Welcome to the Allianz SE stock analysis! This report is structured into three parts:

Part 1 (Questions 1–13) covers the company's operations, business model, and strategy.

Part 2 (Questions 14–36) focuses on financials.

Part 3 (Questions 37–56) dives into the investment thesis, valuation, and capital allocation strategy.

Lets start with Part 1!

Allianz SE

1. What is the company doing?

Allianz SE and its subsidiaries (the Allianz Group) operate in three main business areas:

Insurance Operations:

Property-Casualty Insurance: Includes products such as motor, accident, property, general liability, travel insurance, and assistance services.

Life/Health Insurance: Offers savings and investment-oriented products alongside life and health insurance. Allianz ranks among the top five globally in life/health insurance and is the leading property-casualty insurer.

Asset Management:

Allianz operates through its subsidiaries PIMCO and Allianz Global Investors (AllianzGI), providing a wide range of investment products including equity, fixed income, multi-asset solutions, and alternative investments such as real estate and infrastructure. The primary markets for these services are in the United States, Canada, Germany, France, Italy, the UK, and the Asia-Pacific region.

Corporate and Other Activities:

Includes the management and support of the Allianz Group’s businesses through central functions such as strategy, finance, risk management, treasury, HR, legal, IT, and M&A.

Also covers banking operations in Italy, France, and Bulgaria, as well as digital investments in high-growth tech sectors.

Allianz operates in nearly 70 countries, serving approximately 128 million customers worldwide.

2. When was is established and where is its headquater?

Allianz SE was established in 1890 in Berlin, Germany. The company is now headquartered in Munich, Germany.

3. How many people work for it?

As of December 31, 2024, Allianz Group employed 154,346 people worldwide

4. Whats the current market value and how many shares are outstanding?

As of December 31, 2024, the total number of outstanding shares was 386,166,676, with a current market value of approximately €134 billion.

5. How has the stock performed recently?

Over the past year, the stock has appreciated by approximately 31.86%. Notably, the stock set a new 52-week high during that day's trading session, reaching €354.30. Over the past six months, Allianz SE's stock has increased by 23.37%, and year-to-date, it has risen by 18.34%.

6. What are the key products?

Allianz Group's key products fall under three main business segments:

Property-Casualty Insurance:

Motor insurance (liability and own damage)

Accident insurance

General liability insurance

Fire and property insurance

Legal expense insurance

Credit insurance

Travel insurance and assistance services.

Life/Health Insurance:

Annuities and pension plans

Endowment and term life insurance

Unit-linked and investment-oriented products

Full private health insurance

Supplemental health and long-term care insurance.

Asset Management:

Investment funds (equity, fixed income, multi-asset, and cash)

Alternative investments (real estate, infrastructure debt/equity, liquid alternatives)

Solutions business (investment strategies for institutional and retail clients).

7. What is the business model?

Allianz operates under a comprehensive business model that integrates insurance, asset management, and corporate functions, focusing on customer-centricity, risk management, and financial sustainability. The key aspects of its business model include:

Customer-Centric Insurance Model (Allianz Customer Model - ACM):

Allianz has a global, end-to-end insurance model that ensures consistency, simplicity, and scalability across its subsidiaries.

It streamlines the insurance value chain, from product development and sales to claims management and customer service.

Uses data-driven customer insights (e.g., Net Promoter Score (NPS) surveys) to enhance services and customer engagement.

Risk and Capital Management Strategy:

Allianz applies an internal Solvency II model to measure and steer its risk exposure while maintaining a target solvency ratio range.

The company balances capital allocation, risk appetite, and shareholder returns, ensuring sustainable profitability.

Uses scenario analysis, stress testing, and capital management frameworks to mitigate financial risks.

Asset Management Business Model:

Unlike insurance, which is balance-sheet driven, asset management operates on a cash-flow basis.

Allianz’s asset management subsidiaries (PIMCO and Allianz Global Investors) focus on investment strategies for institutional and retail clients, including equities, fixed income, and alternative investments.

Efficiency is measured through cost-to-income ratios (CIR).

Technology and Digital Transformation:

Allianz leverages advanced data analytics, automation, and AI to enhance customer experience and operational efficiency.

Investments in cybersecurity, cloud computing, and digital claims processing improve agility and reduce costs.

8. What segments does it report?

Allianz reports its business in four key segments, each generating revenue through distinct mechanisms:

Property-Casualty Insurance

Premium Income: Customers pay premiums for insurance policies covering risks such as motor, property, liability, and other casualty risks.

Investment Income: Allianz invests the collected premiums in financial markets to generate returns before claims are paid out.

Fee-based Income: Includes administrative and service fees related to policy management.

Life/Health Insurance

Premiums on Life and Health Policies: Revenue from policyholders for life, disability, annuity, and health insurance products.

Investment Income: Earned by investing premiums in various financial assets.

Fees and Commissions: Allianz earns fees for managing pension and annuity products.

Asset-based Charges: Revenue from managing assets under unit-linked and investment-oriented life insurance products.

Asset Management (PIMCO & Allianz Global Investors)

Management Fees: Charged based on assets under management (AuM) for third-party and proprietary clients.

Performance Fees: Additional revenue earned when investment performance exceeds specific benchmarks.

Distribution and Advisory Fees: Fees generated from structuring and distributing investment products.

Corporate and Other

Banking Revenue: Includes net interest income and transaction fees.

Alternative Investments: Earnings from private equity, infrastructure, and other investment activities.

Holding and Consolidation Adjustments: Internal transactions and eliminations among Allianz business segments.

Each of these segments contributes to Allianz’s diversified revenue streams, ensuring stability and resilience in different market conditions.

9. What are the key markets?

Allianz Group's key markets vary by business segment:

Insurance (Property-Casualty & Life/Health):

Germany

France

Italy

United States

Asia (various countries)

Most of Allianz's insurance markets are served by local Allianz companies, while some business lines, such as Allianz Global Corporate & Specialty (AGCS), Allianz Partners (AP), and Allianz Trade, operate globally.

Asset Management (PIMCO & Allianz Global Investors):

United States

Canada

Germany

France

Italy

United Kingdom

Asia-Pacific region.

These regions represent Allianz's largest markets in terms of premium volume and investment assets under management.

10. What is the strategy?

Allianz SE’s business segment strategies focus on leveraging its global scale, digital transformation, and customer-centric approach to drive growth and efficiency across its three main business areas: Property-Casualty (P&C) Insurance, Life/Health (L/H) Insurance, and Asset Management (AM). Here is the detailed strategy per segment:

Property & Casualty (P&C) Insurance Strategy

Goal: Boost profitable growth through technical excellence, smart growth, and productivity improvements.

Key Strategic Priorities:

Smart Growth:

Net policy growth of 1-2% p.a. without compromising profitability.

Price discipline with rate changes driven by inflation monitoring.

Strengthening direct and digital sales to improve accessibility.

Technical Excellence & Resilience:

Pricing, underwriting, and claims excellence through AI-powered analytics.

Superior claims management: Fraud detection, automation, and improved cost control.

Protection against NatCat (Natural Catastrophe) exposure with better risk modeling.

Rapid Productivity Gains:

Expense ratio reduction of ~30 bps per year through automation and process simplification.

IT decommissioning to enhance operational efficiency.

AI-driven efficiencies in pricing, claims processing, and underwriting.

Financial Targets (2025-2027):

Operating profit CAGR: +10%.

Combined Ratio (CR): ~92.5% (significantly reducing loss volatility).

Expense Ratio: ~-30bps per year.

Competitive Edge:

Largest global retail P&C insurer, with leading positions in key markets.

AI-driven risk modeling and pricing, enhancing profitability.

Expansion of direct insurance and digital claims processing.

Life & Health (L/H) Insurance Strategy

Goal: Capital-efficient growth by expanding in Protection & Retirement solutions and reducing capital intensity.

Key Strategic Priorities:

Retirement & Protection Focus:

Expanding Health & Protection business, which already contributes 11% of Group operating profit.

Innovative retirement solutions to address the widening pension gap.

Leveraging Allianz’s strong brand trust to scale life & pension offerings globally.

Capital Efficiency & Risk Management:

Reducing capital-intensive business models, particularly in the U.S. life insurance segment.

Reinsurance solutions (e.g., Sconset transaction) to optimize capital usage.

Increasing fee-based revenues from alternative asset management rather than traditional spread-based models.

Customer-Centric Digital Expansion:

Digital distribution models to enhance accessibility.

AI-driven underwriting & claims processing for faster policy issuance and claims settlements.

Expansion of preventive healthcare services, telemedicine, and wellness platforms.

Financial Targets (2025-2027):

Operating profit growth to exceed €10bn by 2027.

New business margin: 5%+.

Life & Health AUM growth: ~8% per year.

Competitive Edge:

#3 Life Insurer globally with a balanced portfolio across Europe, the U.S., and Asia.

Growing Health & Protection business in new markets.

Innovative capital optimization via reinsurance transactions.

Asset Management (AM) Strategy

Goal: Strengthen Allianz’s position as a top global asset manager, focusing on alternative investments and retirement solutions.

Key Strategic Priorities:

Accelerating Growth in Alternative Assets:

Expansion in Private Markets (e.g., Private Credit, Infrastructure Debt, Emerging Market Loans).

Targeting €230bn in alternative strategies by 2027.

Strong synergies between Allianz Life and AM businesses, integrating retirement investment solutions.

Strengthening Fixed Income & Equities Business:

Leveraging higher interest rate environments to drive inflows into PIMCO and Allianz Global Investors.

Enhancing risk-adjusted investment performance, focusing on stable, long-term returns.

ESG & Sustainability Leadership:

Incorporating sustainable investment strategies, aligning with EU Taxonomy and SFDR Article 8 & 9 funds.

Targeting €425bn in ESG and sustainable investment strategies.

Financial Targets (2025-2027):

3rd party AUM CAGR: 8%+.

Operating profit to exceed €3bn+ by 2027.

Increase in Alternative Asset Revenues: +30%.

Competitive Edge:

Top 5 active asset manager globally with €1.84tn in AUM.

Strong private markets expertise with diversified investment opportunities.

Leveraging Allianz’s insurance balance sheet for cross-sell opportunities.

Overall Allianz Group Strategy: "Lifting Ambitions"

Allianz is elevating its strategy by:

Enhancing customer trust and expanding direct customer engagement.

Digitizing operations with AI-driven automation

Focusing on smart growth, shifting towards capital-efficient business models.

Strengthening productivity through expense reductions and process simplification.

Ensuring resilience, with improved capital efficiency, risk management, and ESG leadership.

Allianz is positioning itself as the "most trusted" global insurer and asset manager, focusing on Protection, Retirement, and smart capital allocation to drive long-term shareholder value.

11. Who is running the company?

Oliver Bäte – CEO of Allianz SE

Background and Education

Oliver Bäte was born on March 1, 1965, in Bensberg, Germany. He studied Business Administration at the University of Cologne and later earned an MBA from the Leonard Stern School of Business at New York University.

Before his studies, he completed a banking apprenticeship at Westdeutsche Landesbank in Cologne.

Early Career

Bäte began his professional career in 1993 at McKinsey & Company in New York. In 1995, he moved to McKinsey's German office, where he became head of the German insurance practice in 1998. By 2003, he was promoted to Director and led McKinsey’s European insurance and asset management sector.

Career at Allianz SE

2008: Bäte joined the Board of Management of Allianz SE as Chief Operating Officer (COO).

2009: He was appointed Chief Financial Officer (CFO).

2013: Took over responsibility for Allianz’s insurance business in Western and Southern Europe, including France, Italy, and Benelux.

2015: On May 7, he became the CEO of Allianz SE.

Under his leadership, Allianz has strengthened its position as one of the world's leading insurance and financial services companies.

12. What does the compensation of the management look like?

Management compensation at Allianz SE is structured as follows:

Board of Management Compensation

Fixed Remuneration

Base salary

Perquisites (e.g., insurance contributions, tax consultancy fees, company car)

Pension contributions (15% of target remuneration)

Variable Remuneration

Short-Term Incentive (Annual Bonus): Based on financial performance, including operating profit and net income attributable to shareholders.

Long-Term Incentive (LTI): Share-based compensation tied to Allianz stock performance and sustainability assessment.

Maximum Compensation

Chairperson: €14.05 million

Regular Board Members: €7.17 million.

Malus and Clawback Provisions

Variable compensation may be reduced or reclaimed in case of significant breaches of the Allianz Code of Conduct, regulatory policies, or risk limits.

Pension Contributions

Company pension scheme with a 15% contribution of target remuneration.

Supervisory Board Compensation

Fixed Annual Remuneration

Regular members: €150,000

Deputy Chairperson: €225,000

Chairperson: €450,000.

Committee-Related Remuneration

Additional compensation for committee roles, paid pro-rata.

Attendance Fees and Expenses

€1,000 per meeting (only once per day, even if multiple meetings occur)

Reimbursement for expenses incurred.

Variable Remuneration for Allianz SE Board Members

Allianz SE's variable remuneration consists of short-term incentives (Annual Bonus) and long-term incentives (LTI), both structured to align with financial performance, shareholder value, and sustainability goals.

Annual Bonus (Short-Term Incentive)

Based on two financial targets, each weighted 50%:

Operating Profit

Net Income Attributable to Shareholders

Individual Contribution Factor (ICF): Adjusts payout within a range of 0.8 to 1.2, reflecting both divisional and individual performance.

Bonus Cap: Maximum payout is 150% of target.

Adjustment Mechanisms:

Extraordinary factors (e.g., regulatory changes, acquisitions, economic crises) may be considered for adjustments.

Long-Term Incentive (LTI) Plan (Share-Based Compensation)

Largest portion of variable compensation (64%).

Designed to increase enterprise value and align interests with shareholders.

Consists of Restricted Stock Units (RSUs), granted annually.

LTI Allocation Calculation:

LTI target amount × Annual Bonus Achievement Factor.

Capped at 150% of the target level.

Performance Metrics:

Allianz Share Performance (Total Shareholder Return - TSR)

Relative TSR vs. STOXX Europe 600 Insurance Index

Sustainability Metrics (Net-Zero Transition Plan, Digital NPS, Employee Engagement)

Vesting Period: 4 years, payout based on final share price performance.

Maximum Payout: Capped at 200% of grant price.

Sustainability & Risk Adjustments

Sustainability Targets: 20% of variable remuneration is linked to:

Digital Net Promoter Score (dNPS)

Inclusive Meritocracy Index (IMIX)

Climate targets & net-zero alignment

Malus & Clawback:

If a Board member breaches the Allianz Code of Conduct, Solvency II risk limits, or compliance rules, their bonus or LTI can be reduced or reclaimed within three years.

Board of Management Shareholdings at Allianz SE

Shareholding Exposure

Allianz SE Board members have significant shareholding exposure through direct share ownership and Restricted Stock Units (RSUs) accumulated via the Long-Term Incentive (LTI) plan.

Shareholding Requirements

Chairperson of the Board of Management: Required to own Allianz shares equivalent to two times base salary (approx. €4.01 million).

Regular Board Members: Required to hold shares equivalent to one time base salary (approx. €1.02 million).

Shares must be maintained for the entire tenure on the Board.

Economic Exposure to Allianz Stock

Chairperson's economic exposure to Allianz stock is ~800% of base salary.

Regular Board members have exposure of ~700% of base salary.

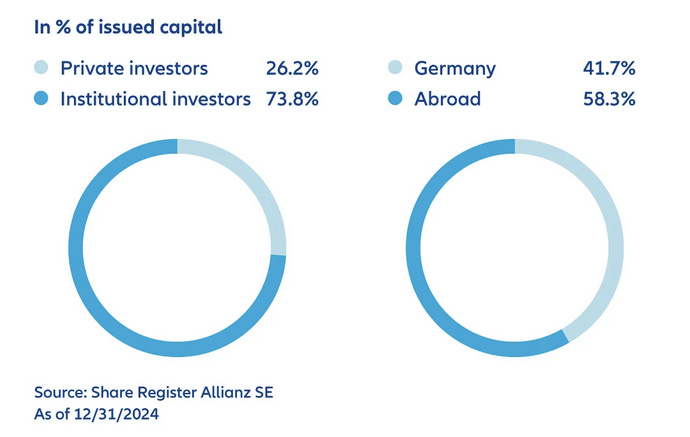

13. What is the shareholder structure?

As of December 31, 2024, Allianz SE's shareholder structure is as follows:

Total Number of Shareholders: 946,871

Total Number of Shares: 386,166,676

Free Float: 100%

Shareholder Composition:

Private Shareholders: 26%

Institutional Shareholders: 74%

Allianz SE is not aware of any direct or indirect interests in the share capital that exceed 10% of the voting rights.

This is Part I of my new business analysis format. Part II, covering all the key financial information you need to know, will be published soon—stay tuned!

Disclaimer: The information provided in this publication is for educational and informational purposes only and does not constitute financial advice. The content is solely reflective of my personal views and opinions based on my research and is not intended to be used as a basis for investment decisions. While every effort is made to ensure that the information is accurate and up-to-date, the writer makes no representations as to the accuracy, completeness, suitability, or validity of any information in this post and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. All readers are advised to conduct their own independent research or consult a professional financial advisor before making any investment decisions. The author is invested in the mentioned stock.