Evolution AB: The Casino Behind Online Casinos

General Description of Evolution AB

Evolution AB (publ) is a Swedish online gaming company that operates behind the scenes of many online casinos worldwide. Founded in 2006, Evolution develops and licenses fully integrated B2B online casino solutions for gambling operators. In other words, it provides the live dealer games and digital casino content that casino websites offer to their players. The company has grown into the leading global provider in this niche, serving 600+ operator customers (including most major online gambling brands) and employing over 16,000 staff across studios in Europe and North America. Evolution’s core product is Live Casino – think real-time blackjack, roulette, poker, and game shows streamed from its studios – though it has also expanded into online slot games through acquisitions of slots developers like NetEnt and Big Time Gaming in recent years. Live dealer offerings remain its primary revenue driver (over 80% of 2024 revenues came from live casino games) while slots and other random-number-generator (RNG) titles contribute a smaller share. The parent company is listed on the Nasdaq Stockholm (ticker: EVO) and has built a reputation as “the casino company behind the online casinos,” with a dominant position in a fast-growing segment of the gambling industry.

Latest Financials (2024 Highlights)

Evolution’s latest financial results underscore its strong growth and profitability. According to the 2024 annual report, net revenues for the full year 2024 reached about €2.06 billion, a ~15% increase from 2023. (Total operating revenues were slightly higher at €2.21 billion, boosted by a one-time accounting item, but the underlying business grew at a healthy mid-teens pace.)

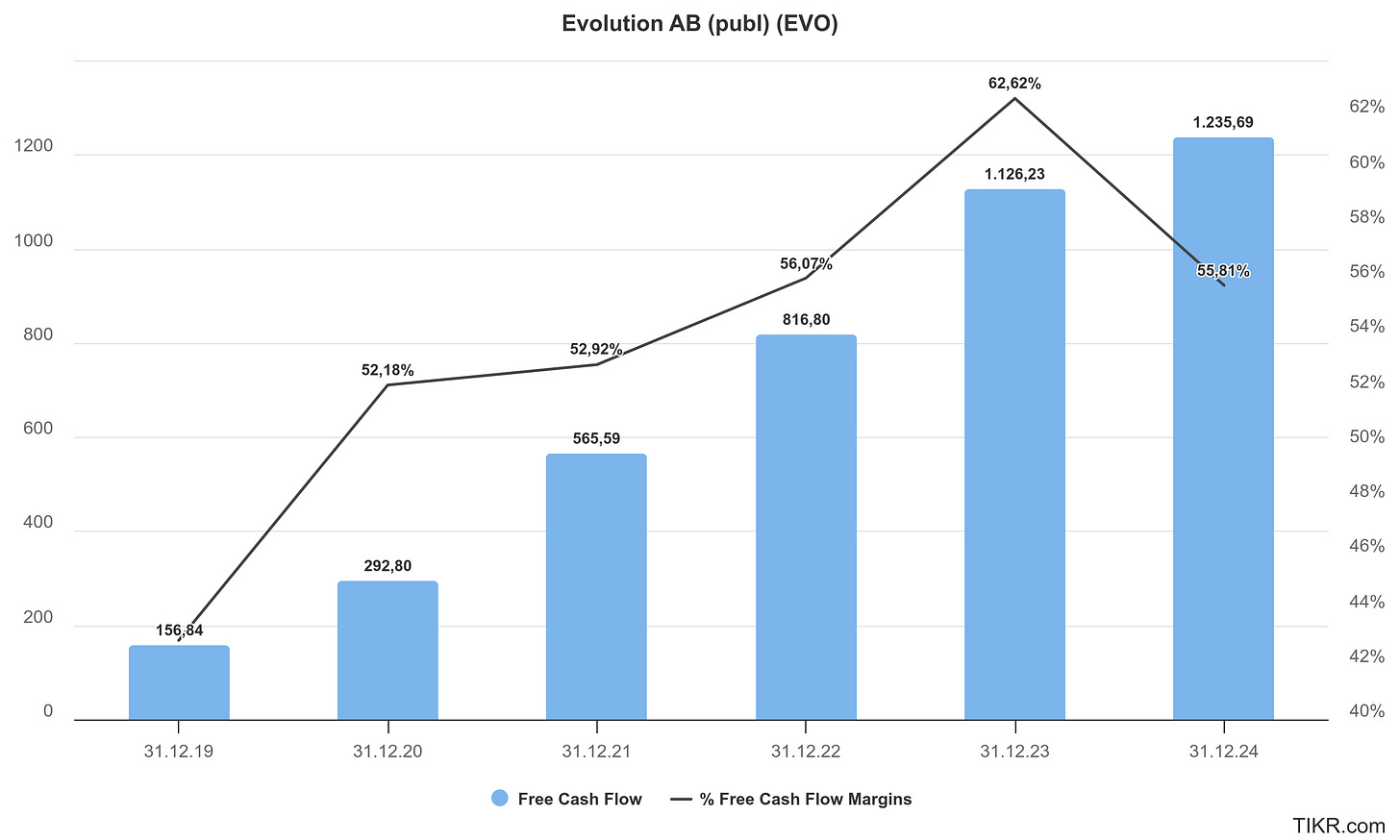

This top-line growth translated into impressive earnings – Evolution generated an operating profit of roughly €1.42 billion for 2024, with an extraordinary operating margin of 64%. After taxes, net profit landed at €1.24 billion, up about 16% year-on-year. Such high margins are a signature of Evolution’s scalable business model (discussed below), and the company continues to pair its growth with strong cash generation.

In fact, EBITDA for 2024 came in around €1.56 billion (about a 68% EBITDA margin) – reflecting the exceptional profitability of its operations. Evolution has been sharing these profits with shareholders as well, with a dividend of €2.80 per share proposed for 2024 (approximately 52% of net earnings). Overall, the latest financials paint a picture of a company that is growing solidly even as it maintains very high margins, a combination that long-term investors find quite attractive.

Business Model

Evolution AB’s business model is a B2B online casino supplier. The company runs studios where real dealers host casino games on camera, and it streams those games live to players who access them via third-party online casinos. The gaming operators (Evolution’s clients) integrate Evolution’s games into their websites and apps, and in turn market these games to their end-users. Evolution essentially provides the platform, technology, and human dealers, while the operators handle player acquisition and betting transactions.

Revenue model: Evolution makes money primarily through commission fees and fixed monthly fees charged to the casino operators. Commission revenues are typically a percentage cut of the operator’s winnings (i.e. the net amount players lose on Evolution’s games) and are earned on an ongoing basis. This means that as players wager on live tables or slots provided by Evolution, the house (casino) keeps the losses and shares a slice with Evolution. It’s a volume-driven model that gives Evolution a direct stake in the success and growth of online casinos’ activity.

In addition, many operators pay for dedicated tables – exclusive tables or environments branded and tailored for a specific casino. For these, Evolution charges a fixed monthly fee per table (which varies based on the game type, hours, and customization). The combination of commission (variable, volume-based) and dedicated table fees (fixed, recurring) provides a robust revenue stream. Evolution also earns smaller amounts from one-time setup fees when onboarding new operators or launching new dedicated environments.

Cost structure: On the cost side, the largest expenses for Evolution are related to its staff and studios. Running dozens of live studios (with real dealers, camera crews, and tech support) 24/7 across multiple countries is labor-intensive – personnel costs (dealers, game hosts, IT developers, support staff) and facility costs (studio space, equipment) are the main cost items. However, the model benefits from operating leverage: adding a new player or even a new operator to an existing game table has minimal marginal cost. Once a live table is running, it can serve hundreds of players simultaneously online, so revenue can scale up far more rapidly than costs.

This scalability is a big reason behind Evolution’s high profit margins. The company can launch new games or studios to grow, but its established operations continue to contribute strong incremental profits as utilization rises. In summary, Evolution’s business model is about providing the infrastructure of online casinos – it earns recurring revenues as a “toll taker” on gaming activity, while managing a large operational network of studios and employees to deliver a seamless experience for its clients and their players.

Strengths and Weaknesses

Strengths: Evolution AB enjoys several competitive advantages that have fueled its success. Firstly, it is the undisputed leader in live casino gaming – it was an early mover and has won the “Live Casino Supplier of the Year” award 10 years in a row, illustrating its strong brand reputation among casino operators. Its scale of operations (dozens of studios and thousands of live dealers) is hard for rivals to match, giving Evolution a rich variety of games and the capacity to serve many markets simultaneously. This scale also contributes to exceptional financial performance – the company’s operating margins north of 60% and robust cash flows are evidence of a highly efficient, scalable model.

Another strength is Evolution’s broad customer base: with 600+ operators on board, including major names like DraftKings, FanDuel, BetMGM, etc., it has deep integration in the industry. This diversifies revenue (no single casino partner dominates) and creates high switching costs – operators are reluctant to drop Evolution’s content given player demand for it. Additionally, Evolution has successfully expanded its product portfolio via innovation and acquisitions. It continually rolls out new game titles (for example, creative live game shows like Crazy Time or Lightning Roulette) to keep players engaged, and it acquired top slot developers (NetEnt, Red Tiger, Big Time Gaming, NoLimit City) to broaden into RNG games.

These moves position Evolution as a one-stop shop for online casino content. Finally, the company’s balance sheet is strong (it carries little debt and generates ample cash), enabling it to fund growth, pay dividends, and make strategic acquisitions without jeopardizing stability.

Weaknesses: Despite its strengths, Evolution faces a number of challenges and risk factors. Regulatory risk is arguably the biggest overhang. The online gambling industry is highly regulated and rules vary across jurisdictions – Evolution must secure and maintain gaming licenses in each market it serves. Any regulatory change can impact its business; for instance, the UK Gambling Commission launched a review in late 2024 amid concerns that Evolution’s games were accessed by unlicensed operators in Britain. Such scrutiny can lead to compliance costs, fines, or even loss of market access if issues aren’t resolved. Evolution’s reliance on third-party operators also means it is indirectly exposed to those operators’ compliance and reputational issues.

Another weakness is the concentration of revenue in live casino – while Evolution dominates that segment, the growth of its RNG (slots) division has been relatively slow (RNG revenues grew only ~4% in 2024). If interest in live casino games plateaus or a new competitor offers a disruptive live product, Evolution’s core business could face pressure. Competition, in general, is a concern: rivals like Playtech, Authentic Gaming, and upstarts are all vying for a piece of the live casino market. Although Evolution is ahead, it must continue innovating to stay on top. Operationally, running large-scale studios carries execution risk – we saw this in 2024 when Evolution’s major studio in Georgia was disrupted by employee strikes and even sabotage attempts. Such incidents can temporarily impact capacity or increase costs (e.g. if higher wages are needed to resolve labor disputes).

Finally, as a B2B dependent on consumer gambling activity, Evolution is somewhat vulnerable to macroeconomic swings or shifts in consumer behavior. If players spend less on gambling due to economic downturns or if there’s a post-pandemic normalization in online entertainment, operators’ revenues (and thus Evolution’s commissions) could be affected. In short, while Evolution is fundamentally strong, investors must keep an eye on regulatory developments, competitive dynamics, and operational hiccups that could pose risks to its growth story.

Detailed stock valuation, bullish and bearish investment theses, outlook and future prospects—as well as my final conclusion—are exclusively available to paid subscribers.

Keep reading with a 7-day free trial

Subscribe to Kroker Equity Research to keep reading this post and get 7 days of free access to the full post archives.