#35 Lululemon Valuation

What is the fair value after its Q1 2024 earnings?

Dear readers,

thank you for being here and for your interest in my work! If you like this article and if you want to support my work, please feel free to subscribe! Please read the disclaimer at the end of this article. This is not an investment advice!

Introduction

Lululemon Athletica Inc. LULU 0.00%↑ had a robust first quarter in 2024, showcasing growth and strong financial results. The company reported a notable 10% increase in net revenue, reaching $2.2 billion, compared to $2.0 billion in the same period of 2023. Adjusting for currency fluctuations, this growth was even more impressive at 11%.

A closer look at the company's performance reveals a robust 6% rise in comparable sales, which translates to a 7% increase on a constant dollar basis. This growth was driven by an impressive surge in the China Mainland market, where comparable sales soared by 26%, or 33% when accounting for currency effects. The Rest of World segment also performed strongly, with a 23% rise in comparable sales, translating to 26% on a constant dollar basis. However, the Americas market saw a plateau in comparable sales.

Lululemon's gross profit for the quarter rose by 11% to $1.3 billion, with a slight improvement in gross margin, which increased by 20 basis points to 57.7%. Income from operations climbed by 8%, totaling $432.6 million, though the operating margin experienced a minor dip of 50 basis points, settling at 19.6%.

The company's net income for the quarter was an impressive $321.4 million, up from $290.4 million in the first quarter of 2023. This increase translated into diluted earnings per share of $2.54, compared to $2.28 in the same period last year.

Breaking down performance by segment, the Americas generated $1.62 billion in net revenue, up from $1.57 billion. China Mainland saw a substantial increase in net revenue to $303.8 million from $210.1 million, highlighting the region's critical role in Lululemon's growth strategy. The Rest of World segment also contributed significantly, with net revenue rising to $282.8 million from $223.0 million.

Lululemon's various sales channels all demonstrated strong performance. Company-operated stores brought in $1.07 billion in revenue, a notable increase from $958.1 million in Q1 2023. E-commerce sales also grew, reaching $905.8 million from $834.9 million. Additionally, other channels, including outlets and temporary locations, contributed $232.6 million, up from $207.8 million in the previous year.

The company's growth was driven not only by its expanding international footprint but also by its ability to adapt to challenging market conditions. Despite facing macroeconomic pressures such as inflation and higher interest rates, Lululemon managed to sustain growth, particularly in its international markets. This was exemplified by the outstanding performance in China Mainland and the Rest of World segments, which more than compensated for the moderation in growth seen in the Americas.

In terms of product performance, the company saw a 10% increase in women's revenue and a notable 15% rise in men's revenue. Accessories continued to perform well, growing by 2% despite last year's exceptional performance. The men's segment, in particular, continued to shine, driven by innovations across performance and lounge categories.

However, the U.S. market presented some challenges. Lululemon identified internal issues in the women's segment, notably a limited color palette and inventory shortages in smaller sizes. Despite these hurdles, the company is optimistic about the second half of the year, with plans to address these gaps and introduce new product innovations.

International markets remain a key growth area for Lululemon. In 2023, international sales made up 21% of the business, and there is potential for this to grow to 50% as the company expands its presence outside North America. This growth strategy is backed by the strong performance seen in international markets this quarter.

Despite a slower start in the U.S., Lululemon remains confident about its growth potential. The company is focused on acquiring new guests and boosting brand awareness through local engagements and larger-scale campaigns. The U.S. men's business has shown strong market share gains, and with planned new product launches and inventory adjustments, the women's segment is expected to bounce back in the latter half of the year.

Product innovation continues to be a cornerstone of Lululemon's strategy. The company is particularly excited about upcoming launches in the women's leggings assortment and new styles in the men's category. Recent changes in the organizational structure are aimed at increasing the speed of innovation and enhancing product flows, ensuring that Lululemon stays ahead of market trends.

In terms of expansion, Lululemon plans to open 35-40 new stores this year, with a focus on international markets, especially in China Mainland. The company's omnichannel strategy aims to balance growth between physical stores and e-commerce, providing a seamless shopping experience for customers.

In summary, Lululemon's Q1 2024 results underscore its strong international growth, strategic adjustments in the U.S. market, and continued focus on product innovation and brand expansion. The company remains confident in its long-term growth potential and its ability to navigate the current market challenges, setting a positive tone for the rest of the year.

Share repurchase program

The company reported about its robust share repurchase program, emphasizing its strategic approach to returning value to shareholders. In the first quarter of 2024 alone, Lululemon repurchased nearly $300 million worth of its own stock. This momentum continued into the second quarter, with an additional $230 million in shares repurchased by early June.

Reflecting confidence in its long-term growth prospects and financial health, the Board of Directors recently boosted the company's share repurchase authorization by an additional $1 billion. This significant increase brings the total capacity for share repurchases to approximately $1.7 billion. Lululemon views these buybacks as a strategic use of capital, reinforcing its commitment to enhancing shareholder value.

Notably, the company’s EPS guidance for the full year of 2024, projected to be between $14.27 and $14.47, excludes the impact of any future share repurchases. However, it does account for the repurchases made so far this year and factors in higher forecasted interest income.

Overall, Lululemon’s share repurchase program underscores its confidence in its ongoing financial and operational performance, showcasing its dedication to maximizing shareholder value through strategic capital management.

Outlook

During Lululemon Athletica Inc.'s Q1 2024 earnings call, the company shared an optimistic outlook for the remainder of the year, underpinned by detailed guidance and strategic growth plans.

For the full year 2024, Lululemon anticipates total revenue to be in the range of $10.7 billion to $10.8 billion, marking an 11% to 12% increase from 2023. Excluding the extra 53rd week in the fourth quarter, this growth is expected to be between 10% and 11%. This robust forecast is supported by plans to open 35 to 40 new company-operated stores and complete around 40 co-located optimizations, driving overall square footage growth in the low double digits. Most of the new stores will be in international markets, particularly in China Mainland, with 5 to 10 stores planned for the Americas.

Lululemon is also focused on maintaining its gross margin, expecting it to be flat compared to 2023. This includes projections for both markdowns and airfreight costs to remain stable. Additionally, the company plans to leverage SG&A expenses by approximately 10 basis points, strategically investing in marketing, brand building, international growth, market expansion, and technology infrastructure.

The operating margin is projected to increase by about 10 basis points for 2024, building on the 110 basis point expansion achieved in 2023. The effective tax rate is expected to rise slightly to 30%, primarily due to lower stock-based compensation deductions and favorable adjustments realized in the previous year.

Earnings per share (EPS) for 2024 are forecasted to be between $14.27 and $14.47, excluding the impact of any future share repurchases. This guidance accounts for repurchases made so far this year and higher forecasted interest income. Lululemon also plans to invest between $670 million and $690 million in capital expenditures, focusing on supporting business growth through a multi-year distribution center project, new store locations, relocations, renovations, and technology investments.

As of the end of Q1, inventory stood at $1.3 billion, down 15% year-over-year. For the second quarter, Lululemon expects revenue to be between $2.4 billion and $2.42 billion, representing growth of 9% to 10%. The company plans to open 14 net new company-operated stores in Q2. While the gross margin for Q2 is expected to decrease by 100 to 110 basis points due to fixed costs and ongoing investments in a multi-year distribution center project, the product margin is anticipated to remain flat compared to last year.

Looking ahead to the second half of 2024, Lululemon is optimistic about its performance, driven by significant product launches and innovations. The company aims to address any inventory challenges and capitalize on new product offerings to drive growth and improve margins.

In summary, Lululemon's guidance for 2024 reflects a strategic and balanced approach to growth and investment. The company is focused on expanding its store footprint, enhancing digital capabilities, and driving product innovation, all while maintaining financial discipline. This forward-looking strategy underscores Lululemon's confidence in its ability to navigate the market and achieve sustained success.

Competition Risks

Lululemon Athletica Inc. navigates a fiercely competitive landscape, facing substantial challenges from well-established companies and nimble newcomers alike. The company's market, dominated by technical athletic apparel, is teeming with rivals eager to capture a share of this lucrative segment.

Lululemon's direct competitors include large, diversified apparel giants and specialized women's athletic wear brands. These competitors boast significant financial, marketing, and distribution resources, allowing them to rapidly achieve and maintain brand awareness and market share. Despite Lululemon's robust market presence, the sheer scale and reach of these competitors present a formidable challenge that cannot be underestimated.

A critical vulnerability for Lululemon is the lack of patents protecting many of its fabrics and manufacturing technologies. This gap leaves the company exposed to imitation, with competitors able to replicate their products and sell them at lower prices. Such imitation threatens to erode Lululemon's net revenue and profitability, highlighting a significant strategic risk.

While Lululemon has made impressive strides in market share, particularly in the men's segment with successful innovations in performance and lounge wear, its brand awareness in the U.S. remains relatively low at under 30%. This limited recognition underscores a crucial growth potential but also a vulnerability, as the company struggles to firmly establish its brand in a crowded marketplace.

The competitive environment is further intensified by the promotional activities of other brands, which frequently use discounts and special offers to drive demand. Over the past few years, Lululemon has seen a rise in promotional intensity among its competitors. Although this level of promotion has remained stable from Q4 2023 to Q1 2024, Lululemon's performance in the U.S. has suffered more due to internal missteps rather than competitive pressures, suggesting a deeper vulnerability.

Despite these challenges, Lululemon continues to pursue growth through product innovation, customer engagement, and retail expansion. The company plans to open 35 to 40 new stores in 2024, focusing heavily on international markets like China Mainland. Additionally, it aims to optimize existing stores to enhance customer experience and sales productivity. However, these strategies, while promising, may not be enough to secure a lasting competitive edge.

Recent organizational shifts at Lululemon are intended to accelerate innovation and enhance accountability within product teams. Yet, without a significant moat—such as strong intellectual property protections or a dominant market position—these efforts may only provide temporary respite against the relentless competition.

In summary, Lululemon's competitive environment is characterized by intense rivalry, risks of product imitation, and heightened promotional activities. The company's current position lacks a robust defensive moat, leaving it vulnerable to competitors who can rapidly adapt and replicate its successes. As Lululemon pushes forward, the challenges it faces are substantial and require careful strategic management to ensure long-term sustainability and growth.

Valuation

Lululemon has experienced a rollercoaster ride in recent times. The stock soared to an impressive all-time high of around $509 at the end of 2023 but has since dropped by 37% due to unmet investor expectations. This raises the question: after such a significant decline, is the company now attractively valued? Let's delve into the details to find out.

Base Case Assumptions

The foundation of this growth projection rests on Lululemon's ability to continually enhance its brand awareness, consistently open new stores each year, and boost its sales on a comparable basis, all while avoiding major disruptions to its supply chains.

Revenue Growth

In the DCF Model, a five-year detailed planning period is used, projecting a 9.5% Compound Annual Growth Rate (CAGR) until 2028. This trajectory anticipates Lululemon’s revenue to reach a staggering $15 billion by 2028.

EBIT Margin

In the last twelve months, Lululemons’s EBIT margin was 22.8%. For the DCF Model, I have normalized this margin to a more conservative 21.2%.

Normalized Net Income Margin

Based on the EBIT margin, the Last Twelve Months (LTM) Normalized Net Income margin stands at 18.5%. Moving forward, it is estimated to stabilize around 17%.

Free Cash Flow

My Free Cash Flow assumptions include a Net Capex ratio as a percentage of sales (Net Capex = Capex - Depreciation) of 2.7%, reflecting the average of recent years. Working Capital, expressed as a percentage of sales, is determined by the average Working Capital over the past years, calculated at 3.0% of net sales. The Free Cash Flow estimation does not adjust for stock-based compensation.

WACC

The Weighted Average Cost of Capital (WACC) is set at 8.0%.

Results

Based on these assumptions, Lululemon’s equity value is estimated at $36.9 billion. Dividing this by the current number of shares, we derive a fair value per share of $305. In comparison to its latest stock price of $317, the stock appears slightly overvalued.

Adjusting the WACC to 8.5% would lower the fair value per share to $274, while a decrease in WACC to 7.5% would increase it to $332 per share.

Scenarios

Bull Case Scenario:

In an optimistic scenario, assuming a CAGR for revenue of 11.6%, an EBIT Margin of 23%, and a normalized net income margin of 19%, the fair value per share would be $337. In this scenario the stock appears slighly undervalued.

Bear Case Scenario:

Conversely, in a pessimistic scenario with a CAGR for revenue of 7.2%, an EBIT Margin of 19%, and a normalized net income margin of 15%, the fair value per share would be $273. In this scenario the stock appears slighly overvalued.

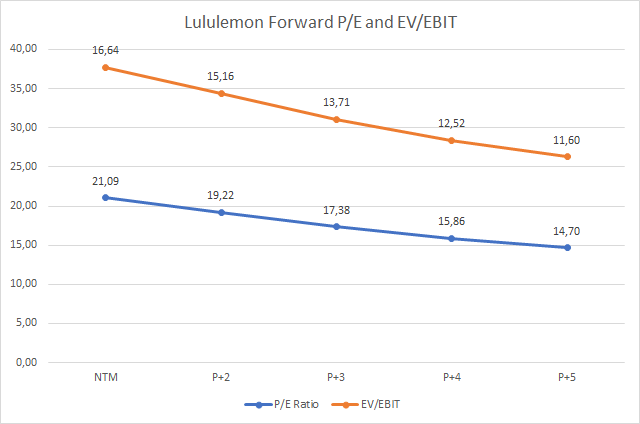

P/E and EV/EBIT

Based on my calculations, Lululemon's average P/E ratio (according to my definition of normalized P/E) over the past six years was approximately 42, while the average EV/EBIT ratio was around 30. In the last three years, excluding the distortions caused by the pandemic, the average P/E ratio was 36, and the EV/EBIT ratio was about 22. These figures suggest that the forward ratios indicate a significant undervaluation of the stock.

However, the DCF model points to an overvaluation. This discrepancy arises because current growth projections are significantly lower, necessitating lower justified ratios. From 2017 to 2023, the company achieved a CAGR of 21% in sales and 25% in EBIT. The growth projections for the upcoming years are expected to be roughly half of these rates. Thus, despite the seemingly attractive multiples, Lululemon remains an expensive stock.

Conclusion

Lululemon Athletica Inc. has demonstrated impressive growth and strong financial performance in Q1 2024, driven by strategic international expansion and product innovation. However, the company faces significant competitive challenges and lacks a robust defensive moat, making it vulnerable to rivals.

The stock's recent 37% decline from its all-time high has raised questions about its attractiveness. While traditional valuation metrics like P/E and EV/EBIT ratios suggest potential undervaluation, the DCF model indicates that the stock remains overvalued due to lower projected growth rates. With historical growth rates halving in future projections, Lululemon's seemingly attractive multiples mask its true valuation challenges.

In summary, despite its strong brand and market position, Lululemon's current valuation and competitive landscape suggest that investors should approach with caution. The company's ability to sustain growth amid intense competition and market pressures will be critical in determining its future valuation.

What do you think about Lululemon right now? Let me know in the poll and in the comments! And don't forget to subscribe. Thanks so much!

Disclaimer: The information provided in this publication is for educational and informational purposes only and does not constitute financial advice. The content is solely reflective of my personal views and opinions based on my research and is not intended to be used as a basis for investment decisions. While every effort is made to ensure that the information is accurate and up-to-date, the writer makes no representations as to the accuracy, completeness, suitability, or validity of any information in this post and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. All readers are advised to conduct their own independent research or consult a professional financial advisor before making any investment decisions. The author is not invested in Lululemon.

Really enjoyed your rational approach to valuation and how you showed the growth expectations still priced into the stock, despite the recent decline.