#69 Jumbo S.A.

Greek retailer

Dear Readers,

Thank you for being here and showing interest in my work! Your support means the world to me. If you enjoyed this article and would like to see more, please consider subscribing and giving it a like—it really helps grow our community of investors. Thank you for your continued support!

Please read the disclaimer at the end of this article. This is not an investment advice!

I've been wanting to write this post about Jumbo for quite some time. I invested in the stock a few months ago and have grown to appreciate the business and its strategy. However, it’s important to note that Jumbo is a small-cap stock based in Greece, with relatively low liquidity. Investing in such stocks requires caution and should only be undertaken after thorough research and analysis. With that said, let’s dive in!

About Jumbo S.A.

Jumbo S.A. (Ticker: BELA) is a leading retail company based in Greece, renowned for its extensive range of products, including toys, household goods, stationery, seasonal items, and various low-cost offerings. The company operates 85 stores across Greece, Cyprus, Bulgaria, and Romania as of the end of 2023, and has further expanded internationally through franchise agreements, adding 36 stores in non-EU countries such as Albania, Kosovo, Serbia, North Macedonia, Bosnia, Montenegro, and Israel.

Jumbo’s operational model focuses on large hyper-stores, with an average size of 9,000 square meters, which helps maintain cost efficiency. The company leverages its direct purchasing strategy and low-cost production sources to offer competitive prices. Furthermore, it has been investing in digital expansion, operating online stores in Greece, Cyprus, and Romania to enhance its e-commerce presence.

Strategically, Jumbo is continuously expanding its footprint, opening new stores in Cyprus, Romania, and Bulgaria, with a particular emphasis on markets like Romania, which has a higher growth potential due to its larger population and disposable income levels. Despite global challenges such as supply chain disruptions, the company has maintained resilience by optimizing logistics and refusing to accept inflated shipping costs, thereby safeguarding its profitability.

Jumbo is also committed to returning value to its shareholders through generous dividends and share buybacks, underscoring its strong financial position. Looking ahead, the company remains focused on growth, exploring opportunities in both existing and new markets, while adapting to changing market conditions with agility and strategic foresight.

Jumbo S.A. business model

Jumbo S.A. operates a robust and distinctive business model centered on cost efficiency, scalability, and value-driven retailing. At the heart of this model is its diverse product range, which includes toys, household goods, seasonal items, stationery, and low-cost everyday essentials. The company’s value proposition is built around affordability, targeting price-sensitive consumers across various demographics. By providing high-quality, diverse products at competitive prices, Jumbo has solidified its position in the retail market.

The company’s large hyper-stores, averaging approximately 9,000 square meters, serve as destination shopping locations, attracting customers from wide catchment areas. This format allows Jumbo to leverage economies of scale, reducing costs while offering a broad range of products under one roof. As of 2023, Jumbo operated 85 stores across Greece, Cyprus, Bulgaria, and Romania, supplemented by franchise stores in non-EU countries like Israel, Albania, and North Macedonia.

A key strength of Jumbo’s business model lies in its procurement strategy. The company sources products directly from low-cost production hubs, primarily in Asia, bypassing intermediaries to achieve significant cost savings. This approach enables it to maintain low retail prices while preserving healthy profit margins. Complementing its physical presence, Jumbo has expanded into e-commerce with online platforms in Greece, Cyprus, and Romania. These platforms provide customers with the convenience of online shopping, while also serving as an additional sales channel for high-demand products and optimizing inventory across regions.

Jumbo’s geographic expansion strategy combines organic growth with a strategic franchise model. While it directly operates stores in its core markets, the company leverages franchise agreements in countries such as Israel and several Balkan nations. This approach extends the brand’s footprint with minimal capital investment, generating steady revenue streams through franchise fees and turnover-based royalties.

Cost control and operational efficiency are central to Jumbo’s model. The company optimizes logistics, effectively manages inventory, and utilizes large-scale stores to reduce per-unit operating costs. It avoids unprofitable ventures, such as overpaying for transportation during global supply chain disruptions, ensuring its financial sustainability.

Jumbo’s revenue streams are diverse, including retail sales from its stores, e-commerce revenue from its online platforms, and franchise royalties. Retail sales account for the majority of its income, while e-commerce and franchise revenues are increasingly contributing to overall performance. The company relies minimally on traditional marketing, instead leveraging its reputation for low prices and diverse offerings to attract customers. Strategic store locations and seasonal promotions further enhance footfall and drive sales.

Financially, Jumbo is supported by a strong framework characterized by high liquidity, low debt levels, and disciplined capital expenditure. Its commitment to shareholder returns is evident in its generous dividend payouts and share buyback programs, while investments are focused on opening new stores and enhancing logistics infrastructure. The company’s adaptability and resilience are also evident in its response to challenges such as supply chain disruptions, where it maintained inventory levels without incurring inflated shipping costs, ensuring stable operations and profitability.

Finally, Jumbo prioritizes a positive customer experience, featuring wide aisles, organized product layouts, competitive pricing, and engaging seasonal themes that attract families, students, and budget-conscious shoppers alike. In summary, Jumbo S.A.’s business model is underpinned by cost efficiency, strategic sourcing, large-scale operations, and a strong customer-centric approach. This ensures value for consumers while driving sustainable growth and profitability, positioning Jumbo as a leading player in the retail market.

Key financials

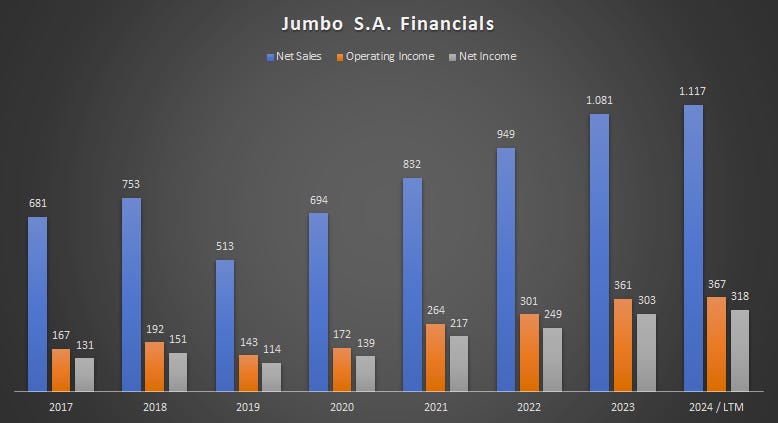

In the last twelve months, based on HY2024 results, Jumbo achieved net sales of €1.117 billion. Since 2017, the company has demonstrated a robust revenue growth trajectory, with a compound annual growth rate (CAGR) of 7.3%.

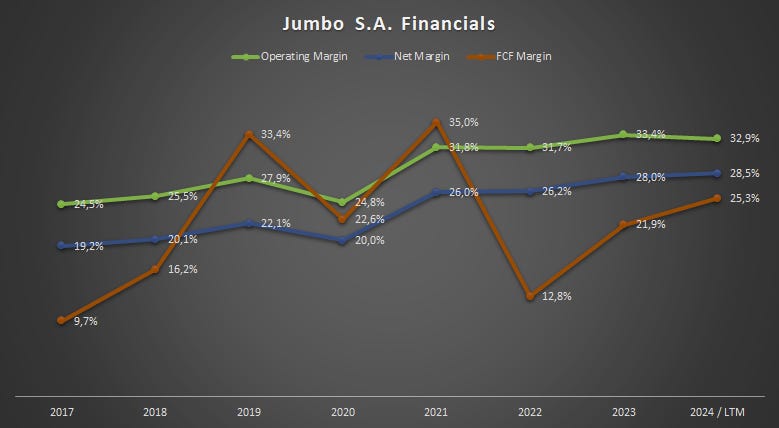

Over the same period, Jumbo significantly improved its operational efficiency, achieving a compound annual growth rate (CAGR) of 11.9% in operating income and 13.5% in net income. The operating income margin increased from 24.5% to an impressive 32.9%, while the net income margin rose from 19.2% to an outstanding 28.5%. These figures highlight the company’s ability to enhance profitability alongside consistent revenue growth.

Although Jumbo is primarily a brick-and-mortar retailer, the company operates with an asset-light model, maintaining capital expenditures at just 6% of sales. This efficient approach has enabled Jumbo to achieve a robust free cash flow margin of 25.3% over the past twelve months, underscoring its ability to generate substantial cash flow despite its traditional retail foundation.

Segments financials

Jumbo's segment financials for the year 2023 highlight the performance of its key markets—Greece, Cyprus, Bulgaria, and Romania—revealing the relative contributions of each to total revenue and operating income. Greece is by far the dominant segment, contributing €623.47 million to total net sales, which represents approximately 57.6% of the group's total revenue of €1.081 billion. Greece also generates €195.11 million in profit before tax, interest, and investment results, accounting for 53.9% of the total operating income of €361.58 million. This underscores Greece's central role as the largest and most profitable market for Jumbo.

Cyprus, while a smaller segment, contributed €119.26 million to net sales, making up roughly 11% of total revenue. The segment achieved €43.42 million in operating income, representing 12% of the group's total, highlighting its profitability relative to its size.

Bulgaria generated €107.54 million in net sales, which is approximately 9.9% of the total, with an operating income of €32.99 million, contributing 9.1% to the group’s total operating income.

Romania stands out as a high-growth market, contributing €231.11 million in net sales, or 21.4% of the group’s total revenue. The Romanian segment generated €83.13 million in operating income, which accounts for 23% of the group's total, reflecting the market’s growing importance and profitability.

Overall, Greece remains the backbone of Jumbo's operations, but Romania’s significant share of both revenue and operating income indicates its rising strategic importance. Cyprus and Bulgaria continue to be steady contributors, showcasing healthy profitability despite their smaller size. This diversified performance across regions underscores Jumbo’s balanced growth strategy and its ability to leverage opportunities in both established and emerging markets.

Long-term Strategy

Jumbo S.A.'s long-term strategy focuses on achieving sustainable growth, expanding its geographic footprint, improving operational efficiency, and maintaining resilience in the face of market challenges. The company aims to strengthen its position as a leading retailer while exploring new markets and adapting to changing consumer demands. A key pillar of Jumbo's strategy is geographic expansion, achieved through both organic growth and franchise partnerships. The company continues to open new hyper-stores in its core markets, including Greece, Cyprus, Bulgaria, and Romania, with plans to increase store density in high-growth areas like Romania. It also leverages franchise agreements to expand into non-EU markets, such as Israel and the Balkans, enabling growth with minimal capital expenditure while generating revenue through royalties.

To diversify its revenue streams, Jumbo is enhancing its e-commerce operations, particularly in Greece, Cyprus, and Romania, to capture the increasing demand for online shopping. This complements its physical stores and broadens customer reach. Additionally, the company is expanding its product range to cater to diverse customer needs and encourage larger basket sizes, with a focus on seasonal and unique items to maintain customer interest. Operational efficiency remains central to Jumbo’s strategy. The company continues to source products directly from low-cost hubs, primarily in Asia, to keep procurement costs low, while optimizing its logistics and supply chain processes to align inventory with consumer demand and minimize overstock risks.

Jumbo also prioritizes resilience to market disruptions, such as supply chain challenges and geopolitical tensions. Its adaptable logistics strategies and disciplined cost management, such as refusing to pay inflated shipping costs during global disruptions, help protect profitability. Financially, Jumbo focuses on maintaining high liquidity and prudent capital allocation, ensuring its ability to self-finance store expansions and other investments without increasing financial risk. The company consistently returns value to shareholders through dividends and share buybacks, while maintaining low leverage for long-term stability.

The company’s customer-centric approach is another cornerstone of its long-term strategy. Jumbo continuously works on enhancing the shopping experience through well-designed store layouts, integration of technology, and attractive seasonal promotions. The hyper-store model remains the focus, but the company is also exploring ways to improve efficiency and adapt to consumer trends. Although sustainability is not currently a significant emphasis, Jumbo recognizes its importance and may incorporate more environmentally friendly practices and products to meet evolving consumer expectations and regulatory requirements.

In the broader regional market, Jumbo aims to solidify its leadership by increasing market share in existing countries and tapping into the potential of emerging markets with favorable demographics and economic conditions. The company closely monitors changing consumer preferences, staying committed to its core value proposition of offering quality products at competitive prices. Additionally, its focus on digital integration seeks to create a seamless shopping experience across online and offline channels.

Overall, Jumbo’s long-term vision is to achieve steady and sustainable growth while remaining resilient to market fluctuations. By leveraging its established strengths, such as its hyper-store model, cost-efficient operations, and strong financial foundation, the company is well-positioned to remain competitive and profitable in the evolving retail landscape. Its strategy reflects a careful balance of expansion, diversification, and adaptability, ensuring it can navigate future challenges and continue delivering value to customers and shareholders alike.

Franchise

Jumbo S.A.’s franchise system is a key component of its international growth strategy, allowing the company to expand its presence into new markets with minimal financial risk. Through franchising, Jumbo extends its brand into regions where direct operations may be less feasible due to geographical, logistical, or regulatory challenges. This model enables the company to leverage local expertise, as franchise partners are deeply familiar with their respective markets, ensuring better market penetration and smoother operations.

Currently, Jumbo operates 37 franchise stores across seven countries, including Albania, Kosovo, Serbia, North Macedonia, Bosnia, Montenegro, and Israel. These stores complement Jumbo’s directly operated network and help the company reach consumers in non-EU markets. The franchise system is structured to maintain brand consistency while allowing franchisees some autonomy to adapt to local market conditions. Jumbo earns revenue from franchise agreements through operational fees and royalties, with the company taking a 4% cut of the franchisee’s turnover, regardless of profitability. Jumbo also supports its franchise partners with logistical assistance, product supply, and operational guidance to ensure alignment with its brand standards.

Franchise stores are supplied directly by Jumbo’s efficient procurement network, ensuring competitive pricing and a consistent product mix. The stores adhere to Jumbo’s branding and layout, providing customers with a similar shopping experience across regions. At the same time, franchisees can tailor certain aspects, such as marketing strategies and product offerings, to better meet local consumer preferences. The franchise model offers several benefits, including rapid scalability without significant capital investment, risk mitigation by transferring operational risks to franchise partners, and diversification of revenue through royalties. Additionally, franchisees bring valuable local market insights that help refine Jumbo’s overall strategy.

The franchise system has seen notable success in markets like Israel, where the first franchise store opened in 2022, followed by a second store in 2024. These stores serve a high-income market, offering significant growth potential while being managed independently by the franchise partner. Despite the advantages, challenges remain, such as ensuring consistent quality and customer experience across all franchise stores and maintaining strong oversight to align with Jumbo’s brand values.

Looking ahead, Jumbo sees its franchise model as a crucial driver of international growth, with plans to expand further into Southeast Europe and the Middle East. This model is particularly suitable for markets with high entry barriers or smaller growth potential, while the company reserves direct operations for its core markets like Greece and Romania. As franchise sales continue to grow, this system is expected to play an increasingly significant role in Jumbo’s revenue and brand expansion. By balancing strong brand oversight with local market expertise, Jumbo’s franchise system complements its directly operated stores, contributing to its long-term success and market leadership.

Family owned

The Vakakis family is at the heart of Jumbo S.A., playing a pivotal role in the company's founding, strategic direction, and overall success. Led by Apostolos-Evangelos Vakakis, the founder and Chairman, the family has been instrumental in transforming Jumbo into one of Southeast Europe’s largest and most successful retail chains. Apostolos Vakakis is widely regarded as the driving force behind the company's rise, known for his entrepreneurial vision and strategic foresight. Under his leadership, Jumbo has expanded its footprint across multiple countries by combining innovative sourcing strategies, a strong focus on cost efficiency, and a customer-centric approach. As Chairman, Vakakis remains actively involved in the company's strategic decisions, ensuring Jumbo stays aligned with its long-term growth objectives. His significant ownership stake makes him a dominant figure in the company’s governance, providing stability and a long-term focus but also centralizing decision-making power within the family.

The Vakakis family owns a substantial portion of Jumbo’s shares, making them the largest shareholder and ensuring their control over key strategic decisions. This ownership reflects their deep-rooted commitment to the company’s success. Apart from Apostolos, other family members are likely involved in various aspects of the business, contributing to its operations and governance. Although specific roles of other family members are not publicly disclosed, their influence is evident in Jumbo’s consistent strategic alignment. The family’s involvement has provided continuity in leadership and governance, a critical factor in the company’s long-term success. Their deep understanding of the retail industry and commitment to Jumbo’s values have fostered consistent growth over the years. Their dual role as major shareholders and active participants in governance ensures strong alignment between management and shareholder interests.

Apostolos Vakakis is known for his cautious yet ambitious approach to expansion. He has steered the company away from excessive risk, focusing instead on sustainable growth through organic expansion and franchise partnerships. His leadership style emphasizes operational efficiency, robust financial management, and a long-term perspective, ensuring that Jumbo remains competitive and resilient in a challenging retail environment. However, the family’s concentration of power, while providing stability, has raised concerns about governance risks, particularly in balancing family interests with those of minority shareholders. Additionally, reliance on a single figure like Apostolos Vakakis highlights the importance of succession planning and leadership diversification.

Despite their significant role, the Vakakis family maintains a relatively low public profile outside of the corporate sphere, with limited information available about their philanthropic activities. Their primary focus appears to be on building and sustaining Jumbo’s success. Looking ahead, succession planning will be a critical focus as the family seeks to ensure the continuity of Jumbo’s strategic vision. Whether future leadership remains within the family or transitions to professional management will be an essential consideration. As the family explores opportunities for the next generation to take on more active roles, there is potential for fresh perspectives while maintaining the company’s core values.

Major risks

Jumbo S.A. faces several major risks that could impact its operations, financial performance, and strategic goals. One significant risk is supply chain disruptions, as the company relies heavily on sourcing products from low-cost production hubs, primarily in Asia. Events such as geopolitical tensions, global shipping delays, or increased transportation costs could disrupt inventory flow and inflate operational costs, potentially affecting product availability and pricing. Another major risk is economic uncertainty and inflationary pressures in its operating regions. Rising inflation, currency fluctuations, or economic slowdowns in key markets like Greece, Romania, and Bulgaria could reduce consumer purchasing power and dampen demand for non-essential goods, directly impacting Jumbo's sales and profitability.

Competitive pressure is also a significant concern, as Jumbo faces increasing competition from both traditional retailers and e-commerce platforms, including global players like Amazon. This could affect market share, pricing strategies, and customer retention. Additionally, regulatory risks are ever-present, particularly as the company expands internationally. Changes in tax laws, labor regulations, or trade policies in the countries where Jumbo operates or sources products could increase costs or create operational challenges.

Dividends and Share buybacks

Jumbo S.A. places a strong emphasis on shareholder returns, with dividends and share buybacks forming integral parts of its capital allocation strategy. The company has a history of consistent and generous dividend payouts, which reflect its robust financial performance and commitment to rewarding shareholders. For example, in 2024, Jumbo distributed a cash dividend of €0.6 per share in March, followed by an additional €1 per share in July. These payouts highlight the company’s ability to generate strong cash flows and its dedication to maintaining a high payout ratio. In 2023, the company returned an impressive €400 million to shareholders through dividends, demonstrating its focus on delivering substantial value.

Currently, Jumbo’s forward dividend yield stands at approximately 7.35%, significantly above its 3-year average of 6.64%. Despite this attractive yield, the company maintains a moderate average payout ratio of around 56% of net income. This prudent payout policy, combined with Jumbo’s robust financial position, suggests that the risk of a dividend cut is minimal at this time.

In addition to dividends, Jumbo actively utilizes share buybacks to further enhance shareholder value. The buyback program allows the company to reduce the number of outstanding shares, thereby increasing earnings per share (EPS) and potentially boosting the stock’s market value. In 2024, Jumbo announced a new share buyback program, reflecting its confidence in the company’s financial health and growth prospects. The buybacks are strategically timed based on market conditions, ensuring optimal impact while maintaining financial prudence. These initiatives complement the dividend strategy, providing shareholders with a mix of income and capital appreciation opportunities.

Jumbo’s disciplined approach to dividends and share buybacks is supported by its strong financial foundation, including high liquidity and minimal debt. The company’s ability to fund these shareholder returns without compromising its investment in growth initiatives or operational stability underscores its robust capital management.

Stock Valuation

Base Case Assumptions

Jumbo’s geographic expansion strategy leverages opportunities in both established and emerging markets. The company continues to grow its store network across Greece, Cyprus, Bulgaria, and Romania, with a particular emphasis on Romania due to its favorable demographics and growth potential. By utilizing franchise partnerships, Jumbo has also entered non-EU markets such as Israel and the Balkans, achieving cost-efficient growth through royalties while limiting capital expenditure.

To further strengthen its position, Jumbo is diversifying its revenue streams by enhancing e-commerce operations in Greece, Cyprus, and Romania. This broadens customer reach and complements its physical stores, capturing the increasing demand for online shopping.

Operational efficiency is a key component of Jumbo’s success. The company sources products directly from low-cost hubs, primarily in Asia, enabling competitive pricing and strong profit margins.

While risks such as supply chain disruptions, economic uncertainty, and competitive pressures exist, Jumbo’s focus on diversification, cost management, and operational adaptability mitigates their potential impact. The company’s strong financial foundation and strategic resilience provide a solid base to navigate challenges effectively.

Revenue Growth

In the DCF Model, a five-year detailed planning period is used, projecting a 4.3% Compound Annual Growth Rate (CAGR). This trajectory anticipates Jumbo‘s revenue to reach about $1.4 billion in FY 2029.

Normalized Net Income Margin

I estimate a normalized net income margin of approximately 23.1% over the forecasting period. While this is notably lower than the 28.5% margin achieved over the past 12 months, this projection adopts a more conservative stance, reflecting uncertainty about the sustainability of such elevated margin levels in the long term.

Free Cash Flow

My Free Cash Flow assumptions are based on a Net Capex ratio (Net Capex = Capex - Depreciation) of 2.2% of sales, consistent with the average of recent years and reflective of Jumbos's asset-light model. Working Capital, expressed as a percentage of sales, is derived from the historical average, calculated at 22% of net sales. The Free Cash Flow estimate does not account for adjustments related to stock-based compensation. These assumptions result in a normalized Free Cash Flow margin of approximately 29%.

WACC

The Weighted Average Cost of Capital (WACC) is set at 7.5%.

Results

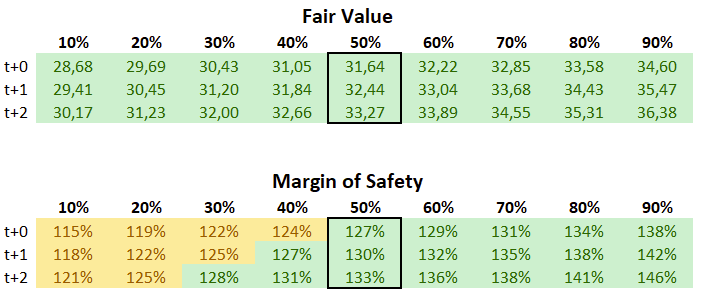

Based on these assumptions, Jumbo’s equity value is estimated at €4.3 billion. Dividing this by the current number of shares, we derive a fair value per share of €32. In comparison to its latest stock price of 25€ the stock appears undervalued.

Adjusting the WACC to 8.0% would lower the fair value per share to €30, while a decrease in WACC to 7.0% would increase it to €35 per share.

Scenarios

In the two tables below, I present my estimated fair values for the stock under three key scenarios: baseline, bear case, and bull case, providing a range for comparison. These estimates are derived from my Discounted Cash Flow (DCF) valuation, reflecting varying assumptions about growth rates, margins, and other key factors.

The baseline scenario corresponds to the 50% column, representing the most likely outcome. The 90% confidence interval represents the bull case, while the 10% confidence interval reflects the bear case, with intermediate scenarios filling the remaining columns. This framework offers a comprehensive view of potential outcomes based on different assumptions.

The second table presents the margin of safety, calculated as the ratio of the estimated fair value to the current share price. To make this more visually intuitive:

Margins of safety above 125% are highlighted in green, indicating that the stock meets my personal margin of safety threshold.

Margins between 100% and 125% are marked yellow, suggesting a moderate level of safety.

Margins below 100% indicate potential overvaluation and are marked red.

This approach provides a clear and systematic way to evaluate the stock's fair value and its attractiveness based on risk-adjusted scenarios.

Conclusion

Jumbo S.A. presents a robust investment case, underpinned by a strong operational model, disciplined financial management, and a clear long-term strategy. The company has demonstrated consistent growth in revenue and profitability, driven by its geographic expansion, cost-efficient operations, and focus on customer value. Its asset-light model and disciplined capital allocation enable high free cash flow generation, supporting both growth initiatives and shareholder returns through dividends and share buybacks.

While risks such as supply chain disruptions, economic uncertainty, and competitive pressures exist, Jumbo’s focus on operational efficiency, diversification, and resilience positions it to navigate these challenges effectively. The company’s prudent approach to expansion, with a balanced mix of direct operations and franchise partnerships, further strengthens its growth outlook.

From a valuation perspective, Jumbo appears to be undervalued based on a Discounted Cash Flow (DCF) analysis, with an estimated fair value per share of €32 compared to a current market price of €25. This reflects a potential upside while accounting for conservative assumptions around margins and growth. Scenarios based on varying assumptions provide a comprehensive risk-adjusted view, highlighting the stock's attractiveness for long-term investors.

In summary, Jumbo’s consistent operational performance, financial discipline, and strategic focus on growth and resilience make it a compelling investment opportunity, offering both stability and potential upside in the evolving retail landscape.

Thank you once again for being here and for your interest! If you enjoyed my analysis, please consider leaving a "like" and subscribing. Your support means a lot!

Disclaimer: The information provided in this publication is for educational and informational purposes only and does not constitute financial advice. The content is solely reflective of my personal views and opinions based on my research and is not intended to be used as a basis for investment decisions. While every effort is made to ensure that the information is accurate and up-to-date, the writer makes no representations as to the accuracy, completeness, suitability, or validity of any information in this post and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. All readers are advised to conduct their own independent research or consult a professional financial advisor before making any investment decisions. The author is invested in the mentioned stock.

Thank you very much for the article.

I have looked at Jumbo several times before, but I have never received such comprehensive information as you provided here — so a big thank you for that.

I am actually considering investing in Jumbo, as in my opinion, the valuation offers a good risk-reward opportunity.

The biggest risk I see is if profits were to decline, possibly due to a significant recession even in Southeastern Europe.

However, it’s worth noting that the markets in which Jumbo operates are developing much better than the rest of Europe.

Jumbo certainly isn’t a highflyer, but in my view, it offers diversification for a portfolio with a margin of safety.

How did you buy it, not available through my brokerage and doesn't seem to be available from IBKR either