Dear Readers,

Thank you for being here and showing interest in my work! Your support means the world to me. If you enjoyed this article and would like to see more, please consider subscribing and giving it a like—it really helps grow our community of investors. Thank you for your continued support!

Please read the disclaimer at the end of this article. This is not an investment advice!

About PepsiCo

PepsiCo, Inc. PEP 0.00%↑ is a global food and beverage company headquartered in Purchase, New York, and one of the largest players in the industry. The company's diverse product portfolio includes well-known brands such as Pepsi, Mountain Dew, Lay's, Gatorade, Tropicana, Quaker, and many more. PepsiCo operates through six main divisions: Frito-Lay North America (snacks), Quaker Foods North America (grains and cereals), PepsiCo Beverages North America (beverages), Latin America, Europe, and the APAC (Asia Pacific, Australia, New Zealand, and China) & AMESA (Africa, Middle East, and South Asia) regions.

PepsiCo’s business model is built around producing, marketing, distributing, and selling a wide variety of snacks, beverages, and food products worldwide. The company’s approach centers on brand diversification, global expansion, and continuous innovation to meet evolving consumer preferences, such as healthier eating habits and convenience. PepsiCo generates revenue from both its beverages and convenient foods, allowing it to capture significant market share across multiple categories and regions.

A key aspect of PepsiCo's business model is its vertically integrated supply chain, which includes sourcing raw materials, manufacturing, warehousing, and distributing its products. This enables the company to control costs, ensure quality, and maintain efficient distribution. Additionally, PepsiCo focuses on sustainability, aiming to minimize its environmental footprint through responsible sourcing, waste reduction, and resource-efficient practices.

The company also leverages its global scale and strong distribution network, including both direct-to-store delivery and partnerships with bottlers and retailers, to reach consumers across various markets. PepsiCo is dedicated to driving long-term growth through a balance of organic expansion, innovation, productivity initiatives, and strategic acquisitions. This mix enables it to compete effectively in a highly competitive global market while delivering consistent shareholder returns.

PepsiCo's arrangement with Celsius is a strategic partnership aimed at boosting PepsiCo’s presence in the fast-growing energy drink market. Under the deal, PepsiCo took a minority stake in Celsius and became its preferred distribution partner. This means PepsiCo uses its extensive distribution network to expand Celsius' market reach, helping it get into more retail outlets and channels, including convenience stores, grocery chains, and gas stations.

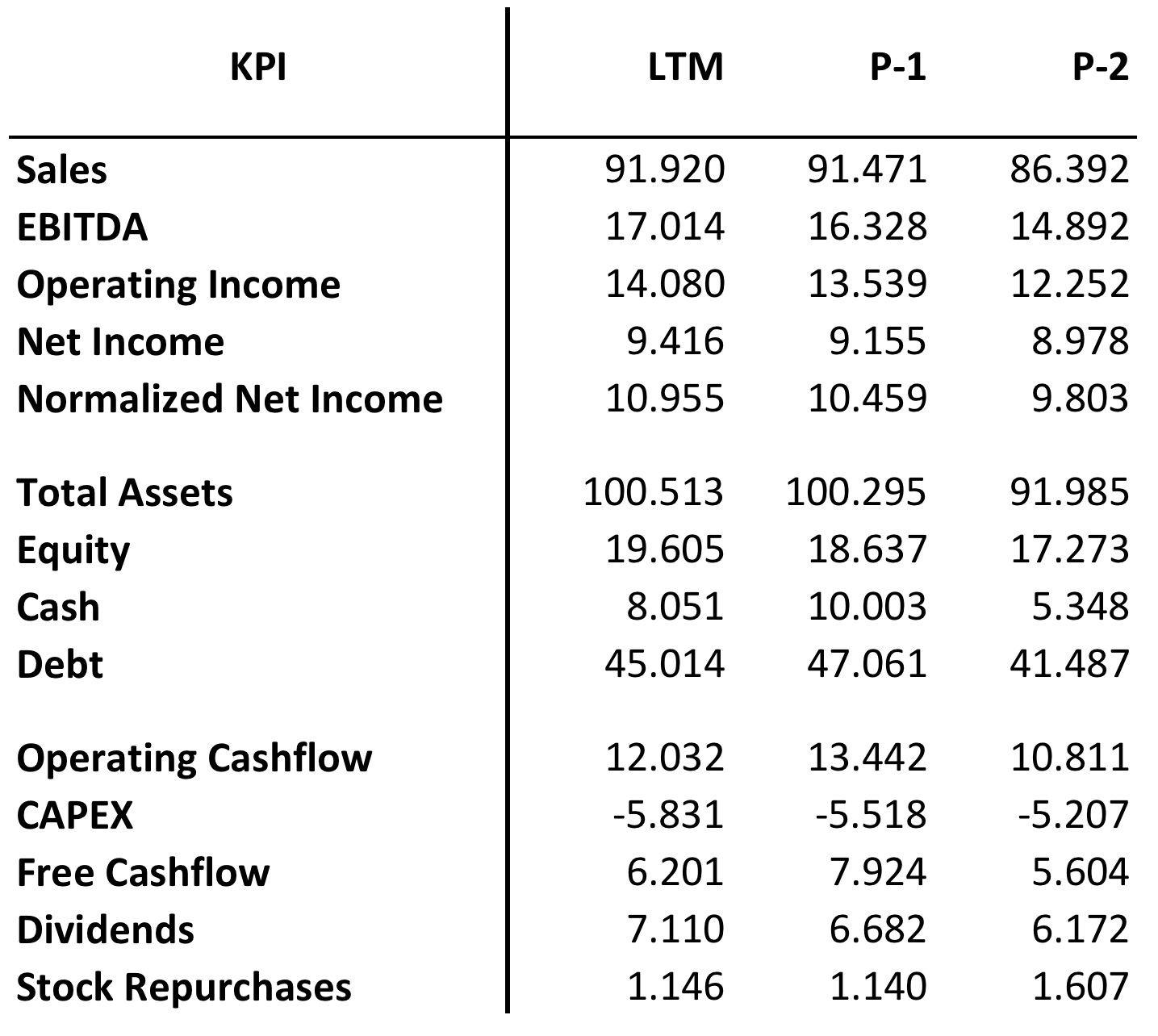

Financials and KPI’s

PepsiCo is in excellent financial health and consistently delivers reliable results. In recent years, the company has demonstrated strong pricing power by offsetting inflation-driven cost increases through strategic price hikes. Although organic volumes dipped slightly, PepsiCo achieved significant revenue growth, which in turn boosted both earnings and cash flow. The company continues to prioritize returning value to shareholders, with steady free cash flow being distributed through dividends and share buybacks. This approach underscores PepsiCo's commitment to maintaining shareholder returns while navigating cost pressures.

Share Repurchases and Dividends

PepsiCo’s dividend policy and share repurchase program reflect the company’s strong commitment to returning value to shareholders. The company has a long-standing history of paying reliable and steadily increasing dividends, which underscores its financial stability and strong cash flow generation. As a Dividend Aristocrat, PepsiCo has increased its dividend for over 50 consecutive years, showcasing its priority of delivering consistent value to shareholders. Each year, PepsiCo has also steadily raised its dividend payouts, maintaining a target payout ratio that balances cash returns to shareholders with reinvestment in growth and innovation. Dividends are paid on a quarterly basis, and PepsiCo’s dividend yield remains competitive within the consumer staples sector, providing regular income to shareholders as part of its broader capital return strategy.

The current dividend yield of 3.2% is above PepsiCo's five-year average of approximately 2.86%, reflecting an enhanced return for shareholders compared to recent historical levels.

Now, let's turn our attention to PepsiCo stock valuation.

Stock Valuation

Base Case Assumptions

For the valuation of PepsiCo, the revenue is expected to grow steadily, driven by a combination of slight organic growth and pricing adjustments in line with the Consumer Price Index (CPI). This approach reflects PepsiCo's ability to leverage its strong brand portfolio and pricing power to offset inflationary pressures. Margins are projected to remain stable, as the company has demonstrated effective cost management and productivity initiatives in recent years. Additionally, current challenges within the Quaker Foods division are anticipated to be resolved, restoring its contribution to the overall business.

Food will continue to be a significant part of PepsiCo's revenue, with the Frito-Lay and Quaker brands playing a crucial role in diversifying the company’s income streams beyond beverages. This diversification not only supports consistent revenue growth but also mitigates risks tied to changes in consumer preferences in the beverage sector. Meanwhile, PepsiCo’s energy drinks segment is expected to further boost earnings, capitalizing on partnerships like the one with Celsius and the growing consumer demand for functional beverages.

Together, these factors point to a stable and growth-oriented outlook for PepsiCo, with reliable performance across its key segments.

Revenue Growth

In the DCF Model, a five-year detailed planning period is used, projecting a 2.6% Compound Annual Growth Rate (CAGR). This trajectory anticipates PepsiCo‘s revenue to reach about $104 billion in FY 2029.

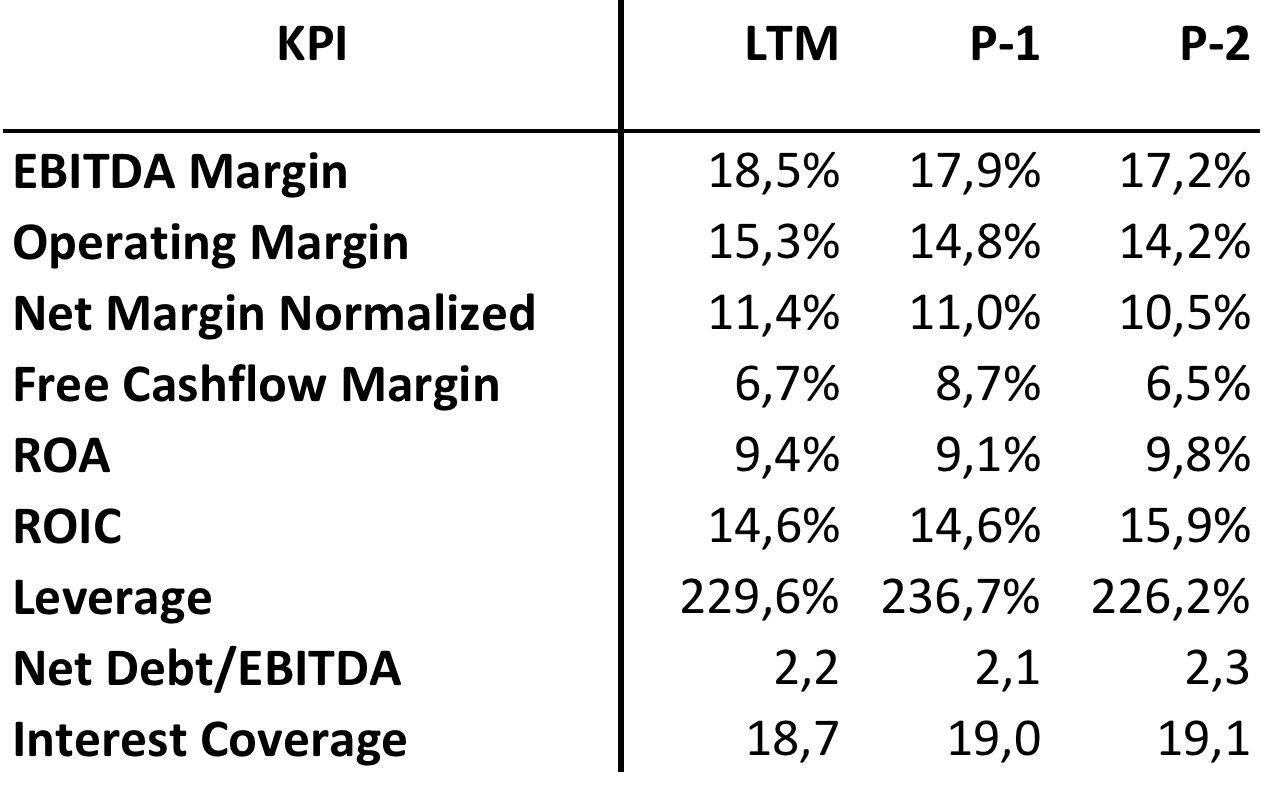

EBIT Margin

In the last twelve months, PepsiCo‘s EBIT margin was 15.3%. For the DCF Model, I have normalized this margin to an average of 15.4%.

Normalized Net Income Margin

Based on the EBIT margin, the Last Twelve Months (LTM) Normalized Net Income margin stands at 10.2%. Moving forward, it is estimated to stabilize around 11.1%.

Free Cash Flow

My Free Cash Flow assumptions include a Net Capex ratio as a percentage of sales (Net Capex = Capex - Depreciation) of 1.8%, reflecting the average of recent years. Working Capital, expressed as a percentage of sales, is determined by the average Working Capital over the past years, calculated at 7.7% of net sales. The Free Cash Flow estimation does not adjust for stock-based compensation. This results into a normalized free cash flow margin of about 9.3%.

WACC

The Weighted Average Cost of Capital (WACC) is set at 5.5%.

Results

Based on these assumptions, PepsiCo’s equity value is estimated at $256 billion. Dividing this by the current number of shares, we derive a fair value per share of $187. In comparison to its latest stock price of $173 the stock appears slightly undervalued.

Adjusting the WACC to 6.0% would lower the fair value per share to $155, while a decrease in WACC to 5.0% would increase it to $232 per share.

Scenarios

Bull Case Scenario:

In an optimistic scenario, assuming a CAGR for revenue of 4.6%, an EBIT Margin of 16.2%, and a normalized net income margin of 13.1%, the fair value per share would be $210. In this scenario the stock appears to be undervalued, too.

Bear Case Scenario:

Conversely, in a pessimistic scenario with a CAGR for revenue of 0.4%, an EBIT Margin of 14.7%, and a normalized net income margin of 9.1%, the fair value per share would be $164. In this scenario the stock also appears to be slightly overvalued.

P/E and EV/EBIT

To further validate the valuation estimate, let’s consider my preferred metrics: forward EV/EBIT and P/E ratios. Over the past five years, the average P/E ratio was approximately 23.52x, while the current P/E stands at 20.55x. Similarly, the average EV/EBIT ratio was 20.39x, and it has now fallen to 18.13x. These metrics align with my DCF valuation, reinforcing the view that the stock is somewhat umdervalued. Overall, I would conclude that PepsiCo stock is currently slightly undervalued.

Conclusion

PepsiCo is a high-quality company with a long-standing track record as a Dividend Aristocrat, known for its stability and consistent shareholder returns. While it is currently facing some challenges, such as the Quaker Foods recall and inflationary pressures, the stock remains slightly undervalued. With strong opportunities for future value creation, including growth from its partnership with Celsius in the energy drinks market, PepsiCo presents an attractive investment for those seeking both stability and potential for long-term growth.

Thank you once again for being here and for your interest! If you enjoyed my analysis, please consider leaving a "like" and subscribing. Your support means a lot!

Disclaimer: The information provided in this publication is for educational and informational purposes only and does not constitute financial advice. The content is solely reflective of my personal views and opinions based on my research and is not intended to be used as a basis for investment decisions. While every effort is made to ensure that the information is accurate and up-to-date, the writer makes no representations as to the accuracy, completeness, suitability, or validity of any information in this post and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. All readers are advised to conduct their own independent research or consult a professional financial advisor before making any investment decisions. The author is invested in the mentioned stock.