to a $420 million loss in the same quarter of the previous year.

Subscriber growth played a key role in this performance. By the end of the fiscal year, Disney+ Core and Hulu had a combined 174 million subscriptions, with Disney+ adding 4.4 million new subscribers in Q4 alone. The introduction of an ad-supported tier for Disney+ in several markets, including the U.S., Canada, and parts of Europe and Latin America, contributed to this growth while diversifying revenue streams.

Advertising revenue within the DTC segment increased by 14% in Q4, supporting profitability alongside careful cost management. Combined, Disney’s streaming businesses—including Disney+, Hulu, and ESPN+—reported a total operating income of $321 million in Q4, a significant improvement over the $387 million loss recorded in the prior-year quarter.

While the segment’s gains are evident, challenges remain in sustaining subscriber momentum and managing operational costs as the streaming market matures. However, initiatives such as the planned integration of ESPN content into Disney+ in fiscal 2025 signal the company’s ongoing efforts to enhance its offerings and drive engagement.

The Direct-to-Consumer segment’s results underscore Disney’s ability to adapt to shifting audience preferences while steadily improving its financial performance in this competitive space. As the company continues to refine its strategy, the DTC segment remains a critical component of Disney’s broader business transformation.

Sports Segment

Disney’s Sports segment delivered mixed results in fiscal year 2024, reflecting both its strengths in the domestic market and challenges internationally. Revenues for the segment remained steady in Q4 at $3.91 billion, unchanged from the prior-year quarter, and grew modestly by 3% for the full year, reaching $17.62 billion. However, operating income declined by 5% in Q4 to $929 million and fell 2% for the year to $2.41 billion, highlighting the pressure of rising costs.

Domestic operations, led by ESPN, showed resilience. Advertising revenue for domestic ESPN grew by 7% in Q4, driven by strong demand for live sports content. However, the segment faced increased programming costs, particularly related to U.S. college football rights, which weighed on profitability.

Internationally, the performance was more challenging. Star India, a key part of Disney’s international sports strategy, saw a 37% drop in sports revenue in Q4 due to reduced advertising revenues and declining viewership. Disney+ Hotstar, a prominent streaming platform in India, experienced a 26% decline in monthly revenue per paid subscriber, despite a slight increase in its subscriber base.

Looking ahead, Disney is focusing on several strategic initiatives to strengthen its sports segment. Plans to integrate ESPN content into the company’s Direct-to-Consumer platforms aim to enhance accessibility and subscriber engagement. Additionally, efforts to manage programming and operational costs while continuing to invest in high-demand sports rights are expected to support long-term growth.

While the Sports segment encountered financial pressures in fiscal year 2024, particularly in international markets, Disney’s continued focus on delivering premium sports content and optimizing costs positions the segment for sustainable performance in the competitive sports broadcasting landscape.

Experiences Segment

Disney’s Experiences segment, which includes theme parks, resorts, and cruise lines, achieved record financial performance in fiscal year 2024. Full-year revenues increased by 5% to $34.1 billion, while operating income rose 4% to nearly $9.3 billion, marking new highs for the segment. In the fourth quarter, revenues grew modestly by 1% to $8.3 billion, though operating income declined by 6% to $1.7 billion compared to the same period last year.

Domestic parks performed strongly, benefiting from higher guest spending driven by increased ticket prices and enhanced guest experiences. Attendance levels remained consistent with the prior year, underscoring sustained interest in the domestic offerings. However, international parks faced variability in performance, with some locations impacted by external factors such as economic conditions and geopolitical challenges.

Disney Cruise Line also contributed to the segment’s growth, with fleet expansion being a key focus. The Disney Treasure is scheduled to begin its maiden voyage in December 2024, and the company has announced plans to double its cruise fleet by 2031, highlighting its commitment to this area of the business.

Looking ahead, Disney is investing heavily in the segment, with plans to allocate $60 billion over the next decade to expand and enhance its parks and experiences offerings. Upcoming projects include new attractions and themed areas, such as the "World of Frozen" at Hong Kong Disneyland, which aims to draw more international visitors. However, higher operational costs and expenses related to new offerings weighed on Q4 profitability, and international markets remain susceptible to economic and geopolitical fluctuations.

Overall, Disney’s Experiences segment continues to be a major growth driver for the company, supported by strategic investments and a focus on enhancing guest experiences. While challenges persist in some areas, the segment is well-positioned for long-term success.

Disneys Financials from 2015 to today

Between 2015 and 2024, The Walt Disney Company underwent a transformative journey shaped by strategic acquisitions, major shifts in its business model, and significant external challenges, including the COVID-19 pandemic. These developments had profound effects on Disney’s revenues, operating income, free cash flow, and margins, marking a decade of both resilience and adaptation.

In 2019, Disney completed its $71 billion acquisition of 21st Century Fox, which significantly expanded its content library and intellectual properties, including Avatar and X-Men, while bolstering its global market presence. This acquisition, combined with the 2019 launch of Disney+, marked the company’s decisive shift toward a streaming-first strategy under its Direct-to-Consumer (DTC) segment. These initiatives fueled substantial revenue growth, particularly in the years following 2020, but also increased costs and placed pressure on operating income and free cash flow due to high content spending and integration expenses.

The pandemic in 2020 brought unprecedented challenges. Global shutdowns forced the closure of Disney’s Parks and Experiences segment, delayed productions, and severely reduced advertising revenue across its linear networks. As a result, Disney’s revenues fell to $65.4 billion in 2020, down from $69.6 billion in 2019. Operating income plummeted to $3.8 billion, and free cash flow dropped to $1.7 billion, as operational disruptions significantly reduced cash inflows while fixed costs persisted. Margins were also deeply affected; the operating margin declined from 25.2% in 2015 to just 5.5% in 2020, and the net profit margin turned negative, reaching -4.4%.

Despite these challenges, Disney’s recovery from 2021 onward demonstrated its resilience and adaptability. The Parks and Experiences segment rebounded strongly, benefiting from pent-up demand, increased guest spending, and innovations like Disney Genie+. By 2024, the Parks segment reached record-breaking revenues, bolstered by expansion efforts and new offerings. At the same time, Disney’s DTC business turned profitable, supported by subscriber growth across Disney+, Hulu, and ESPN+, and the introduction of ad-supported tiers. These efforts drove a steady rise in revenues, which reached $91.4 billion in 2024, representing a 74.14% growth over the decade, with a compound annual growth rate (CAGR) of 6.36%.

Operating income recovered to $12.3 billion in 2024, reflecting improved profitability in the DTC segment and efficient cost management. Free cash flow surged to $8.6 billion, driven by higher cash generation from Parks and streaming operations, while the free cash flow margin rebounded to 9.4%. Although still below its historical peak of 15.8% in 2017, this recovery underscores Disney’s ability to generate liquidity to fund investments and reduce debt.

Margins have also shown signs of recovery, though they remain below pre-2019 levels. The operating margin, which peaked at 26.0% in 2016, improved from its low of 5.5% in 2020 to 13.5% in 2024, driven by the strong performance of the Parks segment and the stabilization of streaming costs. Similarly, the net profit margin improved from -4.4% in 2020 to 5.4% in 2024, although still below its 2016 peak of 16.9%.

Disney’s return on invested capital (ROIC) further reflects the company’s financial trajectory. ROIC peaked at 14.4% in 2018 but fell to a low of 1.9% in 2021 due to pandemic-related disruptions and heavy investments in the DTC business. By 2024, it recovered to 5.0%, supported by operational improvements and higher income.

Throughout the decade, Disney’s strategic decisions shaped its financial performance. The acquisition of 21st Century Fox and the launch of Disney+ positioned the company as a leader in streaming, driving long-term revenue growth but initially straining profitability and margins. Meanwhile, the recovery of the Parks and Experiences segment post-pandemic has been a critical driver of revenue and cash flow resurgence. Despite the challenges of declining linear network revenues and the capital-intensive nature of streaming, Disney’s diversified business model has allowed it to stabilize and recover strongly.

Share Repurchases

In February 2024, The Walt Disney Company announced a new share repurchase program aimed at enhancing shareholder value and demonstrating confidence in its financial health. On February 7, 2024, Disney's Board of Directors authorized the repurchase of up to 400 million shares of common stock. During the 2024 fiscal year the Company repurchased 28 million shares of its common stock for $3.0 billion.

The share repurchase program is designed with flexibility, allowing Disney to execute buybacks through various methods, including open market purchases and privately negotiated transactions. The timing and exact number of shares repurchased will depend on market conditions, the company's stock price, and other relevant factors. Notably, the program does not have a fixed end date, providing Disney with the ability to adjust its repurchase activities as circumstances evolve.

By reducing the number of outstanding shares, Disney aims to increase earnings per share and return capital to shareholders, reflecting a commitment to delivering long-term value. This initiative complements other shareholder-friendly actions, such as the 50% increase in the semi-annual dividend to $0.45 per share, announced concurrently.

The decision to implement the share repurchase program is supported by Disney's strong financial performance and improved cash flow. In FY 2024, the company reported significant growth in operating income and free cash flow, driven by robust performance in its Parks and Experiences segment and profitability in its Direct-to-Consumer streaming services.

That’s it for today! In Part 5 of our Disney analysis, we’ll dive deeper into the company’s outlook and explore its current valuation. Stay tuned!

Thank you once again for being here and for your interest! If you enjoyed my analysis, please consider leaving a "like" and subscribing. Your support means a lot!

Disclaimer: The information provided in this publication is for educational and informational purposes only and does not constitute financial advice. The content is solely reflective of my personal views and opinions based on my research and is not intended to be used as a basis for investment decisions. While every effort is made to ensure that the information is accurate and up-to-date, the writer makes no representations as to the accuracy, completeness, suitability, or validity of any information in this post and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. All readers are advised to conduct their own independent research or consult a professional financial advisor before making any investment decisions. The author is not invested in the mentioned stock.