Dear Readers,

Thank you for being here and showing interest in my work! Your support means the world to me. If you enjoyed this article and would like to see more, please consider subscribing and giving it a like—it really helps grow our community of investors. Thank you for your continued support!

Please read the disclaimer at the end of this article. This is not an investment advice!

Welcome to part 5 of the 5-part Disney DIS 0.00%↑ analysis series.

Part 1: General Overview and Entertainment Segment

Part 2: Sports Segment

Part 3: Experiences Segment

Part 4: Group Financials and recent developments

Part 5: Outlook, Valuation and Conclusion

In this part, we will take a closer at the Outlook and the Valuation of The Walt Disney Company. If you missed one part, here you go:

Outlook, Valuation and Conclusion

Management Outlook

For fiscal year 2025, the company projects high single-digit growth in adjusted earnings per share (EPS), with expectations of double-digit EPS growth in fiscal years 2026 and 2027. Cash flow is expected to remain strong, with $15 billion in operating cash flow projected for fiscal year 2025. Additionally, Disney plans to invest $8 billion in capital expenditures for infrastructure and content development.

In the Direct-to-Consumer (DTC) segment, Disney aims to build on recent profitability by continuing to invest in its streaming platforms, including Disney+, Hulu, and ESPN+. The company plans to enhance its content offerings, focusing on high-quality original productions and leveraging its extensive intellectual property portfolio to attract and retain subscribers. Efforts to integrate ESPN content further into streaming services are also expected to bolster engagement and revenue.

The Parks, Experiences, and Products segment is set to receive significant investment, with $60 billion earmarked over the next decade for expansion and enhancement. This includes plans to develop new attractions, upgrade existing infrastructure, and double the fleet of Disney Cruise Line ships by 2031 to meet growing demand. These initiatives aim to maintain Disney's leadership in providing immersive, world-class guest experiences.

In Media Networks, Disney intends to optimize its linear television offerings by focusing on high-performing content and exploring partnerships to maximize profitability. The company is also committed to strengthening its sports broadcasting portfolio through ESPN, securing key sports rights, and enhancing its digital offerings to engage a broader audience.

Leadership continuity is also a priority. CEO Bob Iger is set to retire by the end of 2026, with a successor expected to be named by early 2026. In early 2025, James Gorman will assume the role of chairman of the board, bringing significant experience in corporate governance and strategic oversight.

Disney acknowledges the competitive pressures within the media and entertainment industry, particularly in the streaming market. The company plans to differentiate itself through exclusive content, brand strength, and investments in technology and user experience. At the same time, it remains committed to financial discipline, emphasizing cost management and operational efficiency to maintain a strong balance sheet and deliver shareholder value.

Valuation and analyst estimates

The path forward for Disney appears well-defined. The company is focused on making its Direct-to-Consumer (DTC) segment more profitable while continuing to grow its subscriber base and average revenue per user (ARPU). This will be a critical pillar for Disney's success in the coming years. At the same time, the Parks and Experiences segment remains the company’s “cash cow”, demonstrating strength and resilience that are expected to persist into the future. Additionally, content and sports will continue to play significant roles in Disney's long-term strategy, while the Linear Networks segment is becoming increasingly less relevant to the group’s overall vision. This shift in focus is evident in Disney’s 2025, 2026, and 2027 outlook, which did not include a single mention of Linear Networks, signaling its declining importance to the business.

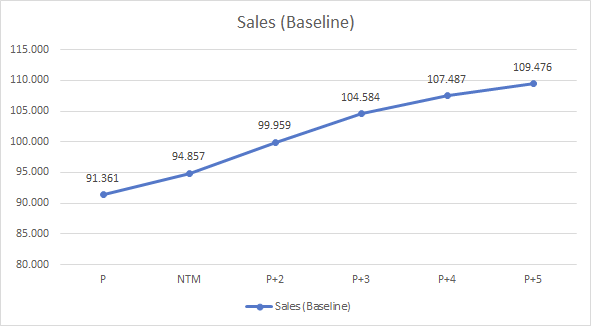

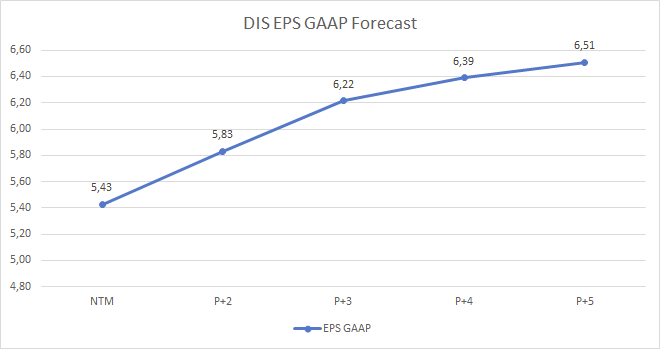

Turning to the numbers, analysts forecast a compound annual growth rate (CAGR) of net sales of approximately 4.0% through 2029 (P+5), leading to an estimated $111 billion in net sales. However, I take a more conservative view, forecasting $109 billion in net sales by that time. Analysts are also projecting a CAGR of 21.1% for GAAP EPS through 2029, which is notably optimistic. In my view, a more realistic estimate would be a 15.3% CAGR for EPS, accounting for potential challenges in achieving consistent profitability across segments.

Free cash flow (FCF) is another critical metric for Disney. Based on historical trends, I expect the FCF margin to stabilize at approximately 10% per year, aligning with the average of recent years. This assumption underscores Disney's capacity to generate strong cash flow, particularly from its Parks and Experiences segment, which will continue to fund strategic investments and shareholder returns.

How does this translates into the valuation of the stock?

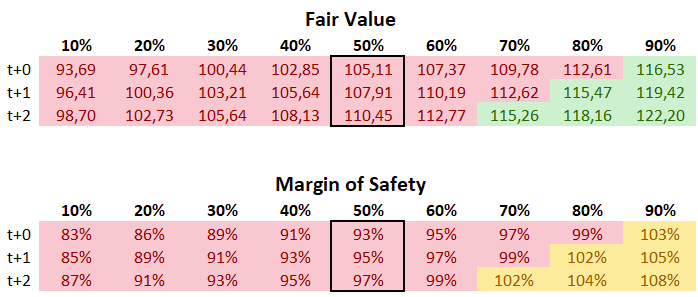

Based on my DCF valuation, I currently estimate a fair value per share for Disney at approximately $105 in my baseline scenario. In a more optimistic bull case scenario, which assumes slightly improved margins and higher growth, the fair value rises to around $117. Given the current share price of $113, the stock appears to be slightly overvalued under the baseline scenario and perhaps fairly valued if you lean toward the more optimistic outlook.

Recently, I’ve received feedback suggesting that I should better incorporate the concept of margin of safety into my analysis and explicitly compare the fair value to the actual stock price. The margin of safety is calculated as the fair value estimate divided by the current share price, where a result of 100% indicates the stock is fairly valued. A margin below 100% suggests the stock is overvalued, while a margin above 100% indicates undervaluation.

For example, in my baseline and bullish scenario:

Margin of safety = ($105 fair value / $113 current price) = 93%, indicating slight overvaluation. In the bull case:

Margin of safety = ($117 fair value / $113 current price) = 103.5%, suggesting the stock is fairly valued but offers little additional safety.

The concept of margin of safety is particularly useful as it accounts for potential inaccuracies in forecasting, which are always a risk when estimating fair value. For my personal investment decisions, I typically require a margin of safety of at least 125% (i.e., fair value estimate / stock price > 125%) to compensate for uncertainties and ensure a sufficient cushion. However, this is a personal preference, and there is no universal rule. Each investor should consider their own expectations and risk tolerance when determining the margin of safety appropriate for their decisions.

This approach provides a clearer framework for evaluating whether a stock is attractively priced relative to its intrinsic value, while incorporating a buffer to account for forecasting variability.

In this two tables below, I present my estimated fair values for the stock, providing a baseline scenario, a bear case and a bull case scenario for comparison. These estimates are based on my DCF valuation and reflect differing assumptions about growth rates, margins, and other key factors.ant to show my estimated fair values for the DIS 0.00%↑ stock.

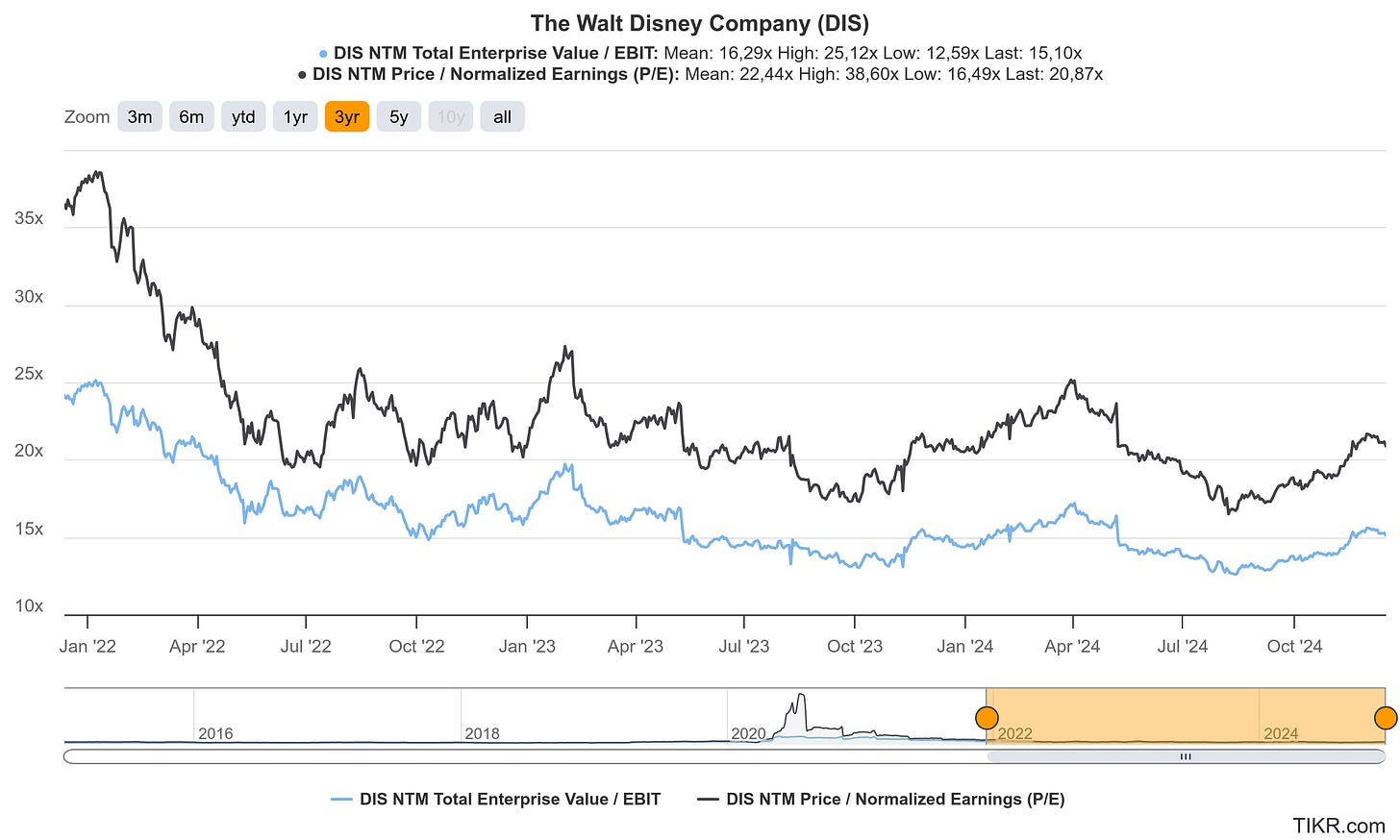

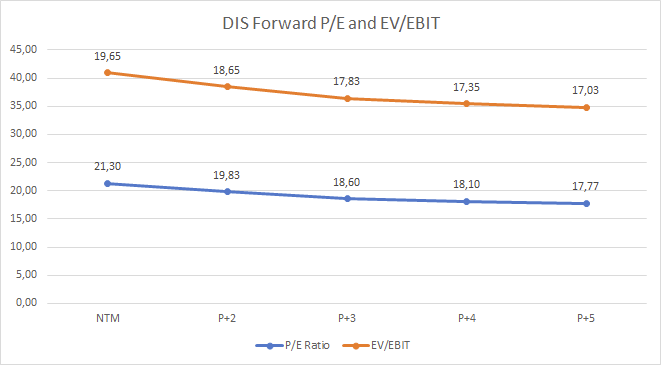

To provide additional context to my valuation, I also analyze the stock using EV/EBIT and normalized P/E ratios. Over the past three years, the average EV/EBIT ratio for Disney has been 16.29x, while the normalized P/E ratio averaged 22.44x. Currently, both metrics are slightly below their historical averages, with the EV/EBIT ratio at 19.65x and the P/E ratio at 21.3x.

While these figures indicate that the stock is trading below its historical highs, it is important to consider the impact of exceptionally high valuation multiples observed at the end of 2022, when Disney's stock reached record levels. Adjusting for these outliers, I believe the current ratios provide additional confirmation that the stock is fairly valued at present, aligning with my earlier DCF-based estimates.

Insider activity

Insider trading activity at The Walt Disney Company over the past year has involved both purchases and sales by company executives and directors. Insiders have purchased a total of 72,676 shares while selling 493,316 shares. Insider ownership currently stands at 0.10% of the company's outstanding shares.

It's important to note that insider transactions can be influenced by various factors, including personal financial planning and company policies, and may not necessarily reflect insiders' views on the company's future performance.

I don’t typically focus heavily on insider activity, as I believe its significance is often limited. However, to provide a comprehensive perspective in this Disney analysis series, I felt it was important to include it for a more complete picture.

Conclusion on The Walt Disney Company

This five-part series on The Walt Disney Company provided an excellent overview of its business and various segments. While the linear networks segment continues to lose relevance, the company’s future success is highly dependent on its Direct-to-Consumer (DTC) business. Despite these challenges, Disney retains a very strong content and sports division, and its Parks and Experiences segment remains a true cash cow. It will be crucial to see how the company evolves after Bob Iger steps down again and who will be named as his successor. Iger’s leadership has been deeply intertwined with Disney’s past success, and the company faced significant struggles following his initial retirement.

I am not currently invested in Disney stock, and from my perspective, now is not the best time to buy. The stock appears fairly valued, and the risk/reward ratio is not particularly favorable at the moment. While Disney’s DTC business is improving and becoming more profitable, it has yet to reach the level of success achieved by the streaming industry leader, Netflix. It will be interesting to watch how this develops, and I will continue to monitor the situation closely.

Thank you once again for being here and for your interest! If you enjoyed my analysis, please consider leaving a "like" and subscribing. Your support means a lot!

Disclaimer: The information provided in this publication is for educational and informational purposes only and does not constitute financial advice. The content is solely reflective of my personal views and opinions based on my research and is not intended to be used as a basis for investment decisions. While every effort is made to ensure that the information is accurate and up-to-date, the writer makes no representations as to the accuracy, completeness, suitability, or validity of any information in this post and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. All readers are advised to conduct their own independent research or consult a professional financial advisor before making any investment decisions. The author is not invested in the mentioned stock.