Rheinmetall AG is a German defense and automotive company headquartered in Düsseldorf. It operates primarily in two sectors: Defense (armaments, military vehicles, ammunition, and electronic systems) and Automotive (components for internal combustion engines and electric mobility). However, in recent years, and especially amid geopolitical tensions, Rheinmetall's Defense division has become its core growth driver.

Financial Highlights 2024

Rheinmetall AG achieved record-high sales and earnings in 2024, driven by a surge in its defense business. Key financial metrics for the year include:

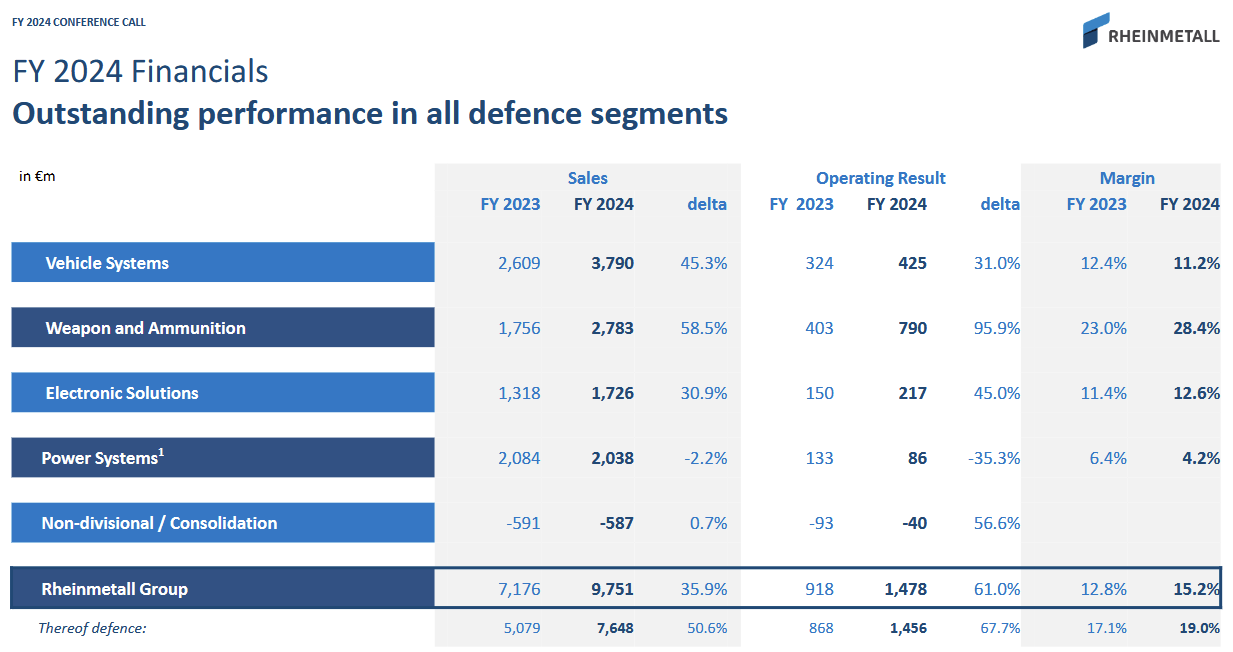

Revenue (Sales): €9,751 million, a 36% increase over 2023. Defense-related sales grew 50% year-on-year, now accounting for ~80% of group revenue.

Operating Profit (EBIT): €1,478 million (operating result), up 61% from €918 million in 2023. This marks a new record, with the EBIT margin rising to 15.2% (vs. 12.8% in 2023). The defense segment’s margin was even higher at ~19%.

Net Profit: €808 million after taxes, a 38% increase (2023: €586 million). Net profit attributable to Rheinmetall shareholders was €717 million (up from €535 million), yielding earnings per share (EPS) of €16.51 (versus €12.32 in 2023).

Order Backlog: Reached a record €55.0 billion as of Dec 31, 2024, up 44% from €38.3 billion a year earlier. This enormous backlog includes multi-year defense framework contracts and ensures high capacity utilization in coming years.

Dividend: The Board proposes a €8.10 per share dividend for 2024 (pending shareholder approval at the May 2025 AGM), a significant rise from the €5.70 paid for 2023. This represents a payout of roughly 39% of earnings, in line with the prior year’s payout ratio.

Boom in Defense Business and Major Contracts

Surging Defense Demand: Rheinmetall’s defense divisions experienced exceptional growth in 2024, fueled by a dramatically changed geopolitical environment. The Russian–Ukraine war and the “Zeitenwende” (turning point) in European security policy led to sharply higher defense spending, especially in Germany. Defense sales jumped ~50%, and domestic demand from the German armed forces grew so much that the share of foreign sales fell to 70% (from 76% in 2023). The company noted that “major high-volume orders from military customers” drove its record order intake and will keep factories busy for years.

Record Order Backlog: By year-end 2024, Rheinmetall’s order backlog hit an all-time high of €55 billion. This was bolstered by several landmark contracts in 2024: for example, the Vehicle Systems division received a new €2.93 billion framework contract to supply unprotected military transport trucks and a €1.67 billion order for “Heavy Weapon Carrier” Boxer 8x8 vehicles (including a service agreement). In the Weapon & Ammunition segment, Rheinmetall saw unprecedented demand for artillery munitions – a multi-year framework agreement with the German government for artillery shells was increased by €7.1 billion in 2024 to replenish stocks, far exceeding the scope of similar contracts from the prior year.

This surge reflects the urgent need for ammunition highlighted by the war in Ukraine and NATO’s effort to boost readiness. Rheinmetall’s newly acquired Spanish subsidiary, Expal Munitions, also contributed significantly to ammunition sales, helping that division grow revenue 58% to €2.78 billion. Additionally, the Electronic Solutions division booked major orders for air-defense systems (short-range and very short-range air defence, LVS NNbS, and Skyranger 30 mobile systems) and soldier equipment for the Bundeswehr, driving a 132% jump in its order intake to €5.07 billion. Notable wins included contracts to develop and supply Germany’s new ground-based air defense systems and Army digitalisation projects (communications and battlefield management equipment).

Geopolitical Tailwinds: The war in Ukraine and heightened threat environment in Europe directly boosted Rheinmetall’s business. The company markedly increased direct deliveries of military equipment to Ukraine in 2024 (an additional €609 million in sales) while simultaneously benefitting from larger orders by NATO member nations replenishing their own arsenals. CEO Armin Papperger described 2024 as the beginning of “an era of rearmament” in Europe, bringing growth prospects “never experienced before” for the defense industry. Thanks to its broad product portfolio (from vehicles and weapons to ammunition and electronics), Rheinmetall is positioned as a key supplier in this build-up of defense capabilities in Germany and allied countries.

Investments and Expansion of Production Capacity

To meet soaring demand, Rheinmetall undertook major expansion initiatives in 2024. Over the past two years, the company has invested nearly €8 billion in increasing capacity – building new plants, acquiring strategic businesses, and strengthening supply chains. In February 2024, Rheinmetall broke ground on a new €300 million ammunition factory in Unterlüß, Germany, with the aim of producing up to 200,000 artillery shells per year at full capacity. This “Werk Niedersachsen” plant (entirely company-funded, creating 500 new jobs) will ensure Germany has a domestic supply of large-caliber ammunition and reduce reliance on foreign suppliers. Rheinmetall is also expanding its international production footprint – for instance, it announced an expansion of its ammunition plant in Várpalota, Hungary to add new lines for 155mm artillery and 120mm tank ammunition, further boosting output of critical munitions (a response to European efforts to supply 1 million rounds to Ukraine).

In addition to organic growth, Rheinmetall pursued acquisitions and partnerships to broaden its capabilities. The contribution of Expal (acquired in 2023) to ammunition output in 2024 is one example. The company also increased investment in military digitalization and electronics – e.g. taking a majority stake in software firm blackned GmbH (announced January 2025) to enhance its command-and-control and networking solutions, and entering a joint venture with Italy’s Leonardo to cooperate on defense electronics (approved by regulators in late 2024). These moves align with Rheinmetall’s strategy to transform itself “from a European systems supplier to a global champion” in defense technology.

Automotive (Power Systems) Segment Performance

While defense dominated growth, Rheinmetall’s smaller civilian segment – regrouped as Power Systems in 2024 – faced headwinds. Power Systems (which now encompasses the former automotive-focused Sensors & Actuators and Materials & Trade divisions) saw sales dip slightly to €2,038 million in 2024, a 2% decline year-on-year. This was largely due to general weakness in the automotive market: demand softened in product areas like air management, emissions control, and bearings, and new e-mobility projects have yet to contribute significantly. The division’s order intake (booked business) also dropped 28% versus 2023 amid slower electric vehicle market growth and uncertainties around new EU emissions standards.

Despite these challenges, there were some bright spots. Rheinmetall’s aftermarket Trade business achieved its highest sales in company history in 2024, growing 14% year-on-year as it capitalized on spare parts demand. Certain product lines (like solenoid and coolant valves, and electrification/digitalization components) showed resilience or modest growth. However, overall Power Systems operating profit declined to €86 million, with a 4.2% margin (down from 6.4% in 2023) due to the softer sales and less favorable mix. This underlines Rheinmetall’s ongoing transition away from legacy automotive components toward higher-growth defense and dual-use technologies.

Profitability and Cash Flow

Rapid growth has come with improving profitability. The defense business is highly lucrative – for example, Rheinmetall’s weapons & ammunition division earned a nearly 28.4% operating margin in 2024. Group return on equity is strong (around 22% ROE recently) and return on invested capital about 14%, indicating efficient use of capital. Importantly, cash generation has accelerated: operating cash flow in 2024 was €1.045 billion, nearly tripling year-on-year thanks to advance customer payments. Free cash flow turned sharply upward – about €911 million in 2024, up from €345 million in 2023 – reflecting robust cash profits and improved working capital dynamics. This influx of cash gives Rheinmetall more flexibility to invest in new capacity and technology (as it has been doing) and to support dividend growth. Overall, the company’s profit margins and returns have risen to healthy levels, underpinned by surging defense volumes and operating leverage on higher sales.

Dividend Increase and Shareholder Returns

On the back of the strong 2024 results, Rheinmetall’s board has recommended a significantly higher dividend for the year. The proposed dividend is €8.10 per share for 2024, up from €5.70 the prior year. This proposal, to be voted on at the Annual General Meeting in May 2025, represents roughly a 39% payout of net earnings – maintaining a similar payout ratio as last year despite the higher absolute dividend. The dividend hike reflects management’s confidence and rewards shareholders for a year in which Rheinmetall delivered record profits. It also signals optimism for sustained growth, as the company enters 2025 with an unprecedented order backlog and plans for further expansion.

Overall, Rheinmetall AG’s 2024 performance was marked by booming defense revenues, record profitability, and robust future orders, all underpinned by extraordinary geopolitical-driven demand. The company responded with aggressive investments in capacity and strategic initiatives, positioning itself for continued growth in the “new era” of defense spending. With a stronger balance sheet and increased dividend, Rheinmetall’s 2024 results highlight a transformative year, setting a foundation for the years ahead.

Short-term Outlook for 2025

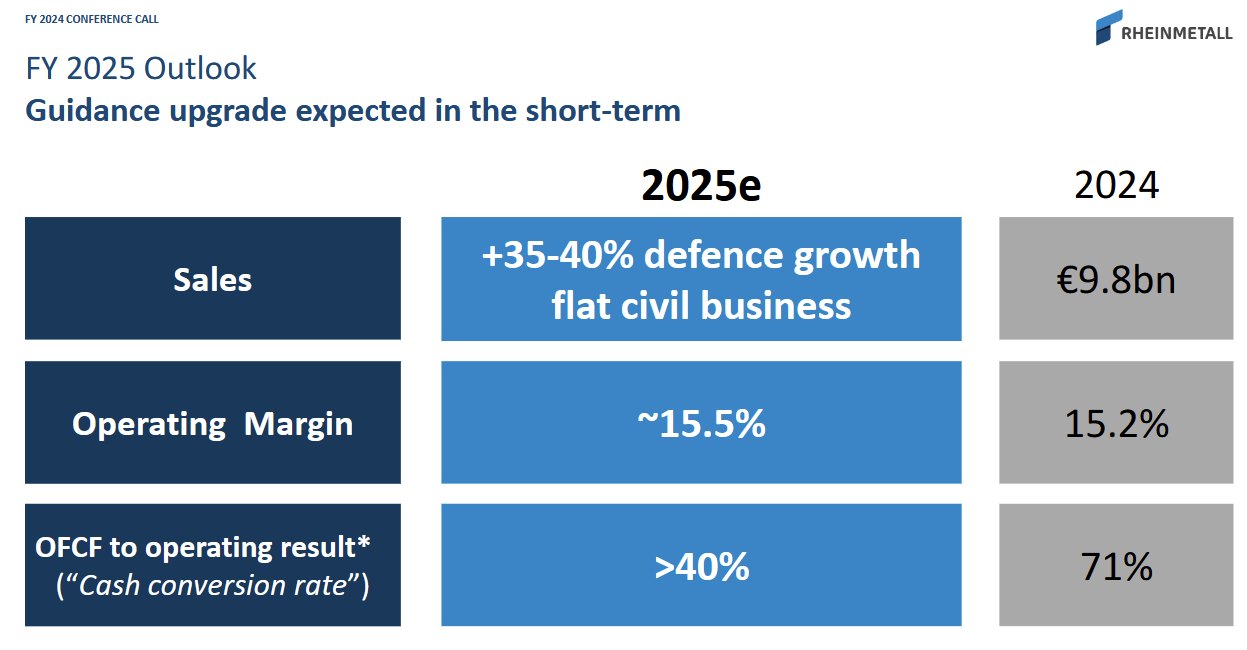

Rheinmetall AG has issued a highly optimistic outlook for 2025, following its record-breaking financial performance in 2024. The company expects to increase its revenue to between €11 and €12 billion, representing growth of approximately 12 to 15 percent compared to the €9.75 billion achieved in 2024. This growth is anticipated to be driven almost entirely by the Defense division, particularly through strong demand for ammunition, armored vehicles, and air defense systems.

Profitability is also expected to remain robust, with Rheinmetall forecasting an operating margin (EBIT margin) of around 15 percent, in line with the previous year’s strong performance. The company anticipates further increases in both operating earnings and net profit, supported by ongoing efficiency gains and the full utilization of its expanded production capacity.

Entering 2025, Rheinmetall holds a record order backlog of €55 billion, providing multi-year revenue visibility and securing high capacity utilization across its production sites.

Strategically, 2025 will focus heavily on expanding ammunition production. New facilities in Germany (Unterlüß), Lithuania, Hungary, and potentially Ukraine will begin or scale up operations. Rheinmetall aims to produce over 700,000 artillery rounds in 2025, working toward its long-term goal of reaching 1.1 million rounds annually by 2027.

Beyond production, the company will continue investing in technological innovation, particularly in areas such as autonomous systems, air defense technologies, AI-driven military platforms, and digital battlefield solutions. Rheinmetall also plans to strengthen its position as a full-spectrum defense systems integrator.

International expansion remains another key priority, with the company seeking to secure further orders from NATO partners and allies worldwide. Efforts are especially focused on North America, Australia, Eastern Europe, and emerging markets in Asia.

Long-Term Fundamental Investment Analysis

Valuation Metrics and Returns

Despite its significantly higher earnings, Rheinmetall’s stock price has surged so much that traditional valuation multiples remain elevated. The shares trade at a high trailing P/E (over 70× based on the last twelve months earnings) but a much lower forward P/E in the low-40s.

This gap reflects the expectation of rapid earnings growth ahead, as analysts project profits to continue climbing with the order backlog. The PEG ratio is around 1.0, suggesting the stock’s price-to-earnings is roughly in line with its growth rate – not obviously overpriced relative to its prospects, but no longer cheap after a huge rally. Other metrics show a rich valuation: the EV-to-EBIT ratio is close to 30, well above historical norms.

Trailing P/E: ~73× (reflecting past 12-month earnings)

Forward P/E: ~44× (based on projected earnings growth)

PEG Ratio: ~1.0 (valuation in line with expected growth)

EV/EBIT: ~30× (Enterprise value to EBIT)

These multiples indicate that a lot of good news is already priced in. Rheinmetall’s market capitalization has exploded (recently exceeding €56 billion, even surpassing Volkswagen’s valuation) as investors anticipate a “super-cycle” in defense spending. From a long-term fundamental perspective, the stock’s valuation is demanding but not absurd given the extraordinary growth outlook. The earnings yield (inverse of P/E) is still low in the near term, but if Rheinmetall can execute on its massive backlog and if defense budgets remain high, its forward multiples should improve as earnings catch up. In short, the company’s valuation reflects a bullish long-term view – a wide-moat defense business with years of revenue locked in – but it leaves less margin for error. Any slowdown in growth or setback in execution could cause the lofty P/E to compress. Prospective long-term investors should be aware that they are paying a premium for Rheinmetall’s stellar fundamentals and future potential.

Strategic Positioning and Long-Term Growth Drivers

Rheinmetall is strategically positioned as a key supplier in the defense sector, and current geopolitical dynamics strongly favor its long-term growth. The company is at the forefront of Europe’s military “Zeitenwende” (turning point), benefiting directly from the large-scale rearmament underway. In the wake of Russia’s invasion of Ukraine, NATO countries – especially in Europe – have committed to boosting defense spending dramatically. Germany, for instance, created a €100 billion special defense fund in 2022 and is raising its annual defense budget toward 2% (or even 3%) of GDP. Germany's recent approval of a substantial debt-financed budget package, allocating approximately €1 trillion for defense and infrastructure, is poised to significantly benefit Rheinmetall AG.

As the country’s largest defense contractor, Rheinmetall has secured numerous big contracts funded by this initiative. The result is a record order intake for vehicles, weapons, and munitions. Notably, Rheinmetall’s market share in European defense has been climbing; analysts estimate it could capture 20–25% of European NATO countries’ equipment spending through 2030. The company’s value proposition – supplying critical land warfare equipment (armored vehicles, tank cannons, ammunition, air defense systems, etc.) – aligns perfectly with the urgent priority to replenish Western military stockpiles and modernize aging arsenals.

Several long-term growth drivers underpin Rheinmetall’s outlook:

Geopolitical Tailwinds: A structural increase in defense budgets is expected to persist for years. European defense spending is becoming “non-cyclical,” with nations rearming to deter threats and reduce reliance on U.S. support. NATO members are reshoring production and ramping up munitions stockpiles after decades of underspending, creating sustained demand for Rheinmetall’s products. The CEO has declared “an era of rearmament has begun in Europe” bringing unprecedented growth prospects. Beyond Europe, global tensions (e.g. in Asia and the Middle East) could lead to more orders from partner countries, potentially making Rheinmetall a “global champion” in defense as it aspires.

Robust Order Pipeline: The company’s backlog of €55 billion provides multi-year revenue visibility. Many contracts are multi-year programs for vehicles (like the Boxer armored vehicle and Lynx IFV) or multi-phase ammunition supply agreements. For example, Rheinmetall landed one of its largest-ever deals in 2024 – an €8.5 billion framework contract for artillery ammunition – which will be delivered over several years. Such agreements practically lock in future growth. Management is guiding for continued double-digit sales growth (~25–30% in 2025) as these orders convert to revenue. Major high-volume orders from the German armed forces and other NATO allies will ensure Rheinmetall’s factories stay fully utilized in the coming years.

Expansion of Production Capacity: Rheinmetall has been aggressively investing in new production facilities and technology to meet demand. Over the past two years, it has invested nearly €8 billion in building new plants, acquisitions, and supply chain security. This includes opening or planning new ammunition factories in Germany and allied countries. For instance, it broke ground on a €300 million state-of-the-art munitions plant in Germany (Unterlüß) to produce 200,000 shells annually. It’s also partnering with governments in Lithuania and others to establish local ammo production (a €180 million plant in Lithuania by 2026 to churn out tens of thousands of artillery rounds per year). Even an ammunition facility in Ukraine is under way. This expansion not only allows Rheinmetall to fulfill its backlog faster but also deepens its strategic importance – e.g. ensuring Germany’s self-reliance in critical defense supplies. The company’s capital expenditure now will likely translate into significantly higher output (management targets annual shell production of 1.1 million rounds by 2027, up tenfold from pre-war levels).

Technological and Product Portfolio: While known for tanks and munitions, Rheinmetall is also broadening into defense technology areas that promise future growth. It has initiatives in drone systems, counter-drone defenses, battlefield software, and mobile air-defense units. This R&D and diversification means Rheinmetall can tap into emerging defense needs (such as anti-drone warfare and digital battlefield management) in addition to traditional hardware. The company’s “broad technological positioning” – as management calls it – and its long heritage in defense give it a “wide moat”. Its scale and expertise make it a natural lead contractor for big projects (for example, Rheinmetall is expected to play a role in Europe’s next-generation tank development and has teamed with other firms for combat system upgrades). Overall, Rheinmetall’s strategic moves (capacity growth, acquisitions like Expal for ammunition, and product innovation) position it to capitalize on the long-term defense upcycle. The firm appears poised to benefit from both the immediate surge in orders (replacing equipment sent to Ukraine and meeting NATO spending targets) and the longer-term modernization of military forces.

Key Risks and Potential Headwinds

While the outlook is strong, investors should also consider risks that could impact Rheinmetall’s long-term performance. The company operates in a cyclical, politically-sensitive industry, and its fortunes are tightly linked to government policies and global events. Key risks include:

Political & Budget Risk: Overreliance on government spending is an inherent risk – virtually all of Rheinmetall’s revenue comes from government defense contracts. Its growth is fueled by political decisions to boost military budgets. A change in the political climate could slow that momentum. For example, if geopolitical tensions ease (e.g. a lasting peace in Ukraine or détente with Russia), there could be pressure to reduce defense spending or divert funds elsewhere. Some forecasts predict that after a mid-term spike, Europe’s defense equipment spending may normalize (possibly declining again to ~25% of budgets by the mid-2030s). Such a scenario would mean fewer new orders down the line. Additionally, Rheinmetall is now quite dependent on Germany’s procurement plans – a domestic political shift (e.g. a more pacifist government or fiscal austerity regime) could delay or cancel programs. In short, future orders are not guaranteed: they hinge on geopolitical events and political will. The current multi-year supercycle could eventually cool off, leaving Rheinmetall with lower growth or excess capacity (especially if it has geared up for permanently high demand).

Regulatory and Export Controls: As a defense contractor, Rheinmetall faces strict regulatory oversight and export restrictions. Government approvals are needed for many foreign sales, and these can become political issues. Changes in regulations (for instance, tighter export controls on arms sales to certain regions) could limit Rheinmetall’s accessible market or delay deliveries. The company has navigated such issues by focusing on sales to NATO/EU partners (and building domestic production to avoid third-country export vetoes), but regulatory risk remains. Moreover, defense procurement can be bureaucratic – budget approvals, contracting delays, or cost-overrun disputes could impact the timing and profitability of projects. Any unexpected shift in NATO collaboration or European Union defense policy might also influence Rheinmetall’s cross-border contracts. In essence, Rheinmetall’s revenues depend on political decision-making and compliance, which adds uncertainty outside of its direct control.

Execution and Capacity Risks: Rheinmetall’s rapid expansion comes with execution challenges. The company is investing heavily to scale up production (new factories, hiring thousands of workers, integrating acquisitions). Managing this growth without significant hiccups is crucial. There is a risk of overexpansion – if defense orders peak sooner or fall off, Rheinmetall could end up with underutilized facilities or inflated costs. Conversely, any delays or bottlenecks in ramping up capacity could slow deliveries and disappoint customers (or investors). Keeping complex military projects on schedule and on budget can be difficult, and cost overruns could eat into margins. Furthermore, incorporating new technologies (drones, software) and ensuring successful R&D outcomes will be important for staying ahead; failure in a major development program or losing out on a key contract (to a competitor) would be a setback. In summary, Rheinmetall must execute well to translate its order book into profits. Supply-chain disruptions, skilled labor shortages, or integration issues with new acquisitions are all potential headwinds that could temporarily impair results as the company scales up.

Competitive and Market Factors: Although Rheinmetall is currently in a favorable spot, competition in the defense sector is intense. Other defense giants (international players like Lockheed Martin, BAE Systems, General Dynamics, etc.) may compete for some of the same programs or markets. Rheinmetall’s ability to become a “global champion” will depend on fending off such rivals and continuing to innovate. If European governments decide to spread contracts across multiple domestic suppliers (for diversification or political reasons), Rheinmetall might not win the same share of future spending as it has recently. The company also still has a legacy automotive/mechanical engineering segment – while smaller now, it faces its own headwinds (e.g. the shift away from combustion engines). Any weakness or losses in that area could drag on overall performance, though Rheinmetall’s strong defense earnings currently overshadow it.

Finally, one should note that the stock’s high valuation is itself a risk: if growth prospects dim or the defense “supercycle” doesn’t fully materialize, the market could sharply reprice the stock. A high valuation multiple means high expectations; any disappointment in earnings growth or order intake could lead to a notable pullback in share price (even if the underlying business remains solid).

Conclusion

From a long-term, fundamentals-driven perspective, Rheinmetall AG appears to be a robust investment candidate. The company boasts record financial performance, strong profitability, and an enormous backlog that essentially charts a course for continued growth. Its strategic positioning in a rearming Europe gives it a multi-year tailwind supported by firm government commitments to defense. Rheinmetall’s investments in capacity and technology further reinforce its ability to capitalize on this defense supercycle. These factors suggest that the company is well-placed to deliver long-term earnings expansion and value creation. However, investors should weigh the risks: the business is tied to geopolitical and political currents, and the current valuation leaves little room for error. Over the long haul, sustainable returns will depend on continued execution and the durability of defense spending trends. In summary, Rheinmetall’s fundamentals depict a company with exceptional growth drivers and solid financial quality, making it a potentially strong long-term investment – provided one remains mindful of the unique risks inherent in the defense industry. The stock offers exposure to a historic upswing in defense outlays, but prudent investors will monitor how political conditions evolve and whether the company can convert its blockbuster order book into lasting shareholder value.

Disclaimer: The information provided in this publication is for educational and informational purposes only and does not constitute financial advice. The content is solely reflective of my personal views and opinions based on my research and is not intended to be used as a basis for investment decisions. While every effort is made to ensure that the information is accurate and up-to-date, the writer makes no representations as to the accuracy, completeness, suitability, or validity of any information in this post and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. All readers are advised to conduct their own independent research or consult a professional financial advisor before making any investment decisions. The author is invested in the mentioned stock.