Dear readers,

thank you for being here and for your interest in my work! If you like this article and if you want to support my work, please feel free to subscribe and like! Please read the disclaimer at the end of this article. This is not an investment advice!

I have decided to keep my articles shorter and limit them to a maximum of 10 minutes of reading time by focusing on essential information. I hope this approach makes the articles more enjoyable for all readers. When analyzing companies, readers should form their own opinions and not invest in a stock solely based on an article.

On Friday, NIKE NKE 0.00%↑ published its Q4 earnings for the year ending May 31st. While the actual results were not bad, the guidance for 2025, especially for the first quarter, shocked the market, causing the stock to plummet nearly 20% to around $75 per share. Naturally, for long-term investors, the question arises: Is this now an interesting entry point for the stock?

I will briefly summarize the results and draw conclusions about what this could mean for NIKE's long-term development.

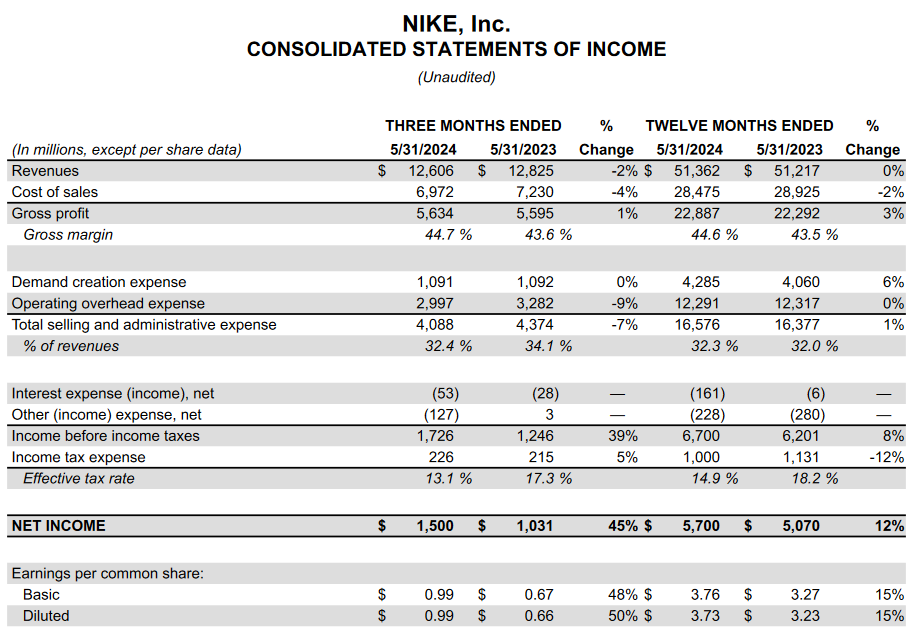

NIKE’s Q4 2024 and FY 2024 earnings overview

As Nike closed its fiscal year 2024, the company presented mixed financial results, raising both optimism and concern among investors. Fourth-quarter revenues were $12.6 billion, a 2% decrease from the previous year, and annual revenue was $51.4 billion, a marginal 1% increase on a currency-neutral basis. While financially solid, these figures signal challenges that could impact long-term performance.

A positive highlight was the improvement in the fourth-quarter gross margin to 44.7%, driven by strategic pricing and reduced logistics costs. However, an 8% decrease in Nike Direct revenues and declining demand in key markets such as North America are concerning. The reliance on direct-to-consumer (DTC) channels poses risks when these channels underperform.

John Donahoe, Nike's President & CEO, emphasized efforts to address challenges while focusing on innovation. Despite these efforts, significant operational hurdles remain. The 10% decline in Nike Brand Digital sales and a 2% drop in revenue from Nike-owned stores highlight issues in maintaining consumer engagement and sales momentum.

Matthew Friend, Nike's CFO, acknowledged the fourth-quarter difficulties, leading to a revised outlook for fiscal 2025. Nike faces macroeconomic pressures, increased competition, fluctuating consumer demand, and economic uncertainties that are substantial obstacles to sustaining growth.

Converse, a subsidiary brand, reported disappointing performance, with fourth-quarter revenues declining by 18% and full-year revenues by 14%, primarily due to poor performance in North America and Western Europe, indicating potential brand fatigue.

Looking forward, Nike's prospects depend on its ability to innovate and adapt. The company plans to enhance digital engagement, optimize its supply chain, and leverage data analytics to anticipate consumer trends, requiring significant investment and execution.

Nike's strong brand equity and commitment to sportswear technology innovation are assets. However, the company must address current vulnerabilities and realign strategies to meet consumer expectations and stay ahead of competitors. The path forward involves capitalizing on strengths while critically assessing and addressing weaknesses revealed by recent financial performance.

Outlook for 2025

As Nike gears up for fiscal year 2025, the company is adopting a cautious yet strategic approach, reflecting both optimism and the need to address several pressing challenges. The revised outlook for FY 2025 indicates a period of transformation and recalibration for the sportswear giant.

Despite some strategic initiatives, Nike's revised outlook for FY 2025 acknowledges several headwinds, including an expected revenue decline. Economic uncertainties and competitive pressures influence the projected decrease in revenue. Nike expects negative currency-neutral revenue growth, indicating a conservative approach amidst global market volatility. The company anticipates maintaining or slightly improving its gross margin through strategic pricing and cost efficiencies, though unfavorable foreign currency exchange rates and rising product input costs pose risks. Nike also expects a slight increase in operating expenses due to continued investments in technology, innovation, and market expansion. While the restructuring charges from FY 2024 are expected to taper off, ongoing investments in key areas will keep operating expenses elevated.

A significant component of Nike’s strategy moving forward involves strengthening its wholesale channels. In the fourth quarter, wholesale revenues increased by 5% on a reported basis and 8% on a currency-neutral basis. This growth in wholesale is a key pillar of Nike's strategy to balance its sales portfolio and mitigate the declines seen in direct-to-consumer channels. By enhancing relationships with wholesale partners and optimizing the wholesale distribution network, Nike aims to ensure a steady revenue stream and broaden its market reach.

The big picture and NIKE Valuation

Over the past decade, Nike's financial journey has been a tale of resilience and strategic maneuvers. However, the most recent fiscal year has been particularly challenging from a revenue growth perspective. Excluding the exceptional disruptions of the COVID-19 year, this past year has marked the lowest growth in Nike's revenue, barely inching forward by 0.28%.

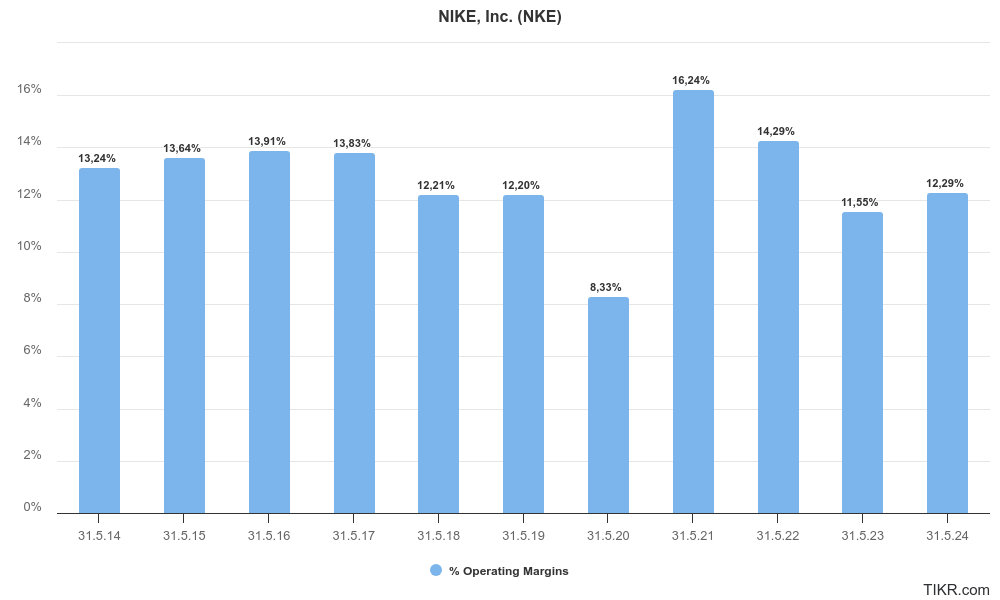

Examining the operating margins, there's a clear narrative of recovery and resilience. While the margins have not returned to the pre-COVID highs of over 13%, they are still commendably above the previous year's levels.

One of the most compelling aspects of Nike's financial performance is its strong free cash flow generation. The company has consistently maintained a high free cash flow margin, peaking impressively at 13.39% in the fiscal year ending May 2021. Even in the most recent fiscal year, the free cash flow remained robust at $4.872 billion with a margin of 9.67%.

In addition to maintaining a healthy cash flow, Nike has demonstrated a strong commitment to returning capital to its shareholders. Over the past two years, the company has executed significant share buybacks, retiring millions of shares from the market. In the last fiscal year alone, Nike repurchased $5.48 billion worth of shares.

In summary, despite the disappointing top-line development in the last FY, Nike's margins and free cash flow remain robust. Additionally, management is committed to increasing shareholder returns.

Base Case Assumptions

For my valuation model, I assume that NIKE will return to revenue growth after a challenging year in 2025. The company is expected to release new, fashionable clothing and footwear, maintain a strong position in sports and fashion, and potentially increase its market share. Notably, NIKE has secured a deal to become the next kit provider for the German Football Association (DFB), replacing Adidas after decades, as just one example of NIKE's economic strength.

Revenue Growth

In the DCF Model, a five-year detailed planning period is used, projecting a 3.1% Compound Annual Growth Rate (CAGR). This trajectory anticipates NIKE’s revenue to reach 59.8 billion in FY 2029.

EBIT Margin

In the last twelve months, NIKE’s EBIT margin was 12.3%. For the DCF Model, I have normalized this margin to an average of 12.5%.

Normalized Net Income Margin

Based on the EBIT margin, the Last Twelve Months (LTM) Normalized Net Income margin stands at 10.3%. Moving forward, it is estimated to stabilize around 10%.

Free Cash Flow

My Free Cash Flow assumptions include a Net Capex ratio as a percentage of sales (Net Capex = Capex - Depreciation) of 0.3%, reflecting the average of recent years. Working Capital, expressed as a percentage of sales, is determined by the average Working Capital over the past years, calculated at 10.0% of net sales. The Free Cash Flow estimation does not adjust for stock-based compensation.

WACC

The Weighted Average Cost of Capital (WACC) is set at 8.0%.

Results

Based on these assumptions, NIKE’s equity value is estimated at $80.9 billion. Dividing this by the current number of shares, we derive a fair value per share of $54. In comparison to its latest stock price of $75, the stock appears still significantly overvalued.

Adjusting the WACC to 8.5% would lower the fair value per share to $50, while a decrease in WACC to 7.5% would increase it to $59 per share.

Scenarios

Bull Case Scenario:

In an optimistic scenario, assuming a CAGR for revenue of 5.1%, an EBIT Margin of 13.5%, and a normalized net income margin of 11.0%, the fair value per share would be $65. In this scenario the stock appears to be also overvalued.

Bear Case Scenario:

Conversely, in a pessimistic scenario with a CAGR for revenue of 1.1%, an EBIT Margin of 11.5%, and a normalized net income margin of 9.5%, the fair value per share would be $53. In this scenario the stock also appears to be overvalued.

P/E and EV/EBIT

When analyzing the forward P/E and EV/EBIT ratios over the last five years, it is evident that they are significantly distorted by the impacts of the pandemic, making them difficult to interpret meaningfully. The average ratios during this period were very high, rendering them unhelpful for estimating the current intrinsic valuation. Based on these inflated ratios, the forward metrics might misleadingly suggest that the company is undervalued, which is not accurate.

Additionally, NIKE's growth prospects and financial performance were notably better in the previous year, which would justify higher ratios under normal circumstances. However, considering the present scenario, would you be willing to invest in a company with an estimated CAGR of 3.1% in revenues (with anticipated declining revenue over the next 12 months) and similar trends for EPS and EBIT, at 22.5 times EPS or 20 times EBIT? Probably not. Despite its 20% decline, the current ratios still indicate a very high price.

Conclusion

NIKE faces significant competition in the US from newer, trendier brands like Hoka and On, as well as retro models from Adidas. The company's strategy to boost sales through direct-to-consumer channels, such as its own stores and online platforms, has not been successful, with an 8% drop in sales in this segment. In response, NIKE has strengthened relationships with wholesale partners, resulting in an 8% increase in wholesale revenue.

Despite these challenges, NIKE's CEO John Donahoe remains optimistic about the company's long-term progress in crucial areas. Analysts, however, believe that it will take time for Nike to revive demand due to the time required for innovation and the introduction of new product lines.

To me, it appears that NIKE is becoming the next Adidas. The German company struggled in recent years, peaking with the Kanye West controversy, but is now successfully recovering. Despite this, I believe Nike remains a strong brand with the ability to regain its position and return to growth, though it will take time. Currently, I still think the stock is not attractively valued. Even after a 20% decline, the stock still seems too expensive.

On a side note, I recently listened to Phil Knight's biography "Shoe Dog" on Audible and didn't enjoy it much. While the story of Nike's founding is interesting, Phil Knight and his business partners did not come across as particularly likable or sympathetic to me.

That is all for today. Thank you for your interest and if you enjoy my articles, please like them and subscribe to my free newsletter!

Disclaimer: The information provided in this publication is for educational and informational purposes only and does not constitute financial advice. The content is solely reflective of my personal views and opinions based on my research and is not intended to be used as a basis for investment decisions. While every effort is made to ensure that the information is accurate and up-to-date, the writer makes no representations as to the accuracy, completeness, suitability, or validity of any information in this post and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. All readers are advised to conduct their own independent research or consult a professional financial advisor before making any investment decisions. The author is invested in NIKE

Couldnt agree more on the book.