Dear Readers,

Thank you for being here and showing interest in my work! Your support means the world to me. If you enjoyed this article and would like to see more, please consider subscribing and giving it a like—it really helps grow our community of investors. Thank you for your continued support!

Please read the disclaimer at the end of this article. This is not an investment advice!

I closely follow Lululemon, both as an investor and as someone intrigued by the brand's growth trajectory. In Germany, the brand is gaining increasing popularity, making it particularly exciting to observe how both the business and the stock are evolving. Witnessing its expansion and the impact of its strategic initiatives adds another layer of interest to this journey. That was my last post about Lululemon—let’s take a look at what has transpired since then.

Q3 2024 Earnings

Lululemon Athletica reported solid results in the third quarter of fiscal 2024, with total revenue reaching $2.4 billion, a 9% year-over-year increase (8% on a constant currency basis). While the Americas accounted for 74% of total revenue, regional growth was modest at 2%, with a 2% decline in comparable sales. International markets, however, were a key driver of overall performance. Revenue in China Mainland rose by 39% (36% in constant currency), with a 24% increase in comparable sales. The Rest of the World segment also contributed positively, with revenue increasing by 27% (23% in constant currency) and comparable sales rising by 20%.

In the Americas, challenges included a muted product color palette and warmer-than-expected fall weather, which affected outerwear sales. Management indicated that adjustments to product offerings have been made, and early holiday-season trends show improvement.

Internationally, the company saw strong results, particularly in China. Growth in this region was supported by localized marketing and alignment with health-focused initiatives such as "Healthy China 2030." The company also expanded its store footprint in China, opening six new locations during the quarter. Globally, Lululemon operated 749 stores at the end of Q3, reflecting a net increase of 63 stores year-over-year.

Profitability improved during the quarter, with gross profit reaching $1.4 billion, or 58.5% of net revenue, up from 57% in Q3 2023. Operating income rose to $490.7 million, representing 20.5% of net revenue, an increase from 15.3% in the prior year. Net income for the quarter was $351.9 million, translating to $2.87 per diluted share, compared to $1.96 per share in Q3 2023.

On the balance sheet, inventory grew by 8% year-over-year to $1.8 billion. The company invested $178.5 million in capital expenditures, primarily for store openings, distribution centers, and technology enhancements. Lululemon repurchased 1.6 million shares during the quarter, totaling $408.5 million. An additional $1 billion was authorized for share repurchases, bringing the total buyback capacity to $1.8 billion.

The company's product strategy showed consistent growth across categories, with men’s, women’s, and accessories segments increasing by 9%, 8%, and 8%, respectively. Seasonal collections and partnerships, such as collaborations with Disney and the NHL, added to customer engagement. Digital revenue also grew by 4% year-over-year, contributing $945 million, or 39% of total revenue.

Lululemon updated its full-year guidance, raising its revenue target to $10.452 billion–$10.487 billion and its EPS forecast to $14.08–$14.16. These adjustments reflect approximately 9% revenue growth and 14% EPS growth year-over-year.

The company reiterated its "Power of Three ×2" strategy, targeting $12.5 billion in revenue by 2026. This strategy emphasizes product innovation, enhancing the customer experience, and expanding global market presence. The company plans to open 40 new stores globally in 2024, with a focus on high-growth markets like China and franchise-led expansions in new regions.

Lululemon’s Q3 2024 results highlight its strong international growth and ongoing strategic initiatives, while challenges in the U.S. market remain an area of focus. The company’s updated outlook and emphasis on long-term growth align with its efforts to balance operational adjustments and market expansion.

Stock Valuation

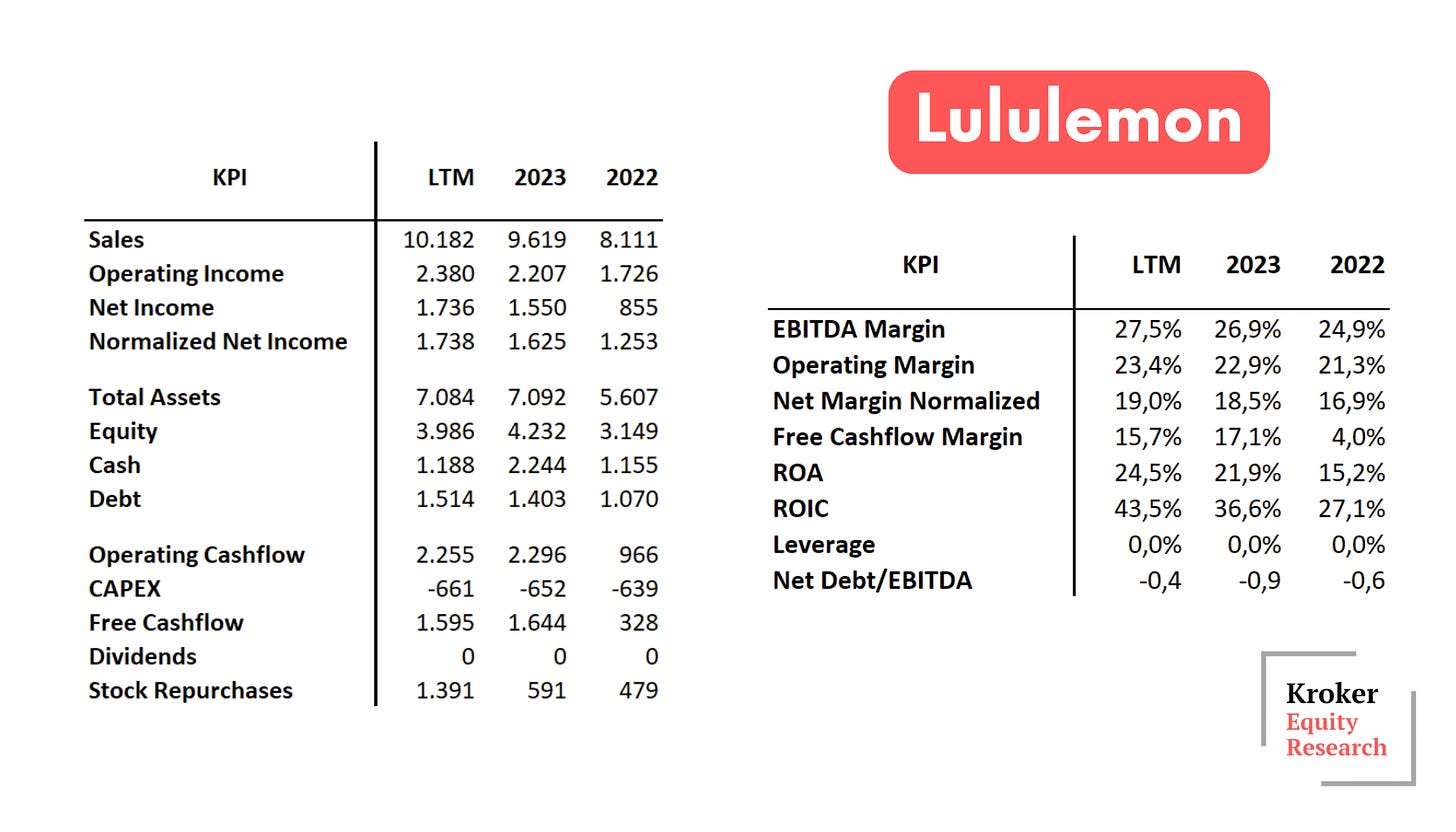

In my previous post following Lululemon’s Q1 2024 earnings, I concluded that the stock appeared expensive, even after a 37% decline from its all-time high. At the time, Lululemon was trading at approximately 16.61x EV/EBIT and 21.09x P/E. While these metrics seemed cheap compared to historical levels, they were less compelling when measured against the company’s historical growth rates.

Fast forward five months, and the stock has become even pricier. It’s now trading at 26.93x P/E and 19.56x EV/EBIT, marking a significant valuation increase. But what has fundamentally changed during this period? In my view, not much.

Comparable sales growth remains subdued, hovering near its lowest levels, while Q3 revenue growth of 8.7% year-over-year aligns with expectations, providing no meaningful positive surprise. Although the company modestly raised its full-year guidance, the adjustments were incremental and, in my opinion, do not justify the sharp jump in share price. My stance remains unchanged: Lululemon is undeniably a great company with strong fundamentals, but at these valuation levels, the stock appears too expensive.

Thank you once again for being here and for your interest! If you enjoyed my analysis, please consider leaving a "like" and subscribing. Your support means a lot!

Disclaimer: The information provided in this publication is for educational and informational purposes only and does not constitute financial advice. The content is solely reflective of my personal views and opinions based on my research and is not intended to be used as a basis for investment decisions. While every effort is made to ensure that the information is accurate and up-to-date, the writer makes no representations as to the accuracy, completeness, suitability, or validity of any information in this post and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. All readers are advised to conduct their own independent research or consult a professional financial advisor before making any investment decisions. The author is invested in the mentioned stock.