#58 ASML Holding N.V.

Finally fairly valued?

Dear Readers,

Thank you for being here and showing interest in my work! Your support means the world to me. If you enjoyed this article and would like to see more, please consider subscribing and giving it a like—it really helps grow our community of investors. Thank you for your continued support!

Please read the disclaimer at the end of this article. This is not an investment advice!

Initially, I hadn’t planned on writing a post about ASML. The company has been on my watchlist for quite some time, but I’ve always found the stock to be overvalued. However, after the recent dip following ASML's Q3 earnings, I became curious: could this be an attractive entry point? Let’s dive in and take a closer look!

Overview

ASML is a crucial player in the semiconductor industry, specializing in photolithography machines that enable advanced chip manufacturing. ASML's key advantage lies in its monopoly over Extreme Ultraviolet (EUV) lithography machines, essential for producing cutting-edge chips. These machines use a specialized photolithography process, projecting intricate patterns onto silicon wafers to create microchips.

ASML’s business model revolves around producing and selling these highly complex lithography systems primarily to major chip manufacturers like TSMC, Samsung, and Intel. These companies, in turn, use the machines to manufacture chips based on designs from fabless firms such as Nvidia, Qualcomm, and AMD. With exclusive access to EUV lithography and a strong position in Deep Ultraviolet (DUV) technology, ASML faces minimal competition, enabling it to command a monopoly of the EUV market and over 90% of the DUV market.

ASML's financials are exceptionally robust, marked by impressive returns, healthy profit margins, minimal debt, and strong cash flow generation. Its operating and net profit margins are among the highest in the industry, underscoring its ability to maintain pricing power and cost efficiency. Coupled with its strong cash flow generation, ASML is well-positioned to fuel both its ongoing R&D initiatives and shareholder returns.

The moat

ASML, which is based in Veldhoven in the Netherlands, holds a near-monopoly in advanced semiconductor manufacturing equipment, specifically in the production of extreme ultraviolet (EUV) lithography machines. These machines are essential for producing the most advanced and miniaturized chips, allowing semiconductor manufacturers to etch intricate patterns onto silicon wafers at nanometer scales. The sophistication and precision of these machines make them indispensable for leading-edge chip fabrication.

ASML's EUV lithography technology is so advanced that no other company currently offers a competitive alternative. It took ASML nearly two decades and billions in R&D investments to make EUV viable. EUV technology uses light at an extremely short wavelength to create finer and more complex circuit patterns on chips, which is crucial for manufacturing cutting-edge processors and memory chips.

ASML has built strong relationships with major chipmakers, including TSMC, Samsung, and Intel, who have even invested in ASML’s development of EUV to secure access to the technology. This collaboration has reinforced ASML’s position in the market and helped it fine-tune its technology to meet the exact needs of the industry.

The EUV machines are so complex, involving thousands of intricate components and extremely high precision, that it would be nearly impossible for a competitor to replicate them quickly. This complexity creates high barriers to entry, as companies would need both technological expertise and massive investment to compete.

With ASML’s technology critical to producing advanced chips, the company has become a strategic player in the global semiconductor supply chain. Nations and corporations are keen to access ASML’s technology, especially as the demand for advanced chips grows in fields like AI, 5G, and consumer electronics.

Due to the strategic nature of ASML’s technology, governments (particularly the Netherlands and the U.S.) restrict sales of its advanced machines to certain countries. For example, ASML’s EUV machines are not sold to China, as part of an effort to control the spread of leading-edge chip technology.

ASML has an overwhelming influence in a market where its only competitors are producing less advanced machines. This dominance allows ASML to wield significant pricing power and influence over the semiconductor industry, making it a crucial and powerful player in the tech world.

Q3 2024 earnings and outlook

ASML’s Q3 earnings exceeded expectations in many aspects, with net sales reaching €7.5 billion (up 12% year-over-year) and gross margin at 50.8%. This growth was largely driven by strong demand for DUV (Deep Ultraviolet) machines and increased revenue from servicing its installed base. Net income rose to €2.1 billion, marking a 10.5% year-over-year increase, with earnings per share (EPS) growing by 10% to €5.28. However, free cash flow (FCF) declined by 14% year-over-year, primarily due to postponed orders, impacting down payments and cash flow.

The major disappointment in Q3 was the order intake, which fell short of expectations at €2.6 billion, down from the anticipated €5.6 billion. The decline is attributed to cyclical industry factors, as major clients like Samsung and Intel show caution in new fab investments. ASML’s backlog remains strong at over €36 billion, though challenges persist due to delayed fab completions, cyclic demand fluctuations, and geopolitical constraints affecting revenue from China.

Looking ahead, ASML’s guidance for Q4 suggests further growth, with expected sales between €8.8 billion and €9.2 billion, indicating a year-over-year increase of 25%. However, ASML has tempered its expectations for 2025, predicting revenue in the €30 billion to €35 billion range, down from an earlier range of €30 billion to €40 billion. This guidance considers slower-than-expected demand recovery and projected declines in Chinese revenue due to new export restrictions.

Risks

The recent developments highlight several key risks:

Cyclical Demand and Order Volatility: The semiconductor industry is inherently cyclical, and ASML’s Q3 results reflect the volatility in order intake. As chip manufacturers like Samsung and Intel hold back on capital expenditures, ASML’s sales and order volume can be unpredictable. Prolonged cyclical downturns could result in extended periods of reduced demand.

Dependence on Major Customers: ASML’s revenue relies heavily on a few large customers, such as TSMC, Samsung, and Intel. Any changes in these companies' spending plans or financial health can directly impact ASML's performance. Additionally, Samsung’s recent decision to delay its machine deliveries underscores the potential for sudden changes in demand from key customers.

Geopolitical and Export Risks: ASML’s substantial revenue from Asia, particularly China, exposes it to geopolitical tensions. New export restrictions on ASML’s EUV machines to China could further reduce sales and create revenue volatility. Additionally, tightened regulations may limit ASML’s ability to maintain market share in regions affected by trade restrictions.

Supply Chain Dependency: ASML relies on a network of 800 specialized suppliers for its lithography machines, which are extremely complex and difficult to source. Any disruption in this supply chain—whether from geopolitical issues, natural disasters, or supplier-specific problems—could impact ASML’s ability to manufacture and deliver its machines.

Technological Disruption: While ASML currently holds a strong position with its EUV technology, the risk of emerging technologies (like e-beam lithography or alternative chip-making technologies) poses a potential threat. If a disruptive technology emerges that can bypass or outperform ASML's lithography approach, ASML’s dominance could be challenged.

Pricing and Valuation Risks: With ASML trading at a premium due to its strong market position, there’s a valuation risk if growth or profitability fails to meet expectations. Any decline in revenue, orders, or margin compression due to increased R&D costs (as seen with the next-gen EUV machine) could lead to downward pressure on the stock.

These risks indicate that while ASML’s long-term growth story remains strong, its near-term financial performance is vulnerable to a mix of external pressures and structural dependencies.

Stock Valuation

Base Case Assumptions

ASML is set to maintain its monopoly in EUV lithography and its strong market position in DUV technology, supported by a growing installed base that will further increase its share of recurring service revenues. The company is committed to R&D investments to drive innovation in even more advanced machines. Currently, EUV machines are ASML’s flagship product, but it is also investing in high-numerical-aperture (High-NA) EUV technology, enabling finer resolution and smaller chip nodes.

High-NA EUV technology will allow chipmakers to move toward sub-2nm nodes, solidifying ASML’s role as a long-term supplier of cutting-edge lithography tools. Additionally, ASML is diversifying its product lineup with DUV lithography machines, which, while more cost-effective than EUV, are critical for producing many essential chips used in various applications.

The base case assumes that geopolitical tensions and current export restrictions to China will persist. While chip demand and production capacity will likely experience cyclical variations, the long-term upward trend is expected to remain strong, driven by expanding cloud infrastructures, advancements in AI, and other technological developments.

Revenue Growth

In the DCF Model, a five-year detailed planning period is used, projecting a 10.4% Compound Annual Growth Rate (CAGR). This trajectory anticipates ASML‘s revenue to reach about €43 billion in FY 2029.

EBIT Margin

In the last twelve months, ASML‘s EBIT margin was 30.7%. For the DCF Model, I have normalized this margin to an average of 31.0%.

Normalized Net Income Margin

Based on the EBIT margin, the Last Twelve Months (LTM) Normalized Net Income margin stands at 26.4%. Moving forward, it is estimated to stabilize around 26.6%.

Free Cash Flow

My Free Cash Flow assumptions include a Net Capex ratio as a percentage of sales (Net Capex = Capex - Depreciation) of 2.7%, reflecting the average of recent years. Working Capital, expressed as a percentage of sales, is determined by the average Working Capital over the past years, calculated at 10.5% of net sales. The Free Cash Flow estimation does not adjust for stock-based compensation. This results into a normalized free cash flow margin of about 22.5%.

WACC

The Weighted Average Cost of Capital (WACC) is set at 8.0%.

Results

Based on these assumptions, ASML’s equity value is estimated at €174 billion. Dividing this by the current number of shares, we derive a fair value per share of €435. In comparison to its latest stock price of €664 the stock appears overvalued.

Adjusting the WACC to 8.5% would lower the fair value per share to €396, while a decrease in WACC to 7.5% would increase it to €500 per share.

Scenarios

Bull Case Scenario:

In an optimistic scenario, assuming a CAGR for revenue of 12.5%, an EBIT Margin of 35%, and a normalized net income margin of 28.6%, the fair value per share would be €390. In this scenario the stock appears to be overvalued, too.

Bear Case Scenario:

Conversely, in a pessimistic scenario with a CAGR for revenue of 8.1%, an EBIT Margin of 29%, and a normalized net income margin of 24.6%, the fair value per share would be €480. In this scenario the stock also appears to be overvalued.

P/E and EV/EBIT

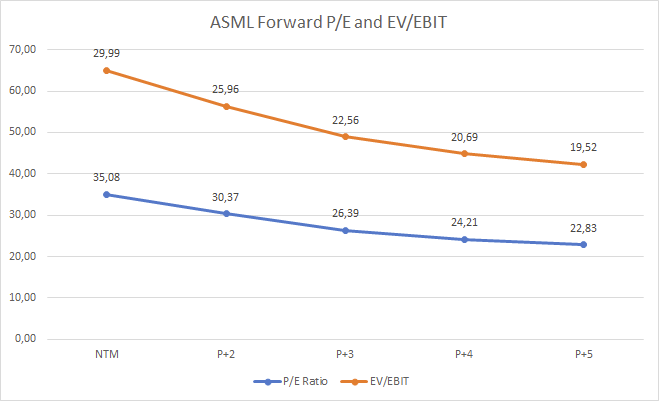

To further validate the valuation estimate, let’s consider my preferred metrics: forward EV/EBIT and P/E ratios. Over the past five years, the average P/E ratio was approximately 35.52x, while the current P/E stands at 28.13x. Similarly, the average EV/EBIT ratio was 30.64x, and it has now fallen to 24.10x.

Based on my conservative forecast, I currently see a P/E of 35.08 for 2024 (NTM in the graph) and an EV/EBIT of nearly 30. The figures shown in TIKR above reflect analyst NTM estimates, including the first three quarters of 2025, which aligns with my FY 2025 (P+2) projections. While these valuation metrics appear attractive compared to historical averages, it’s essential to recognize that ASML’s rapid growth over recent years is unlikely to continue indefinitely. Current indicators already reflect a deceleration in growth, and as outlined in my DCF assumptions, future CAGR is estimated at around 10%, down from over 30% from 2018 to 2023. From this perspective, despite recent declines due to a weaker outlook, I view the stock as still overvalued.

Conclusion

In conclusion, ASML stands as an unparalleled leader in the semiconductor equipment industry, with its dominance in EUV lithography technology creating high entry barriers and granting significant market control. However, while ASML's long-term growth potential remains solid, its current valuation appears stretched against recent projections and inherent risks, including geopolitical challenges, cyclical demand fluctuations, and potential disruptive technologies. Investors should weigh ASML's essential role in chip production against these risks, especially given the stock's premium valuation. I stay on the sidelines.

I want to emphasize that my fair value estimation should not be interpreted as a target price. While a stock may appear overvalued, it can still experience price increases. However, I am convinced that purchasing a stock—especially ASML—at its current price levels significantly raises the risk for investors.

Thank you once again for being here and for your interest! If you enjoyed my analysis, please consider leaving a "like" and subscribing. Your support means a lot!

Disclaimer: The information provided in this publication is for educational and informational purposes only and does not constitute financial advice. The content is solely reflective of my personal views and opinions based on my research and is not intended to be used as a basis for investment decisions. While every effort is made to ensure that the information is accurate and up-to-date, the writer makes no representations as to the accuracy, completeness, suitability, or validity of any information in this post and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. All readers are advised to conduct their own independent research or consult a professional financial advisor before making any investment decisions. The author is not invested in the mentioned stock.

Nice to finally find someone that still finds the company to be overvalued. My fair price is between 477 and 527 euro. We might be wrong, but there are plenty of other fish in the sea.