Inditex: Zara’s Parent as a Long-Term Investment Analysis

Company Overview

Industria de Diseño Textil S.A. (Inditex BME:ITX) is a Spanish multinational fashion retailer best known as the parent company of Zara, one of the world’s largest apparel brands. Founded in 1975 by Amancio Ortega in Galicia, Spain, Inditex has grown into a global empire of affordable fashion. The group operates a portfolio of popular retail brands including Zara (and Zara Home), Pull&Bear, Massimo Dutti, Bershka, Stradivarius, and Oysho. Zara is the flagship brand and accounts for the bulk of revenue (over 70% of sales and profits), while the other concepts target various segments from youth fashion (Pull&Bear, Bershka) to premium casualwear (Massimo Dutti) and lingerie/athleisure (Oysho). Inditex’s mission is to deliver the latest fashion trends in clothing, accessories and home textiles that meet customer demand for stylish, quality products at affordable prices.

Today, Inditex is truly global in scope. It operates in 214 markets worldwide (through a mix of physical stores and online platforms), with a store network concentrated in Europe but spanning all continents. As of the end of fiscal 2024, Inditex had 5,563 stores across its concepts, including flagship stores in major cities and an increasing number of smaller markets reached via franchising or online.

The company’s reach extends from developed markets (Spain, its home, and wider Europe, which together account for around half of sales) to emerging regions. In 2024, Inditex opened stores in 47 different markets, entering new countries such as Uzbekistan and planning entries into Iraq, among others. This global footprint and multi-brand strategy have positioned Inditex as the world’s largest fashion retailer by revenue and market capitalization, having overtaken long-time rival H&M in recent years.

Latest Financials – FY2024 Highlights and Early 2025 Updates

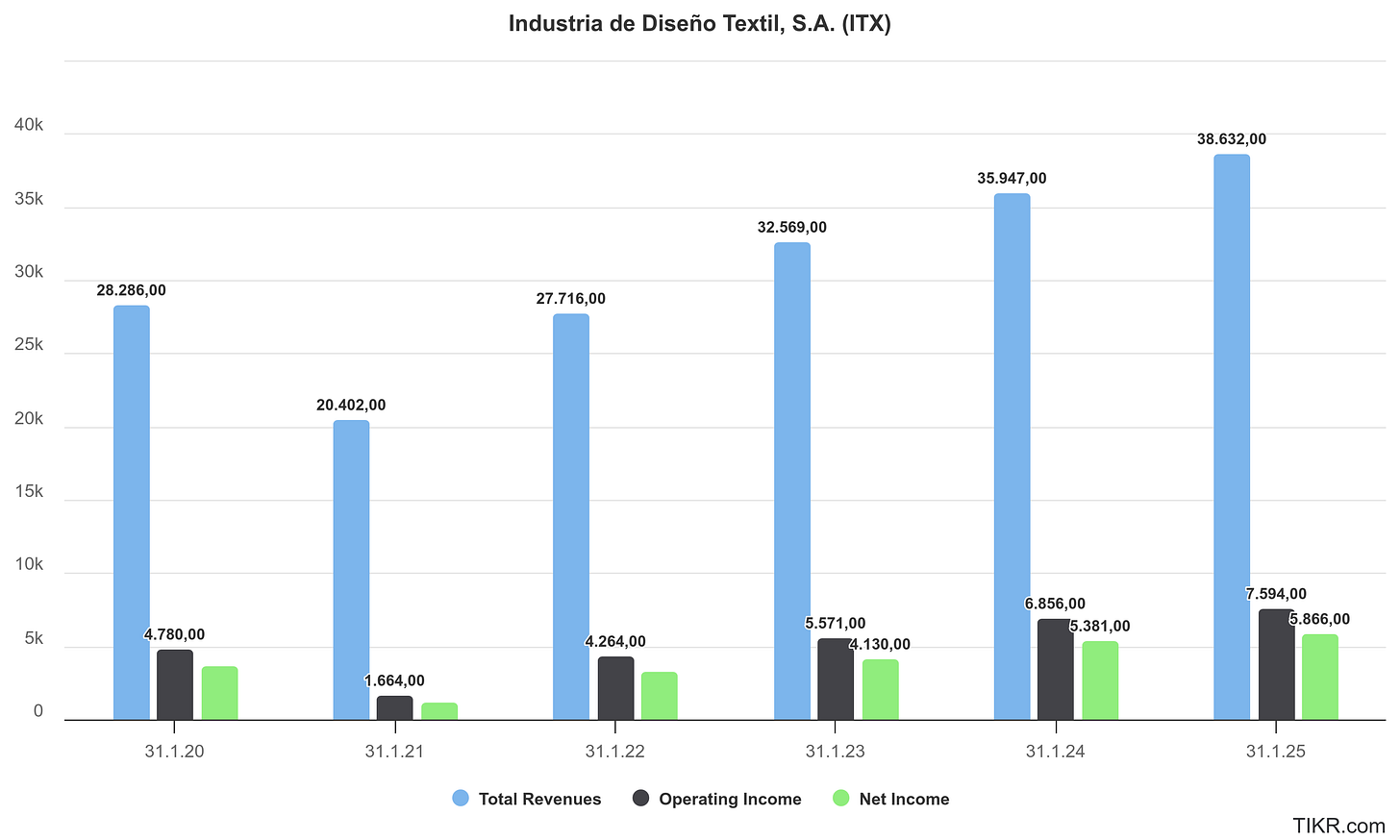

Inditex delivered record financial results in FY2024 (for the year ended January 31, 2025), underscoring its post-pandemic momentum. Sales reached €38.6 billion, a 7.5% increase year-on-year, with growth observed across all brands and channels. In constant currencies, sales grew an even stronger 10.5%, reflecting solid underlying demand despite currency headwinds.

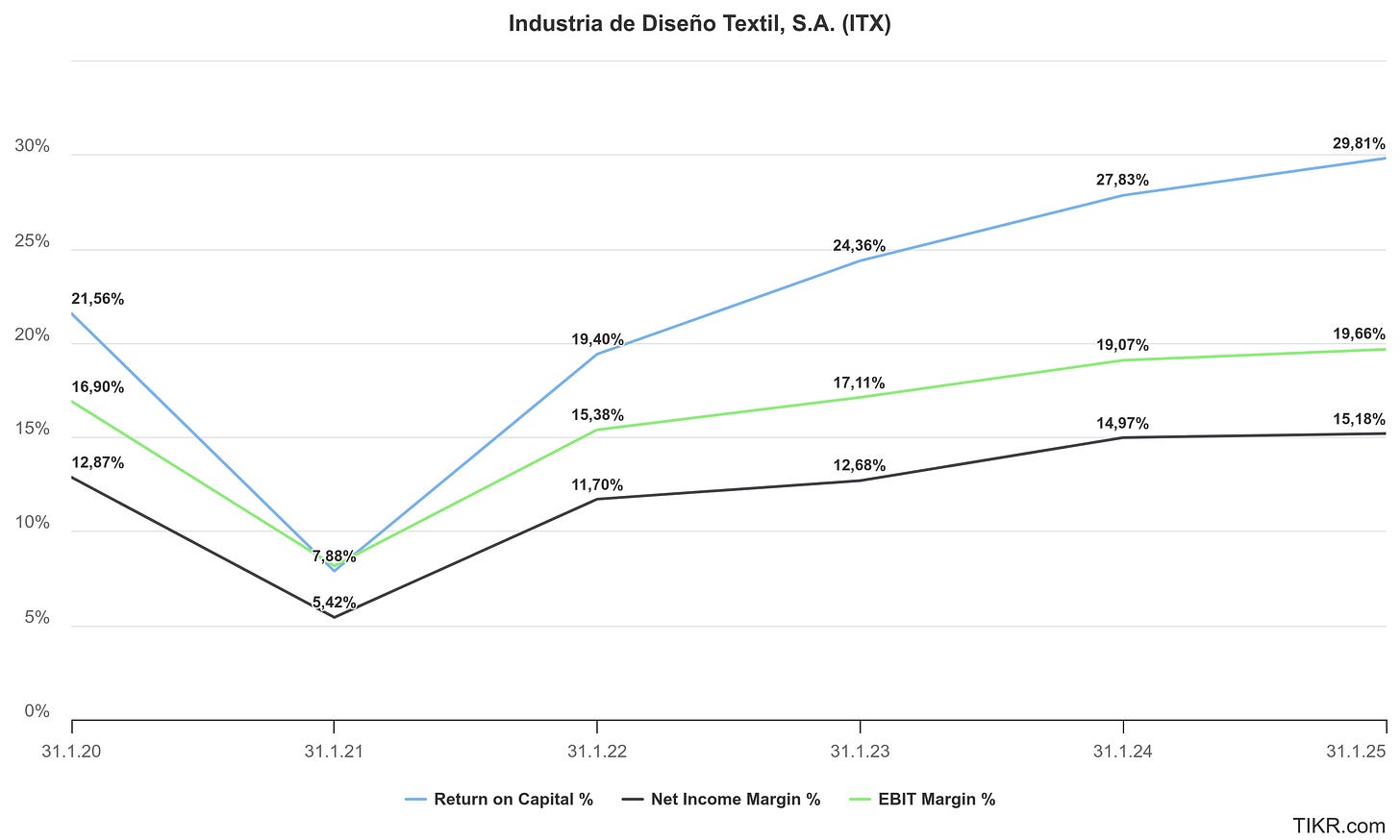

The company’s net income climbed to €5.9 billion, up 9% from the prior year, marking a new all-time high. These gains were driven by both top-line expansion and healthy profit margins: gross profit was €22.3 billion with a gross margin of 57.8% (slightly higher than last year), and EBITDA rose ~9% to €10.7 billion. Inditex’s EBIT margin (operating margin) stands near 20% – well above most peers – highlighting its efficient cost structure and full-price selling strategy.

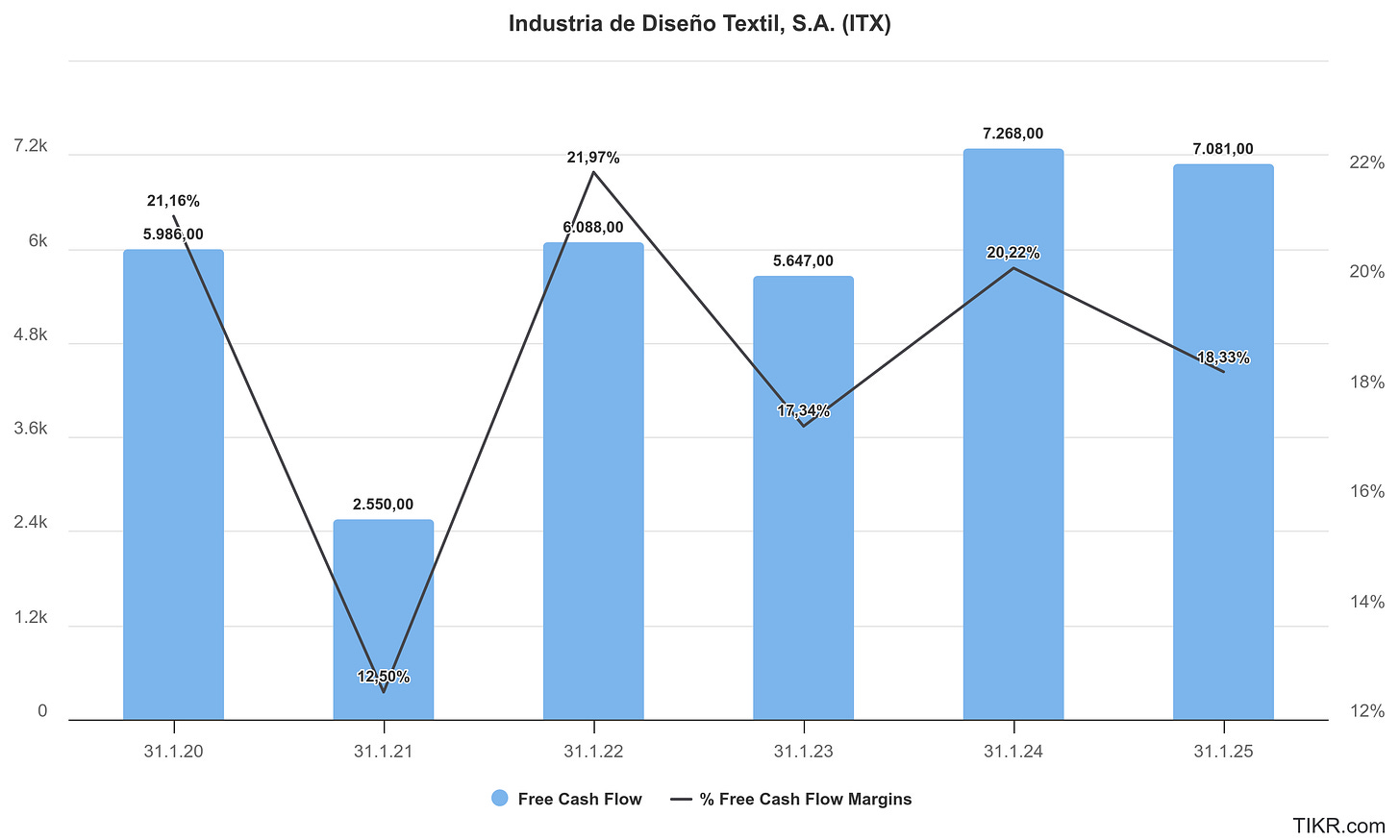

Notably, online sales have become a substantial part of the business, contributing €10.2 billion in FY2024 (about 26% of total revenue) after growing 12% year-on-year. Inditex’s omni-channel approach – integrating online and physical retail – has helped maintain sales momentum as consumer shopping habits evolve. Store sales also grew ~6%, aided by a rebound in foot traffic and productivity improvements. Inditex ended FY2024 with a very strong balance sheet, including a net cash position of €11.5 billion (cash and equivalents minus debt). This cash hoard inched up from €11.4 billion a year earlier, even after significant capital expenditures and dividend payouts, underscoring the company’s robust cash generation. Free cash flow for the year was approximately €4.8 billion.

Q1 2025 Update: Early signs in the new fiscal year have been more mixed. Inditex management noted that the Spring/Summer 2025 collections were well received, but sales growth has moderated compared to the prior year’s fast start. From February 1 to March 10, 2025, store and online sales in constant currency grew 4% versus the same period in 2024 – a deceleration from the double-digit growth a year ago. (Adjusting for an extra trading day in Feb 2024 due to leap year, growth was similar ~4%.) In the most recent week of that period, growth picked up to 7%, indicating some volatility. Analysts have pointed out that this was Inditex’s weakest early trading update since 2016 (excluding the pandemic disruptions), raising questions about whether macroeconomic headwinds or tougher competition are beginning to temper sales. Despite the slower start, management expressed optimism and maintained a “strong commitment to profitable growth” for 2025. For the full year 2025, Inditex is forecasting a roughly flat gross margin (±50 basis points) and only a minor -1% sales impact from currency at current exchange rates, suggesting confidence in sustaining healthy margins and continued growth.

In summary, FY2024 showed excellent results – record revenues, margins, and earnings – while early 2025 indicates growth is continuing, albeit at a more normalized mid-single-digit pace so far. Inditex’s financial foundation (strong profits, cash, and manageable costs) provides a solid base as we examine its business model and future prospects.

Business Model and Global Strategy

Inditex’s success is rooted in a unique business model that integrates all parts of the fashion retail value chain – from design to manufacturing, logistics, and retail – enabling agility and fast turnaround. Often cited as the pioneer of “fast fashion,” Inditex excels at rapidly translating runway and street trends into affordable garments in its stores within weeks. This is made possible by tight vertical integration and a flexible supply chain. Unlike many rivals who outsource all production to Asia with long lead times, Inditex produces a significant portion of its merchandise in proximity to its key markets (Spain, Portugal, Morocco, Turkey, Eastern Europe) using a network of specialized suppliers and its own factories. This proximity sourcing and in-season production capability allow Inditex to react to fashion trends in real time, adjusting inventory on the fly. The result is lower fashion risk (they can quickly scale up best-sellers and curtail duds) and a scarcity-driven model – stores receive new designs in limited quantities twice a week, encouraging shoppers to visit often for fear of missing out on new items.

Another pillar of Inditex’s model is its omni-channel retail integration. The company has seamlessly merged its online and offline operations. All inventory is managed under one integrated system (Inditex’s SINT stock management system), allowing online orders to be fulfilled from store inventory if needed and vice-versa. This boosts efficiency (less stockouts and markdowns) and creates a uniform shopping experience across channels. Inditex views its physical stores as an essential part of its ecosystem – not only as sales drivers but also as local distribution hubs and brand showcases. In recent years, the strategy has been to optimize the store footprint: closing smaller, less productive stores and opening larger flagship stores in prime locations, often with advanced technology and improved layouts. In 2024, for example, Inditex grew total retail space by 2.0% even as it reduced the number of stores by 2.3%, reflecting this focus on larger, more productive stores. The company continues to invest in store refurbishments and new concepts (such as adding in-store cafes or pop-ups) to enhance the customer experience. Meanwhile, digital growth remains a key strategic focus – Inditex’s apps and websites attracted 8.1 billion online visits in 2024, and the group has over 200 million app users and 250+ million social media followers, underscoring the reach of its online engagement.

From a global strategy perspective, Inditex aims to expand where it sees high growth potential while reinforcing its dominance in core markets. The company has a relatively low market share in the global apparel market (roughly ~3% for Zara brand globally), which means plenty of room to grow in a fragmented industry. Key growth initiatives include:

Deeper penetration of the U.S. and other large non-European markets: The United States has become Inditex’s second-largest country by sales (after Spain), but Inditex believes it still has significant headroom in North America. The company is adding flagship stores in major U.S. cities and expanding awareness of its brands. Similarly, Inditex is expanding in markets like India (with Zara and now other brands like Massimo Dutti and Bershka), and it plans to open its first stores in new countries such as Iraq in 2025.

Selective growth in Asia: China was once a major growth market for Inditex, and the company still operates hundreds of stores there. However, Inditex has been pruning smaller stores in China and focusing on online sales and flagship locations, as competition from local players and online channels intensifies. Still, new store openings in high-profile Asian locations (e.g., a new Zara in a prime mall in Nanjing, or expansions in Japan like the upcoming Osaka store) show Inditex is far from retrenching in Asia. Japan, where its Bershka and other brands have gained traction, and Southeast Asia are also on the radar for growth.

Europe – strengthening core strongholds: Europe (especially Western Europe) is a more mature market for Inditex, but the company continues to consolidate its leadership here by upgrading stores and occasionally entering untapped niches. For instance, Inditex will launch Bershka (its youth streetwear brand) in Sweden and Stradivarius in Austria in 2025, filling out its brand presence even in markets where Zara is established. Even at home, Inditex innovates – such as piloting a “Zara Café” concept in a Madrid store to elevate the shopping experience.

Sustainability and innovation as strategic drivers: Recognizing that the future of fashion retail will be shaped by sustainability and tech innovation, Inditex has made these core to its strategy. The company has pledged ambitious sustainability goals (e.g., 100% of fibers to be low-impact or recycled by 2030; substantial reductions in carbon emissions). It’s investing in material innovation (through its Sustainability Innovation Hub, partnering with startups to develop new recycled textiles) and rolling out technologies like RFID and new anti-theft tagging systems that improve inventory tracking and customer convenience. By integrating sustainability and technology, Inditex aims to future-proof its model and appeal to the next generation of consumers.

In essence, Inditex’s business model is built on speed, flexibility, and integration – from design to distribution – while its global strategy balances optimizing existing markets with selective expansion into new ones. This model has yielded strong competitive advantages, but it also faces certain limitations, which we explore next.

Strengths and Competitive Advantages

Inditex enjoys several core strengths that underpin its industry-leading performance:

Fast Fashion Supply Chain Excellence: Inditex’s vertically integrated supply chain and proximity manufacturing give it unmatched agility in product turnover. The ability to go from design to store in a few weeks allows Zara and sister brands to capture emerging trends quickly, avoid large overstocks, and keep customers returning frequently. This responsiveness is a key differentiator against competitors who often must commit to inventory far in advance.

Diverse Brand Portfolio with a Global Footprint: With multiple brands targeting different segments and 5,500+ stores worldwide, Inditex has a broad customer reach. Zara, in particular, is a globally recognized brand synonymous with fashionable apparel at accessible prices. This scale provides economies of scale in sourcing and logistics, as well as resilience – weakness in one brand or region can be offset by strength elsewhere. Inditex’s presence across 200+ markets also diversifies its revenue streams geographically.

Omnichannel Integration and Strong Digital Platform: Inditex has been lauded for successfully integrating its brick-and-mortar stores with its online business. Customers experience a seamless shopping journey (buy online, return in store; browse in store, order online if size is unavailable, etc.). The company’s digital investments have paid off in robust online sales (~€10B in 2024) and high levels of app engagement. Few apparel retailers of Inditex’s size have managed this omnichannel transition so well.

Consistent Innovation and Customer Experience Focus: From new store concepts (flagships, click-and-collect points, in-store RFID) to fashion-forward product strategies (frequent new collections like Zara’s limited “Studio” collections or collaborations), Inditex continuously refreshes its offering. The customer-centric approach – using data from sales and social media to inform design – means Inditex is often ahead of trends. Its stores are kept attractive and engaging, which reinforces brand loyalty and foot traffic.

Financial Strength and Shareholder-Friendly Policy: Inditex’s business throws off significant cash due to its high margins and efficient working capital (inventory turns quickly). The company has zero net debt and over €11.5B in net cash, giving it flexibility for investments or downturns. It also follows a generous shareholder return policy (60% payout ratio plus bonus dividends), which has meant a rising dividend over time. This financial discipline and strength are a competitive advantage, allowing Inditex to invest in growth initiatives (like €1.8B of capex planned in 2025) without straining its balance sheet.

Inditex’s ability to execute well in all these areas has made it a market leader. In fact, Zara’s strong performance has been chipping away at rivals’ market share – Inditex’s share price more than doubled from 2020 to 2023 as Zara pulled ahead of H&M globally. The company’s model proved resilient even during COVID (pivoting to online) and agile during supply chain disruptions. These strengths form the crux of the bullish case for investing in Inditex long-term.

Weaknesses and Challenges

Despite its many advantages, Inditex faces several weaknesses or risks that investors should note:

Heavy Reliance on Zara: While having a superstar brand is a strength, it’s also a concentration risk. Over 70% of Inditex’s sales and profit come from the Zara segment. If the Zara brand ever stumbles – due to a fashion miss or brand fatigue – the whole group would feel the pain. The smaller brands (Pull&Bear, Bershka, etc.) are successful in niches but none approach Zara’s scale; they would not fully compensate for any major slowdown in Zara’s performance.

Slowing Growth in Core Markets: Inditex has acknowledged it can’t grow at the breakneck pace of the past in mature markets. Europe is fairly saturated, and even China’s growth has cooled. Recent sales updates suggest growth is moderating to mid-single digits. A portfolio manager noted, “Inditex can no longer grow in sales at the rate we were used to”. As the company gets larger, maintaining high growth is challenging – the law of large numbers and fashion cyclicality mean the company must work harder to find new revenue streams.

Intense Competition (Old and New): On one side, Inditex competes with traditional rivals like H&M (which is striving to turn itself around and improve efficiency) and Fast Retailing’s Uniqlo (which competes on quality basics). On the other, new disruptors have emerged: e-commerce upstarts and ultra-fast-fashion players. Shein, for example, has rapidly grabbed market share in Europe and the U.S., reaching ~2% of the European apparel market by 2023 from virtually nothing a few years prior. Shein’s model of even faster, cheaper online-only fashion poses a threat to incumbents. Other online players like ASOS, Zalando, and Chinese marketplace Temu also compete for young shoppers’ wallets. If Inditex fails to keep its edge on trendiness or price, customers have plenty of alternatives. Moreover, in key growth markets like the U.S., it faces strong domestic retailers (from department stores to Target’s fashion lines) and needs to invest in brand awareness.

Fashion Risk and Inventory Management: The very thing that makes Inditex successful – fast fashion – comes with inherent risk. Consumer tastes can be fickle; a few fashion misjudgments or a trend shift (say, sudden pivot to ultra-casual or second-hand clothing craze) could leave Inditex with inventory that even its quick reaction system can’t adapt to in time. While Inditex’s model minimizes big misses, it’s not immune to fashion swings. A competitor producing a viral hit item (e.g., a must-have style from a luxury brand or a niche label) could temporarily draw spending away as well.

Macro and External Risks: As a global retailer, Inditex is exposed to macroeconomic fluctuations – inflation, consumer confidence, currency exchange rates, etc. A stronger euro can dent reported earnings (as seen with the currency-neutral vs actual growth gap in 2024). Also, about 50% of Inditex’s sales are in Europe, so Europe’s economic health (and energy costs, war in Ukraine spillovers, etc.) matter. Geopolitical events have impacted Inditex before – for instance, the closure of its Russian operations in 2022 due to the Ukraine conflict (Russia was a sizable market that essentially vanished from the sales base). Additionally, increasing sustainability regulations could pose challenges: Europe is discussing environmental rules that might raise costs for fast fashion companies or require more recycling and take-back schemes. Inditex’s fast fashion model could come under scrutiny if consumers become more eco-conscious or if governments impose penalties on waste. While Inditex is investing in sustainability, it still produces billions of garments a year – managing the environmental footprint is an ongoing challenge.

In summary, Inditex must continue executing exceptionally well to fend off competitors and avoid pitfalls inherent in the fashion business. These weaknesses feed into the bearish case some might argue for the stock, which we will outline later. First, let’s look at how Inditex rewards shareholders and how its stock valuation compares to peers.

Shareholder Returns: Dividend Policy and Buybacks

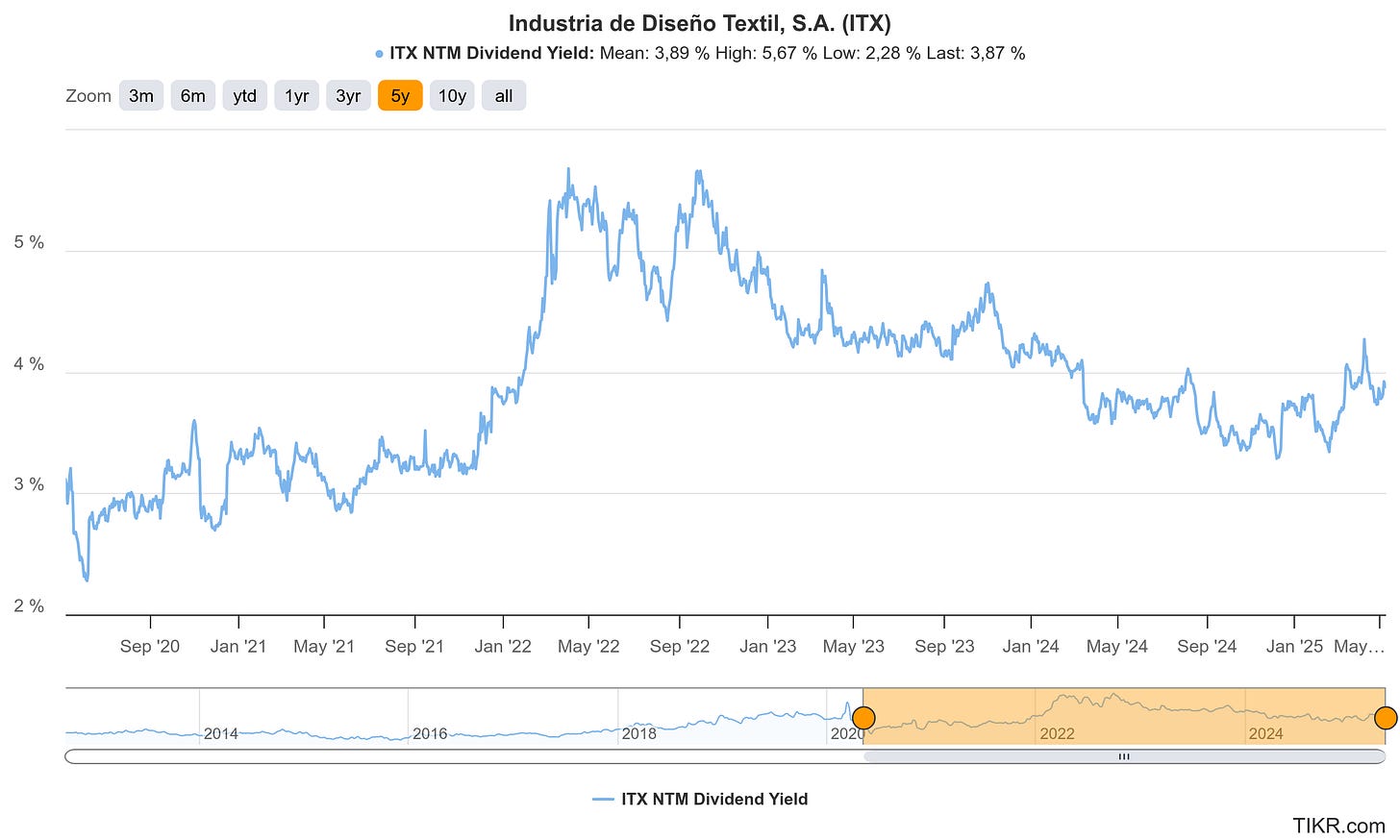

Inditex has a history of generous shareholder returns, primarily through dividends. The company’s official dividend policy is to pay out 60% of annual earnings as an ordinary dividend, and often supplement this with additional “bonus” dividends in good years. In line with rising profits, Inditex’s dividend has seen consistent growth. For FY2024, the Board has proposed a dividend of €1.68 per share, a 9% increase, consisting of a €1.13 ordinary dividend and a €0.55 bonus. This will be paid in two equal installments (one in May 2025 and one in November 2025). At the current share price (~€45), this implies a dividend yield of roughly 3.7%. Such a yield is quite attractive relative to the broader market, especially given Inditex’s growth profile.

Even during challenging periods like 2020, Inditex paid dividends (though somewhat reduced), demonstrating a commitment to returning cash to shareholders. As profits have rebounded post-pandemic, the dividend has been boosted accordingly. The company’s ample net cash position and strong cash flow (over €7.5B cash from operations in FY2024) provide confidence that dividends are well covered by internal funds.

What about share buybacks? Unlike many U.S. companies, Inditex has not heavily relied on buybacks as a means of returning capital, aside from occasional programs. The most notable was a share buyback program executed in 2021-2022, primarily to offset shares issued under management incentive plans. For instance, in 2022 the board approved a buyback of up to 2.5 million shares (~0.8% of capital) for a maximum of €85 million, with the aim of funding long-term incentive payouts in shares. That program was completed by mid-2022. Inditex has not announced large open-ended buybacks to shrink the float or boost EPS – the focus has been on dividends for cash returns, while buybacks are used in a limited way to neutralize dilution from employee stock programs or as occasional capital allocation tools when excess cash accumulates.

Going forward, with over €11B in cash, Inditex has room to consider additional one-off shareholder distributions (either a special dividend or buyback) if it doesn’t find enough internal investment opportunities. However, given the company’s expansion and capex plans (including €1.8B capex budget for 2025 to expand logistics and stores), it appears management prefers to reinvest for growth and keep a conservative balance sheet. Investors can likely count on the 60% payout policy to deliver a steady and growing dividend, and treat any buybacks as an occasional bonus rather than a core part of the strategy. Overall, Inditex’s shareholder return approach has been shareholder-friendly, aligning with long-term investors who appreciate a combination of growth and income.

The sections on Valuation, Bull vs. Bear Case, Outlook, and Conclusion are exclusively available to paid subscribers.

Keep reading with a 7-day free trial

Subscribe to Kroker Equity Research to keep reading this post and get 7 days of free access to the full post archives.