Dear Readers,

Happy new year to everyone!

Thank you for being here and showing interest in my work! Your support means the world to me. If you enjoyed this article and would like to see more, please consider subscribing and giving it a like—it really helps grow our community of investors. Thank you for your continued support!

Please read the disclaimer at the end of this article. This is not an investment advice!

In this post, I’d like to introduce Realty Income, a company I find particularly fascinating. From my perspective, it stands as the most well-known real estate investment trust (REIT) in the United States—and possibly globally. Realty Income is more than just a stock; it’s a robust and resilient business with unique attributes that make it worth exploring. Let’s delve into what a REIT is, understand Realty Income's business model, and examine why I believe this company and its stock are really great.

What is a REIT?

A Real Estate Investment Trust (REIT) in the United States is like a special kind of real estate-focused company designed to let everyday people invest in income-producing properties without having to buy them directly. Picture a REIT as a pool of real estate assets, including commercial buildings, shopping malls, offices, and even industrial spaces, which are managed professionally.

Here’s the catch: to qualify as a REIT under U.S. tax law, these companies must follow some strict rules. The most important one is that they have to distribute at least 90% of their taxable income as dividends to shareholders every year. This makes REITs attractive to investors who want steady income, much like bonds or dividend stocks. In exchange for this high payout requirement, REITs get a special tax break: they don't pay federal corporate income tax on the income they distribute.

REITs can be public (traded on stock exchanges like the NYSE) or private. Public REITs, like Realty Income Corporation, let you invest as easily as buying a share of stock, giving you exposure to the real estate market without having to manage a property yourself. They typically earn their revenue through rent payments from tenants and aim for long-term leases with stable, reliable clients, often focusing on sectors like retail, industrial, healthcare, or residential properties.

About Realty Income O 0.00%↑

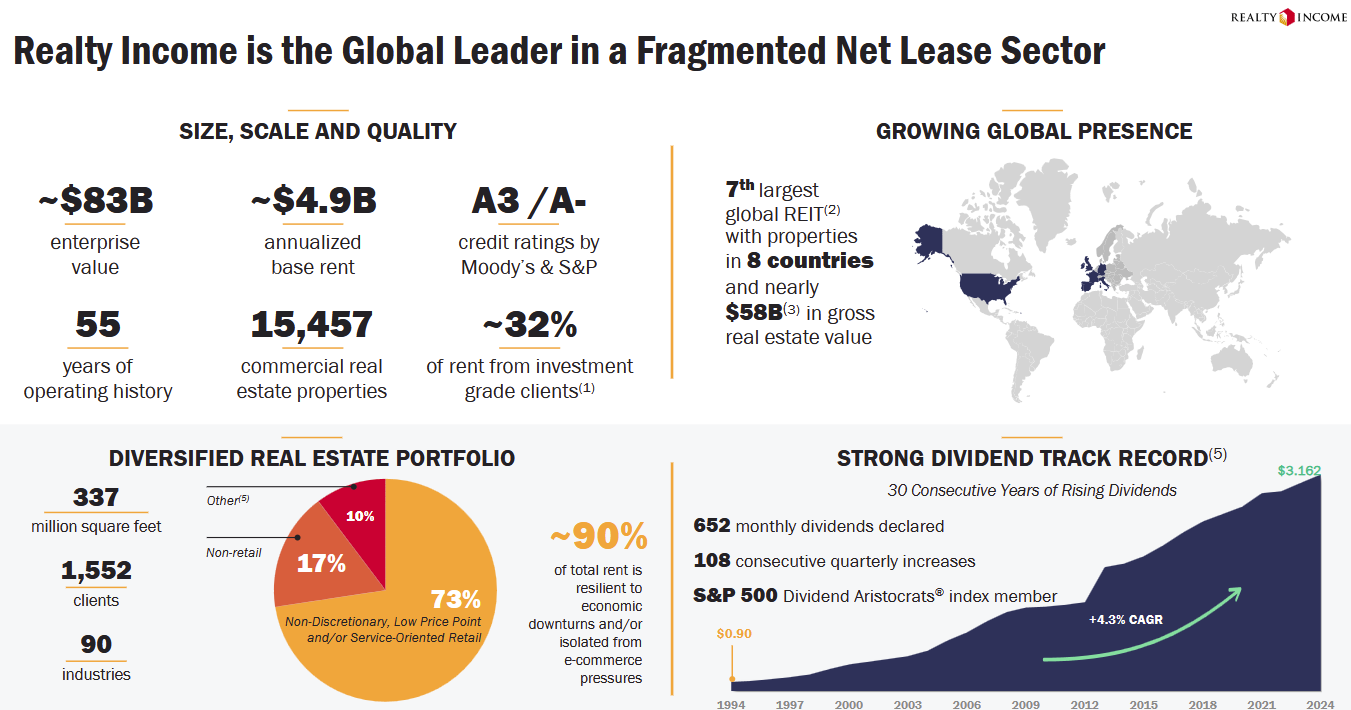

Realty Income Corporation, often called "The Monthly Dividend Company," is a leading Real Estate Investment Trust (REIT) headquartered in San Diego, California. Known for its steady dividend payments, Realty Income is part of the S&P 500 and the Dividend Aristocrats Index, reflecting over 30 consecutive years of annual dividend growth.

The company's business model is straightforward but powerful: it invests in high-quality commercial real estate properties and leases them to well-established businesses under long-term, net lease agreements. Net leases mean tenants are responsible for most property expenses like maintenance, taxes, and insurance, which reduces Realty Income's financial risk. Their portfolio is impressively diversified, spanning over 15,450 properties in all 50 U.S. states, the U.K., and several European countries, with tenants operating across 90 industries.

What sets Realty Income apart is its focus on stability and predictability. The company emphasizes investments in properties leased to creditworthy tenants, often in essential or recession-resistant industries like grocery stores, pharmacies, and convenience retailers. This strategy has contributed to maintaining a high occupancy rate—around 98.7% as of Q3 2024—and delivering consistent rental income.

As of 2024, Realty Income has a enterprise value exceeding $80 billion and generates nearly $5 billion annually in base rent. With a legacy of 652 consecutive monthly dividends and a disciplined approach to growth, Realty Income continues to be a favorite for income-focused investors seeking reliability and long-term performance.

Realty Income’s Tenants

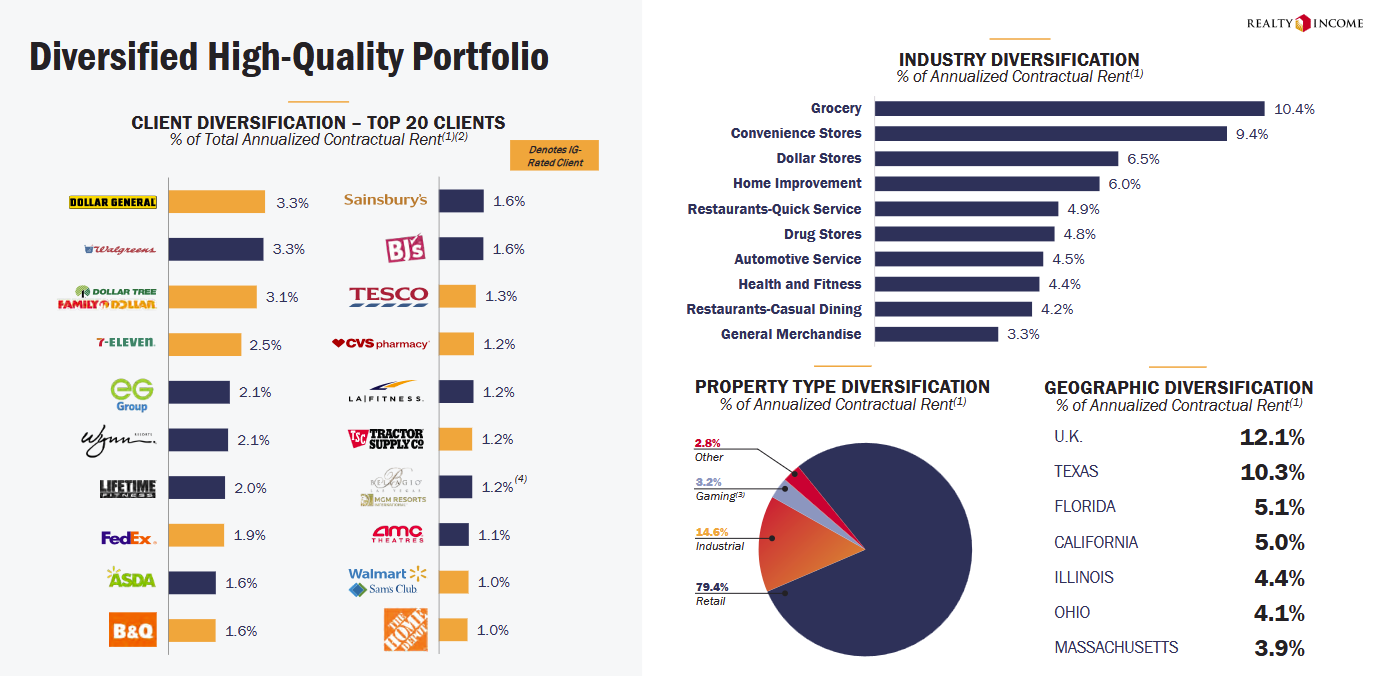

Realty Income Corporation takes pride in its highly diversified and resilient tenant base, which serves as the backbone of its stability and growth. As of Q3 2024, the company leases properties to 1,552 tenants across 90 industries, ensuring that no single client or sector overly dominates its portfolio. This diversification reduces risk and provides steady rental income even during economic fluctuations.

Tenant Quality and Industry Exposure:

Realty Income emphasizes leasing to financially robust and established businesses. Approximately 32% of its rental income comes from tenants with investment-grade credit ratings, indicating a strong ability to meet financial commitments. These tenants are often leaders in their industries, which adds an extra layer of reliability to Realty Income’s cash flow.

Top Industry Segments:

Retail Properties:

Retail tenants account for about 79.4% of Realty Income's total annualized contractual rent. This category includes grocery stores, convenience stores, dollar stores, and drugstores, which are often considered essential services and resilient to economic downturns.

Notably, approximately 73% of Realty Income’s retail tenants operate in service-oriented, non-discretionary, or low-price-point businesses—sectors that are less vulnerable to e-commerce disruption and economic cycles.

Industrial Properties:

These make up 14.6% of the portfolio, including tenants in logistics, manufacturing, and distribution. The growing need for industrial spaces to support e-commerce and supply chains underscores the long-term potential of this sector.

Gaming Properties:

A smaller but growing segment, gaming properties account for 3.2% of annual rent. Realty Income’s ventures here involve partnerships with established players, ensuring stability in a niche but lucrative market.

Other Sectors:

About 2.8% of rent comes from various other property types, including offices and agricultural land.

Tenant Stability and Occupancy:

Realty Income boasts a high portfolio occupancy rate of 98.7%, reflecting strong demand for its properties and the strategic selection of tenants. Its long-term lease agreements, often averaging over nine years, further enhance stability and predictability in earnings.

Realty Incomes financials

Realty Income Corporation's financials paint a clear picture of a dependable and well-managed REIT, showcasing its steady income generation, disciplined approach to capital allocation, and consistent growth trajectory. Renowned for delivering predictable cash flows, Realty Income maintains a robust financial position, underpinned by a strategy focused on long-term stability.

In the first nine months of 2024, Realty Income reported total revenue of $3.93 billion, a notable increase from $3 billion during the same period in 2023. Most of this revenue comes from rental income generated through long-term net lease agreements, ensuring high predictability and stability. Funds from Operations (FFO), a key performance metric for REITs, reached $2.57 billion during this period, marking a 22% year-over-year growth. Normalized FFO per share stood at $3.12, reflecting the company’s ability to generate strong earnings even in fluctuating economic conditions.

Adjusted Funds from Operations (AFFO), which accounts for recurring capital expenditures, totaled $2.7 billion, with AFFO per share reaching $3.14. This highlights Realty Income's consistent earnings growth and robust support for its renowned dividend strategy. Speaking of dividends, Realty Income’s reputation for dependable payouts remains unmatched. As of Q3 2024, the annualized dividend was $3.162 per share, demonstrating a compound annual growth rate (CAGR) of approximately 4.3%. With an AFFO payout ratio of 74.4%, the company has ample room to sustain and grow its dividends without overstretching its resources.

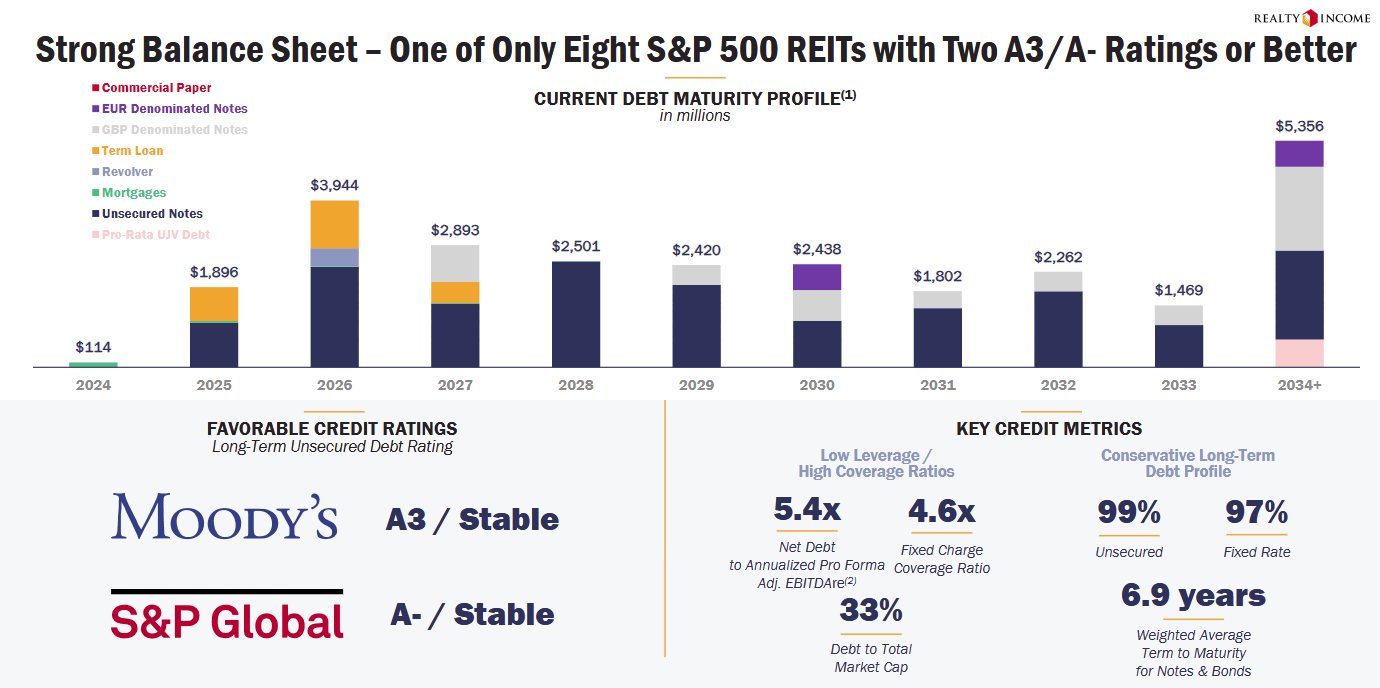

The company’s balance sheet is another pillar of strength, with total assets reaching $68.5 billion, including $57.7 billion in real estate investments at cost. Realty Income’s total debt of $27.1 billion comes with a low weighted average interest rate of 3.92% and a healthy average maturity of 6.9 years. Its net debt to annualized EBITDAre ratio is a conservative 5.4x, supported by a high percentage of fixed-rate debt (97%), ensuring stability even in the face of interest rate volatility.

Realty Income also benefits from a strong occupancy rate of 98.7%, with a weighted average lease term of 9.4 years. This ensures excellent income visibility, as annualized contractual rent reached nearly $4.93 billion, supported by a diverse base of high-quality tenants across 90 industries.

In terms of capital and liquidity, Realty Income ended Q3 2024 with $5.2 billion in available liquidity, which includes cash and unused credit facility capacity. Its strong credit ratings of A3 from Moody’s and A- from S&P underscore its financial resilience and prudent management practices.

Growth remains a key focus for Realty Income, as demonstrated by its $740 million in property acquisitions during Q3 2024 alone, targeting high-yield, long-term leases. Additionally, the company sold 92 properties for $249 million during the same period, showcasing disciplined portfolio management and strategic capital reallocation.

In summary, Realty Income’s financials reflect a perfect balance of growth and prudence. Its steady income, unwavering dividend track record, and disciplined management make it a standout choice for income-focused investors seeking long-term stability. By leveraging its strong balance sheet and strategic investments, Realty Income continues to solidify its reputation as a leading global REIT.

Realty Income’s Strategy

Realty Income’s strategy for the future is all about staying true to its core strengths—delivering predictable income, focusing on high-quality properties, and maintaining financial discipline—while also evolving to capitalize on new opportunities. With a vision rooted in long-term stability and growth, Realty Income is sharpening its focus on expanding its global presence, enhancing its portfolio, and driving shareholder value.

Expanding the Footprint

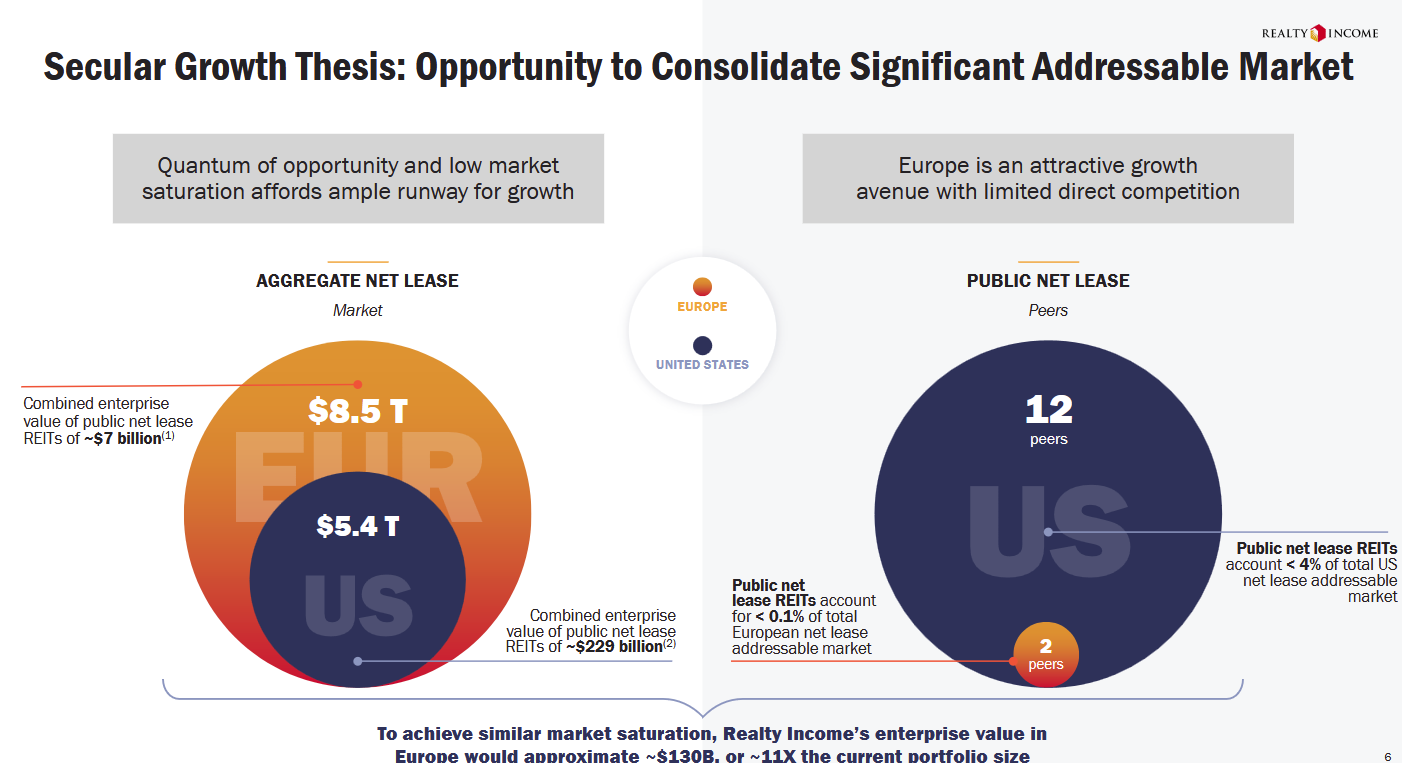

Realty Income is doubling down on international growth, particularly in Europe. The company sees vast opportunities in countries like the United Kingdom, Spain, Germany, France, and Italy, which represent a significant portion of Europe’s $8.5 trillion addressable net lease market. By diversifying geographically, Realty Income reduces risk while tapping into regions with strong economic fundamentals and stable real estate markets.

Realty Income’s international expansion reflects its strategic effort to diversify geographically and tap into new markets that offer significant growth potential. Initially focused on the United States, Realty Income has expanded its footprint into Europe, beginning with the United Kingdom and extending into other countries like Spain, France, Germany, Italy, and the Netherlands. This international growth now represents a substantial portion of the company’s investment activity, highlighting its commitment to becoming a global leader in the net lease REIT sector.

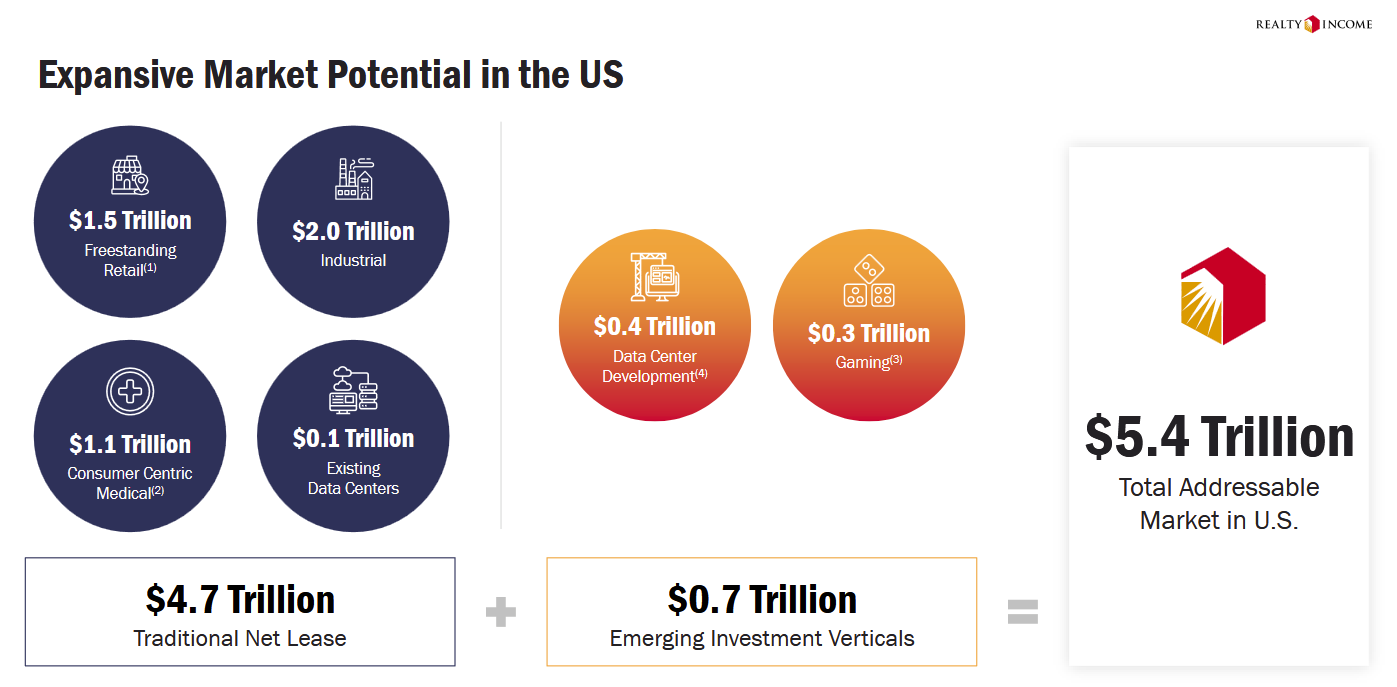

Europe, in particular, has emerged as a key area of focus. Realty Income’s entry into the region was driven by the significant size and untapped potential of the European net lease market, estimated to be approximately $8.5 trillion, compared to the $5.4 trillion market in the U.S. Despite its size, Europe’s net lease market remains relatively underpenetrated, providing Realty Income with ample opportunities to secure high-quality properties at attractive yields. For example, in 2024, the company invested heavily in Europe, accounting for 56% of its year-to-date acquisitions by Q3. These investments included long-term, triple-net lease agreements with established tenants in sectors like retail and industrial.

A notable example of Realty Income’s European strategy is its partnership with Decathlon, the world’s third-largest sporting goods retailer. The company acquired 82 assets across five European countries, including France, Germany, and Spain, under long-term leases with built-in rent escalators. Such deals align with Realty Income’s emphasis on partnering with strong, creditworthy tenants while diversifying its portfolio across regions.

Realty Income’s international investments also benefit from geographic and economic diversification, reducing exposure to U.S.-specific market risks. Countries like the U.K., Germany, and France offer stable economic environments, favorable real estate fundamentals, and robust tenant demand. By leveraging its scale and expertise, Realty Income can capitalize on opportunities in these regions, securing assets in prime locations with strong tenants.

Additionally, Realty Income’s global expansion strategy is supported by its robust capital structure. The company’s ability to access international debt markets, including issuing sterling-denominated bonds, demonstrates its financial flexibility and commitment to funding growth in diverse markets. This approach ensures that its expansion efforts remain sustainable and accretive to shareholder value.

In summary, Realty Income’s international expansion is a testament to its ability to adapt and thrive in new markets. By focusing on high-quality assets, creditworthy tenants, and long-term leases, the company has successfully established itself as a global leader in the net lease REIT space. This growth strategy not only enhances its portfolio diversification but also positions Realty Income to capitalize on the substantial opportunities offered by the international real estate market.

Strengthening the Portfolio

The company is committed to acquiring high-quality properties leased to financially resilient tenants in essential, recession-resistant industries. Future investments will emphasize service-oriented, non-discretionary retail and industrial properties, which together account for the bulk of its current portfolio. At the same time, Realty Income is exploring growth in emerging verticals like data centers and gaming properties, areas with strong demand and limited competition.

Data center

Realty Income's entry into the data center sector through its joint venture (JV) represents a strategic expansion into one of the fastest-growing and most critical areas of digital infrastructure. Partnering with Digital Realty, a leading S&P 100 investment-grade operator, Realty Income is leveraging its expertise in net lease agreements to tap into the high-demand data center market, starting with a significant project in Northern Virginia, the world’s largest and most active data center hub.

The JV’s initial project involves developing a state-of-the-art data center with a capacity of 16 megawatts (MW), with the potential to expand to 48 MW if the tenant exercises their option. This project offers an attractive 6.9% initial cash lease yield and features a 10-year lease term with 2.0% annual rent escalators, ensuring steady income growth. Realty Income has committed an initial equity contribution of $200 million, with the potential for a total contribution of $640 million if the expansion option is executed. The total development cost of the project is approximately $800 million, underscoring the substantial scale and strategic importance of this initiative.

This move aligns perfectly with Realty Income’s strategy to diversify its portfolio beyond traditional retail and industrial properties. The data center sector, driven by the increasing reliance on cloud computing, artificial intelligence, and digital transformation, offers resilient demand and robust growth potential. Northern Virginia, with its low vacancy rates and position as the epicenter of the global data center market, provides an ideal location for this venture.

The JV underscores Realty Income’s ability to adapt to emerging trends while maintaining its commitment to stable, long-term cash flows. By entering the digital infrastructure space, the company not only enhances its portfolio’s diversification but also positions itself as a forward-thinking leader in the REIT sector. The structured lease terms, with built-in escalators, ensure attractive and consistent returns, while the potential for future expansion adds another layer of growth opportunity.

This venture signals Realty Income’s intention to capitalize on the booming data center market, setting the stage for further investments in digital infrastructure. It highlights the company’s commitment to innovation and its ability to deliver value in an increasingly digital economy, reinforcing its reputation as a dependable and progressive investment choice for shareholders.

Gaming

Realty Income’s investments in the gaming sector highlight its strategic diversification into a high-demand, entertainment-focused industry that complements its core portfolio of retail and industrial properties. This move reflects the company’s ability to identify and capitalize on opportunities in sectors offering resilient cash flows and long-term growth potential.

The company’s entry into gaming began with high-profile acquisitions, such as the Bellagio Hotel and Casino in Las Vegas, in partnership with MGM Resorts. This landmark transaction marked Realty Income’s strategic expansion into the gaming and entertainment space, leveraging its expertise in long-term net lease agreements. As of Q3 2024, gaming properties account for 3.2% of Realty Income’s total annualized contractual rent, representing a growing yet measured approach to diversification.

These gaming properties are secured under Realty Income’s signature triple-net lease structure, which transfers most operational costs—such as taxes, insurance, and maintenance—to tenants. This ensures stable, predictable revenue streams. Realty Income has been deliberate in partnering with investment-grade operators like MGM Resorts and Wynn Resorts, companies with strong financial profiles and a proven ability to manage large-scale, high-value assets. This emphasis on high-quality tenants reduces risk while enhancing portfolio stability.

The gaming sector aligns with Realty Income’s broader strategy of diversification and long-term growth. Gaming properties, particularly in prime locations like the Las Vegas Strip, attract consistent consumer spending across gaming, hospitality, dining, and entertainment. This makes them resilient to economic cycles and critical to their tenants’ operations, reducing the likelihood of lease non-renewals. Furthermore, gaming investments offer higher cap rates compared to some traditional real estate sectors, contributing to overall portfolio returns. The long-term lease agreements typically include rent escalators, ensuring income growth over time.

By targeting high-profile, well-operated assets leased to industry-leading tenants, Realty Income positions itself to benefit from the expansion of the gaming industry, which increasingly integrates gaming with broader resort and entertainment experiences. This measured approach ensures that gaming enhances the company’s portfolio without overexposing it to industry-specific risks.

Leveraging Scale and Expertise

Realty Income plans to use its size and financial strength to its advantage, identifying attractive acquisition opportunities with higher initial yields. Its disciplined approach to acquisitions—prioritizing properties with long-term leases and creditworthy tenants—will ensure stability and steady cash flow. Additionally, the company aims to refine its predictive analytics and operational capabilities to optimize portfolio performance and capital deployment.

Driving Shareholder Value

Dividend growth remains at the heart of Realty Income’s strategy. The company is committed to sustaining its legacy of dependable monthly dividends while maintaining a conservative payout ratio. Its focus on AFFO growth and cost-efficient operations ensures that dividends remain well-supported by earnings. Realty Income also plans to continue its strategic dispositions, selling properties that no longer align with its long-term goals and reinvesting in higher-yield opportunities.

The Big Picture

As Realty Income looks ahead, its strategy combines tried-and-true principles with a forward-thinking approach. By expanding internationally, strengthening its core portfolio, and embracing innovation, the company aims to build on its legacy as a reliable income generator while positioning itself for sustainable growth in the decades to come. With its eyes on opportunity and feet firmly planted in stability, Realty Income’s future is as dependable as its famous monthly dividends.

Major risks

Realty Income, while a highly dependable and well-managed REIT, faces several risks that could potentially impact its performance. Understanding these challenges is essential for evaluating its long-term stability and growth.

Economic downturns pose a significant risk, even for a company as diversified as Realty Income. Although the company focuses on essential and non-discretionary industries, a prolonged recession could strain tenants’ operations, leading to rent defaults or vacancies. For example, sectors like retail and industrial, which form the backbone of its portfolio, may still face pressure during sustained economic slowdowns.

Tenant defaults and bankruptcies are another concern. Realty Income leases properties to a wide range of tenants, many of whom are investment-grade. However, the possibility of financial instability among key tenants, particularly in competitive markets like retail, could disrupt revenue streams. Challenges from e-commerce or shifting consumer habits could exacerbate this risk, increasing the difficulty and cost of re-leasing properties.

In Realty Income's Q3 2024 earnings call, the management addressed concerns about its more challenged tenants, including Rite Aid, Red Lobster, and Walgreens, as well as general credit issues in the portfolio. CEO Sumit Roy emphasized that while headlines about these tenants may raise alarms, the company’s proactive management strategies and historical resilience in handling such situations provide confidence.

For Rite Aid, Realty Income currently has 29 locations and achieved an 88% recapture rate on properties impacted by the company’s bankruptcy. Red Lobster and Regal, two other previously troubled tenants, have also emerged from bankruptcy, with Realty Income maintaining recapture rates of 91% and 85%, respectively, on their leases. These examples were highlighted to showcase the company’s ability to manage tenant challenges effectively.

Regarding Walgreens, which announced closures of around 1,500 stores, Realty Income reassured investors that its leases with Walgreens remain stable. Year-to-date, 13 Walgreens leases came up for renewal, and all were successfully renewed. This continues a strong track record, with a historical renewal rate exceeding 100%. Similar renewal strength was reported for other major tenants like CVS, Family Dollar, Dollar Tree, and Dollar General, demonstrating the company’s tenant resilience and lease stability.

Additionally, the company acknowledged a non-cash $64 million charge related to a convenience store tenant defaulting on lease payments. Realty Income expressed confidence in replacing this lost rent, citing strong interest in the vacated assets, particularly in Texas. Management underscored that such assets are often high-value locations, and the company is actively working to regain control and re-lease them quickly.

Interest rate sensitivity is also a critical factor for Realty Income. As a REIT, the company relies heavily on debt for financing operations and acquisitions. Rising interest rates could increase borrowing costs, potentially squeezing profitability and limiting the availability of accretive investment opportunities. While most of Realty Income’s debt (97%) is fixed-rate, future borrowing in a high-rate environment could still impact growth prospects.

Realty Income’s sector-specific risks are also worth noting. Retail properties represent a substantial portion of its portfolio, and while the company focuses on essential retail, the ongoing shift to e-commerce remains a threat. Additionally, the company’s recent foray into sectors like gaming and digital infrastructure introduces new challenges, as these markets come with unique dynamics and higher operational complexity.

The company’s international expansion introduces geopolitical and regulatory risks. With its growing presence in Europe, Realty Income is exposed to potential challenges such as currency fluctuations, varying tax laws, and political instability. For example, stringent real estate regulations in certain European countries could affect the profitability and flexibility of its investments.

As a REIT, Realty Income must comply with specific regulatory and tax requirements, such as distributing at least 90% of its taxable income to shareholders. Any changes in tax laws or REIT regulations could disrupt the company’s operational model. Losing its REIT status would subject Realty Income to corporate income taxes, significantly reducing profitability.

Competition in the net lease REIT market is intense. Numerous players are vying for high-quality properties, which could drive up acquisition costs and reduce the availability of lucrative opportunities. This competitive environment could make it harder for Realty Income to maintain its historical growth trajectory.

Property value declines represent another risk. A decrease in property valuations, whether due to market conditions or tenant departures, could result in write-downs that affect Realty Income’s balance sheet. This is particularly concerning for regions or sectors with concentrated exposure, where a downturn could lead to significant equity losses.

Finally, Realty Income’s strategic expansion into digital infrastructure brings its own challenges. While investments in data centers and related assets align with growth in technology, they also expose the company to operational risks and reliance on tenant performance in a relatively new sector. If not managed effectively, this could limit the anticipated benefits of these investments.

Equity Financing and debt

Equity

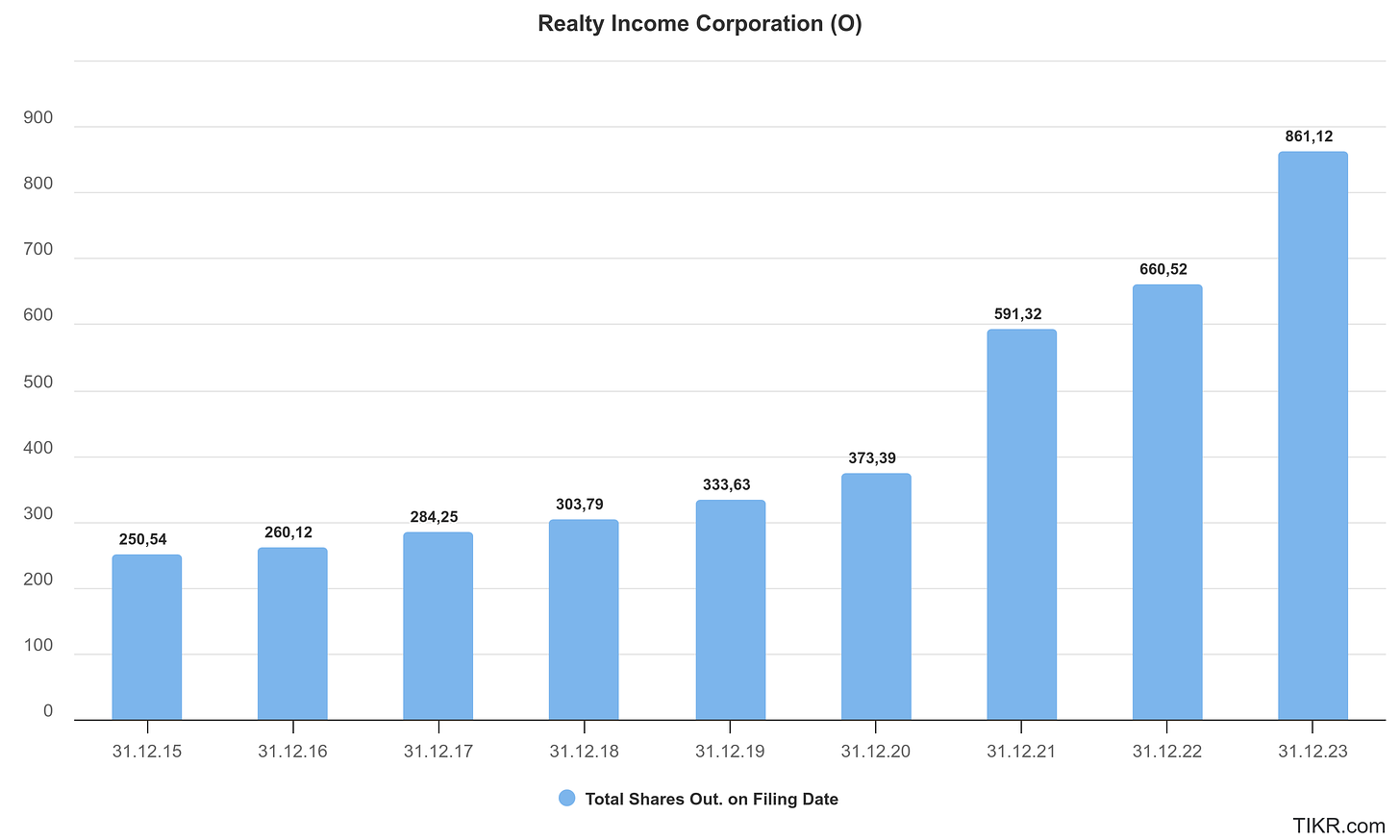

Realty Income has developed a sophisticated strategy to raise equity capital for financing its investments, ensuring it can seize growth opportunities without compromising its financial stability. This approach primarily involves issuing new shares through mechanisms like public offerings and At-the-Market (ATM) equity programs. While these methods allow Realty Income to fund acquisitions and expand its portfolio, they also have implications for shareholders.

The company’s ATM equity program is a particularly flexible tool. Under this arrangement, Realty Income can issue new shares incrementally, allowing it to match capital needs with investment opportunities. This avoids the risk of raising too much capital too soon, which could sit idle and dilute shareholder value unnecessarily. Instead, the ATM program ensures efficient capital deployment, keeping the company's leverage low while funding its growth.

Public equity offerings are another way Realty Income raises funds. These larger-scale issuances are typically used for significant investments, such as high-profile acquisitions or strategic expansions. For example, Realty Income has successfully used public offerings to raise substantial capital for its mergers with VEREIT and Spirit Realty Capital, both of which significantly enhanced its scale and diversification.

However, raising equity capital does come with trade-offs for existing shareholders. Issuing new shares increases the total number of shares outstanding, which can dilute the ownership percentage of existing shareholders. This dilution could also temporarily impact earnings per share (EPS) if the proceeds are not immediately accretive to earnings. Realty Income mitigates these concerns by ensuring that the capital raised is invested in high-yield, income-generating properties that enhance long-term shareholder value.

For investors, this strategy is a double-edged sword. On one hand, equity issuance can dilute their stake and affect near-term metrics like EPS. On the other hand, it enables Realty Income to acquire premium properties, diversify its portfolio, and secure future revenue growth. The company’s disciplined approach to capital deployment ensures that new investments typically generate returns above its cost of capital, resulting in accretive growth over time.

Moreover, Realty Income’s steady track record of growing its dividend reassures shareholders that these equity raises ultimately serve their interests. The company’s strong credit ratings and prudent financial management mean that it doesn’t rely solely on equity; it maintains a balanced capital structure by using a mix of debt and equity financing.

Realty Income last raised equity in Q3 2024 through its At-the-Market (ATM) program, where it issued 4.3 million shares, resulting in $271.0 million in proceeds at an average price of $62.25 per share. Additionally, as of September 30, 2024, there were 16.8 million unsettled shares under forward sale agreements, expected to generate $958.1 million in net proceeds upon settlement. These shares are anticipated to be fully settled by the end of 2024, reflecting Realty Income’s ongoing reliance on equity raises to finance its growth.

The company also maintains a universal shelf registration filed in February 2024, allowing it to issue various securities, including common stock, for the next three years. This provides flexibility to raise additional capital as needed, although specific offerings are announced only when they are planned. The ATM program is expected to remain a key mechanism for raising equity in the future.

Debt

Realty Income’s debt strategy reflects its commitment to financial stability and cost efficiency, which are critical to supporting its growth and reliable dividend payments. With a total consolidated debt of $27.1 billion as of Q3 2024, the company strategically manages its obligations to maintain a healthy balance between leverage and financial flexibility.

A significant portion of Realty Income’s debt—$23.4 billion—consists of senior unsecured notes and bonds, which provide long-term funding without requiring property collateral. This is complemented by $2.4 billion in unsecured term loans, $427.5 million from its revolving credit facility, and $198.1 million in mortgages payable. Notably, 97% of this debt is fixed-rate, effectively shielding the company from rising interest rates. The weighted average interest rate across all debt is a favorable 3.92%, with a well-laddered maturity schedule averaging 6.9 years. This approach minimizes refinancing risks and ensures manageable near-term obligations, with major repayments such as $1.9 billion due in 2025 and $3.9 billion in 2026.

Realty Income’s debt portfolio also reflects its growing international presence. Approximately 70% of its debt is denominated in USD, with 25% in GBP and 5% in EUR, aligning with its European investments. This currency diversification helps the company hedge against exchange rate fluctuations, particularly as it continues to expand its global footprint.

The company’s leverage is conservatively managed, with a net debt-to-annualized EBITDAre ratio of 5.4x and a debt-to-total market capitalization ratio of 32.7%. These figures highlight Realty Income’s strong equity position relative to its debt. The company’s revolving credit facility, totaling $4.25 billion with an option to expand by $1 billion, provides additional liquidity for short-term needs. Meanwhile, the use of interest rate swaps helps maintain predictable borrowing costs for its variable-rate debt.

Realty Income’s robust credit ratings—A3 from Moody’s and A- from S&P—further underscore its financial strength. These ratings enable the company to access capital markets on favorable terms, reducing borrowing costs and providing flexibility for future investments.

In summary, Realty Income’s disciplined approach to debt management supports its growth strategy while protecting against economic uncertainties. With a diversified and well-structured debt portfolio, strong credit ratings, and effective interest rate management, the company is well-positioned to fund acquisitions, expand internationally, and continue delivering reliable returns to shareholders.

Does Realty Income has a moat?

Realty Income possesses a significant economic "moat" that distinguishes it from competitors and safeguards its business from being easily replicated or eroded. This moat is built on several key factors that collectively reinforce its competitive advantage.

First, Realty Income’s scale and diversification are unparalleled. The company owns and manages an extensive portfolio of over 15,450 properties spanning 90 industries and multiple geographies, including the U.S. and Europe. This vast scale enables Realty Income to spread risk, weather economic downturns, and maintain stable cash flows. Its tenant base is highly diversified, ranging from essential retail to industrial and digital infrastructure, ensuring that no single tenant or sector dominates the portfolio, which reduces vulnerability to market-specific shocks.

Second, Realty Income’s reliance on long-term, triple-net leases creates highly predictable revenue streams. These leases transfer most property-related costs, such as taxes, maintenance, and insurance, to tenants, significantly reducing operating risks. The company’s high occupancy rate of 98.7% and average lease term of 9.4 years provide long-term visibility into earnings, further stabilizing its income.

Another key strength lies in its high-quality tenants. Realty Income partners with creditworthy tenants, many of whom hold investment-grade ratings. These financially robust tenants, often operating in essential or recession-resistant industries such as grocery, convenience, and logistics, make defaults less likely and ensure dependable income streams.

Realty Income’s reputation and brand trust add another layer to its competitive advantage. Known as "The Monthly Dividend Company," it has a track record of over 652 consecutive monthly dividends and more than 30 years of annual dividend increases. This reliability has built immense trust among investors and tenants alike. Its inclusion in the S&P 500 and the Dividend Aristocrats Index further underscores its stability and appeal.

The company’s size also gives it cost advantages. Realty Income benefits from access to capital at lower costs, supported by its A3/A- credit ratings from Moody’s and S&P. This financial strength allows the company to fund acquisitions and growth initiatives more efficiently than smaller competitors, enhancing its ability to expand its portfolio profitably.

Realty Income’s operational expertise is another cornerstone of its moat. With decades of experience managing commercial properties, the company leverages sophisticated predictive analytics to optimize portfolio performance, identify high-yield investment opportunities, and adapt to changing market conditions.

Additionally, barriers to entry in the net lease business model work in Realty Income’s favor. The model requires significant capital, operational expertise, and established tenant relationships, making it challenging for new entrants to replicate Realty Income’s scale and success. Its international expansion, particularly in Europe, leverages relationships and market knowledge that would be difficult for newcomers to build quickly.

Investment case

A bullish investment case for Realty Income centers on its reputation as "The Monthly Dividend Company," a powerhouse in the net lease REIT sector that combines stability, growth, and income generation. For income-focused and long-term investors, Realty Income offers a compelling opportunity to invest in a reliable and growing cash flow machine with a proven track record of success.

At the core of the bullish case is Realty Income’s exceptional dividend history. With over 652 consecutive monthly dividends and more than 30 years of annual dividend increases, the company has established itself as a haven for income-seeking investors. Its annualized dividend growth rate of approximately 4.3% underscores its ability to deliver consistent returns. This dividend reliability is supported by a conservative payout ratio of 74.4% of AFFO, leaving room for both stability and future growth.

Realty Income’s portfolio diversification further strengthens the case. With more than 15,450 properties leased to 1,552 tenants across 90 industries, the company has minimized its reliance on any single tenant or sector. Its focus on recession-resistant industries like grocery stores, drugstores, and industrial logistics ensures stability even in challenging economic times. An occupancy rate of 98.7% and a weighted average lease term of 9.4 years provide long-term visibility into its income streams.

The company’s disciplined growth strategy is another key factor. Realty Income continuously acquires high-quality, income-generating properties while maintaining a conservative balance sheet. Its recent expansions into Europe, along with investments in emerging sectors like digital infrastructure and gaming, demonstrate its ability to tap into new growth markets without compromising its core business. These strategic moves diversify its revenue base while positioning the company to benefit from secular trends like e-commerce growth and digital transformation.

Financially, Realty Income’s strong credit ratings (A3 by Moody’s and A- by S&P) allow it to access capital at favorable rates, providing a significant advantage in funding growth initiatives. Its conservative leverage, with a net debt-to-annualized EBITDAre ratio of 5.4x, ensures financial flexibility while maintaining investor confidence. The company’s $5.2 billion in liquidity and 97% fixed-rate debt further enhance its resilience against economic uncertainty and rising interest rates.

From a valuation perspective, Realty Income appeals to investors seeking steady total returns. Its combination of dividend yield, which typically hovers around 4%-5%, and accretive growth opportunities makes it a compelling choice for those looking to balance income and capital appreciation. The long-term growth in Adjusted Funds from Operations (AFFO) ensures the company can continue to fund dividend increases while expanding its portfolio.

Finally, Realty Income’s alignment with macroeconomic trends bolsters the bullish case. As the global economy increasingly shifts toward service-oriented and essential industries, the demand for stable, high-quality commercial properties will likely grow. Realty Income’s ability to lock in long-term leases with creditworthy tenants ensures it remains a beneficiary of this structural shift.

Valuation based on dividend yield and AFFO

A dividend yield of 6.09% for Realty Income, combined with a next twelve months (NTM) price-to-AFFO ratio of 12.34x, presents a compelling entry point for income-focused and long-term investors. This yield, significantly above Realty Income’s historical range of 4%-5%, suggests that the stock is trading at a relative discount compared to its historical norms. Similarly, the P/AFFO ratio, below the company’s long-term average, indicates that the market is likely pricing in broader macroeconomic challenges rather than issues specific to Realty Income. Together, these metrics highlight a potential undervalued opportunity.

The current low valuation also aligns with Realty Income’s long-term stability and growth potential. The company’s disciplined strategy of expanding into Europe and investing in high-growth sectors like digital infrastructure positions it well for sustained AFFO growth. This growth will further support future dividend increases and may contribute to stock price recovery. Additionally, Realty Income’s strong financial management, including 97% fixed-rate debt and a well-laddered maturity schedule, insulates it from immediate interest rate impacts, adding to its resilience.

However, it’s important to recognize the broader factors contributing to this discount. High Interest rates make fixed-income alternatives like bonds more competitive, pressuring REIT valuations across the board. Moreover, negative sentiment in the real estate sector, economic uncertainty and the above mentioned issues with some tenants may suppress Realty Income’s stock price in the short term, even though its fundamentals remain solid.

For investors, this is an opportune moment to consider Realty Income. Its historically high dividend yield and below-average P/AFFO multiple provide a rare combination of value and income potential. With both stability and the prospect of valuation expansion, Realty Income offers an attractive blend of immediate income and long-term growth.

Conclusion

In conclusion, Realty Income stands out as a compelling investment opportunity in the REIT space, combining a legacy of dependable income, a strong growth strategy, and financial stability. As "The Monthly Dividend Company," it offers a unique value proposition through its consistent dividend payments, currently yielding an attractive 6.09%, supported by a disciplined payout ratio and robust AFFO growth.

The company’s diversified portfolio across recession-resistant industries and its strategic expansion into high-potential sectors like gaming and digital infrastructure ensure long-term resilience and growth. Its international footprint, particularly in Europe, highlights Realty Income’s ability to adapt and thrive in untapped markets, adding further layers of geographic and economic diversification.

While short-term risks, such as tenant challenges and macroeconomic pressures, could influence its stock performance, Realty Income’s proactive management and historical track record of handling such issues effectively inspire confidence. With its discounted valuation metrics, including a P/AFFO multiple below its historical average, Realty Income provides an attractive entry point for investors seeking steady income and long-term capital appreciation.

For those looking for stability, growth, and a proven history of delivering shareholder value, Realty Income is well-positioned as a standout choice in the net lease REIT space.

Disclaimer: The information provided in this publication is for educational and informational purposes only and does not constitute financial advice. The content is solely reflective of my personal views and opinions based on my research and is not intended to be used as a basis for investment decisions. While every effort is made to ensure that the information is accurate and up-to-date, the writer makes no representations as to the accuracy, completeness, suitability, or validity of any information in this post and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. All readers are advised to conduct their own independent research or consult a professional financial advisor before making any investment decisions. The author is invested in the mentioned stock.

Very nice write-up!

Kroker,

This is a nice writeup. Thank you.

Just a question: what is the tax which European investors would pay on the dividends received from a US Reit?

Thanks and happy new year