#33 Ulta Beauty Q1-24 Update

Short Update after the Q1 2024 earnings

Dear readers,

thank you for being here and for your interest in my work! If you like this article and if you want to support my work, please feel free to subscribe! Please read the disclaimer at the end of this article. This is not an investment advice!

Ulta Beauty Q1 2024 Earnings

First, I want to highlight my deep dive into Ulta Beauty ULTA 0.00%↑ from the end of March. Please check it out if you are not familiar with Ulta Beauty.

Finincial highlights

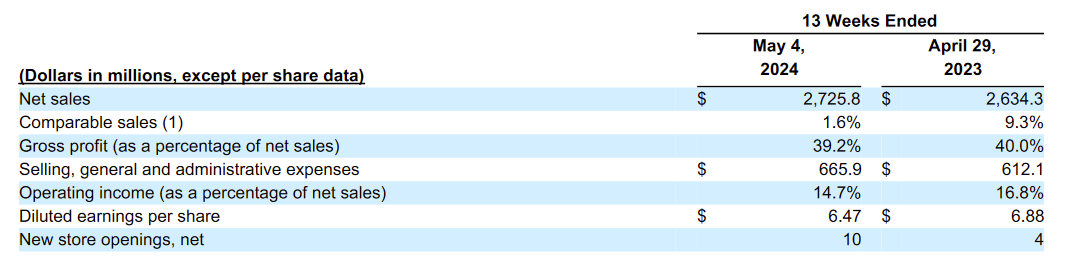

Ulta Beauty had a mixed start to 2024, showcasing its strengths while grappling with a few challenges. For the first quarter ending May 4, 2024, the company reported net sales of $2.73 billion, up 3.5% from the previous year's $2.63 billion. Despite this solid sales growth, net income dipped to $313.1 million from $347.1 million in Q1 2023. This decline was primarily due to a significant increase in selling, general, and administrative (SG&A) expenses, which rose by $53.8 million, alongside a slight drop in interest income.

Ulta’s comparable sales saw a modest growth of 1.6%, a stark contrast to the impressive 9.3% growth in the previous year. The increase was mainly driven by a 2.5% rise in transactions, though the average ticket saw a minor decline of 0.9%.

Gross profit for the quarter increased to $1.07 billion from $1.05 billion, yet the gross margin slightly contracted to 39.2% from 40.0% due to higher costs. The company's SG&A expenses climbed to $665.9 million, which represented 24.4% of net sales, up from 23.2% last year. This hike was attributed to increased corporate overhead, store payroll, and other store-related expenses.

On the cash flow front, Ulta saw a significant reduction in net cash provided by operating activities, which stood at $159.3 million, down from $304.9 million the previous year. This was mainly due to timing differences in accounts payable and accrued liabilities, as well as a larger increase in merchandise inventories. Meanwhile, cash used in investing activities decreased to $93.6 million from $110.1 million, thanks to lower capital expenditures on information technology and supply chain investments. However, cash used in financing activities rose to $307.8 million from $296.2 million, driven by increased share repurchases. During the quarter, Ulta repurchased 588,004 shares at a cost of $287.4 million.

Despite these fluctuations, Ulta's liquidity remains strong. The company's cash and cash equivalents were $524.6 million at the end of Q1 2024, down from $766.6 million at the beginning of the period. Ulta is confident that its primary sources of liquidity, including cash from operations and a credit facility, are more than sufficient to meet both short-term and long-term financial commitments.

Ulta continued to expand its footprint, opening 12 new stores, closing two, and relocating one during the quarter, bringing the total number of stores to 1,395. Merchandise inventories increased to $1.91 billion, up 8.8% from the previous year, driven by new brand launches and store expansions.

In March 2024, Ulta’s Board of Directors authorized a new $2 billion share repurchase program. Under this program, the company repurchased shares worth $287.4 million during the first quarter.

In summary, while Ulta Beauty faced increased operational costs that impacted its net income, the company showed resilience through solid sales growth and strategic investments. With a strong cash position and continued expansion, Ulta is well-positioned to navigate the rest of the year.

Earnings Call Highlights

Ulta Beauty’s Q1 2024 earnings call had some interesting insights and updates, and it felt like listening to a story of resilience, strategy, and ambition in a competitive marketplace.

David Kimbell, the CEO, kicked off by acknowledging a dynamic market landscape where Ulta had to adapt quickly. David spoke passionately about how Ulta's teams adjusted their strategies to tackle the evolving marketplace. They smartly managed expenses while continuing to push their transformational agenda forward. The company opened 12 new stores, bringing their total to nearly 1,400, and expanded their digital presence significantly, driving growth in both store and online traffic.

One of the highlights of the call was the success of Ulta’s loyalty program, which now boasts 43.6 million active members. This program isn’t just about numbers; it’s about building strong emotional connections with their guests. David explained how the loyalty program, combined with strategic marketing efforts, has driven higher traffic to both their stores and digital platforms. The brand awareness and love for Ulta have reached record levels, especially among Gen Z and Baby Boomers, demonstrating the broad appeal of their model.

Ulta’s approach to innovation was evident as David highlighted several new and exclusive brand launches, like Sol de Janeiro and WYN by Serena Williams. These new additions are not only driving sales but also bringing in new members and reengaging existing ones. The company’s strategic investments in marketing, particularly across TV, audio, and social platforms, have been instrumental in amplifying these brand launches and their overall brand equity.

David wrapped up by outlining Ulta’s strategic focus areas: strengthening their product assortment, accelerating social relevance, enhancing the digital experience, leveraging their loyalty program, and evolving promotional strategies. He emphasized how Ulta is well-positioned to navigate the competitive environment with their unique and differentiated approach. Despite the pressures, he expressed confidence in Ulta’s ability to drive significant and sustainable value over the long term.

In conclusion, the call painted a picture of a company that’s not just surviving but strategically thriving in a challenging market. Ulta Beauty is making thoughtful investments, building deeper connections with customers, and innovating continuously to stay ahead. It’s clear that they have a strong plan in place to navigate the near-term pressures while positioning themselves for long-term success.

Updated Outlook

During Ulta Beauty's Q1 2024 earnings call, the company's leadership shared an updated outlook for the year, weaving a narrative of cautious optimism and strategic adaptation in a competitive marketplace.

CEO David Kimbell set the stage by acknowledging the dynamic and challenging environment. Despite these hurdles, he expressed confidence in Ulta's ability to continue growing. For the full year, Ulta now expects net sales to be between $11.5 billion and $11.6 billion, with comparable sales growth anticipated in the range of 2% to 3%. The first half of the year is projected to see low single-digit growth, but David painted a hopeful picture of acceleration in the second half, driven by strategic initiatives and an easier comparison base from the previous year.

The company is also adjusting its expectations for operating margin, now targeting between 13.7% and 14% of net sales. This update reflects the anticipated lower leverage of fixed costs due to moderated sales growth. Paula Oyibo, the CFO, explained that while SG&A expenses are expected to grow in the mid- to high single-digit range, Ulta is committed to disciplined expense management. The first half will see higher growth in these expenses due to investments in marketing, store labor, and completing elements of their transformational agenda, but this growth rate is expected to slow in the second half.

Gross margin is another area where Ulta is adapting its expectations. The company anticipates a slight decline in gross margin for the year, primarily due to lower merchandise margins and the deleverage of fixed costs. However, Paula reassured that these pressures would be mostly offset by lower supply chain costs and growth in other revenue streams. In the first half, merchandise margins will face challenges from increased promotions and unfavorable brand mix impacts, but by the second half, these pressures are expected to ease, leading to a flat to slightly positive gross margin outlook.

David shared an also an update on earnings per share (EPS), revising the guidance to a range of $25.20 to $26 per share. He acknowledged that EPS would be lower in the first half but expressed confidence in improvement during the second half, which would also benefit from an extra week in fiscal 2023.

In terms of capital allocation, Ulta remains committed to repurchasing $1 billion in shares this year, a move that reflects their confidence in the company's cash flow and future prospects. Additionally, investments will continue in new store openings, digital enhancements, and IT infrastructure, all aimed at supporting future growth.

The loyalty program, already a significant strength, will see further enhancements to deepen customer engagement and retention. David shared how the program has been rebranded and revitalized to offer even more value to its 43.6 million members, turning loyal customers into brand advocates.

In closing, the earnings call painted a vivid picture of a company that’s not just surviving but strategically thriving. Ulta Beauty is making thoughtful investments, building deeper connections with customers, and continuously innovating to stay ahead. David and Paula’s updates showcased a company poised to navigate near-term pressures while positioning itself for long-term success, embodying resilience, strategy, and ambition in every step forward.

Upcoming Investor Day

The upcoming Investor Day for Ulta Beauty is scheduled to take place in October. This event is highly anticipated as it will provide detailed insights into Ulta’s long-term strategies, financial goals, and the initiatives they plan to implement to continue driving growth and maintaining their market leadership in the beauty industry.

During the Q1 2024 earnings call, CEO David Kimbell emphasized the importance of this event, suggesting it will be a comprehensive overview of how Ulta plans to navigate the competitive landscape and achieve sustainable success in the years to come.

Valuation “Update”

In my March post on Ulta Beauty, I wrote the following about the stock's valuation:

“Based on these projections, I estimate a fair value per share to be within the $420 to $460 range. Given the current stock price of approximately $514 per share, this suggests that Ulta Beauty's stock might currently be overvalued. Regarding its Price-to-Earnings (P/E) and Enterprise Value to Earnings Before Interest and Taxes (EV/EBIT) ratios, based on the expected earnings for the next twelve months, the stock is trading at multiples of 19.19x and 15.56x, respectively. This is in comparison to its 5-year averages of 22.85x and 18.84x. At first glance, this might indicate that the stock is undervalued. However, it's crucial to consider that growth expectations have significantly reduced compared to previous years. Therefore, the lower multiples appear to be justified, reflecting the adjusted growth outlook more appropriately.”

Here we are just two months later and so much has changed. Since the end of March, the stock has come down from over $500 per share to the current $386 per share.

What exactly does that mean? From my perspective, the market has overreacted and an overvaluation of the stock has turned into an undervaluation. My estimated fair value (per DCF) remains at around $420 to $460 per share. If you also look at the forward EV/EBIT and P/E ratios, they are now trading well below historical averages. My comments from the last article still hold true, the lower multiples also reflect lower expectations for earnings and revenue growth, but I think this is an overreaction by Mr. Market.

Conclusion

From my perspective, Ultas Q1 2024 earnings are in line with what I was expecting. The margin pressure and slowing comparable sales growth is no surprise. What I like is that Ultas management is handling this environment with a lot of confidence in their strategy and operational excellence. The updated outlook is totally fine, but what will be more important for long-term investors will be the investor day in October, where we will see the new long-term strategy for Ulta. I’ll keep an eye on this great business as it develops.

Disclaimer: The information provided in this publication is for educational and informational purposes only and does not constitute financial advice. The content is solely reflective of my personal views and opinions based on my research and is not intended to be used as a basis for investment decisions. While every effort is made to ensure that the information is accurate and up-to-date, the writer makes no representations as to the accuracy, completeness, suitability, or validity of any information in this post and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. All readers are advised to conduct their own independent research or consult a professional financial advisor before making any investment decisions. The author is invested in ULTA.

Thanks for your work on this update! It's clear that the company is able to attract a lot of customers who want to experiment or test a new product; however, for me the big question is can the company keep those customers who find a product they like and want to periodically replenish their supply. Have you seen anything that demonstrates how effective Ulta is at keeping customers who simply want to replenish? Thanks, Steve