#43 Amazon

More than a market place

Dear readers,

thank you for being here and for your interest in my work! If you like this article and if you want to support my work, please feel free to subscribe and like! Please read the disclaimer at the end of this article. This is not an investment advice!

When I need information, I turn to Google, but when I want to buy something, I go straight to Amazon. Do you find yourself doing the same? This behavior highlights Amazon's unparalleled position in the online business and shopping landscape. But Amazon is much more than just a go-to destination for shopping—it's a powerhouse with a wide range of offerings that extend far beyond retail.

In this article, I’ll provide a brief overview of why Amazon is such an extraordinary company. But the real question is: Is it also an exceptional investment opportunity? Let’s explore that further.

AWS - Amazons cash cow

Amazon Web Services (AWS) holds a dominant position in the cloud computing market, consistently leading the industry with its extensive range of services, global infrastructure, and significant customer base. AWS has long been the go-to choice for businesses of all sizes, from startups to large enterprises, thanks to its innovation, reliability, and comprehensive offerings. With today's 30%+ margins, AWS is subsidizing the other Amazon businesses.

However, while AWS remains the leader, it is facing increasing competition from Microsoft Azure and Google Cloud Platform (GCP). Both Microsoft and Google have been investing heavily in their cloud divisions, resulting in substantial growth over the past few years. Microsoft Azure, in particular, has been gaining traction with its strong integration into existing enterprise environments, particularly those already using Microsoft products. Google Cloud, although smaller, is also growing steadily, with a focus on AI, machine learning, and data analytics services that appeal to a wide range of industries.

The growth of Microsoft and Google in the cloud market is gradually eroding AWS's market share. While AWS continues to expand its offerings and maintain a leadership position, the competitive landscape is becoming more balanced. Microsoft and Google are not only capturing new customers but also enticing existing AWS users to diversify their cloud strategies by incorporating multiple providers.

This steady, albeit slow, shift in market share indicates that the cloud computing market is evolving from being dominated by a single player to a more competitive environment with multiple strong contenders. AWS still has the advantage, but Microsoft and Google's continued growth suggests that they will remain significant players, challenging AWS's dominance in the years to come.

Segment Reporting - A weakness

Amazon's segment reporting is structured into three primary segments: North America, International, and Amazon Web Services (AWS). The North America and International segments focus on retail sales and subscriptions, including both online and physical stores, along with other revenue streams like advertising services. AWS, the third segment, handles cloud computing services. Each segment aggregates a vast array of services and products, presenting them as large, comprehensive categories.

From my point of view, for investors, this aggregated level of reporting is problematic. The lack of detailed information makes it challenging to assess the profitability and risks associated with Amazon's diverse range of businesses. Without more granular data, investors cannot fully understand the performance dynamics of Amazon's various business units, particularly when comparing the profitability of different segments or evaluating the sustainability of revenue streams.

However, looking at the two non-AWS segments, it is clear that the North American segment is more mature and profitable. In terms of revenue, it is almost three times larger than the International segment.

The largest international markets are Germany, the United Kingdom and Japan. However, the International segment continues to struggle to achieve sustainable profitability.

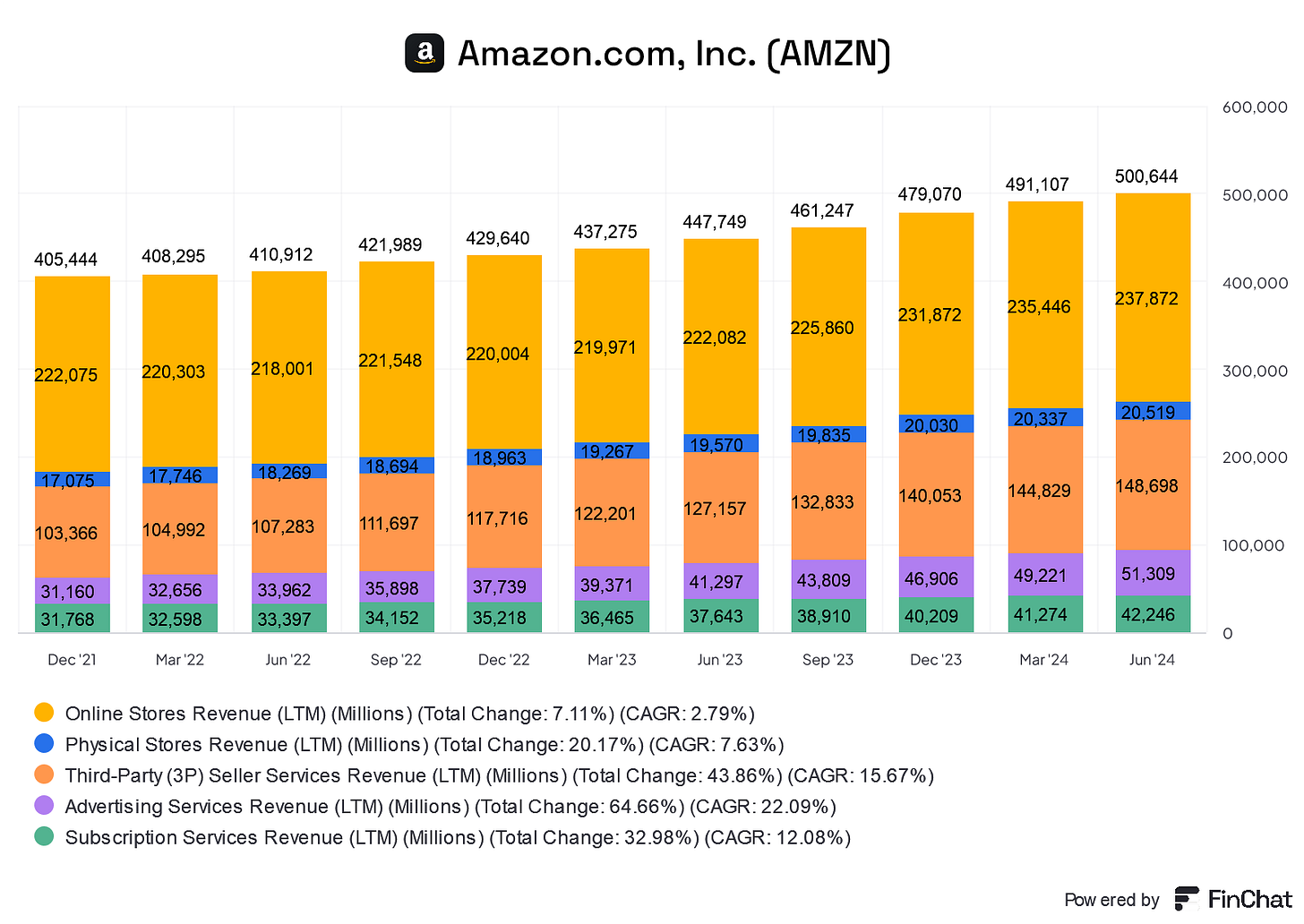

Revenue per product category

From my point of view, what is more helpful to evaluate Amazon's growth is the revenue per product category. Unfortunately, we do not know what the profitability of each category is (only for AWS, which is also a segment, but excluded in this chapter).

Amazon's revenue streams are diverse, reflecting the broad scope of its business activities across various sectors. Here’s an overview of the principal revenue-generating activities:

Retail Sales: Amazon generates a significant portion of its revenue from the sale of consumer products through both its online and physical stores. This includes everything from electronics to groceries.

Third-Party Seller Services: Amazon provides a platform for third-party sellers to offer their products in its stores. While Amazon is not the seller of record in these transactions, it earns commissions and related fees for fulfillment and shipping services.

Advertising Services: Amazon offers advertising services to a wide range of clients, including sellers, vendors, publishers, and authors. These services include sponsored ads, display, and video advertising.

Subscription Services: Amazon’s subscription revenue comes from several sources, most notably Amazon Prime memberships. Prime members pay a fee for access to a suite of benefits, including free shipping, digital content, and other services. Additionally, Amazon offers subscriptions for digital video, audiobooks, digital music, e-books, and other non-AWS services.

Other Revenue: This category includes revenue from various other sources, such as the licensing and distribution of video content, health care services, shipping services, and co-branded credit card agreements.

Amazon's Online Store revenue and Third-Party Seller Services revenue remain the largest pillars of its business, both deeply connected to the company's powerful marketplace and expansive logistics network. These segments continue to be the core of Amazon's vast empire. However, what stands out is the impressive growth of its Subscription Services, primarily driven by Amazon Prime, and its burgeoning Advertising Services. Both are on the brink of reaching an annual run rate of $100 billion, underscoring their growing significance within Amazon's portfolio.

On the other hand, the smallest revenue stream comes from its physical stores, which include Amazon Fresh and, predominantly, Whole Foods Market. Interestingly, the smallest (physical stores) and largest (online stores) revenue streams are also the slowest-growing segments. Online store revenue experienced a decline in 2022 but has since rebounded strongly in 2023. In contrast, physical store revenue, though declining since 2022, is still growing at a reasonable pace compared to other brick-and-mortar retailers like Target or Kroger.

Amazon Prime - More than free delivery

Amazon Prime began in 2005 as a straightforward membership program offering free two-day shipping on millions of items. Over the years, it has evolved into a comprehensive subscription service that plays a critical role in Amazon’s ecosystem. Today, Prime offers a variety of benefits that extend well beyond expedited shipping, making it a significant driver of customer loyalty and engagement.

At its core, Amazon Prime provides members with fast and reliable shipping options. This includes free same-day or next-day delivery on a vast selection of products, which has set a high standard in the e-commerce industry. For many customers, the convenience of quick delivery is a key reason for maintaining their Prime membership.

In addition to shipping benefits, Prime includes a range of digital services. Prime Video offers a wide selection of movies, TV shows, and original content, making Amazon a notable player in the competitive streaming market. Prime Music gives members access to a large library of songs, complementing the entertainment offerings.

For investors, Amazon Prime is a crucial component of the company’s business model. With over 200 million members globally, Prime not only generates recurring revenue but also encourages higher spending among subscribers compared to non-members. This increased engagement and spending power contribute significantly to Amazon’s overall growth and profitability.

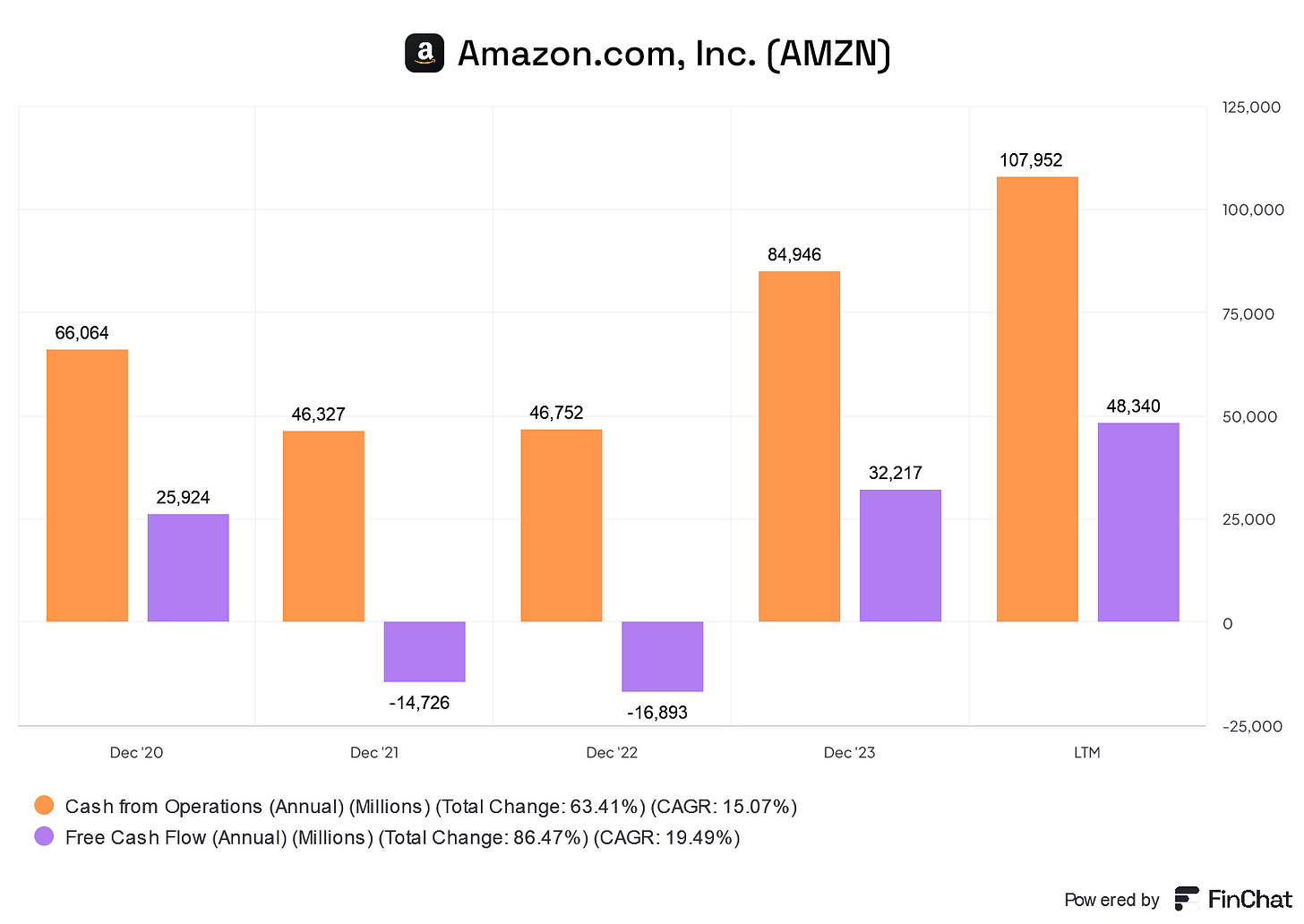

Free cash flow - Bezos baby

“When forced to choose between optimizing the appearance of our GAAP accounting and maximizing the present value of future cash flows, we’ll take the cash flows.”

- Jeff Bezos in the 1997 Annual letter

Amazon is very focused on its cash flows. This is not presented by Besos quote from their annual letter, if you look at the 10-Q's and 10-K's, the cash flow statements always come first.

The latest quarterly earnings report revealed a trailing twelve-month (TTM) cash flow from operations exceeding $100 billion and a free cash flow approaching $50 billion. Amazon's operations are undeniably capital-intensive, driven by its expansive logistics network and substantial investments in cloud infrastructure. However, it appears that the company has reached a scale where its free cash flow is consistently growing. This indicates that despite the significant capital requirements, Amazon's business model is increasingly efficient, allowing it to generate substantial cash flow while continuing to invest in its core operations and growth initiatives.

In my view, it is only a matter of time before this free cash flow is returned to investors, which brings us to the next important point.

Dividends and share buybacks

In 2022, Amazon initiated a share buyback, authorizing the repurchase of approximately $10 billion in shares. However, the company has since paused further buybacks, with recent earnings calls notably silent on the topic, as well as on dividends.

During the Q2 2024 call, the focus was on financial performance, AWS growth, and investments in AI and Project Kuiper, with no mention of capital returns to shareholders. In Q1 2024, CFO Brian Olsavsky made it clear that Amazon has no current plans for share buybacks or dividends, emphasizing the company's commitment to growth and long-term investments, particularly in generative AI.

Even when share buybacks were briefly mentioned in Q4 2023, Olsavsky reiterated that Amazon’s priority remains on strategic investments over capital returns. This approach reflects Amazon’s focus on long-term value creation rather than short-term shareholder returns.

As other tech giants like Alphabet and Meta increasingly engage in stock repurchases and have even begun paying dividends, it's likely that Amazon will eventually follow suit. Given Amazon's strong financial position and consistent cash flow growth, the potential for Amazon to initiate similar shareholder returns is significant. When Amazon decides to "join the club," it could unlock substantial value for shareholders, adding a new dimension to its already impressive growth story.

Valuation of Amazon Stock

Valuing Amazon stock presents a significant challenge. The difficulty lies not only in forecasting revenue growth for such a diverse company but also in predicting margins and cash flows. Despite its massive scale, Amazon continues to grow across a wide array of businesses while aggressively expanding internationally. This makes it difficult to apply traditional valuation methods with any degree of certainty.

Given these complexities, I’ve opted not to perform a discounted cash flow (DCF) valuation on Amazon. The assumptions and estimates required for a DCF model would be too uncertain, rendering the results unreliable. In a company as multifaceted and dynamic as Amazon, the variability in growth rates, margins, and investment needs makes it nearly impossible to construct a DCF model that can reasonably capture the company's future performance.

As an investor, it's essential to know whether to be bullish, neutral, or bearish on Amazon stock. I'm not placing it in the "No" basket, because I do see Amazon as having a promising future, especially for long-term investors who can benefit significantly from its growth. Despite the challenges in estimating a precise fair value for this complex enterprise, I believe the stock is currently fairly valued.

Looking at valuation multiples, Amazon's forward EV/EBIT and forward P/E ratios are near their lows compared to the past three years, and even when viewed over a longer period. Although revenue growth may slow due to the company's enormous scale, I expect growth in free cash flow and earnings per share (EPS) to accelerate. This positive outlook leads me to remain bullish on Amazon, and I've committed to investing heavily in the stock.

Conclusion

In conclusion, Amazon is a complex and multifaceted giant that dominates the cloud computing market through AWS, which remains its most profitable segment. The company’s diverse revenue streams—from retail and third-party services to subscription and advertising—highlight its expansive reach, but also make it challenging for investors to fully grasp its profitability and risks, especially with Amazon’s broad segment reporting.

Amazon Prime plays a crucial role in driving customer loyalty and recurring revenue, further strengthening Amazon’s position. The company’s focus on free cash flow, highlighted by its consistent operational growth, suggests that Amazon is well-positioned to eventually return capital to shareholders through dividends or buybacks, though it currently prioritizes long-term investments over immediate returns.

Valuing Amazon is inherently difficult due to its scale and diversity. Despite this, the stock appears fairly valued, with strong potential for future growth in free cash flow and earnings. As a long-term investor, I remain bullish on Amazon, recognizing the significant opportunities it presents, even amidst the challenges of evaluating such a vast and dynamic enterprise.

Thank you once again for being here and for your interest! If you enjoyed my analysis, please consider leaving a "like" and subscribing. Your support means a lot!

Disclaimer: The information provided in this publication is for educational and informational purposes only and does not constitute financial advice. The content is solely reflective of my personal views and opinions based on my research and is not intended to be used as a basis for investment decisions. While every effort is made to ensure that the information is accurate and up-to-date, the writer makes no representations as to the accuracy, completeness, suitability, or validity of any information in this post and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. All readers are advised to conduct their own independent research or consult a professional financial advisor before making any investment decisions. The author is invested in this stock.