#99 Cisco System - A Stock Analysis

A Tech Titan Navigating the Future of Connectivity

Cisco: A Tech Titan Navigating the Future of Connectivity

Cisco Systems CSCO 0.00%↑ has long been a cornerstone of the internet’s infrastructure, almost synonymous with the hardware that made modern digital communication possible. From its early days linking university networks to becoming a global tech powerhouse, Cisco’s story has closely followed the internet’s own evolution. But today, the company finds itself at a crossroads. No longer just the king of routers and switches, Cisco is pushing into new territory: software, subscriptions, and now, the fast-growing world of artificial intelligence.

For long-term investors, the key question is no longer about Cisco’s legacy, it’s about its future. Can the company innovate quickly enough, execute effectively, and stay agile in a tech world that’s constantly reinventing itself?

This post takes a closer look at how Cisco is positioning itself for the next chapter—its financial health, strategic shifts, and the opportunities (and risks) ahead.

At the heart of Cisco’s transformation is its identity as a hardware-first company. That legacy is both a strength and a challenge. On one hand, Cisco’s global footprint of networking equipment gives it a huge built-in customer base—each device a potential on-ramp to software and subscription services. On the other hand, shifting from a product-based model to a recurring-revenue one means rethinking internal culture, sales incentives, and how investors measure success.

A major part of this transition is acquisition-led. Cisco’s $28 billion purchase of Splunk is a bold bet on security and observability, two areas critical in the age of AI and data. But making big acquisitions work is hard. It’s not just about plugging in new tech; it’s about merging teams, aligning go-to-market strategies, and actually delivering the promised synergies. For Cisco, integrating Splunk deeply into its ecosystem, not just letting it operate in a silo, will be key to making this move pay off.

Snapshot: Understanding Cisco Systems

Cisco Systems got its start in December 1984, born out of a simple but powerful need: connecting computers across Stanford’s campus. Founders Leonard Bosack and Sandy Lerner—both computer scientists at the university—came up with a novel solution: the multiprotocol router. This early breakthrough allowed different types of computer networks to communicate with each other and became a foundational building block of the modern internet.

Headquartered in San Jose, California, and led today by Chair and CEO Chuck Robbins, Cisco has come a long way from its academic roots. What began as a networking hardware company is now a global tech leader with a much broader focus.

At its heart, Cisco still builds the infrastructure that powers digital communication—think routers, switches, and everything that makes local and global networks run. But its business has expanded well beyond that. Today, Cisco is also deeply invested in cybersecurity, collaboration tools (like Webex), data center solutions, and increasingly, full-stack observability and AI infrastructure.

This shift reflects Cisco’s move up the value chain. Where it once provided the “plumbing” of the internet, it’s now positioning itself as a provider of intelligent, secure, and integrated platforms. That’s not just a nice-to-have—it’s a necessity in a world where networks are sprawling across hybrid clouds, IoT devices are everywhere, and AI is changing the rules.

The recent acquisition of Splunk is a clear signal of this strategic direction. As IT environments grow more complex, businesses aren’t looking for isolated tools—they want cohesive, end-to-end solutions. Cisco is betting big that it can meet this demand by becoming a one-stop shop for connectivity, security, and real-time insights.

In short, the company’s transformation is about staying relevant—and competitive—in a world where the lines between hardware, software, and services are rapidly blurring. The next phase of Cisco’s story is about more than connecting networks. It’s about making those networks smarter, safer, and more visible.

Cisco’s business model

Cisco’s revenue engine runs on two main cylinders: Product revenue and Service revenue.

Traditionally, hardware has been the dominant force. Think routers, switches, security appliances, and collaboration gear—plus the software licenses that go with them. In Q3 FY25 alone, Cisco pulled in over $10.3 billion from product sales.

On the service side, Cisco earned $3.8 billion in the same quarter. This includes things like technical support, maintenance contracts, consulting, and advanced network services. What’s notable is that a growing share of this is recurring revenue—a critical metric as the company shifts its focus.

And that shift is intentional. Cisco is actively moving away from a business model heavily reliant on one-off hardware sales toward one that’s centered on software and subscriptions. The goal? Smoother, more predictable revenue streams, stronger customer relationships, and better margins over time.

It’s a big cultural and operational pivot—but one that reflects how customers now prefer to buy and manage tech. Instead of buying gear outright every few years, companies increasingly want scalable, subscription-based solutions that evolve with their needs. Cisco is aiming to meet that demand head-on.

Revenue Streams: A New Lens on Performance

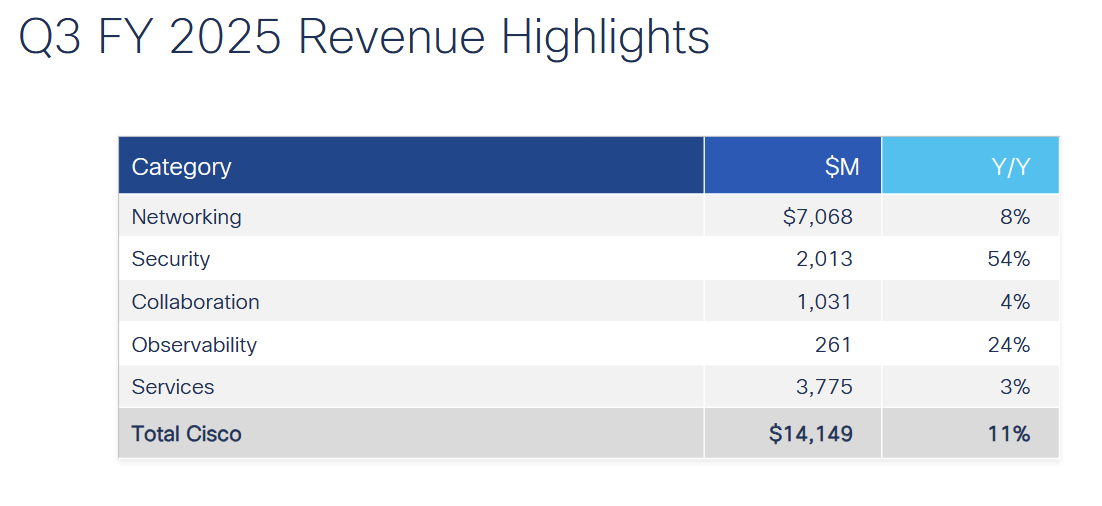

Effective from the first quarter of fiscal year 2024, Cisco implemented a new reporting structure to provide clearer visibility into its performance across strategic growth areas. Revenue is now categorized into five key segments:

Networking: This remains Cisco's largest segment and encompasses its traditional core offerings, including switching solutions (like the Catalyst and Nexus lines), enterprise routing, wireless technologies (Wi-Fi access points and controllers), and data center networking. In Q3 FY25, the Networking segment reported revenue growth of 8% year-over-year. Cisco continues to innovate here, with developments like its Silicon One architecture aimed at providing a unified, programmable silicon foundation for various networking applications.

Security: A critical growth engine for Cisco, this segment includes a comprehensive suite of solutions such as firewalls, intrusion prevention systems, advanced threat protection (e.g., XDR - Extended Detection and Response), Secure Access solutions (including Zero Trust Network Access), and Multicloud Defense suites. The acquisition of Splunk has significantly bolstered this segment, contributing to a remarkable 54% year-over-year revenue increase in Q3 FY25. Cisco is also innovating with offerings like AI Defense, designed to secure AI applications and infrastructure.

Collaboration: This segment features the Webex suite of products (including meetings, messaging, and calling), as well as physical collaboration devices like video conferencing units and IP phones. In Q3 FY25, Collaboration revenue grew by 4% year-over-year, reflecting ongoing efforts in a highly competitive market.

Observability: This is another key strategic growth area, largely defined by the integration of Splunk's market-leading capabilities. Observability solutions provide customers with full-stack visibility and insights across their applications, infrastructure, and security posture. This segment saw revenue growth of 24% year-over-year in Q3 FY25.

Services: This segment comprises technical support and advanced services, underpinning all of Cisco's product offerings. It continues to be a consistent revenue contributor, with growth of 3% year-over-year in Q3 FY25.

Geographically, Cisco's revenue is well-diversified. In Q3 FY25, the Americas region was the largest, with revenue up 14% year-over-year. The EMEA (Europe, Middle East, and Africa) region saw an 8% increase, while the APJC (Asia Pacific, Japan, and China) region grew by 9%.

Cisco’s Go-To-Market Strategy: A Network of Relationships Driving a Changing Business

Cisco takes a hybrid approach when it comes to selling its products and services. On one hand, it has a large direct sales force focused on big enterprise and service provider clients. On the other, a significant share of revenue—especially from small and mid-sized businesses—flows through an extensive global network of channel partners. These include systems integrators, value-added resellers, distributors, and service providers. Add to that a range of strategic alliances with other tech companies, and Cisco has built a sales and development ecosystem that’s both wide-reaching and deeply integrated.

This broad go-to-market engine has been key to Cisco’s long-standing dominance. But as the company shifts from hardware to software and subscription-based services, it’s clear that this ecosystem also needs to evolve.

New Segment Reporting: More Clarity, But With Caveats

Cisco’s updated reporting structure sheds more light on fast-growing areas like Security and Observability, which is a welcome change for investors. Still, some challenges remain—particularly with the way the “Networking” segment is presented. It groups together everything from legacy campus switching to cutting-edge data center solutions built for AI workloads. While that makes sense operationally, it can blur the picture for investors trying to parse which parts of the business are truly growing and which are maturing. Often, you’ll need to dig into management’s earnings commentary to get that detail.

Services: Stable Now, But Poised for Change

Cisco’s Services segment has long been fueled by its massive installed base of hardware, primarily through support and maintenance contracts. That’s a reliable revenue stream—but one that’s also evolving. As Cisco leans further into software, cloud, and security, its service offerings are shifting toward higher-value work: software integration, cloud optimization, cybersecurity consulting, and managed services.

Over time, this could reshape the margin profile and growth potential of the Services business. It may also demand new delivery models and skill sets—both within Cisco and across its partner ecosystem.

Channel Partners: Key to Cisco’s Transformation

Here’s where things get really interesting—and challenging. Cisco’s partner network has been incredibly effective at selling hardware. But selling software subscriptions, complex security solutions, and integrated AI offerings is a different game. It requires a more consultative sales approach, deeper product knowledge, and, in many cases, a shift in how partners operate and get compensated.

Helping partners make that transition—through training, new incentives, and co-selling strategies—will be crucial. Cisco’s success in scaling its next-gen offerings will depend not just on what it builds, but on how effectively its partners can sell and support those solutions in the real world.

The Financial Pulse: Latest Numbers and Trends

Cisco's recent financial performance offers valuable insights into its operational momentum and the progress of its strategic initiatives. The third quarter of fiscal year 2025 (Q3 FY25), which ended on April 26, 2025, demonstrated notable strength across several key areas.

Latest Financial Highlights

For Q3 FY25, Cisco reported total revenue of $14.1 billion, an 11% increase year-over-year (YoY), surpassing the higher end of its own guidance range of $13.9 billion to $14.1 billion. This performance was driven by robust product order growth, which surged 20% YoY, or 9% when excluding the impact of the recently acquired Splunk. On the earnings front, GAAP earnings per share (EPS) reached $0.62, a significant 35% YoY increase, while non-GAAP EPS stood at $0.96, up 9% YoY, also beating the guided range of $0.90 to $0.92

Looking at segment performance in Q3 FY25, Security was a standout, with revenue climbing 54% YoY, heavily influenced by Splunk. Observability also showed strong growth at 24% YoY. The core Networking segment grew by a solid 8% YoY, and Collaboration revenue increased by 4% YoY. A particularly bright spot was the AI infrastructure business, with orders from webscale customers exceeding $600 million in Q3 alone.

This positive momentum in Q3 builds upon the performance seen in Q2 FY25 (ended January 25, 2025), where Cisco reported revenue of $14.0 billion (up 9% YoY) and non-GAAP EPS of $0.94 (up 8% YoY). AI infrastructure orders in Q2 FY25 were over $350 million.

These recent results stand in contrast to the full fiscal year 2024 (ended July 27, 2024), which was characterized by a period of demand normalization and customer inventory digestion following robust post-pandemic growth and earlier supply chain-driven over-ordering. For FY24, Cisco reported total revenue of $53.8 billion, a decrease of 6% YoY, and non-GAAP EPS of $3.73, down 4% YoY. However, the fourth quarter of FY24 had already signaled a potential turnaround, with product order growth of 14% (6% excluding Splunk).

Software/Subscription Transition Progress

Tracking Cisco's shift towards a more software-centric and recurring revenue model is crucial for long-term investors. Key metrics provide insight into this transition:

Remaining Performance Obligations (RPO): RPO represents the total contracted future revenue that has not yet been recognized.

As of the end of Q3 FY25, total RPO stood at $41.7 billion, up 7% YoY. Product RPO saw stronger growth at 10% YoY, while Services RPO grew 5% YoY. Cisco expects to recognize 51% of this total RPO as revenue over the subsequent 12 months.

This Q3 RPO figure follows a Q2 FY25 total RPO of $41.3 billion, which was up 16% YoY, with Product RPO up an even more impressive 25%.

Annualized Recurring Revenue (ARR): ARR is a measure of the annualized run-rate of recurring revenue.

For the full fiscal year 2024, Cisco's total ARR reached $29.6 billion, a 22% YoY increase. This figure included a $4.3 billion contribution from Splunk.5

Software Revenue:

In FY24, total software revenue was $18.4 billion, up 9% YoY. Within this, software subscription revenue grew 15% YoY to $16.4 billion, accounting for a significant 89% of total software revenue.

Deferred Revenue: This represents billings for products and services that are yet to be recognized as revenue.

At the end of Q3 FY25, total deferred revenue was $28.0 billion, up 2% YoY.

The acceleration in product order growth observed in Q2 and Q3 of FY25, particularly the positive growth figures even when excluding Splunk's contribution, strongly suggests that the challenging period of customer inventory digestion that impacted FY24 is largely in the rearview mirror. This indicates a healthier underlying demand for Cisco's broader portfolio, setting a more positive baseline even before fully accounting for the anticipated ramp-up in AI-specific infrastructure demand.

While the 7% total RPO growth in Q3 FY25 is a solid figure, it represents a deceleration from the 16% RPO growth reported in Q2 FY25. This moderation could be attributable to several factors, including the timing of very large multi-year contracts, a shift in the mix of subscription durations being signed, or simply tougher year-over-year comparisons. For long-term investors, it will be important to monitor this trend and listen to management's commentary on the drivers and composition of RPO, as it is a key leading indicator of future recurring revenue streams.

The robust growth in the Security (up 54% YoY) and Observability (up 24% YoY) segments in Q3 FY25 is directly fueling the expansion of Product RPO (up 10% YoY). This dynamic clearly illustrates the financial impact of Cisco's strategic emphasis on these software-centric offerings, as they are predominantly sold on a subscription basis. This linkage underscores how successful execution in these growth areas translates into a more predictable and recurring revenue profile for the company.

Cisco's Strengths

Cisco may be in the midst of a major transformation, but it’s doing so from a position of strength. The company isn’t scrambling to reinvent itself—it’s leveraging decades of dominance in networking to expand into the next wave of tech innovation. Here’s what’s powering that pivot:

1. Market Leadership & Brand Trust

Cisco has been at the heart of the internet since the early days. Its leadership in routers and switches is more than just a historical footnote—it’s created a global brand with deep customer trust and an enormous installed base. That footprint gives Cisco an edge: it’s much easier to introduce new solutions when you’re already part of a company’s infrastructure. This stickiness is key for cross-selling software, services, and now AI-powered offerings.

2. Relentless Focus on Innovation

Cisco invests heavily in R&D—$2.3 billion in Q2 FY25 alone. This funding fuels critical work in AI, cloud infrastructure, and cybersecurity. A standout here is Cisco’s custom silicon, particularly Silicon One, which underpins next-gen network performance and is tailored to meet the growing demands of AI workloads. From high-performance optics to software-defined networking, Cisco is pushing to stay ahead of the curve—not just catch up.

3. All-In on AI and Cybersecurity

These two areas are at the center of Cisco’s future bets:

AI Infrastructure: Cisco has already blown past its $1 billion FY25 order goal—one quarter early. Products like Nexus switches, AI PODs (modular AI-ready infrastructure), and new tools like AI Defense are positioning the company as a foundational player in building and securing AI environments.

Cybersecurity: A long-time focus that’s now scaling fast. With offerings spanning firewalls, XDR, Secure Access, and Multicloud Defense—and a 54% revenue jump in Security for Q3 FY25—Cisco is doubling down. The Splunk acquisition adds powerful data and analytics capabilities, making Cisco’s threat detection and response platform even more compelling.

4. The Splunk Effect

Splunk is a game-changer. With this $28B acquisition, Cisco isn’t just adding a top-tier data platform—it’s accelerating its shift toward software, cloud, and recurring revenue. More importantly, Splunk supercharges Cisco’s security and observability offerings, enabling real-time insights across complex IT environments. The potential for cross-selling into Cisco’s enterprise base is huge—and the opportunity to deliver truly integrated, AI-driven solutions even bigger.

5. Deep Partner Network and Customer Relationships

Cisco’s reach is massive. Through a global network of resellers, distributors, systems integrators, and service providers, it touches nearly every industry and region. These partners are now being activated to help sell Cisco’s evolving portfolio—software, subscriptions, observability, and AI. When you pair that with Cisco’s deep relationships across enterprise and public sector clients, the company is in a strong position to scale its new offerings fast.

6. Financial Firepower

Cisco generates serious cash—and uses it wisely. With strong operating cash flow and a big war chest, the company can fund innovation, pursue major acquisitions (like Splunk), and still return capital to shareholders through dividends and buybacks. This financial flexibility provides stability even as Cisco takes on big strategic shifts.

7. The Full-Stack Advantage

Cisco’s value proposition is increasingly about integration. Rather than selling point solutions, it’s building a “full stack” platform—hardware, software, services, and security—all under one roof. In a tech world that’s only getting more complex, this kind of unified approach can be a big win for customers who want fewer vendors, less integration pain, and more accountability.

8. Silicon One: A Bigger Strategic Play

While most know Silicon One as Cisco’s in-house chip effort, the strategy runs deeper. Cisco isn’t just building chips for its own gear—it’s aiming to become a critical supplier to the hyperscalers and service providers building out the next generation of internet and AI infrastructure. That could unlock entirely new markets and give Cisco a seat at the table in shaping future network architectures.

9. Security from the Inside Out

Cisco’s own Security and Trust Organization (S&TO) plays a dual role: protecting Cisco’s internal operations and informing its product development. This internal-first approach helps ensure that Cisco’s security tools aren’t just theoretical—they’re battle-tested in real-world environments. That credibility matters when selling security solutions to enterprises facing increasingly sophisticated threats.

In short: Cisco has the scale, brand, and resources to take on the next era of enterprise tech—and it's laying the groundwork to do just that. The transformation won’t be easy, but with this kind of foundation, the company has more than a fighting chance to not just stay relevant, but lead.

Cisco's Risks

While Cisco brings serious strengths to the table, it operates in one of the most competitive and fast-moving sectors in tech. For long-term investors, understanding the key risks and headwinds is just as important as tracking its strategic progress.

1. A Fierce Competitive Landscape

Cisco faces strong rivals across nearly every business segment:

Networking: Arista Networks is making major inroads in high-performance data center and AI networking. Hewlett Packard Enterprise, bolstered by its pending acquisition of Juniper Networks, will become a more formidable challenger. Meanwhile, Huawei remains a global competitor—despite geopolitical constraints.

Security: The cybersecurity space is fragmented and fiercely contested. Cisco is up against specialists like Palo Alto Networks, Fortinet, and Check Point, as well as a swarm of nimble, cloud-native startups.

Collaboration: Webex continues to face stiff competition from Microsoft Teams and Zoom. Staying competitive here requires constant product development just to maintain parity.

Observability: With Splunk, Cisco has a strong foothold—but it’s competing against agile, cloud-native players like Datadog and Dynatrace. These firms innovate quickly, especially in software-defined and cloud-native environments.

2. Sensitivity to IT Spending Cycles

Cisco’s performance is tightly linked to global IT budgets. When enterprises or service providers cut capital expenditures—often due to macroeconomic uncertainty, inflation, or geopolitical unrest—Cisco feels the impact. The revenue dip in FY24, driven in part by customers digesting earlier purchases, highlights how cyclical the business can be.

3. Integration Risk: The Splunk Challenge

The $28 billion Splunk acquisition could be transformative—but only if the integration goes well. That includes blending company cultures, aligning roadmaps, merging sales channels, and unlocking revenue synergies. It’s a tall order, and tech history is filled with large acquisitions that didn’t live up to expectations.

4. Market Maturity in Core Businesses

Cisco still dominates in enterprise routing and campus switching—but these are mature markets with limited growth upside. That reality underscores the urgency of its pivot to software, AI infrastructure, and security. The core business remains foundational, but it can no longer be the primary growth engine.

5. Supply Chain Complexity

Like many global tech companies, Cisco relies on a vast network of contract manufacturers and component suppliers. That makes it vulnerable to disruptions—from semiconductor shortages and trade restrictions to natural disasters and geopolitical instability. While Cisco has shown it can manage these risks (e.g., navigating China tariffs), it’s an ongoing operational challenge.

6. Cyber Threats—To Cisco Itself

Cisco is both a security provider and a high-value target. A significant breach—whether of its own systems or a major flaw in its products—could severely damage customer trust and its reputation. Staying ahead of rapidly evolving cyber threats requires constant R&D and operational vigilance.

7. Tariffs and Geopolitical Risks

Global trade tensions can impact Cisco’s bottom line. Tariffs on imported components or on Cisco’s products themselves can squeeze margins. Meanwhile, regional instability can affect sales and disrupt supply chains. Cisco mitigates through supply diversification, but it’s not immune.

8. Execution Risk in Subscription and Software Strategy

Transitioning to a software- and subscription-heavy model is complex. It involves product development, pricing, customer onboarding, and support changes—not to mention evolving partner incentives. If demand doesn’t scale as expected or operational costs remain high, the benefits of recurring revenue could take longer to materialize.

9. Talent and Retention

Cisco’s transformation hinges on attracting and keeping top talent in cybersecurity, AI, and cloud. But it’s competing in an industry where talent is scarce, and tech professionals often favor high-growth startups or digital-native giants.

10. The Bullwhip Effect: FY24’s Inventory Digestion

Cisco’s FY24 slowdown wasn’t just about soft demand—it was a classic bullwhip effect. Customers, trying to avoid supply chain shortages, over-ordered during the crunch. As things normalized, they burned through inventory instead of placing new orders. Cisco is working to offset this kind of volatility with more predictable software and subscription revenue—but hardware cycles still matter.

11. Cloud Providers as Structural Threats

The competitive picture is broader than traditional hardware vendors. Hyperscalers like AWS, Microsoft Azure, and Google Cloud now offer their own networking and security solutions, often bundled directly with cloud services. Over time, this could erode Cisco’s relevance in some workloads—especially if customers lean more heavily into cloud-native platforms. Cisco’s answer is its full-stack, hybrid-cloud strategy—connecting, securing, and observing everything from edge to cloud, with Splunk as a key linchpin. Whether this platform vision resonates with customers will be critical to long-term growth.

Bottom Line: Cisco isn’t just facing product competition—it’s navigating a structural shift in how IT is bought, built, and delivered. Success will depend not only on what Cisco builds, but how well it executes, integrates, and educates the market. For investors, that means keeping a close eye on execution, especially around Splunk, AI, and the broader software transition. The opportunity is real—but so are the risks.

Returning Value to Shareholders: Dividends and Share Buybacks

Cisco isn’t just focused on innovation—it’s also a reliable income stock. The company has a long track record of returning capital to shareholders through both dividends and share buybacks, supported by its strong free cash flow and mature financial profile.

A Growing Dividend

For income-focused investors, Cisco’s dividend policy is a key highlight. Not only has the company paid a quarterly dividend consistently, but it’s also steadily increased it over time.

With its Q2 FY25 earnings, Cisco announced a bump in its quarterly dividend to $0.41 per share, up from $0.40. That higher dividend was paid during Q3 FY25, and the company has already declared another $0.41 payout for Q4 FY25, payable in July. While the 3% increase may not turn heads in a high-growth context, it reflects a steady, shareholder-friendly approach that appeals to long-term holders seeking reliable income.

Cisco’s dividend yield often compares favorably to peers in the tech space, offering a blend of stability and capital appreciation potential that’s increasingly rare among large-cap technology companies.

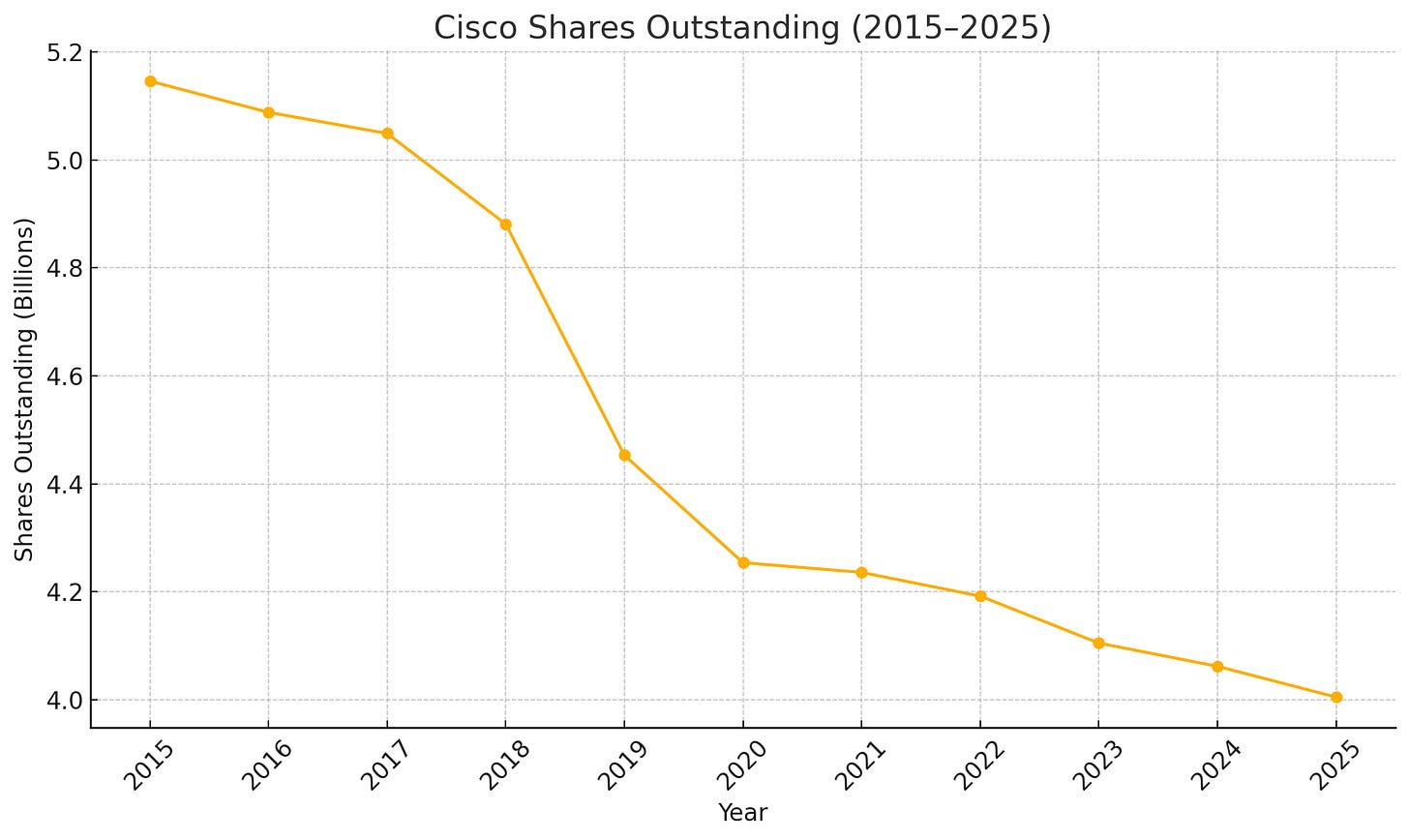

Share Repurchase Programs

Beyond dividends, Cisco makes regular use of share repurchase programs to return value to shareholders. These buybacks not only reduce the number of outstanding shares—boosting earnings per share—but also signal confidence from management in the company’s long-term value.

Recent Buyback Activity Highlights:

Q3 FY25: Cisco repurchased around 25 million shares for $1.5 billion. Including dividends, the total return to shareholders for the quarter reached $3.1 billion.

Q2 FY25: The company bought back 21 million shares at a cost of $1.2 billion. Alongside its Q2 results, Cisco’s Board also approved a fresh $15 billion authorization for additional share repurchases.

By the end of FY24 (July 27, 2024), Cisco still had $12.7 billion remaining under its prior repurchase program—some of which was used in Q1 and early Q2 FY25 before the new authorization kicked in.

A Balanced Approach to Capital Returns

Cisco’s steadily growing dividend and sizable share buyback program speak volumes about where the company stands today: a mature, cash-generating business with a disciplined approach to returning capital to shareholders.

For long-term investors, this dual strategy offers both income stability and the potential for per-share value growth, helping provide a cushion during periods of slower top-line expansion.

The newly authorized $15 billion share repurchase plan, announced alongside Q2 FY25 earnings, is particularly notable. It signals continued confidence in Cisco’s long-term value—but it also comes at a time when the company is deep into a strategic transformation and integrating a massive $28 billion acquisition (Splunk).

As always, the key will be balance. Investors should keep an eye on how aggressively Cisco uses its buyback authorization relative to other priorities—like funding R&D, pursuing future M&A, and managing its debt. The strength of Cisco’s free cash flow gives it flexibility, but capital discipline will be critical as the company reshapes itself for the next era of growth.

Valuing Cisco: Is the Stock Attractively Priced?

Cisco has never been the kind of high-flying tech stock that trades at extreme multiples, but a closer look at its valuation over the past five years shows a story of consistent investor recalibration—shaped by broader market cycles, interest rate shifts, and changing expectations about Cisco’s role in the evolving tech landscape.

The five-year chart of Cisco’s valuation multiples—next-twelve-month (NTM) Price-to-Earnings (P/E) and Enterprise Value to EBIT (EV/EBIT)—provides a helpful benchmark. On average, Cisco has traded at about 14.3× forward earnings, with a range from a low of around 11.2× (seen in mid-2022) to a high of 18.3× (in late 2021). On an EV/EBIT basis, the stock’s mean multiple has been roughly 11.2×, ranging from 8.5× at the low to 14.2× at the peak. As of now, Cisco trades at around 15.6× forward earnings and 12.9× EV/EBIT—placing it above its long-term average but comfortably below the historical highs. That signals a valuation that is neither stretched nor particularly cheap.

So how does Cisco’s current valuation look in this context? On a forward P/E basis, the stock trades slightly above its five-year average, and in EV/EBIT terms, it's also leaning higher than usual but not excessively so. Compared to the broader market (the S&P 500 trades near 20× forward earnings) and to many large-cap tech peers that often exceed 25× P/E, Cisco still trades at a discount—emphasizing its status as a “value tech” stock. It’s priced less like a high-growth innovator and more like a stable, cash-generating incumbent.

Of course, valuation is only half the story. Cisco’s forward growth profile is moderate. Management expects mid-single-digit revenue growth and slightly better EPS growth, especially as the company buys back shares and realizes synergies from recent deals. At 15–16× earnings, Cisco is trading at roughly 2–3× its expected revenue growth—a reasonable multiple for a company with strong free cash flow, a generous capital return policy, and significant market share, but not a bargain if growth were to stumble.

Looking ahead, the direction of these multiples will largely depend on execution and macro factors. On the upside, a sustained wave of AI infrastructure investment, strong cybersecurity tailwinds, and successful cross-selling of Splunk’s platform could push Cisco’s valuation back toward the high-teens. Because Cisco is buying back stock and paying a reliable dividend (~3% yield), even modest earnings growth could drive attractive total returns. On the downside, if enterprise IT budgets shrink, security attach rates disappoint, or integration efforts stall, multiples could compress back toward the 13–14× range—or lower if macro uncertainty resurfaces.

A quick 5-year DCF puts Cisco’s intrinsic value a bit below where the stock trades today. Starting with FY-2024 revenue of roughly $53.8 billion, I project modest top-line growth—about 3 % next year, easing toward 2½ % by year 5—and keep the EBITDA margin at a historically consistent 28 %. Capital spending stays lean at ~1½ % of revenue and working-capital swings are assumed minimal, so most operating profit turns into free cash flow. Discounting those cash flows at an 8 % WACC and using a 2½ % perpetual growth rate yields an enterprise value near $222 billion; after subtracting roughly $13 billion of net debt, equity value comes out around $209 billion, or roughly $52-53 per share. With the market price hovering near $64, Cisco looks fairly valued to slightly rich—unless you lean on rosier inputs (say a 7½ % discount rate or 3 % terminal growth), which nudge fair value into the low $60s. In short, the networking giant’s slow-and-steady cash machine seems fully baked into today’s quote: a solid, reasonably priced blue chip, but not a bargain unless growth or margins meaningfully surprise on the upside.

Bottom line: today’s pricing paints Cisco as a dependable, cash-rich incumbent with only modest growth ahead. It’s certainly not priced at bubble levels, but it’s also no longer the bargain it was in the 2022 reset—if anything, my DCF suggests the shares are a touch expensive. Long-term investors can still find appeal in the 3 % dividend, steady buybacks, and exposure to AI-driven networking and security; just recognize that the current valuation already bakes in a fair amount of that upside, leaving limited room for disappointment.

Investment Thesis: The Bullish and Bearish Arguments

When evaluating Cisco as a long-term holding, the case is far from one-sided. The company is undergoing a meaningful transformation—but success is not guaranteed. Here's a breakdown of the bull and bear cases to help frame the opportunity and the risks.

The Bull Case: Why Cisco Could Be a Strong Long-Term Bet

1. A Transformation That’s Gaining Traction

Cisco is making real progress in shifting toward a more predictable, high-margin business model focused on software and recurring revenue. Metrics like rising Annualized Recurring Revenue (ARR) and Remaining Performance Obligations (RPO) suggest the shift is working.

2. Riding the AI Wave

With AI infrastructure orders already surpassing its FY25 goal a quarter early, Cisco is positioning itself as a foundational enabler of the AI boom—providing the networking, security, and observability backbone for data centers and enterprise AI deployment.

3. A Stronger Position in Security & Observability

The Splunk acquisition is a game-changer. Together, Cisco and Splunk create a compelling platform that gives customers both visibility and protection across increasingly complex IT environments.

4. Deep Market Roots

Cisco’s legacy in networking means a massive installed base and longstanding customer relationships—creating opportunities for cross-selling new offerings and minimizing churn.

5. Financial Strength & Shareholder-Friendly Policies

With solid free cash flow, a strong balance sheet, and consistent dividends and buybacks, Cisco offers downside protection and a steady total return profile for investors.

6. Reasonable Valuation

Cisco often trades at a discount to high-growth peers. If the transformation continues to deliver, there’s room for multiple expansion—making the stock potentially undervalued today.

7. Innovation at the Core

Even as it pivots, Cisco is still investing heavily in core networking tech—like Silicon One, advanced optics, and DPUs—to support future internet and AI infrastructure demands.

The Bear Case: Why Caution Is Still Warranted

1. Execution Risk Remains High

Successfully transforming a company of Cisco’s scale—while integrating a $28B acquisition like Splunk—is no small task. Strategy alone won’t cut it. Flawless execution will be critical.

2. Competitive Pressures Everywhere

Cisco is battling strong, fast-moving rivals in AI networking, cybersecurity, and cloud-based software. These challengers could limit growth, compress margins, or take market share.

3. Macro Sensitivity

Cisco’s fortunes are still tied to global IT spending, which can swing with recessions, geopolitical shocks, or shifts in enterprise budgets. It’s not immune to macro headwinds.

4. Legacy Drag

The traditional routing and switching business may see slower growth—or decline. That could offset gains from newer segments and make it harder to reignite overall company momentum.

5. Scale Can Be a Double-Edged Sword

While Cisco’s size is a strength in resources and reach, it can also slow down innovation or limit agility compared to leaner, more focused competitors.

6. Margin Pressures in New Markets

Whether competing for large AI infrastructure deals or in crowded SaaS environments, Cisco could face pricing pressure that eats into its historically strong margins.

The Big Question for Investors

At the heart of Cisco’s investment case is this:

Can growth in its strategic focus areas—AI, cybersecurity, and observability—scale fast enough to offset the maturity of its core business?

Cisco has the resources, reach, and vision to pull it off—but transforming a legacy giant takes time, talent, and tight execution. For investors, success in this transition could unlock significant upside. But the path won’t be without volatility or competitive pressure.

If you believe Cisco can evolve into a full-stack infrastructure and security platform for the AI and cloud era—while continuing to deliver shareholder value along the way—it may well deserve a spot in your long-term portfolio.

Outlook

Cisco’s management is approaching the rest of FY25 with measured optimism. The company recently raised its full-year guidance following a strong Q3 performance, signaling confidence—but also an awareness of ongoing macro uncertainties like tariffs and fluctuating IT budgets.

Updated Guidance at a Glance:

Q4 FY25 Revenue: $14.5–$14.7 billion

Non-GAAP EPS: $0.96–$0.98

Gross Margin: 67.5%–68.5%

Operating Margin: 33.5%–34.5%

For the full fiscal year, Cisco now expects revenue of $56.5–$56.7 billion, up from its previous forecast of $56.0–$56.5 billion. Full-year non-GAAP EPS has also been nudged higher to $3.77–$3.79, reflecting strong execution—particularly in high-growth areas.

AI: Not Just a Buzzword, But a Real Business Driver

Cisco isn’t chasing AI headlines—it’s enabling AI at the infrastructure level. And so far, it's paying off. The company hit its $1 billion AI infrastructure order goal for FY25 a full quarter early, driven by demand from webscale customers and large enterprises. In Q3 alone, Cisco booked $600 million in AI orders, adding to $350 million in Q2.

This momentum is built on Cisco’s strengths: high-performance networking (via its Nexus and Silicon One platforms), enterprise-grade security (like the new AI Defense solution), and deep observability (thanks to the $28B Splunk acquisition). The company is also partnering with Nvidia and developing its own Data Processing Units (DPUs) to accelerate AI workloads.

Splunk: The Centerpiece of Cisco’s Software Pivot

Make no mistake—Splunk is the linchpin of Cisco’s broader transformation. It’s not just about bolstering security and observability capabilities; it’s about embedding these tools into Cisco’s full-stack offering and scaling them across its enormous enterprise customer base.

New products like Splunk on Azure and AI Assistants for Observability are early signs of this integration in action. But the real test will be whether Cisco can fully fuse Splunk into its platform and monetize it through cross-selling, bundling, and recurring software revenue.

Beyond AI & Splunk: What Else Is Driving Growth

While AI and observability steal the spotlight, Cisco has several other engines powering its next chapter:

Security: Rising cyber threats are fueling demand for Cisco’s expanded, AI-enhanced security offerings.

Cloud Networking: Hybrid and multi-cloud environments continue to grow—and Cisco is building tailored solutions to serve them.

Software & Subscriptions: The transition to recurring revenue is well underway, boosting visibility and customer lifetime value.

Industrial IoT: Cisco’s ruggedized networking gear for factories and industrial AI is a promising, underappreciated niche.

Strategically Aligned with Macro Tech Trends

Cisco’s bets are aligned with several major shifts shaping enterprise tech:

Networking: AI-optimized networking, 5G, SD-WAN, and edge computing are reshaping infrastructure—and Cisco is at the center of it.

Cybersecurity: Zero Trust, AI-powered threat detection, and supply chain security are high-stakes areas where Cisco is actively investing.

AI Infrastructure: With the market expected to grow at a 26–30% CAGR, Cisco is staking a credible claim as a key enabler—not by building AI models, but by powering the platforms they run on.

Industrial Edge: A Potential Sleeper Hit

One area that could quietly outperform? Industrial automation. Cisco’s strength in ruggedized connectivity, real-time analytics, and secure infrastructure positions it well for the rise of AI-powered robotics and predictive maintenance in manufacturing and energy sectors. It’s a less crowded space—and one where Cisco’s end-to-end platform could be a real differentiator.

Final Takeaway: Execution Will Be Everything

Cisco has laid out a compelling roadmap—and early results are encouraging. But the company is still in the thick of its transformation. For the bull case to play out, Splunk must be integrated smoothly, AI-driven infrastructure must scale, and recurring revenue must become a bigger part of the mix.

With strong free cash flow, a shareholder-friendly capital return strategy, and a growing portfolio aligned to major tech trends, Cisco has the ingredients for long-term success. But as always, the market will be watching not just the vision—but the execution.

Conclusion

For long-term investors, Cisco presents a solid—though not straightforward—opportunity. This is a company with strong financial footing, decades of market leadership, and a clear focus on evolving with the times. It’s not resting on its legacy; it’s actively reshaping its business to stay competitive in a fast-moving tech landscape.

Cisco’s pivot toward AI infrastructure, cybersecurity, and observability is starting to show real momentum. The $28 billion Splunk acquisition could be a game-changer—if integration goes smoothly. That’s a big “if” with any major deal, but early signals, especially around AI-driven product development and software traction, are encouraging.

Meanwhile, Cisco’s commitment to returning capital to shareholders adds another layer of appeal. Between a steadily growing dividend and aggressive buybacks, it offers a level of income and stability that’s rare among big tech names. And with its valuation still trailing more glamorous software peers, there’s potential for upside if its transformation gains momentum.

Of course, execution is everything. Cisco needs to prove it can integrate Splunk, scale its software and AI offerings, and stay competitive in a landscape filled with agile rivals. But it’s not going in empty-handed—decades of customer relationships, a strong partner ecosystem, and serious financial firepower give it the resources to navigate this pivot.

The bottom line? Cisco might not be the fast-growth name it once was, but it’s far from irrelevant. It’s a mature company adapting to a new era—and if it gets this right, it could remain a core holding for tech-focused investors looking for durability, dividends, and exposure to the infrastructure behind the AI and cloud revolutions.

This isn’t a hype story—it’s a watch-and-execute story. And it might just be one worth betting on for the long haul.

Disclaimer: The information provided in this publication is for educational and informational purposes only and does not constitute financial advice. The content is solely reflective of my personal views and opinions based on my research and is not intended to be used as a basis for investment decisions. While every effort is made to ensure that the information is accurate and up-to-date, the writer makes no representations as to the accuracy, completeness, suitability, or validity of any information in this post and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. All readers are advised to conduct their own independent research or consult a professional financial advisor before making any investment decisions. The author is not invested in the mentioned stock.