This is Part III of the Allianz SE analysis. You can access the previously published Parts I and II here:

Part I: https://krokerequityresearch.substack.com/p/78-allianz-se-part-i

Part II: https://krokerequityresearch.substack.com/p/82-allianz-se-part-ii

1. How does Allianz allocate its capital?

Allianz has made its approach to capital allocation remarkably transparent and shareholder-friendly. In December 2024, the company formalized a clear Capital Management Framework that guides how it allocates earnings, balancing growth investments with generous returns to shareholders.

At the core of this framework is a strong commitment to financial stability. Allianz will only proceed with distributions if its Solvency II ratio remains comfortably above 150%, ensuring the group maintains a robust capital base even in volatile times.

When it comes to payouts, Allianz has stepped up its game. The company now aims to return at least 75% of its net income to shareholders over the 2025–2027 period. This includes a regular dividend of 60% of earnings, plus an additional 15% or more through share buybacks or special dividends. If earnings grow, shareholders can expect the dividend per share to increase by at least 5% per year, assuming results support it.

Importantly, Allianz doesn’t reinvest capital without discipline. Any internal project or external acquisition must pass a four-step test: it must be a strategic fit, involve high-quality assets, deliver returns above the cost of capital, and not materially weaken the solvency position. If there are no better uses for capital, Allianz defaults to returning it to shareholders.

This framework is backed by concrete targets: 7–9% annual EPS growth, a return on equity of at least 17%, and over €27 billion in cash remitted to the holding company between 2025 and 2027. These metrics help steer capital deployment and set expectations for investors.

In short, Allianz has built a capital allocation policy that combines prudence with generosity. It protects the balance sheet, invests in profitable growth where possible, and shares the rest with shareholders. It’s a smart, structured approach and one that’s clearly designed with long-term value creation in mind.

2. How much did Allianz spend on Capex?

As an insurance company, Allianz SE typically has relatively low capital expenditures (CapEx) compared to industrial or tech firms. This is simply due to the nature of the business: insurers don’t operate heavy machinery or physical production facilities. Instead, their operations are largely driven by human capital, IT infrastructure, data processing, and regulatory compliance systems. As a result, Allianz’s annual CapEx usually lands in the range of €1.5 to €2.5 billion, primarily directed toward digitalization, IT upgrades, and process efficiency rather than physical assets.

So while CapEx is a part of Allianz’s capital allocation, it plays a much smaller role than in asset-heavy sectors.

3. How much has Allianz spent on acquisitions?

Allianz has also been selective but bold in acquisitions to strengthen its core insurance and asset management businesses. In 2021, it agreed to acquire Aviva’s operations in Poland for €2.5 billion, instantly boosting Allianz to a top-5 insurer in that market. Earlier, Allianz expanded in the UK by buying out the remaining 51% of LV General Insurance and acquiring Legal & General’s general insurance portfolio (a combined deal valued around £800 million in 2019). It has also grown in Asia-Pacific – for instance, in 2020 Allianz struck a 20-year bancassurance partnership with Westpac in Australia, acquiring Westpac’s general insurance business for AUD 725 million (about $535 million). These deals, alongside numerous smaller stake increases (such as the full integration of Euler Hermes by 2018), demonstrate Allianz’s willingness to deploy capital for accretive acquisitions that consolidate its market position or open new distribution channels. Management maintains a strict profitability and strategic fit criteria for M&A, evidenced by acquisitions being “immediately earnings accretive” in cases like Aviva Poland. In summary, Allianz allocates capital by investing in growth where returns justify it, and returning the rest to shareholders, reflecting a prudent and shareholder-friendly philosophy.

4. Does Allianz pay a dividend?

Allianz’s dividend track record is a key attraction for investors. The company has consistently increased its dividend per share over the past decade, with particularly strong growth in recent years.

5. What is the dividend policy?

Allianz SE has a clear and shareholder-friendly dividend policy that reflects both discipline and generosity. As part of its broader capital management strategy, Allianz commits to distributing 60% of its adjusted net income to shareholders each year in the form of a regular dividend. This payout is based on net income adjusted for items like gains or losses from disposals, amortization from M&A, and certain non-operating market effects.

What makes the policy particularly attractive for long-term investors is its focus on stability and growth. Allianz aims to keep the dividend per share at least flat from one year to the next, and ideally increase it, provided earnings support it. In recent years, this has resulted in a steady and reliable upward trend in payouts.

Since 2024, Allianz has gone a step further by introducing a total shareholder return target. In addition to the 60% base dividend, the company now plans to return at least another 15% of its net income through share buybacks or special dividends. This means that for the years 2025 to 2027, Allianz is targeting a minimum total payout of 75% of net income on average—making it one of the more generous returners of capital in the European financial sector.

The most recent example of this policy in action is the proposed dividend of €15.40 per share for fiscal 2024, up from €13.80 the year before. That represents an 11.6% increase and reflects both strong earnings and management’s commitment to rewarding shareholders. Based on the current share price, the dividend yield stands at just over 4%, which is attractive in today’s market—especially when paired with the potential for continued buybacks.

6. What is the most recent dividend payment per share?

€15,40

7. What is the current yield and average dividend yield?

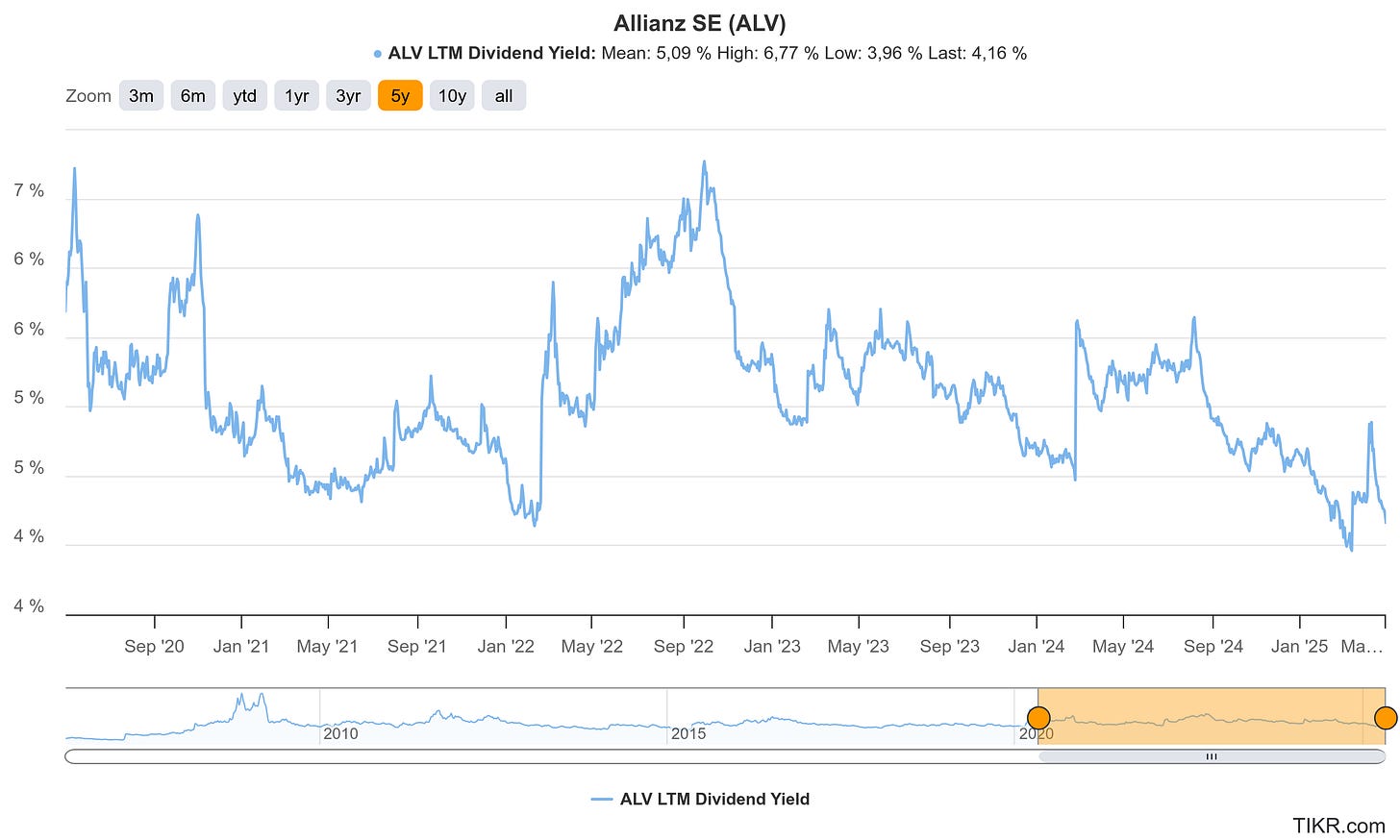

Allianz’s current dividend yield is attractive, albeit a bit lower after a strong share price run-up. At the recent share price (~€377), the yield is around 4.2%. Historically, Allianz yielded about 4–5% (it was about 5.1% in 2023, well above the insurance sector average). The combination of a generous yield and steady growth means Allianz has delivered robust dividend income to investors.

8. What is the payout ratio?

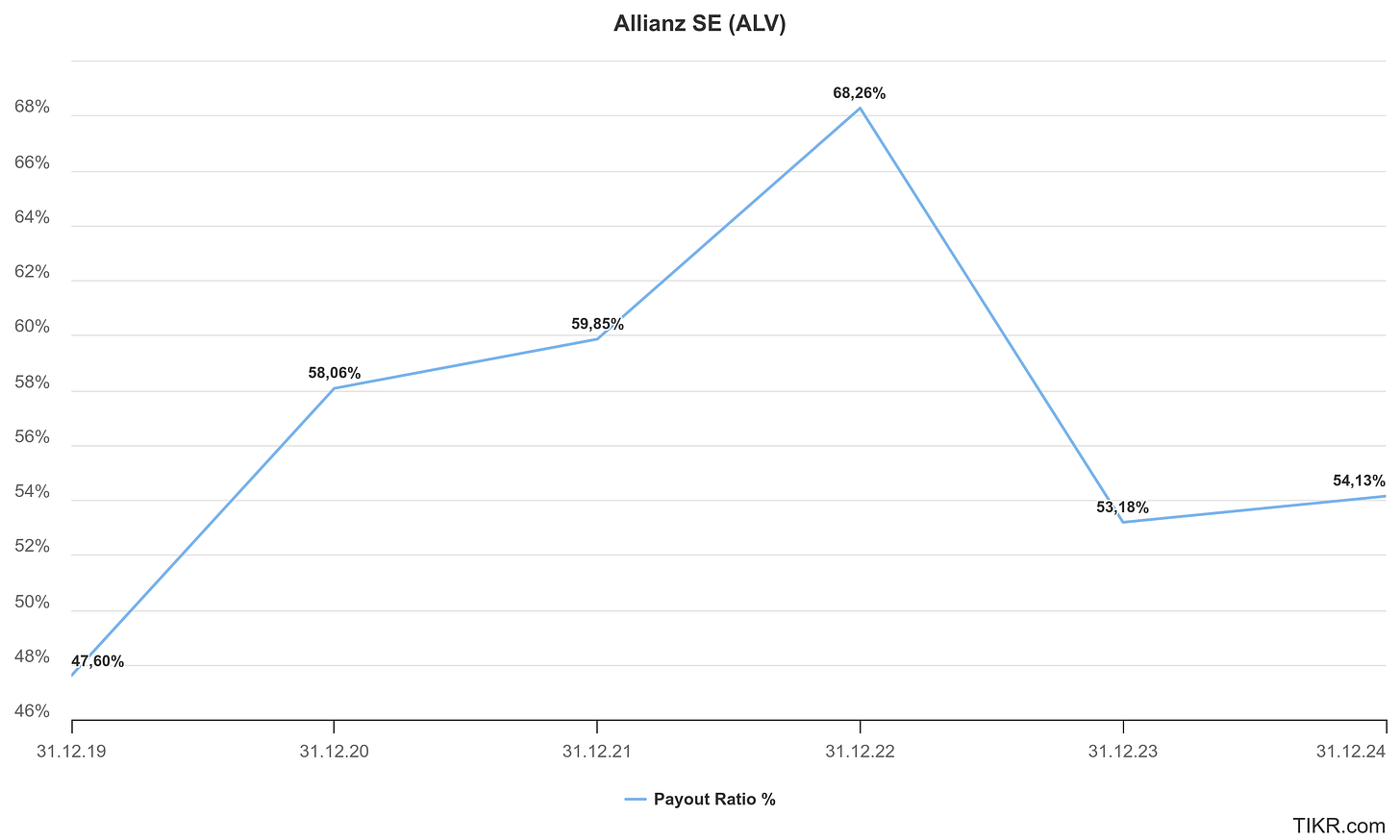

The payout ratio for 2024 was roughly 54% of net earnings, aligning with the new policy. This still leaves a healthy portion of profits to reinvest or buy back shares, and management’s updated capital plan actually targets an even higher total capital return (more on buybacks below). Importantly, Allianz’s dividends have grown in tandem with earnings – DPS has increased about 10% annually on average over the last decade, supported by rising profits. This indicates a sustainable dividend trajectory. With the latest policy, Allianz explicitly aims to return more cash to shareholders: management commits to a total payout (dividends plus buybacks) of at least 75% of earnings going forward. Overall, the dividend outlook appears bright – shareholders are enjoying record-high payouts, a hefty yield, and a policy prioritizing dividend growth and reliability.

9. Has Allianz increased its dividend per share?

Allianz’s dividend track record is a key attraction for investors. The company has consistently increased its dividend per share over the past decade, with particularly strong growth in recent years. Management had long followed a policy of paying out about 60% of net income as dividends and ensuring the dividend per share (DPS) grows by at least 5% annually if earnings allow. This resulted in a steady rise from a €7.30 DPS in 2015 to €10.80 by 2021.

Even during challenging periods, Allianz demonstrated dividend resilience – for example, holding DPS flat at €9.60 through the 2019–2020 pandemic years, then resuming growth thereafter. In early 2022, the firm confirmed its commitment to a growing dividend with a policy guaranteeing the higher of 50% of earnings or +5% DPS growth each year. This gave shareholders a raise to €11.40 per share for 2022. By 2023, strong results and confidence in future earnings prompted Allianz to enhance its dividend policy – the payout ratio was officially lifted from 50% to 60% of net income. Consequently, the 2023 dividend jumped 21% to €13.80 (from €11.40 prior year). For fiscal 2024, Allianz has proposed a further increase to €15.40 per share, reflecting an 11.6% hike.

10. Does Allianz buy back shares?

Beyond dividends, Allianz returns capital through share buybacks, which have meaningfully reduced the share count and enhanced per-share metrics.

11. Has Allianz bought back shares in the past?

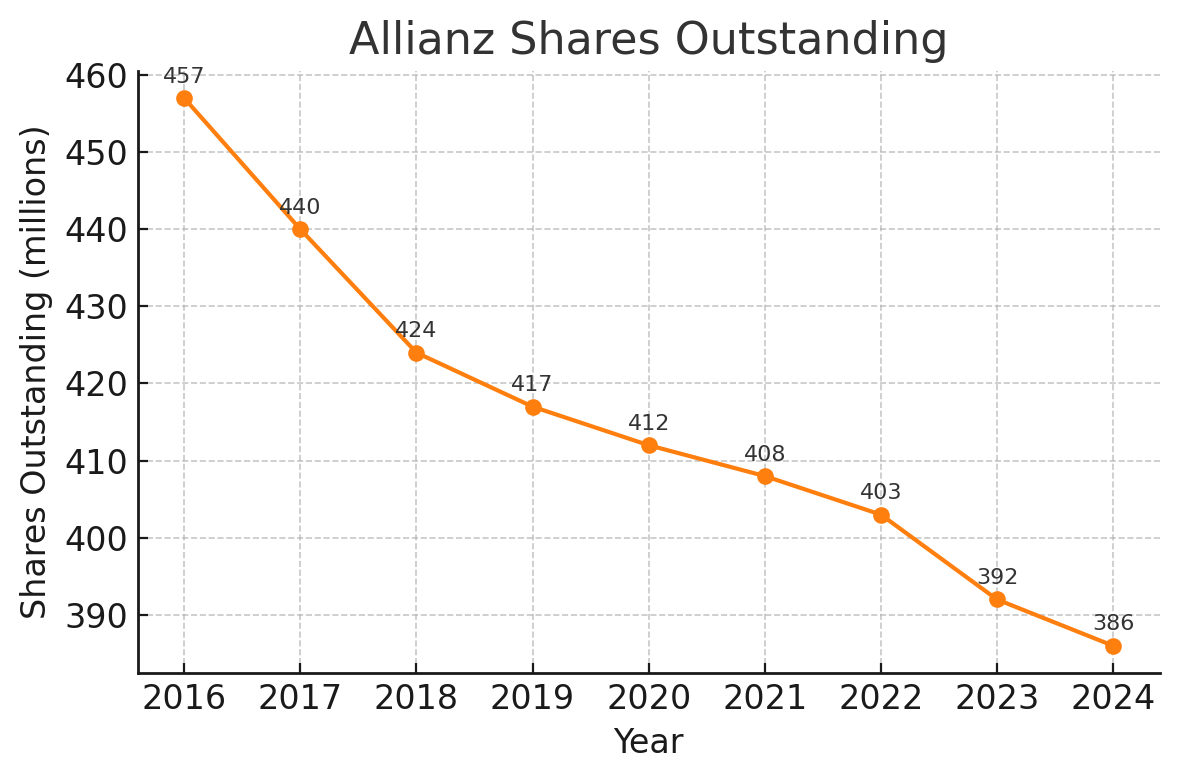

The group has been executing buyback programs regularly since 2017. In total, eleven buyback programs from 2017 through 2024 repurchased about 70.8 million Allianz shares, deploying €14 billion in capital. These are significant sums – for context, €14 billion is roughly 10% of Allianz’s current market capitalization. All repurchased shares are cancelled, directly boosting the remaining shareholders’ ownership stake.

12. Is there an active program at the moment?

In February 2025, alongside strong 2024 results, management announced a new €2 billion buyback program for 2025. This ongoing commitment to repurchases underlines Allianz’s capital strength and shareholder focus.

13. How has the number of shares outstanding changed?

Thanks to these buybacks, earnings per share have been augmented beyond organic profit growth. The chart above shows the impact: Allianz had 457 million shares in 2016, before the buyback streak began; by late 2024 only 386 million shares remained. In other words, an investor’s percentage ownership in Allianz would have risen by roughly one-sixth over that period purely due to share cancellations.

This also supports the dividend growth, since the total dividend pie is spread across fewer shares. Notably, Allianz typically executes buybacks without jeopardizing its strong capital ratios – the Solvency II ratio remains around 200% even after these returns, reflecting robust excess capital. Management uses buybacks as a flexible tool: if there are no large acquisition opportunities and the internal solvency is above target, cash is handed back to shareholders.

14. What are the major risks?

No investment is without risks, and as a global financial institution, Allianz faces a variety of risks. Investors should be aware of the major risk factors that could impact Allianz’s performance:

Market and Investment Risk: Allianz’s insurance operations collect premiums which are invested in financial markets. Therefore, market volatility (in interest rates, equity prices, credit spreads, etc.) can affect the value of its investment portfolio and capital position. For instance, rising interest rates can cause short-term losses on bond holdings (though they improve future returns), while equity market downturns reduce assets under management in its fund business, hurting fee income. Adverse market movements could also dent the group’s solvency ratio or create unrealized losses in its large investment book.

Insurance Risk and Catastrophes: As one of the world’s largest property-casualty insurers, Allianz is exposed to natural catastrophe losses (hurricanes, earthquakes, etc.) and other extreme claims events. Years with severe catastrophes can drive up combined ratios (claims as a percentage of premiums) and compress underwriting profit. Climate change is a concern as it may increase the frequency or severity of disasters over time. Allianz mitigates this with reinsurance and prudent risk selection, but earnings volatility from big loss events remains a risk. Similarly, in life insurance, Allianz bears longevity and morbidity risks – if policyholders live much longer or a pandemic drives higher mortality, it can affect claim payouts and reserves.

Economic and Inflation Risk: High inflation can drive up claim costs (for example, repair costs in auto insurance) and weak economic growth can slow demand for insurance products or strain policyholder finances. Allianz’s diversified business (insurance plus asset management) gives it resilience, but a broad economic downturn could pressure sales and profits in multiple segments. Persistently low interest rates (though less a concern now) historically have been a challenge for life insurers guaranteeing returns, whereas rapidly rising rates pose short-term balance sheet risks. Navigating the economic cycle is an inherent risk for all insurers.

Regulatory and Legal Risk: The financial services industry is heavily regulated. Changes in insurance regulations, capital requirements (e.g. Solvency II in Europe), or tax laws can impact Allianz’s operations and capital needs. Moreover, compliance failures or misconduct can lead to severe penalties. A stark example was the Allianz Global Investors “Structured Alpha” case in the U.S., where a subsidiary’s fund mismanagement led to billions in investor losses during the 2020 market turmoil. Allianz ultimately paid over $5 billion to investors and around $840 million in fines to settle fraud charges. This episode highlighted operational and reputational risk – Allianz had to wind down the offending asset management unit and secured exemptions to prevent broader business restrictions. While Allianz has since reinforced controls, it underscores how operational risk or litigation can have a material financial impact.

Competitive and Technological Disruption: Allianz faces strong competition in all markets from other global insurers, local incumbents, and emerging insurtech players. Competitive pressure could affect pricing and profit margins. Additionally, technology is changing insurance (e.g. digital distribution, AI in underwriting). Allianz must continually invest to stay ahead – failure to adapt could erode its market share over time. Cybersecurity is another growing risk; a major cyber attack or IT failure could disrupt business or compromise sensitive data.

In sum, Allianz’s size and diversification help spread risk, and it maintains robust risk management practices (with high solvency buffers and extensive reinsurance). However, severe financial market dislocations, catastrophe events, adverse regulatory actions, or operational missteps (like the U.S. fund fiasco) are key risk factors that could negatively affect the company. Investors should monitor these and consider whether they are comfortable with the inherent volatility and risk profile of a large global insurer.

15. What are the latest results?

Allianz’s latest results have been strong, showcasing the company’s resilience and growth even amid recent global challenges. For the full year 2024, Allianz achieved record financial performance. Operating profit reached €16.0 billion for 2024, up 8.7% from the prior year, with all segments (Property-Casualty, Life/Health, and Asset Management) contributing. Total revenues grew double-digits (+11% internal growth), indicating healthy underlying business momentum.

Net income for 2024 rose markedly. Net income attributable to shareholders was €9.9 billion, a 16.3% increase from €8.5 billion in 2023. This result benefited from both improved operating profits and a higher non-operating investment result. Allianz’s core earnings per share hit €25.42 in 2024, reflecting record-high profitability. By comparison, 2023 was already strong: net income was €8.5 billion (itself up ~33% from a subdued 2022), and operating profit was €14.7 billion. The bounce-back from 2022 was partly due to one-off charges in the prior year (the aforementioned U.S. legal provision), but also solid growth in insurance operations.

Notably, Allianz’s Property-Casualty division saw good growth in 2024 with a robust combined ratio despite elevated natural catastrophe claims. The Life/Health segment delivered higher profit as well, aided by volume growth (present value of new business premiums increased) and favorable product mix. Even the Asset Management segment (which includes PIMCO and Allianz Global Investors) stabilized – after facing outflows in 2022 amid bond market turmoil, it saw solid net inflows in 2023 and into 2024, as market conditions improved.

Allianz’s capital position remains very strong. At the end of 2024, the Solvency II capital ratio stood around 206% (after accounting for the new dividend), comfortably above internal targets. This gives confidence in the group’s balance sheet strength and ability to withstand shocks. Return on equity (ROE) for 2024 was about 16.9% on a “core” basis, up from ~16% prior year – near the top of management’s target range.

On the back of these results, Allianz has rewarded shareholders with those aforementioned higher distributions. The dividend for 2024 is set at €15.40 (pending AGM approval), and a €2 billion share buyback was announced in February 2025. These moves signal confidence in continued earnings strength.

Overall, the latest numbers show Allianz is executing well, with record earnings, growing revenues, and fortified capital. The business is benefiting from both external trends (higher interest rates improve investment income, a rebound in economic activity boosts insurance demand) and internal efficiencies (cost discipline and pricing measures). Investors will want to watch upcoming quarters for sustained momentum – but as of the most recent results, Allianz’s financial health is robust, providing a solid foundation for future shareholder returns and growth initiatives.

The last part of the analysis is for paid subscribers only and consists of the following information:

16. What is the current valuation?

17. What is speaking in favor of an investment?

18. What speaks against an investment?

19. Has there been any insider activity?

20. Has there been a capital markets day or similar event recently?

21. Conclusion

Keep reading with a 7-day free trial

Subscribe to Kroker Equity Research to keep reading this post and get 7 days of free access to the full post archives.