Dear Readers,

Thank you for being here and showing interest in my work! Your support means the world to me. If you enjoyed this article and would like to see more, please consider subscribing and giving it a like—it really helps grow our community of investors. Thank you for your continued support!

Please read the disclaimer at the end of this article. This is not an investment advice!

Previously, I wrote about the luxury group Kering, which is currently experiencing significant challenges. I overestimated both the management’s ability to stabilize the business and the strength of the Gucci brand. Although Gucci remains popular and consistently ranks highly within the fashion community, this has not translated into the financial stability one might expect, as Kering's recent results reveal.

By contrast, LVMH, the French conglomerate led by Bernard Arnault, stands as the undisputed leader in the luxury sector and a model of resilience in a competitive industry. In this post, I’ll delve into LVMH’s recent developments, with a particular focus on its long-term prospects and stock valuation.

About LVMH and some key metrics

LVMH, or Moët Hennessy Louis Vuitton, is a French multinational luxury goods conglomerate known for its prestigious portfolio of iconic brands spanning various luxury sectors. Founded in 1987 from the merger of Louis Vuitton, a historic French fashion house, and Moët Hennessy, a premium wines and spirits producer, LVMH has grown to become the world’s largest luxury group. The company operates across five main business sectors: Wines & Spirits, Fashion & Leather Goods, Perfumes & Cosmetics, Watches & Jewelry, and Selective Retailing. Each division comprises world-renowned brands, such as Louis Vuitton, Dior, Fendi, Givenchy, Bulgari, Tiffany & Co., and Sephora, among others.

LVMH’s success is attributed to its focus on quality, craftsmanship, and heritage, which allows the group to cater to a global clientele seeking exclusive and high-end products. Innovation and creativity are also integral to its brand strategy, fostering continued relevance in the competitive luxury market. The group is led by CEO Bernard Arnault, one of the wealthiest individuals in the world, whose vision has driven strategic acquisitions and investments that enhance LVMH’s portfolio and market presence.

Recent earnings

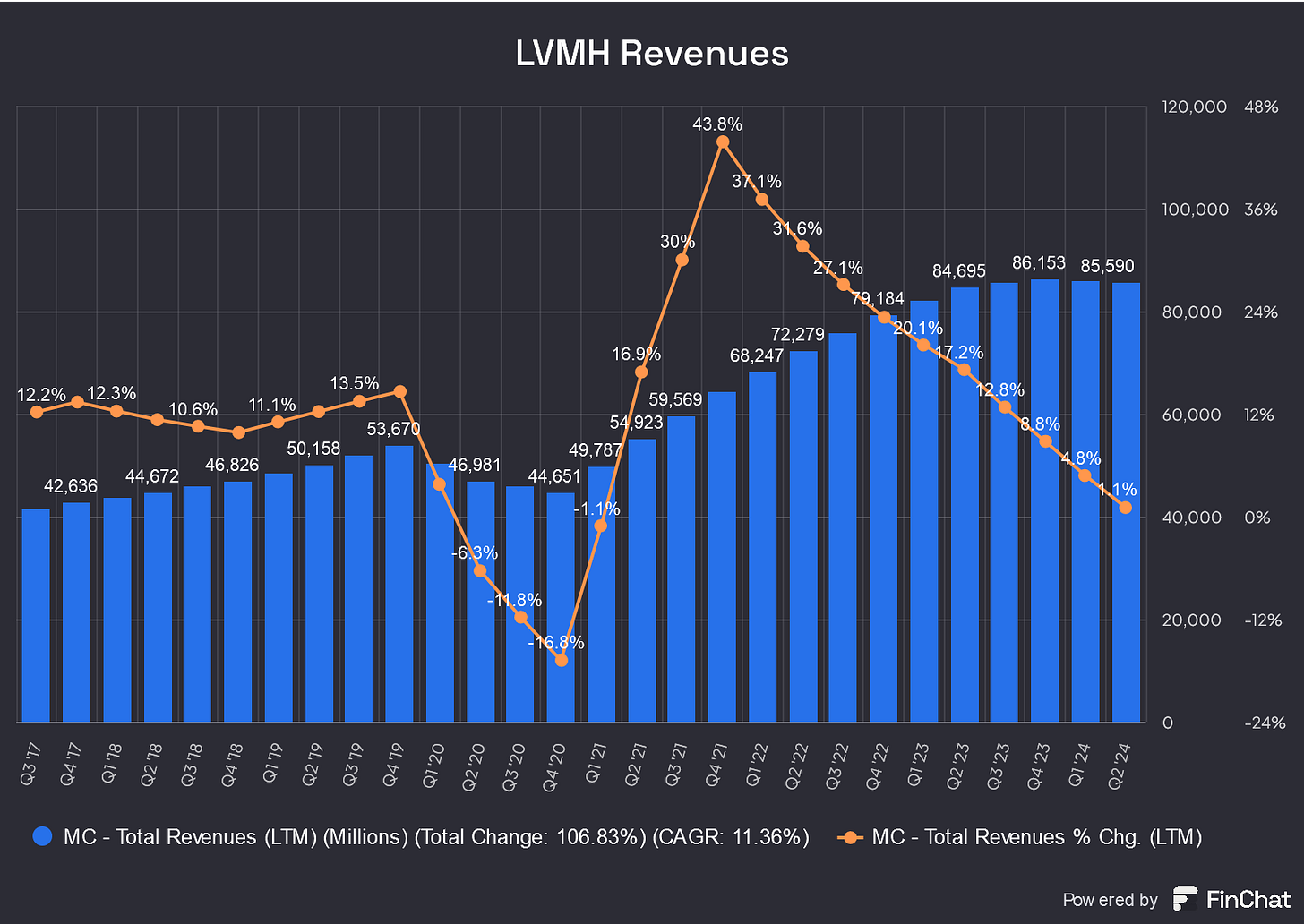

As the world’s largest luxury goods conglomerate, LVMH has seen years of impressive growth, fueled by post-COVID demand and a global appetite for high-end products. However, in the first nine months of 2024, LVMH reported a slight decline in revenue, a shift that reflects both internal adjustments and external pressures on the luxury market. Here’s what’s happening behind the scenes.

A Softening Demand in Key Markets

For LVMH, Asia has long been a vital region, with Chinese consumers playing a crucial role in driving growth across various segments. This year, though, demand in China has softened, particularly impacting LVMH’s iconic Hennessy cognac, which saw a notable slowdown in sales. The reasons are multifaceted: while the early pandemic years saw a surge in luxury spending as restrictions eased, 2024 has brought a more cautious consumer sentiment. Rising economic uncertainties and fluctuating market conditions have tempered demand, particularly in high-ticket categories like Wines & Spirits, which often depend on discretionary spending.

Japan, another pivotal market, initially showed robust growth for LVMH this year. However, as the yen strengthened against the euro, the growth slowed. Currency exchange fluctuations have also influenced the company’s revenue in other regions, highlighting how vulnerable luxury spending can be to economic headwinds. For a brand with a global presence, currency shifts like these can significantly impact revenue figures, sometimes making a stable performance appear as a decline.

Adjusting to Post-Pandemic Norms

The COVID-19 pandemic brought unique and unexpected consumer behaviors, especially in luxury markets. Post-pandemic demand surged for LVMH’s Wines & Spirits division, especially in champagne, as consumers celebrated a return to normalcy. But by 2024, demand for champagne and other luxury goods in this segment has begun to normalize, settling at a level that’s still above pre-pandemic benchmarks but no longer at the heightened levels seen during recovery. This “new normal” is a return to steady demand that, while still solid, doesn’t carry the sharp growth previously seen.

Economic Pressures Cast a Shadow on Big Purchases

Globally, luxury markets are sensitive to economic uncertainties, and 2024 has been a year marked by them. Geopolitical tensions and cautious consumer spending have made an impact, particularly in high-cost items within the Watches & Jewelry and Fashion & Leather Goods segments. While LVMH's stalwarts, Louis Vuitton and Dior, continue to lead in innovation and brand visibility, this year’s financial environment has tempered spending in these areas, especially among consumers whose budgets are now more reserved.

Cost Control and Strategic Adjustments

In response to these shifting market dynamics, LVMH has maintained a disciplined approach to cost management while staying committed to brand investments. Cost control has been a priority, particularly in advertising and promotions, as demand in some segments has softened. However, LVMH isn’t scaling back on long-term investments—new store concepts for Tiffany and sustained marketing for its flagship Maisons remain central to the strategy, with executives underscoring the importance of balancing short-term financial prudence with enduring brand visibility.

Demand Shifts and Product Strategy

While demand from aspirational luxury consumers has shown signs of slowing, LVMH executives have cautioned against drastic changes in pricing strategy or an expanded lower-price product range. Instead, they see strength in staying true to the luxury standards that define their brand. By maintaining focus on high-quality products and selective innovation rather than competing on price, LVMH aims to uphold the prestige of its brands, even in a market facing economic pressures.

Resilience Across Segments and Regional Differences

Segments like Perfumes & Cosmetics have remained resilient, bolstered by strong demand for fragrances and selective growth strategies. Sephora continues to perform well globally, albeit with a more moderate growth rate compared to the exceptional figures of recent years. Meanwhile, the Watches & Jewelry segment has shown resilience in select regions, particularly due to Tiffany’s revamped store concepts and ongoing brand visibility initiatives. In the U.S. and Europe, LVMH has seen slight improvements in some categories, and executives have expressed cautious optimism that these regions are stabilizing.

Strategic Adjustments and New Initiatives

Despite these headwinds, LVMH has continued to innovate and introduce new initiatives to maintain its brand appeal. Recent moves include a collaboration with Beyoncé on an American whiskey called “SirDavis” and a partnership with French Bloom, a premium alcohol-free sparkling wine brand, underscoring LVMH’s agility and responsiveness to evolving consumer tastes. The company has also doubled down on high-profile engagements, such as Louis Vuitton’s involvement in the Paris 2024 Olympics and its bespoke products tailored for iconic sporting events, emphasizing brand prestige in a year where brand resilience is paramount.

A Balanced Outlook Amid Economic Uncertainty

As LVMH looks ahead, the company remains confident, drawing on the authenticity and timeless appeal of its brands while navigating a more cautious global economy. While this year’s revenue may have softened, LVMH’s strategy underscores an enduring commitment to quality, craftsmanship, and adaptability. With plans to leverage its powerful brand portfolio and a focus on emerging markets and new product lines, LVMH continues to position itself as a resilient leader in luxury, ready to weather whatever economic challenges lie ahead.

In an industry as volatile as luxury goods, LVMH’s slight revenue decline this year serves as a reminder that even the strongest brands must adapt to an ever-shifting market landscape. And for LVMH, adaptation means keeping an eye on evolving tastes and emerging markets, while holding steady to the heritage and excellence that have long defined the world of luxury.

Arnaults long term vision for LVMH

Imagine a company that embodies the height of luxury, capturing the allure of the world’s most coveted brands while remaining financially unshakeable, even amid economic cycles. For Bernard Arnault, the mastermind behind LVMH, this isn’t just a corporate ambition; it’s a legacy built on careful planning, discipline, and an unwavering focus on the long game. His vision for LVMH is not merely a conglomerate of iconic brands but a carefully crafted empire that endures through time, shaped by a unique blend of pragmatism and artistry.

Arnault didn’t start as a traditional luxury insider. Coming from a background far from the aristocratic roots of French luxury houses like Hermès or Chanel, he brought a fresh, outsider’s perspective. This has allowed him to approach each acquisition, expansion, and market strategy with an engineer’s precision and an artist’s sensibility. Under his leadership, LVMH has grown into an empire, not only through acquiring some of the world’s most recognizable luxury brands—Dior, Louis Vuitton, Tiffany, Bulgari, to name a few—but by ensuring each brand’s distinctiveness remains preserved, strengthened, and infused with a timeless appeal. His approach to growth doesn’t just look at next year or the next big trend; he’s thinking of LVMH as a fixture in the world of luxury, built to last for generations.

Key to Arnault’s approach is his commitment to nurturing brand equity above all else. In an age where brands are often stretched thin in pursuit of short-term gains, Arnault’s focus is on the long term. Take the Samaritaine department store in Paris: acquired by Arnault in 2001, it was shuttered for over 16 years and reopened only after a billion-dollar restoration. To Arnault, the wait was secondary to the vision—he wanted to restore this historic icon to its former glory, creating an experience steeped in heritage, artistry, and exclusivity. For him, this wasn’t just about a return on investment; it was a statement about the timeless values that luxury represents.

This mindset of “optimism long term and caution short term” defines LVMH’s financial management. Arnault emphasizes a conservative approach to the balance sheet, aiming to keep leverage low and financial stability high. This strategy has allowed LVMH to expand during difficult economic times and continue investing in its brands, avoiding the common pitfall of short-term cost-cutting. Like a luxury equivalent of Berkshire Hathaway, LVMH’s financial resilience isn’t an accident—it’s a carefully orchestrated part of Arnault’s vision to build an empire that can withstand whatever the future holds.

Central to this vision is Arnault’s strategy of disciplined capital allocation. His acquisitions are rarely random; he targets brands that, while well-regarded, show clear potential for growth under LVMH’s stewardship. Take Tiffany or Bulgari: both brands were beloved but lacked the resources or guidance to fully capitalize on their potential. Under LVMH, they were transformed with capital investments, brand rejuvenation, and a sharper focus on the luxury experience. For Arnault, each acquisition is a chance to elevate these brands to their fullest potential, expanding LVMH’s reach while ensuring each brand remains iconic.

Arnault’s commitment to LVMH’s longevity extends to his family, too. LVMH is still a first-generation business, but he’s already prepared his children to step into the company’s leadership, actively involving them in decision-making and preparing for succession. Unlike a single-brand entity, LVMH is a vast collection of luxury houses, each with its own identity and challenges, making succession far more complex. Yet Arnault envisions a dynasty that will uphold the empire he’s created, moving LVMH toward a family-run, multi-generational business. In a sense, he’s setting up LVMH to be not just an empire, but a family legacy that mirrors the multi-generational elegance of luxury itself.

Global reach is another pillar of Arnault’s long-term strategy, with China leading as LVMH’s primary growth engine. While the pandemic has altered the dynamics of Chinese luxury spending, Arnault remains focused on building a robust presence there, adapting quickly to the changes in consumer behavior. Beyond China, emerging markets like India and Africa hold promise as the next big frontiers for luxury. Arnault’s strategy is to stay agile, making sure LVMH is ready to cultivate new generations of luxury consumers while staying grounded in its heritage.

Yet, amid all this expansion, Arnault is acutely aware of the importance of exclusivity. For luxury brands, growth must be carefully balanced to avoid diluting their allure. This is where LVMH’s unique structure shines: each brand enjoys operational autonomy, allowing it to retain its identity, yet under Arnault’s close guidance, ensuring it aligns with the group’s vision. The decentralization at LVMH means each brand can stay true to its roots, yet every brand leader answers to Arnault, who keeps a watchful eye on how each piece contributes to the greater whole.

While Arnault is far from averse to innovation, he respects tradition. LVMH has embraced digital marketing, modern design collaborations, and new retail formats to stay relevant, especially among younger consumers. But whether through store layouts or advertising campaigns, Arnault ensures LVMH remains rooted in the classic values of craftsmanship and quality that define true luxury. This balance of old and new reflects Arnault’s view of LVMH as a custodian of luxury, where progress doesn’t mean compromise.

In Bernard Arnault’s world, LVMH is more than a collection of brands; it’s a legacy of heritage, quality, and endurance. His ambition is to build an empire that, much like the products it sells, only grows more valuable with time. As he puts it, the strategy is simple: be cautious today to ensure tomorrow, while never losing sight of the opportunity to shape the future. Under his guidance, LVMH isn’t just preparing for the next season or trend but for a future where it remains, unquestionably, at the pinnacle of luxury.

Stock Valuation

Assessing LVMH's value through a DCF model proves challenging due to the difficulty in forecasting its future performance. This complexity is evident in the frequent adjustments analysts make to their projections. However, given LVMH's strong long-term vision and unique corporate culture, I believe the stock’s short-term performance holds limited significance in predicting its future. Despite the near-term challenges, these factors do not reflect any underlying weaknesses in its business model, which I view as robust and resilient.

For investors, finding an attractive entry point into LVMH can help manage risk in this high-quality business. Currently, LVMH trades at a forward P/E ratio of 15.53x and an EV/EBIT ratio of 21.17x, both below its 5-year averages of 19.30x and 27.01x. While I do not foresee the rapid recovery we saw post-COVID, I believe a 21x P/E is justified for a company with LVMH’s dominant position in the luxury sector, strong financials, and solid returns. This suggests that LVMH may indeed be slightly undervalued at present, offering potential upside for long-term investors.

Conclusion

LVMH's unique combination of long-term vision, financial resilience, and brand authenticity positions it as a leader in the luxury sector, even amid recent market challenges. Unlike its struggling peer Kering, LVMH has navigated economic pressures and shifting consumer trends with agility and strength, backed by Bernard Arnault’s disciplined approach to growth and brand preservation. While short-term revenue fluctuations have slightly impacted LVMH’s performance, the company’s foundational values and commitment to quality remain unchanged, supporting its lasting appeal in the global luxury market.

For investors, LVMH offers both a compelling business model and potential value, currently trading below historical valuation levels despite its dominance in the sector. The near-term challenges do not overshadow the strength of its business fundamentals, and the stock’s current valuation may provide a promising entry point for those looking to invest in a well-positioned luxury leader with enduring growth potential. As LVMH continues to expand strategically, driven by Arnault’s legacy-minded leadership, it stands well-prepared to retain its stature as a true custodian of luxury for generations to come.

Thank you once again for being here and for your interest! If you enjoyed my analysis, please consider leaving a "like" and subscribing. Your support means a lot!

Disclaimer: The information provided in this publication is for educational and informational purposes only and does not constitute financial advice. The content is solely reflective of my personal views and opinions based on my research and is not intended to be used as a basis for investment decisions. While every effort is made to ensure that the information is accurate and up-to-date, the writer makes no representations as to the accuracy, completeness, suitability, or validity of any information in this post and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. All readers are advised to conduct their own independent research or consult a professional financial advisor before making any investment decisions. The author is invested in the mentioned stock.

A great business, a great empire. Just temporary difficulties (:

Pretty sure you are overstating FCF by 20-25% because you have not reduced them by ~3.5-4B of lease payments.