Dear Readers,

Thank you for being here and showing interest in my work! Your support means the world to me. If you enjoyed this article and would like to see more, please consider subscribing and giving it a like—it really helps grow our community of investors. Thank you for your continued support!

Please read the disclaimer at the end of this article. This is not an investment advice!

About JP Morgan Chase

JPMorgan Chase & Co. JPM 0.00%↑ is one of the largest and most well-established financial institutions in the world, operating globally across investment banking, financial services for consumers and businesses, financial transaction processing, asset management, and private equity. Headquartered in New York City, the firm serves millions of clients and businesses worldwide. Its operations are structured into four key business segments, each tailored to specific markets and services.

The Consumer & Community Banking (CCB) segment offers retail banking, credit cards, home lending, auto finance, and small business banking services. It is renowned for its extensive branch network and advanced digital banking capabilities, providing a seamless experience for customers. The Corporate & Investment Bank (CIB) segment focuses on delivering investment banking, market-making, and securities services. It specializes in capital raising, advisory services, and trading across multiple asset classes, catering to large corporations, governments, and institutions. The Commercial Banking (CB) segment provides financial solutions to medium-sized businesses, real estate firms, and large corporations, emphasizing lending, treasury services, and payment solutions. Finally, the Asset & Wealth Management (AWM) segment manages investments for institutions, individuals, and financial intermediaries. It offers comprehensive financial planning, retirement solutions, and personalized wealth management services.

In 2024, JPMorgan Chase achieved substantial annual growth across its business lines, showcasing diversified income sources. The firm recorded robust profitability, driven by strong performance in investment banking and asset management. It remains a global leader in assets under management (AUM), consistently achieving growth in this area. Recent initiatives reflect the company's commitment to innovation and sustainability. Its heavy investments in AI, blockchain, and other technologies aim to enhance customer experiences and operational efficiency. Additionally, the firm has pursued strategic acquisitions to strengthen its position in wealth management, payments, and technology.

JPMorgan Chase has a significant global presence, operating in over 100 markets worldwide, with a strong footprint in North America, Europe, Asia-Pacific, and Latin America. Under the leadership of Jamie Dimon, Chairman and CEO, the firm has earned a reputation for stability, resilience, and strategic vision. Dimon’s leadership has been instrumental in maintaining JPMorgan Chase's position as a cornerstone of the global financial industry. The company remains a leader in innovation, customer service, and market expertise, continuously adapting to evolving market conditions and client needs.

History of JPMorgan Chase

JPMorgan Chase & Co. is one of the oldest and most influential financial institutions in the United States, with a history that dates back to 1799. It originated with the founding of The Manhattan Company in New York City by Aaron Burr. Although initially established to provide clean water to the city, the company soon shifted its focus to banking, laying the foundation for what would become a financial giant. Over the years, JPMorgan Chase grew through a series of mergers and acquisitions, with its most notable predecessor being J.P. Morgan & Co., founded by the legendary financier John Pierpont Morgan in the late 19th century. J.P. Morgan & Co. became a dominant force in global finance, orchestrating major mergers and helping to establish iconic corporations such as U.S. Steel and General Electric.

In its modern form, JPMorgan Chase emerged from the combination of several major banks, each with its own significant legacy. Chemical Bank, founded in 1824, acquired Chase Manhattan Bank in 1996, forming one of the largest banks in the United States. Chase Manhattan Bank itself was created in 1955 through the merger of Chase National Bank and The Bank of Manhattan Company. Another critical step in JPMorgan Chase’s evolution was the acquisition of Bank One Corporation in 2004, which brought Jamie Dimon into the leadership team. Dimon would later become the CEO of JPMorgan Chase, steering the company to new heights.

The financial crisis of 2008 was a defining moment for the bank. During this turbulent period, JPMorgan Chase acquired Bear Stearns and Washington Mutual, significantly expanding its footprint and solidifying its position as a leader in global finance. Today, headquartered in New York City, JPMorgan Chase operates across various sectors, including investment banking, commercial banking, asset management, and consumer banking, and continues to play a crucial role in the global economy. Its long history reflects not only the evolution of the banking industry but also the resilience and adaptability of one of the world’s most powerful financial institutions.

Business Model

JPMorgan Chase operates through four primary business segments, each with a unique business model and revenue-generation strategy. The Consumer & Community Banking (CCB) segment caters to individual consumers and small businesses by offering a wide array of services, including retail banking, credit cards, home lending, auto finance, and small business banking. It leverages a nationwide branch network, ATMs, and robust digital and mobile platforms to deliver these services. Revenue in this segment is driven by net interest income earned from the spread between interest received on loans, such as mortgages and auto loans, and the interest paid on deposits. Additionally, the CCB segment generates substantial fee income from account maintenance charges, overdraft fees, and interchange fees on credit and debit card transactions.

The Corporate & Investment Bank (CIB) segment serves large corporations, governments, and institutions globally, providing services such as investment banking, market-making, and securities services. This segment generates revenue through investment banking fees earned from advisory services for mergers and acquisitions (M&A), debt underwriting, and equity issuance. Trading revenue forms another significant component, derived from market-making and trading activities across fixed income, currencies, commodities, and equity markets. Additionally, the segment earns fees from securities services such as custody, clearing, and fund servicing, as well as interest income from loans extended to institutional clients.

The Commercial Banking (CB) segment focuses on medium-sized businesses, real estate firms, and large corporations, offering financial solutions that include lending, treasury services, and payment processing. It emphasizes cross-selling opportunities by leveraging relationships to provide investment banking and asset management services. Revenue in the CB segment comes primarily from lending income, such as interest on commercial loans and real estate financing, as well as treasury and payment processing fees. Additional income is generated through advisory services and the cross-selling of investment banking and wealth management products.

The Asset & Wealth Management (AWM) segment caters to high-net-worth individuals, institutions, and financial intermediaries, offering services such as investment management, retirement planning, private banking, and financial planning. This segment generates revenue mainly from management fees, which are based on a percentage of assets under management (AUM), and performance fees for exceeding benchmark investment performance. Net interest income is also a significant contributor, earned from deposit balances and lending to high-net-worth clients. Furthermore, fees for tailored wealth planning and advisory services add to the segment's revenue.

Across all segments, JPMorgan Chase relies on key income drivers, including net interest income, which benefits from the prevailing interest rate environment and credit demand, and fee-based income from advisory, management, and transactional services. Operational efficiency, supported by significant investments in technology, enhances customer experience and reduces costs, improving margins. The firm's ability to cross-sell products and services across segments amplifies income potential, such as offering investment banking or asset management services to clients in the Commercial Banking segment.

What you should know before investing into a bank stock

The profitability of banks is unique compared to other companies due to their distinct business model and revenue-generation mechanisms, which rely heavily on financial intermediation and risk management. Here are the key factors that make bank profitability special:

1. Net Interest Margin (NIM) as a Core Metric

Banks derive a significant portion of their income from the difference between the interest earned on loans and investments and the interest paid on deposits and borrowings. This net interest margin (NIM) is a critical profitability metric unique to financial institutions, as their business fundamentally revolves around managing this spread.

2. Balance Sheet Structure

Banks operate with highly leveraged balance sheets, meaning they use deposits and borrowed funds to finance a much larger asset base. This leverage amplifies returns on equity (ROE) when managed effectively, but it also introduces unique risks related to credit quality, liquidity, and interest rate movements.

3. Fee-Based Income

In addition to interest income, banks earn a substantial portion of their revenue from fees associated with investment banking, asset management, trading, payment processing, and other financial services. This diversification reduces reliance on interest income and helps maintain profitability during periods of low interest rates.

4. Regulatory Requirements

Banks must adhere to stringent regulatory frameworks, such as maintaining specific capital ratios and liquidity buffers, which directly influence their profitability. These requirements are designed to ensure financial stability but can constrain earnings potential compared to non-regulated businesses.

5. Economies of Scale

Larger banks often benefit from economies of scale, enabling them to spread operational costs over a wider base of clients and transactions. This advantage is particularly significant in areas like technology, compliance, and global operations, contributing to higher profitability margins.

6. Risk-Weighted Profitability

Banks manage profitability on a risk-adjusted basis, focusing on returns relative to the risks undertaken. For example, higher interest rates might increase profitability through loan yields, but they also elevate credit risk, requiring careful management of the trade-off between income and potential losses.

7. Impact of Interest Rates

Unlike many other industries, bank profitability is highly sensitive to interest rate changes. Rising rates generally boost net interest income as the yield on assets adjusts faster than the cost of liabilities, but they can also increase default rates and impair fixed-income investments.

8. Market Sensitivity

Banks are exposed to market risks, including currency, equity, and commodity price fluctuations, which directly impact trading revenue and investment portfolios. This contrasts with most non-financial companies, where market risks are less central to operations.

9. Customer Trust and Reputation

Profitability in banking is heavily reliant on customer trust and brand reputation, as these influence deposit stability and the willingness of clients to engage in long-term relationships. Non-financial companies may face similar challenges, but the consequences for banks are more immediate due to their reliance on public deposits and market confidence.

10. Cyclicality and Economic Conditions

Bank profitability is closely tied to macroeconomic conditions. During economic expansions, loan demand increases, default rates decline, and fee-based activities flourish. In contrast, recessions often lead to reduced credit demand and increased loan losses, directly affecting profitability.

Key metrics and financials

As previously mentioned, banking metrics and financials differ significantly from those of industrial companies. Therefore, I aim to provide a concise overview of some key metrics for JPMorgan Chase.

Balance sheet overview

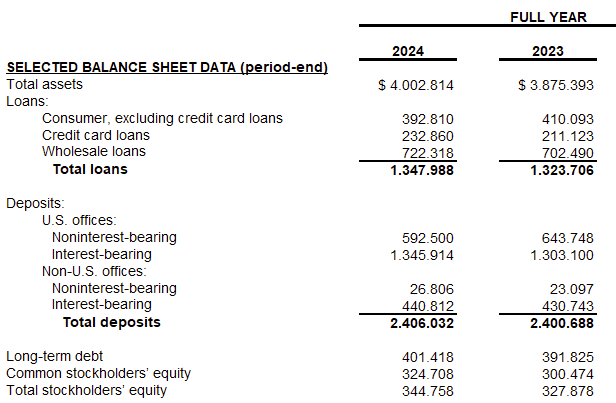

JPMorgan Chase's 2024 balance sheet data reveals significant insights into its financial health and business model. Total assets grew from $3.88 trillion in 2023 to $4.00 trillion in 2024, reflecting the bank's ability to expand its resource base.

The bank's loan portfolio experienced notable changes. Total loans increased from $1.32 trillion in 2023 to $1.35 trillion in 2024, driven by growth in both credit card loans and wholesale loans. Credit card loans rose to $232.9 billion, up from $211.1 billion, demonstrating stronger consumer spending or a higher market share in this segment. Wholesale loans also grew, suggesting enhanced engagement with corporate clients. Consumer loans, excluding credit card loans, saw a slight decline. The increase in overall lending highlights the bank's ability to deploy capital effectively while managing credit risk, which is central to its profitability.

Deposits remained stable, increasing slightly from $2.40 trillion in 2023 to $2.41 trillion in 2024. While noninterest-bearing deposits in U.S. offices declined, interest-bearing deposits grew, offsetting the reduction. This shift indicates a competitive environment for attracting depositors, as banks may offer higher interest rates to secure funding. Non-U.S. deposits also increased, reflecting JPMorgan Chase's global footprint. Stable deposit levels are critical to the bank's business model as they provide a low-cost source of funding for its lending and investment activities.

Long-term debt increased modestly from $391.8 billion to $401.4 billion, suggesting the bank accessed additional funding, potentially to support its asset growth or refinance existing debt. This reflects prudent balance sheet management and the bank's ability to leverage debt markets effectively.

Income statement overview

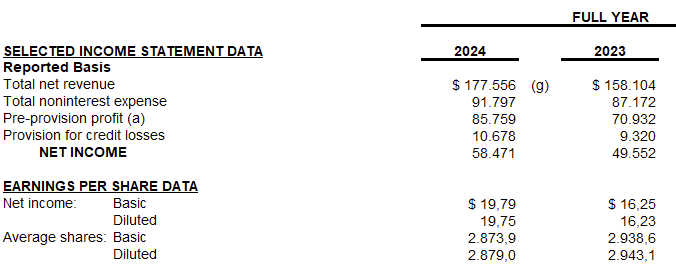

Total net revenue increased significantly, reaching $177.6 billion in 2024 compared to $158.1 billion in 2023. This notable growth reflects the bank's ability to expand its income streams, likely driven by higher net interest income, robust fee-based revenue, or other diversified activities.

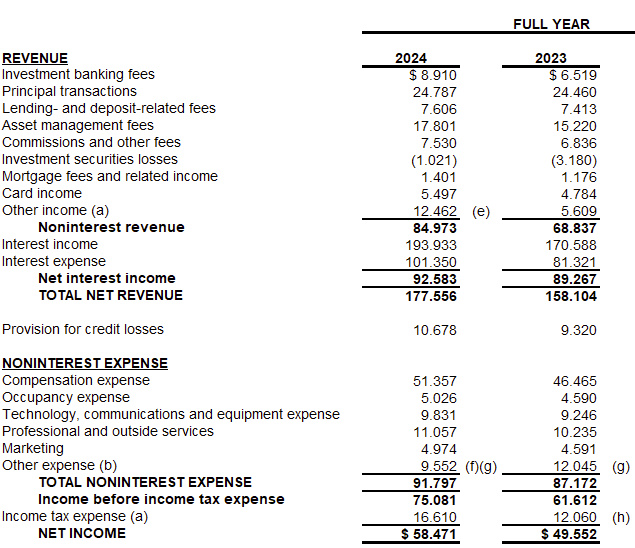

Noninterest revenue saw a significant increase from $68.8 billion in 2023 to $85.0 billion in 2024, highlighting strength in fee-based income:

Investment banking fees grew sharply from $6.5 billion to $8.9 billion, indicating robust performance in capital markets and advisory services.

Principal transactions remained stable at $24.8 billion, reflecting consistent earnings from trading and market-making activities.

Asset management fees rose from $15.2 billion to $17.8 billion, showing higher client assets under management, due to market growth or increased client inflows.

Card income and mortgage-related fees also increased, showcasing the bank's broad consumer engagement.

Other income doubled from $5.6 billion to $12.5 billion, contributing significantly to the year-over-year growth in noninterest revenue.

Interest income climbed from $170.6 billion in 2023 to $193.9 billion in 2024, reflecting higher loan balances or elevated interest rates. After accounting for interest expenses, net interest income grew from $89.3 billion to $92.6 billion, underlining the bank’s ability to capitalize on its core lending activities.

Total noninterest expenses also increased, rising from $87.2 billion in 2023 to $91.8 billion in 2024. While this growth indicates higher operating costs, due to inflationary pressures, technology investments, or expansion initiatives, the bank’s efficiency remains evident.

Compensation expenses increased from $46.5 billion to $51.4 billion,

Technology and equipment expenses grew from $9.2 billion to $9.8 billion, emphasizing JPMorgan Chase's continued focus on digital innovation and infrastructure.

Other expense categories, such as professional services and marketing, also saw moderate increases.

Despite these expenses, pre-provision profit (profit before accounting for credit loss provisions) surged from $70.9 billion to $85.8 billion, underscoring JPMorgan Chase’s operational strength and its ability to maintain strong margins.

Provisions for credit losses rose from $9.3 billion in 2023 to $10.7 billion in 2024. This increase reflects a more cautious approach to potential loan defaults or economic uncertainties. However, the impact of this higher provision was outweighed by the bank's strong revenue and profit generation, leading to a significant increase in net income. Net income for 2024 reached $58.5 billion, compared to $49.6 billion in 2023, marking a robust year-over-year improvement.

In terms of shareholder returns, basic earnings per share (EPS) increased from $16.25 in 2023 to $19.79 in 2024, and diluted EPS followed a similar trajectory, rising from $16.23 to $19.75. This growth reflects not only the bank’s improved profitability but also its commitment to delivering value to its shareholders.

Segment perspective

JPMorgan Chase's business lines delivered strong results in 2024, reflecting the resilience and effectiveness of its diversified business model.

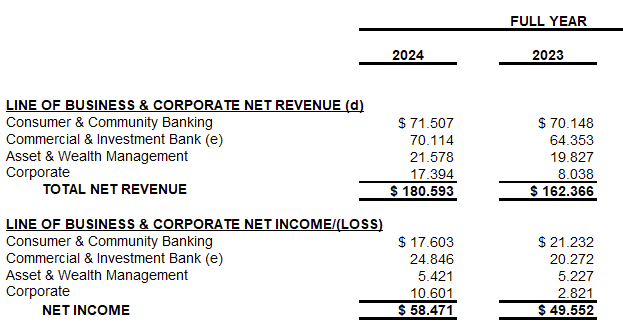

Consumer & Community Banking generated $71.5 billion in revenue, accounting for approximately 39.6% of the bank's total revenue. This reflects consistent growth in retail banking, credit card activities, and deposit-related services, which form the backbone of the bank's consumer-facing operations. However, net income for this segment decreased slightly to $17.6 billion, representing about 30.1% of total net income, down from $21.2 billion in 2023.

The Commercial & Investment Bank segment saw revenue rise from $64.4 billion to $70.1 billion, accounting for roughly 38.8% of total revenue. This underscores the bank's success in investment banking, trading, and corporate advisory services, highlighting its ability to capitalize on market opportunities and strengthen client relationships. Net income for this segment increased significantly, reaching $24.8 billion, or approximately 42.4% of total net income, compared to $20.3 billion in 2023, driven by favorable market conditions and strong profitability in core activities.

Asset & Wealth Management delivered $21.6 billion in revenue, up from $19.8 billion in 2023, contributing about 12.0% of total revenue. This reflects higher client assets under management and strong demand for investment products and advisory services. This segment accounted for $5.4 billion in net income, approximately 9.2% of the total.

The Corporate segment experienced the most significant growth, with revenue surging from $8.0 billion in 2023 to $17.4 billion in 2024, representing about 9.6% of total revenue. Correspondingly, net income for the Corporate segment jumped to $10.6 billion, approximately 18.1% of total net income, compared to $2.8 billion in 2023.

These results underscore the strength of JPMorgan Chase's diversified business model. Consumer & Community Banking, contributing the largest share of revenue at nearly 40%, remains the bank's stable foundation. Meanwhile, the Commercial & Investment Bank, with its significant 38.8% share of total revenue and 42.4% of net income, demonstrates strong profitability and market leadership. Asset & Wealth Management adds further stability, and the explosive growth in the Corporate segment highlights its strategic importance. This balanced contribution across business lines reduces dependency on any single revenue stream and enhances resilience against sector-specific headwinds.

Net interest margin over time

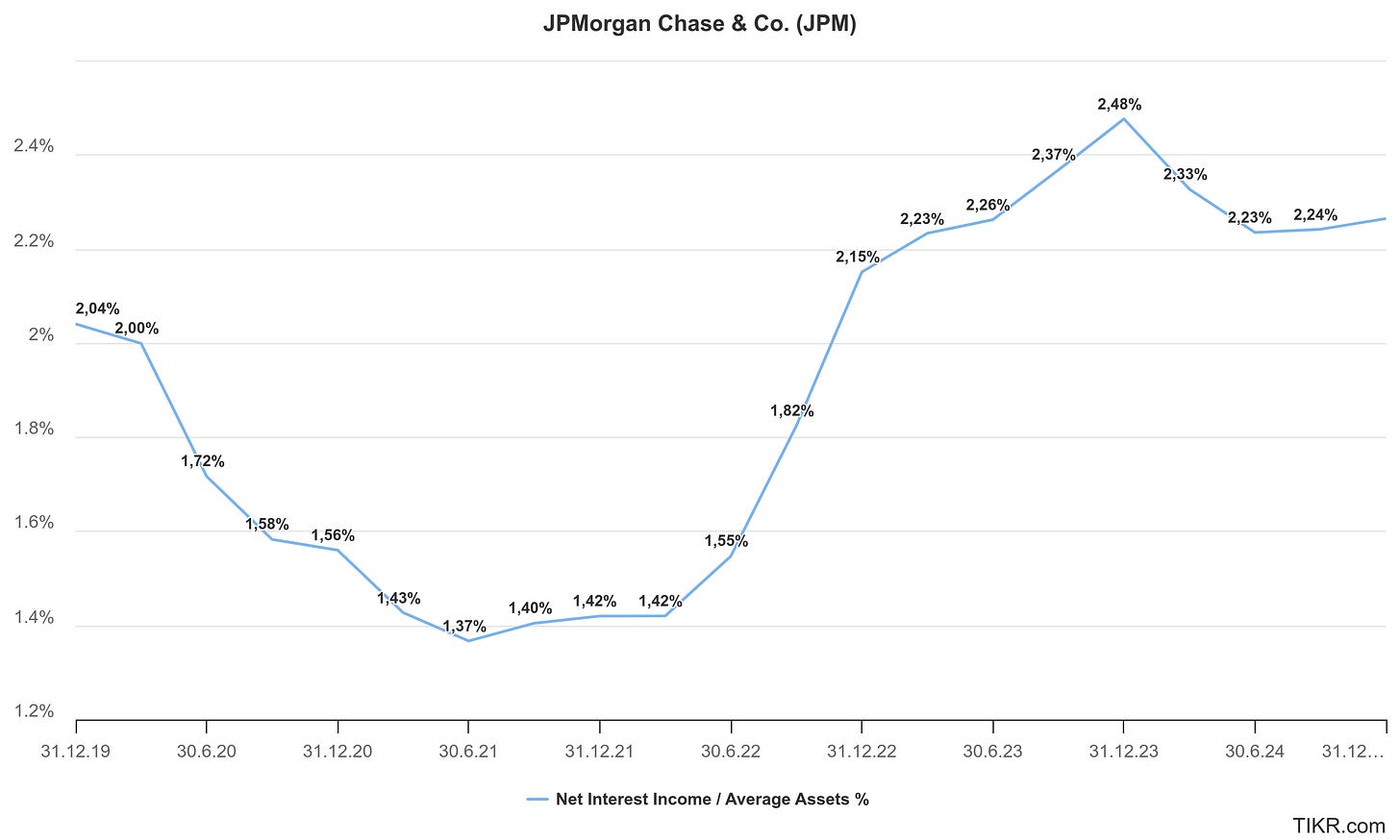

JPMorgan Chase’s Net Interest Margin (NIM), measured as net interest income as a percentage of average assets, has experienced significant fluctuations between 2019 and 2024, reflecting shifts in the interest rate environment. Starting at 2.04% in December 2019, NIM declined steadily through 2020 and 2021, reaching a low of 1.37% in June 2021. This drop was largely driven by the historically low interest rates during the COVID-19 pandemic, which compressed margins as loan yields fell while deposit costs remained stable.

Following this decline, NIM began to stabilize toward the end of 2021 at around 1.40%-1.42%. A notable recovery started in mid-2022, driven by the Federal Reserve’s rate hikes, which increased loan yields. By the end of 2022, NIM had risen to 1.82%, signaling the bank’s ability to adapt to the changing rate environment. In 2023, NIM surged further, peaking at 2.48% in June, as the higher interest rate environment allowed interest-earning assets to re-price upward more quickly than funding costs.

However, after reaching this peak, NIM began to moderate, declining slightly to 2.33% by the end of 2023 and stabilizing at around 2.24% in 2024. This decline reflects increasing deposit costs as competition for funds intensified in the high-rate environment, which compressed margins.

Overall, the NIM trajectory highlights JPMorgan Chase’s ability to navigate interest rate volatility effectively. The bank capitalized on rising rates to recover from the pandemic-driven decline, but the slight moderation in 2024 underscores the challenge of balancing funding costs and asset yields in a competitive market.

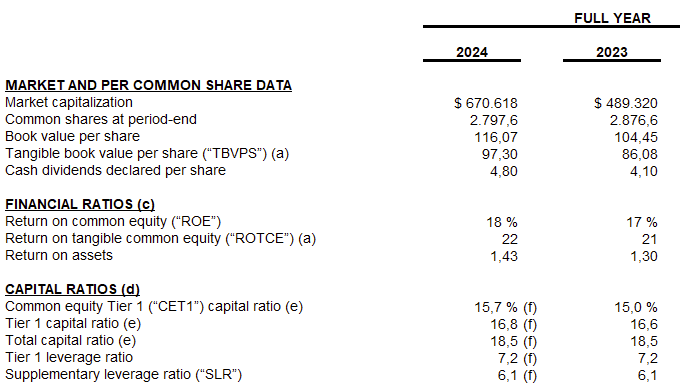

Market and profitability ratios

Profitability improved, with return on equity (ROE) increasing from 17% to 18%, and return on tangible common equity (ROTCE) rising from 21% to 22%. Return on assets (ROA) grew from 1.30% to 1.43%, reflecting more efficient asset utilization.

The bank maintained a robust capital position, with its CET1 capital ratio rising from 15.0% to 15.7%, while Tier 1 and total capital ratios remained stable. These metrics highlight JPMorgan Chase’s resilience, profitability, and strong risk management, positioning it as a leader in the industry and primed for sustained growth.

Credit quality and metrics

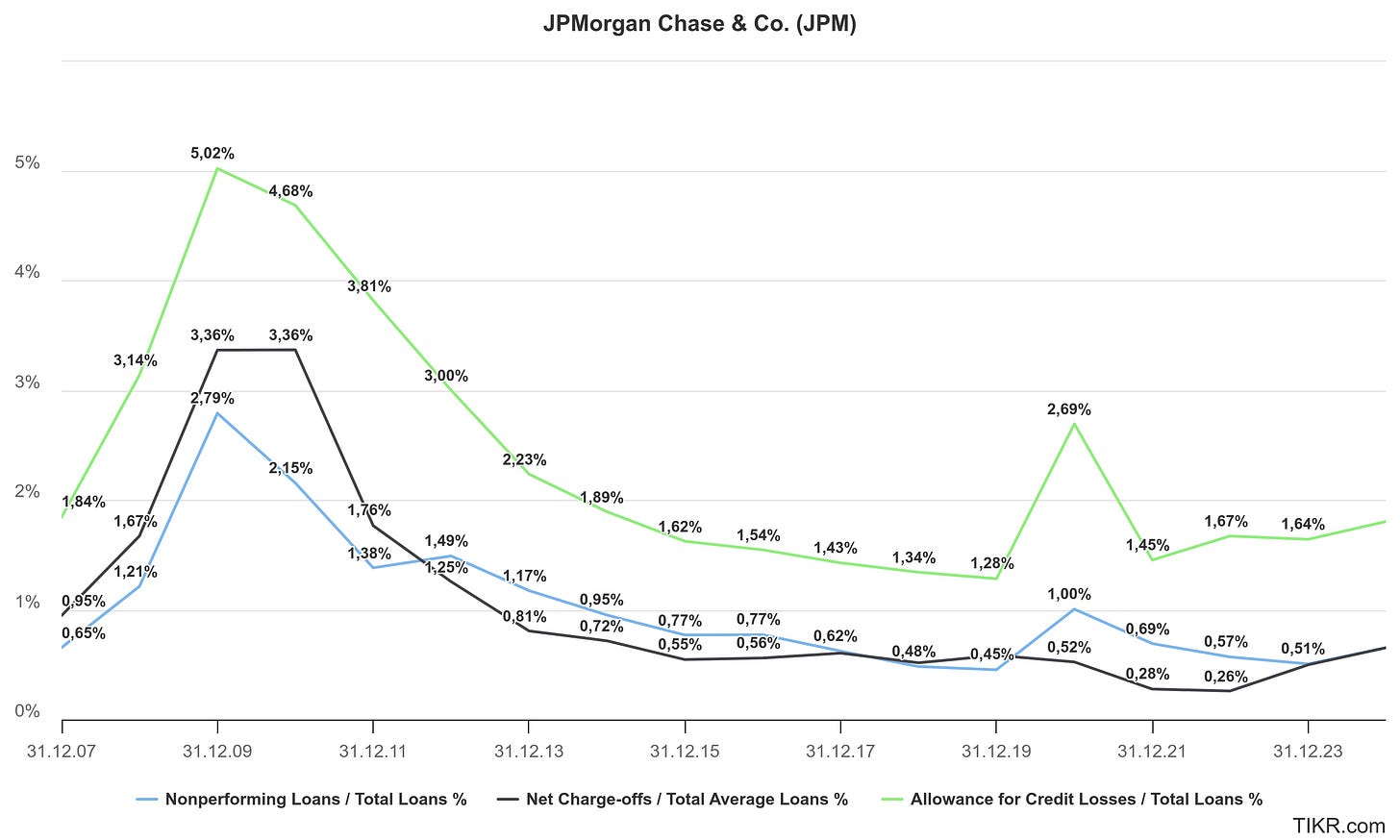

JPMorgan Chase’s credit metrics over time demonstrate its strong risk management capabilities and the quality of its loan portfolio. Nonperforming Loans (NPLs) as a percentage of total loans peaked at 1.67% during the 2009 financial crisis, reflecting widespread credit deterioration at the time. However, this ratio has steadily improved over the years, reaching a low of 0.28% in 2021 and stabilizing at 0.51% in 2023, indicating robust underwriting standards and improved loan quality.

Net charge-offs, which represent loans written off as uncollectible, followed a similar trend. These peaked at 2.79% in 2009 due to defaults in both consumer and corporate loans but have since steadily declined. By 2021, net charge-offs fell to 0.26%, before slightly increasing to 0.51% in 2023, likely reflecting the normalization of credit conditions as pandemic-era fiscal supports eased.

The bank’s allowance for credit losses, a reserve set aside to cover potential loan defaults, peaked at 5.02% in 2009, reflecting heightened credit risk during the financial crisis. This ratio gradually decreased to 1.34% by 2017, showcasing a healthier credit environment. However, it spiked again in 2020 to 2.69% amid the economic uncertainty caused by the COVID-19 pandemic. As of 2023 and 2024, the allowance for credit losses has stabilized at about 1.64%, reflecting prudent risk management while maintaining a sufficient buffer for potential future uncertainties.

Valuation

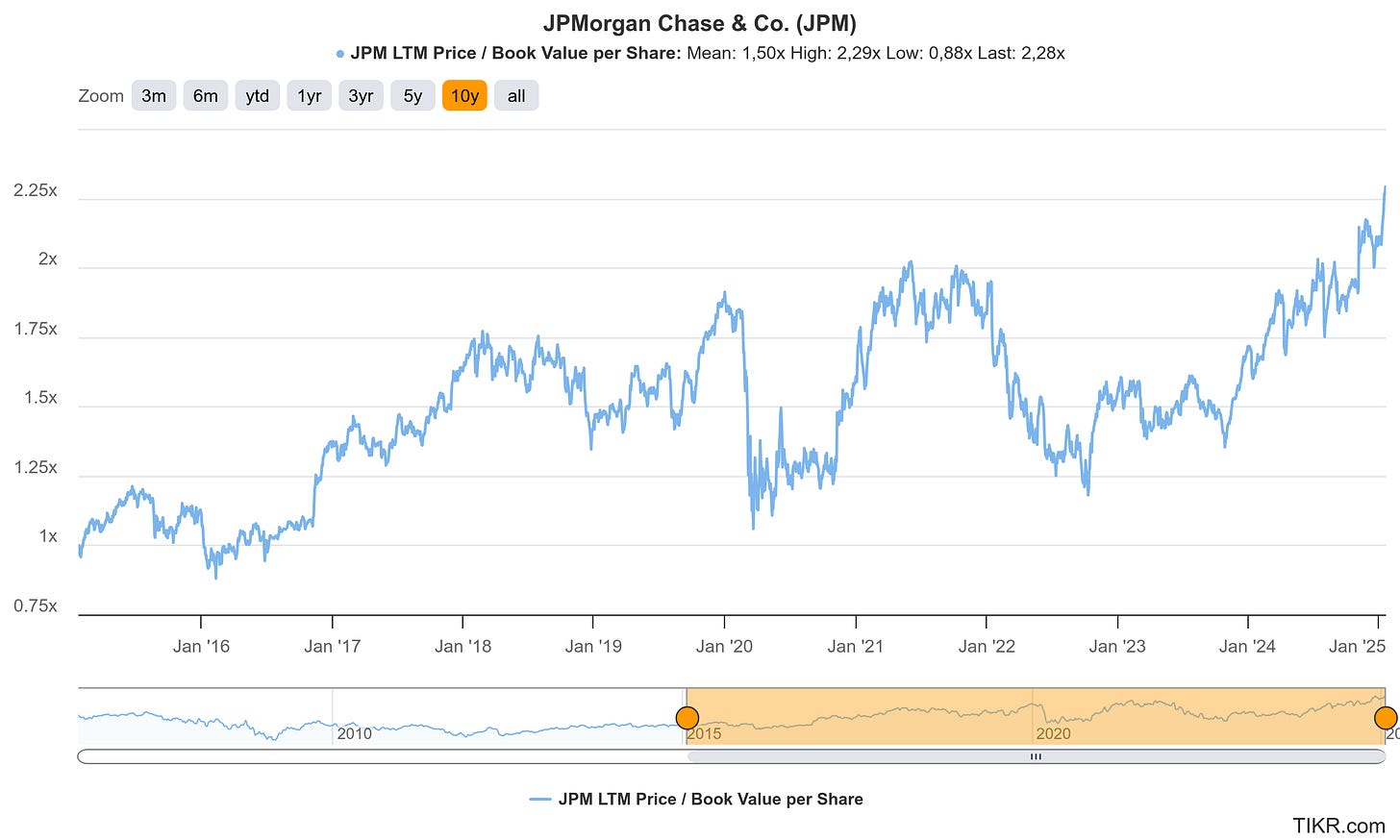

When valuing a bank, we often rely on straightforward but highly important metrics such as the price-to-book (P/B) ratio and the price-to-earnings (P/E) ratio based on normalized income. Currently, JPMorgan Chase’s P/B ratio stands at an all-time high of approximately 2.28x, which is exceptionally elevated for a bank. Over the past decade, the average P/B ratio for JPMorgan Chase was 1.5x, highlighting the significant premium investors are currently assigning to its equity.

The P/B ratio is particularly useful for banks because many of their balance sheet items are recorded at or near fair value, providing a more accurate reflection of the company’s equity value. At its core, a P/B ratio greater than 1 might indicate overvaluation, while a ratio below 1 could suggest undervaluation. However, such a simplistic interpretation often overlooks the nuances of a bank’s business model, quality of earnings, and growth prospects. For example, a higher P/B ratio could be justified by strong profitability, superior risk management, or a dominant market position. Therefore, while the current ratio suggests a high valuation, it is essential to consider the broader context and qualitative factors driving this premium.

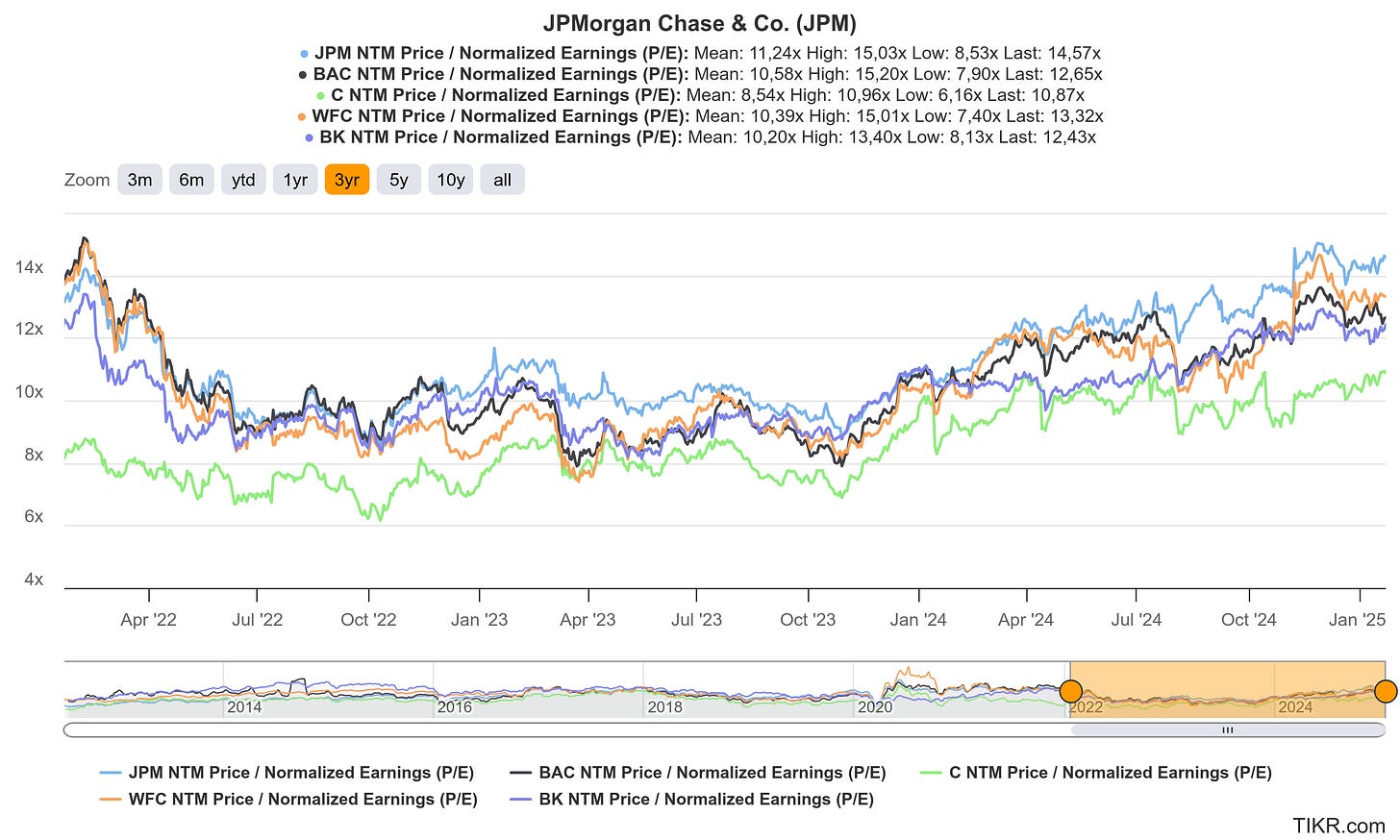

A similar, albeit less extreme, trend can be observed in JPMorgan Chase’s price-to-earnings (P/E) ratio. While its current P/E ratio of 14.57x is significantly higher than its 10-year historical average of 11.88x, the premium valuation reflects the company’s record-high profitability, strong reputation, and market dominance. However, this elevated multiple warrants caution, as the current valuation appears expensive, especially given the uncertainties surrounding the economic and political landscape.

Furthermore, when compared to its primary U.S. peers, JPMorgan Chase clearly stands out as the strongest, but it also trades at a noticeable premium relative to these competitors. While this premium is justified by the bank’s superior performance, market leadership, and resilience, it also underscores the importance of carefully assessing future risks and growth potential before making investment decisions.

In my view, JPMorgan Chase is currently overvalued. However, as one of the largest holdings in my portfolio, I’m extremely satisfied with its performance. While I don’t plan to add to my position immediately, I’m keeping a close eye on the market and will look for the right opportunity to increase my investment when the timing is favorable.

Conclusion

JPMorgan Chase & Co. stands as a dominant force in the global financial sector, underpinned by a well-diversified business model, strategic leadership, and an ability to adapt to changing market conditions. Its strong 2024 financial performance across all business segments highlights its resilience, with impressive revenue growth, record profitability, and robust credit metrics showcasing disciplined risk management.

From a valuation perspective, the stock currently trades at a historically high price-to-book (P/B) ratio of 2.28x, compared to its 10-year average of 1.5x. This premium reflects investor confidence in the bank's stability, profitability, and leadership. Similarly, the price-to-earnings (P/E) ratio of 14.57x is well above the historical average of 11.88x, underscoring the market’s recognition of the firm’s record-high earnings and strong reputation. However, these elevated valuations warrant caution, as they may leave limited upside in the short term, particularly given ongoing economic and geopolitical uncertainties. Additionally, JPMorgan Chase trades at a premium compared to its U.S. peers, highlighting its superior performance but also signaling the need for careful risk assessment when considering the stock as an investment.

As a financial institution with a rich history of navigating complex economic landscapes, JPMorgan Chase continues to excel in balancing profitability with risk, ensuring long-term value for shareholders. Whether for institutional clients, high-net-worth individuals, or everyday consumers, the bank’s diversified services and strategic adaptability underscore its unparalleled position as a cornerstone of the global banking industry.

Disclaimer: The information provided in this publication is for educational and informational purposes only and does not constitute financial advice. The content is solely reflective of my personal views and opinions based on my research and is not intended to be used as a basis for investment decisions. While every effort is made to ensure that the information is accurate and up-to-date, the writer makes no representations as to the accuracy, completeness, suitability, or validity of any information in this post and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. All readers are advised to conduct their own independent research or consult a professional financial advisor before making any investment decisions. The author is invested in the mentioned stock.

Thank you. Excellent review. I was about to purchase a financial, and now I am more confident of what to buy. Despite expensive levels, go with quality!