Dear readers,

thank you for being here and for your interest in my work! If you like this article and if you want to support my work, please feel free to subscribe! Please read the disclaimer at the end of this article. This is not an investment advice!

Several months ago, I wrote an article about Kering, the French luxury conglomerate. At that time, I was somewhat optimistic about its potential due to its prestigious brands and strategic shift toward pure luxury, alongside a retail strategy that emphasized directly operated stores over wholesale. However, last week, major French luxury groups Kering, LVMH, and Hermès released their Q1 sales figures—a common practice in France. Among these, Kering's performance was notably the weakest, a fact that is not just disappointing but verges on disastrous.

In this article, I aim to delve deeper into the sales developments to try to uncover the fundamental weaknesses at Kering, particularly focusing on Gucci.

Kerings Q1 Sales development

In Q1 2024, Kering faced a significant setback, with a reported revenue decline of 11% and a comparable decline of 10%, totaling €4.5 billion. This disappointing performance included a negative currency impact of 3% and was slightly cushioned by a positive scope effect of 2% due to the consolidation of Creed. Here’s a detailed critique of the performances across Kering's major houses:

Development per Segment

Gucci

Steep Revenue Decline: Gucci’s revenue plummeted to €2.1 billion, marking a severe drop of 21% as reported and 18% on a comparable basis.

Dismal Retail and Wholesale Results: The directly operated retail network saw a comparable revenue decline of 19%, heavily influenced by significant losses in the Asia-Pacific market. Wholesale revenue also decreased by 7% on a comparable basis, reflecting ongoing challenges in distribution.

Yves Saint Laurent

Underwhelming Retail Performance: Revenue stood at €740 million, down 8% as reported and 6% on a comparable basis. Although retail was somewhat resilient, falling just 4% comparably, this still reflects underlying issues in market penetration and consumer appeal.

Sharp Decline in Wholesale: The wholesale sector suffered a substantial 25% drop on a comparable basis, signaling a troubling trend in market dynamics and distribution strategies.

Bottega Veneta

Marginal Growth Amidst Troubles: Revenue was nearly stagnant at €388 million, up just 2% on a comparable basis. This slight increase masks underlying vulnerabilities in its market strategy.

Inconsistent Regional Performance: Despite a 9% increase in directly operated retail network revenue on a comparable basis, driven by sporadic growth in North America, Western Europe, and the Middle East, a decline in Asia-Pacific raises concerns about global consistency.

Wholesale Woes: A 25% comparable decrease in wholesale revenue highlights significant challenges in maintaining brand desirability and distribution effectiveness.

Other Houses

Modest Retail Gains Overshadowed by Broader Issues: While revenue was down 7% as reported and 6% on a comparable basis at €824 million, a slight 3% increase in retail revenue cannot offset broader strategic failings.

Jewelry Houses as Sole Bright Spots: The standout performance of Kering’s Jewelry Houses, particularly Boucheron, with sharp double-digit growth, was a rare highlight in an otherwise troubled portfolio.

Kering Eyewear and Corporate

Limited Positive Developments: While Kering Eyewear showed an 8% increase on a comparable basis, the broader segment’s growth to €536 million, up 24% as reported and 9% on a comparable basis, was primarily driven by the integration of Creed, masking weaknesses in other areas.

Development per geographic region

Based on Kering's Q1 2024 earnings call, the regional sales development reflects a challenging landscape for the group, particularly marked by significant underperformance in critical markets. Here is a critical analysis of the sales development across different regions:

Asia-Pacific

Significant Decline: Asia-Pacific, traditionally a stronghold for luxury goods consumption, notably in China, experienced a sharper decline than other regions. This downturn is particularly concerning as it indicates a loss of momentum in a region that has been a major growth driver for luxury brands. The reduction in store traffic and subdued local demand during key selling periods like the Chinese New Year suggest deep-rooted issues such as brand fatigue, competitive pressures, or possibly a failure to align with local consumer tastes and expectations.

Western Europe and North America

Stagnation and Inconsistency: Both Western Europe and North America showed trends in line with the fourth quarter of 2023, indicating a lack of improvement and ongoing stagnation. This continuity of weak performance might point to ineffective regional strategies or inadequate responses to evolving market dynamics and consumer preferences. For a luxury conglomerate like Kering, maintaining the status quo in such critical markets could risk further erosion of market share to more agile competitors.

Japan

Relative Stability Yet Concerning: While Japan did not experience as sharp a decline as Asia-Pacific, the mere alignment with previous quarters' performances where other competitors might be capitalizing on rebounding tourism and consumer spending poses a strategic concern. Japan's resilience needs to be bolstered by innovative retail experiences and product offerings to capture the increasing influx of tourists, especially from China, which appears underleveraged.

The overall regional performance suggests a troubling lack of resilience and failure to innovate adequately across Kering’s portfolio. While other luxury groups might be experiencing buoyant growth by adapting swiftly to post-pandemic market conditions and shifting consumer behaviors, Kering’s consistent underperformance across multiple regions could reflect deeper issues within its brand strategies or operational execution.

Deteriorating Outlook

Kering's outlook remains grim amidst its significant revenue downturn, reflecting poorly on its long-term strategy and market positioning. Despite ongoing investments, the expected significant decline in recurring operating income in the first half of 2024, amidst a normalizing luxury sector and persistent economic and geopolitical challenges, casts doubt on the group's current strategic direction. Kering’s focus on cost optimization and strategic investment to foster long-term growth appears increasingly urgent as it strives to maintain its status in a fiercely competitive luxury market.

How did the peers perform in Q1 2024?

LVMH

LVMH Moët Hennessy Louis Vuitton reported a revenue of €20.7 billion for the first quarter of 2024, with a modest organic revenue growth of 3%. Despite the challenging geopolitical and economic conditions, the group saw growth in Europe and the United States, with significant gains in Japan driven by spending from Chinese customers. The revenue mix saw adjustments, particularly with Japan gaining prominence due to increased tourism.

In its first quarter of 2024, LVMH Moët Hennessy Louis Vuitton demonstrated a varied performance across its business groups. The Wines & Spirits sector faced a 12% organic decline, attributed to a post-COVID normalization and cautious retailer attitudes in the U.S. In contrast, the Fashion & Leather Goods sector achieved a 2% organic growth, buoyed by strong performances from iconic brands Louis Vuitton and Christian Dior. The Perfumes & Cosmetics sector enjoyed a 7% increase, driven by successful product lines and innovative launches. However, the Watches & Jewelry sector experienced a slight decrease of 2%, despite ongoing efforts to enhance its product lines. Notably, the Selective Retailing sector reported an impressive 11% organic growth, led by Sephora's continued market share gains.

Key differences and insights between LVMH and its competitor Kering highlight the former's resilience. LVMH showed greater stability and managed to sustain growth in challenging economic conditions, while Kering faced significant struggles, particularly with its flagship brand Gucci. Regionally, LVMH benefited from strong spending by Chinese tourists in Japan and steady growth in the US and Europe. Conversely, Kering suffered from weak traffic and sharp declines in the Asia-Pacific region. LVMH's broad diversification across different sectors helped mitigate risks and capture growth opportunities, particularly in cosmetics and retail sectors. This strategic spread has helped shield LVMH from some of the focused distress that Kering experienced in its fashion and leather goods divisions, especially through Gucci.

Overall, while both companies emphasize innovation and quality, LVMH's effective execution across a wider range of brands and regions highlights a more robust strategic positioning compared to Kering’s current challenges. This comparative stability and strategic diversification underscore LVMH's strong standing in the luxury market.

In summary, while both LVMH and Kering navigate through uncertain times, LVMH’s Q1 performance illustrates a stronger position and a more balanced portfolio approach, which has allowed it to better withstand regional fluctuations and capitalize on market opportunities compared to Kering.

Hermès

In the first quarter of 2024, Hermès experienced robust sales growth, generating consolidated revenue of €3.805 billion, an increase of 17% at constant exchange rates and 13% at current exchange rates. This performance reflects the strength of Hermès' artisanal model, the quality of its materials, and its strategic focus on exceptional craftsmanship, which has enhanced the desirability of its products globally.

Geographically, Hermès saw double-digit growth across all regions. Notably, Asia excluding Japan grew by 14%, driven by sustained demand despite softer traffic in Greater China post-Chinese New Year. Japan itself saw an impressive 25% growth, buoyed by strong local customer loyalty, while the Americas recorded a 12% increase, spurred by dynamic activity in the United States. Europe, including France, also showed solid performance, with events such as the Saut Hermès and various exhibitions enhancing brand engagement.

By sector, the Leather Goods and Saddlery segment stood out with a 20% increase, supported by new model introductions and ongoing expansion in production capacities. Ready-to-Wear and Accessories also performed well, achieving a 16% growth. Other areas such as Silk and Textiles, and Perfume and Beauty saw healthy increases of 8% and 4%, respectively, while the Watches sector grew by 4%.

Hermès' robust results can be attributed to its consistent investment in artisanal quality and global brand strengthening, which seems to resonate well with its clientele. This strategy contrasts with Kering's struggles, particularly with Gucci, which is undergoing a challenging phase with significant revenue declines across key markets.

Hermès remains optimistic about its future, driven by a strong, integrated artisanal model, a balanced distribution network, and ongoing creative innovation. The company's commitment to sustainability and responsible growth further supports its long-term strategy, in contrast to Kering's current restructuring efforts aimed at revitalizing its core brands.

Looking to 2022 and beyond

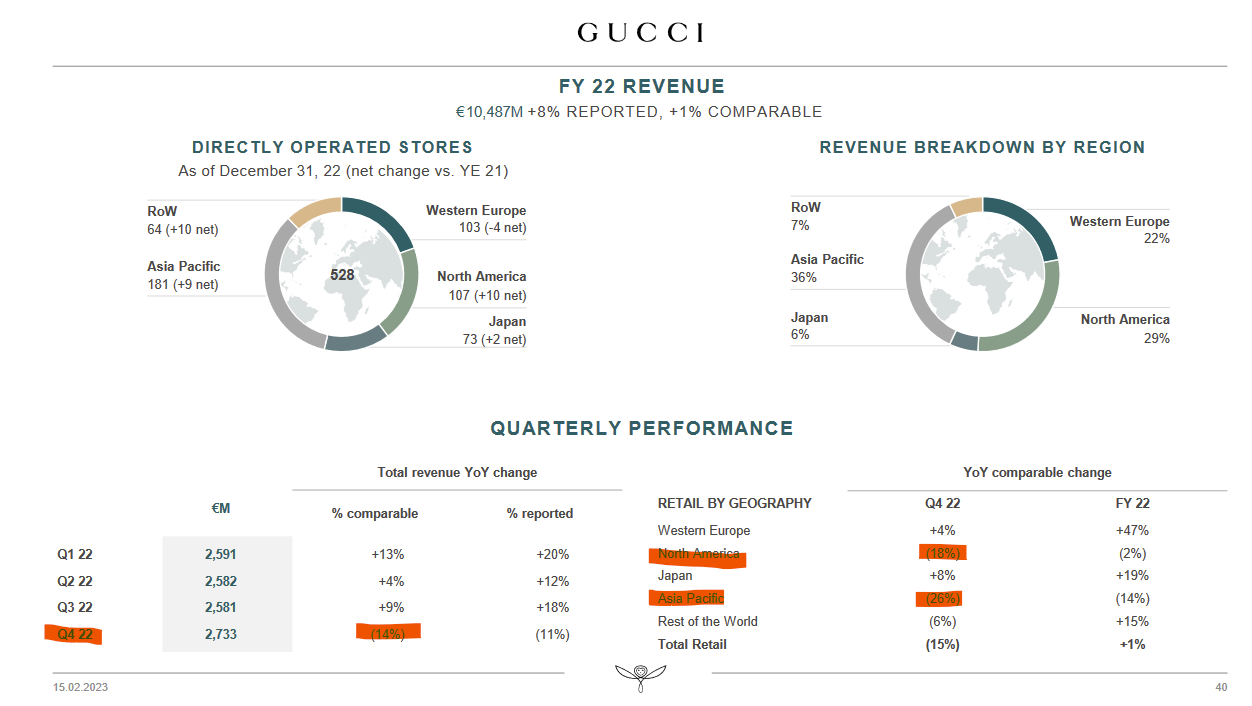

Looking into the sales development for Kering, LVMH, Hermes on a monthly basis since Q1 2022 indicates that Kering is lacking behind its competitors for several years. Although Kering was somehow able to grow until Q3 2022, in Q4 2022 the deterioration started incredible strong.

In Kering's 2022 Full Year Results Presentation, CEO François-Henri Pinault detailed the reasons behind the underperformance, especially focusing on Gucci, which did not meet the company’s expectations.

Despite Kering's overall revenue growth, Gucci, as the largest brand in their portfolio, failed to perform up to the expected standards. The decline at Gucci was particularly disappointing because it contrasted with the success of other houses within the group. This underperformance at Gucci can be attributed to a combination of product misalignment with market trends and possibly an inadequate response to changing consumer preferences.

The controversy at Balenciaga, one of Kering's high-profile brands, occurred towards the end of 2022 and involved a marketing campaign that was widely criticized for its content. This incident not only affected Balenciaga's image but also had a broader impact on Kering's reputation. Pinault took full responsibility for the oversight, mentioning that the company's existing procedures were followed but proved inadequate in preventing the controversy. Following this, Kering conducted a comprehensive review of their procedures and introduced additional oversight measures to better manage and vet creative content across all brands to prevent similar incidents in the future.

Pinault emphasized that despite the setbacks, Kering was committed to continuing its strategic initiatives aimed at enhancing the desirability and performance of its brands. This includes investing in product innovation, brand positioning, and customer experience. For Gucci, in particular, efforts are being made to rejuvenate the brand by refreshing its creative direction and product offerings.

The leadership changes, especially at Gucci with the appointment of a new creative director, are part of Kering’s efforts to realign the brand with market dynamics and consumer expectations. These changes are aimed at infusing new energy and perspectives into the brand’s offerings.

External factors such as economic uncertainty and shifting market dynamics also played a role in the sales decline. These factors affected consumer spending patterns, particularly in key markets like Asia and North America, which are significant for Kering’s overall performance.

After the shock in Q4 2022, Kering's revenue recovery appeared tepid, showing only marginal growth in the first half of 2023 before beginning to deteriorate again. In contrast, LVMH and Hermès managed to sustain their momentum and significantly increase their revenues. LVMH experienced slower growth in the second half of 2023 and, for the first time, reported a decline in sales in Q1 2024. Hermès, known for its high-end luxury products, continued to achieve impressive growth during this period.

Gucci is losing market share

Search engine results frequently rank Gucci among the top places in brand rankings, underscoring its status as a successful and desirable brand. Indeed, Gucci continues to generate billions in sales for Kering. However, since Q4 2022, with the exception of Q1 2023, Gucci's sales have declined in five of the last six quarters, including four consecutive quarters of decline.

In comparison, I analyzed the performance of LVMH's Fashion and Leather Goods segment and Hermès. Unlike Gucci, both Hermès and LVMH’s Fashion and Leather Goods segment have shown significant growth. Similar to the trends noted earlier, LVMH’s Fashion and Leather Goods segment also experienced a sales decline on a reported basis in Q1 2024.

The decline in Q4 2022 was primarily attributed to economic uncertainties in China and the US, which were escalating rapidly. More than a year later, Kering's financial performance exhibits a similar trend, now compounded by a sharp decline in revenues across Europe.

I would also suggest that the marketing disaster at Balenciaga in Q4 2022 had a more significant impact on Kering's overall brand than initially anticipated. Consequently, traditional rankings may no longer be reliable indicators of a brand's strength and resilience, as Kering’s sales trends do not reflect those of a robust brand. Despite facing similar economic conditions, LVMH and Hermès have shown markedly better development. This superior performance can likely be attributed not just to LVMH’s broader diversification, but also to the inherent desirability of their individual brands.

As one brand experiences sales growth while the other faces decline, Gucci is inevitably losing valuable market share. Reversing this disastrous downward trend and regaining lost ground will undoubtedly prove challenging.

Stock Valuation

Gucci's and Kering's underperformance is evident not only in their weak fundamentals and disappointing revenue growth but also in their stock price performance. In a period where luxury stocks have generally thrived, Kering's struggles stand out starkly. Over the past five years, while LVMH has seen its stock value increase by 125% and Hermès by an impressive 285%, Kering has experienced a significant decline, losing 34% of its market value.

In my previous article on Kering, I discussed the potential undervaluation of its stock, highlighting the opportunities that seemed hidden within the company and its brands. However, I am increasingly skeptical about the current management's ability to steer the company toward a turnaround. Consequently, my confidence in Kering's future growth prospects is waning.

A few months ago, analysts projected that Kering’s sales revenue would grow at a compound annual growth rate (CAGR) of 7.3% through to 2027. They also forecasted even stronger growth in EBIT (Earnings Before Interest and Taxes) and normalized net income, with increases expected at 10.1% and 11.8% CAGR, respectively. Recent revisions have sharply reduced these expectations, with revenue growth now anticipated at only 4.6% CAGR, EBIT at 4.2% CAGR, and normalized net income at 5.2% CAGR—more than halving the initial projections.

With the current level of uncertainty, I find it increasingly difficult to trust analyst forecasts, my own projections, or even the expectations set by Kering's management, complicating the task of determining an intrinsic value for Kering. The company's stock is trading significantly below its peers, a discrepancy that can be justified given its revenue declines and the substantial challenges it faces. Even with an EV/EBIT multiple of 15.11x, this valuation might still be too high considering the company’s ongoing struggles.

Conclusion

Kering's Q1 sales results were disastrous. Compared to its peers, LVMH and Hermès, Kering’s performance is even more disappointing. The management team appears unable to bolster the strength of its brands, including its flagship, Gucci, which is struggling more than ever. Kering's management often cites the transition from wholesale to purely retail channels as a normalization strategy within the luxury market. However, this increasingly seems like a pretext to divert attention from deeper issues.

“Our Q1 performance reflects the well-flagged normalization of the growth in our sector, amplified by our own long-term strategic decision to elevate our houses, notably in terms of distribution as we scale down wholesale.” - CFO Armelle Poulou

In my view, despite Gucci's enduring popularity, the brand's competitive edge is waning, and it has lost significant appeal and desirability relative to other luxury brands.

I hold an investment in Kering and plan to maintain my position. However, I no longer view this as an undervalued opportunity but rather as a bet on a potential turnaround. This approach deviates from my typical investment style, but I am reluctant to sell my shares since they constitute a small proportion of my portfolio. Additionally, I remain interested in observing the company's progress closely.

Disclaimer: The information provided in this publication is for educational and informational purposes only and does not constitute financial advice. The content is solely reflective of my personal views and opinions based on my research and is not intended to be used as a basis for investment decisions. While every effort is made to ensure that the information is accurate and up-to-date, the writer makes no representations as to the accuracy, completeness, suitability, or validity of any information in this post and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. All readers are advised to conduct their own independent research or consult a professional financial advisor before making any investment decisions. The author is invested in Kering.

One of the best write-ups I've seen on Kering. Great work! 👍

I've been thinking about the value of luxury goods in a world characterized by increasing geopolitical tensions, potenially speading over to Asia (China, Taiwan..)

Any thoughts on that ?