Welcome to episode 7 of the “World’s best stocks”. As for the previous episodes, I used the Finchat (Affiliate Link) screener to find the best companies.

Norway isn’t just about oil and fjords – it’s also home to some world-leading companies in defense, seafood, and recycling technology. In today’s post, we’ll take a conversational look at three notable Norwegian firms (all listed on the Oslo Stock Exchange) and break down what they do, how they’re performing, and how they’re valued. First up: Kongsberg Gruppen, followed by Mowi ASA, and then a third great business for paying subscribers only. Let’s dive in!

For your information: 1000 NOK ~ 95 USD ~ 88 EUR

Kongsberg Gruppen

General Description

Kongsberg Gruppen (OSE: KOG) is a diversified Norwegian technology conglomerate with core businesses in the maritime, defense, and aerospace sectors. In plain terms, Kongsberg builds everything from advanced missile systems and naval electronics to high-tech gear for merchant ships and offshore installations. The group operates through three main segments: Kongsberg Maritime (ship navigation, automation, and subsea systems), Kongsberg Defence & Aerospace (missiles, remote weapon stations, and other defense tech), and Kongsberg Digital (software and digital solutions for industries like energy and marine). This mix makes Kongsberg a unique blend of old-world industrial expertise and cutting-edge innovation. It’s not a household name globally, but in its niches – like the NASAMS air defense system and ship automation – it’s a big deal. In fact, Kongsberg is Norway’s premier supplier of defense and aerospace systems, and a leading provider of maritime technology worldwide.

Financial Summary

Kongsberg just wrapped up an impressive year. For 2024, the company reported operating revenues of NOK 48.9 billion, a 20% increase over 2023’s NOK 40.6 billion. Net income surged to NOK 5.13 billion, up 38% year-on-year, lifting the profit margin to about 11%. That translated into earnings per share (EPS) of NOK 29.14 for 2024, compared to NOK 21.08 the year before. In other words, Kongsberg earned a lot more money both in absolute terms and per share. The defense boom and strong demand in all divisions helped drive these results. The company’s order intake was massive (nearly NOK 87.8 billion in 2024) and it ended the year with arecord-high order backlog of NOK 128 billion (44% higher than a year ago), giving plenty of revenue visibility for the future. Overall, 2024 was a banner year financially –“new records for order intake, revenue, and operating profit,”as the CEO summed up. YoY growth was robust across the board, showing solid momentum.

Business Model

So how does Kongsberg Gruppen actually make money? Think of it as an engineering powerhouse selling high-tech systems and solutions to government and industry customers. In defense/aerospace, Kongsberg sells missiles (like the Naval Strike Missile), air defense systems (like NASAMS), combat vehicle electronics, and other military tech – often via large contracts with governments or prime contractors. In maritime, it provides ship systems (automation, propulsion control, sensors) and services to commercial shipping, offshore oil & gas, and renewable energy vessels. And through Kongsberg Digital, it sells software platforms and digital services that help industries monitor and optimize operations (for example, digital twins for oil rigs or vessels). The business model typically involves long sales cycles and big-ticket projects (especially in defense), but also a steady stream of after-market service and support revenues (maintenance contracts, upgrades, spare parts) which can be quite profitable. Kongsberg’s operations are global, serving navies, armies, shipyards, energy companies and more in numerous countries. This breadth gives it multiple revenue streams: defense contracts provide a boost when military spending is high, while maritime and digital segments tap into commercial markets. One notable aspect is that the Norwegian government is a major stakeholder and customer (Norway’s military uses a lot of Kongsberg gear), which provides stability. Overall, Kongsberg makes money by delivering complex tech solutions that its clients rely on for critical operations – whether it’s a missile that needs to hit its target or a ship that needs safe navigation.

Strengths and Weaknesses

Strengths: Kongsberg Gruppen’s key strength is its technological expertise and diversified portfolio. Few companies its size span defense, maritime, and digital domains – this gives Kongsberg multiple growth avenues and reduces reliance on any single market. It enjoys a strong competitive position in niche markets: for example, its Joint Strike Missile and NASAMS air defense system are globally respected, and its maritime systems have a solid installed base on ships worldwide. The company’s record order backlog is evidence of robust demand for its products, especially with heightened defense spending internationally (geopolitical tensions have led many countries to invest in Kongsberg’s missiles and weapons stations). Being partly government-owned also provides stability and trust for winning defense contracts. In short, Kongsberg has engineering pedigree (founded in 1814!), a broad solution set, and tailwinds from both defense and offshore/energy markets.

Weaknesses: On the flip side, Kongsberg faces some challenges. Heavy exposure to defense and government budgetscan be a double-edged sword – while spending is strong now, political shifts or peace dividends could slow orders in the future. The company operates in highly competitive global industries (going up against giants like Raytheon or Thales in defense, or Wärtsilä in maritime); staying ahead on innovation is a must. Its diverse segments, while a strength, also mean complex operations – managing everything from software development to missile manufacturing isn’t easy, and execution risks exist (delays or cost overruns on large projects can hurt margins). Additionally, Kongsberg’s maritime business can be cyclical, tied to shipbuilding and energy activity which rise and fall with the economic tide. Finally, the stock’s recent surge (more on that below) suggests high expectations – any stumble in performance or order intake could disappoint investors. In summary, Kongsberg’s weaknesses include reliance on government spending cycles, tough competition, and the need to flawlessly execute a very broad portfolio. These aren’t fatal flaws, but they are factors to watch.

Stock Valuation

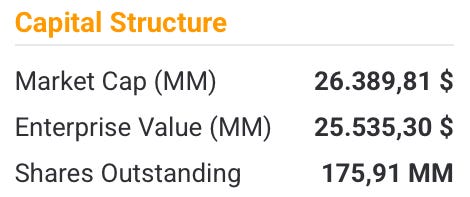

Kongsberg’s stock has been on a tear, doubling over the past year thanks to its strong results and the market’s enthusiasm for defense-related companies. This has left thevaluation quite stretchedby traditional metrics. At current prices, KOG shares trade around 53-57 times trailing earnings (P/E ~53.6x TTM), which is extremely high for an industrial/defense company. Even on a forward basis (looking at next year’s earnings), the P/E is about 43x – still pricing in a lot of growth. Likewise, the enterprise value to EBIT ratio (EV/EBIT) is roughly 38x, and EV/EBITDA about 31x, indicating a rich valuation. For context, many defense firms trade at mid-teens multiples; Kongsberg is way above that due to its unique growth profile. Some of this premium is arguably justified – the company has ambitious growth targets (management aims to triple revenue over the next decade) and is in the sweet spot of multiple favorable trends. However, it does mean the stock is priced for perfection right now. Analysts have taken note: the stock’s rapid rise to all-time highs has led to a more cautious stance from some. For example, as of March 2025, the consensus rating is mixed, with several analysts at a Hold and noting the high valuation, even as they acknowledge Kongsberg’s quality. In short, Kongsberg Gruppen’s shares carry a lofty valuation (P/E in the 50s, EV/EBIT ~38), well above market averages. Investors are effectively betting on continued strong growth and execution. Any positive surprises (like major new contracts) could keep the momentum going, but any hiccups might trigger a pullback given the high multiples. It’s a great company, but not a cheap stock at the moment.

Mowi ASA

General Description

Mowi ASA (OSE: MOWI) is a Norwegian seafood company and the world’s largest producer of farmed Atlantic salmon. If you’ve eaten farmed salmon, there’s a good chance it came from Mowi – the company accounts for a significant chunk of global supply. Formerly known as Marine Harvest, Mowi operates avertically integrated aquaculture business: they breed salmon from eggs, grow them in ocean farms, harvest and process the fish, and distribute seafood products worldwide. Mowi’s operations span 25 countries with farms in Norway, Scotland, Canada, Chile, Ireland, the Faroe Islands, and Iceland, plus processing and sales offices around the globe. The company is structured into three main business areas Feed (producing its own fish feed in mills in Norway and Scotland), Farming (raising salmon in sea cages and some primary processing like gutting/filleting in the farming regions), and Sales & Marketing (further processing into consumer products – think smoked salmon, portions, etc. – and selling to retailers, foodservice, and wholesalers). This structure means Mowi controls the salmon’s journey from “feed to fork.” It’s a bit like the “IBM of salmon” – highly integrated and a dominant player. Mowi also has a premium branded product line (simply called MOWI) in some markets, aiming to capture more value by selling branded salmon products. Overall, Mowi is in the business of turning fish feed into high-quality protein for a world with growing food demand, all while navigating the challenges of nature and markets.

Financial Summary

Mowi’s latest full-year results show steady (if not spectacular) growth, reflecting a somewhat challenging year balanced by strong demand for salmon. In 2024, Mowi reported revenue of EUR 5.60 billion, up about 1.8% from EUR 5.51 billion in 2023. In Norwegian Krone terms, that’s roughly on the order of NOK 60+ billion(depending on exchange rates). Net income for 2024 came in at EUR 468.5 million, an increase of around 5.4% from EUR 444.4 million the prior year. Earnings per share (EPS) were EUR 0.91, up from EUR 0.86 in 2023. So, despite only modest revenue growth, Mowi managed to notch a slightly higher profit – indicating a bit of margin improvement. Indeed, the profit margin for 2024 was about 8.4%, a tad higher than 2023’s ~8.1%. The company set a new record harvest volume of 502,000 tonnes of salmon in 2024 (vs 475,000 tonnes in 2023, +5.7%), which helped offset some weaker pricing or higher costs in parts of the year. It’s worth noting that 2023 had seen a big drop in net income from 2022 (due to weaker prices and a controversial new tax, more on that later), so 2024 was a recovery year in some respects. Operating profit (operational EBIT) for 2024 was EUR 828.9 million, down from EUR 1,027.5 million in 2023 (lower salmon prices in certain markets squeezed margins early in the year). But by Q4 2024, Mowi was hitting record quarterly revenues and improved profits. All in all, the financial summary is: small top-line growth, moderate earnings growth, and a decent year given the biological and market headwinds. The balance sheet remains solid, and Mowi continued to pay dividends (it’s known for good payouts). Investors often watch harvest volumes, salmon prices, and costs per kilo – in 2024 volumes were up and costs were fairly controlled, which bodes well if pricing holds up.

Business Model

Mowi’s business model is best described as “ocean farming + global salmon supply chain.” The company makes money by selling salmon and salmon products. But unlike a simple fishing company, Mowi farms the fish from start to finish. Here’s how it works: Mowi operates freshwater hatcheries where salmon eggs are hatched and grown into smolt (juvenile fish). These smolt are then transferred to large sea cages in coastal waters, where they are fed (often with Mowi’s own feed) and grown over 1-2 years into market-size salmon (around 4-5 kg). Mowi harvests these fish, processes them (cleaning, filleting, portioning), and then sells the salmon either as whole fish or value-added products to customers worldwide. Revenue comes from selling fresh whole salmon, fresh/frozen fillets, smoked salmon, and other prepared seafood items.

The business model is vertically integrated: Mowi controls the feed (a major input cost), the farming (where biological growth happens), and the sales distribution. This integration can give cost advantages and supply reliability. However, it also means Mowi is exposed to the entire value chain’s risks – disease or algae blooms can kill fish (production risk), feed ingredient prices (like fish meal or soy) can affect costs, and market prices for salmon (which are globally determined by supply/demand) dictate the selling price. Essentially, Mowi’s profitability swings with the market price of salmon, which can be volatile (booming when supply is short, dropping if there’s oversupply). To mitigate this, Mowi also produces value-added products (brands, smoked salmon, ready-to-eat meals) to capture more stable margins and differentiate from commodity fish. They also engage in contract sales and hedging to smooth out price swings somewhat. Another aspect of Mowi’s model: economies of scale. As the largest producer, Mowi can spread its overhead and R&D over huge volumes, and often has lower unit costs than smaller competitors. In recent years, the company has also focused on sustainability (e.g. reducing antibiotic use, improving feed efficiency, and even exploring offshore or land-based farming). In summary, Mowi makes money by growing salmon efficiently and selling it globally – it’s farming, manufacturing, and marketing rolled into one. When salmon prices are high, Mowi mints money; when prices are low or fish get sick, it feels the pain. The integrated model is its strength, as well as its challenge (because there are so many moving parts to manage).

Strengths and Weaknesses

Strengths: Mowi’s biggest strength is its scale and market leadership. As the world’s largest salmon farmer, it benefits from economies of scale in production, feed manufacturing, and global distribution. It can produce salmon at a lower cost per kilo than many competitors and has the volume to supply large customers year-round. Its vertical integration (Feed, Farming, Sales & Marketing) provides more control over the supply chain – for example, producing its own feed can improve margins and ensure quality control. Mowi also has a diversified geographic footprintin farming; it operates in multiple countries, which helps spread biological and political risk (a bad algae bloom in one region won’t wipe out the whole company’s output). Another strength is strong global demand for salmon – farmed salmon consumption has been rising as a healthy protein choice, and Mowi, with its massive output and established customer relationships, is in prime position to fulfill that demand. The company’s branding and value-added efforts (like the MOWI brand, smoked products, etc.) could give it an edge in capturing premium market segments beyond just selling commodity fish. Lastly, Mowi’s financials have been solid over the years, allowing it to pay consistent dividends – a plus for investors looking for income. In essence, Mowi is the 800-pound (or rather, 800,000-tonne) gorilla of its industry – it has the strengths of size, integration, and a product (salmon) with generally positive secular trends (health and sustainability considerations favor fish over red meat for many consumers).

Weaknesses: Despite its strengths, Mowi faces notable challenges. The salmon farming business is inherently exposed to biological and environmental risks – disease outbreaks (like sea lice infestations or viruses) can cause significant fish mortality or slow growth, which can dent output and raise costs. For instance, Mowi’s Scotland farms have occasionally suffered “biological issues” (disease, algae) that hurt volumes. The company is also heavily dependent on the natural environment (water quality, ocean temperatures, etc.), many factors of which are out of its control (e.g., an unusually harsh winter or marine heatwave can stress or kill fish). Another weakness is the volatility of salmon prices. Mowi’s earnings can swing widely with global salmon price cycles – and those prices can be affected by supply gluts (if competitors expand too much) or demand shocks. We saw this when prices and profits dropped in 2020 during early COVID, and similarly if there’s an oversupply year, Mowi’s margins shrink. Additionally, regulatory risk is significant for Mowi. Norway (where Mowi harvests ~60% of its fish) introduced a new resource rent tax on salmon farming in 2023, initially proposed at 40% but later adjusted to 35% (and eventually set at 25%) on profits in addition to the standard corporate tax. This kind of tax can directly hit Mowi’s bottom line and is a reminder that governments might seek a bigger share of the profits from what they see as exploiting natural resources. Mowi’s CEO even publicly criticized the “salmon tax” as destructive, indicating how big an issue it is for the company. Beyond tax, regulatory changes on environmental standards or licenses can impact operations. Another weakness: while vertical integration is a strength, it also means high operational complexity– Mowi has to excel at farming and processing and marketing, which is tough. If any link (say feed formulation or a processing plant) underperforms, the whole chain suffers. Finally, Mowi faces sustainability scrutiny and public perception issues; as a large fish farmer, it’s under the microscope from environmental groups concerned about pollution, fish welfare, and impact on wild salmon. Any reputational hit could become a business risk in the era of ESG investing and conscientious consumers. Summing up, Mowi’s weaknesses include its vulnerability to nature (diseases, environmental changes), commodity price swings, regulatory/tax changes, and the challenges of managing a complex, global farming operation. These factors can cause earnings to be less predictable than, say, a typical manufacturing firm.

Stock Valuation

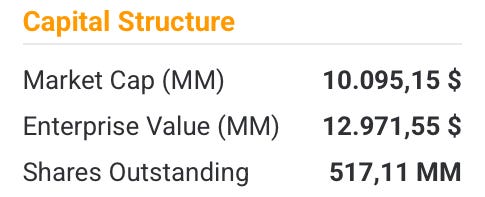

Mowi’s stock is generally viewed as a more moderate or value-oriented play compared to high-growth tech names – essentially a mature company with dividends. Mowi trades at about a P/E ratio in the high teens based on trailing earnings (roughly 18–20x). This reflects its latest earnings and current share price (the stock has been trading around the low-200s NOK per share, and with EPS around EUR 0.91 ≈ NOK 10, that math makes sense). Looking forward, if salmon prices improve, the forward P/E could drop to nearly ~12x, as analysts expect higher earnings next year (partly due to volume growth and possibly better pricing). In terms of enterprise multiples, EV/EBIT is in the low double digits (roughly 12–13x), and EV/EBITDA even lower, which is fairly normal for this industry. Mowi’s offers a dividend yield of about 3–4% (the company typically pays out quarterly dividends that sum up to a healthy yield, subject to earnings). This yield is attractive for investors looking for income, and it’s supported by Mowi’s cash flows – though the new tax might trim distributions a bit.

As for analyst sentiment, it’s somewhat mixed-positive. Some analysts see Mowi as a stable pick on the back of growing seafood demand and have overweight/buy ratings with price targets in the NOK 230-240 range, especially after the stock lagged in 2023 due to tax fears (meaning there could be value to unlock if operations continue to improve). Others are a bit cautious due to the regulatory overhang and biological risks, issuing hold ratings – for example, DNB recently downgraded to Hold with a target of NOK 230, essentially saying the stock is fairly valued around current levels. Overall, compared to the broader market, Mowi’s valuation is not demanding: a mid-teens earnings multiple for the world leader in its field, which seems reasonable given its cyclical nature. You could say the stock is priced like a “steadily paddling fish” rather than a high-flying tech rocket– investors expect decent, not explosive, returns. If Mowi can boost earnings (via higher salmon prices or efficiency gains) and navigate the new tax smoothly, there might be upside, especially with that solid dividend as a backstop. But if salmon prices were to slump or costs spike, the stock’s valuations would quickly look less cheap. Right now though, Mowi’s forward valuation metrics (P/E ~13x, EV/EBIT ~11x) are in a comfortable range, and the dividend yield adds to the investment case, making it something of a dividend/value play in the seafood industry.

The third stock pick is exclusive to paying subscribers.

Keep reading with a 7-day free trial

Subscribe to Kroker Equity Research to keep reading this post and get 7 days of free access to the full post archives.